Cleaner Chemistry, Clearer Glass – Homerun’s ultra-pure Brazilian silica enables 100% antimony-free solar glass production – a first for the Americas. Disseminated on behalf of Homerun Resources Inc.

Today, Homerun Resources Inc. announced that its technical partners for the Belmonte Solar Glass Manufacturing Project in Bahia, Brazil, have confirmed that the exceptional purity of the company’s Santa Maria Eterna silica resources allow the production of solar glass 100% free of added antimony compounds.

The breakthrough comes as global regulators and recyclers tighten restrictions on antimony, a heavy metal flagged as hazardous even at trace concentrations. Homerun’s high-purity quartz (HPQ) silica, containing less than 20 ppm oxidizable iron ions, enables flawless melting without antimony additives – producing ultra-clear solar glass with superior environmental performance and lower operating costs.

Homerun‘s VP of Operations, Odir Pedrazzi, commented in today‘s news-release: “Starting our operations without adding antimony represents a decisive economic and environmental milestone for Homerun. By leveraging the exceptional purity of our silica sand resources, we can combine cutting-edge technology with the highest standards of environmental responsibility, positioning the Company as a leader in the global solar glass industry.”

CEO Brian Leeners added: “Homerun’s ability to deliver commercial-scale, antimony-free solar glass from Brazil puts the Company at the forefront of a global shift toward safer, recyclable, and ESG-compliant materials.”

Highlights

• Market tailwind: Global bans and recycling concerns are accelerating demand for antimony-free solar glass.

• First-mover advantage: Homerun is positioned to produce 100% antimony-free solar glass from startup, establishing itself as one of the world’s first large-scale manufacturers of next-generation, environmentally compliant solar glass.

• Same CAPEX, lower OPEX: Equipment and furnace designs already optimized.

• Ultra-pure feedstock: Santa Maria Eterna HPQ silica ( < 20 ppm iron) enables flawless optical clarity without antimony.

• Strategic positioning: One of the few companies worldwide capable of producing commercial-scale antimony-free solar glass, providing a distinct ESG and competitive edge.

Today‘s announcement marks a pivotal step in Homerun’s vertical integration strategy and sets the stage for the following analysis on why antimony-free solar glass represents one of the most important technological and environmental advances in the solar industry today.

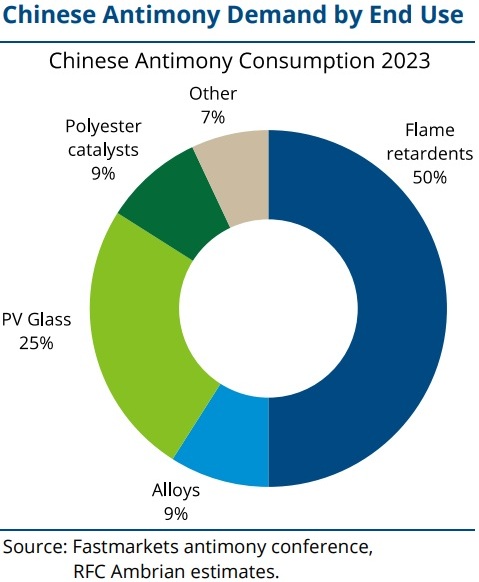

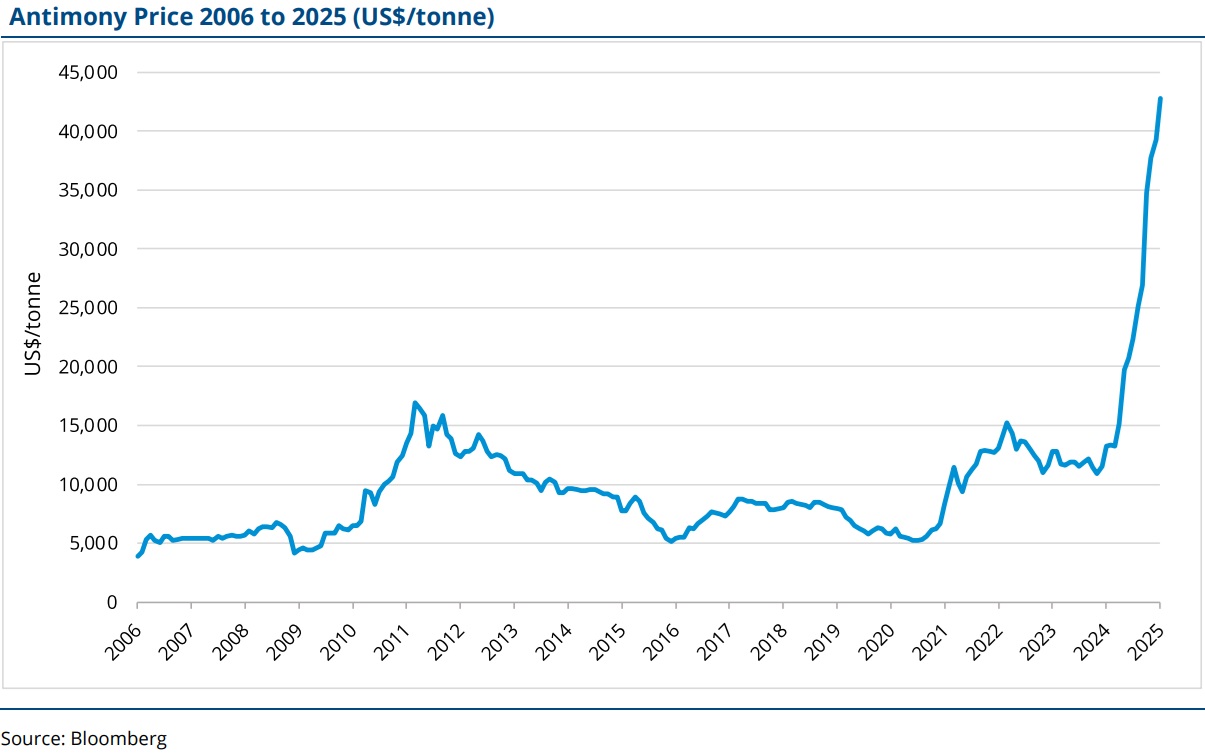

Antimony in Solar Glass

Demand and prices have surged: Analysts and commodity researchers note that solar glass has become a major consumer of antimony, propelling global prices upward. Reuters reported record antimony prices in 2024 driven by PV glass. China, the predominant supplier of antimony products, implemented export restrictions effective September 2024, significantly increasing supply risk for downstream industries beyond its borders. Industry studies also show antimony’s role in PV expanding rapidly over the past decade, with solar glass rising to a significant share of global antimony consumption. This has put the antimony market under severe stress, causing a supply shortage.

"As a result, the antimony market is under severe stress and is arguably one of the most critical of the Critical Mineral commodities." (Source)

Full size / “The antimony market is currently under severe stress, primarily due to a lack of global supply of ore and concentrate, along with recent export controls by China that limit the global availability of refined products. The bleak outlook is further exacerbated by the limited prospect of new mine capacity coming onstream due to the lack of projects capable of recovering antimony. This weak supply outlook, combined with the growing consumption in the PV market, suggests that the antimony market could remain in deficit for an extended period.“ (Source)

Why does solar need antimony? Many solar glass producers add antimony during melting to clear bubbles and control oxidation. This step is mainly needed when the raw silica contains more impurities; with high-purity feedstock, such additives become unnecessary. European policy groups and recyclers specifically flag antimony’s use in solar glass.

"[Antimony] consumption in solar PV glass has increased significantly in recent years and is now the third-largest consumption area. The outlook is for further growth based on the continued growth of the PV sector, particularly in China, which dominates the PV glass industry. Growth in this sector is expected to continue despite recent US tariff increases on imported PV cells from China... China is the leading producer of solar PV cells, controlling 80 to 90% of certain segments of the global solar supply chain. Antimony consumption in the solar PV sector has significantly increased in recent years and was expected to reach about 50 kt in 2023." (Source)

