“Rare earths are booming again as a clampdown on wildcat miners in China crimps supply in the world’s biggest producer while the clean energy boom bolsters their use in everything from electric vehicles to wind turbines. Prices for “light” rare earths including neodymium and praseodymium have exploded in recent months as traders and consumers snap up material that’s becoming scarcer.“ (Source: Bloomberg in “Rare Earth Metals Electrified by China‘s Illegal Mining Clean-Up“)

Disseminated on behalf of Commerce Resources Corp. and Zimtu Capital Corp.

Arguably the most important REE conference for the year, Metal Events‘ International Rare Earths Conference, took place again in Hong Kong on November 8-10 and was well attended by industry.

The main takeaway was the optimism for a continued and sustained bull market for REEs in the foreseeable future. As the keynote speaker, Chairman of Neo Performance Materials, Constantine Karayannopoulos, said:

“The good times are back – after 5 years of misery – and I expect that next year we will see many more bankers and investors here.“

In regards of Constantine’s stated optimism, you may have seen that he has launched the $300 million IPO for his new REE company, and I would argue that the underwriters (Bank of Nova Scotia, Royal Bank of Canada and Cormark Securities) would not attempt this without a decisive opinion that they would be successful in this endeavour and that they only could be successful with the prevailing REE market winds behind their backs, with current upward demand and price pressure for the REEs.

Similar to today‘s news, I expect more ground-breaking news from Commerce Resources Corp. putting its Ashram REE Project in Québec on the map globally.

“The price for neodymium and praseodymium oxide, which are priced in tandem, is trading at $73.50 a kilogramme in China, compared to an annual average of $38.94 last year, according to consultancy Adamas Intelligence... Chinese and overseas carmakers are now looking to sign long-term supply agreements with Chinese rare-earth producers, according to Ryan Castilloux, an analyst at Adamas Intelligence. “We’re really just at the outset of electric vehicle demand really taking off and having a material impact for magnets,” he says... Rare-earth projects outside China are already gearing up...“ (Source: Financial Times in “Rare Earths Make Electric Comeback After Bust“)

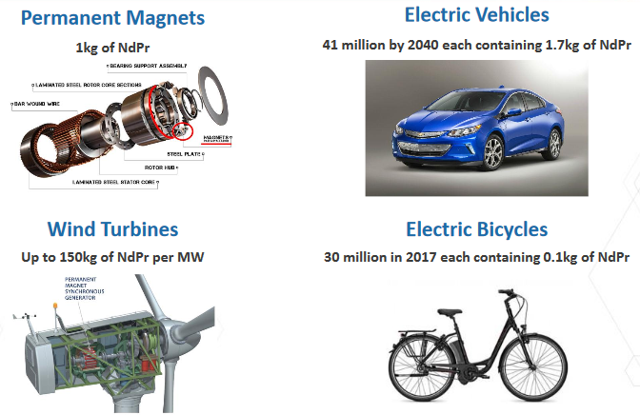

“The likes of Tesla are choosing to use rare earth-based permanent magnet motors, rather than induction motors, in some vehicles, as they are lighter and more powerful. That is key to improving how far the vehicles can go without being recharged, according to David Merriman, an analyst at consultancy Roskill... Argonaut Research analysts estimate that use of magnets in electric vehicles and wind turbines will cause demand for neodymium and praseodymium to increase almost 250 per cent over the next 10 years. Electric vehicles use roughly 1kg more rare-earth oxides than conventional internal combustion cars, according to their research.“ (Source: Financial Times in “Rare Earths Make Electric Comeback After Bust“)

As we like to say “it’s the early bird that gets the worm, but it‘s the 2nd mouse that gets the cheese” meaning, as huge profits are being made by some investors in the Battery Metals space, all investors should be looking for that next big win, which is arguably going to be the REEs.

This is to say, whatever the upside that is being realized by companies in the Battery Metals space, this same upside has a direct relation to the products that are powered by these batteries. At the end of day, all batteries, no matter what the design is – whether the market will continue to be dominated by the lithium ion design or possibly the new Toshiba niobium/ titanium design – these batteries provide charge for what? An electric motor of some kind, of which nothing beats the performance of an REE permanent magnet motor!

There is also a “double whammy“ effect here that is essential to understand: The overall number of REE juniors, still active on their projects, is a fraction of what it was in the heyday of 2011, whereas the market looks much more robust and poised for a healthy long-term upward trend in prices and demand for the future. The opportunity has clearly arrived and has never looked as promising and sustainable as today. While everyone has focused on lithium and cobalt for the “Electric Revolution“, it’s clearly the REEs which have been overlooked and will potentially now provide profits to those invested in this sector.

While there are hundreds of juniors and seniors actively pushing into the once-niche metal markets of lithium and cobalt, there is barely a handful of REE companies at which investors could possibly look for a meaningful exposure. Lynas, the biggest REE producer outside of China, is up 120% this year.

But what about the junior exploration and development space? Where is the future supply to come from?

In 2011, we saw the flashy presentations from companies such as Frontier, Quest, Matamec and Avalon touting themselves as some of the most “advanced“ juniors with the best future. None of these companies came back this year to present in Hong Kong, because none of them are active on their projects any longer.

One of the main differences since 2011 is the movement away from the Heavy REEs (HREEs) (see the section on the new Magnet “Recipe“ following) and the much increased focus on the Light REEs (LREEs), especially the magnet feed material led by Neodymium (Nd) and Praseodymium (Pr) or collectively called “NdPr“. Commerce Resources Corp. with its Ashram REE Deposit in Québec has one of the best distributions of NdPr out of all of the REE projects globally, no matter what stage they are at – exploration, development or mining commercially; and this includes Lynas.

There is a scenario that exists whereby some investors have been scared off the REE market, because it’s dominated by China, which produces in excess of 80% of the world’s REEs. When REE prices started to “crash“ in 2011, the culprit was seen as being China – the big manipulator – who does not tolerate any competitors in the Western World, and simply flooded the market with cheap REEs to put out of business any emerging miners in the Western World such as Molycorp. However, this is far from reality and is another reason why the opportunity now is huge, because the market has been grossly misinterpreted.

In reality, China literally did nothing – meaning they simply stopped shipments of REEs to the world’s 2nd largest market for the REEs (Japan) – and following this stoppage the rest of the world overreacted and prices did go to the moon. (There may still be some who would argue this point because they inherently believe that China only looks to crush competition, but I would argue that this is not true in this instance).

The reality is, as I see it: China was incredibly uncomfortable when REE prices went ballistic because China feared what would come next (as it indeed did!): A worldwide drive to find substitutes for the “criminally and unashamedly high-priced REEs“. And so prices were basically left to free fall!

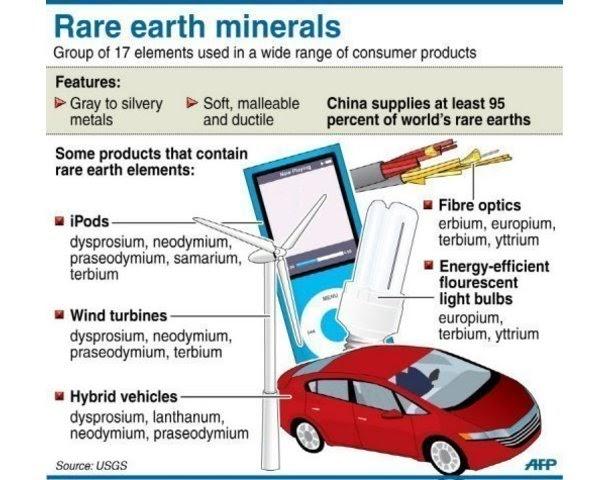

Some 5 years of global R&D later, that drive was finally concluded in late 2016, with no success for the magnet sector as it was universally agreed and concluded that (1) REEs are the only viable materials for permanent magnets and (2) there was no more reason to continue looking for substitutes because prices had reverted to where everyone was comfortable using as much REEs as they want now, and for the future.

