Disseminated on behalf of Core Assets Corp. and Zimtu Capital Corp.

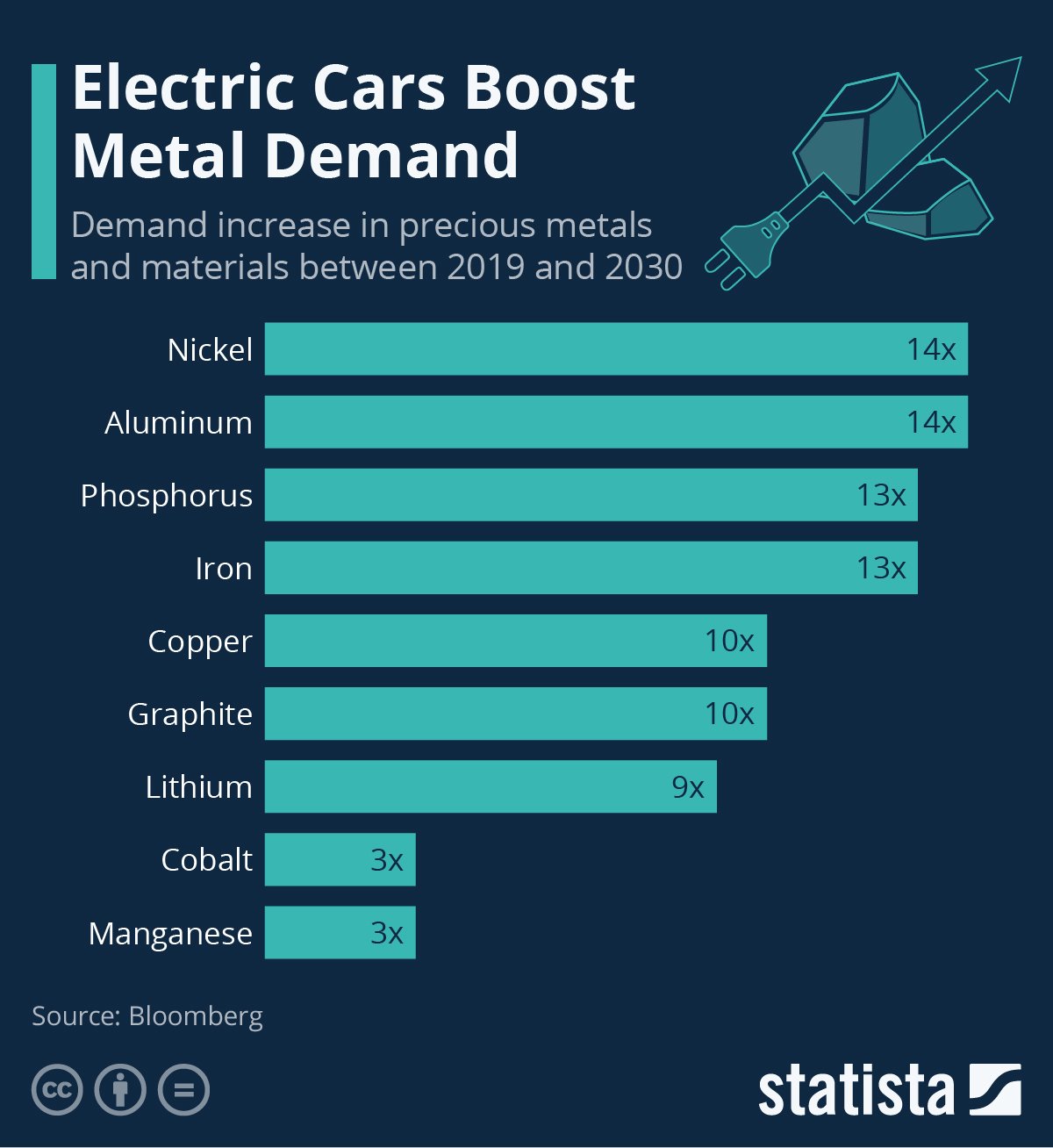

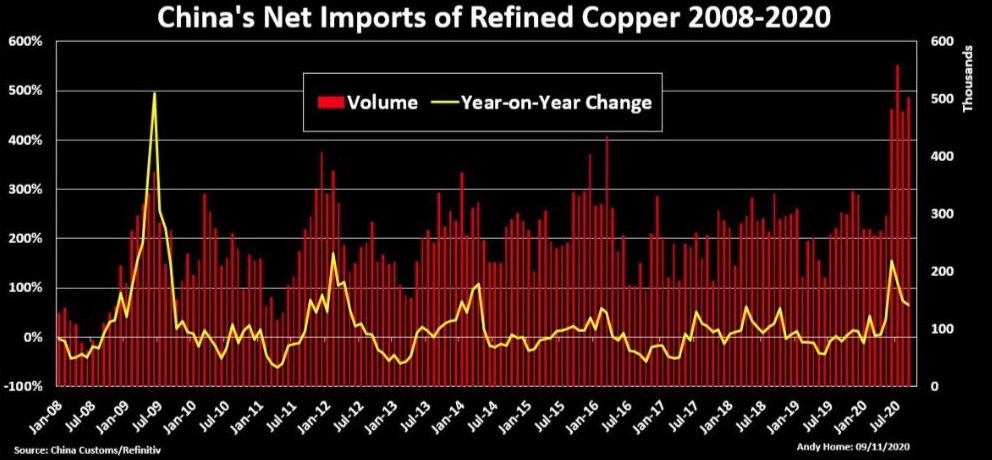

The Gamestop short squeeze, followed by the latest #SilverSqueeze frenzy around the globe, are a testament to how powerful social media communities have become and what force they can unleash simply by spreading information in no time. People never invested in silver before are now rushing into the shiny metal as if there was no tomorrow, or more in an attempt to trigger a short-squeeze to one of the world‘s most shorted commodities. It remains to be seen if this turns out as “The Greatest Short Squeeze in History“. With copper expected to turn into a supply-demand deficit on the strength of the “green wave“ around the globe, the red metal already entered a “super-cycle“ as analysts have figured. With copper being tagged as “the world‘s most important industrial metal“, more and more investors are waking up to the reality that much higher commodity prices are necessary, and probably unpreventable.

