Credit: Diavik Diamond Mines (source)

Disseminated on behalf of Arctic Star Exploration Corp. and Zimtu Capital Corp.

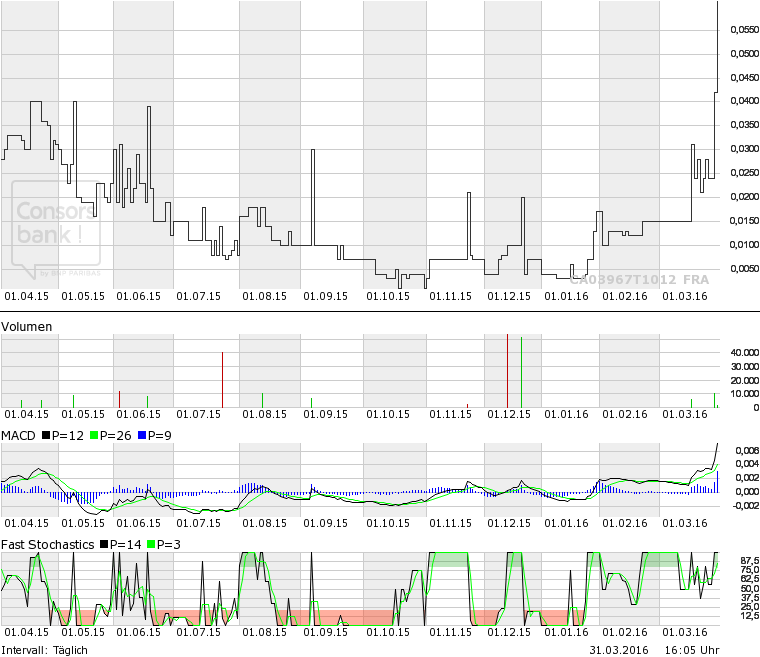

Marc Davis from BNW News made it crystal clear in his latest Mineweb article “Another World Class Diamond Discovery?”. A major new diamond discovery in Canada is long overdue, whereas Arctic Star Exploration Corp. has teamed up with North Arrow Minerals Inc. to fund exploration of its Redemption Project in the diamondiferous Lac de Gras region in the Northwest Territories. Last week, the start of a drilling and ground geophysical program was announced. Arctic Star’s stock on the TSX Venture has been experiencing a tremendous amount of trading lately: +33 million shares traded thus far in March with 11.5 million shares changing hands yesterday.

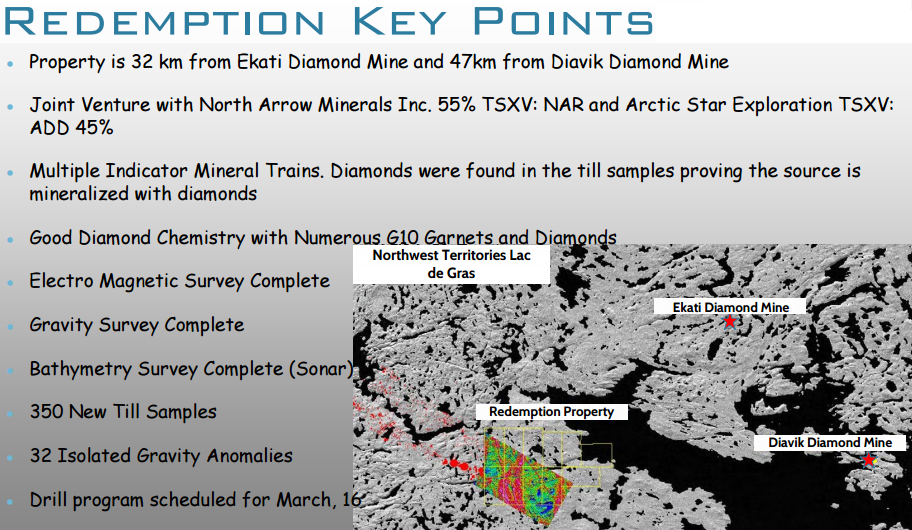

By now, the geophysical survey should be completed and drilling is expected to continue through the end of April with a focus on the discovery of a kimberlite bedrock source to the South Coppermine Indicator Mineral Train.Redemption is located 32 km southwest and 47 km west of the NWT’s 2 currently producing diamond mines, Dominion Diamond’s majority-held Ekati and the Dominion/Rio Tinto joint venture at Diavik.

As operator, North Arrow is exploring Arctic Star‘s Redemption Property under an option agreement, under which North Arrow can earn a 55% interest by incurring $5 million CAD in exploration expenditures prior to July 1, 2017. Arctic Star‘s CEO, Patrick Power commented:

“This agreement will allow the team to immediately move ahead with exploration drilling programs at the Redemption diamond property without impacting Arctic Star’s treasury at all.“

Another World Class Diamond Discovery?

There have been no significant discoveries for a while.

By Marc Davis (BNW News) for Mineweb.com on March 28, 2016

Finding a multi-billion dollar diamond discovery is something that geologist Buddy Doyle dreams of every day. For well over a decade, it’s been his obsession.

But it would be foolish to dismiss him as a self-deluded wishful thinker. History bears testament to him being quite the opposite. Which is because he’s done it all before, unearthing a rich diamond deposit — that became the Diavik mine — in Canada’s far north, while still a relatively youthful up-and-comer. This is when he was exploration manager for Kennecott Canada Exploration Inc. — a subsidiary of the world’s biggest mining company, Rio Tinto plc.

Within weeks, we’ll know if Doyle can do it again. And he likes his odds, even though they’re still a long shot at best. Now in his 50s, he’s far shrewder and scientifically savvier than the first time around, he points out. He also has the benefit of vastly improved diamond-hunting technology, as well as the collaboration of one of the world’s top diamond-hunting gurus, Dr. Chris Jennings.

Even though his last claim to fame was a generation ago, Doyle hasn’t exactly been idle since. In fact, his latest shot at glory has been over a decade in the making. During this time, his dogged pursuit of a new diamond discovery has seen him traverse much of the frigid vastness of the Northwest Territories (NWT).

Though he’s drilled without success elsewhere in recent years, he’s learned invaluable lessons each time. Now we’re about to see if he’s amassed enough geological savoir faire to pull off a masterstroke in the sunset of his 30-year-plus career.

A modest man by nature, Doyle’s confidence doesn’t seem to be over-inflated. After all, he has the support and encouragement of some important players in the diamond exploration business. They include world-famous diamond hunter, Dr. Jennings, who helped select the best drill targets on Arctic Star’s property, which is called Redemption.

Dr. Jennings also played a key preliminary role in the discovery of the rich Diavik diamond deposit in 1992. (The NWT’s other diamond mine, Ekati, was discovered a year earlier).

It was Dr. Jennings who originally found the right locality in the NTW to zero-in on Ekati’s hidden treasures. And that was quite an achievement considering that the NTW is bigger than Germany, France and Spain combined. And it was Doyle who next figured out the correct spot to drill in order to reveal the exact whereabouts of Ekati’s huge bounty all those years ago.

Now Dr. Jennings is putting his money where his mouth is. He’s committed close to a million dollars of his own funds for this drill project, largely because he really likes what he sees — in terms of all the physical clues that a new multi-billion dollar discovery may be within reach. (More on this in a moment).

In recent years, Doyle has been doing his geological sleuthing work at the helm of a small exploration company, Arctic Star (TSX.V: ADD) — a TSX Venture Exchange publicly-traded company.

Ironically, Doyle’s long, circuitous search for diamonds has finally led him to a locality that’s within a 50-kilometer radius of both the Ekati and Diavik mines. And that may be a good thing. Which is because the rock formations that often host diamonds — known as kimberlite pipes — typically occur in clusters that resemble a shotgun blast spread out over an area in diameter of up to 100 kilometers. So when one of them is located, geologists know that other potentially diamond-rich kimberlite pipes are likely nearby.

That said, Arctic Star’s ten or so top-priority targets were selected primarily because of their excellent geochemistry. This means they’re ideally located at the head of a prolific “dispersion train” of diamond indicator minerals (significantly, one that also includes tiny diamonds).

In other words, an approximately 40-kilometre-long indicator mineral trail comes to an abrupt end in the immediate vicinity of Arctic Star’s drill targets. This situation is comparable to a trail of crumbs leading back to a loaf of bread.

