Researchers from NASA and Caltech developed a new type of amplifier for boosting electrical signals that is made of superconducting niobium titanium nitride. (Source)

Disseminated on behalf of Commerce Resources Corp., Saville Resources Inc. and Zimtu Capital Corp.

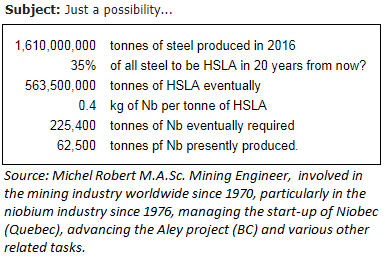

Today, niobium is one of the most attractive metals and this trend may remain well into the future. Strong demand is coming from the increased production of High-Strength Low-Alloy (HSLA) steel, which is growing in excess of 20% annually. Market analysts forecast the overall global niobium market to grow at a CAGR of 7.7% during the period 2017-2021. Such an impressive growth rate could further accelerate in light of Toshiba’s newly developed next-generation lithium-ion battery with an innovative titanium-niobium anode that can triple the driving range of electric vehicles on a 6 minute ultra-fast recharge.

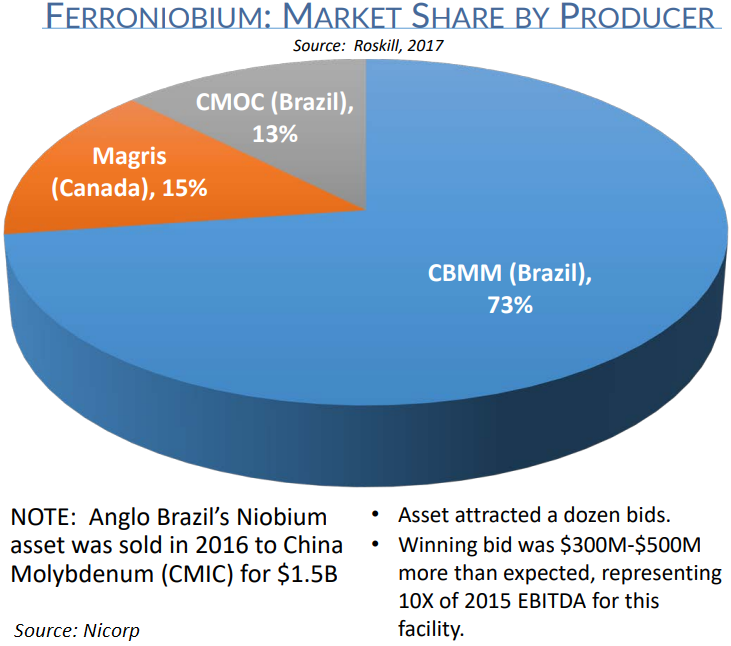

“For a metal that many people have never even heard of, upwards of US$5Bn of investment in less than five years is pretty impressive. Equally remarkable is that, from a standing start, Asian investors have gained control of, Roskill estimates, at least a third of global ferroniobium production capacity... The niobium industry in its current form is really only a few decades old. It has seen big changes over the last decade or so and there may well be more to come.“ (Source: Roskill, 2017)

Today, Commerce Resources Corp. (TSX.V: CCE) and Saville Resources Inc. (TSX.V: SRE) made striking announcements of advancing the Eldor Niobium Claims, which are adjacent to the Ashram REE Deposit from Commerce Resources and represent a separate mining target. Commerce‘s President, Chris Grove, commented:

“I am excited by this opportunity to see new work being done on these claims where we have formerly returned excellent grades of niobium. The global niobium market is seeing significant increased demand and I wish Saville the best in proving up what we have already started. We see joint utility in having Saville working with such proximity to the Ashram REE deposit in all regards, and especially with future plans for infrastructure. Saville’s President, Mike Hodge, is very well known and well regarded by Commerce, as he has been involved in both of our projects, beginning with the hand staking of our Blue River claims in 1999 and the first program on the Eldor in 2007. Commerce’s primary focus will remain on advancing and marketing both the Ashram REE deposit and the Blue River Tantalum and Niobium project, as it becomes more apparent that new sources of such critical commodities are urgently needed and wanted by industry and governments.”