Magnet Recipe

An additional extremely important point is that there was success in terms of altering the magnet recipe to significantly reduce the amount of Dysprosium (Dy) being used. While the REE permanent magnet was, and still is 100% REE, there was a signifcant reduction of this most expensive REE, championed by many and led by Siemens, but offsetting this reduction in Dy meant that there is then a concomitant increase in Neodymium (Nd) or Praseodymium (Pr). This is most significant for the REE projects whose economics were more based on Dy, the same projects that called themselves “Heavy REE projects” because the value of Dy has not appreciated the way that NdPr has. These projects ultimately saw the greatest negative effect on their economics, while those that had the balanced distribution, or were more enriched with the “Magnet Feed Material” saw a benefit from this new “recipe”.

Overall, it has yet to be seen (and eventually will be seen) that it was not China specifically manipulating prices, it was the rest of the world overreacting.

The fact that the falling prices then also made most non-Chinese REE projects uneconomic was just an added benefit, but clearly it was not the primary interest of China which essentially was to “rescue and resuscitate“ the REE market while at the same time increase their downstream manufacturing for the REEs – increasing their “value add“.

While the rest of the world was on that substitution drive, the Chinese were active on R&D for even more uses of the REEs, especially for cerium and lanthanum – and they have had some success in this venture.

Of greatest importance, over the same time period (late 2010 until now) the demand for REEs has steadily increased mostly due to the ascendancy of the “green revolution“ focusing on renewable sources of energy, primarily wind (which require REEs), and for the adoption of electric vehicles (which require REEs). This increase of demand came at the same time as the prices continued to revert – and while all REE juniors attempted to achieve positive metallurgy. In this regard, only a very few were successful.

Therefore, it is argued that the current and continuing increased demand for REEs, as well as the ongoing rising prices for the REEs, create a much greater opportunity for those projects that compare to Chinese REE deposits.

I believe that Commerce Resources‘ Ashram REE Deposit can compare to the Chinese REE mines for the simplest of reasons: The fact that the Ashram Project has the same geology and basic mineralogy as have the dominant Chinese REE projects.

The largest market for the REEs is also China and they are continuing to increase their imports of REE feedstock to satisfy their ever-growing downstream manufacturing industries.

China is continuing to be an importer because (1) they can buy foreign material for a similar cost, and they then (2) reduce their environmental impact on China, and (3) they stretch out their domestic resources. It is also a political move to gain influence over the rest of the world through direct investment.

At this year‘s REE Conference in Hong Kong, it was argued that China is much more interested in the value add coming from the manufacturing using REEs than simply being the breadbasket of feedstock for itself and the rest of the world. In this regard, it was opined by several presenters – but most compellingly by Ryan Castilloux of Adamas Intelligence – that China will likely, at some point in the future, become a net importer of REE feedstock! This was a controversial point but the upside to REE projects outside of China should not be overlooked. In terms of one of these projects, Commerce Resources‘ Ashram REE Deposit has a robust list of positives that may put it at the front of the class.

Bottom Line

REE prices are rising not because of market manipulation but because of (1) higher labour costs in China, (2) the Chinese Government actively shutting down polluting projects, and (3) the Chinese Government actively halting illegal mining. These same reasons are affecting all commodities that China produces, whether it is zirconium, antimony, fluorspar or REEs – and it only looks like these prices will continue to rise!

Let it also be stated clearly that the Chinese Government has, over the last 20 years, been successful with one of the largest social programs of all human history: They have taken hundreds of millions of their citizens from abject poverty and moved them into cities and into the middle class.

However, this social “hamster wheel“ is spinning faster and faster, and this burgeoning middle class has new needs that include clean air, clean water, food that is safe to eat, and perhaps most importantly higher wages.

Source: Matt Bohlsen in “A Look At The Rare Earths EV Magnet Metals And Their Miners“ on November 14, 2017

Exclusive Interview with Ryan Castilloux of Adamas Intelligence

In 2011, Ryan Castilloux (B.Sc., MBA) founded Adamas Intelligence, an independent research and advisory firm that helps to make informed decisions involving strategic metals and minerals sectors. Clients include exploration companies, investors, technology developers, government agencies and other advisory firms. Adamas Intelligence has offices in Sudbury, Canada, and Amsterdam, Netherlands. More information and sign-up to free newsletter: www.adamasintel.com

How long have you been observing this trend of declining exports and increasing imports of REE feedstock into China?

Since Lynas started production in Australia and Malaysia in 2013, the biggest importer of China’s rare earths, Japan, has gone from being 100% reliant on China’s supplies to less than 50% reliant today as end-users in Japan have increasingly been sourcing from Lynas instead. This has had a major impact on export numbers out of China.

Over the same period, China’s domestic rare earth demand has grown by around 7% annually while production in the nation has steadily declined due to a reduction in illegal rare earth mining – particularly in 2017 due to ongoing company inspections by government authorities.

This decrease in production, and simultaneous increase in demand, has resulted in China consuming more and more of its own production while exporting less. It has also resulted in China importing more and more rare earth feedstocks from abroad – particularly monazite – to keep up with rapidly growing internal demand for neodymium and praseodymium (the key input materials for high strength permanent magnets).

Which deposits would you suggest would be more attractive to the Chinese for sources of REE feedstock for the future?

I would expect the primary interest to be in deposits that are enriched in REEs that are used in high-strength NdFeB permanent magnets, such as neodymium, praseodymium, dysprosium, and terbium.

The magnets that are made from these REEs are used in a lot of high-demand-growth applications like EV motors, wind turbine generators, industrial robots, consumer electronics, and many, many others.

China is increasingly dominating the value chains and assembly lines that produce these components and integrate them into final products so we believe they will be keen to ensure they have the magnet input materials they need to keep their manufacturing lines churning.

China is openly encouraging domestic rare earth enterprises and investors to support development of overseas resources, and encouraging the import of monazite and other feedstocks as a measure to keep up with strong internal demand growth for neodymium and praseodymium.

Considering some of the projects that some Chinese companies are already working with, such as Greenland Minerals & Energy, Northern Minerals and Hastings Technology Metals, can you explain why you think that these companies and their projects have been successful with the Chinese?

The Kvanefjeld project in Greenland is an absolutely massive REE resource and comes with some value-adding co-products which is a plus.

The Browns Range and Yangibana projects in Australia are both being developed by companies with Chinese partners, shareholders, or affiliates, and the owners of these projects have fostered good relationships with potential buyers in China that have helped them pave a way towards production.

Does having a deal with a Chinese company make the western company less attractive to other countries and companies?

I don’t think so. At the end of the day, China is the largest demand market for rare earths globally and that demand level is growing at a faster rate than any other region. Moreover, the non-China world (with the exception of Japan) is lacking production capacity to transform rare earth feedstocks and rare earth oxides into metals, alloys, magnets, and other value-added products that global consumers want. So it makes sense that emerging producers in the west should expect to sell at least some of their output to buyers in China.

What correlation can you give for REE demand for the expected increase in EVs?

There will be a direct correlation between EV production growth and NdFeB permanent magnet demand growth; a correlation that will drive strong demand for Nd, Pr, Dy, and Tb used in those magnets.

As a rough guide, it’s fair to assume that the average battery electric vehicle (BEV) produced in the future will create demand for approximately 1 kg of Nd/Pr oxide and approximately 100 grams of Dy/Tb oxide just for the traction motor alone.

So when the global market reaches 20+ million BEVs per annum in the next decade, we will see global annual demand for Nd/Pr oxide increase by around 66% versus today, and global annual demand for Dy/Tb oxide by over 100% versus today, just from this one application alone.

Factor in strong demand growth for the same REEs in numerous other applications like industrial robots, wind turbines, elevator motors, mobile phones, tablets, laptops, and many others and the outlook is extremely bright.

In terms of overall demand for REEs, is this growing faster in China than outside China?

Absolutely. We estimate that TREO demand within China is growing at 6 to 10% annually depending on which specific REOs we are talking about whereas demand outside of China is growing slower – at about 4 to 6%.

Demand for a couple of the rare earths – namely europium and yttrium – is actually decreasing globally each year at present due to the ongoing replacement of fluorescent lamps with LED lamps worldwide.

Demand for Nd and Pr on the other hand is growing strongly in China, and modestly in Japan, and is expected to remain strong in the coming years due to strong demand growth for permanent magnets.