"Sodium antimonate (NaSb(OH)6) is primarily used as a fining and degassing agent in producing high-quality clear glass, including solar PV glass. The antimonate decomposes in the molten glass, generating large bubbles that rise to the surface and scavenge much slower-moving fine bubbles, which leads to the purification and homogenisation of the glass batch. Sodium antimonate also acts as a decolourant for glass, effectively eliminating traces of iron that can produce a greenish tint... The outlook for using sodium antimonate in solar PV cells suggests continued growth, driven by the ongoing expansion of the PV sector, particularly in China... In 2023, China produced 36% of the world‘s mined antimony, making it the leading global antimony producer. Russia was the second largest producer, accounting for 28%, followed by Tajikistan (19%), Turkey (6%), Myanmar (4%), Bolivia (3%), and Australia (2%)." (Source)

Antimony is a Problem

• Health classification: (Di)Antimony trioxide (ATO) is harmonized in the EU (CLP) as Carcinogen Category 2 (H351: suspected of causing cancer); similar warnings appear on SDS (safety data sheet) documents used by industry. While encapsulated in glass, this classification drives stricter handling, regulatory scrutiny, and brand-risk concerns.

• Recycling barriers: Antimony-bearing cullet can’t simply be blended into ordinary glass streams; even ~2,000 ppm antimony in shards is cited as unacceptable for European solar glass producers. This makes recycling of PV glass more difficult, weakening circular-economy efforts and increasing end-of-life costs.

• Supply-chain risks: As China dominates antimony mining and refining capacity – and is now limiting exports – downstream manufacturers face price and availability risks especially in Europe and the Americas.

Antimony-free Solar Glass is Superior

• Proven performance: Independent tests by the SPF Institute show that antimony-free solar glass exhibits no photo-degradation and achieves the highest efficiency among tested solar glasses, confirming that clean chemistry can deliver equal or better performance.

• Safer and regulation-friendly: Avoiding antimony simplifies compliance (no carcinogen labeling on additives), reduces ESG and worker-safety burdens, and can ease customer acceptance in sensitive markets (EU/US).

• Better recyclability: Antimony-free compositions simplify recycling processes and open access to higher-value secondary glass markets.

• Strategic supply resilience: Removing antimony decouples glass lines from a volatile, geopolitically sensitive feedstock and its price shocks.

How Common is Antimony in Solar Glass Today?

Exact global statistics are not available, but industry and policy studies (Solar Alliance 2023; RIVM 2023; RSC 2025) indicate that roughly 95% of crystalline-silicon PV modules use patterned or rolled glass, which typically contains antimony. Consequently, the volume of antimony-free solar glass is “not yet significant“, reinforcing recyclers’ concerns about antimony contamination in end-of-life PV glass.

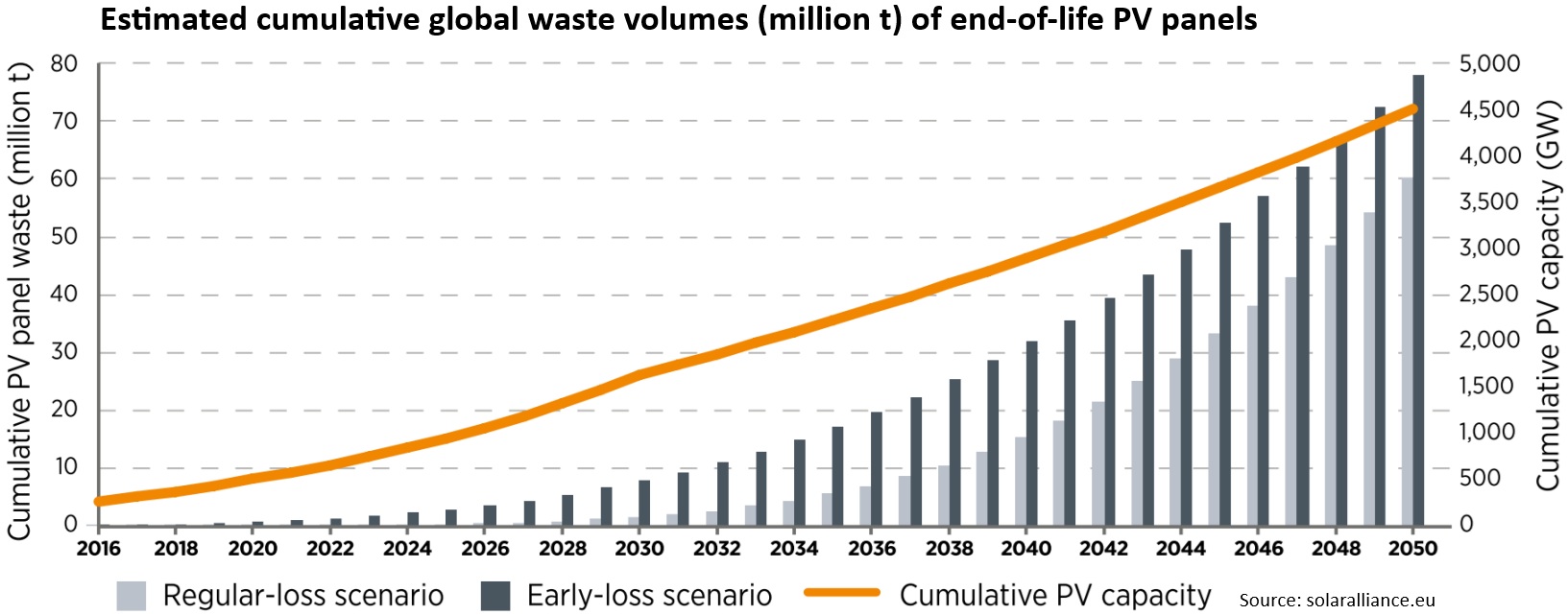

The PV Module End-of-Life Waste Challenge

"There is a challenge with the rapidly growing end-of-life waste of photovoltaic (PV) modules in Europe. The estimated annual volume of discarded PV panels is already 200,000 tons, and it is projected to exceed 400,000 tons by 2030. About 60% to 70% of this waste is comprised of high-transparency solar glass... With regards to absorption, it is influenced by the iron content, the state of the iron oxide, and of course the glass thickness. Low-iron float glass usually has an iron content of around 100 ppm, compared to paterned glass with around 120 ppm. Heavy metal oxides are used to convert the colorizing ferrous oxide (FeO) into ferric oxide (Fe2O3) in paterned glass... The chemical refining agents used to increase the proportion of ferric oxide are traditionally arsenic or antimony compounds... The problem with adding antimony trioxide (or sodium antimonate) in the glass process is that it raises sustainability and health concerns due to its toxicity. Antimony compounds are rather volatile and can create toxic emissions after melting. The effects of antimony poisoning are similar to arsenic poisoning... Additionally, antimony trioxide is possibly carcinogenic to humans, so is not used in the EU in glass production as it presents health risks for workers. In addition to China, in the last few years, antimony containing solar glass has also been supplied to the EU from other countries/regions like Malaysia, Vietnam, India, Middle East, and Northern Africa... The variable antimony content in paterned glass adds a substantial cost to the recycling process... To summarize, recycling glass from solar panels produced in China and installed in the EU poses a huge challenge to fulfil the EU circular economy framework." (Source)

Antimony-free Solar Glass is Difficult to Achieve

Think of a glass furnace like a soup pot:

• You want perfectly clear broth: No bubbles, no tint, consistent texture.

• Iron and other impurities are like tiny “spices” that add unwanted color (a greenish tint) and trap bubbles.

• Antimony has been the “secret ingredient” that helps skim bubbles and keep the broth clear.

Going antimony-free means you must:

1) Start with purer sand (very low iron and trace metals) so there’s less to “fix” later.

2) Control the melting process more precisely (temperature, oxygen levels, and alternative fining methods) to remove bubbles without relying on antimony.

3) Maintain optical clarity across continuous production at industrial scale.

This is why ultra-clean feedstock is the true unlock: It makes the entire process simpler, safer, and more sustainable – achieving perfect optical clarity without toxic additives. In practice, only a select few deposits worldwide possess the purity required to enable this.

Homerun: Positioned to Do it

• Ultra-low-impurity silica: Homerun’s Santa Maria Eterna Silica Sand District in Bahia, Brazil, contains high-purity silica with very low iron, which CEO Brian Leeners says allows sand to go “directly into a solar-glass furnace with no antimony required”, also noting a substantial cost advantage versus competitors that depend on antimony and heavier chemical pretreatment.

• Resource base and control: In 2025, Homerun reported NI 43-101 resources totaling ~63.9 million tonnes averaging >99.6% SiO₂ (Measured + Inferred) and has secured control (through ownership and suppy agreements) across the entire Santa Maria Eterna Silica Sand District, ensuring long-term supply security and supporting large-scale development.

• Regulatory progress: Brazil’s National Mining Agency (ANM) has approved Homerun‘s Final Exploration Report for the district’s leased mineral rights, marking another key step toward long-term project development.

• Downstream integration: Homerun plans to build Latin America’s first dedicated high-efficiency solar glass manufacturing plant in Brazil, and recently announced an updated offtake indicating pricing expectations for solar glass. These steps matter because antimony-free advantages monetize only when you own the furnace (and the brand).

• R&D processing upside: Homerun‘s 2025 corporate presentation cites UC Davis lab work has achieved >99.99% SiO₂ on raw sand from Santa Maria Eterna via femtosecond-laser purification without chemical reagents; while early-stage, such results support the “clean chemistry” narrative behind antimony-free glass.

• Market timing: With antimony prices highly elevated and Chinese export controls in place, a Brazil-based antimony-free solar glass line offers cost predictability and geo-diversification for OEMs targeting the Americas and Europe. The absence of antimony also simplifies Homerun‘s ongoing Bankable Feasibility Study (BFS) by removing a volatile input cost and regulatory variable, thereby improving project economics and financing clarity.

• Peer validation exists, but remains limited. Only a few producers market antimony-free solar glass today (e.g. AGC in Europe; Borosil in India), which underscores both the difficulty and the scarcity value of achieving this at scale.

Strategic Implications

• ESG and policy advantage: Easier alignment with international circularity rules and recycling markets; potential to command a “circular-ready” premium. EU stakeholders are already calling for mandatory disclosure of antimony content – a tailwind for antimony-free products.

• Cost and complexity reduction: Eliminating antimony chemical costs and the handling+monitoring burden of a carcinogen-classified additive simplifies compliance across jurisdictions.

• Recycling revenue optionality: Antimony-free composition increases the likelihood that end-of-life cullet can flow into higher-value glass streams, improving lifecycle economics for customers.

• Supply security: A Brazil-based solar glass plant largely eliminates reliance on antimony and shields production from export controls and price volatility, providing greater stability for long-term supply agreements.

• Brand boost / competitive differentiation: Being among the first in the Americas to produce antimony-free, high-transmission solar glass strengthens Homerun’s brand positioning and enhances its leverage with ESG-focused module manufacturers.

Bottom Line

Antimony-free solar glass directly addresses a growing challenge at the intersection of health, recycling, and geopolitics. The status quo still relies heavily on antimony, yet regulators, recyclers, and customers are steadily pushing the industry toward cleaner, non-toxic chemistries.

With the exceptional purity of its Santa Maria Eterna silica sand feedstock and a vertically integrated development plan in Brazil, Homerun is well positioned to deliver commercial-scale, antimony-free solar glass – representing not only a major technical milestone but also a durable strategic advantage for Brazilian and Western solar supply chains.

Achieving this would place Homerun among the very few solar glass manufacturers worldwide capable of producing truly antimony-free glass – a rare capability that provides a powerful competitive edge in a global market increasingly prioritizing antimony-free, environmentally responsible manufacturing.

Previous Rockstone Coverage

Report #4: "Green Light from Brazil‘s Mining Authority Strengthens Homerun‘s Silica Development" (Web / PDF)

Report #3: "Game-changer for Homerun to process its high-purity silica sand in hot sand batteries" (Web)

Report #2: "Homerun in Bahia: At the forefront of one of the world‘s highest quality silica sand districts: Comparison of silica sand projects globally" (Web / PDF)

Report #1: "The Energy Transition is Running Low on High-Purity Silica Sand: The Elephant in the Room" (Web / PDF)

Company Details

Homerun Resources Inc.

#2110 - 650 West Georgia Street

Vancouver, BC, V6B 4N7 Canada

Phone: +1 844 727 5631

Email: info@homerunresources.com

www.homerunresources.com

ISIN: CA43758P1080 / CUSIP: 43758P

Shares Issued & Outstanding: 64,073,179

Canadian Symbol (TSX.V): HMR

Current Price: $0.99 CAD (10/07/2025)

Market Capitalization: $63 Million CAD

German Ticker / WKN: 5ZE / A3CYRW

Current Price: €0.57 EUR (10/08/2025)

Market Capitalization: €37 Million EUR

Contact:

Homerun News-Disclaimer: FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE: The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements”. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

Disclaimer and Information on Forward Looking Statements: Rockstone Research and Homerun Resources Inc. (“Homerun“) caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to Homerun’s public filings for a more complete discussion of such risk factors and their potential effects, which may be accessed through its documents filed on SEDAR+ at www.sedarplus.ca. All statements in this report, other than statements of historical fact, should be considered forward-looking statements. Much of this report is comprised of statements of projection. Forward-looking statements in this report include, but are not limited to, statements regarding Homerun’s plans to design, construct, and finance an antimony-free solar glass facility in Bahia, including assumptions about nameplate capacity, modular expansion, and expected timing of commercial operations; the Bankable Feasibility Study (BFS) process and its anticipated outcomes, including expectations that high-purity feedstock, confirmed offtake agreements, and supportive policy frameworks will enable project bankability and large-scale financing; the vertical integration strategy linking the Santa Maria Eterna Silica Sand District to downstream solar-glass manufacturing, including assumptions that resource control, logistics, and energy access will support continuous production; the belief that Homerun’s ultra-pure silica feedstock can be processed into solar glass without antimony or other toxic fining agents, achieving commercial-scale production with reduced operational costs and environmental impact; the expectation that Homerun will be among the first large-scale producers globally to supply 100% antimony-free solar glass, creating a competitive and ESG advantage in Western markets; anticipated market demand for sustainable, antimony-free solar glass and potential price premiums tied to cleaner chemistries and recyclability; the assumption that ongoing government policies, tariffs, and credit programs in Brazil will continue to promote domestic solar manufacturing and infrastructure investment; potential participation from strategic, institutional, or development-finance partners to advance project financing, construction, and offtake execution; the view that Homerun’s success could contribute to Brazil’s emergence as a regional solar-manufacturing hub, supplying the Americas and Europe with locally sourced, low-carbon solar glass. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in these forward-looking statements. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Risks and uncertainties include, but are not limited to: Permitting and Approvals: Homerun may not obtain all necessary governmental, regulatory, contractual, board, shareholder, or third-party approvals in a timely manner or at all. Market Risks: Adequate buyers for Homerun’s silica, solar glass, or other products may not be secured; demand projections may not materialize. Technical Risks: The reduction of impurities in silica may not achieve levels required for advanced applications or for consistent antimony-free glass manufacturing; mineral grades and quantities may not be as expected; historical data and drilling results may not be indicative of future economic viability. Geology and Resource Risks: The geological characteristics of the Santa Maria Eterna District may differ from current interpretations. Resource size, grade, and homogeneity may not match previous measurements or expectations, and the silica sand may prove unsuitable for solar glass or may not deliver the optical characteristics required for high-efficiency PV applications. Even if suitable, the material may not meet buyer specifications or achieve acceptance in commercial markets. Operational Risks: Difficulties in exploration, mining, construction, processing, or scaling up solar glass production could increase costs or cause delays; infrastructure challenges may hinder development. Financing Risks: Required capital expenditures for exploration, mine development, and downstream facilities may exceed estimates; financing may not be available on reasonable terms, or at all. Geopolitical and Regulatory Risks: Legislative, political, social, or economic developments in Brazil or other jurisdictions may hinder progress or add costs; agreements with governments, communities, or partners may not be reached. Human Capital Risks: Homerun may not be able to retain or attract key employees and technical partners needed to execute its strategy. Commodity Price Risks: Prices for silica, solar glass, or energy storage materials may fluctuate and may not be sufficient to support profitable operations. Comparability Risks: What appear to be similarities with other successful projects may not be substantially comparable in geology, costs, or economics. Environmental and ESG Risks: Environmental opposition or stricter ESG requirements could delay or prevent development. Failure to comply with evolving sustainability standards, or to maintain verified antimony-free certification, could limit financing or offtake opportunities. Offtake and Counterparty Risks: Non-binding offtake agreements may not convert into binding contracts. Counterparties may fail to perform or may renegotiate terms under adverse market conditions, especially as antimony-free glass supply and pricing models evolve. Technology Adoption Risks: The market acceptance of antimony-free solar glass, or the willingness of end users to pay a premium for cleaner chemistries, may develop more slowly than anticipated. Currency and Macroeconomic Risks: Brazil’s currency fluctuations (Real vs. US Dollar) could affect CAPEX, OPEX, and financing. Inflation, interest rate shifts, or global economic downturns could weaken project economics. Timing Risks: Project milestones, completion of the Bankable Feasibility Study (BFS), and financing timelines may take longer than anticipated, leading to delays in construction, commissioning, or revenue generation. Force Majeure / Natural Events Risks: Extreme weather, droughts, flooding, earthquakes, pandemics, or other uncontrollable events could disrupt exploration, construction, logistics, or operations. Logistics and Infrastructure Risks: Project success relies on dependable access to ports, roads, utilities, and energy supply. Delays, failures, or cost overruns in infrastructure build-out could materially impact timelines and economics. Third-Party Information Risks: Certain information contained in this report, including market data, industry statistics, and third-party commentary, has been obtained from sources believed to be reliable but has not been independently verified. Rockstone and the author make no representation or warranty as to its accuracy, completeness, or reliability. Liquidity and Trading Risks: Securities of small-cap issuers such as Homerun often involve a high degree of risk and may be subject to volatility, limited trading liquidity, wide bid/ask spreads, and potential loss of invested capital. Investors should be prepared to bear the risk of illiquidity and price fluctuations. Accordingly, readers should not place undue reliance on forward-looking information. Rockstone and the author of this report do not undertake any obligation to update any statements made in this report except as required by law. Past performance and comparisons to other companies or jurisdictions are provided for illustrative purposes only and should not be considered indicative of future results.

Disclosure of Interest and Advisory Cautions: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Rockstone, its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including Rockstone’s report, especially if the investment involves a small, thinly-traded company that isn’t well known. The author of this report, Stephan Bogner, is paid by Homerun Resources Inc. On September 8, 2025, Homerun announced that the company “entered into an agreement with Rockstone Research to provide marketing services to the company”, and that “Rockstone Research is an arm’s-length marketing firm and has been engaged for an initial three-month term for total consideration of $25,000, which is payable up front. The company does not propose to issue any securities to Rockstone in consideration for the services to be provided to the company.” The author owns equity of Homerun and thus will profit from volume and price appreciation of the stock. This also represents a significant conflict of interest that may affect the objectivity of this reporting. The author may buy or sell securities of Homerun (or comparable companies) at any time without notice, which may give rise to additional conflicts of interest. Overall, multiple conflicts of interests exist. Therefore, the information provided in this report should not be construed as a financial analysis or recommendation but as an advertisement. This report should be understood as a promotional publication and does not replace individual investment advice. Rockstone’s and the author’s views and opinions regarding the companies that are featured in the reports are the author‘s own views and are based on information that was received or found in the public domain, which is assumed to be reliable. Rockstone and the author have not undertaken independent due diligence of the information received or found in the public domain. Rockstone and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, Rockstone and the author do not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons that were made to other companies may not be valid or come into effect. Please read the entire Disclaimer carefully. If you do not agree to all of the Disclaimer, do not access this website or any of its pages including this report in form of a PDF. By using this website and/or report, and whether or not you actually read the Disclaimer, you are deemed to have accepted it. Information provided is educational and general in nature. Data, tables, figures and pictures, if not labeled or hyperlinked otherwise, have been obtained from Stockwatch.com, Tradingview.com, Homerun Resources Inc. and the public domain. The cover picture (amended) has been obtained and licenced from Shutterstock.com.