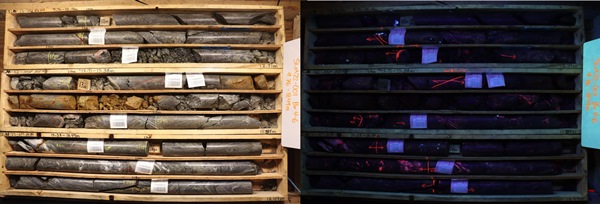

Full size / “Fugitive vein BBQ rock“: Core from hole SLM22-011 at Grizzly showing limestone (white) and massive sulphides (dark), while under UV light exhibiting fluorescence (red-orange) indicating contact with mineralized fluids. Low wave UV light is a useful and inexpensive tool for core logging, mapping and finding near-by mineralization and ultimately the source. Photographs courtesy of Core Assets Corp.

Disseminated on behalf of Core Assets Corp. and Zimtu Capital Corp.

Today, Core Assets Corp. announced assay results from selected high-grade carbonate replacement mineralization encountered in 2 drill holes located 2 km apart at the Silver Lime Porphyry-CRD Project on its 100%-owned, district-scale Blue Property near Atlin, British Columbia. It‘s very rare, and thus highly impressive, to see drill results yielding higher grades than prior grab and channel sampling – normally, it‘s the other way around with surface sampling returning higher grades than drilling. What we know about CRDs is that these systems are continuous and geochemically zoned with regards to their porphyry source. When you intersect a CRD at depth, you simply follow it to the source – and by doing this with the drill bit, CRD mineralization typically gets thicker while the grades may increase even more.

As most CRDs globally are enriched with silver, zinc and lead, it‘s even more appealing to also see respectable grades of copper at Grizzly and Jackie, while Grizzly additionally has appreciable gold credits.

It‘s the tremendous size and long mine-life that makes porphyry deposits so attractive to major mining companies. However, the enormous capital expenditures (CAPEX) involved to get such mines up and running have oftentimes proven as a project-killer. When you have a rich and robust CRD system, which can be mined from surface, it promises to pay for the construction of a large porphyry mine and processing facility, possibly reducing CAPEX significantly. As such, it would be extremely desirable for a company to have both CRD and porphyry deposit-types on its property, which Core Assets believes being the case at Silver Lime – that is to say at favorable depths, which would be all the more rare when compared to many other projects globally.

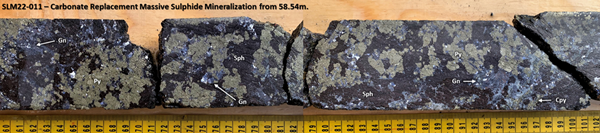

Full size / Massive CRD sulfide intercept from Hole SLM22-011 in the Grizzly Ag-Pb-Zn-Cu-Au Target (SLM22-011) showing typical sulfides. (Chalcopyrite = Cpy; Galena = Gn; Sphalerite = Sph; Pyrrhotite = Po; Pyrite = Py). This intercept is part of the 1.16m zone grading: 1,145g/t Ag, 23.5% Zn, 23.2% Pb, 0.52% Cu, 0.37g/t Au. (Source: Core Assets´ news on October 31, 2022)

Excerpts from today‘s news-release:

“The 47% combined metal content of the Grizzly CRD intercept is the highest-grade result recovered from the Silver Lime Project to-date and puts the Silver Lime Project on the map for high-grade CRD projects globally,” said Core Assets’ President & CEO Nick Rodway. “This high-grade CRD mineralization fits well into the Porphyry-CRD continuum model that we are revealing through drilling and gives us a much better understanding of the system’s plumbing network. We look forward to good results from the remaining drill holes and integrating what we’ve learned in 2022 into our future drill targeting for the additional >250 exposed CRD occurrences at Silver Lime.”

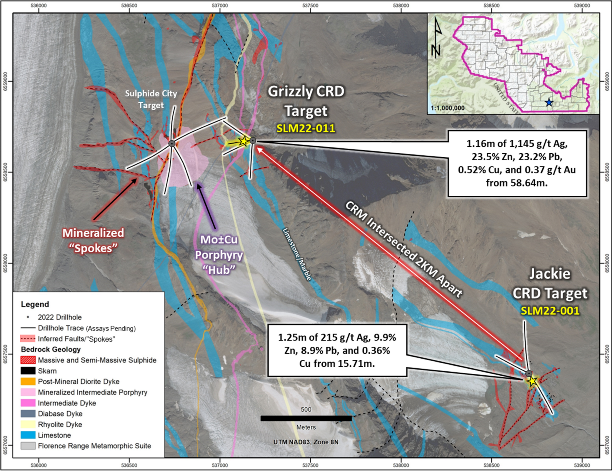

SLM22-011 (Grizzly CRD Target) returned 1.97m grading 661g/t Ag, 13.2% Zn, 14.0% Pb, 0.27% Cu, and 0.22g/t Au including 1.16m of 1,145g/t Ag, 23.5% Zn, 23.2% Pb, 0.52% Cu, 0.37g/t Au, whereas SLM22-001 (Jackie CRD Target) returned 17.19m of 28g/t Ag, 1.2% Zn, 1.4% Pb, and 0.10% Cu including 1.25m of 215g/t Ag, 9.9% Zn, 8.9% Pb, and 0.36% Cu (Table 1). These zones were selected for rush analysis to determine overall grade ranges to guide drilling and evaluation of over 250 additional mineralized CRD outcrops identified in the 6.6km x 1.8km mineralized project area. Assays for the balance of these two holes, plus 13 additional holes, totalling 5,355 meters are pending.