Even though Arctic Star’s drill program — which started late last week —will cost up to a million dollars, it may end up being a small price to pay. And it’s Arctic’s joint venture partner, North Arrow Minerals, that’s footing the bill (along with Dr. Jennings). It can earn up to a 55% stake in the joint-ventured project by spending as much as CDN $5 million on exploration work by July of 2017.

In fact, an economic discovery would make both these upstart companies the toast of Canada’s mining investment community. After all, these diamond fields have already yielded unimaginable buried wealth. Consider this: the NWT’s two diamond mines have collectively produced over US $25 billion worth of high-quality gems so far.

There are historic precedents for the kind of stratospheric success that shareholders of Arctic Star and North Arrow dream of. In fact, several other mining juniors have hit the geological jackpot since the early 90s. And of course, they include Dia Met Minerals, which discovered the Ekati mine. This fabulous find propelled the company’s share price from mere pennies in 1991 to over $67 the following year.

However, a new discovery is long overdue — especially because Canada’s supplies are already dwindling. In fact, there’s only been one economic diamond discovery in Canada in well over a decade. And that was De Beers’ Victor pipe in Ontario. It’s the only diamond mine outside of the NWT (though another mine — Gahcho Kué — which has been in development for a long time, is expected to come on-stream in the NWT later this year.)

Nonetheless, Doyle remains convinced that the NWT has at least one more dazzling secret to give up.

But why does Arctic Star believe it can beat the odds when so many other diamond exploration mining juniors have failed? It’s all about the “exceptional” geochemistry that has led him to Arctic Star’s high-priority drill targets at Redemption, Doyle says.

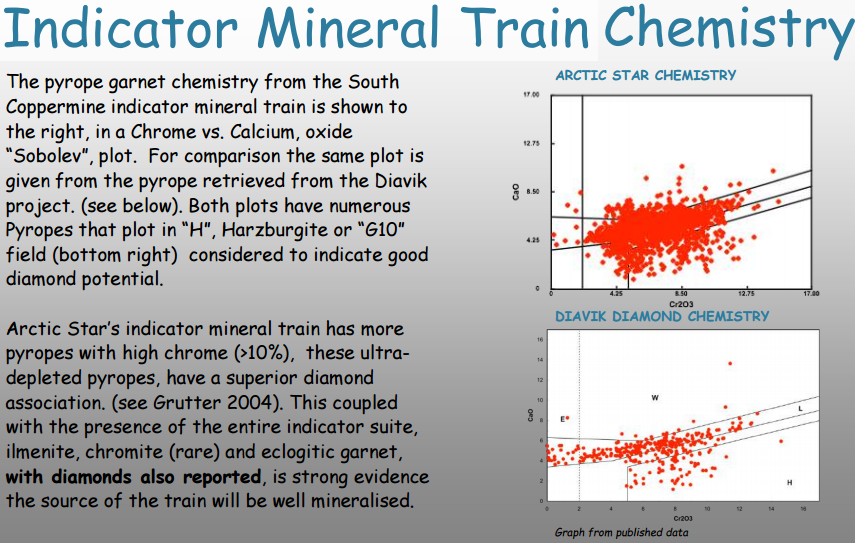

“The abundant indicator minerals in the South Coppermine mineral train have the same unique chemistry as ones that co-exist with diamonds. In other words, they must have been formed under the exact same conditions that create diamonds,” he explains. “This makes it probable that the source of these trace elements is diamondiferous.”

Scientific advancement is also on Arctic Star’s side, he adds.

“The depth of experience and level of sophistication that we have in finding diamond pipes has come a long way since the Diavik and Ekati diamond mines were found,” Doyle says. “Whereas these past discoveries were largely reliant on using one particular exploration tool or another, we’re now using all the tools in the tool kit.”

“And these exploration techniques that we’ve used to identify our best drill targets each corroborate one other. Which is very exciting.”

Drill results are expected by the end of April.

Disclaimer: Marc Davis does not directly or indirectly have any stock positions in any of the companies mentioned in this article.

