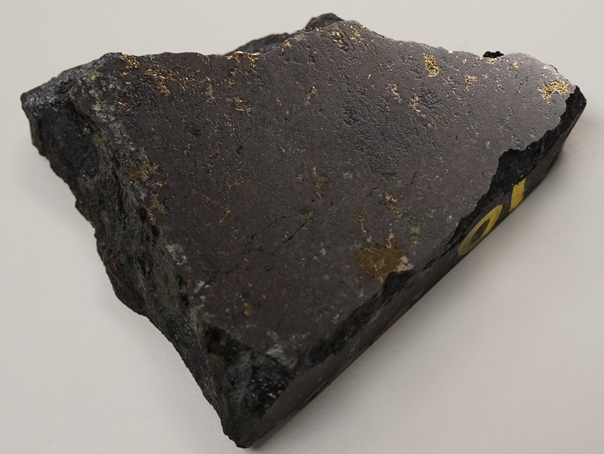

Full size / Polished sample of CRD mineralization from Silver Lime‘s Jackie Target assaying 1,530 g/t silver, 14.6% zinc, >20% lead and 0.23% copper.

Disseminated on behalf of Core Assets Corp. and Zimtu Capital Corp.

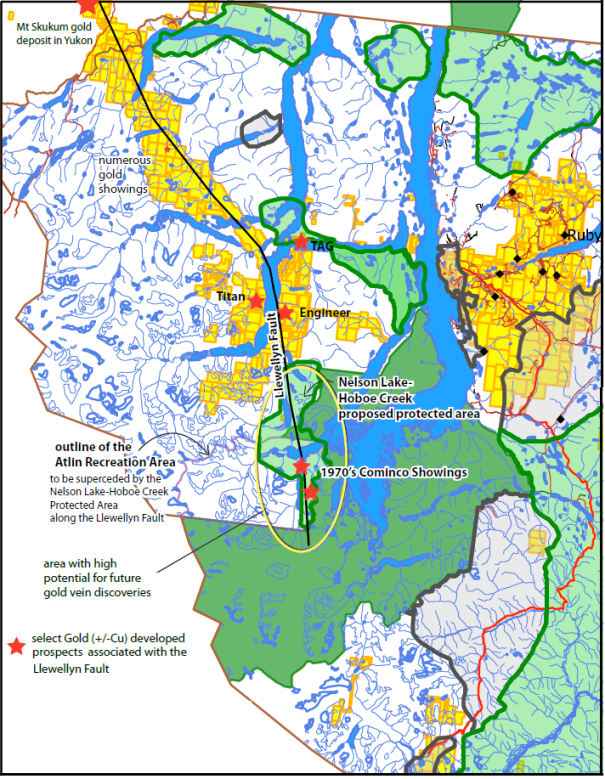

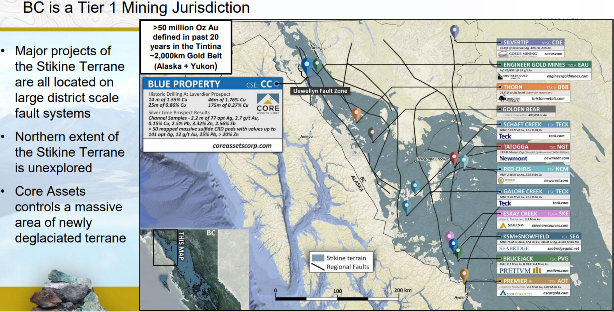

Today, Core Assets Corp. announced the start of its maiden 5,000 m drill program at its district-scale Blue Property (1,116 km2) within the Atlin Mining District of northwest British Columbia, Canada. Drilling has begun at the Laverdiere Skarn-Porphyry Project with up to 1,500 m at three drill locations, followed by an additional 3,500 m of drilling at the Silver Lime CRD Project, where the company discovered an unusual high number of outcropping CRD mineralization last year.

Many if not most exploration projects worldwide are going back into known areas of mineralization, or into the shadow of established mining operations. Nowadays, virtually nobody is making new, boots-on-the-ground discoveries, not to speak of establishing new mining districts.

Voisey‘s Bay was probably the largest discovery of massive sulfides we have seen globally for about 30 years – the last pure, at-surface discovery, totally unexpected. People said there was nothing there and nobody went until two prospectors did anyway. Same with Core Assets‘ Silver Lime discovery – some people told Nick not to go there. “There‘s nothing to find but slippery glaciers and hungry grizzlies!“

Nick went anyway. And he found “the largest known, untested exposure of carbonate replacement mineralization (CRM) globally“, as he humbly noted in a recent news-release. With some glaciers in the area having retreated on the back of global warming, strongly mineralized outcrops rich in silver, zinc, lead and copper have been revealed to the one who dared to take a first look.

As it‘s true to say “it‘s not a discovery until proven by the drill bit“, the two prospectors realized within 15 minutes of standing on the Voisey‘s Bay “discovery outcrop“ that they had made “a potentially significant mineral discovery“. Looking at Nick‘s frequent open-market buying of Core Assets shares, he obviously shares that 30-year-old feeling of potentially making a major discovery, totally out of the blue.

With drilling at Silver Lime‘s “2021 discovery outcrops“ expected to start in July, my bets are fully placed now – before freshly cut core delivers official numbers. It‘s the opportunity of potential that creates the greatest reward, or total loss. For me and a few others, it‘s worth a bet anyway.

Nain, in the remoteness of northern Newfoundland and Labrador, is the closest town to the Voisey‘s Bay massive sulfides mine, most comfortably reachable with a 15-minutes helicopter flight. There‘s water (and ice in winter) everywhere. “By any standards the Voisey’s Bay nickel mine is remote... No roads connect it to the outside world.“ (Source: “Ice and Lolly“, 2014)

Atlin, in the remoteness of northern British Columbia bordering the Yukon, is the closest town to Blue‘s Laverdiere and Silver Lime Projects, the latter includes targets with futuristic names such as “Sulphide City“. To get there from Atlin, it‘s best to take a snow-mobile over iced waters or a 15-minutes ride in a helicopter. There‘s an unheard-of high number of rusty outcrops hosting massive sulphides at (its) best.

In the late 1960s, a protected provincial park (covering parts of today‘s Blue Property) was proposed by the government – killing all exploration projects in the area for a very long time. The park was never implemented, probably thanks to governmental assessments and companies such as Cominco Ltd., Bethlehem Copper Corporation Ltd. and Hobo Creek Coppermines Ltd. writing letters to the government highlighting the high potential for mineral discoveries to be made in the area.

Unfortunately, the same companies were unable to convince investors to finance exploratory projects with a `Sword of Damocles‘ hanging above their heads (i.e. risk of proposed park to be implemented). This makes Core Assets Corp. all the more fortunate to have picked up 1,116 km2 of vastly pristine ground, including the properties which several companies held back then.

“Pleasure to me is wonder – the unexplored, the unexpected, the thing that is hidden and the changeless thing that lurks behind superficial mutability. To trace the remote in the immediate; the eternal in the ephemeral; the past in the present; the infinite in the finite; these are to me the springs of delight and beauty.“ (H. P. Lovecraft, 1890-1937, American writer of weird, science, fantasy and horror fiction)

Full size / Laverdiere Copper Prospect 2020: Mineralized outcrop with green malachite oxidation.

Full size / Laverdiere Copper Prospect 2020: Mineralized outcrop with green malachite oxidation.

In May 1969, Mr. Ahrens wrote a letter to Mr. Blakey (Deputy Minister), stating the following: “Our present studies of mineral occurrence, both known and inferred, show the proposed park to be in a zone of high to relatively high potential. Little is known regarding mineral deposits because the entire Atlin area has not received much attention for a good many years. However, there is a property on Willison Creek at the head of Willison Bay owned by Cominco. Work has been done on this ground in recent years and Cominco informs me that although no work is proposed for 1969 there will definitely be a programme in 1970. At Hobo Creek, ground is held by Bethlehem which has been farmed out to others for drilling and investigations in 1969. Both these properties include Crown-granted as well as located claims. We have not had a geologist in the Atlin region for many years but this year Sutherland Brown will go in at least to look at some current activity north and east of Atlin and there is a possibility that he can visit Willison Bay also, within the proposed park... I think there is too great a conflict with mining interests for a park of the proposed dimension, and that to put mining out of the bounds in that area would be a major disservice to this Province.“

Upon receipt of above letter, Mr. Hedley (Chief, Mineralogical Branch) forwarded it to Mr. Blakey with the following note: “Certainly a Class A park of the proposed size should not be considered. It is hard to see how any mining operations in that area could be large enough or destructive enough to spoil the head of Atlin Lake or to ruin the views of the Llewellyn Glacier.“

In July 1971, Sutherland Brown (Deputy Chief, Mineralogical Branch) filed a preliminary assessment of the mineral potential of the proposed park area, stating the following: “The highest potential of the area is in the western block [i.e. west of the Llewellyn Fault, i.e. the location of today‘s Blue Property]... About half of the park area is formed of the western block. This has the highest potential of the three [besides eastern block and central block, both of which were appraised with a moderate potential], with many showings and gossans known even though it is largely glacier covered, difficult to access, and poorly prospect except along the lake margins. Map No.2 shows the large number of valid claims south of Willison Bay, and map No. 3 shows known showings and properties. These are of diverse types but the most important are porphyry molybdenum stockworks, massive sulphides (Cu, Zn, Pb) deposits most of which are along shear zones, skarn deposits (Cu, Fe (Au, Ag)), and veins (Cu; and Pb Zn Ag Sb). Only a minor amount of drilling or development has been done of any prospects. Two have received preliminary drilling (Molly Atlin and Laverdiere) and several copper veins near the lakes have adits driven on them. Molly Atlin (Cominco) has only had preliminary testing but is an active copper prospect. It is a large low grade molybdenum porphyry prospect that has a “high“ grade core, a breccia zone containing 2.5 million tons of 0.35% MoS2. Its full potential is unknown. Access to it is easy for it is just a few thousand feet from Willison Bay. The Laverdiere property (Cantex) is a copper bearing magnetite skarn deposit in complexly folded Paleozoic limestone. It is high grade... It is on Hobo Creek with relatively easy access and is currently being prospected. The Glacier Group (Falconbridge) on Upper Willison Creek is potentially interesting. It consists of a sheeted zone of pods and veins of replacement in limestone by galena and sphalerite with some silver and also galena, stibnite veins (Sb, Ag, Pb). It is surrounded by a broad halo of pyrite with pyrite and chalcopyrite veinlets. In all likelihood the main mineralization has not been found as much of the vicinity is glacier covered... RECOMMENDATION: The area should be held open for prospecting and consideration should be given to a full mineral potential assessment.“

It took the provincial government many years to do so, during which uncertain times most exploration projects were put on hold and claims ultimately lapsed, although the protected park was never established.

Full size / Malachite (copper oxide) rind on weathered surface of an outcrop at Laverdiere.

Laverdiere Skarn-Porphyry Project

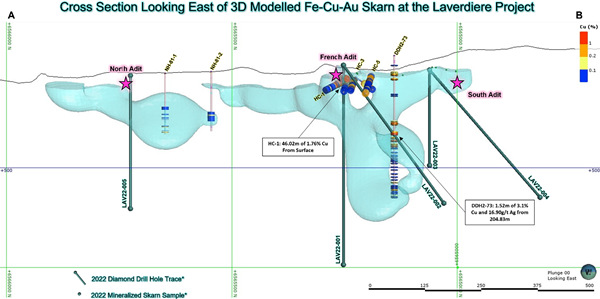

According to above letter from 1972, Hobo Creek Coppermines Ltd. first drilled Laverdiere in 1969 (19.51 m @ 1.83% copper), followed by a second drill program in 1971 which was “once again very successful in proving up more high grade tonnage“ (46 m @ 1.76% copper), hence “very exciting“ despite low base metals prices during that time. Hobo Creek‘s geologist, Arpaad Fustos, who supervised the drilling in 1971, was of the opinion and has stated that Laverdiere‘s porphyry deposit could be “the find of the 70‘s“. The company was negotiating with a number of majors for further financing, however the proposed park put a spoke in Hobo Creek‘s wheel.

In the 1980s, when metals prices were nosediving, Noranda picked up Laverdiere and drilled 2 holes, however only a total of 19.3 m was reported from hole NH-81-1

and only 20.8 m was reported from NH-81-2. Back then, a lot of data was never submitted to the government or the public. Although the government decided against the park in the 1970s, similar proposals were made again in the 1980s, once more deciding against it years later. This uncertainty left many projects unexplored.

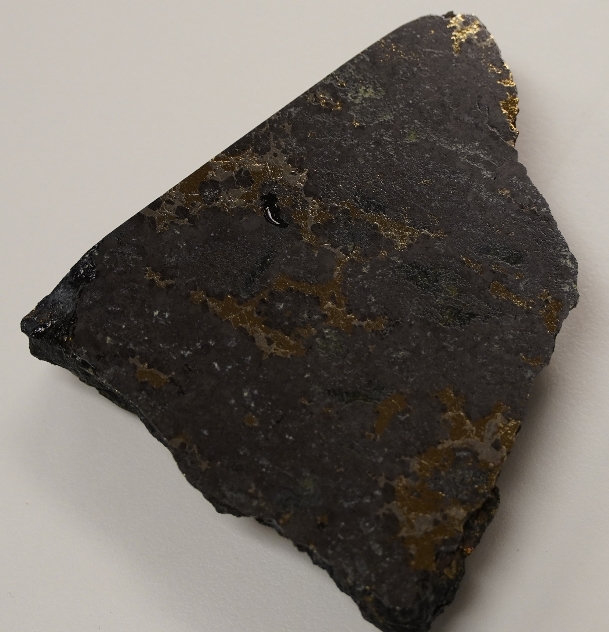

Full size / Chalcopyrite veining in copper-gold-magnetite skarn from Laverdiere. “High-grade Fe-Cu-Au skarn mineralization delineated from prospecting and historic drilling between the South and North adits at Laverdiere is currently traceable for 800m along surface, to 300m at depth, and remains open in all directions. The LFZ represents a regional, crustal-scale structure that remains untested by deep diamond drilling at Laverdiere, and is spatially and temporally related to porphyry, skarn, and epithermal-type mineralization along its entire length in NW BC (>170km).“ (April 2022)

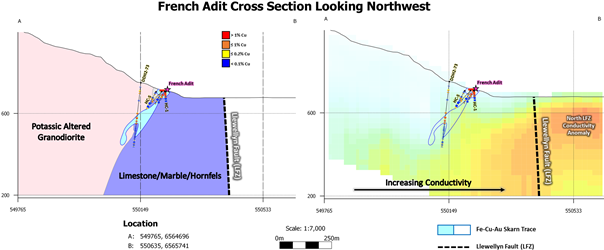

Today, Core Assets announced that a 1,500 m drill program at Laverdiere has started, targeting high-grade Fe-Cu-Au skarn and Cu-Mo porphyry mineralization mapped over a surface extent of 800 m between the historic North and South Adits.

Full size / Property geology map of the Laverdiere Project showing the extent of Fe-Cu-Au skarn mineralization, Cu grade in surficial grab samples, and the locations of historic and 2022 drill holes. Line A-B illustrates the location of the east-looking cross-section/3D model in below Figure.

Full size / Illustrated 3D Model of the high-grade Fe-Cu-Au skarn at the Laverdiere Project highlighting 2022 drill plans, skarn mineralization extents modelled from historic and recent surficial assay data and historic diamond drilling.

Drill targets and plans at Laverdiere include 3 separate drill locations for a total of 5 holes (see above map):

• Pad 1: Confirming and extending the high-grade, historic massive Fe-Cu-Au skarn intersections and Cu-Mo porphyry mineralization proximal to the French Adit.

• Pad 2: Drill testing the undrilled Cu-rich skarn mineralization proximal to the historic South Adit.

• Pad 3: Drill testing and extending Fe-Cu-Au skarn and associated Cu-Mo porphyry mineralization at the North Adit.

Core Assets’ President and CEO, Nick Rodway, commented in today‘s news-release: “The weather in Atlin this season has been spectacular, and we are drilling earlier than expected. While the diamond drill turns at Laverdiere, we will be mobilizing field crews to the Silver Lime CRD-Porphyry Project to complete preliminary field work, and geological mapping, to better prepare for drilling at this high priority project in late June or early July.”

Excerpts from today‘s news:

2022 Diamond Drilling at the Laverdiere Project

1,500 Metres of exploratory HQ-sized diamond drilling is planned for the Laverdiere Project in June. 2022 drilling efforts will aim to confirm and extend high-grade Fe-Cu-Au skarn and associated Cu-Mo porphyry style mineralization observable for 800 Metres along the western flank of Hoboe Creek and for up to 300 Metres depth, situated between the historic North and South Adits.

The Laverdiere Project is located proximal to the Llewellyn Fault Zone, coincident with Hoboe Creek in the eastern Blue Property. Laverdiere is characterized as a fine-to-coarse grained and locally massive Fe-Cu-Au-rich skarn (magnetite and/or magnetite-chalcopyrite-dominant ±bornite-tetrahedrite-molybdenite-pyrite-pyrrhotite) hosted in dolomitic limestone and marble of the Devonian Boundary Ranges Metamorphic Suite. Along the western side of Hoboe Creek, dolomitic limestone is overlain by thin-bedded calcareous siltstone, quartzite, and schist – all of which are locally folded, dip moderately to the west, and are intruded by an Early Cretaceous post-accretionary granodiorite intrusion of batholith size (Coast Plutonic Complex). The granodiorite is locally foliated, Cu-Mo-bearing, and exhibits potassic alteration in the form of secondary K-feldspar and shreddy biotite after hornblende along the Fe-Cu-Au skarn contact.

The highest-grade skarn occurrences observed at Laverdiere are hosted in dolomitic limestone, near the siltstone contact and along the margins of the granodiorite intrusion. Disseminated and quartz-vein/fracture-hosted chalcopyrite, molybdenite, magnetite, and malachite have been observed in granodiorite outcropping along the Lewellyn Fault Zone (LFZ/Hoboe Creek) for up to 3.9km south from the main Fe-Cu-Au Skarn body (See News Release Dated April 6, 2022). An increase in disseminated and fracture-hosted chalcopyrite and molybdenite mineralization within the granodiorite unit at depth has also been reported in the deepest drill hole completed on the property to-date (DDH2-73 near the French Adit).

National Instrument 43-101 Disclosure

Nicholas Rodway, P.Geo, (Licence# 46541) (Permit to Practice# 100359) is President, CEO and Director of the Company, and qualified person as defined by National Instrument 43-101. Mr. Rodway supervised the preparation of the technical information in this news release.

In April 2022, Core Assets Corp. announced to have detected an extensive (5 x 4.2 km) magnetic and corresponding resistivity high, coinciding with a causative, potassically-altered and Cu-Mo-bearing granodiorite located adjacent to the Fe-Cu-Au Skarn Target.

A large-scale and untested conductivity anomaly is coincident with the Llewellyn Fault Zone (LFZ), traceable along the entire length of Hoboe Creek. The strongest conductivity highs residing along the LFZ persist to depths of up to 500 m. Cu and Au values in surficial rock samples collected from the Laverdiere Project, as well as the Cu content reported from historic drilling, show increases in overall grade with increasing proximity toward the North LFZ Conductivity Anomaly and the Llewellyn Fault. Figure Left: Map showing Total Magnetic Intensity (TMI) and the distribution of magnetic and overlapping resistivity anomalies at the Laverdiere Project; Figure Right: Map showing the distribution of conductive (hot colors) and resistive (cold colors) geological features in the subsurface at the Laverdiere Project. Line A-B illustrates the location of both cross sections presented in [below] Figure“.

Silver Lime CRD-Porphyry Project

Following the completion of the drill program at the Laverdiere Project, crews will mobilize to the Silver Lime Project to complete an additional 3,500 m of drilling.

The Laverdiere Skarn-Porphyry and the Silver Lime CRD-Porphyry are not related (different age) and hence separate systems 10-15 km apart.

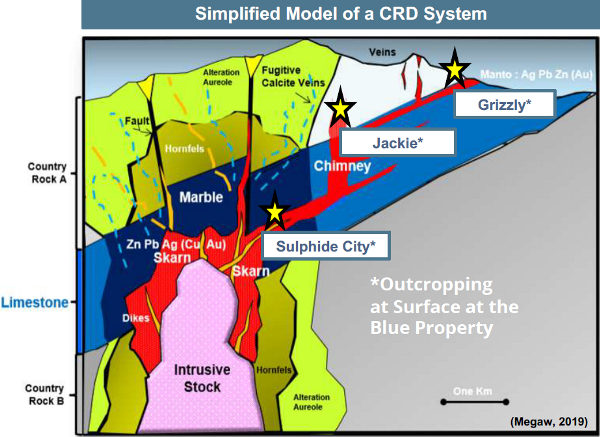

Silver Lime‘s CRD mineralization should be continuous all the way back to the source (porphyry), getting thicker and higher grade at depth.

CRDs (Carbonate Replacement Deposits) are geochemically zoned, so you should be able to tell quickly where you are in the system once initial drill data is available.

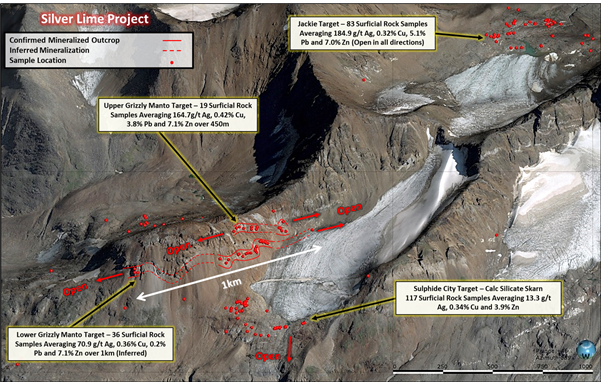

Core Assets is fortunate that Silver Lime‘s targets (Grizzly, Jackie, Sulphide City) are outcropping at surface, which makes drill targeting much easier.

Full size / Interpreted position of the Grizzly, Jackie and Sulphide City Targets at the Silver Lime Project within a simplified model of the CRD-Porphyry environment (Modified after Megaw, 2019). (April 2022)

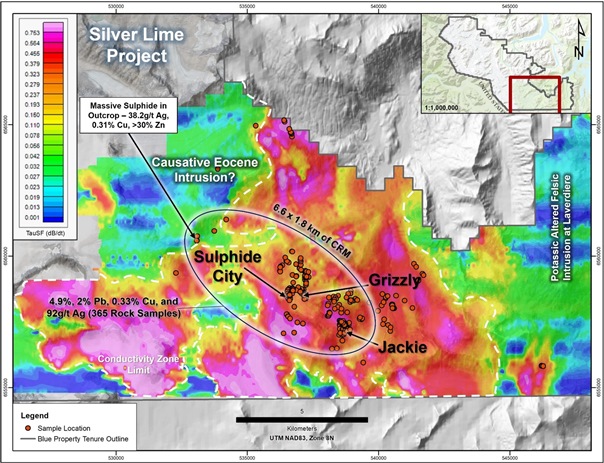

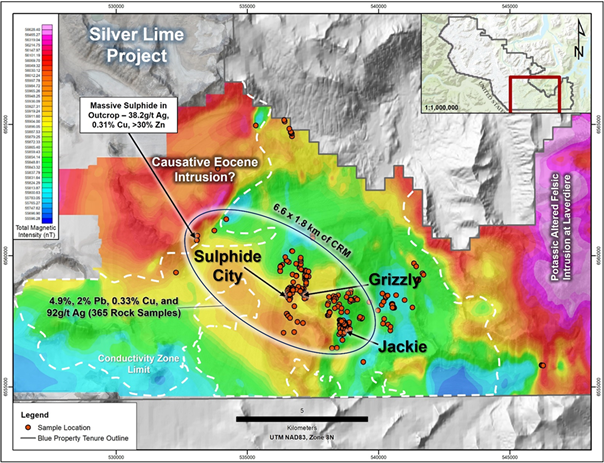

In May 2022, Core Assets announced results and interpretations from the 2021-VTEM Geophysical Survey completed at Silver Lime:

Full size / Map showing the distribution of conductive (hot colors) and resistive (cold colors) geological features in the subsurface at the Silver Lime Project. Samples plotted consist of recent and historical data points. (May 2022)

Full size / Map showing Total Magnetic Intensity (TMI) and the distribution of magnetic and overlapping resistivity anomalies at the Central Blue Property. (May 2022)

• VTEM detected large-scale, untested conductivity anomalies (~104 km2) that are interconnected at depth by local vertical conductive features.

• Conductivity anomalies extend well beyond areas prospected during the 2021 field season.

• The central portion of the conductivity anomalies coincide with the surficial 6.6 x 1.8 km mineralized corridor indicating that this system could have a significantly larger mineralized footprint below surface. See below video animation (3D view of the Silver Lime Project’s main Target areas in reference to the interconnected conductivity zone (hot colours) at the central Blue Property):

• A magnetic and corresponding resistivity high intensifies to the northwest of the Silver Lime Project area and coincides with a potentially causative felsic intrusion (source of ore-bearing fluids) of Eocene age.

• Silver Lime currently boasts an average surficial grade (365 rock samples) of 4.9% Zn, 2% Pb, 0.33% Cu, and 92 g/t Ag within the extensive 6.6 x 1.8 km mineralized corridor making it the largest known, untested exposure of carbonate replacement mineralization (CRM) globally.

• CRM at Silver Lime can be traced along surficial strike lengths of 450 m to 1 km (i.e. Grizzly) with an average surficial grade of 164.7 g/t Ag, 0.42% Cu, 3.8% Pb and 7.1% Zn (19 rock samples over 450 m).

• The Silver Lime Project checks all boxes for CRM exploration criteria including being hosted within a favourable tectonomagmatic terrane (long lived geologic history), and the surface exposure represents the top of the carbonate succession with room to grow, and numerous CRM samples grading >400 g/t Ag with associated high-grade Zn, Cu, and Pb.

Full size / 3D Leapfrog image illustrating the local mineralization features of the Upper and Lower Grizzly Ag-Zn-Cu±Pb CRM Target (average surficial grade - rock samples = 19 for Upper Grizzly; rock samples = 36 for Lower Grizzly), the Sulphide City Zn-Cu±Ag Skarn Target (average surficial grade - rock samples = 117), the Jackie Ag-Pb-Zn-Cu Skarn Target (average surficial grade - rock samples = 83), and surficial sampling progress completed to date. (May 2022)

Core Assets’ President and CEO Nick Rodway commented in the May-news: “The Silver Lime Project is a one-of-a-kind carbonate replacement exploration target that has never been tested by diamond drilling. We are unaware of any known unmined CRDs in the world that boast comparable grades of zinc, lead, silver, and copper over extensive surface exposures like Silver Lime, and that remain unexplored at depth. Combining the surficial assay results at Silver Lime with the newly interpreted deep geophysical features should make for an extremely exciting drill campaign with a high potential for success.”

Full size / Zinc-rich volcanic rock sample from Silver Lime‘s Sulphide City Target.

Full size / Polished sample of CRD mineralization from Silver Lime‘s Jackie Target assaying 111 g/t silver, 8.3% zinc and 5.59% lead.

Full size / Rock sample with 35% zinc carbonate replacement (99% sulfides) from Silver Lime‘s Grizzly Manto Target.

Full size / Polished sample of CRD mineralization from Silver Lime‘s Grizzly Manto Target assaying 1.15% copper, 81.7 g/t silver and 9.17% zinc.

Full size / Polished sample of CRD mineralization from Silver Lime‘s Grizzly Manto Target assaying 0.43% copper, 561 g/t silver, 9.16% zinc and 2.35% lead.

Full size / Polished sample of CRD mineralization from Silver Lime‘s Grizzly Manto Target assaying 0.36% copper, 82 g/t silver and 5.49% zinc. (All rock images courtesy of Core Assets Corp.)

CRD: King of Grade and continuity

• CRDs are known for its high grades of silver, zinc and lead.

• Mining engineers love CRD‘s continuous ore-mining widths of a few metres (up to 10 m and sometimes even more; thickening at depth; ideally suited for underground mining).

• It‘s rare to find unmined CRD outcrops today, simply because if someone had seen just one in the long past of humanity, it would most likely be mined out artisanally or professionally by now. That‘s because they strike the eye with its almost pure, not-uncommonly-90%-pure-metal content.

• Strip Ratio: Without much barren gangue material or deleterious elements, a lot of metal is concentrated in a small tonnage, perfectly suited for low-cost mining and processing methods to boost economics. If you can find +10 million tonnes of high-grade CRDs at or near surface, you can consider yourself fortunate.

• Some CRDs host +100 million tonnes.

• Most CRDs are blind deposits; only rarely with surface exposure. To drill such deposits, deeply and blindly, takes more time and money than to drill into outcrops to quickly chase them with the drill all the way to the source a bit deeper (hopefully not too deep for mining reasons): A magmatic intrusion, typically in form of a porphyry, either barren or enriched with copper, gold and/or molybdenum.

• All CRDs are driven by an intrusion (e.g. porphyry). It is abnormal for a single company (Core Assets) to own both the CRD and the (porphyry) intrusion without any option payments or underlying royalties (e.g. NSR; Net Smelter Royalty). If you can find both deposit types on your property at mineable depths with economic grades, you are off to the races for the world‘s most attractive deposits.

• With its district-scale Blue Property, Core Assets owns 1,116 km2 of highly prospective ground. CRDs generally occur in clusters and bunches (e.g. in Chihuahua, Mexico, where the Santa Eulia and Niaca deposits each host ~45 million tonnes of world-class CRD mineralization – and that does not include the porphyry system). If you can also find the associated porphyry being well-mineralized, you are looking at billions of tonnes (porphyries are large but low-grade; relatively expensive to mine as a lot of throughput).

As such, Core Assets aims to first drill for CRDs, followed by looking for the porphyry by following the CRDs.

Full size / The world-class Hermosa CRD Project is located in the Patagonia Mountains, about 80 km southeast of Tucson, Arizona (USA). (Source)

The last major CRD transaction was the Hermosa CRD Project (formerly Taylor-Hermosa / Hardshell Project).

On June 17, 2018, for an All-Cash-Offer of $1.8 billion CAD, ASX-listed South32 Ltd. took over TSX-listed Arizona Minerals Inc. (offer price of $6.20 CAD per share represented a 50% premium to previous day closing).

Full size / When South32 acquired Hermosa in June 2018, CEO Graham Kerr commented: “Our all cash offer for Arizona Mining will allow us to optimise the design and development of one of the most exciting base metal projects in the industry. We have been a major shareholder in Arizona Mining since May 2017 and an active participant in the Hermosa Project with representation on the operations committee and a nominee on the board of directors. Our deep understanding of this high grade resource and surrounding tenement package, and extensive experience at Cannington, makes us the natural owner of this project and ensures we are well positioned to bring it to development, delivering significant value to our shareholders.” (Image Source)

According to South32 (2022):

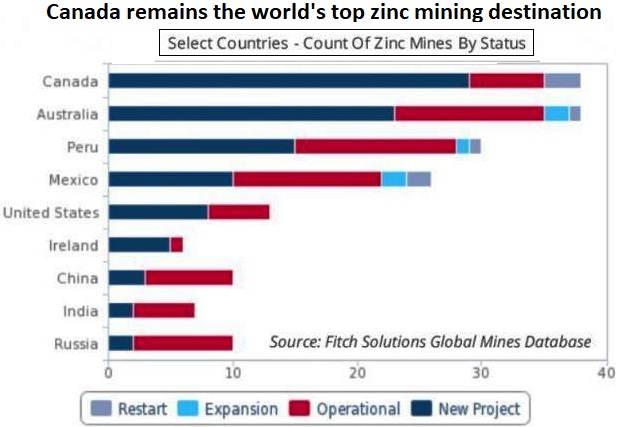

“Our work at Hermosa is part of our strategy to reshape our portfolio and increase exposure to the base metals critical for a low carbon future. Zinc is used in renewable energy infrastructure and to protect against corrosion, while silver is used in solar panels and electric vehicles.“

“Hermosa comprises the zinc-lead-silver Taylor sulphide deposit (Taylor Deposit), the zinc-manganese-silver Clark oxide deposit (Clark Deposit) and an extensive, highly prospective land package with the potential for further polymetallic and copper mineralisation.“

“We have completed a Pre-feasibility Study (PFS) for the Taylor Deposit, our first development option at Hermosa. It is a large, carbonate replacement massive sulphide deposit with a Mineral Resource estimate of 138Mt, averaging 3.82% zinc, 4.25% lead and 81 g/t silver. The deposit remains open at depth and laterally, offering further exploration potential. We are designing the Taylor Deposit to be our first ‘next generation mine’, using automation and technology to minimise our impact on the environment and to target a carbon neutral operation, in line with our goal of net zero operational carbon emissions by 2050.“

“A scoping study for the spatially linked Clark Deposit has confirmed the potential for a separate, integrated underground mining operation producing battery-grade manganese, as well as zinc and silver. The Clark Deposit has a reported resource of 55 million tonnes, averaging 2.31% zinc, 9.08% manganese and 78g/t silver.“

About CRDs

CRDs offer much larger tonnage potential than VMS and MVT deposits while at the same time typically hosting higher grades of silver, zinc, lead, and copper, sometimes with appreciable credits of gold and other metals.

CRDs are responsible for roughly 40% of Mexico’s 10 billion ounce historic silver production and are characterized by massive to semi-massive silver-lead-zinc-sulphide replacements of limestone. CRDs occur along major regional structures that hosts several of the largest CRDs in Mexico: “The Carbonate Replacement Deposit (CRD) model evolved from Dr. Peter Megaw’s PhD studies at Santa Eulalia: repeatedly validated worldwide...The Santa Eulalia District ranks as one of Mexico’s chief silver and base metal producers, and its largest CRD. Historic district production (1703-2020) amounts to 51 Mt of ore at average grades of 310 g/t Ag, 8.2% Pb, 7.1% Zn, yielding a total of 500 Moz Ag, 4 Mt Pb and 3.6 Mt Zn.“ (Source)

“CRDs are the second largest contributor to the historic silver production of Mexico. CRDs are the backbone of Mexico’s world-class underground lead-zinc mining industry. The country contains many Ag-Pb-Zn (Cu, Au) CRDs, which occur along the intersection of the Mexican Thrust Belt and Sierra Madre Occidental Magmatic Belt. The biggest CRD deposits appear to lie along inferred deep crustal structures.“ (Source)

While VMS deposits oftentimes host metallurgically complex ores, CRDs and MVTs are rather uncomplicated metallurgically. The total average operating costs (for mining, milling and processing) are generally lower for CRDs and MVTs than for VMS and Sedex-type deposits or even vein-type deposits. (Source) Moreover, CRDs typically form as a result of a near-by porphyry intrusion, thus offering potential to add large tonnage from mining such deposit aside from CRDs. These days, most of such projects worldwide are facing the challenge of many companies controlling small portions of a CRD-porphyry system, oftentimes under option agreements and/or with underlying royalty liabilities (NSRs; Net Smelter Royalties; somewhat unattractive for majors). This makes it difficult for majors to acquire the full extent of such large CRD-porphyry systems to better understand the regional geology and structure of the complex with district-scale exploration programs. With Blue, Core Assets owns 100% of a very large, district-scale property (1083 km2), royalty-free. Once the geology and structure of the CRD showings at surface are better delineated with drilling, this potential CRD mineralization (chimneys, mantos, and/or skarns) is targeted to lead to the source – possibly a large and well-mineralized copper porphyry enriched with gold or molybdenum.

Despite over 130 million ounces of gold, 800 million ounces of silver and 40 billion pounds of copper already found in Golden Triangle‘s rugged terrain, significant discovery potential remains. With glaciers retreating in many parts of the region, new geological explanations and modern exploration methods are paving the way for new discoveries in the making.

Bull market in base and precious metals

Previous Coverage

Report #7: “With a portable core drill, Nick tested some discovery outcrops“ (Web Version / PDF)

Report #6: “Exceeding expectations with high grades of silver, copper, zinc, lead, and gold from sampling at the Blue Property in northern British Columbia“ (Web Version / PDF)

Report #5: “Retreating ice uncovers major discovery potential for CRD-Porphyry system at district-scale Blue Property, BC“ (Web Version / PDF)

Report #4: “The Silver-Copper Super-Cycle“ (Web Version / PDF)

Report 3: “The Llewelyn Fault Zone: A district-scale plumbing system analog to other prolific mining and exploration camps in the Golden Triangle?“ (Web Version / PDF)

Report 2: “On a Mission to Become the Premier Copper-Gold Porphyry Explorer of the Northernmost Extent of the Golden Triangle“ (Web Version / PDF)

Report 1: “Perfect Time to Reshape the Golden Triangle in British Columbia“ (Web Version / PDF)

Company Details

Core Assets Corp.

Suite 1450 – 789 West Pender Street

Vancouver, BC, V6C 1H2 Canada

Phone: +1 604 681 1568

Email: info@coreassetscorp.com

www.coreassetscorp.com

Incorporation Date: April 20, 2016

Listing Date: July 27, 2020

CUSIP: 21871U05 / ISIN: CA21871U1057

Shares Issued & Outstanding: 74,112,523

Canadian Symbol (CSE): CC

Current Price: $0.66 CAD (06/03/2022)

Market Capitalization: $49 Million CAD

German Symbol / WKN: 5RJ / A2QCCU

Current Price: €0.468 (06/03/2022)

Market Capitalization: €35 Million EUR

Contact:

Rockstone Research

Stephan Bogner (Dipl. Kfm.)

8260 Stein am Rhein, Switzerland

Phone: +41-44-5862323

Email: info@rockstone-research.com

www.rockstone-research.com

Core Assets News-Disclaimer: Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release. FORWARD LOOKING STATEMENTS: Statements in this document which are not purely historical are forward-looking statements, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. Forward looking statements in this news release include the Company’s future objective of becoming a premier explorer; that the Company’s exploration model can facilitate a major discovery on the Blue Property; that the Blue Property is prospective for copper, zinc and silver; that Core Assets will undertake additional exploration activity, including drill testing, on the Blue Property; and that the Blue Property has substantial opportunities for a discovery and development; It is important to note that the Company´s actual business outcomes and exploration results could differ materially from those in such forward-looking statements. Risks and uncertainties include that further permits may not be granted in a timely manner, or at all; the mineral claims may prove to be unworthy of further expenditure; there may not be an economic mineral resource; certain exploration methods, including our proposed exploration model for the Blue Property, that we thought would be effective may not prove to be in practice or on our claims; economic, competitive, governmental, geopolitical, environmental and technological factors may affect the Company´s operations, markets, products and prices; our specific plans and timing drilling, field work and other plans may change; we may not have access to or be able to develop any minerals because of cost factors, type of terrain, or availability of equipment and technology; and we may also not raise sufficient funds to carry out or complete our plans. Additional risk factors are discussed in the section entitled "Risk Factors" in the Company´s Management Discussion and Analysis for its recently completed fiscal period, which is available under the Company´s SEDAR profile at www.sedar.com. Except as required by law, the Company will not update or revise these forward-looking statements after the date of this document or to revise them to reflect the occurrence of future unanticipated events.

Rockstone Disclaimer: This report contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Core Assets Corp. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to Core Assets Corp.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through its profile on SEDAR at www.sedar.com. Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, holds an equity position in Core Assets Corp., as well as in Zimtu Capital Corp., and is being paid by Zimtu Capital Corp. for the preparation, publication and distribution of this report, whereas Zimtu Capital Corp. also holds a long position in Core Assets Corp. Note that Core Assets Corp. pays Zimtu Capital Corp. to provide this report and other investor awareness services. Zimtu Capital Corp. is an insider of Core Assets Corp. by virtue of owning more than 10% of Core’s issued stock. Core Assets Corp. has one or more common directors with Zimtu Capital Corp.