Full size / *Assay results are presented as uncut weighted averages. Interval widths represent drilled HQ core lengths and true width is unknown currently.

Holes SLM22-001 and SLM22-011 were part of the first-pass diamond drilling of two of the >250 exposed mineralized structures cross-cutting favourable host rocks and surrounding one or more molybdenum-copper porphyry centers within the mineralized area observed at the Silver Lime Project. These high-grade intercepts show that surface mineralization continues to depth and the preliminary select assays indicate that base and precious metals grades increase with depth.

Full size / Schematic plan view geological map of the Silver Lime Porphyry-CRD Project showing 2022 drilling locations, surficial mapping progress, as well as skarn and CRD massive and semi-massive sulphide mineralization extents and observed and inferred favourable host structures/ore fluid pathways (faults, fractures, contacts, or “spokes”).

About Rushed Samples from the Jackie and Grizzly CRD Targets

Samples from two drill holes (SLM22-001 and SLM22-011) representing classic CRD mineralization and textures were rushed for assay in order for the company to confirm near surface grade and to compare these values to visual mineralization estimates and portable XRF values obtained in 2022. These early assay results will aid the geological modelling process in terms of defining metal zoning patterns and linking mineralized structures (“spokes”) in the subsurface in anticipation for the 2023 drilling campaign. The 2022 diamond drilling program has been concluded with a total of 5,355 meters drilled at the Silver Lime Porphyry-CRD Project.

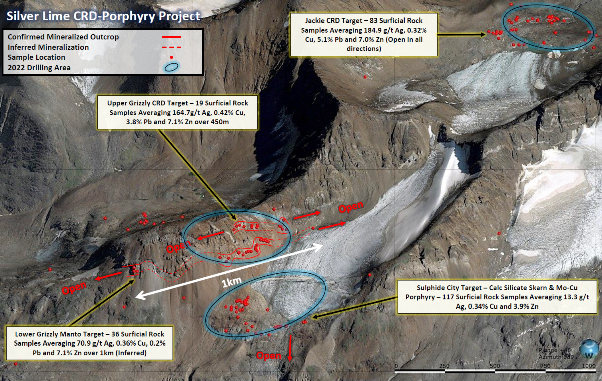

About the Silver Lime Porphyry-CRD Project

Three well-defined target areas exist at the Silver Lime Porphyry-CRD Project and include the Jackie, Sulphide City, and Grizzly targets. The Jackie Target represents a distal expression of Ag-Pb-Zn-Cu CRM that consists of numerous massive-to-semi massive sulphide occurrences measuring up to 30 metres long and 6 metres wide and comprise an approximate area of 400 metres by 380 metres, within the extensive 6.6-kilometre by 1.8-kilometre mineralized zone that remains open in multiple directions. Many sulphide occurrences at Jackie are clustered and hosted within NE-SW trending faults and fault splays, proximal to undeformed felsic dykes oriented sub-parallel to faulting. These fault-hosted sulphide bodies are interpreted as “spokes” that typically broaden at depth and express continuity back towards a causative intrusion. The Sulphide City Zn-Cu±Ag Target is characterized by multiple semi-massive to massive sulphide occurrences measuring up to 40 metres along strike and 8 metres wide. In 2022, detailed geological mapping and diamond drilling discovered a Mo-Cu-bearing and causative porphyry intrusion. The Sulphide City Target boasts an average surficial grade of 13.3g/t Ag, 0.34% Cu, and 3.9% Zn (83 rock samples) that remains open. The Grizzly Ag-Zn-Pb-Cu-Au CRD Target represents the largest, untested surficial exposure of CRM globally. Carbonate replacement manto, chimney, and dyke-contact skarn mineralization at Grizzly are observable at surface across open strike lengths of up to 1 kilometer, and at widths of over 5 meters. Average surficial grade at the Upper Grizzly CRD Target yields values of 164.7g/t Ag, 0.42% Cu, 3.8% Pb, and 7.1% Zn over 450m strike length, whereas the Lower Grizzly Manto has an average graded of 70. g/t Ag, 0.36% Cu, 0.2% Pb, and 7.1% Zn over an inferred strike length of 1km. [End of quote]

Full size / Source / Important Note about Total Gross Metal Value: "Please note that the gross metal value should be not be used as a factor when considering investment in a mining company. Gross metal value does not factor in any capital costs associated with bringing a property into production, nor allow for adjustments due to recovery percentages, metallurgical issues (for example, dealing with undesirable minerals), the availability of infrastructure, country-specific mining and taxation laws, reclamation costs and more. Consequently, even a high gross metal value can be reduced to an uneconomic, or even negative, net metal value once all the costs and challenges of production are taken into account." (Source)

Full size / BBQ Rock: Core from hole SLM22-001 at Jackie (from 9.76-18.49 m) with assays released today. Photographs courtesy of Core Assets Corp.