This agreement brings many advantages for both companies going forward. As Saville has agreed to spend $5 million over the next 5 years for the exploration and development to earn a 75% interest in these claims, Commerce can focus on the development of its near-by Ashram REE Deposit. The active development of 2 projects in the same area could make both projects more valuable.

As Miranna is located only 1 km east of the Ashram REE Deposit, there is great potential for development synergies in the event a deposit of merit is defined at Miranna. Having 2 strategic metals deposits right at surface would greatly facilitate the infrastructure development on the Eldor Property, as well as the entire region. Developing 2 separate deposits on the Eldor Property would allow for significant synergies in CAPEX and OPEX, thereby bringing the overall costs down considerably in the event both assets were developed. The Plan Nord initiative, which has a focus on fostering the development of Quebec’s northern mineral resources, could soon have another good reason to consider Eldor in its infrastructure development plans.

According to today´s deal, Commerce Resources will receive a cash payment of $25,000 upon signing and a cash payment of $225,000 following exchange approval. Commerce will also receive a 2% NSR ("Net Smelter Royalty") on production from some of the claims, with a 1% NSR buyback for $1 million, and a 1% NSR on the claims that are already subject to royalties.

With a current market capitalization of $2 million, Saville has now gained a major flagship project which includes the high-priority, drill-ready Miranna Target and the Northwest and Southeast Zones where previous drilling returned wide intercepts of mineralization, including 46.88 m @ 0.46% Nb2O5 (EC08-008) and 26.10 m @ 0.55% Nb2O5, including 10.64 m @ 0.78% Nb2O5 (EC08-015).

Prior sampling programs on the Miranna claim by Commerce Resources (current market capitalization: $23 million) have returned exceptionally high-grade niobium grades at surface: Of the 64 rock samples collected in the Marianna Area in 2015, 40 samples returned grades in excess of 0.5% Nb2O5, with 16 in excess of 1% to a peak of 5.9% Nb2O5. Sampling also found significant grades of tantalum, phosphate and rare earth oxides (2 samples each graded >1,000 ppm Ta2O5 and 1% Nb2O5, while several samples revealed >10% P2O5). Saville believes that these numerous high-grade niobium-tantalum mineral occurrences demonstrate the prospective nature of the property and indicate a strong potential to host a deposit of significance.

When comparing these niobium grades with the range of global average mining grades between 0.5% to 1.5% Nb2O5, and the grades of the few top niobium exploration projects globally, Saville now has every reason for being enthusiastic, especially when considering its current market capitalization of a mere $2 million. As below chart of significant niobium deposits shows, grades in excess of 0.3% Nb2O5 are significant and could make a deposit economic these days:

Source: "Critical Mineral Resources of the United States" (USGS, 2017)

Most of the current exploration, development, and operating mines for niobium have grades between 0.3% and 1.2% Nb2O5, apart from the world‘s largest and highest grade niobium mine, Araxá in Brazil, with resource grades of 2.5% Nb2O5. With an average of 2.3% Nb2O5 in the 9 samples reported from the Miranna Area, Saville could be close to the discovery of a high-grade niobium deposit comparable to the leading global producer. Miranna has the right host rock and ore mineral for standard, highly efficient metallurgical processing, that being carbonatite rock and pyrochlore mineralogy hosting the niobium.

The mineralogy of the samples from the Miranna Area is highly favourable. Previous mineralogical work on the carbonatite complex indicates that the niobium and tantalum mineralization present is hosted by the mineral pyrochlore, which is the dominant mineral source of niobium globally. Further, much of the pyrochlore is visible to the naked eye, thus indicating a relatively course grain size which is advantageous to metallurgical recovery.

About Carbonatite Deposits

Carbonatites are an important exploration target because of their potential to host large, commonly bulk-minable niobium (with lesser amounts of tantalum) resources. About 80 percent of carbonatites are associated with silicate rocks, the majority of which are highly alkaline (Woolley and Bailey, 2012). Not all alkaline complexes and provinces contain carbonatites, however. (Source)

Jody Dahrouge of Dahrouge Geological Consulting once said: “Carbonatite is an extremely rare rock type with only around 550 complexes identified worldwide. In addition to their rarity, they are also well-known for being the source of production for a plethora of commodities, including being the dominate source for niobium and rare earth elements (REEs).“

Carbonatite is a type of intrusive or extrusive igneous rock defined by mineralogic composition consisting of greater than 50% carbonate minerals. Carbonatites are rare, peculiar igneous rocks formed by unusual processes and from unusual source rocks. (Source)

Schematic cross-section of a carbonatite complex (source):

Economic Importance of Carbonatite Deposits

Carbonatites may contain economic or anomalous concentrations of rare earth elements, phosphorus, niobium-tantalum, uranium, thorium, copper, iron, titanium, vanadium, barium, fluorine, zirconium, and other rare or incompatible elements. Apatite, barite and vermiculite are among the industrially important minerals associated with some carbonatites. Vein deposits of thorium, fluorite, or rare earth elements may be associated with carbonatites, and may be hosted internal to or within the metasomatized aureole of a carbonatite. As an example the Palabora complex of South Africa has produced significant copper (as chalcopyrite, bornite and chalcocite), apatite, vermiculte along with lesser magnetite, linnaeite (cobalt), baddeleyite (zirconium-hafnium), and by-product gold, silver, nickel and platinum. (Source)

Niobium Supply

In nature, niobium is closely associated with tantalum in igneous carbonate rocks, most commonly carbonatite. It is usually found in the interior parts of zoned alkaline igneous complexes, commonly associated with minerals containing thorium, titanium, uranium and rare earth elements. The oxide mineral pyrochlore is the most important mineral source of niobium. Between 2009 and 2012, 99 percent of mined niobium production globally occurred at just three mines: two in Brazil and one in Canada. Columbite is also a mineral source for niobium. It occurs mostly as an accessory mineral disseminated in granitic rocks or in pegmatites associated with granites. In most cases, economic mineral concentrations of columbite have been produced by weathering of pegmatites and the formation of residual or placer deposits. The United States obtains most of its supply of niobium in the form of ferroniobium. The only niobium recovered in the United States is from the recycling of niobium-bearing alloys. Niobium is recycled when niobium-bearing microalloyed or stainless steel and superalloy scrap is reused. The United States produces about 2 million metric tons per year of stainless steel that contains an estimated average of 0.014 percent niobium. (Source)

Brazil has the world‘s largest niobium reserves (98.5%), followed by Canada (1%) and Australia (0.5%). Brazilian niobium reserves total about 840 million t of Nb2O5, with an average grade of 0.73%. The only 2 Brazilian niobium mines are Araxá and Catalão with reserve grades of about 1.2% Nb2O5 (resources at 0.93% Nb2O5). Most of the current exploration, development, and operating mines for niobium have grades between 0.3% and 1.2% Nb2O5 (apart from Araxa averaging 2.5% Nb2O5). According to USGS in 2017: "Most of the identified carbonatites in the United States are currently known to have only low grades of niobium (Berger and others, 2009). An exception may be the Elk Creek carbonatite in Nebraska, which has inferred niobium resources of 102.6 million metric tons grading 0.638 percent Nb2 O5 (Daigle, 2012)."

For almost 50 years now, only 3 primary niobium mines are responsible for global supply:

Niobec (Québec, Canada)

• Deposit: Carbonatite

• Share in world supply: ~7%

• Average grade: 0.4-0.53% Nb2O5

• Owned by Magris Resources, a privately-held company (purchased from IAMGold for $500 million CAD in 2015)

Catalao (Brazil)

• Deposit: Carbonatite

• Share in world supply: ~7%

• Average grade: 0.9-1.3% Nb2O5

• Owned by China Molybdenum since April 2016 ($1.5 billion transaction with Anglo American)

Araxa (Brazil)

• Deposit: Carbonatite

• Share in world supply: ~85%

• Average grade: ~2.5% Nb2O5 (but with a 50% recovery)

• Owned by CBMM (Companhia Brasileira de Metalurgia e Mineração)

CBMM is a privately-held company, founded in 1955; since 1965 controlled by the Moreira Salles family, which became one of Brazil’s wealthiest families primarily thanks to its bet on niobium.Between 2006-2008, CBMM doubled the price of ferroniobium to address the strong demand growth that was, according to CBMM, not priced in correctly. As niobium prices remained flat over the last 9 years, CBMM may increase prices again to better reflect heightened demand.