Demand for La is also growing quite strongly in the west – particularly in the U.S. – where it is used in substantial quantities each year in fuel cracking catalysts. We expect La demand for this application will remain strong in the coming years given that La helps refiners get more gasoline out of a barrel of crude oil versus diesel and other distillates. Following the recent diesel emissions scandal in Europe, and the consumer shift back towards gasoline that it evoked, we expect that refiners will be keen to maximize gasoline make to cater to the changing market.

Do you expect to see more magnet production coming from Japan or China to meet the growing demand?

Yes, most certainly. In China we expect to see more high-grade magnet production capacity coming on line in the next five years to cater to growing demand for high-grade NdFeB permanent magnets that can operate at elevated temperatures.

These grades of magnets (UH, SH, EH, etc.) are typically used in EV traction motors, wind turbine generators, industrial motors, and other applications involving high temperatures (> 160 C) and high demagnetization fields.

We also expect that Japan will build out some additional production capacity in the coming years to coincide with demand growth in the EV market and beyond.

Do you believe that there will be a return of magnet manufacturing in North America in the future?

I would like to think that within the next 10 years there is a reasonable possibility this could happen but it’s going to take a risk-embracing, forward-looking person or company to do it because the magnet industry is such a bird’s nest of patents and intellectual property, and feedstock outside of China is hard to come by – at least today. But U.S. businesses and industries could definitely benefit from domestic NdFeB supply, especially as domestic EV production increases.

What would need to happen to allow magnet manufacturing to return to North America?

Bottom line, we need a low-cost, reliable, sustainable source of REE supply, or several sources, to emerge outside of China.

Which REE projects do you see being good potential suppliers to a North American magnet maker?

Within North America there are two strong candidates – Commerce Resources in Quebec and a potential joint-venture between Medallion Resources and Rare Earth Salts.

For what reasons?

For Commerce, its Ashram rare earth project checks all the right boxes. Huge resource, ideal mineralogy, super low production cost targets, and a good mix of REEs in its basket – a mix that aligns well with the needs of the evolving demand market.

There’s also a number of unrealized upsides unfolding at the moment that could make Ashram even more attractive in the future.

For example, the company is looking at a new road development route that we believe could possibly spur the Quebec government to finance the road in its entirety taking a big chunk off the project’s development cost.

Additionally, the company has reported plans to produce a fluorspar concentrate by-product (along with an offtake MoU with Glencore) and we expect that this by-product credit will help slash production costs even lower in the upcoming PFS.

For Medallion, we like the company’s low-cost, low-risk business model. The company is focused on recovering REEs from existing monazite waste streams in North America. It is looking to procure monazite from numerous potential sources and upgrade the material into a mixed REE chemical concentrate.

Medallion has an agreement with emerging REO separation company Rare Earth Salts to then produce separated REOs from the chemical concentrate, which Rare Earth Salts will market to buyers globally and share profits with Medallion accordingly. In my view, this is just a business model that makes a lot of sense.

It’s also possible we could see supply from Mineria Activa in Chile feeding into the North American market in the coming years. The company is developing an extremely low-cost rare earth project called BioLantanidos that could be producing upwards of 1,500 tonnes of TREO per annum by 2020.

Do you believe that jurisdiction is a major consideration in terms of a REE project?

Absolutely, it can be a make-or-break factor. In the past couple of years we have seen government interventions with several notable projects in Europe and Africa that have created challenges and uncertainty for the companies developing them.

At the same time, we have seen some emerging success stories in Europe and Africa as well, so it can be a major challenge to predict which projects are likely to get clotheslined with red tape until it happens.

We tend to like stable, predictable jurisdictions with government stakeholders that recognize the importance of making informed, fact-based decisions, and so I also like companies with management teams that go the extra mile to engage and inform government counterparts and local residents. Greenland Minerals has been exceptional in that regard. So has Commerce Resources in Quebec. So has Mkango Resources in Malawi.

Do you find that metallurgy is a factor that is often overlooked by investors looking to educate themselves on the REE market?