Full size / BBQ Rock: Core from hole SLM22-013 at Sulphide City (from 91.54-101.26 m) with assays pending. Photographs courtesy of Core Assets Corp. “Fugitive vein BBQ rock“ means that calcite, created from the mineralizing phase, has escaped into surrounding unmineralized rock, indicating zones of near-by sulphide mineralization.

Full size / Source: Core Assets Corp.

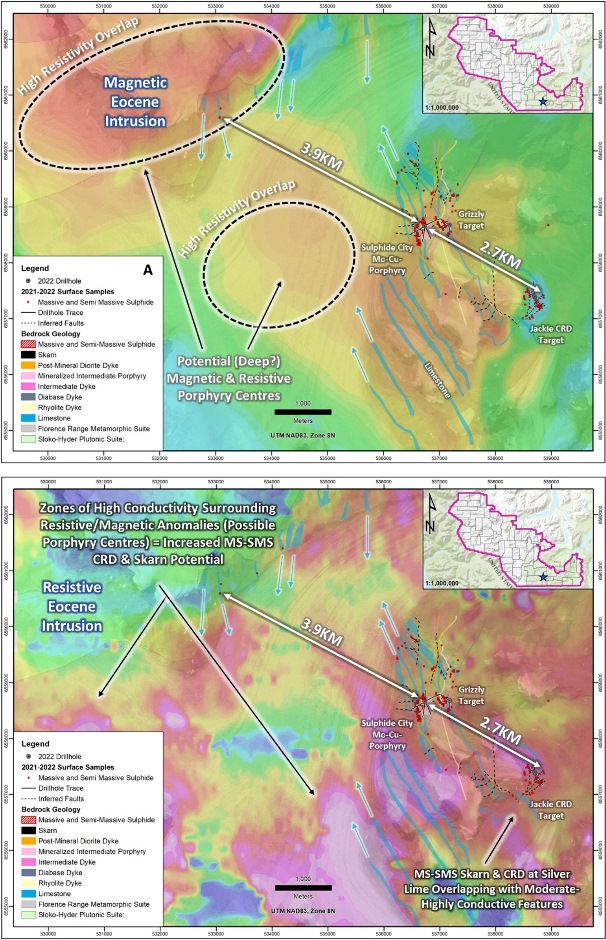

Full size / Geophysical maps of the Silver Lime Porphyry-CRD Project showing 2022 drilling and mapping progress and interpreted skarn and CRD massive and semi-massive carbonate replacement sulphide mineralization at the Sulphide City, Grizzly and Jackie Targets and deep magnetic anomalies (with overlapping resistivity highs) trending between the Sulphide City Mo-Cu porphyry and an extensive, exposed Eocene Intrusion to the northwest of the 2022 drilling area; a) Total Magnetic Intensity (hot colours = increased magnetic response; cold colours = decreased magnetic response); b) Apparent Resistivity & Conductivity (hot colours = increased conductive response; cold colours = increased resistive response). Source: Core Assets‘ news on October 11, 2022

Recenty on October 11, Core Assets announced the intersection of nearly continuous porphyry-style sulphide mineralization over 471 m at the Sulphide City Target:

• “Diamond drilling over three additional holes at the Sulphide City Target has intersected impressive molybdenite-pyrite±chalcopyrite mineralization and moderate-to-intense porphyry-style vein densities...“

• “The extent of the causative porphyry body at Sulphide City as determined by diamond drilling now measures 310m in the north-south direction and 240m in the east-west direction and remains open for exploration...“

• “Potentially large and clustered porphyry centres that trend southeast from a large felsic intrusion of Eocene age and extend below the Sulphide City Mo±Cu Porphyry have been outlined by the 2021 Versatile Time Domain Electromagnetic (VTEM) Survey. This increases the potential for additional high grade carbonate replacement massive sulphide occurrences in limestone located proximal to these centres...“

• Core Assets‘ President and CEO, Nick Rodway, commented: “We are thrilled to have intercepted so much widespread mineralization in the first ever drill program at the Silver Lime Project... The goal of the 2022 drilling program was to demonstrate that the CRD occurrences seen at surface are traceable in the subsurface. We not only hit significant CRD and skarn mineralization in every drill hole this season, but we also tapped into a molybdenum-rich porphyry. Molybdenum porphyries are commonly responsible for being the source to world class CRD deposits. Now that we have a better understanding of the structure of the host limestone beds, we will be able to step out into the >250-meter-thick limestone beds and drill where we would expect to see greater volumes of high grade CRD mineralization.”

As the crow flies only ~180 km east from Atlin, BC, you need to travel ~370 km by car to reach the Silvertip Mine. Soon after the initial discovery in 1955, a 26 km long access road (gravel) was built to reach one of the world‘s highest grade CRD projects. The long history of exploration shows how difficult it was in the past to find this buried (blind) deposit at vertical depths ranging from 30 m to 475 m, whereas “the resources identified to date likely represent the distal portions of the CRD system and that the higher-grade feeder ‘chimneys’ and the proximal copper-gold skarn portions of the system have not been found,“ according to a 2019-Technical-Report.

In 2017, Chicago-based Coeur Mining Inc. (NYSE: CDE; current market capitalization: $1.1 billion USD) paid $250 million USD to acquire privately owned JDS Silver Holdings Ltd., which owned and developed Silvertip. For this price, Coeur acquired a newly built mine with 2.35 million t @ 352 g/t silver, 9.4% zinc and 6.7% lead (Indicated).

“While this newly constructed operation came with a rich resource base and an operation that Coeur has ramped up to commercial production, a technical report and mine plan to elevate the high-grade silver resources to reserves had yet to be completed for Silvertip. With the information gleaned from a rigorous drill program carried out over the 14 months since its acquisition, Coeur has converted some 58 percent of the resources that came with Silvertip into enough reserves to support the mine for about 4.5 years [with a 1,000 t/day mill on-site]... Over that initial span, the Silvertip Mine is expected to average around 2.9 million oz of silver, 45 million lb of zinc and 37 million lb lead, or roughly 8.2 million oz silver-equivalent, per year. This would put Silvertip on par with the second highest producing operation in Coeur‘s portfolio, the Rochester silver-gold mine in Nevada.“ (Source, 2019)

Full size / Map showing significant intersections from the 2017-2018 drilling program at Silvertip. Note the 2017-drill-hit of 1.7 m @ 1,137.5 g/t silver, 21.3% zinc and 18.8% lead with today‘s gross metal value: $1,656 USD/t; silver equivalent grade: 2,682 g/t. (Source: Coeur Mining)

According to Coeur‘s current ”Silvertip” project website: “The Silvertip silver-zinc-lead mine is an underground operation... Silvertip is one of the highest-grade silver-zinc-lead operations in the world and sits within a highly prospective land package... Coeur temporarily suspended mining and processing activities at Silvertip in early 2020... [but] has since conducted additional technical work and exploration activities to evaluate and support a potential expansion and restart of the operation.“

Reserves (Proven & Probable, 2021):

1.8 million t @ 252 g/t silver, 8.21% zinc and 5.36% lead, containing:

• 14.6 million ounces of silver [in-situ-value today: $280 million USD]

• 296 million pounds of zinc [in-situ-value today: $379 million USD]

• 193 million pounds of lead [in-situ-value today: $164 million USD]

Resources (Measured & Indicated, 2021):

2.8 million t @ 291 g/t silver, 10.46% zinc and 5.55% lead, containing:

• 26.3 million ounces of silver [in-situ-value today: $505 million USD]

• 589 million pounds of zinc [in-situ-value today: $754 million USD]

• 313 million pounds of lead [in-situ-value today: $266 million USD]

Resources (Inferred, 2021):

2.4 million t @ 236 g/t silver, 8.98% zinc and 4.27% lead, containing:

• 17.8 million ounces of silver [in-situ-value today: $342 million USD]

• 422 million pounds of zinc [in-situ-value today: $540 million USD]

• 201 million pounds of lead [in-situ-value today: $171 million USD]

With a total tonnage (reserves plus resources) of around 7 million t, the contained metals have an in-situ-value of $3.4 billion USD at today‘s market prices.

As a more recent example, the Waterpump Creek CRD in Alaska gained much attention this summer, when Western Alaska Minerals Corp. (current market capitalization: $147 million; fully diluted) announced 102.7 m @ 159 g/t silver, 5.4% zinc and 5.3% lead after 147 m of core length, including 7.2 m @ 349 g/t silver, 7.3% zinc and 9.7% lead after 159 m of core length (gross metal value: $603 USD/t).

Full size / Cross-section through the Waterpump Creek CRD in Alaska. (Source: Western Alaska)

As above image shows, hole WP-84-029 was drilled vertically in 1984, yielding a mineralized thickness of 1.4 m, however widths increase considerably at greater depths to the south.

In 2021, Western Alaska drill-tested Waterpump Creek for the first time since 1984: Hole WPC21-09 intersected 10.5 m @ 522 g/t silver, 22.5% zinc and 14.5% lead after 109 m of core length (gross metal value: $1,229 USD/t; silver equivalent grade: 1,991 g/t).