Niobium Demand

Niobium can deliver powerful economic and environmental benefits in applications where it is used. For example, according to the World Steel Association, approximately $9 USD of niobium added to a mid-sized automobile can reduce its weight by 100 kg. That helps increase its fuel efficiency by 5%. And that‘s a huge return to consumers and our environment. As a commodity, niobium enjoys relatively stable pricing at attractive levels. It also is characterized by robust and diverse global markets, solid forecast growth rates, relatively limited substitution risk, and multiple applications across environmentally preferred technologies. Niobium has the largest magnetic penetration depth of any element. Niobium is used in making superconductive magnets owing to its superconductive properties. These magnets are in the form of niobium zirconium (Nb-Zr) wires. Hope exists that one day this Nb-Zr wire could direct large scale power generation.

Demand for niobium is expected to increase on the backs of national defense and the production of high-efficiency vehicles and super-alloys.Gobal steel production is expected to increase its usage of niobium (to make steel stronger and lighter) from currently about 10% to up to 20% over the next few years.

“Ferroniobium (FeNb) – key component of High Performance Steel used in mega-steel infrastructure projects, oil and gas pipelines, and most cars and trucks with a steel chassis. Ferroniobium is used in virtually all steel chassis vehicles today in order to reduce weight, increase fuel efficiency, reduce emissions, and increase safety margins. Niobium strengthens steel, allowing for lighter structures and vehicles, and makes steel more corrosion resistant. Niobium is vital to many markets, including aerospace, construction, transportation, oil & gas, superalloys. Ferroniobium is considered such a strategic and critical material by the U.S. Department of Defense that it stores FeNb in the National Defense Stockpile.“ (Source: Niocorp)

Applications & Benefits Full version

Full version

“$9 of Niobium added to a mid-sized automobile reduces its weight by 100kg, increasing fuel efficiency by 5%.“ (Source: World Steel Assosciation)

“The addition of 0.025% of Niobium to the steel in the Millau Viaduct reduced the weight of the steel and concrete by 60% in the overall project.“ (Source: CBMM)

Niobium: A Critical and Strategic Metal

The US Department of Defence has declared niobium as one of its top “strategic” metals as it is not mined domestically, is a matter of national security and is important to the nation’s economy. The US government maintains a stockpile of niobium at all times and according to the USGS, the DLA Strategic Materials plans to acquire more niobium to address the current shortfall. The US imports all of its niobium from Brazil (83%), Canada (12%) and others (5%). According to Reuters in December 2017:

"The United States needs to encourage domestic production of a handful of minerals critical for the technology and defense industries, and stem reliance on China, U.S. Interior Secretary Ryan Zinke said on Tuesday. Zinke made the remarks at the Interior Department as he unveiled a report by the U.S. Geological Survey (USGS), which detailed the extent to which the United States is dependent upon foreign competitors for its supply of certain minerals. The report identified 23 out of 88 minerals that are priorities for U.S. national defense and the economy because they are components in products ranging from batteries to military equipment. The report found that the United States was 100 percent net import reliant on 20 mineral commodities in 2016, including manganese, niobium, tantalum and others. In 1954, the U.S. was 100 percent import reliant for the supply of just eight nonfuel mineral commodities.

“We have the minerals here and likely we have enough to provide our needs and be a world trader in them, but we have to go forward and identify where they are at,” Zinke told reporters at an Interior Department briefing... Zinke said the report is likely to shape Interior Department policy-making in 2018, as the agency looks to carry out its “Energy Dominance” strategy, expanding mining and resource extraction on federal lands... It does not offer policy recommendations, but Zinke will rely on the findings as he prioritizes research into certain mineral deposit areas on federal land and plans policies to promote mining. “We do expect that to lead to policy changes. The USGS is not involved in policy, but I suspect you will see some policy changes,” said Larry Meinert, deputy associate director for energy and mineral resources at the USGS. The lead author of the report was Klaus Schultz, a geologist at the USGS."

The USGS study, Critical Mineral Resources of the United States, details 23 commodities deemed crucial due to their possibility of supply disruption with serious consequences.

See Niobium Chapter here. (Source: "Critical Attention: The U.S. embarks on a national strategy of greater self-reliance for critical minerals")

Consumption of niobium and tantalum is expected to increase in the coming years as industrial development in such countries as Brazil, China, and India continues, and the rapidly increasing global population demands more consumer goods, such as cars, cell phones, computers, and other high-tech products. Although the estimated reserves and resources of both niobium and tantalum are large and appear more than sufficient to meet global demand for the foreseeable future (British Geological Survey, 2011), the restricted concentration of niobium resources and production, and, to a lesser extent, those of tantalum, makes their stable supply vulnerable to potential influence and disruption. The United States currently lacks domestic self-sufficiency for both mineral commodities and is dependent on imports and recycling to meet its current and future needs. For the United States, the discovery of additional deposits of niobium and tantalum of better quality and quantity than those currently identified would be advantageous. New discoveries in the United States, particularly of niobium, may be facilitated by ongoing efforts to identify additional REE resources because alkaline and carbonatite complexes can host both deposit types. (Source: USGS, 2017)

Niobium Price

"Niobium -- named for a Greek goddess who became a symbol of the tragic mourning mother -- is used to produce stronger, lighter steel for industrial pipes and aircraft parts. It is mined in only three places on Earth, and the price of every kilogram is seven times higher than copper." (Source: "The commodity no one knows about but everybody wants to buy", Bloomberg)

In contrast to other strategic metals and REEs, niobium prices have only corrected marginally since the overall commodity slump started in 2011 and is rather explained with the USD strength. There are no official niobium prices as it is not traded on any metal exchange. Its price is determined solely by negotiation between buyer and seller.

In contrast to other strategic metals and REEs, niobium is not controlled by China; for instance: “China controls most of the world’s molybdenum and the country has taken advantage of this, flooding the market with supplies when international producers became a threat and then charging exorbitant prices for exports once the country has resumed its control of the metal’s supply. This has caused some massive fluctuations in the commodity’s price...“ (Source)

Company Details

Commerce Resources Corp.

#1450 - 789 West Pender Street

Vancouver, BC, Canada V6C 1H2

Phone: +1 604 484 2700

Email: cgrove@commerceresources.com

www.commerceresources.com

Shares Issued & Outstanding: 309,589,908

Canadian Symbol: CCE

Current Price: $0.075 CAD (01/10/2018)

Market Capitalization: $23 Million CAD

German Symbol / WKN (Tradegate): D7H / A0J2Q3

Current Price: €0.05 EUR (01/10/2018)

Market Capitalization: €16 Million EUR

Previous Coverage

Report #25 “The Good Times are Back in the Rare Earths Space“

Report #24 “Commerce Resources and Ucore Rare Metals: The Beginning of a Beautiful Friendship?“

Report #23 “Edging China out of Rare Earth Dominance via Quebec‘s Ashram Rare Earth Deposit“

Report #22 “Security of REE Supply and an Unstoppable Paradigm Shift in the Western World“

Report #21 “Commerce well positioned for robust REE demand growth going forward“

Report #20 “Commerce records highest niobium mineralized sample to date at Miranna“

Report #19 “Carbonatites: The Cornerstones of the Rare Earth Space“

Report #18 “REE Boom 2.0 in the making?“

Report #17 “Quebec Government starts working with Commerce“

Report #16 “Glencore to trade with Commerce Resources“

Report #15 “First Come First Serve“

Report #14 “Q&A Session About My Most Recent Article Shedding Light onto the REE Playing Field“

Report #13 “Shedding Light onto the Rare Earth Playing Field“

Report #12 “Key Milestone Achieved from Ashram’s Pilot Plant Operations“

Report #11 “Rumble in the REE Jungle: Molycorp vs. Commerce Resources – The Mountain Pass Bubble and the Ashram Advantage“

Report #10 “Interview with Darren L. Smith and Chris Grove while the Graveyard of REE Projects Gets Crowded“

Report #9 “The REE Basket Price Deception & the Clarity of OPEX“

Report #8 “A Fundamental Economic Factor in the Rare Earth Space: ACID“

Report #7 “The Rare Earth Mine-to-Market Strategy & the Underlying Motives“

Report #6 “What Does the REE Market Urgently Need? (Besides Economic Sense)“

Report #5 “Putting in Last Pieces Brings Fortunate Surprises“

Report #4 “Ashram – The Next Battle in the REE Space between China & ROW?“

Report #3 “Rare Earth Deposits: A Simple Means of Comparative Evaluation“

Report #2 “Knocking Out Misleading Statements in the Rare Earth Space“

Report #1 “The Knock-Out Criteria for Rare Earth Element Deposits: Cutting the Wheat from the Chaff“

Disclaimer: Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist.

Company Details

Saville Resources Inc.

#1450 – 789 West Pender Street

Vancouver, BC, V6C 1H2 Canada

Phone: +1 604 681 1568

Email: mhodge@savilleres.com

www.savilleres.com

Shares Issued & Outstanding: 23,116,714

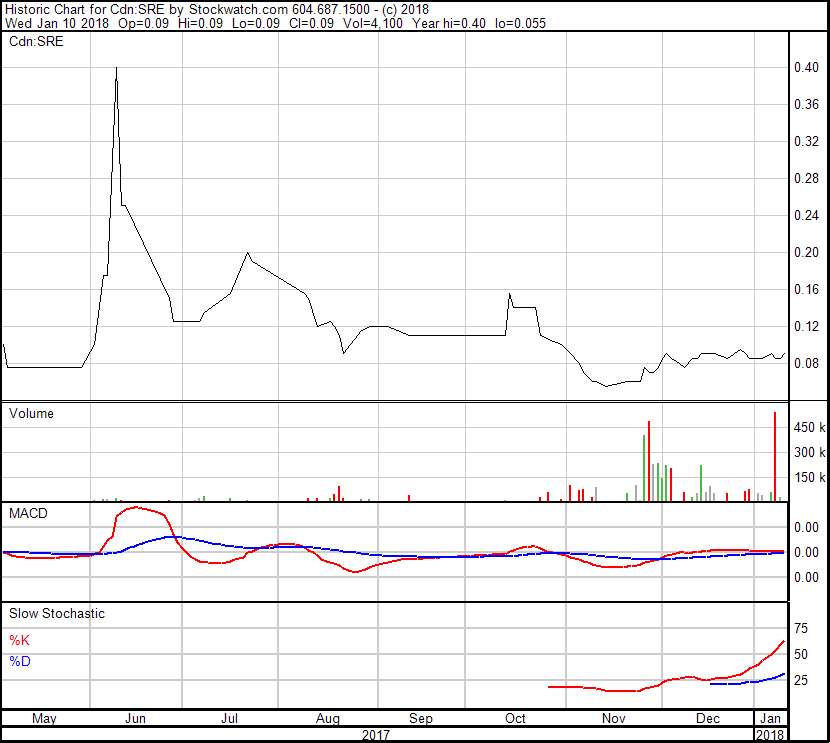

Canadian Symbol (TSX.V): SRE

Current Price: $0.09 CAD (01/10/2018)

Market Capitalization: $2.1 Million CAD

German Symbol / WKN (Frankfurt): S0J / A2DY3Z

Current Price: €0.05 EUR (01/10/2018)

Market Capitalization: €1.2 Million EUR

Previous Coverage

Report #1 “Saville Resources: Getting Ready to Create Shareholder Value“

Disclaimer: Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist.