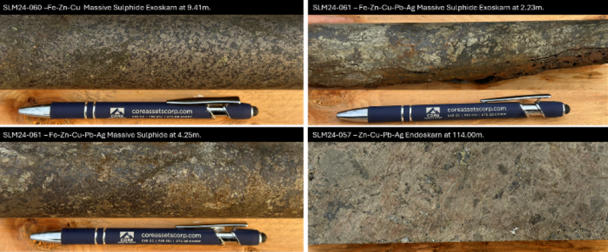

Full size / Photographs of mineralization intersected in holes SLM2-060 and -061 from the Whaleback Target and SLM24-057 from the Sulphide City Target. (Source: News-release on August 7, 2024)

Disseminated on behalf of Core Assets Corp. and Zimtu Capital Corp.

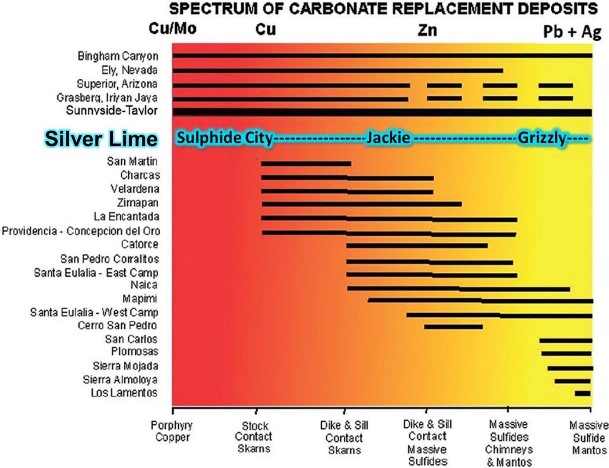

Today, Core Assets Corp. announced assay results from this year‘s drilling program at the Silver Lime Project in British Columbia‘s Atlin Mining District. A total of 11 holes, totalling 3,602m, were completed across a 2.7km mineralized trend, successfully extending the footprint of the Mo-Cu-Ag porphyry and Fe-Zn-Cu massive and semi-massive sulphide-skarn mineralization in and around the Sulphide City Target. These results set the bar for next year‘s drill program, anticipating some 120m-intercepts of massive sulphides from surface along with tapping into a fertile, well-mineralized porphyry at depth.

Although the market has yet to fully appreciate Core Assets‘ systematic exploration efforts over the past 2 drilling seasons, this year‘s drill results pave the way for a possible breakthrough in 2025: The announcement of wide intercepts of substantial skarn and porphyry mineralizations. Apparently, this is precisely what the market has been eagerly awaiting. Yet only few truly grasp the complexity of achieving such discoveries.

To drill wide intercepts of significant mineralization, numerous “scout” holes are typically required to map and understand the intricate pathways of mineralized systems beneath the surface. These initial exploratory holes serve as a critical foundation, revealing how the system behaves underground. Once this vital knowledge is acquired, drillers can strategically target the heart of the mineralized zones with precision, maximizing the potential for major discoveries and unlocking the project‘s full value.

Naturally, this process takes time, a resource that seems in short supply among many investors. Yet this very circumstance offers a lucrative advantage to those who understand the path to discovery.

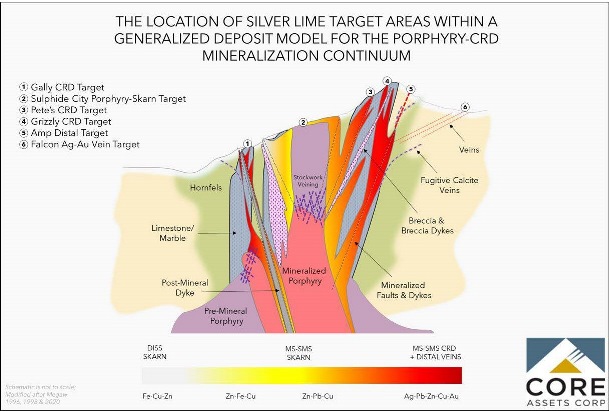

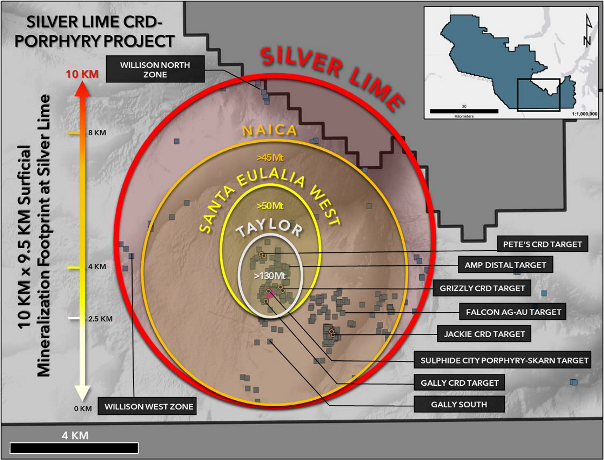

Full size / “The Silver Lime Project has an extremely large surficial expression of CRD mineralization, extending over an area of 10 km by 9.5 km. The current mineralized footprint is much larger than many of the world’s largest CRD deposits.“ (Source)

What Core Assets has accomplished in just 3 drill seasons is truly remarkable and warrants full attention, as the market is beginning to recognize the potential for major discoveries ahead and the value of its strategic and methodical exploration approach.

Some of the largest CRD deposits in the Americas were not discovered with the first few drill holes but only after dozens, if not hundreds, of strategically placed holes.

As shown in previous Rockstone reports, other major CRD deposits (typically high-grade, low-tonnage) in North and South America have few surface expressions and/or are located at greater depths, making it highly drill-intensive to locate favorable structures and to subsequently delineate ore zones. Oftentimes, the associated deeper-seated porphyry deposits (typically low-grade, high-tonnage) remain to be discovered, or are located too deep to warrant drilling at this time.

In contrast, the Silver Lime Project has abundant surface expressions of CRD and porphyry-skarn mineralizations, which were successfully confirmed with shallow holes over the last 3 drill seasons at numerous, wide-spread targets. The drill core reveals important clues for favorable host rocks and how the mineralized system runs beneath the surface.

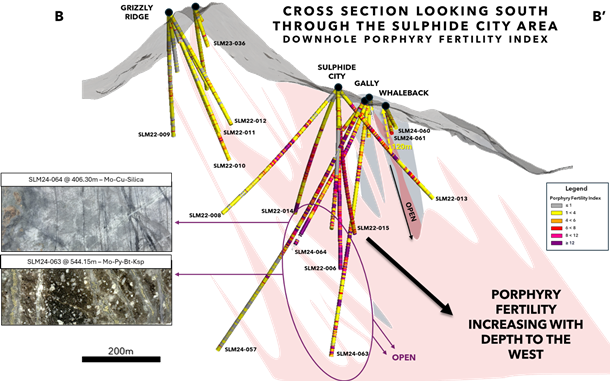

This year‘s drill program not only tested new targets (Whaleback, Pike Valley, and Pete’s North) but also the Sulphide City Target again – this time drilling deeper to look for indications of how a porphyry system may run at depth. Fortunately, highly significant assays were obtained from well-mineralized porphyry dykes which typically connect to much wider zones of porphyry mineralization. Most notably, the Mo-Cu grades increase with depth to the west.

Next year‘s drill season is now set to target long intercepts of porphyry mineralization, building on the valuable insights gained from this year’s drilling. On top of that, drilling at Whaleback not only confirmed the presence of high-grade skarn but, more strikingly, suggests that this impressive mineralization extends from the surface to a true depth of at least 120m, as evidenced by connecting the dots with data from the 2022 drill program.

Full size / Photograph of the continuous 11.8-metre interval of massive sulphide (sphalerite-pyrrhotite-pyrite+/-chalcopyrite-galena-rich) skarn mineralization in Sulphide City-Whaleback hole SLM24-061. (Source: News-release on August 7, 2024)

Click below player or here for a video synopsis of the 2024 drilling highlights and work completed to date at the Silver Lime Project featuring Core Assets’ Project Geologist Lauren Piccott:

Source: https://youtu.be/J6FMU6KAJOc?si=Sph5m-rhnX4akTt7

Click below player or here for a video discussion on today´s news featuring Core Assets’ President & CEO, Nick Rodway:

Source: https://youtu.be/kIcWBHSc4ew?si=VdNs9kTIrlbExu6o

On November 28 @ 10am PST, Core Assets’ Vice President of Exploration, Monica Barrington, is offering a live technical session where she will discuss the results of the 2024 drill program. Please send technical questions to info@coreassetscorp.com prior to the session. Link to live technical session: https://us02web.zoom.us/j/82377544148

Excerpts from today‘s news-release:

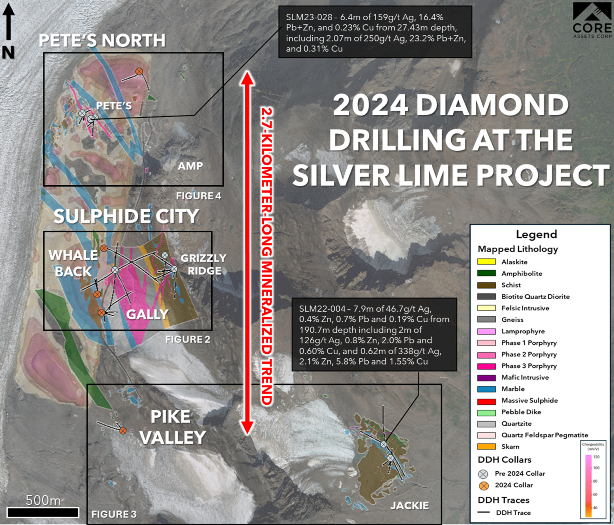

Full size / Figure 1: Plan view geology map showing pre-2024 and 2024 diamond drilling locations at the Silver Lime Project.

HIGHLIGHTS

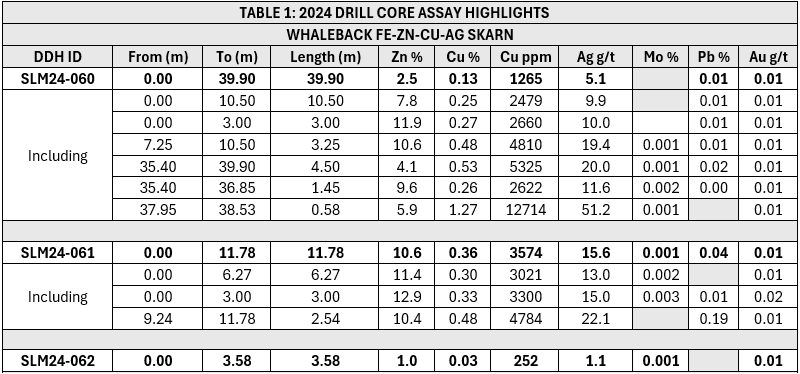

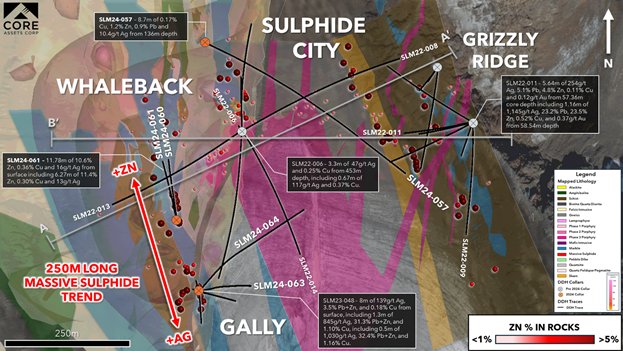

Three (3) drill holes were completed from one (1) pad at the Whaleback Fe-Zn-Cu Skarn Target in 2024 for a combined total of 304.15m (Figures 1 and 2; Table 1). All holes were oriented north-northwest and targeted the high-grade Fe-Zn-Cu massive sulphide skarn mineralization that was channel sampled at surface in 2021:

• SLM24-060 returned 10.5m of 7.8% Zn, 0.25% Cu and 10g/t Ag within 39.9m of 2.5% Zn, 0.13% Cu and 5.1g/t Ag.

• SLM24-061 returned 11.78m of 10.6% Zn, 0.36% Cu and 16g/t Ag from surface.

• Skarn mineralization at Whaleback forms a 250m long trend with high-grade Zn-Cu-Ag-Pb carbonate replacement mineralization exposed at surface at the Gally Target, where shallow drilling in 2023 intersected 8m of 139g/t Ag, 3.5% Pb+Zn and 0.18% Cu from surface, including 1.3m of 845g/t Ag, 31.3% Pb+Zn and 1.10% Cu. (Figure 2a).

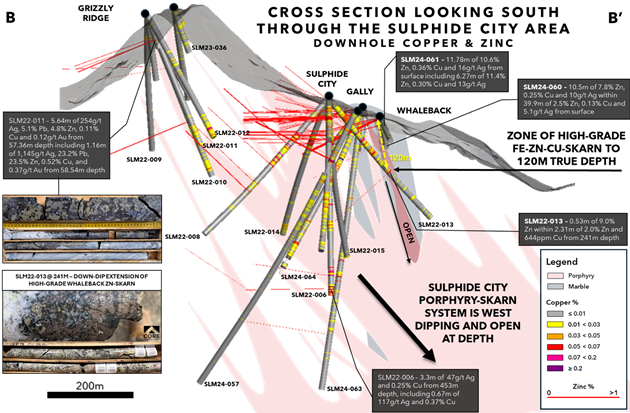

Drilling at Sulphide City in 2022 intersected the same mineralized marble horizon that hosts the mineralization at the Whaleback & Gally targets at a drilled depth of 241m in hole SLM22-013 (or 120m true depth). This intercept returned 0.53m of 9.0% Zn within 2.31m of 2.0% Zn and 644ppm Cu and indicates that high-grade Fe-Zn-(Cu) skarn mineralization extends from surface to a minimum true depth of 120m below the Whaleback Skarn (Figure 2b-d).

Full size / *Assay results are presented in this Table as uncut weighted averages. Interval widths represent drilled HQ or NQ core lengths and true width is unknown currently. NATIONAL INSTRUMENT 43-101 DISCLOSURE: Nicholas Rodway, P.Geo, (Licence# 46541) (Permit to Practice# 100359) is President, CEO and Director of the Company, and qualified person as defined by National Instrument 43-101- Standards of Disclosure for Mineral Projects. Mr. Rodway has reviewed and approved the technical content in this release.

Core Assets’ President & CEO Nick Rodway commented, “Our longest and highest-grade massive sulphide zinc intercepts were obtained during the 2024 drilling season. We’ve also successfully tapped quartz-sericite-pyrite zones and potassically altered porphyritic intrusions carrying Mo-Cu-Ag signatures at depth at Sulphide City. This impressive system remains open at depth and in multiple directions for exploration and is primed for additional discoveries. We look forward to presenting our surficial assay data in the coming weeks, as well as new structural interpretations for the Silver Lime Project.”

Full size / Figure 2a: Plan view geologic map of the Sulphide City Target area illustrating drill core assay highlights at the Sulphide City, Gally, Grizzly and Whaleback targets. Two cross-sections are indicated by the grey lines.

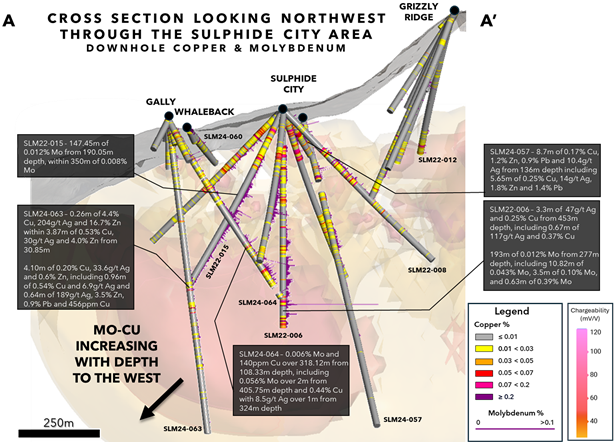

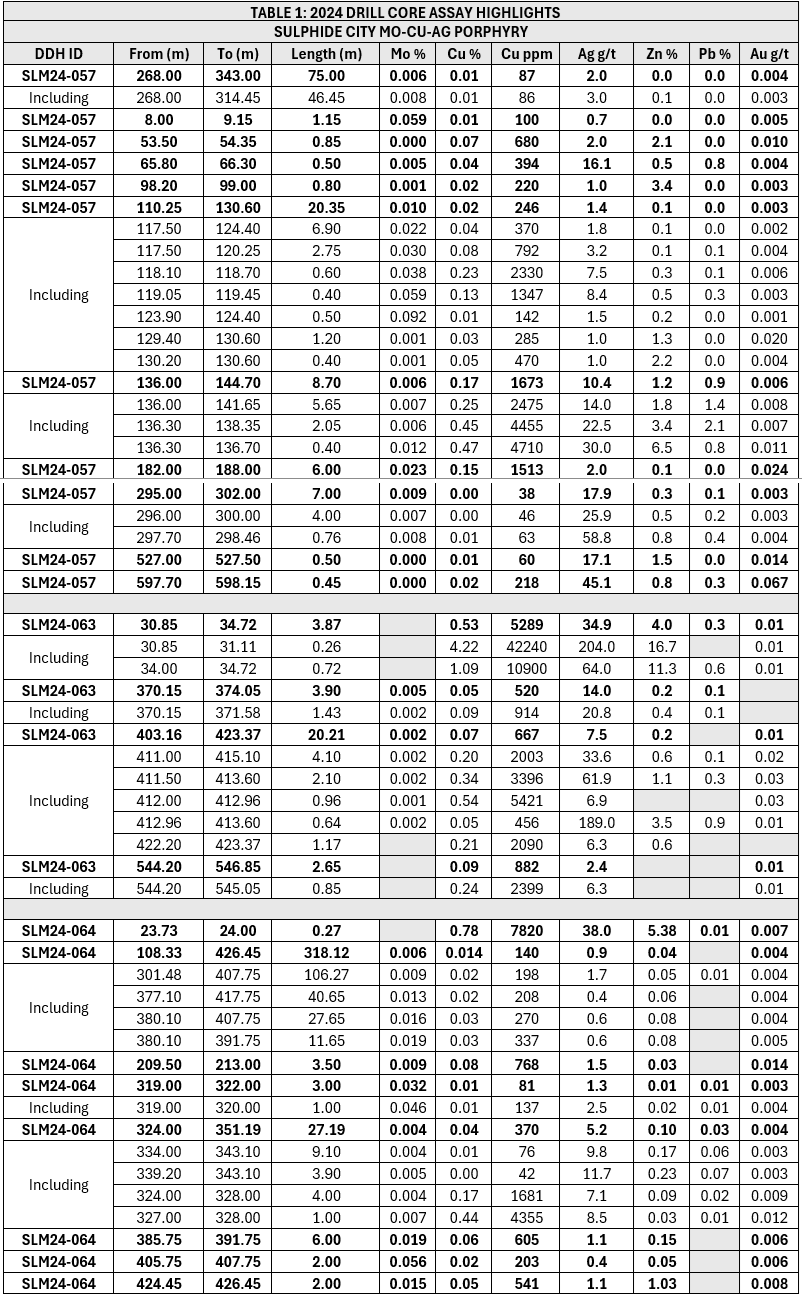

Three (3) of the deepest drill holes at the Silver Lime Project were completed at Sulphide City in 2024 for a combined total of 1,959.25m (Figures 1 and 2; Table 1). All holes successfully intersected impressive endo/exoskarn mineralization and the top of the mineralized porphyry system. The transition into the top of the porphyry system at Sulphide City is marked by drastic increases in porphyry-style veining (A, B, D veins), multiphase porphyritic dykes, and intense quartz-sericite-pyrite (QSP) alteration:

• SLM24-057 returned multiple mineralized intercepts including: 8.7m of 0.17% Cu, 1.2% Zn, 0.9% Pb and 10.4g/t Ag from 136m depth including 5.65m of 0.25% Cu, 14g/t Ag, 1.8% Zn and 1.4% Pb.

• SLM24-063 returned multiple upper massive and semi massive sulphide skarn intercepts including 0.26m of 4.4% Cu, 204g/t Ag and 16.7% Zn within 3.87m of 0.53% Cu, 30g/t Ag and 4.0% Zn from 30.85m depth; and

o A 4.10m zone of mixed contact Ag-Zn-Pb-Cu skarn and Cu-Ag bearing porphyry beginning at 411m returned 0.20% Cu, 33.6g/t Ag and 0.6% Zn which includes 0.96m of 0.54% Cu and 6.9g/t Ag and 0.64m of 189g/t Ag, 3.5% Zn, 0.9% Pb and 456ppm Cu.

• SLM24-064 intersected widespread Mo mineralization from 108.33m depth that graded 0.006% Mo and 140ppm Cu over 318.12m that contain zones of Mo and Cu-Ag porphyry mineralization running up to 0.056% Mo over 2m (from 405.75m depth) and 0.44% Cu with 8.5g/t Ag over 1m (from 324m depth). These porphyritic intrusions carry anomalous Cu with Mo and Ag to end of hole.

Drilling at Sulphide City in 2024 intersected widespread QSP altered zones and potassically altered porphyritic intrusions at depth in holes SLM24-063 and SLM24-064. These intrusions are associated with anomalous porphyry molybdenum-copper-silver mineralization and increasing porphyry fertility at depth (Figures 2b-d). Porphyritic dykes carrying anomalous and increasing copper and molybdenum grades with depth were intersected at Sulphide City. Oriented drilling and detailed structural mapping data obtained in 2024 suggests that the mineralizing system at Silver Lime is dipping westerly and that the surrounding high-grade Fe-Zn-Cu skarn mineralization shows continuity along strike and to depths >100m (Figures 2b-d).

Full size / Figure 2b: Cross Section view looking northwest through the Sulphide City Target. Drill core assays for Copper and Molybdenum are illustrated downhole.

Full size / Figure 2c: Cross Section view looking south through the Sulphide City Target. Drill core assays for Copper and Zinc are illustrated downhole.

Full size / Figure 2d: Cross Section view looking south through the Sulphide City Target. Porphyry Fertility plotted downhole based on the Modified Porphyry Index Calculation (Halley, 2005).

Oriented drill core and detailed structural mapping data obtained during the 2023 and 2024 seasons indicate that the mineralizing porphyry system at Sulphide City is west dipping and crosscuts steeply dipping, folded stratigraphy. This new data has increased our confidence for targeting deeper porphyry copper mineralization at the Sulphide City Target and will aid in delineating high-grade massive sulphide trends hosted in additional receptive marble horizons across the Project.

Full size / *Assay results are presented in this Table as uncut weighted averages. Interval widths represent drilled HQ or NQ core lengths and true width is unknown currently.

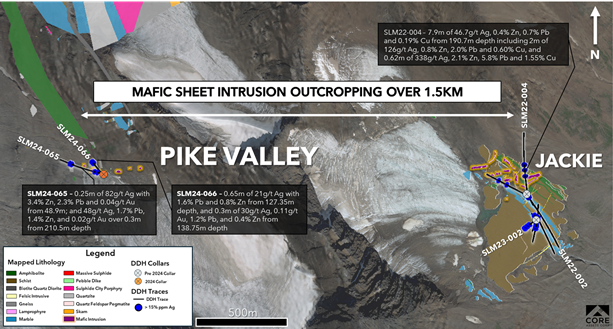

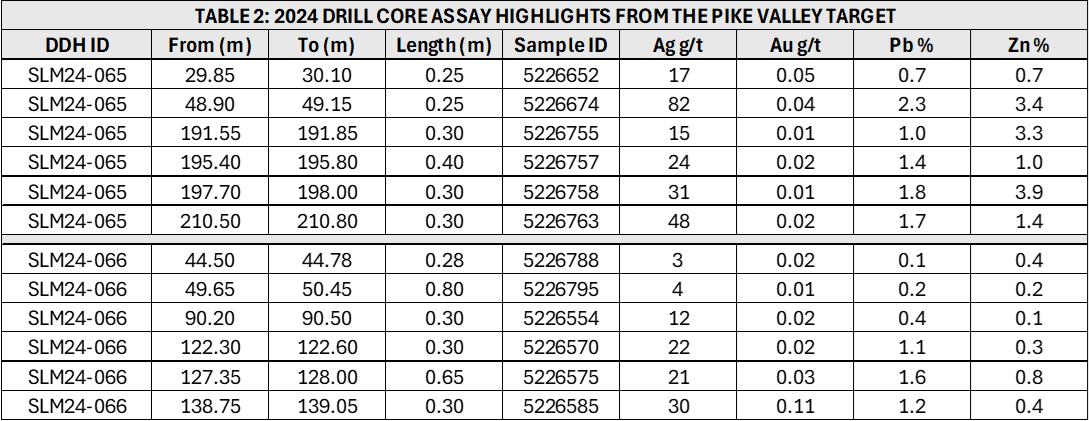

Preliminary exploratory drilling at the Pike Valley Target (discovered in 2023) was designed to test the downdip extension and grade potential of quartz-carbonate-Ag-Zn-Pb-Au veins that are exposed at surface. Two (2) shallow drill holes totalling 420.95m were completed from one (1) drill pad and selectively sampled (Table 3; Figure 3). Both holes intersected quartz-carbonate sulphide veining over narrow widths and with low-to-moderate Ag-Pb-Zn-Au grades. Overall, grade appears to increase to the west and with depth:

• SLM24-065 returned 0.25m of 82g/t Ag with 3.4% Zn, 2.3% Pb and 0.04g/t Au from 48.9m depth, and 48g/t Ag, 1.7% Pb, 1.4% Zn, and 0.02g/t Au over 0.3m from 210.5m depth.

• SLM24-066 returned 0.65m of 21g/t Ag with 1.6% Pb and 0.8% Zn from 127.35m depth, and 0.3m of 30g/t Ag, 0.11g/t Au, 1.2% Pb, and 0.4% Zn from 138.75m depth.

Full size / Figure 3: Plan view map of the Pike Valley and Jackie Targets illustrating drill core assay highlights for 2024 and 2022 in both areas related to a newly identified mafic sheet intrusion that host’s widespread epithermal base metal veins.

High sulphidation veining at Pike Valley is hosted in numerous stratigraphic units, as well as a recently mapped mafic sheet intrusion. It intermittently outcrops for 1.5km along strike between Pike Valley and the Jackie Target where it hosts coarse grained quartz-galena-pyrite veins.

This mafic sheet intrusion was intersected in drill core at Jackie in 2022 and returned 7.9m of 46.7g/t Ag, 0.4% Zn, 0.7% Pb and 0.19% Cu from 190.7m depth including 2m of 126g/t Ag, 0.8% Zn, 2.0% Pb and 0.60% Cu, and 0.62m of 338g/t Ag, 2.1% Zn, 5.8% Pb and 1.55% Cu. It is geochemically distinct from the Sulphide City Porphyry and responsible for at least one generation of massive sulphide Fe-Zn-Cu-Ag-Pb skarn mineralization at Jackie.

Full size / *Assay results are presented in this Table as uncut weighted averages. Interval widths represent drilled HQ or NQ core lengths and true width is unknown currently.

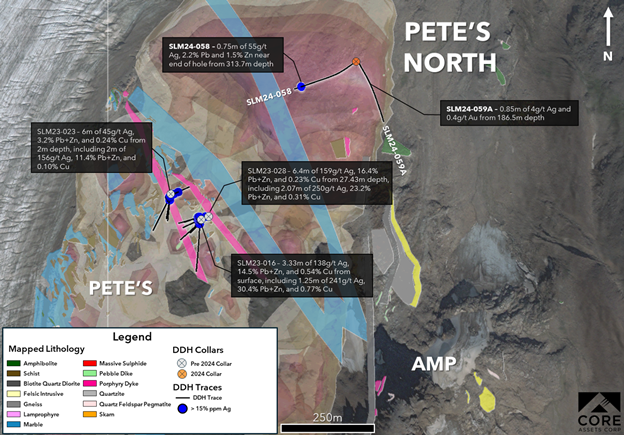

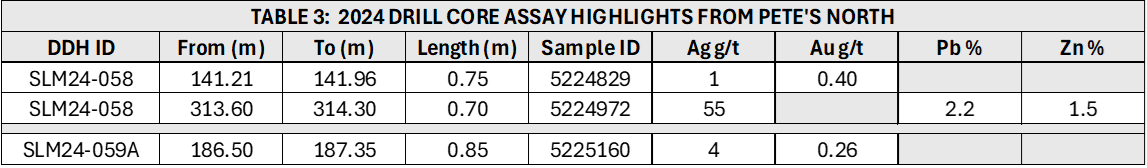

Drilling at Pete’s North was designed to test the mineralization potential of an ultra-high chargeability anomaly (120mV/V) that extends from surface to >400m depth. In 2024, a series of sheeted sulphide veins and veinlets within zones of intense pyritization and silicification, and altered porphyritic dykes were observed at surface above the chargeability anomaly. Three (3) drill holes totalling 918m were completed from one (1) pad in 2024 (Table 4; Figure 4):

• SLM24-058 returned 0.75m of 55g/t Ag, 2.2% Pb and 1.5% Zn near end of hole from 313.7m depth.

• SLM24-059A returned 0.85m of 4g/t Ag and 0.4g/t Au from 186.5m depth.

Hole SLM24-059 failed in a fault zone at 9m depth and was not sampled. The following hole was steepened (SLM24-059A) to cut through the fault. An increase in Ag-Zn-Pb grade was obtained near the bottom of hole SLM24-058 in a silicified zone carrying thin sulphide veinlets like those targeted from surface, indicating that overall grade may increase to the west and with depth. Multiple porphyry dykes were intersected at Pete’s North and are geochemically related to the Sulphide City Porphyry System.

Full size / Figure 4: Plan view map of the Pete’s and Pete’s North targets illustrating drill core assay highlights for 2024 and 2023 in both areas.

Full size / *Assay results are presented in this Table as uncut weighted averages. Interval widths represent drilled HQ or NQ core lengths and true width is unknown currently.

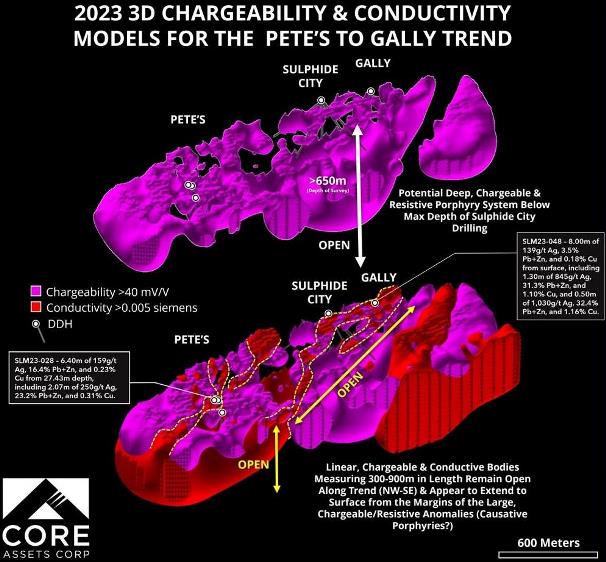

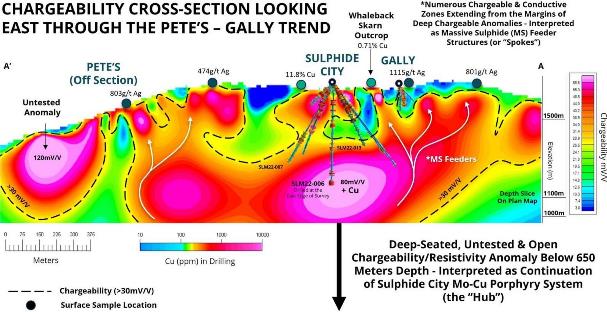

The 2023-figure below shows the overlay of conductivity over chargeability and is strong evidence for the existence of a large and continuous massive sulphide CRD system.

Full size / Chargeability = The ability of a porous rock to hold an electric charge – used to target porphyry mineralization (lower grade, higher tonnage)

Conductivity = The ability of a rock to conduct an electric current – used to target CRD mineralization or massive sulphide (higher grade, lower tonnage) (Source)

• The chargeability and conductivity model clearly outlines the potential for continuous massive sulphide (red in the figure) extending from depth directly to surface. More importantly, the survey illustrates that the massive sulphide could get more extensive at depth.

• Drilling from the last 2 seasons has proved that the CRD mineralization is extremely high-grade (over 1,000g/t silver) and continues at depth.

The 3D-DCIP survey (figure below) identified 2 large and significant deep-seated porphyry targets.

• Copper mineralization is increasing at depth as evidenced by SLM22-006 which intersected the top of the chargeability anomaly and returned 0.67m of 2.5% CuEq1 at the end of the hole.

• The anomalies remain open for exploration at depth and in multiple directions.

Full size / 1 Assay results are presented as uncut weighted averages and assume 100% metal recovery. Copper equivalent (CuEq) grades are calculated using metal prices of silver $21.25 USD/oz., gold $1,850 USD/oz, copper $4 USD/lb, lead $1 USD/lb, molybdenum at $30 USD/lb, and zinc $1.4 USD/lb. See also news-release dated March 29, 2023 (Source)

Full size / Silver Lime displays characteristics that match up to some of the largest porphyry-CRD systems globally, covering the full mineralization evolution spectrum from Cu-Mo Porphyry through to Ag-Pb Carbonate Replacement Mineralization. (Source)

Previous Coverage

Report #10: “Drill results confirm major new discoveries of CRD, porphyry and skarn at the Blue Property in British Columbia“ (Web / PDF)

Report #9: “Core Assets drills ultra-high-grade silver, zinc and lead at Silver Lime: 3,019 g⁄t silver equivalent at Grizzly and 982 g⁄t silver equivalent at Jackie“ (Web / PDF)

Report #8: “Drills are turning at Laverdiere (the find of the 1970s) followed by Silver Lime (the find of the 2020s?)“ (Web / PDF)

Report #7: “With a portable core drill, Nick tested some discovery outcrops“ (Web / PDF)

Report #6: “Exceeding expectations with high grades of silver, copper, zinc, lead, and gold from sampling at the Blue Property in northern British Columbia“ (Web / PDF)

Report #5: “Retreating ice uncovers major discovery potential for CRD-Porphyry system at district-scale Blue Property, BC“ (Web Version / PDF)

Report #4: “The Silver-Copper Super-Cycle“ (Web / PDF)

Report 3: “The Llewelyn Fault Zone: A district-scale plumbing system analog to other prolific mining and exploration camps in the Golden Triangle?“ (Web / PDF)

Report 2: “On a Mission to Become the Premier Copper-Gold Porphyry Explorer of the Northernmost Extent of the Golden Triangle“ (Web / PDF)

Report 1: “Perfect Time to Reshape the Golden Triangle in British Columbia“ (Web / PDF)

Company Details

Core Assets Corp.

Suite 1450 – 789 West Pender Street

Vancouver, BC, V6C 1H2 Canada

Phone: +1 604 681 1568

Email: info@coreassetscorp.com

www.coreassetscorp.com

Incorporation Date: April 20, 2016

Listing Date: July 27, 2020

CUSIP: 21871U05 / ISIN: CA21871U1057

Shares Issued & Outstanding: 127,105,689

Canadian Symbol (CSE): CC

Current Price: $0.06 CAD (11/18/2024)

Market Capitalization: $8 Million CAD

German Symbol / WKN: 5RJ / A2QCCU

Current Price: €0.044 (11/18/2024)

Market Capitalization: €6 Million EUR

Contact:

www.rockstone-research.com

Core Assets News-Disclaimer: Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release. FORWARD LOOKING STATEMENTS: Statements in this document which are not purely historical are forward-looking statements, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. Forward looking statements in this news release include, but are not limited to, expectations regarding the pending core assays, including speculative inferences about potential copper, molybdenum, gold, silver, zinc, and lead grades based on preliminary visual observations from results of diamond drilling at the Silver Lime Project and the Laverdiere Project, as applicable; the Company’s plans to further investigate the geometry and extent of the skarn and carbonate replacement type mineralization continuum at the Silver Lime Project through additional field work and diamond drilling and any planned or proposed program related thereto; and any other general statement regarding the Company’s planned or future exploration efforts at the Blue Property. It is important to note that the Company´s actual business outcomes and exploration results could differ materially from those in such forward-looking statements. Risks and uncertainties include that expectations regarding pending core assays based on preliminary visual observations from diamond drilling results at the Silver Lime Project and the Laverdiere Project, as applicable, may be found to be inaccurate; that results may indicate further exploration efforts at the Silver Lime Project and the Laverdiere Project, as applicable, as not warranted; that the Company may be unable to implement its plans to further explore at the Silver Lime Project and the Laverdiere Project, as applicable; that certain exploration methods, including the Company’s proposed exploration model for the Blue Property, may be ineffective or inadequate in the circumstances; that economic, competitive, governmental, geopolitical, environmental and technological factors may affect the Company´s operations, markets, products and prices; our specific plans and timing drilling, field work and other plans may change; that the Company may not have access to or be able to develop any minerals because of cost factors, type of terrain, or availability of equipment and technology; and we may also not raise sufficient funds to carry out or complete our plans. The ongoing COVID-19 pandemic, labour shortages, inflationary pressures, rising interest rates, the global financial climate and the conflict in Ukraine and surrounding regions are some additional factors that are affecting current economic conditions and increasing economic uncertainty, which may impact the Company’s operating performance, financial position, and prospects. Collectively, the potential impacts of this economic environment pose risks that are currently indescribable and immeasurable. No assurance can be given that any of the events anticipated by the forward-looking statements will occur or, if they do occur, what benefits the Company will obtain from them. Readers are cautioned that forward-looking statements are not guarantees of future performance or events and, accordingly, are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty of such statements. Additional risk factors are discussed in the section entitled “Risk Factors” in the Company´s Management Discussion and Analysis for its recently completed fiscal period, which is available under the Company´s SEDAR profile at www.sedar.com. Except as required by law, the Company will not update or revise these forward-looking statements after the date of this document or to revise them to reflect the occurrence of future unanticipated events.

Rockstone Disclaimer: This report contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Core Assets Corp. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to Core Assets Corp.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through its profile on SEDAR at www.sedarplus.ca. Please read the full disclaimer within the full research report as a PDF (here or below) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, holds an equity position in Core Assets Corp., as well as in Zimtu Capital Corp., and is being paid by Zimtu Capital Corp. for the preparation, publication and distribution of this report, whereas Zimtu Capital Corp. also holds a long position in Core Assets Corp. Both the author and Zimtu Capital Corp. will benefit from volume and price appreciation of Core Assets´ stock price. Note that Core Assets Corp. pays Zimtu Capital Corp. to provide this report and other investor awareness services. Core Assets Corp. has one or more common directors with Zimtu Capital Corp.

Disclaimer and Information on Forward Looking Statements: Core Assets’ News-Disclaimer on November 19, 2024: “Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release. FORWARD LOOKING STATEMENTS: Statements in this document which are not purely historical are forward-looking statements, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. Forward looking statements in this news release include, but are not limited to, expectations regarding the pending core assays, including speculative inferences about potential copper, molybdenum, gold, silver, zinc, and lead grades based on preliminary visual observations from results of diamond drilling at the Silver Lime Project and the Laverdiere Project, as applicable; the Company’s plans to further investigate the geometry and extent of the skarn and carbonate replacement type mineralization continuum at the Silver Lime Project through additional field work and diamond drilling and any planned or proposed program related thereto; and any other general statement regarding the Company’s planned or future exploration efforts at the Blue Property. It is important to note that the Company´s actual business outcomes and exploration results could differ materially from those in such forward-looking statements. Risks and uncertainties include that expectations regarding pending core assays based on preliminary visual observations from diamond drilling results at the Silver Lime Project and the Laverdiere Project, as applicable, may be found to be inaccurate; that results may indicate further exploration efforts at the Silver Lime Project and the Laverdiere Project, as applicable, as not warranted; that the Company may be unable to implement its plans to further explore at the Silver Lime Project and the Laverdiere Project, as applicable; that certain exploration methods, including the Company’s proposed exploration model for the Blue Property, may be ineffective or inadequate in the circumstances; that economic, competitive, governmental, geopolitical, environmental and technological factors may affect the Company´s operations, markets, products and prices; our specific plans and timing drilling, field work and other plans may change; that the Company may not have access to or be able to develop any minerals because of cost factors, type of terrain, or availability of equipment and technology; and we may also not raise sufficient funds to carry out or complete our plans. The ongoing COVID-19 pandemic, labour shortages, inflationary pressures, rising interest rates, the global financial climate and the conflict in Ukraine and surrounding regions are some additional factors that are affecting current economic conditions and increasing economic uncertainty, which may impact the Company’s operating performance, financial position, and prospects. Collectively, the potential impacts of this economic environment pose risks that are currently indescribable and immeasurable. No assurance can be given that any of the events anticipated by the forward-looking statements will occur or, if they do occur, what benefits the Company will obtain from them. Readers are cautioned that forward-looking statements are not guarantees of future performance or events and, accordingly, are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty of such statements. Additional risk factors are discussed in the section entitled “Risk Factors” in the Company´s Management Discussion and Analysis for its recently completed fiscal period, which is available under the Company´s SEDAR profile at www.sedar.com. Except as required by law, the Company will not update or revise these forward-looking statements after the date of this document or to revise them to reflect the occurrence of future unanticipated events.” All statements in this report, other than statements of historical fact, should be considered forward-looking statements. Statements in this report that are forward looking include that these results set the bar for next year‘s drill program, anticipating some 120m-intercepts of massive sulphides from surface along with tapping into a fertile, well-mineralized porphyry at depth; that although the market has yet to fully appreciate Core Assets‘ systematic exploration efforts over the past 2 drilling seasons, this year‘s drill results pave the way for a possible breakthrough in 2025: The announcement of wide intercepts of substantial skarn and porphyry mineralizations; that apparently, this is precisely what the market has been eagerly awaiting; that once this vital knowledge is acquired, drillers can strategically target the heart of the mineralized zones with precision, maximizing the potential for major discoveries and unlocking the project‘s full value; that this very circumstance offers a lucrative advantage to those who understand the path to discovery; that the market is beginning to recognize the potential for major discoveries ahead and the value of its strategic and methodical exploration approach; that highly significant assays were obtained from well-mineralized porphyry dykes which typically connect to much wider zones of porphyry mineralization; that Mo-Cu grades increase with depth to the west; that next year‘s drill season is now set to target long intercepts of porphyry mineralization, building on the valuable insights gained from this year’s drilling; that drilling at Whaleback not only confirmed the presence of high-grade skarn but, more strikingly, suggests that this impressive mineralization extends from the surface to a true depth of at least 120m, as evidenced by connecting the dots with data from the 2022 drill program; that this intercept returned 0.53m of 9.0% Zn within 2.31m of 2.0% Zn and 644ppm Cu and indicates that high-grade Fe-Zn-(Cu) skarn mineralization extends from surface to a minimum true depth of 120m below the Whaleback Skarn; that this impressive system remains open at depth and in multiple directions for exploration and is primed for additional discoveries; that we look forward to presenting our surficial assay data in the coming weeks, as well as new structural interpretations for the Silver Lime Project; that these intrusions are associated with anomalous porphyry molybdenum-copper-silver mineralization and increasing porphyry fertility at depth; that oriented drilling and detailed structural mapping data obtained in 2024 suggests that the mineralizing system at Silver Lime is dipping westerly and that the surrounding high-grade Fe-Zn-Cu skarn mineralization shows continuity along strike and to depths >100m; that oriented drill core and detailed structural mapping data obtained during the 2023 and 2024 seasons indicate that the mineralizing porphyry system at Sulphide City is west dipping and crosscuts steeply dipping, folded stratigraphy; that this new data has increased our confidence for targeting deeper porphyry copper mineralization at the Sulphide City Target and will aid in delineating high-grade massive sulphide trends hosted in additional receptive marble horizons across the Project; that grade appears to increase to the west and with depth; that the 2023-figure is strong evidence for the existence of a large and continuous massive sulphide CRD system; that the survey illustrates that the massive sulphide could get more extensive at depth. Such forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. It is important to note that Core‘s actual business outcomes and exploration results could differ materially from those in such forward-looking statements. Risks and uncertainties include that further permits may not be granted timely or at all; the mineral claims may prove to be unworthy of further expenditure; there may not be an economic mineral resource; certain exploration methods that were thought would be effective may not prove to be in practice or on the claims; economic, competitive, governmental, geopolitical, environmental and technological factors may affect Core‘s operations, markets, products and prices; Core‘s specific plans and timing drilling, field work and other plans may change; Core may not have access to or be able to develop any minerals because of cost factors, type of terrain, or availability of equipment and technology; and Core may also not raise sufficient funds to carry out or complete its plans. Additional risk factors are discussed in the section entitled “Risk Factors“ in Core‘s Management Discussion and Analysis which is available under Core‘s SEDAR profile at www.sedarplus.ca. Further risks that could change or prevent these statements from coming to fruition include that Core and/or its partner will not find adequate financing to proceed with its plans; that management members, directors or partners will leave the company; that the option agreement to acquire the Blue Property will not be completed and that the property returns back to the vendors; that Core will not fulfill its contractual obligations; there may be no or little geological or mineralization similarities between the Blue Property and other properties in BC‘s Golden Triangle or elsewhere; that uneconomic mineralization will be encountered with sampling or drilling; that the targeted prospects can not be reached; that exploration programs, such as mapping, sampling or drilling will not be completed; that uneconomic mineralization will be encountered with drilling, if any at all; changing costs for exploration and other matters; increased capital costs; interpretations based on current data that may change with more detailed information; potential process methods and mineral recoveries assumption based on limited test work and by comparison to what are considered analogous deposits may prove with further test work not to be comparable; mineralization may be much less than anticipated or targeted; intended methods and planned procedures may not be feasible because of cost or other reasons; the availability of labour, equipment and markets for the products produced; world and local prices for metals and minerals; that advisory terms may be changed or no positive results from the advisory are reached; and even if there are considerable resources and assets on any of the mentioned companies‘ properties or on those under control of Core, these may not be minable or operational profitably; the mineral claims may prove to be unworthy of further expenditure; there may not be an economic mineral resource; methods we thought would be effective may not prove to be in practice or on our claims; economic, competitive, governmental, environmental and technological factors may affect the Core‘s operations, markets, products and prices; our specific plans and timing of them may change; Core may not have access to or be able to develop any minerals because of cost factors, type of terrain, or availability of equipment and technology; and Core may also not raise sufficient funds to carry out our plans. The writer assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law. Cautionary notes: Stated references of other companies or projects are not necessarily indicative of the potential of Core Assets Corp. and its Silver Lime Project (Blue Property) and should not be understood or interpreted to mean that similar results will be obtained from Core Assets Corp. and its the Blue Property. Results of stated past producers, active mines, exploration and development projects elsewhere are not necessarily indicative of the potential of the Blue Property and should not be understood or interpreted to mean that similar results will be obtained from the Blue Property. The historical information on the Blue Property is relevant only as an indication that some mineralization occurs on the Blue Property, and no resources, reserve or estimate is inferred. A qualified person has not done sufficient work to classify the historical information as current mineral resources or mineral reserves; and neither Rockstone nor Core Assets Corp. is treating the historical information as current mineral resources or mineral reserves.

Disclosure of Interest and Advisory Cautions: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Rockstone, its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including Rockstone’s report, especially if the investment involves a small, thinly-traded company that isn’t well known. The author of this report, Stephan Bogner, is not a registered financial advisor and is paid by Zimtu Capital Corp. (“Zimtu”), a TSX Venture Exchange listed investment company. Part of the author’s responsibilities at Zimtu is to research and report on companies in which Zimtu has an investment or is being paid to conduct shareholder communications. So while the author of this report may not be paid directly by Core Assets Corp. (“Core”), the author’s employer Zimtu is being paid and will benefit from appreciation of Core’s stock price. The author also owns equity of Core, as well as of Zimtu Capital Corp., and thus would also benefit from volume and price appreciation of its stocks. Core pays Zimtu to provide this report and other investor awareness services. As per news on October 6, 2021: “Zimtu Capital Corp. announces it has signed an agreement with Core Assets Corp. to provide its ZimtuADVANTAGE program. Zimtu shall receive $12,500 per month for a period of 12 months.” Core has one or more common directors with Zimtu. Overall, multiple conflicts of interests exist. Therefore, the information provided should not be construed as a financial analysis but as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable but may not be. Rockstone and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned will perform as expected, and any comparisons made to other companies may not be valid or come into effect. Please read the entire Disclaimer carefully. If you do not agree to all of the Disclaimer, do not access this website or any of its pages including this report in form of a PDF. By using this website and/or report, and whether or not you actually read the Disclaimer, you are deemed to have accepted it. Information provided is for entertainment and general in nature. Data, tables, figures and pictures, if not labeled or hyperlinked otherwise, have been obtained from Core Assets Corp., Tradingview, Stockwatch, and the public domain.