With a grade of 3,019 g/t silver equivalent at Grizzly and a gross metal value of $1,864 USD/t, Core Assets has a 52% higher rock value than Western Alaska‘s hole #9 of 2021.

As the figures above and below indicate, CRD mineralization typically widens at depth.

Full size / Pierce point plan map of the Waterpump Creek CRD manto. (Source: Western Alaska)

Full size / Source: Western Alaska

Full size / Source: Western Alaska

Core Assets is extremely fortunate that its CRD system is exposed at surface, which makes it much easier to drill and trace towards its source, where grades and widths are expected to increase in closer proximity to the source (a low-grade but high-tonnage copper-molybdenum porphyry).

Many CRDs globally are buried (blind) deposits and occur at significant depths, which makes a discovery a lengthy and costly venture. For example, it took 15 years of prospecting and research to finally make the Cinco de Mayo CRD Project in Mexico a high-priority drill target for MAG Silver Corp.

In early 2007, MAG Silver announced assays from the first 9 holes at Cinco de Mayo, with the best one yielding 1.88 m @ 190.9 g/t silver, 7.9% zinc and 4.3% lead after 355 m of core length. At today‘s metals prices, this hole has a gross metal value of $421 USD/t.

Core Assets‘ first hole at Grizzly grades 3,019 g/t silver equivalent with a gross metal value of $1,864 USD/t, encountered after only 58.54 m of core length.

A year later in 2008, MAG Silver announced the discovery of the José Manto in hole #20: 6.8 m @ 254 g/t silver, 7% zinc and 6.4% lead after 471 m of core length (gross metal value: $435 USD/t).

It was not until 2012, when MAG Silver announced the discovery of the Pegaso Zone: 61.6 m @ 89 g/t silver, 0.78 g/t gold, 0.13% copper, 7.3% zinc and 2.1% lead after 928 m of core length. Before this deep discovery was made, an inferred resource was published: At today‘s prices with an in-situ-value of $4.1 billion USD, contained in just 12.5 million t of rock.

Full size / Cinco de Mayo‘s Pegaso Zone: Cross Section through the hole which discovered 61.6 m @ 89 g/t silver, 0.78 g/t gold, 0.13% copper, 7.3% zinc and 2.1% lead (after 928 m of core length) with interpreted geology and massive sulphide body highlighted in red. (Source: MAG Silver)

Considering the extremely high grades encountered near surface in the first holes at Silver Lime, I would not be surprised if Core Assets continues discovering a major CRD system, along with its source, at a much faster pace (and possibly more favorable depths) than other CRD plays globally.

Cinco de Mayo: A World-Class CRD at Depth without Surface Access

Full size / Drilling at the Cinco de Mayo Property (25,113 hecatres). “Small scale mining took place in the Property area in at least twelve locations sometime prior to the 1990s. In the mid-1990s, an affiliate of Industrias Peñoles S.A. de C.V. (Peñoles) drilled six reverse circulation holes for a total of 1,368 m to test several silicified zones. In 1992, the area was visited by Peter Megaw on behalf of Teck Corporation (Teck) as part of a reconnaissance program in Chihuahua State carried out from 1991 to 1994. Megaw determined that the area exhibited characteristics favourable for large CRDs. Teck’s field work included reconnaissance mapping and detailed sampling of the jasperoid veins along Cinco de Mayo Ridge. Teck transferred the Property to Cascabel in early 2000 with no retained interest. Cascabel continued to stake claims until 2003. In 2004, MAG optioned the ground from Cascabel.“ (Source)

The discovery of the buried José Manto on the Cinco de Mayo Property in Mexico was not an overnight success. It was only after 15 years of research and systematic exploration when it emerged as a high-priority target for MAG Silver Corp. (TSX: MAG; current market cap.: $1.8 billion) in 2007.

In February 2007, assays from the first 9 holes were announced: 1.88 m @ 190.9 g/t silver, 7.9% zinc and 4.3% lead (starting after 355 m of core length)

In February 2008, assays from discovery hole #20 at José Manto were announced: 6.8 m @ 254 g/t silver, 7% zinc and 6.4% lead (after 471 m of core length)

In July 2008, more assays were announced (drilled near discovery hole): 3.46 m @ 612 g/t silver, 13.2% zinc and 11.59% lead (after 520 m of core length, which is at a vertical depth of ~400 m)

In September 2008, more assays with significant gold credits were announced: 1.5 m @ 370 g/t silver, 6.89 g/t gold, 9.46% zinc and 19.15% lead (after 750 m of core length)

In December 2008, more assays were announced: 5.57 m @ 487 g/t silver, 16.46% zinc and 8.97% lead (after 460 m of core length)

In January 2009, more assays were announced: 2.72 m @ 462 g/t silver, 13.62% zinc and 10.06% lead (after 485 m of core length)

Despite the extensive alluvial cover, the 2007/2008-drilling program intersected significant mineralization within a laterally traceable, low-angle structural host over an area of more than 8 km2.

In September 2009, first assays from drilling at Pozo Seco (4 km southwest of the José Manto discovery) were announced: 75 m @ 0.307% molybdenum (beginning near surface), including 34.5 m @ 0.637% molybdenum and 0.467 g/t gold (after 47 m of core length)

“The Pozo Seco moly-gold results may be a strong indicator that a causitive intrusive [porphyry] center is located nearby.“ (MAG Silver in September 2009)

In November 2009, more assays from the Pozo Seco moly-gold discovery were announced: 57.34 m @ 0.35% molybdenum and 0.73 g/t gold (after 19 m of core length)

In July 2012, first assays from newly discovered, deep Pegaso Zone were announced: 61.6 m @ 89 g/t silver, 0.78 g/t gold, 0.13% copper, 7.3% zinc and 2.1% lead (after 928 m of core length)

“[This hole at the Pegaso Zone] has cut by far the strongest mineralization yet seen at Cinco de Mayo. The size and geological characteristics we see are the kind of major mineralization centre/source we have long expected at Cinco de Mayo, and it is open in all directions. This is a real victory for our systematic exploration methodology and we are very pleased to deliver another discovery of this magnitude to our shareholders, this time 100% owned.“ (MAG Silver in July 2012)

MAG Silver started aggressive drilling programs at Cinco de Mayo in 2007, which continued until September 2012. In November 2012, MAG Silver announced that “landholders from the local community of Ejido Benito Juarez (the “Ejido“) voted [...] to expel MAG from its Cinco de Mayo property and establish a 100 year mining moratorium over the area.“

According to MAG Silver‘s current “Cinco de Mayo“ project website: “As MAG Silver has been unable to negotiate a renewed surface access agreement with the local Ejido controlling the surface access to key portions of the property, a full impairment was recognized in the year ended December 31, 2016. MAG Silver continues to believe that the Cinco de Mayo Property has significant geological potential and will continue to maintain these mineral concessions in good standing.“

Excerpts from MAG Silver‘s Annual Information Form (2016):

• MAG has made a major carbonate replacement deposit (CRD) discovery at its 100% owned Cinco de Mayo Property in northern Chihuahua, Mexico.

• The Upper Manto Pb-Zn-Ag (Au) deposit, formerly known as the Jose Manto-Bridge Zone deposit, consists of two parallel and overlapping manto deposits referred to as the Jose Manto and the Bridge Zone. The Property also hosts the Pozo Seco Mo-Au deposit [...] the two deposits host distinctly different mineralization with different commodities, are separated by four kilometres and small mountain range, will potentially be mined by different methods, underground for Upper Manto and open pit for Pozo Seco, and have no significant synergies between them.

• A total of six zones were modelled, with the largest, Manto M10, extending from the northwest part of the Jose Manto deposit to partway into the Bridge Zone and measuring 2,500 m long by 350 m down dip by 1.5 m to 9 m thick. The zones extend from surface to a depth of 950 m below surface

Upper Manto resource (Inferred, 2012):

12.45 million t @ 132 g/t silver, 0.24 g/t gold, 6.47% zinc and 2.86% lead, containing:

• 52.7 million ounces of silver [in-situ-value today: $1 billion USD]

• 96,000 ounces of gold [in-situ-value today: $158 million USD]

• 1.77 billion pounds of zinc [in-situ-value today: $2.3 billion USD]

• 785 million pounds of lead [in-situ-value today: $667 million USD]

The 61.6 m of massive sulphide intercept, known as the Pegaso Zone located deeper in hole CM-12-431, was not included in this resource estimate. That intercept indicates excellent potential for a much larger resource at depth, however, additional drilling is required to establish the geometry of the Pegaso Zone.

Full size / Conceptual model for CRDs in Chihuahua, Mexico. (Source)

Excerpts from “Cinco de Mayo: A new silver, lead, and zinc discovery in northern Mexico“ (2009):

• CRD deposits account for roughly 4 billion ounces or 40% of the 10 billion total silver ounces produced in Mexico. They are second only to Mexico’s epithermal veins in historic silver production.

• Major CRDs average 10-13 million tonnes with the largest exceeding 50 million tonnes of high-grade ore. Grades typically range from 60-600 g/t silver, 2-12% lead, 2-18% zinc, with trace copper and gold. CRD ore bodies are generally straightforward metallurgically, amenable to low-cost underground mining methods, and their environmental footprint is minimal.

• The vast majority of CRDs found to date outcropped and were followed from surface to depth. Such opportunities are now mostly exhausted. [As such,] CRDs are difficult exploration targets... Focusing the search on areas where known CRDs have adequate size and grade potential and then applying modern and appropriate exploration techniques is essential.

Full size / Source: Core Assets Corp.

Dr. Peter Megaw is the co-founder of Minera Cascabel and MAG Silver. His Ph.D. work was an exploration-focused geological study of the Santa Eulalia Ag-Pb-Zn District in Mexico and CRDs in general. He has published extensively on CRDs in both geological and mineralogical journals and books. Dr. Megaw and his team are credited with the significant discoveries at Platosa, Durango (Excellon Resources), Juanicipio-Fresnillo, Zacatecas (JV between Fresnillo and MAG Silver), Pozo-Seco/Cinco de May (MAG Silver).

Source: https://youtu.be/KtATQ4dvCW0

About CRDs

CRDs offer much larger tonnage potential than VMS and MVT deposits while at the same time typically hosting higher grades of silver, zinc, lead, and copper, sometimes with appreciable credits of gold and other metals.

CRDs are responsible for roughly 40% of Mexico’s 10 billion ounce historic silver production and are characterized by massive to semi-massive silver-lead-zinc-sulphide replacements of limestone. CRDs occur along major regional structures that hosts several of the largest CRDs in Mexico: “The Carbonate Replacement Deposit (CRD) model evolved from Dr. Peter Megaw’s PhD studies at Santa Eulalia: repeatedly validated worldwide...The Santa Eulalia District ranks as one of Mexico’s chief silver and base metal producers, and its largest CRD. Historic district production (1703-2020) amounts to 51 Mt of ore at average grades of 310 g/t Ag, 8.2% Pb, 7.1% Zn, yielding a total of 500 Moz Ag, 4 Mt Pb and 3.6 Mt Zn.“ (Source)

“CRDs are the second largest contributor to the historic silver production of Mexico. CRDs are the backbone of Mexico’s world-class underground lead-zinc mining industry. The country contains many Ag-Pb-Zn (Cu, Au) CRDs, which occur along the intersection of the Mexican Thrust Belt and Sierra Madre Occidental Magmatic Belt. The biggest CRD deposits appear to lie along inferred deep crustal structures.“ (Source)

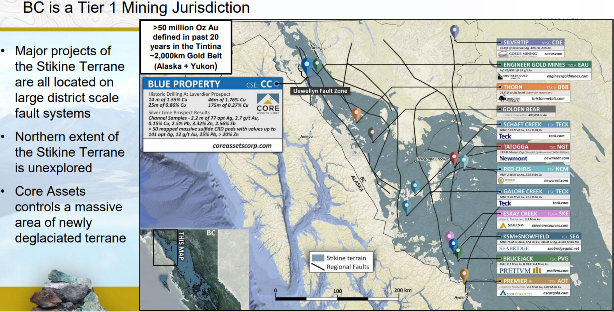

While VMS deposits oftentimes host metallurgically complex ores, CRDs and MVTs are rather uncomplicated metallurgically. The total average operating costs (for mining, milling and processing) are generally lower for CRDs and MVTs than for VMS and Sedex-type deposits or even vein-type deposits. (Source) Moreover, CRDs typically form as a result of a near-by porphyry intrusion, thus offering potential to add large tonnage from mining such deposit aside from CRDs. These days, most of such projects worldwide are facing the challenge of many companies controlling small portions of a CRD-porphyry system, oftentimes under option agreements and/or with underlying royalty liabilities (NSRs; Net Smelter Royalties; somewhat unattractive for majors). This makes it difficult for majors to acquire the full extent of such large CRD-porphyry systems to better understand the regional geology and structure of the complex with district-scale exploration programs. With Blue, Core Assets owns 100% of a very large, district-scale property (1083 km2), royalty-free. Once the geology and structure of the CRD showings at surface are better delineated with drilling, this potential CRD mineralization (chimneys, mantos, and/or skarns) is targeted to lead to the source – possibly a large and well-mineralized copper porphyry enriched with gold or molybdenum.

Full size / Source: Core Assets Corp.

Despite over 130 million ounces of gold, 800 million ounces of silver and 40 billion pounds of copper already found in Golden Triangle‘s rugged terrain, significant discovery potential remains. With glaciers retreating in many parts of the region, new geological explanations and modern exploration methods are paving the way for new discoveries in the making.

Bull market in base and precious metals

Previous Coverage

Report #8: “Drills are turning at Laverdiere (the find of the 1970s) followed by Silver Lime (the find of the 2020s?)“ (Web Version / PDF)

Report #7: “With a portable core drill, Nick tested some discovery outcrops“ (Web Version / PDF)

Report #6: “Exceeding expectations with high grades of silver, copper, zinc, lead, and gold from sampling at the Blue Property in northern British Columbia“ (Web Version / PDF)

Report #5: “Retreating ice uncovers major discovery potential for CRD-Porphyry system at district-scale Blue Property, BC“ (Web Version / PDF)

Report #4: “The Silver-Copper Super-Cycle“ (Web Version / PDF)

Report 3: “The Llewelyn Fault Zone: A district-scale plumbing system analog to other prolific mining and exploration camps in the Golden Triangle?“ (Web Version / PDF)

Report 2: “On a Mission to Become the Premier Copper-Gold Porphyry Explorer of the Northernmost Extent of the Golden Triangle“ (Web Version / PDF)

Report 1: “Perfect Time to Reshape the Golden Triangle in British Columbia“ (Web Version / PDF)

Company Details

Core Assets Corp.

Suite 1450 – 789 West Pender Street

Vancouver, BC, V6C 1H2 Canada

Phone: +1 604 681 1568

Email: info@coreassetscorp.com

www.coreassetscorp.com

Incorporation Date: April 20, 2016

Listing Date: July 27, 2020

CUSIP: 21871U05 / ISIN: CA21871U1057

Shares Issued & Outstanding: 74,112,523

Canadian Symbol (CSE): CC

Current Price: $0.35 CAD (10/28/2022)

Market Capitalization: $26 Million CAD

German Symbol / WKN: 5RJ / A2QCCU

Current Price: €0.268 (10/28/2022)

Market Capitalization: €20 Million EUR

Contact:

Rockstone Research

Stephan Bogner (Dipl. Kfm.)

8260 Stein am Rhein, Switzerland

Phone: +41-44-5862323

Email: info@rockstone-research.com

www.rockstone-research.com

Core Assets News-Disclaimer: National Instrument 43-101 Disclosure: Nicholas Rodway, P.Geo, (Licence# 46541) (Permit to Practice# 100359) is President, CEO and Director of the Company, and qualified person as defined by National Instrument 43-101. Mr. Rodway supervised the preparation of the technical information in this news release. Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release. FORWARD LOOKING STATEMENTS: Statements in this document which are not purely historical are forward-looking statements, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. Forward looking statements in this news release include expectations regarding the pending core assays, including speculative inferences about potential copper, molybdenum, gold, silver, zinc, and lead grades based on preliminary visual observations from results of diamond drilling at the Silver Lime Project; that preliminary results of drilling have exceeded the Company’s expectations; the Company’s plans to further investigate the geometry and extent of the skarn and carbonate replacement type mineralization continuum at Silver Lime through additional field work and diamond drilling; the proposed diamond drilling program planned for Silver Lime in 2022; that drilling efforts will aim to confirm and extend certain targets and mineralization on the property; that the Company’s exploration model could facilitate a major discovery at the Blue Property; that the Company anticipates it can become one of the Atlin Mining District’s premier explorers and that there are substantial opportunities for new discoveries and development in this area. It is important to note that the Company´s actual business outcomes and exploration results could differ materially from those in such forward-looking statements. Risks and uncertainties include that expectations regarding pending core assays based on preliminary visual observations from diamond drilling results at Silver Lime may be found to be inaccurate; that results may indicate Silver Lime does not warrant further exploration efforts; that the Company may be unable to implement its plans to further explore Silver Lime and, in particular, that the proposed diamond drilling program planned for Silver Lime may not proceed as anticipated or at all; that drilling efforts may not confirm and extend any targets or mineralization on the Silver Lime; that the Company’s exploration model may fail to facilitate any commercial discovery of minerals at the Blue Property; that the Company may not become one of Atlin Mining District’s premier explorers or that the area may be found to lack opportunities for new discoveries and development, as anticipated; that further permits may not be granted in a timely manner, or at all; that the mineral claims may prove to be unworthy of further expenditure; there may not be an economic mineral resource; that certain exploration methods, including the Company’s proposed exploration model for the Blue Property, may be ineffective or inadequate in the circumstances; that economic, competitive, governmental, geopolitical, environmental and technological factors may affect the Company´s operations, markets, products and prices; our specific plans and timing drilling, field work and other plans may change; we may not have access to or be able to develop any minerals because of cost factors, type of terrain, or availability of equipment and technology; and we may also not raise sufficient funds to carry out or complete our plans. Additional risk factors are discussed in the section entitled "Risk Factors" in the Company´s Management Discussion and Analysis for its recently completed fiscal period, which is available under the Company´s SEDAR profile at www.sedar.com. Except as required by law, the Company will not update or revise these forward-looking statements after the date of this document or to revise them to reflect the occurrence of future unanticipated events.

Rockstone Disclaimer: This report contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Core Assets Corp. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to Core Assets Corp.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through its profile on SEDAR at www.sedar.com. Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, holds an equity position in Core Assets Corp., as well as in Zimtu Capital Corp., and is being paid by Zimtu Capital Corp. for the preparation, publication and distribution of this report, whereas Zimtu Capital Corp. also holds a long position in Core Assets Corp. Note that Core Assets Corp. pays Zimtu Capital Corp. to provide this report and other investor awareness services. Zimtu Capital Corp. is an insider of Core Assets Corp. by virtue of owning more than 10% of Core’s issued stock. Core Assets Corp. has one or more common directors with Zimtu Capital Corp.