Full size / A Coca-Cola advertisement in 1936 noting “Broad highways have become America‘s streets. We‘re a nation on wheels. Distance doesn‘t matter if you pause now and then ... to put your feet on the ground“. The Coca-Cola Company used to have “CCE“ as its U.S. stock symbol (now “KO“).

Disseminated on behalf of Commerce Resources Corp. and Zimtu Capital Corp.

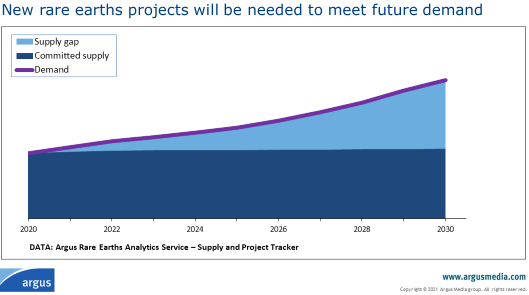

Most recently, U.S. President Joe Biden and Canadian Prime Minister Justin Trudeau committed to building an EV (“Electric Vehicle“) supply chain between both countries. “The move comes as demand for electrified transportation is set to surge over the next decade“, Reuters noted and added that “Washington is increasingly viewing Canada as a kind of ´51st State´ for mineral supply purposes and plans to deepen financial and logistical partnerships with the country’s mining sector over time, according to a U.S. government source“. In light of China still dominating the rare earth elements (“REEs“) supply chains and a supply gap emerging over the next few years, new REE projects are needed to meet future demand.

In Canada, the Saskatchewan Research Council (SRC) plans to set up the country’s first REE processing facility with an annual capacity of 3,000 tonnes of REE-bearing monazite material, slated to be operational in late 2022.

In the United States, Energy Fuels Inc. intends to enter the REE market already this year, by processing annually 2,500 tonnes of monazite with its permitted White Mesa Mill in Utah. This quantity contains approximately 8% of current U.S. REE demand, as per Energy Fuels, and as such much more monazite-feedstock is needed to make a meaningful impact in reducing U.S. dependence on Chinese sources. Energy Fuels is looking for at least 15,000 tonnes of annual monazite feedstock as that quantity contains around 50% of current U.S. REE demand and would only require <2% of White Mesa Mill’s annual throughput capacity.

Commerce Resources Corp.’s (“CCE”) Ashram REE & Fluorspar Deposit in Québec is the largest defined monazite dominant deposit in North America. Energy Fuels is one of the many processors having requested a REE concentrate sample from CCE.

Full size / Source / Ashram is one of the largest REE and fluorspar deposits in the world with defined resources at an advanced stage (actively working towards Prefeasibility Study level). Ashram´s primary commodities of interest are magnet-feed REEs as well as fluorspar being a highly attractive by-product target at limited extra cost.

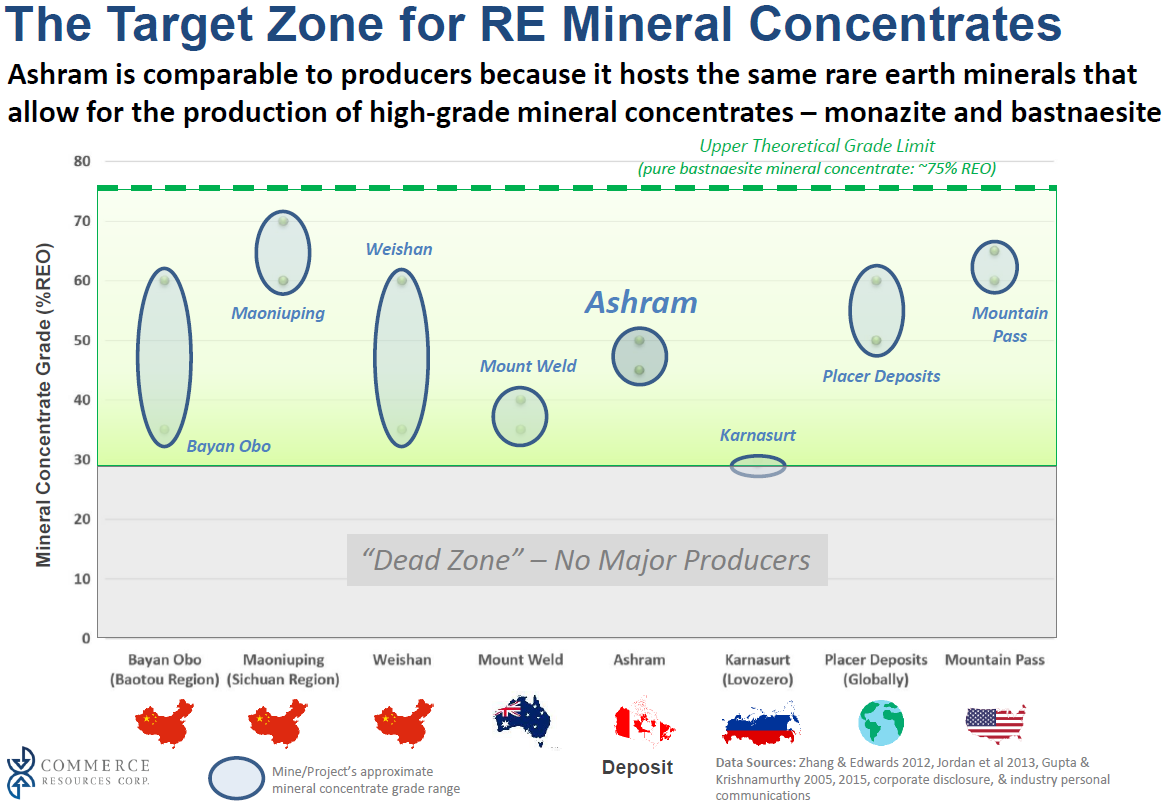

Full size / “The Ashram Deposit is one of only a select group of deposits in development globally that can produce mineral concentrate at high recovery (> 70%) and high grade (> 40% REO). All major hard rock REE miners globally produce mineral concentrates of at least 40% REO, which are then used for downstream processing to marketable products. Such high grades of mineral concentrate considerably reduce the downstream processing cost and risk through lower reagent use, fewer deleterious elements entering solution, and a smaller hydromet plant requirement by comparison. Following the production of this monazite mineral concentrate sample, the Company continues to advance its metallurgical programs at Hazen Research, which have been designed to both satisfy several key industry sample requests, as well as obtain the remaining design criteria required to complete the Pre-feasibility Study for the Ashram Rare Earth and Fluorspar Project.” (Source: Commerce Resources Corp.’s news-release on March 8, 2021)

Full size / Commerce Resources was requested to deliver REE concentrate samples to the following parties (not including majors under NDA): Energy Fuels Inc., Urban Mining Co., Albemarle Corp., Blue Line Corp., Advanced Magnet Lab Inc. (all USA) as well as Ucore Rare Metals Inc. (Canada), Solvay/Rhodia (Belgium/France), BASF (Germany), Thyssen-Krupp (Germany), Siemens (Germany), Treibacher Industrie AG (Austria), Auer-Remy (Germany), REEtec (Norway), Less Common Metals (UK), DKK (Japan).

Recently on March 8, CCE announced to have delivered “a sample of high-grade monazite mineral concentrate from the Ashram Rare Earth and Fluorspar Deposit to an industry processor per their request. The 1.0 kg sample grades 44.3% rare earth oxide (REO) and was produced using the conventional recovery flowsheet developed by Hazen Research at their facilities in Colorado, USA...” CCE’s President Chris Grove commented in the news: “We are very pleased to provide this sample to satisfy a third-party request by an industry REE processor. Ashram has a very favourable rare earth mineralogy that is dominated by monazite – a well-known and easily processable mineral for REEs, as well as one having an affinity for high distributions of NdPr. Ashram is one of only a select few projects in development that is capable of producing high-grade mineral concentrates at high recoveries, making it an attractive feed source for REE mineral processors, and then for downstream permanent magnet manufacturers.”

Monazite: The Mona Lisa of Rare Earth Minerals

Leonardo da Vinci’s famous painting, the Mona Lisa, has been described as “the best known, the most visited, the most written about, the most sung about, the most parodied work of art in the world” and is one of the most valuable paintings in the world.

Monazite, the reddish-brown phosphate mineral containing rare earth elements, has jumped into the spotlight of the REE sector for a good reason. Monazite-hosted deposits are praised for having a high percentage neodymium (Nd) and praseodymium (Pr), the two most widely used REEs in rare earth permanent magnets (the fastest growing and highest value market of all REEs). Nd and Pr are critical for high performance magnets used by the automotive sector and in wind turbines. Monazite also contains notable amounts of terbium (Tb) and dysprosium (Dy), also used in certain rare earth permanent magnet applications where high temperature operation is required.

Roskill noted: “By 2030, rare earth magnet applications are forecast to account for ~40% of total demand, raising potential for a tight supply-demand balance for key magnetic rare earth elements, providing opportunity for new production capacity to be financed, constructed and commissioned.”

Full size / Approximately 85% of Ashram’s REO value is from the magnet-feed REOs (Pr, Nd, Tb, Dy). Roughly 2/3rd of this value is from neodymium (Nd).

The Saskatchewan Research Council (SRC) and Energy Fuels Inc. are both setting up to process monazite-hosted feedstock material:

SRC’s $35 million Rare Earth Processing Facility was announced in the summer of 2020 by the Government of Saskatchewan and will be located in Saskatoon, Saskatchewan, with completion slated for late 2022. At a planned treatment capacity of 3,000 tonnes per year, the initial product is a mixed rare earth carbonate concentrate to be fed to SRC’s separation plant to produce approximately 500 tonnes of separated, individual rare earth oxides, excluding cerium.

As the SRC has begun searching for feedstock material, the companies grabbing most headlines recently are Appia Energy Corp. (CSE: API; market capitalization: $69 million) and Medallion Resources Ltd. (TSX.V: MDL; market capitalization: $26 million).

Appia’s Alces Lake Property in northern Saskatchewan is an early-stage exploration project which saw drilling in 2018. It is a high-grade, monazite-hosted prospect; however no mineral resource has yet been completed. Although the grades are significant, the tonnage potential is not clear as mineralized intercepts are limited in width (typically 3 m to < 15 m) and modelling indicates that mineralization is comprised of multiple unconnected bodies. The company is planning a 2021 drill program and has started bench-scale monazite processing and metallurgical testing at the SRC.

As SRC’s facility is scheduled to be operational in 2022, a quicker feedstock source might be needed.

With some testwork programs concluded at the SRC, Medallion is developing a processing method for monazite as a by-product from tailing streams (waste) from heavy mineral sands mining operations globally. It remains to be seen if Medallion can secure reliably a meaningful quantity of monazite feedstock to be processed. Further, the impact of the SRC REE processing facility on Medallion’s business model is not clear as both appear to be potentially competitors.

Energy Fuels Inc. (TSX: EFR; market capitalization: $1,1 billion) is an U.S.-based producer of uranium and vanadium (no material sales in 2020 though), planning to enter the REE market in 2021 following a December-2020 agreement to purchase a minimum of 2,500 tonnes of monazite per year (for 3 years) from a facility located in Georgia, USA, owned by The Chemours Company (NYSE: CC; market capitalization: $4.8 billion USD), where monazite is produced as a by-product of heavy mineral sands operations that primarily recover zircon and titanium.

In March 2021, Energy Fuels and Neo Performance Materials Inc. (TSX: NEO; Market capitalization: $803 million) announced the launch of a new “U.S.-European REE Production Initiative”, expected to produce value-added REE products from monazite sands. Energy Fuels plans to process the monazite sands into a mixed REE carbonate at its 100% owned White Mesa Mill in Utah and sell this product as feed material for Neo’s value-added separated REE production plant in Estonia.

In the past, monazite sands were not sold directly to China’s rare earth industry, due to the presence of uranium and other radionuclides. Recovering and managing these radionuclides requires special licenses and expertise, which Energy Fuels has at its White Mesa Mill.

Recently on March 22, Energy Fuels announced that the company is seeking “new sources of alternate feed materials and new fee processing opportunities at the White Mesa Mill that can be processed under existing market conditions (i.e., without reliance on current uranium sales prices)”. This statement indicates that Energy Fuels is capable to process much larger quantities of monazite than supplied under the 2,500 tonnes/year agreement with Chemours, which quantity contains ~8% of current U.S. REE demand, according to Energy Fuel’s latest presentation, which also notes that “15,000 tons of monazite would only require <2% of [White Mesa] Mill’s annual throughput capacity” and that “15,000 tons of monazite contains ~50% of current U.S. REE demand”.

The White Mesa Mill is licensed and designed to process 2,000 tons of ore per day on average, or 720,000 tons of ore per year. Energy Fuels “has a goal to process 15,000+ tons of monazite and other sources of ore per year for the recovery of REEs and uranium”.

According to Energy Fuels: Of the 55% TREO (total rare earth oxides) typically found in monazite sands from the southeast U.S., the neodymium and praseodymium oxides (“NdPr”) comprise approximately 22% of the TREO. Nd and Pr are among the most valuable of the REEs, as they are the key ingredient in the manufacture of high-strength permanent magnets which are essential to the lightweight and powerful motors required in electric vehicles (“EVs”) and permanent magnet wind turbines used for renewable energy generation, as well as to an array of other modern technologies, including, mobile devices and defense applications.

The Fluorspar Kicker

In addition to being one of the largest REE deposits globally, the Ashram Deposit is also one of the world‘s largest fluorspar deposits. On April 5, 2021, CCE announced that it “expects to recover a fluorspar by-product (met-spar and acid-spar) from the tailings of the primary REE recovery circuit. The recovery of fluorspar was not incorporated into the Preliminary Economic Assessment (PEA) for the Project, completed in 2012; however, it is now anticipated to provide a significant secondary revenue stream in the PFS. Further, as the fluorspar concentrate would be produced from the tailings of the REE concentrate, the Company would be generating value from its tailings (i.e. typically waste), and therefore incorporating a circular economy component to the project.“

According to CCE‘s webinar at Amvest Capital (March 8, 2021): The currently defined resource for the Ashram Deposit outlines >11.5 million tonnes of contained fluorspar (based on the contained fluorine content), combined over all categories. At a production rate of ~70,000 tonnes of fluorspar per year, only ~15% of the total resource would be exhausted over the initial 25 year mine-life.

Both the production of REEs and fluorspar are currently dominated by China, placing Ashram in a unique position to potentially address the supply concerns of these two critical commodities. Both REEs and fluorspar are considered critical / strategic commodities by the U.S. Department of the Interior, the European Union, and Natural Resources Canada. Similar to the prevailing dynamics for rare earth elements, China was historically the largest exporter of fluorspar. However, over the last several years, China has become a net importer. This has caused significant price appreciation for fluorspar, and market interest from industry in new sources. Fluorspar is an essential raw material to the steel, aluminum, and chemical industries in primarily two marketable products, acid spar grade and met spar grade. Acid-spar (>97% CaF2), accounting for roughly 60% of the market, is primarily used to synthesise hydrofluoric acid (HF) and subsequent fluorochemicals, and in the production of aluminum metal to reduce process temperatures and energy consumption. It is also a key raw ingredient of materials used in enhancing the operational performance of lithium-ion batteries. Met-spar (>60% CaF2), accounting for roughly 40% of the global fluorspar market, is primarily used as a flux in the steel making process to lower the melting temperature, to reduce slag viscosity and remove impurities.

According to “Fluorspar: Semiconductor chip disruptions persist“ (Roskill, March 31, 2021):

Ongoing shortages in semiconductor chip supplies continue to cause major delays in industrial activity worldwide, with automakers cutting down on production and electronic device manufacturers struggling to keep up with the post COVID-19 surge in demand for mobile phones, gaming consoles and other devices.

The crisis prompted U.S. President Joe Biden to sign an executive order last month to address the issue, after he pledged to seek US$37Bn in funding for legislation to strengthen chip supply chains in the USA. Companies that have been affected include Ford Motor Company, General Motors, Honda, Nissan, Renault, Samsung, Sony, Tesla, Toyota, Visteon, Volkswagen und Volvo. The electric vehicle and internal combustion engine car industries, which both rely on “just-in-time” supply chains, have been negatively impacted particularly. Production of an estimated 1M vehicles will be delayed in Q1 2021.

Roskill View: High purity hydrogen fluoride (HF) is a key chemical used by the electronics industry in the manufacturing of semiconductors and printed circuit boards as it can selectively attack silica (SiO2). It is employed in cleaning agents and etchants and is thus, an important feedstock in the production of devices and critical electronic systems in transport and infrastructure. Semiconductor supply and demand is notoriously cyclical and has been the subject of geopolitical drama before. Electric vehicles contain as many as 3,500 semiconductor chips per vehicle and the latest supply shortages have drawn more attention to the fact that more than 70% of the world’s chip manufacturing capacity is in Asia. Whilst HF is manufactured in large volumes globally and is the starting point for essentially the entire fluorochemicals industry, the number of producers of electronic-grade HF and its derivatives is much more limited. Roskill closely monitors world HF production and trade.

In the Spotlight: Northern Québec

On March 9, 2021, Midland Exploration Inc. (TSX.V: MD; market capitalization: $61 million) announced the execution of “an important strategic alliance“ with SOQUEM Inc., a subsidiary of Investissement Québec which public investment company was established in 1998 under an Act to favour investment in Québec by Québec-based and international companies. Both Midland and SOQUEM have agreed to “combine their efforts and their expertise to jointly explore the excellent potential for gold and strategic minerals in the vast and underexplored Labrador Trough [...] with the main purpose of making new world-class discoveries in a high-potential yet underexplored area of Quebec“.

This new agreement calls for investments in exploration totalling up to $5 million over a period of 4 years, with a firm commitment of $3 million within the first 2 years of the agreement. The area of interest is located in Nunavik. Geologically, it covers the Labrador Trough, the Rachel-Laporte Zone, and the Kuujjuaq Domain. The area of interest extends from Schefferville in the south up to approximately 100 km north of Kuujjuaq.

CCE‘s Ashram REE & Fluorspar Deposit is located about 130 km south of Kuujjuaq and as such may benefit from any development in this mineral-rich region where increased exploration and development activities are expected.

Australian-based BHP Group is moving its exploration headquarters from Santiago, Chile, to Toronto, Canada “in the latest move by the world’s top miner to focus its growth pipeline on future-facing minerals“, Bloomberg stated on March 11, 2021:

The switch to Canada’s most populous city comes after BHP last August entered a partnership with Midland Exploration Inc. to undertake nickel exploration in the far north of Quebec province [and] BHP is also supporting Midland’s hunt for copper in the same region. “Nickel is fast becoming the ‘work horse’ of battery technology, playing an essential role in the world’s efforts to decarbonize,” BHP’s Chief Technical Officer Laura Tyler said in a speech to a mining conference in Toronto. She forecast a “golden age” for exploration in the years ahead, where innovation and new technology would help to unlock resources of the future. “To own the best assets in the best commodities, you have to look for them and develop them well ahead of time,” Tyler said. “To do so, we need to imagine what the world could look like in 50 or even 100 years from now.”

On April 5, 2021, CCE announced to have “also engaged the engineering firm CIMA+ to evaluate sites and design the marine infrastructure component for the PFS. CIMA+ has extensive experience in Quebec’s north and its operating conditions, having designed and constructed the marine facilities for several northern Inuit communities between 2005 and 2012. Specifically, CIMA+ designed and built the marine facility on the Koksoak River for the community of Kuujjuaq, the nearest community to the deposit. The Company is evaluating sites along the Koksoak River for a small marine facility to enable the shipping of materials and concentrate to and from the proposed mine-site, respectively.“

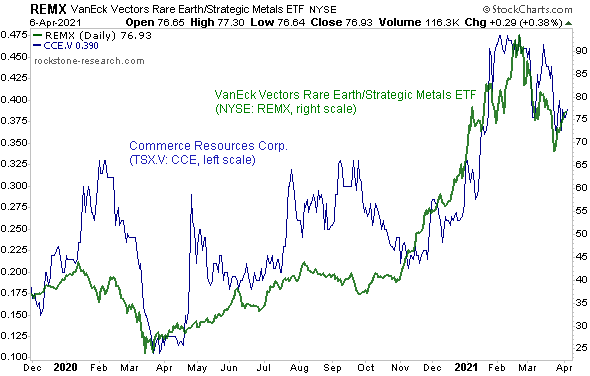

Commerce Resources Corp.‘s share price (blue, left scale, CAD) gained 260% since the March 2020 low while the VanEck Vectors Rare Earth/Strategic Metals ETF (green, right scale, USD) gained 200% in the same period. (Click here for updated prices)

“Analysis by Argus’ global rare earths team has quantified the emerging supply gap in the market, and we have assessed the projects which are best-placed to come onstream to meet future demand. Global demand for rare earths, and NdPr in particular, is set to grow strongly as governments around the world require these critical minerals to meet the commitments in their decarbonisation and renewable energy strategies. Current production capacity alone is unable to meet this future demand.“ (Argus Rare Earths Analytics email note, February 23, 2021)

Excerpts from “U.S. looking to Canada for minerals to build electric vehicles” (Reuters, March 18, 2021):

On Thursday, the U.S. Department of Commerce held a closed-door virtual meeting with miners and battery manufacturers to discuss ways to boost Canadian production of EV materials, according to documents seen by Reuters.

The move comes as demand for electrified transportation is set to surge over the next decade. Conservationists have strongly opposed several large U.S. mining projects, leading officials to look north of the border to Canada and its supply of 13 of the 35 minerals deemed critical for national defense by Washington.

The event comes after U.S. President Joe Biden and Canadian Prime Minister Justin Trudeau committed last month to building an EV supply chain between the two countries. Since Biden’s election, three U.S. mining companies have invested in Canada, where mining accounts for 5% of the country’s gross domestic product, versus roughly 0.9% in the United States.

To be sure, the United States is also trying to boost domestic production of EV metals, which the Biden administration has said is critical. But Washington is increasingly viewing Canada as a kind of “51st State” for mineral supply purposes and plans to deepen financial and logistical partnerships with the country’s mining sector over time, according to a U.S. government source. Both countries are members of the Energy Resource Governance Initiative, a pact to share mining experience and resources.

Last week, privately-held USA Rare Earth invested in Search Minerals Inc’s rare earths project in [Labrador, NF] in eastern Canada. While USA Rare Earth already controls a rare earths deposit in Texas, executives said they wanted access to more of the minerals used to make electronics and weapons. “You can’t just rely on projects in the U.S. for supply,” said Pini Althaus, USA Rare Earth’s CEO. “You have to collaborate with Canada.”

“Prices for ingredients of rare earth magnets, used in wind turbines and electric vehicles, have been on a tear since the fourth quarter of 2020. The surge was driven by booming demand and concerns that dominant producer China would seek to limit rare earths exports and tighten control of a strategic industry. The rally has extended into this year, with terbium oxide and dysprosium oxide, used as magnet inputs, gaining 36% and 58% each, to touch levels this month unseen since 2012, Asian Metal data shows. “The current magnet rare earth price levels in China have baked in a high probability that Myanmar supplies could be disrupted,” said Ryan Castilloux, managing director of consultancy Adamas Intelligence. But this has not happened yet, he added. About half of China’s feedstock of heavy rare earths comes from Myanmar, and the coup unleashed fears of a supply cutoff even though the mines are in northern areas controlled by autonomous militias that face no clear threat. While China’s rare earth imports held firm in January and February, a March 21 report in the state-backed Global Times newspaper said material could not be shipped, but did not delve into the problem further. Downstream, a source at a Chinese maker of auto parts based in eastern Zhejiang province told Reuters this week a shortage of rare earths supply was hitting the company’s deliveries to multinational clients, though it does not rely on imports and attributed the squeeze to tighter domestic controls. There is no significant shortage of feedstock from Myanmar now, but any stoppage would be “pretty catastrophic” for China, said David Merriman, a manager at consultancy Roskill.” (Source: “China rare earths extend surge on worries over Myanmar supply, inspection threat“, Reuters, March 26, 2021)

Economic Importance amid Supply Disruptions

REEs are needed in many industries, e.g. each SSN-774 Virginia-class submarine requires ~4,173 kg (9,200 lbs) of rare earth materials, each DDG-51 Aegis destroyer requires ~2,359 kg (5,200 lbs) of these materials, and each F-35 Lightning II aircraft requires ~417 kg (920 lbs) of REEs, according to a report from the Congressional Research Service. A single iPhone smartphone contains 8 different REEs but when examining several varieties of smartphones, you can find 16 of the 17 REEs (the only one you will not find is promethium, which only really occurs in nuclear reactors and the sun. A typical Toyota Prius, for example, uses 25 kg (55 lbs) of REEs, compared to 1 kg (2.2 lbs) in a typical combustion-engine vehicle. UBS predicts EV penetration will increase from 4% today (~3 million EVs/year) to 20% of the market by 2025, and 50% by 2030 (~46 million EVs/year). During that time, UBS expects global demand for REEs to triple from current demand levels if car makers are to hit its production targets.

According to “UBS Rare Earth Forecasts Only Tell Half the Story” (Adamas Intelligence, March 24, 2021):

Recently, investment bank UBS released a new report on the outlook for EV battery and motor materials following its teardown of the VW ID.3... Of particular interest to us at Adamas Intelligence were the bank’s latest projections for supply, demand and prices of magnet rare earths (namely didymium, “NdPr”). In our humble opinion, the UBS analysis misses the mark.

UBS conclusion: Didymium will see a “step change” in demand growth over the next decade, from approximately 30,000 tonnes per annum now to around a 100,000 tonnes per annum in 2030 with EVs making up 80% of the total.

Our take: Current global didymium oxide demand is approximately 65,000 tonnes per annum, double that estimated by UBS, and will increase to more than 140,000 tonnes per annum by 2030, of which passenger EVs, commercial EVs and other e-mobility types will collectively make up just 25-30% of total demand, considering vehicle traction motors, micromotors, sensors and loudspeakers...

UBS conclusion: Current global didymium supply of around 38,000 tonnes will rise to nearly 60,000 tonnes by 2030.

Our take: As with demand, current global didymium oxide supply (primary + secondary) is also approximately 65,000 tonnes per annum, of which the majority comes from primary production in China, Australia, the U.S., and Myanmar coupled with often-overlooked but abundant secondary supplies from magnet swarf and scrap in China and Japan. By 2030, Adamas Intelligence forecasts that total global didymium oxide supply will rise to 125,000 tonnes per annum (more than double the projection of UBS) and the market will face a deficit of 16,000 tonnes per annum (versus nearly 45,000 tonnes projected by UBS).

UBS conclusion: NdPr price forecasted to peak at $100 per kilogram in 2024 to reflect the “looming deficit and rising supply anxiety,” before returning to $70 per kilogram by 2027.

Our take: The price of didymium (“NdPr”) metal has already surged past UBS’ arbitrary “peak” of $100 per kilogram, although we suspect that throughout their analysis, when referring to supply, demand and prices of “NdPr” the team is actually referring to NdPr oxide, which any market follower will point out is a starkly different product. All things considered, we are thrilled to see more investment banks and research firms dipping toes into the opaque abyss that is the global rare earth market but would caution investors and industry followers to carry out their own due diligence using multiple sources given the rising tide of misinformation washing over the market. More Information: Rare Earth Magnet Market Outlook to 2030 (Adamas Intelligence, August 2021)

According to “Rare earths: Myanmar crisis set to disrupt rare earth supply availability” (Roskill, March 29, 2021):

The conflict in Myanmar has escalated significantly in recent weeks... Disruption to the supply of rare earth ores, concentrates and semi-processed products between Myanmar and China has the potential to create significant supply chain issues for processors in southern China. As reported by Roskill on 25 March, all ionic adsorption clay (IAC) mining operations, including those who had operated throughout in 2020, asked to be suspended in late February, and there are no signs of any re-start yet. The proposed introduction of ammonia-free in-situ leaching technology at various IAC projects in China has not materialised over continued concerns regarding pollutants, recovery rate and social impacts.

This means that there are very few operational alternatives to Myanmar-derived production of HREEs such as dysprosium and terbium, with viable sources either only in pilot scale production or producing mixed HREE products as a by-product of Nd-Pr. In 2020, Myanmar accounted for 39% of global HREE mine production, with China itself the only other major producer of HREE mined products at 48% of global supply. In comparison, the next largest producer of HREE mined products was Lynas Corporation at roughly 5.5% global supply. There are reported to be stockpiles of refined HREEs, including dysprosium and terbium compounds, held by both private and public inventories, which could be drawn down in China, though without primary production these inventories would soon become depleted.

As a result of the growing uncertainty and tight supply availability in China, prices for dysprosium and terbium are expected to be supported at higher levels, following the strong price performance observed during 2020 and Q1 2021. This will result in better economic performance for many projects under development and further incentivise investment in capacity. Investors should be weary, however, that the payability of certain rare earth products will be unaffected by higher Dy and Tb prices, particularly those with dominant light rare earth (LREE) content. Though with the potential for significant supply deficits to form for many HREEs if Myanmar production is heavily disrupted for an extended period, even LREE products may see increased payability for certain HREEs. More Information: Rare Earths: Outlook to 2030 (Roskill, January 2021)

Full size / “Nikola Tesla’s patent for the electro magnetic motor, the basis for today’s alternating current power systems.“ (“Rotating Field Revelation, 1882“, Tesla Science Center; Image).

According to Tesla Science Center:

Tesla’s breakthrough moment was a walk in the park (literally) that changed history. Tesla was 26 years old and living in Budapest, where he had been struggling for months to devise a system for generating electricity using rotating magnetic fields.

The effort affected his health and Tesla became ill from mental and physical exhaustion. During his recovery, he went for a walk in a Budapest park with good friend Anthony Szigety and experienced a sudden epiphany. Here is Tesla’s own account of the moment in which he envisions the solution for an alternating current system to generate electricity.

“One afternoon, which is ever present in my recollection, I was enjoying a walk with my friend in the City Park and reciting poetry. At that age I knew entire books by heart, word for word. One of these was Goethe’s ‘Faust.’ The sun was just setting and reminded me of the glorious passage:

The glow retreats, done is the day of toil;

It yonder hastes, new fields of life exploring;

Ah, that no wing can lift me from the soil Upon its track to follow, follow soaring!

A glorious dream! though now the glories fade.

Alas! the wings that lift the mind no aid Of wings to lift the body can bequeath me.

As I uttered these inspiring words the idea came like a flash of lightning and in an instant the truth was revealed. I drew with a stick on the sand the diagrams shown six years later in my address before the American Institute of Electrical Engineers, and my companion understood them perfectly. The images I saw were wonderfully sharp and clear and had the solidity of metal and stone, so much so that I told him: ‘See my motor here; watch me reverse it.’ I cannot begin to describe my emotions. Pygmalion seeing his statue come to life could not have been more deeply moved. A thousand secrets of nature which I might have stumbled upon accidentally I would have given for that one which I had wrested from her against all odds and at the peril of my existence.”

“The 31 critical minerals on Canada’s list are used to develop clean technologies, from solar panels to EV batteries. They’re all essential to lowering emissions, increasing our competitiveness, and strengthening our energy security. Canada’s list signals to investors where Canada will focus and where Canada will lead. Critical minerals will get us to net-zero.” (Seamus O’Regan Jr., Canada’s Minister of Natural Resources)

“Our expertise in mineral exploration, our vast resources, potential for further discoveries, and leadership in sustainable practices means Canada is in an excellent position to become the global “supplier of choice” for the critical minerals that will drive the transition towards a low-carbon future.” (Felix Lee, President of Prospectors & Developers Association of Canada)

Company Details

Commerce Resources Corp.

#1450 - 789 West Pender Street

Vancouver, BC, Canada V6C 1H2

Phone: +1 604 484 2700

Email: cgrove@commerceresources.com

www.commerceresources.com

Shares Issued & Outstanding: 75,006,544

Canada Symbol (TSX.V): CCE

Current Price: $0.39 CAD (04/06/2021)

Market Capitalization: $29 Million CAD

Germany Symbol / WKN (Tradegate): D7H0 / A2PQKV

Current Price: €0.26 EUR (04/06/2021)

Market Capitalization: €20 Million EUR

Previous Coverage

Report #33 “Research & Advisory Firm looks into the Ashram REE & Fluorspar Project from Commerce Resources“

Report #32 “Already Big Ashram Gets Bigger And Bigger“

Report #31 “Fluorspar: The Sweet Spot for Quebec‘s Steel and Aluminium Industries“

Report #30 “Lean and Mean: A Fighting Machine“

Report #29 “Like A Phoenix From The Ashes“

Report #28 “SENKAKU 2: Total Embargo“

Report #27 “Technological Breakthrough in the Niobium-Tantalum Space“

Report #26 “Win-Win Situation to Develop One of the Most Attractive Niobium Prospects in North America“

Report #25 “The Good Times are Back in the Rare Earths Space“

Report #24 “Commerce Resources and Ucore Rare Metals: The Beginning of a Beautiful Friendship?“

Report #23 “Edging China out of Rare Earth Dominance via Quebec‘s Ashram Rare Earth Deposit“

Report #22 “Security of REE Supply and an Unstoppable Paradigm Shift in the Western World“

Report #21 “Commerce well positioned for robust REE demand growth going forward“

Report #20 “Commerce records highest niobium mineralized sample to date at Miranna“

Report #19 “Carbonatites: The Cornerstones of the Rare Earth Space“

Report #18 “REE Boom 2.0 in the making?“

Report #17 “Quebec Government starts working with Commerce“

Report #16 “Glencore to trade with Commerce Resources“

Report #15 “First Come First Serve“

Report #14 “Q&A Session About My Most Recent Article Shedding Light onto the REE Playing Field“

Report #13 “Shedding Light onto the Rare Earth Playing Field“

Report #12 “Key Milestone Achieved from Ashram’s Pilot Plant Operations“

Report #11 “Rumble in the REE Jungle: Molycorp vs. Commerce Resources – The Mountain Pass Bubble and the Ashram Advantage“

Report #10 “Interview with Darren L. Smith and Chris Grove while the Graveyard of REE Projects Gets Crowded“

Report #9 “The REE Basket Price Deception & the Clarity of OPEX“

Report #8 “A Fundamental Economic Factor in the Rare Earth Space: ACID“

Report #7 “The Rare Earth Mine-to-Market Strategy & the Underlying Motives“

Report #6 “What Does the REE Market Urgently Need? (Besides Economic Sense)“

Report #5 “Putting in Last Pieces Brings Fortunate Surprises“

Report #4 “Ashram – The Next Battle in the REE Space between China & ROW?“

Report #3 “Rare Earth Deposits: A Simple Means of Comparative Evaluation“

Report #2 “Knocking Out Misleading Statements in the Rare Earth Space“

Report #1 “The Knock-Out Criteria for Rare Earth Element Deposits: Cutting the Wheat from the Chaff“

Contact:

Rockstone Research

Stephan Bogner (Dipl. Kfm.)

8260 Stein am Rhein, Switzerland

Phone: +41-44-5862323

Email: info@rockstone-research.com

www.rockstone-research.com

Disclaimer: This report contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Commerce Resources Corp. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to Commerce Resources Corp.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through their respective profiles on SEDAR at www.sedar.com. Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, holds a long position in Commerce Resources Corp. and Zimtu Capital Corp., and is being paid by Zimtu Capital Corp., which company also holds a long position in Commerce Resources Corp. Note that Commerce Resources Corp. pay Zimtu Capital Corp. to provide this report and other investor awareness services.