“If the world transitions to electric vehicles by 2040 every single pound of the world‘s known copper reserves will be used,“ said Mr. Scherb, a former JPMorgan investment banker who now runs London-based private equity group Appian Capital Advisory, recently raising $775 million for its second mining fund. “We’ve been able to attract a lot of investors that didn’t have metals or mining exposure previously. We could have raised significantly more money but we wanted to maintain only what we felt we could invest,” he said, adding that ”We haven‘t had any major copper discoveries at all over the past decade. So there‘s clearly going to be a mismatch between supply and demand.“

Mr. Scherb is not the only one betting big on copper. Many analysts and investors are rushing into copper as its market price entered a fierce uptrend while exploration and mining stocks with a focus on copper are on a roll, generally. The leading copper producers such as Freeport-McMoRan Inc. have been rocketing up more than 450% from a low of $4.82 USD last March. The share price of First Quantum Minerals Ltd. is up more than 350% since its low about a year ago. With Core Assets Corp. now being permitted to drill, as per today‘s news, the explorer is one major step closer to prove that it has a large copper-gold-silver CRD+porphyry deposit on its property at the edge of the world-famous Golden Triangle.

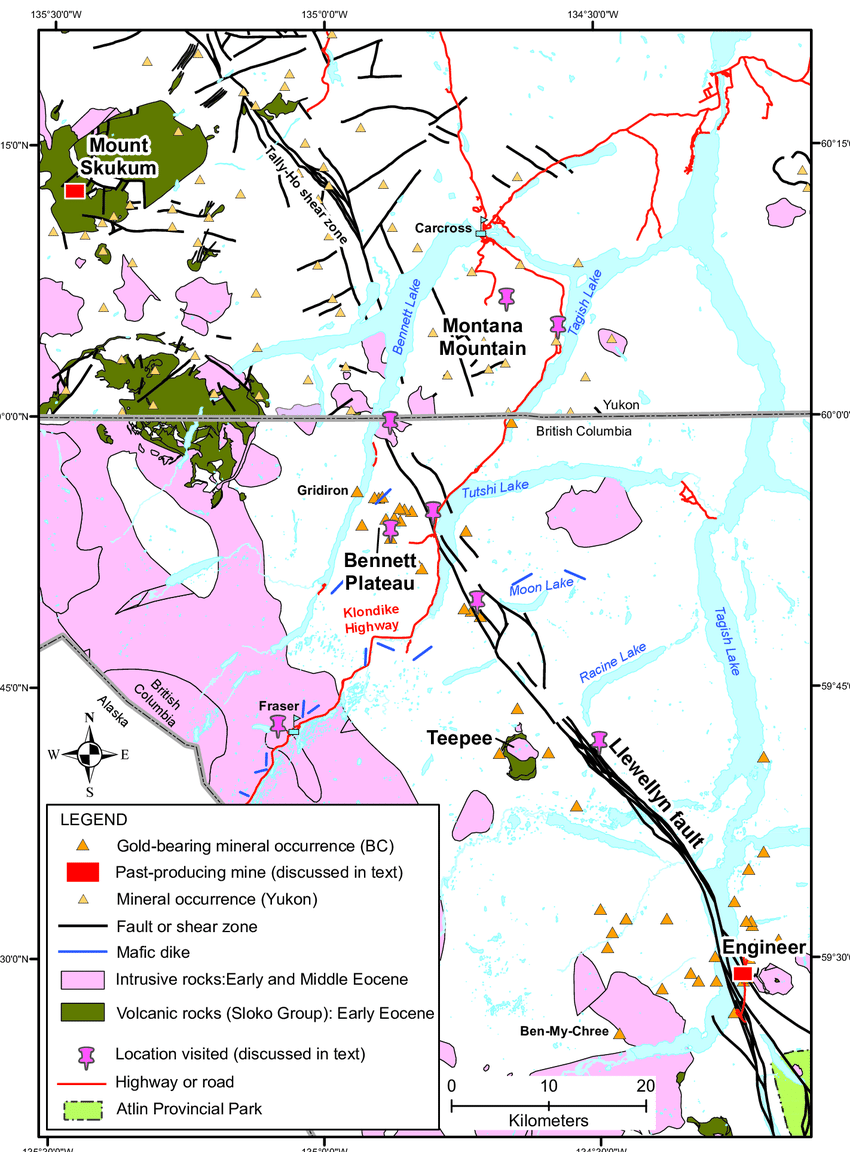

Full size / Regional geologic setting of the Blue Property (red) in the Atlin Mining District. Source / References: Engineer Gold Mine (Minfile 104M 014), Laverdier Mine (ARIS 9162), Silver Lime Prospect (Minfile 104M 087), Tulsequah Chief Mine Minfile (104K 002)

Full size / Map of proposed drill locations at Core Assets‘ 100% owned Blue Property. Source

Target #1: Bonanza Silver Grades At Surface

With 8 of the 18 permitted drill holes targeting the Silver Lime Prospect at its 100% owned Blue Property, Core Assets aims to make a high-grade silver discovery near surface. Historic* rock samples at Silver Lime showed extremely bonanza grades of silver at surface: Channel sampling over 2.2 m “assayed 3.3 g/t gold, 2,641 g/t silver, 0.15% copper, 2.5% lead and 3.32% zinc, 5.0% arsenic and 2.56% antimony (ARIS 21162*)“, according to today‘s news. More recently in 2018, historic work was confirmed with 8 rock samples assaying up to “1.16 g/t gold, 913 g/t silver, 12.45% zinc and >20.0% lead“. Such extremely high grades of silver, zinc and lead, along with appreciable gold grades, are not uncommon for large Carbonate Replacement Deposits (CRD) distal of a porphyry source.

At Silver Lime, massive sulfide pods (enriched with silver, gold, zinc, lead) occur in limestone (a carbonate sedimentary rock) with large zones of limonite alteration cut by porphyry dikes, usually surrounding the massive sulfide pods. The pods are up to 30 m long and 6 m wide.

What makes Silver Lime so compellingly attractive for a maiden drill program is that the area hosts over 30 pod-like occurrences of massive sulfides at surface – and that it has never been drilled to date. As such, Core Assets targets a new, near-surface, high-grade discovery with the drill bit.

Full size / Obe and below pictures courtesy of Core Assets showing the Silver Lime Prospect with CRD (Carbonate Replacment Deposit) massive sulfide lenses/scabs (rusty appearance) high in silver, gold, zinc and lead.

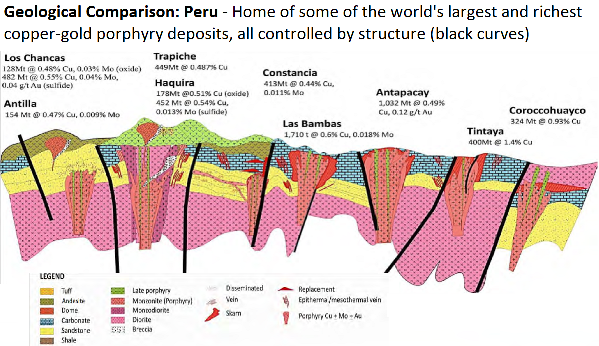

Target #2: Large Copper Porphyry Deposit

With 10 of the 18 permitted drill holes targeting the Laverdier Prospect at the Blue Property, Core Assets aims to confirm a large copper-gold-silver porphyry deposit. At the historic Lavardier Mine, an adit was driven grading 1.2% copper over 27 m. A single drill hole in 1973 (historic*) “assayed 173.2 metres of 0.27% Cu from surface, and includes 1.60% Cu from 173.2-179.2 metres and 1.40% Cu from 186.2–194.0 metres (ARIS 4996*), will serve as a basis for placement of future drill hole delineation“, Core Assets noted in today‘s news.

Elsewhere in the Golden Triangle, long intercepts of low-grade copper are developed successfully by a number of large companies (see figure on the next page). Back in the days, high-grade copper deposits were targeted – but nowadays, low-grade copper over extensive lengths are highly attractive, especially if mineralization starts at surface.

Full size / Select exploration, development and mining projects in the “Golden Triangles“ of British Columbia (Greens Creek Mine located in Alaska). Above stated numbers may be rounded, from companies‘ public disclosure (Koz = thousand ounces; Moz = million ounces; Blb = billion pounds; Eq = Equivalent; M+I = Measured & Indicated Resources; P+P = Proven & Probable Reserves). Note that results of above stated past producers, active mines, exploration and development projects in the region are not necessarily indicative of the potential of the Blue Property and should not be understood or interpreted to mean that similar results will be obtained from the Blue Property. The historical information in reference to the drill hole (1973) on the Blue Property from Core Assets Corp. is relevant only as an indication that some mineralization occurs on the Blue Property, and no resources, reserve or estimate is inferred. A qualified person has not done sufficient work to classify the historical information as current mineral resources or mineral reserves; and neither Rockstone nor Core Assets Corp. is treating the historical information as current mineral resources or mineral reserves.

Perfect Match

Today, Core Assets also announced the appointment of Marcus Adam to its technical advisory board. He currently also serves as Senior Geologist at Seabridge Gold Inc. (TSX: SEA; market cap: $2 billion CAD). For more details on today‘s news from Core Assets, see pages 9-14 of this report.

The Copper Super-Cycle

Full size / “Copper is being sighted as a critical component of a greener global economy. An increased demand for a construction-led global recovery coupled with high demand is outstripping supply. This has led to a number of analysts forecasting a global shortage in the coming years and a significant upturn in the future price... One of the first executive orders signed by the Biden administration was to re-join the Paris Agreement. This points to a more copper-intensive future, as global economies now collectively look to a greener energy policy over the medium to longer term with the US back on board. Prices are likely to continue to trend higher in 2021 suggesting the early stages of a significant long-term bull market. Goldman recently raised their 12-month forecast for copper to $9,500 per metric ton, up from a previous estimate of $7,500. The Wall Street banks say they now expect a sustained, higher average price for 2021 and 2022.“ (Source: “Copper outlook – early-stage bull market“, Miningreview.com on January 28, 2021)

Excerpts from “Copper bulls bet green agenda will push metal on towards record high“ (Financial Times on December 18, 2020):

»Copper, the world’s most important industrial metal... A growing number of analysts and investors view copper’s recent rally as the first leg of a “green-tinted” bull market that could carry the metal past the record high of more than $10,000 a tonne that it reached in early 2011. The rally will receive further fuel, investors say, from a surge in demand for copper to wire the green economy: electric vehicles need around four times more wiring than those with combustion engines, while solar panels and wind farms need as much as five times that needed for fossil fuel power generation, according to industry estimates. Analysts predict a supply crunch unless new mines are discovered and developed quickly.

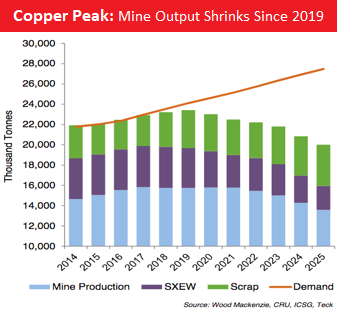

Based on known projects and estimated demand – and taking into account use of scrap metal – Trafigura sees a supply gap of around 5m tonnes emerging by 2030 that will need to be filled by increased investment from the mining industry. Goldman Sachs analysts predict the gap by then will be slightly larger at 5.6m, pointing out that the last time it was this wide was in 2005, when copper recorded a two-year rally [and now expects] copper to hit $9,500 over the next 12 months.

While there the earth’s crust has no shortage of copper, high-grade projects in mining friendly jurisdictions are becoming harder to find.. “The world has a challenging task to meet this new demand,” Glencore’s outgoing chief executive Ivan Glasenberg told its annual investor day this month. “It’s going to have to go to new locations with a lack in infrastructure.“ After several projects are completed in the next couple of years, including Anglo American’s Quellaveco copper mine in Peru, the pipeline looks thin.«

Excerpts from “Another commodity supercycle is coming – this time driven by renewable energy and EVs“ (Financial Post on January 28, 2021):

»Much of the new energy transition hardware requires earthly resources – metals and minerals – which are suddenly escalating in price... Prices of copper, nickel, cobalt, platinum and rare earth elements are all inflating as electric vehicles and the wider electrification trend starts pulling on constrained resources.

The point is, we don’t need a spreadsheet to realize that the transition to an electrified clean energy economy is going to result in a monumental draw on metals and minerals from the earth’s crust. And it’s going to cost a lot more money. In the past few months, rising commodity prices are a wake-up call to that reality. In the old economy, an inflection of demand that pulls on constrained resources leads to price spikes. When commodity prices rise, more resource projects are permitted, financed and built, often in unsavory places.«

Excerpts from “Freezer Rush Helps Drive Copper Towards A Record $10,000 A Ton“ (Forbes on December 21, 2020):

»Copper is being driven by a combination of tight supply caused by years of under-investment in new mines and strong demand from the Chinese construction sector and manufacturers of household appliances... Jeff Currie, head of commodities research at Goldman Sachs told the Bloomberg news service that: “We have all the tell-tale signs of a super-cycle.”«

Excerpts from “Copper price to rise in 2021: analysts“ (S&P Global Platts on January 18, 2021):

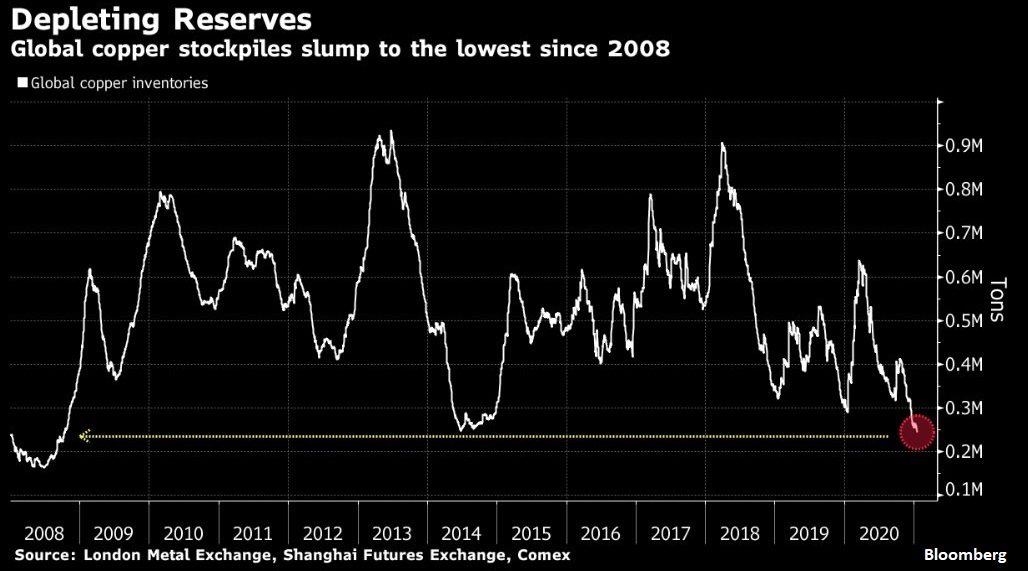

»”While we have factored in an increase of mine production and also scrap supply this year, this is unlikely to be sufficient to prevent the copper market flipping into a deficit,” Bank of America said. “We lift price forecasts especially for copper, which we see averaging $9,500/mt ($4.31/lb) in 4Q21, with the market likely flipping into a deficit, as inventories are low.“ [Bank of America noted:] “Given the increased focus on tackling climate change, the focus of government spending will be worth following as de-carbonization is bullish metals. Linked to that, we believe copper could once again rise above $10,000/mt ($4.54/lb) at some stage.“

In terms of copper supply, two aspects that are also hindering supply are the lower grade and deeper deposits as well as market appetite and availability of projects, Stifel Financial analysts said. “Due to the cyclicality of the copper market, we have looked across the sector at mega projects currently board greenlighted to get a sense of downside price protection for the red metal. With a copper market in excess of 22 million mt Cu annually, only major projects (we define as those greater than 200,000 mt/year Cu produced) have the ability to materially swing the needle on the supply/demand balance,” Stifel said. “Based in part on capital costs, operating costs, and a minimum acceptable return on investment, we estimate that current major projects require a minimum price in excess of $3.20/lb ($7,055/mt) Cu, globally.“

Sustainable energy: The expected increase in copper demand is also a result of the sustainable energy generation and consumption agenda, part of the green energy drive by governments. “Of all the metals used in the generation, transmission, storage, and consumption, copper remains the common denominator,” Stifel said. “Electricity generation, transmission infrastructure, energy storage, and consumption all require copper.”«

Technically, the recent copper price uptrend looks like the start of the last copper bull 2003-2006, or the price surge 2009-2011 – but this time, copper stockpiles worldwide have contracted by more than 60% since March 2020, dropping to the lowest level in more than 10 years. Serious supply bottlenecks might occur once the global recovery restarts.

Excerpts form “Demand for energy metals `will be massive´ Glencore CEO says“ (The Northern Miner on December 23, 2020):

»Pointing out that the world consumes 29.6 million tonnes of copper annually, Glasenberg [Glencore‘s CEO] noted that miners will have to produce 60 million tonnes of the red metal annually by the year 2050, to meet demand... ”You can see demand growth for these metals is massive over the next thirty years and the mining industry is going to have to step up to the plate to produce these extra metals and that’s going to be very difficult to achieve.” Turning specifically to copper, he noted that mining companies are going to have to go farther afield to find it. “There’s limited shovel-ready projects around the world for new copper mines,” he said. “The world has a challenging task to meet this new demand and it’s going to have to go to new geographies, it’s going to have to go to new locations where they lack infrastructure, and you don’t have the mining expertise in those new areas.“

Commodity analysts have already been forecasting shortages of the red metal. In a Dec. 20 research note, analysts at Bank of America Merrill Lynch warned that “copper mine supply has been virtually unchanged since 2017” and said they expect “a global copper market deficit in 2021.” The analysts noted that mine supply growth “has been low in recent years, as miners had cut back capex since 2012/2013,” and the situation has been exacerbated by slowdowns in production in major copper producing countries Chile and Peru. The China recovery scenario, a weaker dollar, and green-inspired reflation wave have also lifted copper, especially with the Chinese stockpiling impulse having been bigger than initially thought and more strategic in nature. Some banks and investors are now drawing comparisons to the spike in the early 2000s, when a jump in Chinese orders ushered in the last super-cycle for commodities... “Copper has in our view the strongest fundamentals going into 2021,” the BofA analysts wrote.«

“We expect another leg to this rally in commodities and mining shares, with momentum extending into the first half of 2021, RBC Capital Markets analysts led by Sam Crittenden wrote in a note to clients.” (Source: Mining.com on December 18, 2020)

Excerpts from “Blankfein Called It, Now the Whole World Is Watching Commodities“ (Bloomberg on January 16, 2021):

»Goldman Sachs, Bank of America Corp. and Ospraie Management LLC have all called for a bull market as stimulus kicks in and vaccines help the world emerge from the coronavirus crisis. JPMorgan Chase & Co. has also joined the chorus, advising clients to boost their exposure to materials while reducing investments in bonds. Commodities haven’t been this sexy since the mid-2000s, when China was stockpiling everything from copper to cotton while crop failures and export bans around the world boosted food prices, eventually toppling governments during the Arab Spring. The backdrop is now starting to look similar, with a broad gauge of commodity prices hitting its highest in six years.

“You have the whole world all of a sudden looking at commodity markets,” said Heber Cardoso, chief commercial officer at HedgePoint Global Markets, the structured commodities unit of ED&F Man Capital Markets that just got bought up by two investment firms. “You have low or negative interest rates fueling inflation, and there are zillions of dollars available looking for returns. There’s a structural change to the way we look at commodities.”

“From an inflation point of view, as an investor, I think investing in material sectors while they’re under-appreciated is not a bad thing now,” he said at the event. “Everyone has decided that we’ll never have inflationary pressure again, oil prices will never go up again. I don’t think so.“

“There’s a view that the dollar is going to be, on a long-term basis, quite weak and, with another round of stimulus coming, that we’re going to be in another circumstance in which the Fed is going to have to really work at controlling inflation,” said Tom Finlon of Brownsville GTR LLC, a trading and logistics firm based in Houston. “When the dollar gets cheap, you’ve got to buy something. That normally begets higher commodity prices.”«

Excerpts from “World‘s copper mines struggle to recover from COVID-19“ (Reuters on January 26, 2021):

»The deadly coronavirus has taken a heavy toll on the world’s copper mines. Output in key producer countries such as Peru cratered over the second quarter of 2020 as lockdowns and quarantine measures caused many mines drastically to reduce operations. Recovery has been patchy. Peruvian mines had just about returned to normal run-rates by October, but output in Chile, the world’s largest copper producer, started sliding in the third quarter after a robust first half of the year.

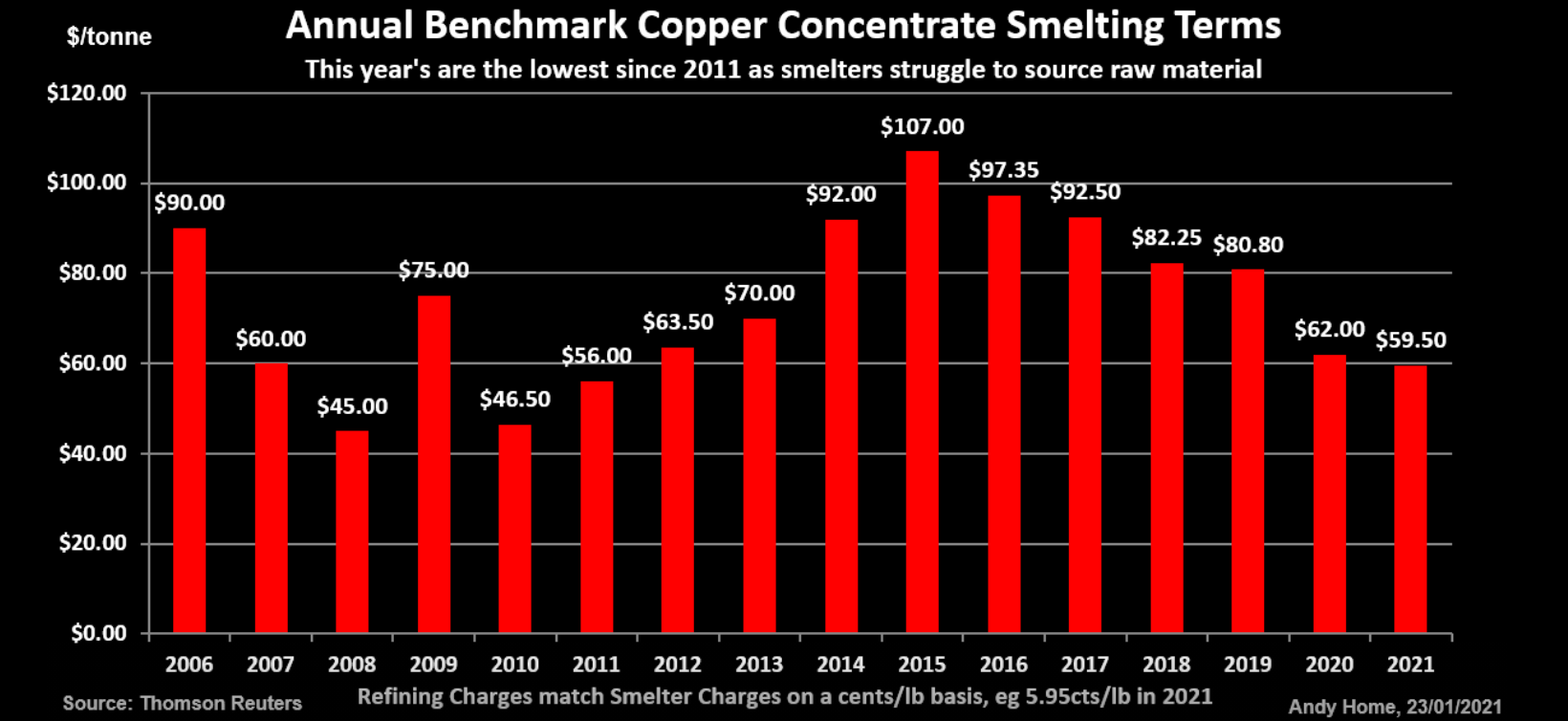

What was supposed to be a year of mined supply growth turned out to be the second consecutive year of zero growth. The resulting supply chain stress is manifest in this year’s benchmark smelter terms which are the lowest in a decade. There is as yet no sign of a turnaround in the raw materials segment of the copper supply chain, suggesting full COVID-19 recovery could be a protracted affair.«

Full size / “Falling Benchmark: Treatment and refining charges, which are what a smelter levies for processing copper concentrates into refined metal, are the best indicator of what is going on in the opaque raw materials market. And the message is clear. There’s not enough concentrate to go around... When copper smelter terms were last this low – 2010 and 2011 – the copper price was at record highs. That was no coincidence. The world’s miners were collectively blindsided by the strength of China’s demand for industrial metals. Their inability to respond saw tightness in the concentrates segment of the supply chain transmitted into the refined metal section. With Chinese demand again booming and analysts looking for a strong pick-up in demand from the rest of the world on the back of “green” technology roll-out, copper mine supply needs to react. However, if Las Bambas [copper mine in Peru] is indicative of operational stresses in the rest of the sector, production is not going to miraculously snap back to pre-pandemic levels this year.“ (Source: Reuters on January 26, 2021)

Excerpts from “Electrification will usher in era for the ´Revenge of the Miners‘, financier Friedland promises“ (VancouverSun on January 19, 2021):

»“It’s our hope that B.C.’s mining and exploration sector can leverage the opportunity within our economic recovery package to strengthen their sector and in turn help the province’s overall economic recovery through investments and job growth,” [Bruce] Ralston [B.C. Minister of Energy Mines and Low Carbon Innovation] said in his remarks to the [AME’s Remote Roundup] conference.“

The federal government is also banking on mining as a source of post-pandemic economic strength... O’Regan said government put a focus on stimulus help for resource industries, such as tax relief, the federal wage subsidy, extending tax breaks on exploration and a $250 million investment in early stage companies.

And [Robert] Friedland, whose career has included involvement in cornerstone discoveries such as the Voisey’s Bay nickel mine in Labrador and the Oyu Tolgoi copper mine in Mongolia, sees potential for B.C. in his scenario for mining expansion. “I think British Columbia has fantastic exploration potential,” Friedland said. “Up there in the Golden Triangle (of the province’s northwest corner), around Kamloops. We’ve looked at some very interesting things. When the world focuses on infrastructure development, economic stimulation, a green New Deal, it’s apparent that you have to call up those Canadian miners,” Friedland said.«

Calling Core Assets

Certainly, it‘s too early to call up Core Assets Corp. (CSE: CC) for mine supply – however, that‘s the opportunity (creating shareholder value by developing the project). The explorer is preparing to make a copper-gold-silver discovery (with the drill bit) at its 100% owned Blue Property in the Atlin Mining District of northern BC in Canada, but historic exploration results* look promising, to say the least.

Today‘s news-release is significant because being fully permitted to drill the company is now one big step closer to possibly make a significant discovery. With 18 permitted drill holes and with priority targets already identified, Core Assets’ CEO, Scott Rose, commented in today‘s news: ”When investing in junior exploration companies, drill permitting can always be an issue. As an early stage junior company, we wanted to mitigate risk for our shareholders early on, and one way to do this is to demonstrate that we can drill our property. We are delighted to now have our full drill permitting in place for the spring which puts us ahead of the game.”

Core Assets today announced the appointment of Marcus Adam to its technical advisory board. He appears to be the perfect fit for Core Assets in regards of planning a drill program for its porphyry target and advancing the Blue Project to the next level. Alone the fact that someone of his calibre joins the Core Asset team and is convinced of the potential of the Blue Property shows that the company is on the right track. Marcus Adam has over 10 years experience in both exploration and mining. He was part of the team that discovered and delineated the Deep Kerr and Lower Iron Cap deposits at the KSM Project in the Golden Triangle for Seabridge Gold Inc. (TSX: SEA; current market capitalization: $2 billion CAD) for which company he has been working since 2012 (as Senior Geologist since 2016). Marcus Adam assisted with the discovery and definition of the initial Deep Kerr resource (5.9 million ounces of gold and 6.1 billion pounds of copper) in 2013 and the step out and further delineation during the 2014 program. He also worked at Seabridge‘s drill programs at the Courageous Lake Project, including preliminary analysis of geophysical and geochemical signatures, mapping followed by the planning, implementation and early analysis of a diamond drill program culminating in the discovery of Walsh Lake, a 480,000 ounces of gold resource at Courageous Lake. He managed and supervised a 20-man camp during summer 2014. Since 2016, Mr. Adam was responsible for designing and conducting exploration programs for Seabridge at the Iskut Project in northwestern BC, which consists of both epithermal and gold-copper related porphyry hydrothermal system hosted within rocks of the Stikine Assemblage. Mr. Adam’s exploration experience for Seabridge spans a variety of deposit types across multiple jurisdictions in British Columbia, Northwest Territories, Yukon, and Nevada. He is registered as a Professional Geologist in B.C. He holds an MSc in Geology from Western University and a BSc in Geological Sciences from the University of Leeds, England.

Full size / Visible bornite (Cu5FeS4) in magnetite-rich limestone collected in 2018 from outside the “French Adit” at the Lavardier Prospect of the Blue Property. The striking iridescence of blue to purple tarnish gives bornite its nickname “Peacock Ore“. Source

Blue Property Highlights

As per today‘s news:

• Core Assets is fully permitted for 18 drill holes.

• It is anticipated drilling will follow a planned spring magnetic and radiometric geophysical survey (See Core Assets News Release Dated Sept 29th, 2020).

• Priority targets located within the vicinity of the Llewelyn Fault Zone (“LFZ”), will be of focus. This important structure bears a spatial relationship to the Cu-Au bearing skarns seen at surface at the Laverdier Prospect and to the Cu-Zn-Pb-Au-Ag skarns at the Silver Lime Prospect; the prospects are about 10 km apart.

• Cu mineralization at the Laverdier Prospect is contained within wide zones of extensive alteration. Historic drill hole DDH 1-73 contained 0.27% Cu over 173.2 metres from surface, 1.60% Cu from 173.2-179.2 metres, 1.40% Cu from 186.2–194.0 metres, and ended in heavily altered skarn (ARIS 9162*).

• The style of alteration and highly anomalous copper content at the property suggest proximity to a porphyry centre (ARIS 4996*).

• The Silver Lime Prospect hosts over 30 pod like occurrences of massive sulfide at surface. A historic channel sample (Sample 88339*) returned 3.3 g/t Au, 2,641 g/t Ag, 0.15% Cu, 2.5% Pb and 3.32% Zn, 2.56% Sb over 2.2 metres and has never been drilled to date.

• Core Assets is very pleased to welcome professional geologist Mr. Marcus Adam to its technical advisory board. Mr. Adam has over 10 years experience in exploring for and delineating porphyry deposits in British Columbia.

• Core Assets’ technical team believes that the Blue Property has exceptional potential for a new porphyry discovery in British Columbia.

Full size / Above picture courtesy of Core Assets showing the Silver Lime Prospect with outcropping limestone (white rock) and massive sulfide lenses/scabs (rusty appearance) high in silver.

Structure is Key

Core Assets currently has a tight shareholder structure with about 22.2 million shares issued and outstanding and a market capitalization of $3 million CAD (last at $0.135 on the CSE). Most importantly, the Llewelyn Fault Zone (LFZ) runs through Core Assets‘ large property (148 km2). The world-class porphyry-related copper-gold deposits in B.C.‘s prolific Golden Triangle typically share a highly important characteristic: Structure, such as a major fault zone acting as a plumbing system for a metal-enriched feeder zone at depth.

For more information about the LFZ, see Rockstone Report #3 “The Llewelyn Fault Zone: A district-scale plumbing system analog to other prolific mining and exploration camps in the Golden Triangle?“

According to today‘s news:

Core Assets believes that the south Atlin Lake area and the LFZ, which transects approximately 140 km from Yukon border to the Juneau Ice Sheet in the United States, has been neglected since the last major exploration campaigns in the 1970‘s. The LFZ passes directly through the property and is thought to play an important role in the transport, mobilization, and concentration of near surface metal occurrences across the property. The past 50 years have seen incremental advancements in the understanding of porphyry, skarn, and carbonate replacement type deposits both globally and in the Golden Triangle, with new discoveries made annually. This knowledge is now coming together in the form of discrete and effective exploration models that the Company believes could drive a major discovery at the Blue Property. Core Assets intends to leverage this shift in understanding and become one of the most extensive explorers in the area of the northern Golden Triangle. The Core Assets team has significant exploration experience and knowledge in the Atlin Mining District, where there is an opportunity for new discoveries and development.

Full size / Simplified geology (Eocene rock units only) near the Llewellyn fault, northwest British Columbia as shown in the preliminary report by the BC Geological Survey (2017) noting the following: “More than 50 mineral occurrences spatially related to the Llewellyn fault have been documented in the study area... Many of these deposits and prospects have been known for more than 100 years, following discoveries during the Klondike gold rush of the late 1890s. Not surprisingly, these occurrences are in clusters near road and rail routes and water access sites at Bennett and Tutshi lakes in the northwest, and Tagish Lake in the southeast. Three past-producing vein-hosted precious and base-metal deposits are in the British Columbia part of the study area. The Engineer Mine was the most productive gold deposit... Gold has been mined intermittently at the Engineer Mine for more than 90 years. BCGold Corp. reported a NI 43-101-compliant Inferred Mineral Resource of about 41,000 tonnes grading 19.0 g/t of total contained gold (5 g/t cut-off grade; Dominy and Platten, 2011).” (Above figure after Doherty and Hart, 1988; Mihalynuk et al., 1999; Source: “Testing the relationship between the Llewellyn fault, gold mineralization, and Eocene volcanism in northwest British Columbia”, British Columbia Geological Survey, 2017)

Full size / Malachite (Cu2[(OH)2|CO3]) rind on weathered surface of an outcrop at the Lavardier Prospect of the Blue Property. Source

Full size / Source/ Work completed by Core Assets to date on the Blue Property consists of a 2D resistivity/induced polarization geophysical survey over a portion of the property in June 2019: “ [...] additional anomalous zones of high chargeability and low resistivity occurring approximately 150 m below the modeled topography have been identified... The 2019 resistivity/induced polarization, geophysical survey successfully confirmed the ability to detect skarn mineralization at depth based on the known surface extents and historic drill logs. Additionally, the survey identified moderate chargeability anomalies up the hillside to the west of Hoboe Creek that can be drill tested... this area has mapped exposures of granitic rocks and therefore are considered to be porphyry style mineralization targets, similar to the mineralization recorded in historical DDH 2-73.“ Source: Technical Report on the Blue Property, 09/2019

About the Laverdier and Silver Lime Prospects

As per today‘s news:

Laverdier Prospect

In 2018, the Company sent a geological team to the Blue Property for preliminary surface sampling. The field crew observed three areas of skarn exposure with massive and disseminated sulfide along the western side of the Llewellyn Fault Zone. A total of 28 grab samples were collected and sent for analysis with peaks values of up to 1.57 g/t gold, 46.5 g/t silver and 8.46% copper reported.

In 2019, Core Assets contracted Aurora Geosciences Ltd. for the execution of an induced polarization geophysical survey over the areas of high priority mineralization, which confirmed and highlighted areas of elevated chargeability response over visible skarns and identified multiple chargeable porphyry style targets. Later in 2019, Nick Rodway, P. Geo. (Director of Core Assets Corp.) and Matthew Carter (Qualified Person of Dahrouge Geological Consulting Ltd.) visited the property to reanalyze some of the high priority areas identified by the 2018 and 2019 programs. The program successfully confirmed elevated gold, silver and copper values.

The amalgamation of Core Assets’ newly obtained geological information, and the historical exploration data, including the 1973 exploration program undertaken by Rio Plata Silver Mines Ltd., where a single diamond drill hole assayed 173.2 metres of 0.27% Cu from surface, and includes 1.60% Cu from 173.2-179.2 metres and 1.40% Cu from 186.2–194.0 metres (ARIS 4996*), will serve as a basis for placement of future drill hole delineation.

Full size / Malachite (Cu2[(OH)2|CO3]) rind on weathered surface of an outcrop at the Lavardier Prospect of the Blue Property. (Source)

Full size / Malachite (Cu2[(OH)2|CO3]) rind on weathered surface of an outcrop at the Lavardier Prospect of the Blue Property. (Source)

Silver Lime Prospect

The Silver Lime Prospect is located just 10 km west of the Laverdier Prospect. The Silver Lime Prospect encompasses two significant mineral occurrences, the Falcon and Jackie showings. The Falcon showing was discovered by Carmac Resources in 1990 and consists of two northwest trending quartz veins. Mineralization comprises galena, sphalerite, pyrite, chalcopyrite, arsenopyrite and stibnite. The vein system is exposed for 25 metres and the strike extensions are covered by talus. Individual veins are up to 2.2 metres wide. To the northwest, a quartz-feldspar porphyry breccia contains smaller quartz veins with semi-massive arsenopyrite and stibnite. Sample 88339 taken from a 2.20 metre vein system assayed 3.3 g/t gold, 2,641 g/t silver, 0.15% copper, 2.5% lead and 3.32% zinc, 5.0% arsenic and 2.56% antimony (ARIS 21162*). In 2018, Zimtu Capital Corp., as part of a helicopter reconnaissance program, prospected the property and collected eight samples. The results confirmed the historic work of Carmac (1990), having returned values of 1.16 g/t gold, 913 g/t silver, 12.45% zinc and >20.0% lead.

The Silver Lime Prospect may represent a carbonate replacement deposit model (CRD). Massive sulphide pods occur in limestone and biotite-muscovite-sericite schists generally near the contacts between the units. Large zones of limonite alteration, cut by alaskite and hornblende porphyry dikes, usually surround the pods. The lenses appear to be widest near the dikes. Several faults follow the general direction of the dikes, suggesting structural control on the mineralization. Sulphides comprise galena, sphalerite chalcopyrite, pyrrhotite and pyrite. The pods are up to 30 metres long and 6 metres wide. The smaller pods host sphalerite and galena mineralization and the larger pods vary mineralogically along length. Galena, quartz and calcite dominate the northwest changing to pyrrhotite, chalcopyrite and pyrite in the centre and border areas (Minfile 104M 031*).

NI 43-101 Disclosure: Nicholas Rodway, P.Geo, is a Director of the Company, and qualified person as defined by National Instrument 43-101. Mr. Rodway supervised the preparation of the technical information in this news release. *Historical technical numbers are not compliant with NI 43-101 and are provided as an indication that mineralization is present. Historical information is relied on by the Company only as encouraging further exploration and assessment of the properties. All references listed under Minfile and ARIS can be found at the following British Columbia database links: Minfile: https://minfile.gov.bc.ca/searchbasic.aspx ARIS: https://aris.empr.gov.bc.ca/

Full size / Picture courtesy of Core Assets showing the Silver Lime Prospect with outcropping limestone (white rock) and massive sulfide lenses/scabs (rusty appearance) high in silver.

Full size / Signs of a Carbonate Replacement Deposit (CRD) at the Silver Lime Prospect on the Blue Property: Typical rusty appearance of a massive sulfide pod (enriched with silver, gold, zinc, lead) within limestone (white-grayish carbonate sedimentary rock). Picture courtesy of Core Assets.

Full size / Porphyry deposits are held accountable for the world’s largest source of copper mined today and are generally the lowest unit-cost mines due to their large size. Porphyry-related deposits are well understood and typically form in similar geological settings, which makes it easier to delineate areas of interest in a cost-effective manner. There is a global proven track record in finding more than one porphyry system in a single geological area. There are numerous world-class porphyry-style deposits already located in the Pacific western margin of Canada. Porphyry exploration projects have seen the most capital raised of any deposit type in BC in the past year.

Core Assets: On the Trail of Sun Metals

Last November, Serengeti Resources Inc. (TSX.V: SIR) and Sun Metals Corp. (TSX.V: SUNM) announced a merger to consolidate its district-scale copper-gold-silver properties in north-central BC. In December, a $10.35 million bought deal was closed.

Sun Metal‘s Stardust Property “hosts one of the most significant, recent highâ€grade copperâ€gold discoveries in Canada. Stardust is located in north-central British Columbia, a region that hosts a large geological endowment and supports numerous operating mines. Sun Metals believes B.C. is a reliable jurisdiction with excellent exposure to capital markets, a deep pool of exploration professionals, a wealth of supporting services, and exceptional infrastructure with direct access to Pacific markets.“

Full size / Exploration model of the Stardust Property. Source: Sun Metals Corp.

Sun Metals‘ exploration model is a blueprint for Core Asset‘s Blue Property due to a similar geological setting:

“Carbonate Replacement Deposits (CRD) are bodies of metallic minerals formed by the reaction of hot magmatic fluids with carbonate rocks, such as limestone or dolomite. The hot, metal-bearing fluids are driven upward from the heat source, an igneous intrusion (Glover Mo-Cu Porphyry), and dissolves the reactive carbonate rocks when they encounter them. That reaction changes the chemistry of the fluid, causing it to precipitate metallic sulphide minerals that often contain lead, zinc, copper and precious metals such as gold and silver. The metallic sulphide minerals effectively “replace” the carbonate host as the reactive fluids dissolve a pathway through it.“

“Nearer to the source of the fluids, mineralization is often in the form of copper - gold skarn (Canyon Creek Skarn Deposit), transitioning to zinc - lead - silver mantos (4b Manto Zone; No.3 Manto Zone; No.2 Manto Zone) and chimneys. In the periphery of the system, the cooler fluids drop out precious metals silver and gold veins (No.1 Vein Zone Ag-Au ±Zn±Cu) form in the edges of the system. The fluid path is always continuous, and therefore the metallic bodies are too.“

“Stardust is a large mineralized system with true district potential. It features a 2.2-kilometre corridor of mineralization including four mineralization styles typical of a CRD system: porphyry, skarn, manto and epithermal vein. Stardust is one of the few CRD systems in the world with all CRD components fully intact.“

Full size / Source: Sun Metals Corp. / Carbonate Replacement Deposits (CRD) are also referred to as Polymetallic Replacements and are significant sources of copper, gold, silver, zinc, lead, and/or manganese. These deposits are often distal to porphyry copper deposits.

Full size / Source: “Visualizing Copper’s Role in the Transition to Clean Energy“

Previous Rockstone Coverage

Report 3: “The Llewelyn Fault Zone: A district-scale plumbing system analog to other prolific mining and exploration camps in the Golden Triangle?“ (Web Version / PDF)

Report 2: “On a Mission to Become the Premier Copper-Gold Porphyry Explorer of the Northernmost Extent of the Golden Triangle“ (Web Version / PDF)

Report 1: “Perfect Time to Reshape the Golden Triangle in British Columbia“ (Web Version / PDF)

Company Details

Core Assets Corp.

Suite 1450 – 789 West Pender Street

Vancouver, BC, V6C 1H2 Canada

Phone: +1 604 681 1568

Email: info@coreassetscorp.com

www.coreassetscorp.com

Incorporation Date: April 20, 2016

Listing Date: July 27, 2020

CUSIP: 21871U05

ISIN: CA21871U1057

Shares Issued & Outstanding: 22,216,000

Canadian Symbol (CSE): CC

Current Price: $0.135 CAD (02/02/2021)

Market Capitalization: $3 Million CAD

German Symbol / WKN: 5RJ / A2QCCU

Current Price: €0.0725 (02/02/2021)

Market Capitalization: €2 Million EUR

Contact:

Rockstone Research

Stephan Bogner (Dipl. Kfm.)

8260 Stein am Rhein, Switzerland

Phone: +41-44-5862323

Email: info@rockstone-research.com

www.rockstone-research.com

Disclaimer: This report contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Core Assets Corp. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to Core Assets Corp.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through its profile on SEDAR at www.sedar.com. Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, holds an equity position in Core Assets Corp.,as well as in Zimtu Capital Corp., and is being paid by Zimtu Capital Corp. for the preparation, publication and distribution of this report, whereas Zimtu Capital Corp. also holds a long position in Core Assets Corp. Note that Core Assets Corp. pays Zimtu Capital Corp. to provide this report and other investor awareness services. Zimtu Capital Corp. is an insider and control block of Core Assets Corp. by virtue of owning more than 20% of Core’s outstanding stock. Core Assets Corp. has one or more common directors with Zimtu Capital Corp. The cover picture (amended) has been obtained and licenced from Patthana Nirangkul.