Disseminated on behalf of Commerce Resources Corp. and Zimtu Capital Corp.

Today, Commerce Resources Corp. announced plans to complete a consolidation of its issued and outstanding common shares on the basis of 1 new share for every 10 currently outstanding shares, therefore reducing the number of outstanding shares from 310,496,558 to approximately 31,049,655.

Commerce Resources believes that this share consolidation will both enhance the marketability of the company as an investment and better position the company to raise the funds necessary to execute its business plan. The share consolidation is subject to approval by the TSX Venture Exchange.

I am confident that this consolidation should put Commerce Resources into the most attractive spot for a REE (Rare Earth Element) junior with a tight capital structure that will be highly financeable for anyone (private, institutional, and strategic investors along with bankers) looking to position themselves in this vital commodity space that appears on the cusp of a new bull market.

The current threat from China that they may halt shipments of REEs to the United States has brought significant focus to the fundamental realities of the REE sector – continued increased global demand against “issues” on the supply side.

“The heavy dependency on foreign supply chains results in vulnerabilities of relevant American industries,“ Chen Zhanheng, an analyst at Association of China Rare Earth Industry, told the Global Times last week. “The US is under pressure from a lack of rare-earth supplies after it started the trade war with China. Now the US is hoisted with its own petard as China indicated that it will keep its options open for using rare earths as a weapon... The US fears that China will limit rare-earth exports, which will result in a huge loss for manufacturing industries in the US as its supply chain may be disrupted,“ said Chen.

Solution: New REE supply from the North American continent. To the rescue Commerce Resources and its counter-striking Ashram REE "weapon"!

The Global Times concluded in last week‘s article:

“The US is concerned about rare-earth supplies. US President Donald Trump has determined to make up for the shortfall in the production of rare-earth permanent magnets, pursuant to the Defense Production Act of 1950s, a US law that was once used to protect its steelmaking capacity, according to a memorandum issued by the White House on Monday. The Pentagon on July 15 sought a quick response about rare-earth output in the US from domestics miners and refiners before July 31, Reuters reported.“

Whether or not China actually halts shipments of REEs to the United States is less important than the actual threat that has been made, because this has finally motivated the Americans to do something about this distressing vulnerability they have to China.

And this brings us to the exciting times we are in today – along with the exciting possibility that Commerce Resources and its Ashram REE Deposit will rise to the top of the REE junior field like the sweet cream it is – arguably the REE project that can compete with the best REE producers globally, past and present.

The other sea change factor to consider is that China has become a net importer of REEs (and also of fluorspar, which the Ashram Deposit hosts in great quantities along with REEs). This simply means that anyone outside of China is now in direct competition with the Chinese for new sources of these critical commodities.

Highly Competitive

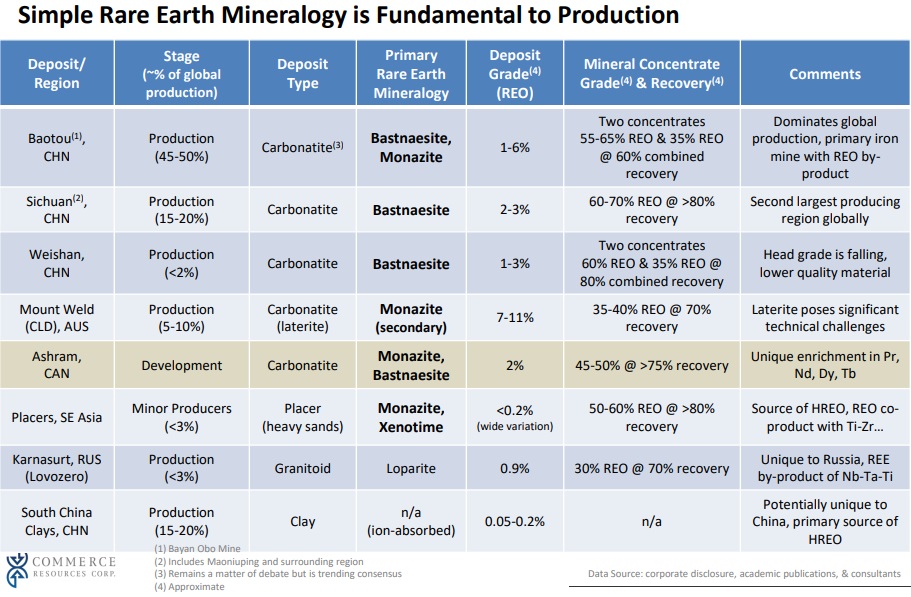

Fundamentally, the Ashram REE Deposit in Québec, Canada, compares favorably to the world’s largest REE producers, including the Bayan Obo REE Mine in China which shows quite plainly the most important criteria for success – being a gargantuan carbonatite deposit hosting the highly advantageous REE minerals monazite and bastnaesite.

Full size / Source: Corporate Presentation from Commerce Resources Corp.

Commerce Resources‘ management has not done anything specifically new to process the Ashram material because they did not have to. Management set their sights on the most standard type of REE producing mines in the world, found the Ashram which compares to these world’s largest REE producers, and then advanced the Ashram REE Project to where it sits now.

According to a statement from Chris Grove, President of Commerce Resources: “More capital is needed to complete the pilot plant and produce the approximately 20 samples requested by global majors who have all basically said that:

1) they are worried about future supplies and prices for the REEs, and

2) they do not want to have to depend upon a Chinese source for their own future.“

Full size / Source: Corporate Presentation from Commerce Resources Corp.

Overall, Commerce Resources has had the immense support of Zimtu Capital Corp. and the patience of all debt holders who believe that Ashram is the right REE project to help solve the Western World’s supply problems for these essential commodities. Zimtu Capital held 17,784,178 shares of Commerce Resources at a cost base of $0.15 CAD per share according to Zimtu‘s Quarterly Report as at February 28, 2019.

Typically, the goal of a share consolidation (also called “roll-back“) is to complete an equity financing sometime thereafter as the first financing after a roll-back is often one of the most lucrative for investors and as such may attract fresh capital more easily.

Note that private investors from all over the world may also participate in an equity private placement, where the company sells and issues new shares to investors, oftentimes attached with a warrant which entitles the holder to acquire more shares from the company at a fixed price exercisable for up to several years.

Existing shareholders are sometimes given priority in an equity private placement following a roll-back.

In case Commerce Resources announces its intent to complete an equity private placement after the roll-back, I plan to participate as an existing shareholder because I continue to be a strong believer in the ability of Commerce Resources‘ management team to advance the Ashram REE Project for the benefit of its shareholders.

Consider that the proposed share consolidation may also create the ability for Commerce Resources to be in a strong position to negotiate terms with interested parties to take the Ashram REE Project to the next level.

It‘s time to take the bull by the horns and make it happen – with a strong corporate structure and strong partners.

Company Details

Commerce Resources Corp.

#1450 - 789 West Pender Street

Vancouver, BC, Canada V6C 1H2

Phone: +1 604 484 2700

Email: cgrove@commerceresources.com

www.commerceresources.com

Shares Issued & Outstanding: 310,496,558

Canadian Symbol: CCE

Current Price: $0.06 CAD (07/26/2019)

Market Capitalization: $19 Million CAD

German Symbol / WKN (Tradegate): D7H / A0J2Q3

Current Price: €0.0385 EUR (07/26/2019)

Market Capitalization: €12 Million EUR

Previous Coverage

Report #29 “Like A Phoenix From The Ashes“

Report #28 “SENKAKU 2: Total Embargo“

Report #27 “Technological Breakthrough in the Niobium-Tantalum Space“

Report #26 “Win-Win Situation to Develop One of the Most Attractive Niobium Prospects in North America“

Report #25 “The Good Times are Back in the Rare Earths Space“

Report #24 “Commerce Resources and Ucore Rare Metals: The Beginning of a Beautiful Friendship?“

Report #23 “Edging China out of Rare Earth Dominance via Quebec‘s Ashram Rare Earth Deposit“

Report #22 “Security of REE Supply and an Unstoppable Paradigm Shift in the Western World“

Report #21 “Commerce well positioned for robust REE demand growth going forward“

Report #20 “Commerce records highest niobium mineralized sample to date at Miranna“

Report #19 “Carbonatites: The Cornerstones of the Rare Earth Space“

Report #18 “REE Boom 2.0 in the making?“

Report #17 “Quebec Government starts working with Commerce“

Report #16 “Glencore to trade with Commerce Resources“

Report #15 “First Come First Serve“

Report #14 “Q&A Session About My Most Recent Article Shedding Light onto the REE Playing Field“

Report #13 “Shedding Light onto the Rare Earth Playing Field“

Report #12 “Key Milestone Achieved from Ashram’s Pilot Plant Operations“

Report #11 “Rumble in the REE Jungle: Molycorp vs. Commerce Resources – The Mountain Pass Bubble and the Ashram Advantage“

Report #10 “Interview with Darren L. Smith and Chris Grove while the Graveyard of REE Projects Gets Crowded“

Report #9 “The REE Basket Price Deception & the Clarity of OPEX“

Report #8 “A Fundamental Economic Factor in the Rare Earth Space: ACID“

Report #7 “The Rare Earth Mine-to-Market Strategy & the Underlying Motives“

Report #6 “What Does the REE Market Urgently Need? (Besides Economic Sense)“

Report #5 “Putting in Last Pieces Brings Fortunate Surprises“

Report #4 “Ashram – The Next Battle in the REE Space between China & ROW?“

Report #3 “Rare Earth Deposits: A Simple Means of Comparative Evaluation“

Report #2 “Knocking Out Misleading Statements in the Rare Earth Space“

Report #1 “The Knock-Out Criteria for Rare Earth Element Deposits: Cutting the Wheat from the Chaff“

Contact:

Rockstone Research

Stephan Bogner (Dipl. Kfm.)

8260 Stein am Rhein, Switzerland

Phone: +41-44-5862323

Email: info@rockstone-research.com

www.rockstone-research.com

Disclaimer: This report contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Commerce Resources Corp. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to Commerce Resources Corp.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through Commerce Resources Corp.´s profile on SEDAR at www.sedar.com. Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, holds a long position in Commerce Resources Corp. and Zimtu Capital Corp., and is being paid a monthly retainer from Zimtu Capital Corp., which company also holds a long position in Commerce Resources Corp., whereas Commerce Resources Corp. has paid Zimtu Capital Corp. to provide this report and other investor awareness services. The cover picture has been obtained from Digital Storm via Shutterstock.com.