Definitely. It’s no coincidence that the REE projects with the lowest operating cost projections tend to be those with simple REE host mineralogy dominated by monazite, bastnaesite, and/or xenotime. These minerals have a lengthy history of commercial production and are amenable to well-established low-cost processing routes.

A number of other minerals show potential for being low-cost sources of REEs as well – minerals like synchysite and steenstrupine – but some other minerals like eudialyte have proven challenging to work with.

Thanks for these valuable insights, Ryan.

Ryan Castilloux in “Made in China 2015 From Foreign Sources Of Rare Earth Supply - Who, When & Where“

Rockstone recorded Ryan Castilloux’s presentation at the Edelmetallmesse in Munich on November 3, 2017 (mentioning Commerce Resources Corp. at minute 13). Ryan‘s presentation can be accessed with the following link: www.adamasintel.com/Previews/Adamas_Intelligence__Munich_IPMCS_Q4_2017.pdf

Interview with Chris Grove from Commerce Resources

Björn Junker from Goldinvest.de interviewed Chris Grove at the Edelmetallmesse in November 2017:

“Rare earth magnets have gotten a lot of coverage in the EV press over the years for being expensive – especially back in 2011 when a supply disruption in China sent the prices up anywhere from fivefold for neodymium to 20-fold for dysprosium over the course of a few months – yet they are still a key component in the vast majority of traction motors found in EVs and hybrids.“ (Jeffrey Jenkins in “A Closer Look At Rare Earth Permanent Magnets“ on September 10, 2017)

Company Details

Commerce Resources Corp.

#1450 - 789 West Pender Street

Vancouver, BC, Canada V6C 1H2

Phone: +1 604 484 2700

Email: cgrove@commerceresources.com

www.commerceresources.com

Shares Issued & Outstanding: 309,569,908

Canadian Symbol: CCE

Current Price: $0.075 CAD (05/12/2017)

Market Capitalization: $23 Million CAD

German Symbol / WKN (Tradegate): D7H / A0J2Q3

Current Price: €0.051 EUR (05/12/2017)

Market Capitalization: €16 Million EUR

Previous Coverage

Report #24 “Commerce Resources and Ucore Rare Metals: The Beginning of a Beautiful Friendship?“

Report #23 “Edging China out of Rare Earth Dominance via Quebec‘s Ashram Rare Earth Deposit“

Report #22 “Security of REE Supply and an Unstoppable Paradigm Shift in the Western World“

Report #21 “Commerce well positioned for robust REE demand growth going forward“

Report #20 “Commerce records highest niobium mineralized sample to date at Miranna“

Report #19 “Carbonatites: The Cornerstones of the Rare Earth Space“

Report #18 “REE Boom 2.0 in the making?“

Report #17 “Quebec Government starts working with Commerce“

Report #16 “Glencore to trade with Commerce Resources“

Report #15 “First Come First Serve“

Report #14 “Q&A Session About My Most Recent Article Shedding Light onto the REE Playing Field“

Report #13 “Shedding Light onto the Rare Earth Playing Field“

Report #12 “Key Milestone Achieved from Ashram’s Pilot Plant Operations“

Report #11 “Rumble in the REE Jungle: Molycorp vs. Commerce Resources – The Mountain Pass Bubble and the Ashram Advantage“

Report #10 “Interview with Darren L. Smith and Chris Grove while the Graveyard of REE Projects Gets Crowded“

Report #9 “The REE Basket Price Deception & the Clarity of OPEX“

Report #8 “A Fundamental Economic Factor in the Rare Earth Space: ACID“

Report #7 “The Rare Earth Mine-to-Market Strategy & the Underlying Motives“

Report #6 “What Does the REE Market Urgently Need? (Besides Economic Sense)“

Report #5 “Putting in Last Pieces Brings Fortunate Surprises“

Report #4 “Ashram – The Next Battle in the REE Space between China & ROW?“

Report #3 “Rare Earth Deposits: A Simple Means of Comparative Evaluation“

Report #2 “Knocking Out Misleading Statements in the Rare Earth Space“

Report #1 “The Knock-Out Criteria for Rare Earth Element Deposits: Cutting the Wheat from the Chaff“

Disclaimer: Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist.