Full size / Left: Nick Rodway on top of a discovery outcrop in ice-free parts of the Blue Property never seen before. Right: Nick taking small-diameter core samples with a Shaw backpack drill.

Disseminated on behalf of Core Assets Corp. and Zimtu Capital Corp.

In 1993, the Newfoundlanders Albert Chislett and Chris Verbiski chipped samples from an iron-stained rock outcrop in the hostile remoteness of northern Labrador. “Within fifteen minutes of standing on the outcrop they realised that they had made a potentially significant mineral discovery,“ the University of Waterloo recalls in the article “The Cu-Ni-Co deposit at Voisey‘s Bay, Labrador“ (1996).

Almost 30 years later, such out-of-the-blue discoveries of large scale have become exceedingly rare as even the remotest lands might have been walked by prospectors by now.

Last year, Newfoundlander Nick Rodway, in his role as Professional Geologist and Director of Core Assets Corp., took a hike across the company‘s Blue Property in northern BC and stumbled upon some rusty outcrops. He chipped off samples, loaded his backpack and returned to civilization, where the rocks were analyzed for its metal content at an independent lab. The results came in late November, when Rockstone last reported, showing up to 9.92% copper, 2,020 g/t silver, 6.75 g/t gold, >30% zinc and >20% lead.

Since then, Nick has become President and CEO of the company, and by the way constantly increasing his stake (currently at >5.2 million shares) as largest shareholder after Zimtu Capital Corp. (8.5 million shares). The stock last traded at 53 cents as new investors like Crescat Capital Corp. are betting that this summer‘s maiden drill program may prove as making history all over again.

Excerpts from Core Assets‘ news today:

Core Assets Reports Handheld Backpack Drilling Results Confirming Continuous Mineralization from Surface in all Holes at the Blue Property

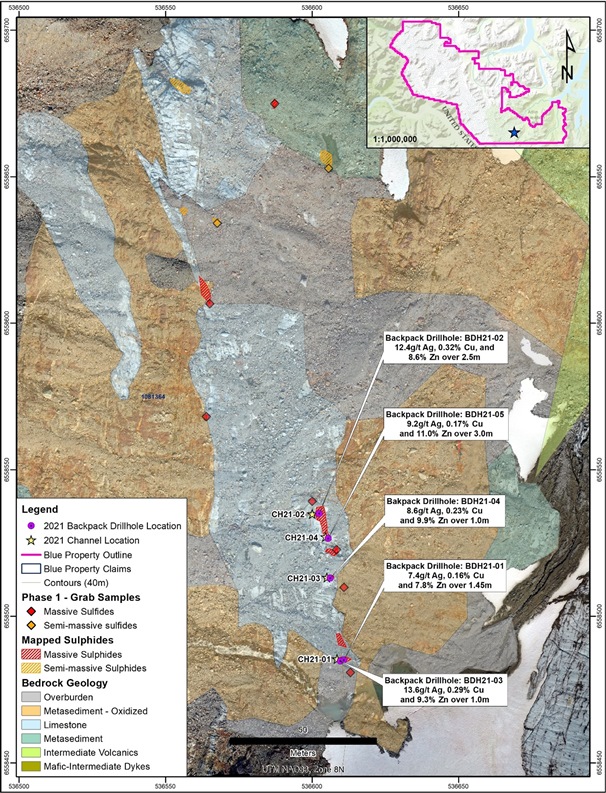

Vancouver, March 14, 2022 – Core Assets Corp., (“Core Assets” or the “Company”) (CSE:CC) (FSE:5RJ) (OTC.QB:CCOOF) is pleased to announce results from six backpack (25mm diameter) drill holes completed during 2021 Phase 2 exploration efforts at the Sulphide City (Whaleback) and Jackie targets on the Company’s Blue Property (the “Property”), located in the Atlin Mining District of British Columbia.

Highlights

• The 2021 backpack drilling campaign at the Blue Property was designed to test the extent of exposed massive-to-semi massive sulphide mineralization. Six, 25mm diameter drill holes were collared with a Shaw handheld backpack drill (max depth limitation of 3m; Figure 4b) within zones of skarn (Sulphide City – Whaleback) or carbonate replacement mineralization (CRM; Jackie Target) that were originally tested by channel sampling during the Phase 2 exploration program.

• All drill core samples submitted (1m to 3m intervals) assayed >7g/t Ag, >0.16% Cu, and >7% Zn and all holes intercepted medium-to-coarse grained, calc silicate-hosted, semi-massive sulphide or massive CRM over their entire lengths and ended in mineralization, indicating that these occurrences exhibit grade consistency and continuity over shallow depths as well as along surface (Table 1).

• BDH21-02 targeted semi-massive skarn mineralization previously tested in CH21-02 (Figure 2) and returned 12.41g/t Ag, 0.32% Cu, and 8.56% Zn over 2.5m; including 1.05m of 18.5g/t Ag, 0.46% Cu, and 10.15% Zn.

• BDH21-03 intercepted 1m of skarn mineralization grading 13.6g/t Ag, 0.29% Cu, and 9.35% Zn (Figure 2).

• BDH21-05 targeted calc-silicate hosted semi-massive skarn mineralization and assayed 9.2g/t Ag, 0.17% Cu, and 11% Zn over 3m (Figure 2).

• One backpack drill hole, collared to test CRM at the Jackie Target (CH21-11), intercepted 3m of soft, massive Galena (PbS – hardness of 2.75) with lesser sphalerite (ZnS), pyrite, and pyrrhotite (75% visual mineralization), and was unrecoverable (Figure 3). Recovery will be improved using large diameter core size during 2022 drilling program. Samples collected from CH21-11 previously returned 1.25m of 336g/t Ag, 0.26% Cu, 7.9% Pb, and 9.6% Zn, including 0.35m of 851g/t Ag, 0.29% Cu, >20% Pb, and 9.7% Zn (See News Release - January 31, 2022).

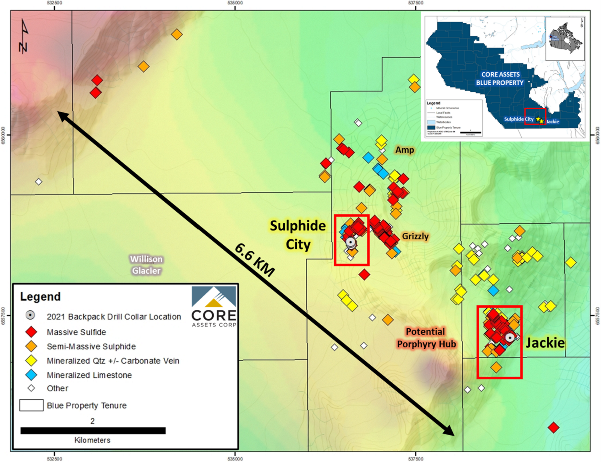

• The 2021 Discovery Zone (Grizzly, Sulphide City, and Amp targets) combined with the Silver Lime Prospect (Jackie Target) currently defines a 3.7km by 1.8km area of tight, high-grade carbonate replacement (CRM) and skarn mineralization within the broad 6.6km mineralized corridor that remains open. Unlike vein-hosted deposits, carbonate replacement deposits (CRDs) typically manifest as continuous sulphide bodies over multi-kilometre-scales that broaden with depth and demonstrate continuity back to the source.

Core Assets’ President and CEO Nick Rodway comments, “Despite the backpack-style drilling depth limitations, the results from the low-hanging skarn and carbonate replacement occurrences at the 2021 Discovery Zone demonstrate that grade is consistently elevated along surface and at shallow depths. Our next steps will focus on incorporating property-wide, reprocessed geophysical data, and interpreting this information with respect to historic drilling, recent surficial geochemistry, and geological mapping.”

Full size / Figure 1: Location of the Jackie and Sulphide City targets (red squares), within the extensive 6.6-kilometre mineralized corridor at the Blue Property. All historic and recent surficial samples, as well as the locations of the 2021 backpack drill collars are plotted.

Full size / Table 1: Backpack Drilling Highlights from the Sulphide City (Whaleback) Target. *Values indicate length weighted average values of full-core samples and true widths are unknown at this time. Bolded interval lengths indicate full backpack drill hole lengths to end of hole (EOH). BDH21-06, collared at the Jackie Target was not recovered due to equipment limitations.

Full size (left): Figure 2: Location and highlights of the 2021 backpack drilling campaign at the Sulphide City (Whaleback) Target, Blue Property, NW BC. Full size (right): Figure 3: Location and highlights of the 2021 backpack drilling and channel sampling campaigns at the Jackie Target, Blue Property, NW BC.

2021 Shaw Handheld Backpack Drilling at the Sulphide City & Jackie Targets

The 2021 Shaw handheld backpack drilling campaign was designed to test the depth extent of target mineralization within the central Blue Property. Six, shallow backpack drill holes (25mm core diameter) were collared proximal to Phase 2 channel locations that previously tested the grade continuity of massive-to-semi massive carbonate replacement or skarn mineralization along surface. The Jackie Target, part of the Silver Lime Prospect, consists of numerous massive-to-semi-massive sulphide occurrences that measure up to 30 metres long and 6 metres wide. Many sulphide occurrences at Jackie are clustered and hosted within mapped NE-SW trending faults and fault splays. These fault-hosted sulphide bodies are interpreted as “spokes” that typically broaden at depth and express continuity back towards a causative intrusion. Backpack drilling efforts at Jackie, although unrecoverable, proved that massive, galena-rich CRM extends to depths of at least 3m. Skarn and CRM showings at the Sulphide City Target are characterized by multiple, Zn-Cu-Ag semi-massive to massive sulphide occurrences measuring up to 40 metres along strike and 8 metres wide. All shallow backpack drill holes completed at Sulphide City (Whaleback) in 2021 intersected calc silicate skarn-hosted semi-massive sulphide over their full lengths ranging from 1 to 3m depth. Overall, Phase 2 backpack drilling and channel sampling efforts at the central Blue Property prove that numerous carbonate replacement and skarn-hosted sulphide occurrences exhibit consistent grade and continuity along surface and for up to 3m at depth.

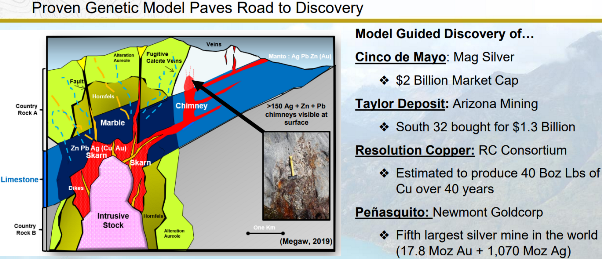

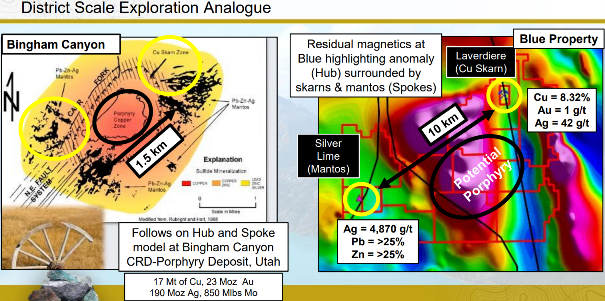

Following the Hub & Spoke model (i.e., Bingham Canyon, Utah, USA), high-temperature, ore-bearing fluids are derived from proximal intrusive phases (the “Hub”). The ore fluids migrate away from the heat source along structurally controlled networks of faults and fractures. During fluid propagation, ore fluids mix with other fluid sources (i.e., meteoric/connate waters or basin brines). Sulphide bodies (“spokes”) are then precipitated through a neutralizing, dissolution replacement reaction between the ore fluid and carbonate-rich lithologies (i.e., limestone).

Full size / Figure 4a: BDH21-03 drill core containing medium-to-coarse grained semi-massive pyrite-sphalerite-pyrrhotite-galena mineralization hosted in cal silicate skarn. Figure 4b: Geologist operating handeheld backpack drill at the Sulphide City (Whaleback) Target; 2021 Phase 2 exploration program at the Blue Property, NW BC.

QA/QC, Sample Preparation & Drill Limitations

A Shaw backpack drill was utilized to drill the 25mm core holes. The backpack drill has a depth limitation of approximately 3 metres which was reached on drill hole BDH21-05 and BDH21-06. The drill was also limited when harder material was intersected with drill hole BDH21-01 hitting refusal at 1.45m depth when a quartz vein was encountered. The backpack drill samples were logged and placed in pre-labelled sample bags. Collar locations were collected using a handheld GPS. All drill holes were vertical, apart from BDH21-06 which was drilled at 270/45°, and from which no core was recovered. The core was not recovered likely due to surficial oxidation and the small diameter of the core which resulted in the soft oxidized massive sulphide material pulverizing. Core recovery in drill holes BDH21-01 to BDH21-05 was 100%. Samples were stored in 5-gallon pails in a secure location until ready for shipment. Two quartz blanks were submitted as part of internal quality assurance and quality control procedures. All full-core samples and quartz blanks were shipped by ground to ALS Geochemistry in Whitehorse, YT for crushing and sample preparation. Samples were then shipped to ALS Geochemistry in North Vancouver, BC for multielement analysis (including Ag) by four-acid digestion with ICP-AES instrumentation (package ME-ICP61) and Au, Pd, Pt by fire assay (package PGM-ICP27). Any overlimit for Ag, Cu, Pb and Zn was analyzed using the applicable assay package ME-OG62.

National Instrument 43-101 Disclosure

Nicholas Rodway, P.Geo, (Licence #46541) is President, CEO and Director of the Company, and qualified person as defined by National Instrument 43-101. Mr. Rodway supervised the preparation of the technical information in this news release. (Source)

Full size / Nick Rodway chipping off rock samples from one of the discovery outcrops in 2021. (Phase-1)

Full size / Nick Rodway taking channel samples with a rock saw in 2021. (Phase-2)

Full size (left) / Full size (right)

Below excerpts from the earlier mentioned article highlight the importance of taking samples from unweathered rocks – that‘s what Core Assets targeted with its 2021 channel sampling program (cutting into the rock for up to 10 cm) and today‘s announced backpack drill program (coring into outcrops for up to 3 m):

“The discovery gossan: The red iron staining on the weathered rocks, which first attracted the prospectors, is referred to as a gossan by geologists. It is formed by the weathering and oxidation of iron sulphides which invariably occur in base metal ore deposits. In the course of weathering, the [...] sulphides [...] are oxidised [...] and it is this “rust“ that gives the gossan its characteristic red colour.“

“It takes only a comparatively small amount of iron sulphides in a rock to produce a strong red colour and consequently it is reasonably easy for a prospector to spot a gossan. But gossans must be examined very carefully. This is because [...] hydrogen ions are produced, resulting in acidic waters. Such water will dissolve or leach the base metals in the deposit, leaving only a small amount of metal in a gossan that may have formed by the weathering of a metal-rich sulphide deposit. This was particularly important at Voisey‘s Bay because at the discovery outcrop, gossan formation and metal leaching had penetrated to greater depths than would normally be expected under the cool climatic conditions of eastern Labrador.“

“The geologists working for the Geological Survey of Newfoundland and Labrador were discouraged by the low metal content of the gossan. The prospectors were more fortunate, maybe even a bit lucky, because they found fresh, unweathered rock comparatively close to surface... They extrapolated what they saw in their samples to the dimensions of the gossan, approximately 500 m long and between 40 m and 80 m wide, and they knew that they were onto an important discovery. It has been estimated that the Voisey‘s Bay Ni-Cu-Co deposit may contain 150 million tons of ore grade material (Financial Post, April 12, 1996). It is one of the most economically significant, geological discoveries in Canada in the last thirty years.“

Full size / Note that stated lengths do not indicate the true width of an outcrop as channel samples were taken in intervals of 50 cm if surface expression permitted.

Full size / Important note about Total Gross Metal Value: Please note that the gross metal value should not be used as a factor when considering investment in a mining company. Gross metal value does not factor in any capital costs associated with bringing a property into production, nor allow for adjustments due to recovery percentages, metallurgical issues (for example, dealing with undesirable minerals), the availability of infrastructure, country-specific mining and taxation laws, reclamation costs and more. Consequently, even a high gross metal value can be reduced to an uneconomic, or even negative, net metal value once all the costs and challenges of production are taken into account. (Source)

Full size / This typical zoning pattern shows the transition from copper-moly to copper to zinc to lead-silver to silver-manganese to gold-silica. (Source)

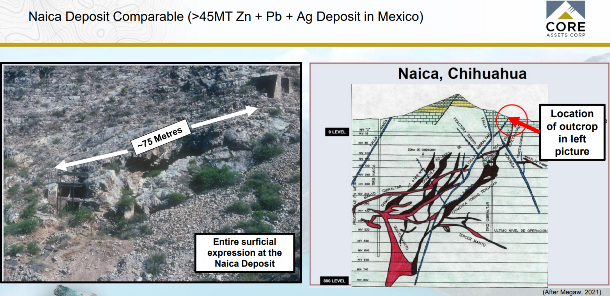

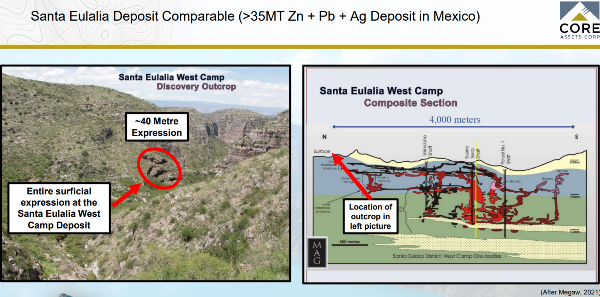

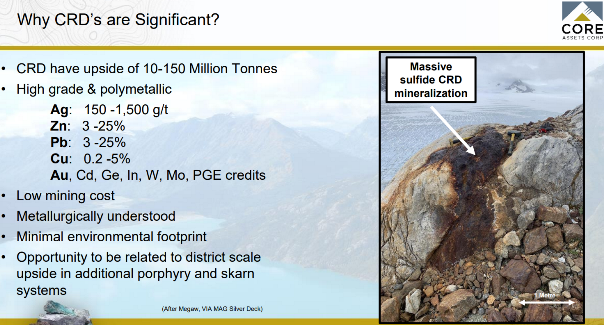

CRDs are polymetallic replacement deposits (also known as high-temperature carbonate-hosted silver-lead-zinc deposits) formed by the replacement of sedimentary (usually carbonate rock) by metal-bearing solutions in the vicinity of igneous intrusions (e.g. copper or molybdenum porphyry). The CRD mineralogy changes with distance from the intrusion: Closest to the intrusion is the copper-gold zone; next is the lead-silver zone, then the zinc-manganese zone. In many instances, CRDs can be considered as the distal part of a continuum with skarn deposits, and in some cases terminology may be misused.

Typically, zinc, lead, silver, gold, copper/moly are all present throughout the full spectrum of a CRD (see below zoning pattern) – the dominant metal just tends to change as you work your way down to the source.

Full size / One of the many discovery outcrops on the Blue Property.

All the more special

1) Core Assets‘ newly found outcrops, probably never seen before by mankind, revealed themselves only because glaciers in the area recently retreated on the back of global warming.

2) To fight global warming in a global effort, much more metal supply is needed, including copper, silver, and lead-acid batteries for an electric car‘s starter motor for example. To make the world‘s aging infrastructure more resilient, metals like zinc are in high demand. To stand one‘s ground against inflation, gold is getting more popular.

3) The discovered outcrops at Blue have been classified as “carbonate replacement mineralization“, indicating the existence of a Carbonate Replacement Deposit (CRD) beneath the surface. Some of the world‘s best CRDs are extensive in size and host high grades of zinc, lead, silver, copper, gold or molybdenum. On top of that: Some CRDs can be followed all the way to the source: A sometimes giant-sized copper (± gold or molybdenum) porphyry stock/deposit. Now we‘re talking not 1 but potentially 2 deposit types on the Blue Property; not to mention porphyry-related skarn deposits near the rim of the intrusive.

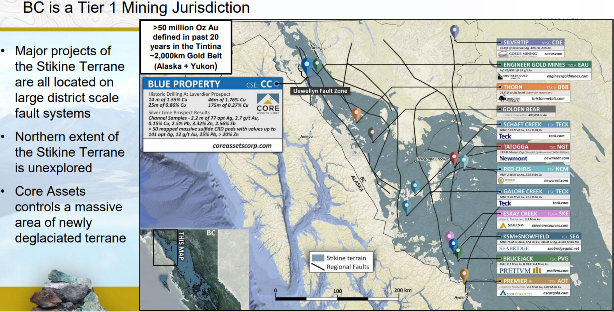

4) Why is there no exploration rush into the area if Blue is so special? By having expanded the Blue Property to more than 1,000 km2, indeed there might be even more deposits along the Llewelyn Fault Zone – a district-scale plumbing system analog to other prolific mining camps in the Golden Triangle?

5) It‘s all about the limestone: How come companies active a few hundreds of kilometres further south in British Columbia‘s Golden Triangle are chasing large porphyry deposits but you never hear about any CRDs? That‘s because they don‘t have the limestone (or dolomite, marl), a permeable and acid-reactive host rock into which the pulsating porphyry pumps its metallic fluids to dissolve and replace sedimentary carbonates with sulphide minerals; watch how limestone reacts with vinegar.

The Bingham Canyon Mine is an open-pit mining operation extracting a large porphyry copper deposit in Utah, USA. The mine is the largest man-made excavation and deepest open-pit mine in the world, which is considered to have produced more copper than any other mine in history – more than 19 million tons. The mine is owned by Rio Tinto Group. Bingham Canyon has been in production since 1906 and has resulted in the creation of a pit over 1,210 m deep, 4 km wide; 7.7 km2. (Source)

“One other thing to take away ... very seldom only one manto. Sort of two end-members for these, one of which I call the “Skeletal Hand“ Model because you end up with a wrist (in this case with...) a porphyry system but with a series of parallel mantos showing a district-wide zonation [fingers]... Note the scale here [at the Deer Trail Project from MAG Silver Corp. in Utah]: 4 km for these enormous high-grade ore bodies. The other end-member is what I call the “Hub & Spoke“ Model and Bingham Canyon demonstrates that beautifully. Everybody knows Bingham Canyon... it‘s one of the world‘s best porphyry copper mines. But people don‘t necessarily remember, or maybe never knew, is that Bingham is completely surrounded by high-grade lead-zinc-silver-copper carbonate replacement and skarn mineralization. A lot of these bodies were mined 60 years before they even started thinking about mining the porphyry.“ (Source)

CRDs offer much larger tonnage potential than VMS and MVT deposits while at the same time typically hosting higher grades of silver, zinc, lead, and copper, sometimes with appreciable credits of gold and other metals.

CRDs are responsible for roughly 40% of Mexico’s 10 billion ounce historic silver production and are characterized by massive to semi-massive silver-lead-zinc-sulphide replacements of limestone. CRDs occur along major regional structures that hosts several of the largest CRDs in Mexico: “The Carbonate Replacement Deposit (CRD) model evolved from Dr. Peter Megaw’s PhD studies at Santa Eulalia: repeatedly validated worldwide...The Santa Eulalia District ranks as one of Mexico’s chief silver and base metal producers, and its largest CRD. Historic district production (1703-2020) amounts to 51 Mt of ore at average grades of 310 g/t Ag, 8.2% Pb, 7.1% Zn, yielding a total of 500 Moz Ag, 4 Mt Pb and 3.6 Mt Zn.“ (Source)

“CRDs are the second largest contributor to the historic silver production of Mexico. CRDs are the backbone of Mexico’s world-class underground lead-zinc mining industry. The country contains many Ag-Pb-Zn (Cu, Au) CRDs, which occur along the intersection of the Mexican Thrust Belt and Sierra Madre Occidental Magmatic Belt. The biggest CRD deposits appear to lie along inferred deep crustal structures.“ (Source)

While VMS deposits oftentimes host metallurgically complex ores, CRDs and MVTs are rather uncomplicated metallurgically. The total average operating costs (for mining, milling and processing) are generally lower for CRDs and MVTs than for VMS and Sedex-type deposits or even vein-type deposits. (Source) Moreover, CRDs typically form as a result of a near-by porphyry intrusion, thus offering potential to add large tonnage from mining such deposit aside from CRDs. These days, most of such projects worldwide are facing the challenge of many companies controlling small portions of a CRD-porphyry system, oftentimes under option agreements and/or with underlying royalty liabilities (NSRs; Net Smelter Royalties; somewhat unattractive for majors). This makes it difficult for majors to acquire the full extent of such large CRD-porphyry systems to better understand the regional geology and structure of the complex with district-scale exploration programs. With Blue, Core Assets owns 100% of a very large, district-scale property (1083 km2), royalty-free. Once the geology and structure of the CRD showings at surface are better delineated with drilling, this potential CRD mineralization (chimneys, mantos, and/or skarns) is targeted to lead to the source – possibly a large and well-mineralized copper porphyry enriched with gold or molybdenum.

Despite over 130 million ounces of gold, 800 million ounces of silver and 40 billion pounds of copper already found in Golden Triangle‘s rugged terrain, significant discovery potential remains. With glaciers retreating in many parts of the region, new geological explanations and modern exploration methods are paving the way for new discoveries in the making.

Previous Coverage

Report #6: “Exceeding expectations with high grades of silver, copper, zinc, lead, and gold from sampling at the Blue Property in northern British Columbia“ (Web Version / PDF)

Report #5: “Retreating ice uncovers major discovery potential for CRD-Porphyry system at district-scale Blue Property, BC“ (Web Version / PDF)

Report #4: “The Silver-Copper Super-Cycle“ (Web Version / PDF)

Report 3: “The Llewelyn Fault Zone: A district-scale plumbing system analog to other prolific mining and exploration camps in the Golden Triangle?“ (Web Version / PDF)

Report 2: “On a Mission to Become the Premier Copper-Gold Porphyry Explorer of the Northernmost Extent of the Golden Triangle“ (Web Version / PDF)

Report 1: “Perfect Time to Reshape the Golden Triangle in British Columbia“ (Web Version / PDF)

Company Details

Core Assets Corp.

Suite 1450 – 789 West Pender Street

Vancouver, BC, V6C 1H2 Canada

Phone: +1 604 681 1568

Email: info@coreassetscorp.com

www.coreassetscorp.com

Incorporation Date: April 20, 2016

Listing Date: July 27, 2020

CUSIP: 21871U05 / ISIN: CA21871U1057

Shares Issued & Outstanding: 70,400,135

Canadian Symbol (CSE): CC

Current Price: $0.53 CAD (03/11/2022)

Market Capitalization: $37 Million CAD

German Symbol / WKN: 5RJ / A2QCCU

Current Price: €0.41 (03/11/2022)

Market Capitalization: €29 Million EUR

Contact:

Rockstone Research

Stephan Bogner (Dipl. Kfm.)

8260 Stein am Rhein, Switzerland

Phone: +41-44-5862323

Email: info@rockstone-research.com

www.rockstone-research.com

Core Assets News-Disclaimer: Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release. Forward Looking Statements: Statements in this document which are not purely historical are forward-looking statements, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. Forward looking statements in this news release include the Company’s future objective of becoming a premier explorer; that the Company’s exploration model can facilitate a major discovery on the Blue Property; that the Blue Property is prospective for copper, zinc and silver; that Core Assets will undertake additional exploration activity on the Blue Property; and that the Blue Property has substantial opportunities for a discovery and development. It is important to note that the Company´s actual business outcomes and exploration results could differ materially from those in such forward-looking statements. Risks and uncertainties include that further permits may not be granted timely or at all; the mineral claims may prove to be unworthy of further expenditure; there may not be an economic mineral resource; certain exploration methods that we thought would be effective may not prove to be in practice or on our claims; economic, competitive, governmental, geopolitical, environmental and technological factors may affect the Company´s operations, markets, products and prices; our specific plans and timing drilling, field work and other plans may change; we may not have access to or be able to develop any minerals because of cost factors, type of terrain, or availability of equipment and technology; and we may also not raise sufficient funds to carry out or complete our plans. Additional risk factors are discussed in the section entitled "Risk Factors" in the Company´s Management Discussion and Analysis for its recently completed fiscal period, which is available under Company´s SEDAR profile at www.sedar.com. Except as required by law, the Company will not update or revise these forward-looking statements after the date of this document or to revise them to reflect the occurrence of future unanticipated events.

Rockstone Disclaimer: This report contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Core Assets Corp. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to Core Assets Corp.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through its profile on SEDAR at www.sedar.com. Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, holds an equity position in Core Assets Corp.,as well as in Zimtu Capital Corp., and is being paid by Zimtu Capital Corp. for the preparation, publication and distribution of this report, whereas Zimtu Capital Corp. also holds a long position in Core Assets Corp. Note that Core Assets Corp. pays Zimtu Capital Corp. to provide this report and other investor awareness services. Zimtu Capital Corp. is an insider of Core Assets Corp. by virtue of owning more than 10% of Core’s issued stock. Core Assets Corp. has one or more common directors with Zimtu Capital Corp.