Disseminated on behalf of Homerun Resources Inc.

With today´s news, Homerun Resources Inc. has taken another decisive step forward in consolidating its position as a leader in high-purity silica. Brazil’s National Mining Agency (ANM) has formally approved the Final Exploration Report for mineral rights leased from Companhia Bahiana de Pesquisa Mineral (CBPM) in the Santa Maria Eterna High Purity Silica District, Bahia, Brazil.

The report, which includes a NI 43-101 compliant Mineral Resource Estimate, outlines 25.56 million tonnes (Measured) and 38.35 million tonnes (Inferred) of ultra-high-grade silica sand (>99.6% SiO2). This marks a significant validation of the scale and quality of Homerun’s silica holdings and provides the foundation for the next step – submission for the Final Mining Permit.

Why It Matters to Investors

This approval is more than a regulatory milestone; an approval that enhances the company’s pathway to commercialization:

• Resource Certainty: The ANM’s approval validates Homerun’s resource base, de-risking the project and supporting long-term development plans.

• Permitting Momentum: With one CBPM lease already fully permitted for immediate extraction, today’s approval accelerates Homerun’s ability to move from exploration into commercial-scale production.

• Strategic Advantage: High-purity silica is a critical raw material for solar glass, advanced batteries, and energy storage technologies. Demand is soaring, while supply chains outside of China remain limited.

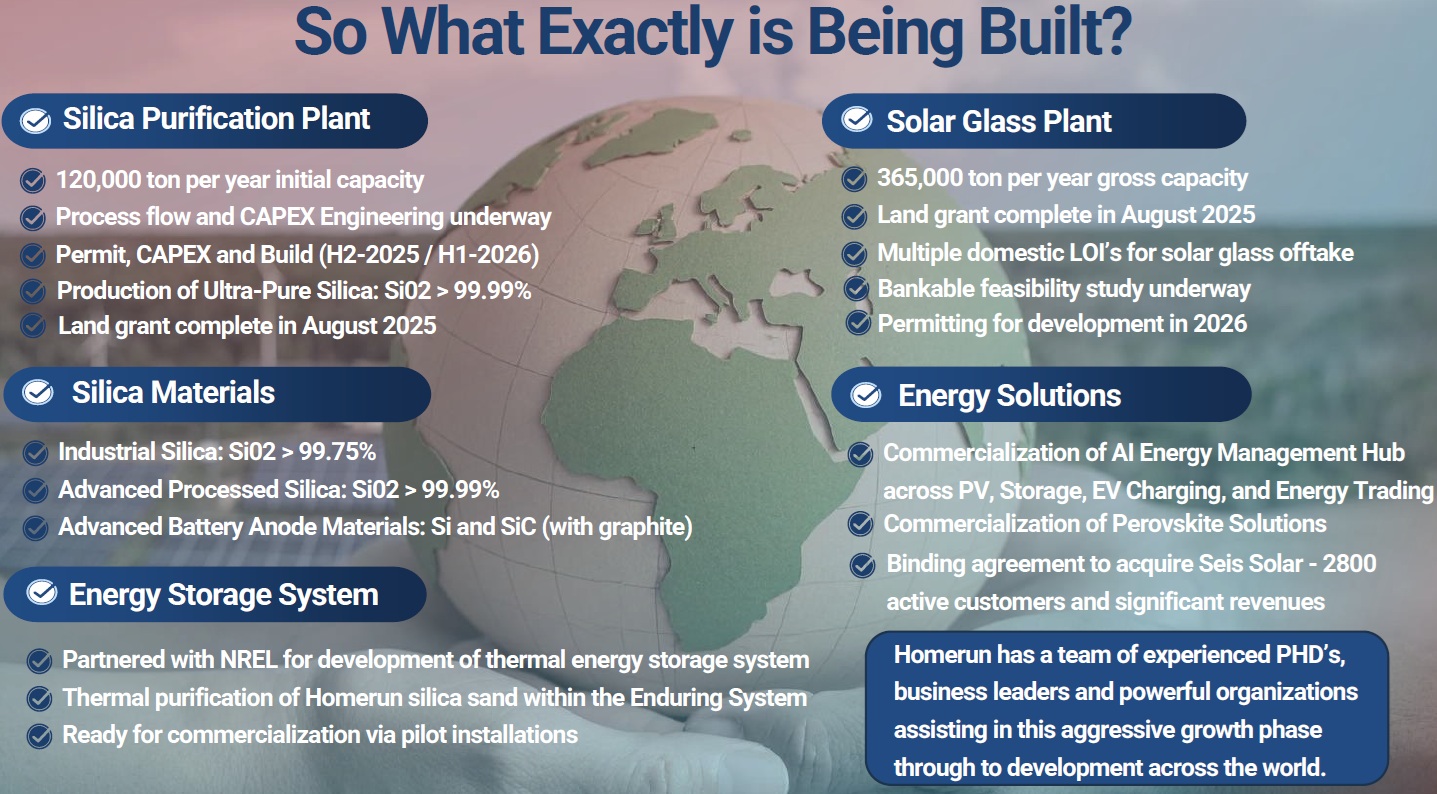

• Vertical Integration: Homerun is not simply a mining play – it is building a vertically integrated energy materials business, including a 120,000 tonnes/year silica processing plant, a 365,000 tonnes/year solar glass facility, and partnerships with UC-Davis and the U.S. Department of Energy/NREL on advanced purification and storage technologies.

Brian Leeners, CEO of Homerun, emphasized: "This is another key step in growing and advancing our controlled resources within the Santa Maria Eterna District. Together with our other CBPM-leased resources and supply partnerships, we are establishing and consolidating multiple large, fully permitted sources of high-purity silica sand to support our processed silica, solar glass, energy storage, and advanced materials initiatives in Brazil for the next 100+ years."

The Bigger Picture

For investors, this announcement confirms that Homerun is executing on its 3-phase development plan:

1. Securing large-scale silica resources in Brazil.

2. Advancing permitting and infrastructure toward extraction and processing.

3. Capturing downstream value in solar, storage, and advanced materials markets.

With 6 profit centers tied to its silica base, Homerun is emerging as a unique, vertically integrated clean energy materials company positioned at the heart of the global energy transition.

Full size / Source: Homerun´s corporate presentation (August 2025)

Homerun: Unlocking a New Era in Advanced Materials and Energy

Homerun Resources Inc. has just unveiled its latest corporate presentation – and the roadmap could not be clearer: The company is on the cusp of transforming from a resource developer into a vertically integrated powerhouse in advanced materials and clean energy solutions. The new deck emphasizes both the scale of the projects underway in Bahia, Brazil, and the near-term milestones that investors can expect as Homerun moves from planning into execution.

At the heart of Homerun’s strategy is the Belmonte silica sand district in Bahia, Brazil – one of the world’s highest-grade and most strategically located deposits of high-purity quartz (HPQ) silica. With long-term supply agreements, government support including tax incentives and a land donation, and integration with Brazil’s national policy on strategic minerals, Homerun is positioned to capture demand from industries currently dependent on Chinese supply chains.

Why This Matters Now

Homerun is aligning with Brazil’s industrial strategy to add value domestically rather than exporting raw minerals. With full government backing, financing pathways through BNDES and Finep, and a unique geological advantage, the company is advancing a multi-pronged project pipeline: Silica purification, solar glass, energy storage, and renewable technologies.

The world’s demand for ultra-pure silica, solar glass, and advanced energy solutions is exploding. Brazil, already the largest solar market outside China, is doubling capacity and incentivizing local production. Into this perfect storm, Homerun is building the first fully integrated silica-to-solar ecosystem in Latin America.

Full size / Source: Homerun´s corporate presentation (August 2025)

Pending Milestones: What Investors Should Watch

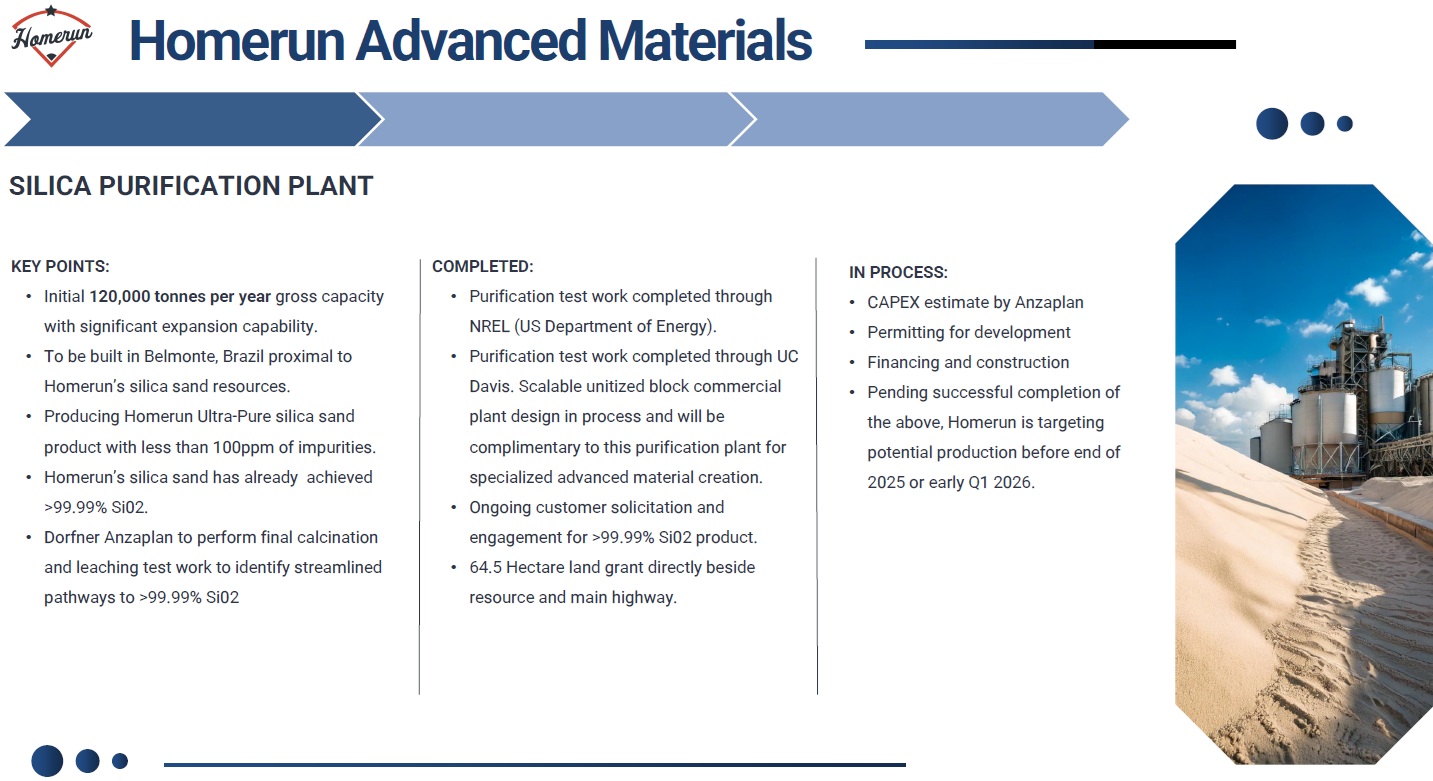

Silica Purification Plant

• Target: First production late 2025 / early 2026

• Initial Capacity: 120,000 tonnes/year, scalable.

• Highlight: Producing >99.99% ultra-pure silica – the foundation for solar, semiconductors, and advanced energy storage

• Investor Catalyst: CAPEX decision, permitting approvals, financing announcements, construction kickoff

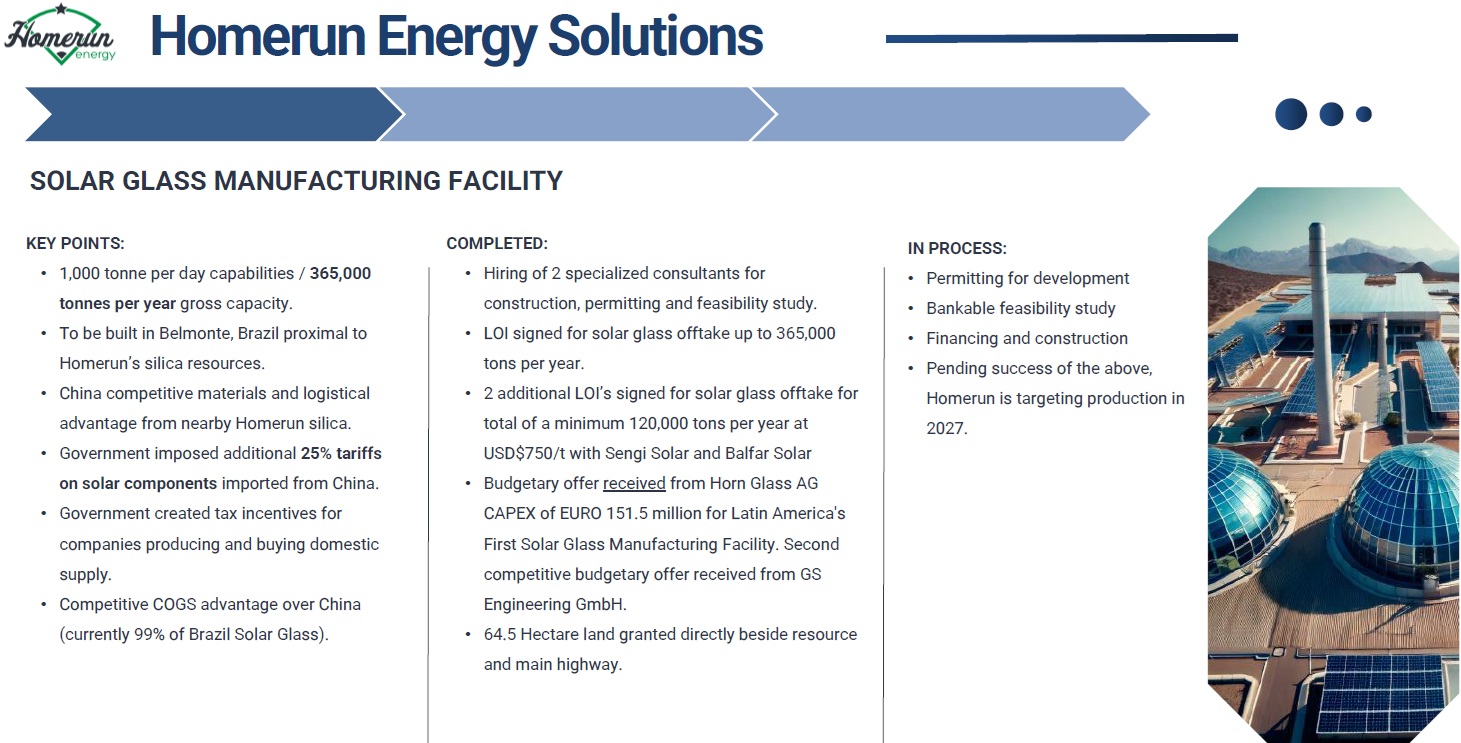

Solar Glass Manufacturing Facility

• Target: 2027

• Capacity: 365,000 tonnes/year – enough to disrupt Brazil’s solar glass dependency on China (currently 99% imported)

• Highlight: Multiple LOIs already signed, including minimum 120,000 tonnes/year at $750 USD/t

• Investor Catalyst: Feasibility study results, binding offtake deals, EPC contracts, BNDES funding updates

Enduring Energy Storage System (TES)

• Target: Pilot commercialization underway

• Highlight: Developed with NREL (U.S. Department of Energy); lower CAPEX, 30+ year lifespan, scalable to utility scale – a true alternative to conventional batteries

• Investor Catalyst: Pilot plant data, first commercial agreements, rollout of scalable storage solutions

Perovskite Solar + AI Energy Management (Halocell + Seis Solar)

• Target: Immediate expansion

• Highlight: Seis Solar brings 2,800 active customers and 70 million EUR in cumulative revenues in the last 3 years (2022-2024); Halocell adds breakthrough perovskite PV tech. Combined with AI energy trading and management, Homerun is building a recurring revenue engine

• Investor Catalyst: Closing of Seis Solar acquisition, SaaS rollout, commercialization of perovskite PV products

The Big Picture

Homerun is not just building mines or plants – it’s building an entire new supply chain for the clean energy transition:

• From raw silica extraction at Belmonte,

• To ultra-pure silica processing,

• To solar glass manufacturing,

• To next-gen solar panels and energy storage solutions.

This full-stack model gives Homerun the potential to capture value at every stage – and with Brazil’s government actively backing domestic value-add, the timing could not be better.

What’s Next for Investors

The coming 12-24 months will be packed with value-driving news: Feasibility study results, financing packages, construction starts, and first production timelines. If successful, Homerun will not only diversify Brazil’s solar supply chain but also become a first-mover in silica-to-energy solutions on a global scale.

For investors looking at the clean energy megatrend, Homerun offers early-stage leverage to a vertically integrated, government-backed growth story – with multiple profit centers, powerful partners, and first-mover advantage. Homerun isn’t just participating in the energy transition. It’s building it.

Full size / Source: Homerun´s corporate presentation (August 2025)

Full size / Source: Homerun´s corporate presentation (August 2025)

Full size / Source: Homerun´s corporate presentation (August 2025)

Full size / Source: Homerun´s corporate presentation (August 2025)

Full size / Source: Homerun´s corporate presentation (August 2025)

Full size / Source: Homerun´s corporate presentation (August 2025)

Previous Rockstone Coverage

"Game-changer for Homerun to process its high-purity silica sand in hot sand batteries" (Web)

"Homerun in Bahia: At the forefront of one of the world‘s highest quality silica sand districts: Comparison of silica sand projects globally" (Web / PDF)

"The Energy Transition is Running Low on High-Purity Silica Sand: The Elephant in the Room" (Web / PDF)

Company Details

Homerun Resources Inc.

#2110 - 650 West Georgia Street

Vancouver, BC, V6B 4N7 Canada

Phone: +1 844 727 5631

Email: info@homerunresources.com

www.homerunresources.com

ISIN: CA43758P1080 / CUSIP: 43758P

Shares Issued & Outstanding: 64,073,179

Canadian Symbol (TSX.V): HMR

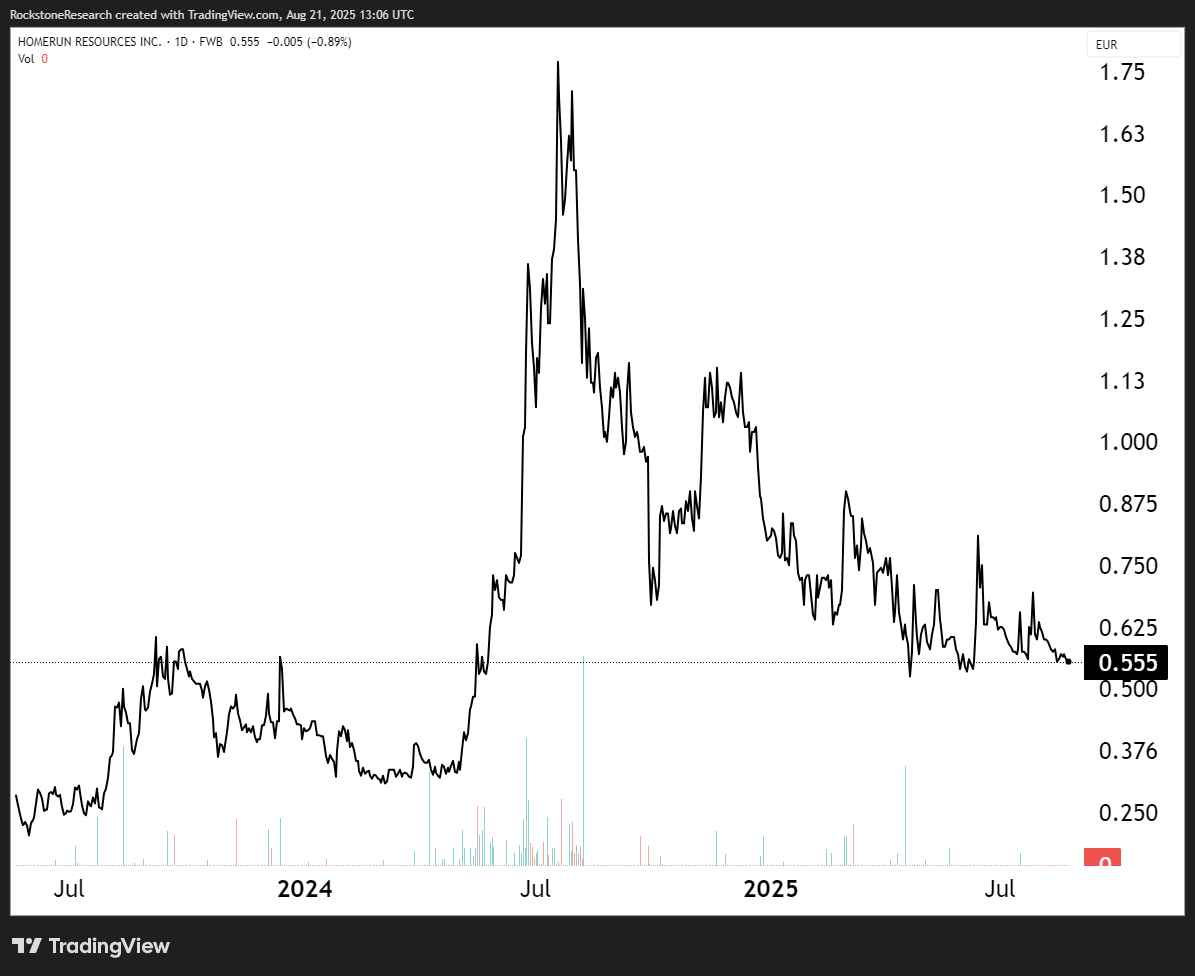

Current Price: $0.96 CAD (08/20/2025)

Market Capitalization: $62 Million CAD

German Ticker / WKN: 5ZE / A3CYRW

Current Price: €0.555 EUR (08/21/2025)

Market Capitalization: €36 Million EUR

Contact:

www.rockstone-research.com

Homerun News-Disclaimer: The information contained herein contains "forward-looking statements" within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be "forward-looking statements". Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Homerun Corporate Presentation-Disclaimer: Disclaimer and Forward Forward-Looking Statements: This presentation has been prepared for Homerun Resources Corporation (HMR). This document contains background information about the resource projects which are current at the date of this presentation. The presentation is in summary form and does not purport to be all inclusive or complete. Recipients should conduct their own investigations and perform their own analysis to satisfy themselves as to the accuracy and completeness of the information, statements and opinions contained in this presentation. This presentation is for information purposes only. Neither this presentation nor the information contained in it constitutes constitutesan offer, invitation, solicitation, or recommendation in relation to the purchase or sales of shares in any jurisdiction. This presentation does not constitute investment advice and has been prepared without taking into account the recipient’s investment objectives, financial circumstances or particular needs and the opinions and recommendations in this presentation are not intended to represent recommendations of particular investments to particular persons. Recipients should seek professional advice when deciding if an investment is appropriate. All securities involve risks which include (among others) the risk of adverse or unanticipated market, financial or political developments. To the fullest extent permitted by law, HMR, its officers, employees, agents and advisors do not make any representation or warranty, express or implied, as to the currency, accuracy, reliability or completeness of any information, statements, opini onsons, estimates, forecasts or other representations contained in this presentation. No responsibility for any errors or omissions f from this presentation arising out of negligence or otherwise is accepted. This presentation may include forwardforward-looking statements. Forward Forward-looking statements are only predictions and are subject to risks, uncertainties and assumptions which are outside the control of HMR. Actual values, results or events may be materially different to those expressed or implied in this presentation. Given these uncertainties, recipients are cautioned not to plac place reliance on forward looking statements. Any forward forward-looking statements in this presentation speak only at the date of issue of this presentation. Subject to any continuing obligations under applicable law, HMR has not undertaken any obligation to update or revise any information or any of the forward forward-looking statements in this presentation or any changes in events, conditions, or circumstances on which any such forward looking statement is based.

Rockstone Disclaimer: This report and the referenced news-release contain forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research and Homerun Resources Inc. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to Homerun Resources Inc.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through its profile on SEDAR+ at www.sedarplus.ca. Please read the full disclaimer (see below or here) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, owns an equity position in Homerun Resources Inc. and thus will profit from volume and price appreciation of the stock. The author is being paid by Homerun Resources Inc. for the preparation, publication and distribution of this report.

Disclaimer and Information on Forward Looking Statements: Rockstone Research and Homerun Resources Inc. (“Homerun“) caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to Homerun’s public filings for a more complete discussion of such risk factors and their potential effects, which may be accessed through its documents filed on SEDAR+ at www.sedarplus.ca. All statements in this report, other than statements of historical fact, should be considered forward-looking statements. Much of this report is comprised of statements of projection. Forward-looking statements in this report include, but are not limited to, statements regarding: Homerun’s ability to secure and expand mineral resources in Brazil; the timing and outcome of permits, approvals, and licenses, including the Final Mining Permit; the development, construction, commissioning, and operation of Homerun’s silica processing plant, solar glass manufacturing facility, and energy storage projects; the scalability and commercial viability of Homerun’s technologies and strategic partnerships; anticipated demand for high-purity silica, solar glass, energy storage, and other advanced material products; the execution of offtake agreements, supply contracts, and financing arrangements; and the ability of Homerun to generate shareholder returns through vertical integration and participation in the global energy transition. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in these forward-looking statements. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Risks and uncertainties include, but are not limited to: Permitting and Approvals: Homerun may not obtain all necessary governmental, regulatory, contractual, board, shareholder, or third-party approvals in a timely manner or at all. Market Risks: Adequate buyers for Homerun’s silica, solar glass, or other products may not be secured; demand projections may not materialize. Technical Risks: The reduction of impurities in silica may not achieve levels required for advanced applications; mineral grades and quantities may not be as expected; historical data and drilling results may not be indicative of future economic viability. Operational Risks: Difficulties in exploration, mining, construction, or processing could increase costs or cause delays; infrastructure challenges may hinder development. Financing Risks: Required capital expenditures for exploration, mine development, and downstream facilities may exceed estimates; financing may not be available on reasonable terms, or at all. Geopolitical and Regulatory Risks: Legislative, political, social, or economic developments in Brazil or other jurisdictions may hinder progress or add costs; agreements with governments, communities, or partners may not be reached. Human Capital Risks: Homerun may not be able to retain or attract key employees and technical partners needed to execute its strategy. Commodity Price Risks: Prices for silica, solar glass, or energy storage materials may fluctuate and may not be sufficient to support profitable operations. Comparability Risks: What appear to be similarities with other successful projects may not be substantially comparable in geology, costs, or economics. Accordingly, readers should not place undue reliance on forward-looking information. Rockstone and the author of this report do not undertake any obligation to update any statements made in this report except as required by law.

Disclosure of Interest and Advisory Cautions: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Rockstone, its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including Rockstone’s report, especially if the investment involves a small, thinly-traded company that isn’t well known. The author of this report, Stephan Bogner, is paid by Homerun Resources Inc. The author also owns equity of Homerun and thus will also profit from volume and price appreciation of the stock. Thus, multiple conflicts of interests exist. Therefore, the information provided in this report should not be construed as a financial analysis or recommendation but as an advertisement. Rockstone’s and the author’s views and opinions regarding the companies that are featured in the reports are the author‘s own views and are based on information that was received or found in the public domain, which is assumed to be reliable. Rockstone and the author have not undertaken independent due diligence of the information received or found in the public domain. Rockstone and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, Rockstone and the author do not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons that were made to other companies may not be valid or come into effect. Please read the entire Disclaimer carefully. If you do not agree to all of the Disclaimer, do not access this website or any of its pages including this report in form of a PDF. By using this website and/or report, and whether or not you actually read the Disclaimer, you are deemed to have accepted it. Information provided is educational and general in nature. Data, tables, figures and pictures, if not labeled or hyperlinked otherwise, have been obtained from Stockwatch.com, Homerun Resources Inc. and the public domain.