Arctic Star And North Arrow Announce Drilling At Redemption Diamond Project

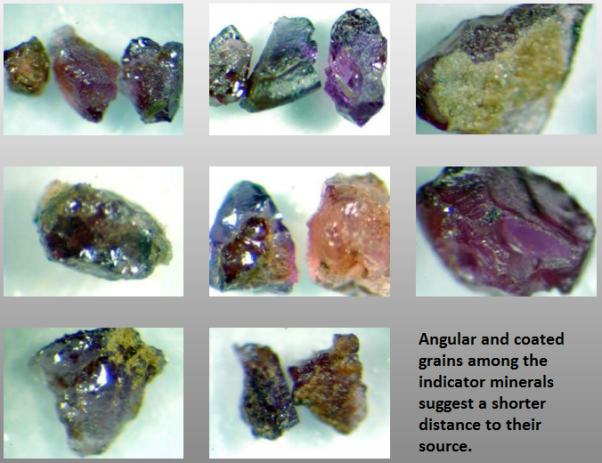

Angular and coated grains among the indicator minerals suggest a shorter distance to their source. “Studies of the indicator minerals from the South Coppermine train, some of which are imaged to the right, show very angular habits, some with soft alteration rims, (kelphyite for pyrope and lucoxene for ilmenite), all evidence for close proximity to source. Mineral grains lose their coats and become rounded as they travel down ice in the glacier. The angular/coated grains were most abundant at the head of the South Coppermine train. One grain with kimberlite attached was also noted." (source)

By Greg Klein for ResourceClips.com on March 22, 2016

Located in the Northwest Territories’ diamondiferous Lac de Gras region, the Redemption project now has ground geophysics and drilling underway. Announced March 22 by Arctic Star Exploration TSXV:ADD and North Arrow Minerals TSXV:NAR, the program calls for a week of geophysics, while the rig’s expected to be busy until late April. The companies hope to find the source of the South Coppermine indicator mineral train.

Previous work has included electromagnetics, gravity and sonar surveys, as well as 350 till samples. Diamonds have been found among the indicator minerals. Other encouraging signs include pyropes with high chrome, ilmenite, chromite and eclogitic garnet. Angular stones, as opposed to smoother shapes, suggest shorter transport from the source.

Redemption lies about 32 kilometres southwest and 47 kilometres west of the NWT’s two currently operating diamond mines, Dominion Diamond’s (TSX:DDC)majority-held Ekati and the Dominion/Rio Tinto NYE:RIO 40%/60% JV at Diavik. North Arrow funds the Redemption program and acts as operator under a 55% earn-in which would require $5 million of work by July 1, 2017.

North Arrow’s portfolio includes a majority stake in the Pikoo diamond project in Saskatchewan, where drilling began last month. Arctic Star also holds the T-Rex and Triceratops kimberlite clusters northwest of Ekati, and the Stein property in Nunavut.

Excerpt from Greg Klein‘s previous article “North Arrow Deal To Fund Drilling On Arctic Star Diamond Project“ (01/25/16):

"Arctic Star Exploration’s (TSXV:ADD) Redemption diamond project stands to gain from a royalty sale by North Arrow Minerals TSXV:NAR. With an option to earn 55% of the project, North Arrow has signed a deal with Umgeni Holdings International to sell part of its share of royalties on the property for $800,000. The money would help fund drill programs at North Arrow’s Pikoo diamond project in Saskatchewan as well as the Redemption project in the Northwest Territories’ diamondiferous Lac de Gras region. Pikoo has drilling scheduled to begin in mid-February, with Redemption following in about a month. North Arrow’s Redemption option requires the company to fund $800,000 in exploration by August. The full 55% calls for North Arrow to spend $5 million by July 2017. Subject to approvals, the $800,000 sale gives Umgeni a 1.5% gross overriding royalty on diamonds and a 1.5% NSR on base and precious metals for three claims held 100% by North Arrow, as well as a 1.25% GOR and 1.25% NSR on 12 claims and five mining leases now under option from Arctic Star. North Arrow holds sole responsibility for paying the royalties."

HIGHLIGHTS

• Close to 2 world-class diamond mines: Ekati and Diavik.

• Experienced management who lead a team that helped discover the Diavik Mine.

• Approximately $20 million spent following Indicator Mineral Trains that are as good as Diavik’s Indicator Mineral Train.

• Arctic Star‘s Indicator Mineral Train contains not only G10 chemistry but diamonds!

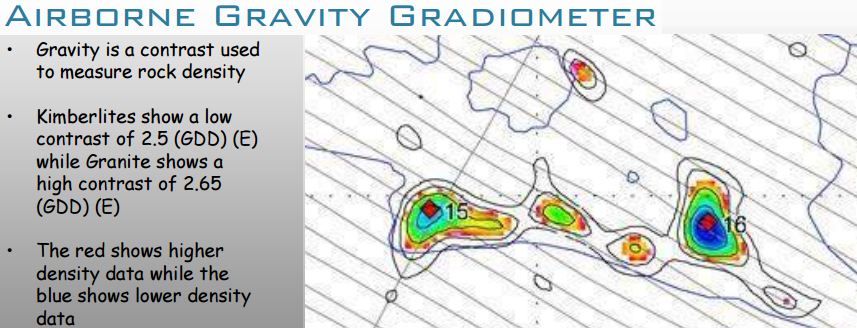

• New technology (airborne gravity survey), has identified a new cluster of anomalies at the head of the mineral train. A recent major discovery has been made in the area using this new technology, which impacted its share price dramatically!

• Redemption Project funded by Arctic Star‘s joint venture partner North Arrow.

• 250,000 acres newly staked (100% owned by Arctic Star).

Source: Arctic Star´s Corporate Presentation (March 2016)

Dominion Diamond Completes Sable Pre-Feas, Construction to Begin Next Year

The Ekati Diamond Mines (Source: Mining.com)

By Greg Klein for ResourceClips.com on February 22, 2016

Now boasting a 10.1-million-carat reserve, Dominion Diamond’s (TSX:DDC) Sable pipe could begin production in 2019 and continue to 2027, helping keep the company’s Ekati plant at full capacity until 2033. Dominion released pre-feasibility highlights on February 22 for an open pit 17 kilometres north of Ekati’s existing infrastructure in the Northwest Territories’ Lac de Gras region.

Dominion holds an 88.9% interest in Ekati’s Core zone, which includes Sable. The company has a 65.3% stake in the adjacent Buffer zone and its Jay pipe, with Archon Minerals TSXV:ACS holding the remaining 34.7%. Jay’s January 2015 pre-feas envisioned that pipe as a standalone operation. But in SeptemberDominion decided to defer Jay production to give Sable higher priority.

Using a one-millimetre cutoff, Sable’s pre-feas shows a probable reserve of 12 million tonnes averaging 0.8 carats per tonne for 10.1 million carats.

The resource estimate used a 0.5-millimetre cutoff, with rounded numbers showing:

-- indicated: 15.4 million tonnes averaging 0.9 ct/t for 14 million carats

-- inferred: 300,000 tonnes averaging 0.9 ct/t for 300,000 carats

The study provides all dollar amounts in U.S. currency based on a 2015 exchange rate of C$1.33. With a 7% discount rate, Dominion’s share of the post-tax net present value comes to $137 million and the post-tax internal rate of return comes to 16.2%. The study assumed a base case diamond price of $140, $50 less than last September’s PEA. The lower price results from a re-evaluation of size frequency and price per size, weaker diamond prices and additional recovery of smaller stones, Dominion stated.

Total capital expenditures would reach $55 million in fiscal 2017, $72 million in 2018 and $15 million in 2019, with another $85 million for pre-stripping, which would mostly take place in 2019.

The company plans to begin building the fully permitted mine in fiscal 2017 without a full feasibility study. Production would begin in 2019. Dominion stated it “plans to re-evaluate and further optimize the Sable mining and processing schedule based on the results of the Jay feasibility study, which is currently underway.” Jay’s probable reserve contains 84.6 million carats.

The company has previously stated that Jay could potentially extend Ekati’s mining life by at least 10 years beyond 2020. Ekati’s Misery Main pipe, with a reserve of 14 million carats, has production scheduled to begin in H1.

The world’s third-largest rough producer by value, Dominion also holds the smaller portion of a 40/60 joint venture with Rio Tinto NYE:RIO in Diavik, another Lac de Gras operation. The mine’s fourth pipe, the 10-million-carat A21, has production scheduled for H2 2018.

Rio Tinto Finds Massive Canadian Diamond

Click above image to watch video

By SBS.com.au on December 3, 2015

Rio Tinto has unearthed one of Canada‘s largest-ever, gem-quality rough diamonds at its Diavik diamond mine in the remote Northwest Territories, a 187.7-carat stone called the Diavik Foxfire.

The gem, now being showcased at Kensington Palace in London, will later be assessed at Rio Tinto‘s diamond sales and marketing hub in Antwerp.

Rio Tinto, which expects the stone to produce at least a 50-carat polished diamond, did not estimate the gem‘s value. Discovered in August, the diamond is the second or third largest rough diamond mined in Canada and the largest ever for a Rio Tinto diamond mine, a spokeswoman said.

Rio Tinto operates the mine and owns a 60-per-cent share, with Dominion Diamond Corp holding the remainder. Late last year, Rio approved the $US350 million ($A477.5 million) expansion at Diavik, with production expected to start in late 2018.

Two weeks ago, a small Canadian diamond miner found the world’s second-biggest gem quality diamond at its mine in Botswana. The 1111-carat stone, slightly smaller than a tennis ball, could sell for more than $US60 million, the chief executive of Lucara Diamond Corp has said.

One day later, the company announced the recovery of an 813-carat and 374-carat stone from its Karowe mine in Botswana.

The world’s biggest ever gem-quality diamond is the Cullinan, a 3106-carat stone found in 1905 at the Premier mine in South Africa.

It was cut into several polished gems, the two largest of which are part of Britain’s crown jewels.

Media Release from Rio Tinto on 12/02/15:

Rio Tinto unveils 187.7 carat Canadian diamond

Rio Tinto has unveiled one of the largest diamonds ever discovered in Canada.

The 187.7 carat gem-quality rough diamond, known as The Diavik Foxfire, was discovered at the Diavik Diamond Mine in the remote Northwest Territories of Canada, 220km south of the Arctic Circle.

The Diavik Foxfire diamond was showcased during an exclusive preview at Kensington Palace in London.

Rio Tinto Diamonds managing director Jean-Marc Lieberherr said “We are delighted to showcase this exceptional, two billion-year-old Canadian diamond. Its ancient beginnings, together with the fortitude, finesse and innovative technology required to unearth a diamond in the challenging sub-arctic environment, make it a true miracle of nature.”

The Diavik Foxfire has also been bestowed an indigenous name, Noieh Kwe which references the strong ties to the land and its legacy. Grand Chief Edward Erasmus from the Tlicho government said “I am very pleased that this has been named to honour the area of the caribou crossing, as this has been important to the Tlicho since time immemorial.”

Local communities have been widely consulted about the operation and impact of the Diavik mine, with this engagement leading to considerable employment, training and capacity building opportunities. Diavik Diamond Mines president and chief operating officer Marc Cameron said “In a landscape so pristine and precious to traditional lifestyles, we have seen and continue to see an inspired collaboration between local indigenous people and a modern mining company.”

The Diavik Foxfire will be showcased in London before returning to Antwerp for careful assessment and planning for the next stage of its journey. It is likely that the 187.7 carat rough diamond will yield at least one very large polished diamond with, its ultimate destiny in an exclusive heirloom piece of jewellery.

Rio Tinto owns a 60 per cent interest in, and operates, the Diavik Diamond Mine in Canada’s remote Northwest Territories. Diavik commenced production in 2003 and has an annual production of some 6-7 million carats of predominantly large, white gem-quality diamonds.

Diavik is a significant contributor to Canada’s northern economy, since 2000, Diavik has spent C$4.8 billion with local businesses and C$2.5 billion of this with northern Aboriginal businesses and their joint ventures.

DIAMOND INDUSTRY OVERVIEW: What is the Future for the "Tears of the Gods"?

By Chris Berry in December 2015 for Zimtu Research

Click here or below to view the full report as a PDF:

Global Diamond Production Forecasted at 137M Cts in 2016

Haul truck at De Beers‘ Jwaneng mine in Botswana, the most valuable diamond mine in the world. Source: De Beers Group

By Paul Zimnisky on February 1, 2016, on PaulZimnisky.com

De Beers

ALROSA/LUKoil

Rio Tinto

Dominion Diamond

Petra Diamonds

Marange and Artisanal Production

New Mines and Development Projects

Itemized Detail of World´s 60 Largest Diamond Mines

Mining‘s Intangibles: The NWT tries to gauge social impacts of its largest industry

By Greg Klein for ResourceClips.com on March 18, 2016

Does diamond mining affect rates of STDs? Tuberculosis, family violence, teen pregnancy or suicide? The Northwest Territories government actually tried to find answers to those questions and others. An exercise that arose out of socio-economic agreements with the territory’s diamond miners, many of its results were—not surprisingly—inconclusive. Even so, the report offers perspective on mining-related issues that are often overlooked.

Two diamond operations comprise the sum total of NWT mining now that a third, De Beers’ Snap Lake, went on care and maintenance last December. That shutdown followedNorth American Tungsten’s (TSXV:NTC) C&M decision for its Cantung mine. But during the last fiscal year, the three diamond mines paid taxes of $44 million to the territory, an 11% increase over the previous year. Miners also pay the territory royalties.

Up to 2013 the territory diverted $39 million in diamond royalties to three native governments with settled land claims, according to figures supplied by the NWT and Nunavut Chamber of Mines. In 2015, the NWT shared nearly $6.3 million with nine native groups that signed the devolution agreement. The territory says it collected $63 million in diamond royalties in 2014 to 2015, half of which went to the feds.

In 2014 diamond mines created over 3,200 person-years of employment and paid more than $653 million to northern businesses, about 33% of which were aboriginal-owned.

Those outcomes can be quantified. What’s harder to assess are changes for better or worse on individuals, communities and culture since diamond mining started in 1998. Nevertheless, the NWT tried, looking at a range of factors affecting Yellowknife and seven small communities, all roughly 250 kilometres southwest of the Lac de Gras diamond camp.

We read about the use of aboriginal languages (declining in the smaller communities but showing a slight increase in Yellowknife and elsewhere), suicide (especially difficult to track on numerical trends), teen births (declining), sexually transmitted infections (increasing in the smaller communities but not Yellowknife), TB (little change), family violence (a series of spikes and declines in the smaller communities, relatively flat in Yellowknife), school achievement (significant improvement) and so on. Again and again, the report concedes that it can’t link those issues with mining.

So what’s the point of the study? If anything, it demonstrates that communities expect mining to provide intangible benefits as well as material rewards. Those communities also show concern about how a large industrial operation might affect their society. Although mining’s by far the territorial economy’s largest private sector driver, companies can’t betray complacency about their importance.

That too was demonstrated by statements miners made during their environmental assessments. In addition to singing the praises of their proposals, companies acknowledged potential disadvantages, for example the possibility of “increasing stress and related alcohol abuse, by alienating people from traditional lifestyles and by increasing the pace of change in communities.”

That comment came from BHP Billiton, which later sold its share of Canada’s first diamond mine toDominion Diamond TSX:DDC. Holding a majority stake in Ekati and 40% of a JV with Rio Tinto NYE:RIO in Diavik, the company looms large over NWT mining. With pre-feas complete on Ekati’s Sable kimberlite, the pipe’s scheduled to begin mine construction next year and possible production in 2019. Diavik’s fourth pipe, meanwhile, has production slated for 2018.

But the biggest diamond development story in the NWT, and indeed the world, is Gahcho Kué. The 51%/49% De Beers/Mountain Province Diamonds TSX:MPV JV has surpassed 87% completion, staying on schedule for production in H2 this year. Barring a drastic decline in demand, diamonds will likely remain the jewels of the NWT economy.

2015 Annual Report of the Government of the Northwest Territories: “Communities and Diamonds“

PDF source: http://www.assembly.gov.nt.ca/sites/default/files/td_28-182.pdf

Company Details

Arctic Star Exploration Corp.

1111 West Georgia Street

Vancouver, B.C. V6E 4M3, Canada

Phone: +1 604 689 1799

Email: info@arcticstar.ca

www.arcticstar.ca

Shares Issued & Outstanding: 86,363,073

Canadian Symbol (TSX.V): ADD

Current Price: $0.075 CAD (Mar. 30, 2016)

Market capitalization: $7 million CAD

German Symbol / WKN (Frankfurt): 82A / A1JCQC

Current Price: €0.042 EUR (Mar. 30, 2016)

Market capitalization: €4 million EUR

Disclaimer: Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist.