Disseminated on behalf of Prospera Energy Inc. and Zimtu Capital Corp.

Though still flying under the radar for many investors, Prospera Energy Inc. is proving to be a rising star in the oil and gas industry. The restructured company is making waves with its strategic approach to oil production and significant achievements under the leadership team. With a current market capitalization of $38 million and 2022 year-end reserve value of $72 million, Prospera is focusing on optimizing production and expanding its portfolio which positions the company as a promising player in the Canadian oil and gas market. With a dynamic leadership team at the helm, successful optimization initiatives and a strategic development plan, the company is well-positioned for future growth. As management continues to expand operations, optimize production, and diversify the company‘s portfolio, Prospera is expected to soon become a recognized force in the Canadian oil and gas sector.

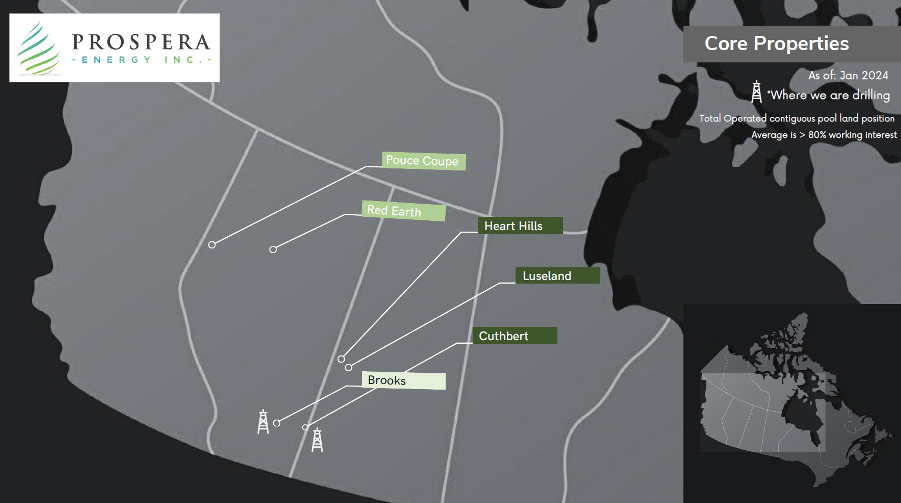

Prospera focuses on properties in Saskatchewan heavy-oil (13-17 API) and Alberta medium-light oil (24+ API) holding an estimated 400 million barrels of untapped oil with roughly 9% recovered.

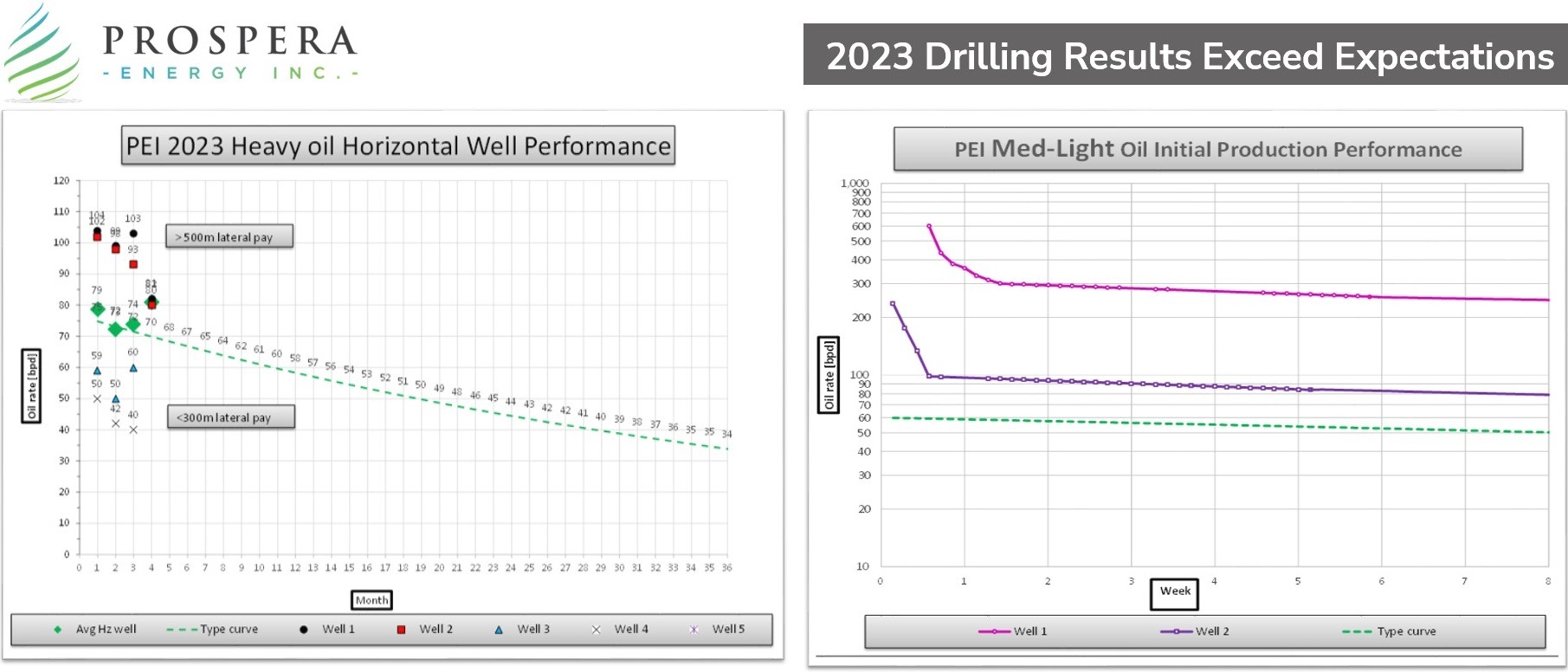

Samuel David, who became CEO in 2021, has implemented a successful restructuring plan, reducing production costs from $68 to as low as $34 per barrel of oil equivalent (boe) and increasing the Net Present Value (NPV) of its properties to $72 million (from -$3.4 million prior to restructuring). The company conducted a horizontal well program, and medium-light oil development in 2023. As a result, Prospera exceeded 2023 year-end production target of 1,800 barrel of oil equivalent per day (boepd) with the capability of 2,200 boepd.

Prospera emerges as a promising investment opportunity in the oil and gas sector, combining strategic planning, technological innovation, and a commitment to growth. With a well-funded development plan and a focus on optimizing production, the company is strategically positioned to capitalize on the increasing global demand for energy.

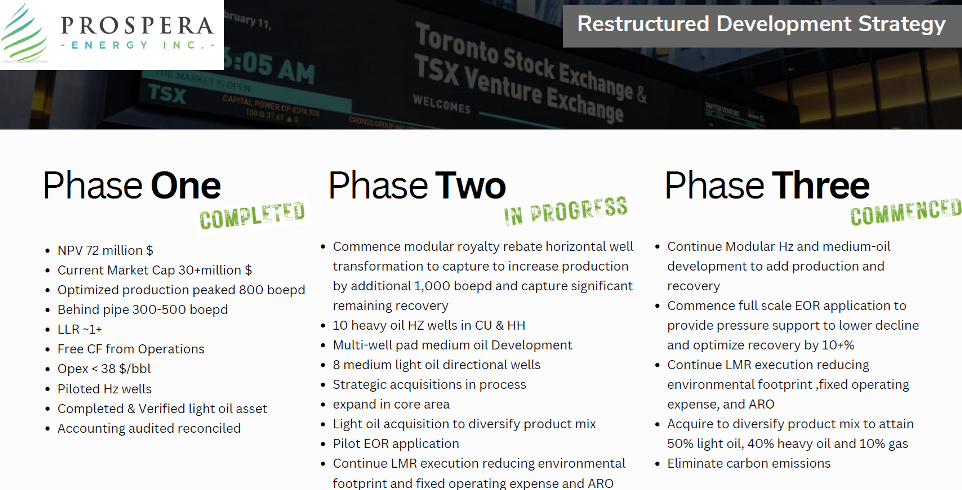

In a strategic move that has captured the attention of the industry, the management team at Prospera Energy Inc. has successfully executed the first phase of a comprehensive restructuring initiative, resulting in a substantial surge in production and market capitalization.

These advancements are a testament to the experienced leadership and skilled decision-making that underscore the company‘s commitment to driving shareholder value with excellence. However, this achievement marks just the initial step, with the subsequent phases of the growth plan poised to propel Prospera even further, solidifying its position as an industry innovator and setting the stage for continued success.

The restructuring efforts, led by Prospera Energy’s leadership and board of directors, reflect a diligent approach to optimizing operations and enhancing efficiency across the organization. The company‘s efforts have translated into meaningful production increases, showcasing the success of experienced management and innovative solutions implemented by the team.

In Q4 of 2023, the company bolstered their leadership team. Chris Ludtke (CPA, CMA), formerly the VP of Finance and Accounting, was appointed Chief Financial Officer (CFO). Prospera brought on a VP of Operations, John McMahon (P.L. Eng.), who holds over 35 years of experience in engineering and operations in Western Canada. Former CFO, Matthew Kenna, remained in the organization and was appointed to Prospera’s board of directors.

Investors and stakeholders have shown confidence in the direction set by this leadership team. Collectively, the Prospera board and management team boast over 200 years of combined experience and expertise, encompassing all facets of business operations and growth planning.

Strategic 3-Phase Growth Plan

Having successfully completed the first phase, Prospera is poised for a pivotal moment, ready to advance into the next phases with a well-funded growth plan and a commitment to significantly increase production. The company aims to maintain its momentum in a positive oil price environment by converting vertical wells to horizontal infill wells. To date, Prospera has successfully drilled 9 horizontal wells (IP > 100 bpd) and completed 2 medium-light oil wells that yielded initial flowing rates of approximately >500 bpd. In 2024, the company plans to further increase production through a summer drilling program of >30 locations and the continuation of the development in medium-light oil. Prospera aims to exit 2024 with its organic development program at 3,500 boepd. Additionally, with strategic acquisitions at play the company is looking at a 2024 exit rate of 5,000 boepd.

The ongoing development program aims to achieve a substantial increase in production, supported by existing cash flow and a recent $3 million royalty agreement for the sale of a 1% royalty on Prospera‘s revenue from its Cuthbert properties. The company’s low-cost operations, coupled with a competitive royalty regime, position it favorably in the current market.

Looking ahead, Prospera plans to implement comprehensive reservoir management to optimize production and reduce decline rates. The long-term goal is to diversify its product portfolio, targeting 50% light oil, 40% heavy oil and 10% gas.

Unlocking Potential with Advanced Technologies

Prospera holds significant pools with high Original-Oil-In-Place (OOIP) and low recovery factors, presenting an opportunity for enhanced oil recovery and an overall production increase.

The company is leveraging technological innovations and enhanced recovery techniques to tap into previously stranded assets. This includes horizontal drilling and enhanced recovery methods conducive to reservoir architecture and parameters which can significantly increase recovery factors.

Prospera‘s focus on reservoirs with excellent porosity and permeability enhances predictability and lowers risks compared to unconventional shale wells. The use of proven technologies and strategic deployment of capital positions the company as a cost-effective player in the Canadian oil and gas sector.

Prospera strategically reinvests revenue generated from oil sales into further development to boost production. By leveraging cutting-edge innovations and seizing enhanced oil recovery opportunities, the company not only amplifies its growth trajectory but also augments its barrel output with remarkable capital efficiency. This approach unlocks previously untapped reserves, contributing to the company‘s Net Asset Value (NAV).

Transformation to Horizontal Well Application

Large Drilling Inventory: >150 horizontal drilling locations.

Significant Remaining Reserves: 400 million barrels of oil in place with roughly 9% recovered.

ARO Liability Reduction: Horizontal wells allow the abandonment of >200 vertical wells on Prospera‘s properties.

Economic Footprint Reduction: Abandoned >60 vertical wells to date as part of the 3-year LMR plan, allowing to reclaim surface land and reduce environmental footprint.

“2023 was a highly successful year for the restructured Prospera Energy Inc. PEI drilled, completed and tied-in nine horizontal wells in heavy oil reservoir with initial production rates exceeding expectations at 100+bpd per well. The ninth well was rig released on December 24th and was brought online on December 28th. In addition, PEI drilled a directional well accessing medium-light oil flowing at 500+ Bpd. Gross peak rates of 1,800 boepd were attained prior to year-end, excluding the production of the recently drilled and completed horizontals, and the shut-in production for drilling. This production was brought on throughout the month resulting in a monthly average of approximately 1,300 gross boepd. Currently, the total production capability of Prospera is 2,200 boepd that will be optimized in the next few weeks barring any extreme winter weather conditions.“ (Source: Prospera‘s news-release on January 5, 2024)

“Prospera was effectively able to fund the 2023 development plan with minimal dilution. The Company raised a total of $16.1 million through the issuance of multi-year promissory notes, GORR financing, private placement, and the exercise of previously issued warrants. A significant amount of these funds was raised through insider participation and strategic investment. PEI’s future development plans are substantiated and encouraged by the 2023 development drilling and production results. Therefore, in 2024, Prospera is proposing robust development and acquisition plans to attain year end production rates of 5,000 boepd. Furthermore, PEI plans to pilot and implement Enhanced Oil Recovery (EOR) methods and add to existing production levels. The strategic acquisitions are to expand the core reserve base and to diversify the product mix.“ (Source: Prospera‘s news-release on January 5, 2024)

"Funding for Prospera’s 2024 development program will be facilitated from cash flow generated from existing operations, debt, and equity financing through private placement. These successful developments translate to significant additional reserve and appreciation of PEI net present value (NPV) for the year end 2023. This production increase will translate to sustainable revenue for operations, development and remains steadfast in its commitment to eliminating the legacy arrears to landowners, regulators, and the local community anticipated by the year end 2024." (Source: Prospera‘s news-release on January 5, 2024)

“Alberta produced a record amount of crude oil in November last year, with the daily average topping 4 million barrels. As the larger Trans Mountain pipeline nears completion, [...] producers in Canada’s oil province ramped up production by more than 330,000 barrels daily to a total of 4.16 million bpd, in November, Bloomberg reported, citing data from the Alberta Energy Regulator. The Trans Mountain pipeline will, after its expansion, be able to carry 590,000 bpd more in crude oil than it did before the expansion, which will raise the total capacity of the pipeline to 890,000 bpd... Alberta oil majors are already planning further production expansion in anticipation of the Trans Mountain project’s completion. Last month, Canadian Natural Resources said it eyed an output expansion of some 40,000 barrels of oil equivalent daily this year. Cenovus is also investing in production growth.“ (Source: “Alberta Posts Record Oil Production“; January 12, 2024)

“Provincial governments in Canada‘s oil and gas regions are fully supportive of the growth of their hydrocarbon sectors... Canada is one of the largest oil and gas producers in the world. The Canadian Association of Petroleum Producers (CAPP) estimates 2022 production was about 4.6 million barrels per day of oil and 17 billion cubic feet per day of gas. The energy ministers of Alberta, Saskatchewan and Newfoundland & Labrador [...] were unified in promoting an objective that their oil and gas sectors should grow. They were also unified in sending a clear message to the Canadian federal government that, as Saskatchewan’s Minister of Energy & Resources Jim Reiter said, “what the world needs right now is… more clean Canadian oil and gas”... He echoed comments by the Alberta Premier Danielle Smith earlier this week that the objective was the “phasing out of emissions, not oil and gas”.“ (Source: “Canadian provincial ministers want oil and gas growth to underpin the energy transition“; September 2023)

Management & Directors

SAMUEL DAVID (P. Eng., BA Econ.)

President, CEO, Director

Samuel has over 35 years of experience in the operation, development, and management of oil and gas assets and companies. He holds a BSc in Mechanical Engineering and a BA in Economics from the University of Calgary. His background consists of both engineering and executive management experience with the majors Petro-Canada (a subsidiary of Suncor Energy Inc.), Alberta Energy Co. Ltd. (now Encana Corp. / Cenovus Energy Inc.), and Husky Energy Inc. (now Cenovus Energy Inc.) as well as founded and operated the juniors Ventura Energy and First West Petroleum Inc. Samuel has proven expertise in corporate planning, production, reservoir engineering, depletion strategies, EOR, property evaluations, acquisitions, and divestitures. He combines his technical skills with an extensive network of high-level industry contacts to identify prospects quickly and efficiently with merit, implement acquisition strategies, design and execute efficient cost-effective drilling and completion programs, and quickly equip and tie-in wells to bring production online. During his career, he has successfully exploited oil and gas in both sedimentary and carbonate reservoirs.

GEORGE MAGARIAN (P.Geo., Honors BSc.)

VP Subsurface

George is a Professional Petroleum Geologist (APEGA) with over 36 years of experience in the Western Canada Sedimentary Basin. After graduating with an Honours BSc degree in Earth Science from the University of Waterloo, he spearheaded many successful exploration programs, conducted evaluations for improved recovery schemes, and assessed/exploited unconventional oil reservoir opportunities. George has held roles of increasing responsibility from Exploration Geologist at the oil industry major Petro-Canada (a subsidiary of Suncor Energy Inc.) and the intermediates Anderson Exploration Ltd. (acquired by Devon Energy Corp. for $7.2 billion) and Jordan Petroleum Ltd. to Geoscience Manager and VP Exploration at the junior companies Ionic Energy Inc., Gentry Resources Ltd., and WestFire Energy Ltd. His extensive geotechnical experience has delivered consistent value growth through production and reserve additions, focusing primarily on the clastic reservoirs of the Mesozoic foreland basin and carbonate reservoirs of the Mississippian cratonic platform.

JOHN MCMAHON (P.L. Eng.)

VP of Operations

With over 35 years of engineering and operations experience in Western Canada, John brings a wealth of knowledge to Prospera’s leadership team. John’s extensive expertise aligns well with Prospera‘s organizational goals, and the company anticipates that his leadership will contribute to innovation and efficiency for Prospera to become a low-cost producer.

CHRIS LUDTKE (CPA, CMA)

CFO

Chris is a high-functioning finance leader with extensive expertise in finance, budgets and planning, accounting, economic evaluation, management, governance, and sound decision making. He has 20 years of experience within the oil and gas, clean energy, and renewables industries. For more than 12 years, he worked for Husky Energy Inc. (now Cenovus Energy Inc.) before moving into an executive role in the junior oil and gas and hydrogen space. Chris graduated from the University of Lethbridge (Bachelor of Management) and is a Chartered Professional Accountant in the Province of Alberta.

MATTHEW KENNA (CPA, CMA)

Director

Matthew has over 30 years of experience leading organizations and helping them expand, drive efficiencies, and grow profitability. He is a Professional Accountant (CPA, CMA) and spent 15 years heading the financial and operating departments at KUDU Industries Inc. (a Schlumberger company), where he fostered financing arrangements, client relationships and manufacturing teams to take the organization from $35 million to $150 million in revenue. Matthew has extensive experience turning companies around, growing them, and building efficient organizations. He has a proven track record of fiscal success, including innovative financing arrangements and efficient operations. He has deep relationships in the Calgary finance community.

MEL CLIFFORD (MBA, PMP)

Director

Mel has worked across Europe, China, and North America as a professional director of organizational change and project management for over 30 years. He stands out as a powerful and knowledgeable resource for any business wanting to grow their organization and enjoy greater project success. Mel has lectured at several universities and institutes in the UK, Ireland and Canada, and assisted in the development of the new Certification of Project Management course at Okanagan College University. His past and present members- hips include MBA Association Ireland, Institute of Project Management Ireland, Project Management Association of Canada, and the Project Management Institute (PMI). Mel has also served as the past Chairperson for Ireland China Association, Technical & Marketing Committee Global Standards 1 Ireland, and Health Action Overseas International Voluntary NGO. The business sectors in which Mel has successfully delivered major projects include finance, IT, retail, print media, aviation, logistics, health care, academia, and advertising.

JASDIP DHALIWAL (Master Mechanic)

Director

Jasdip is a Calgary businessman established in the heavy-duty mechanical industry over a 20-year span. He has demonstrated excellence and achievement in the mechanical industry and has been recognized and awarded by the Elite Worldwide Executives & Professional organization. He is a certified Master Mechanic from SAIT Polytechnic. In 1993, he founded the European auto shop Euroworks with his father. Euroworks is successfully operating on its own land and buildings in the heart of the Calgary industrial area. Jasdip also founded and directed another company in 2001, 3-Ci Machining, which works in conjunction with the oil and gas industry, machining MWD tools and various types of subs, including crossover subs. 3-Ci also manufactures heavy duty industrial cable lines for various power needs, the oil and gas industry, and satellites. Their cables can be found in some of the world’s most challenging applications and are used for everything from deep sea exploration to aerospace testing and military applications. Jasdip has a proven track record from start-ups to full operation. He has compiled management teams and implemented manufacturing operations, accounting systems, and procedures to cost effectively operate profitably. He brings a service provider perspective and unique network from Calgary, Vancouver, and Toronto business communities.

BRIAN MCCONNELL (P.Eng., BSc, Exec. MBA)

Director

Brian has 47 years of oilfield experience in heavy oil, light oil, and natural gas exploration, development, and production. He has worked all the Western Canadian Basins including 10 years consulting in the Arctic Islands for Panarctic Oils Ltd. He spent another 10 years leading the team that developed the West Central Sask Heavy Oil lands for Saskoil (later Wascana Energy Inc.) and the shallow gas assets in south-east Alberta until Wascana was taken over by CanOcci (later Nexen) and later the Chinese state-owned company CNOOC International Ltd. He joined Murphy Oil Corp. as General Manager Heavy Oil and, in partnership with BlackRock, developed the Murphy Seal acreage as well as older operated Murphy‘s heavy oil assets from Lloydminster down to Marengo, Saskarchewan. He then spent 10 years as VP Exploration at Tundra Oil & Gas Ltd. and helped in growing their production from 4,000 to 28,000 bbls/d light oil mainly in Manitoba.

MARK LACEY (BA)

Director

Mark is an entrepreneur and investor in both the public and private markets. He also serves as President of a family office based out of Central Alberta. He is a graduate from the Canadian Securities Institute and a Business Administration graduate from the Red Deer College. Mark has 20 years of experience trading in the public markets and managing portfolio growth.

Click the above player or here to watch a presentation (November 14, 2023) by CEO Samuel David and other team members providing a production update and explaining how the drilling program has been progressing:

• Prospera is extending drilling through the winter into next year.

• Learn more about the first 5 horizontal wells and how the IP60 has exceeded the company‘s expectations.

• The Prospera team answered questions during the Q&A after the presentation.

Company Details

Prospera Energy Inc.

Suite 730 – 444 - 7th Ave SW

Calgary, Alberta, T2P 0X8 Canada

Phone: +1 403 454 9010

Email: admin@prosperaenergy.com

www.prosperaenergy.com

ISIN: CA74360U1021 / CUSIP: 74360U

Shares Issued & Outstanding: 421,191,515

Canadian Symbol (TSX.V): PEI

Current Price: $0.09 CAD (01/25/2024)

Market Capitalization: $38 Million CAD

German Ticker / WKN: OF6B / A2JQ37

Current Price: €0.0525 EUR (01/25/2024)

Market Capitalization: €22 Million EUR

Contact:

www.rockstone-research.com

Disclaimer: This report, the referenced news-releases and video contain forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Prospera Energy Inc. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to Prospera Energy Inc.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through its profile on SEDAR at www.sedar.com. Please read the full disclaimer within the full research report as a PDF (see here or below) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, currently does not own any equity of Prospera Energy Inc., however he owns equity of Zimtu Capital Corp. and thus will profit from volume and price appreciation of this stock. The author is being paid by Zimtu Capital Corp. for the preparation, publication and distribution of this report, whereas Zimtu Capital Corp. holds an equity position of Prospera Energy Inc. and thus will profit from volume and price appreciation. Note that Prospera Energy Inc. pays Zimtu Capital Corp. to provide this report and other investor awareness services.

Disclaimer and Information on Forward Looking Statements: Rockstone Research, Zimtu Capital Corp. (“Zimtu“) and Prospera Energy Inc.(“Prospera“; “PEI“; “the company“; “the Corporation”) caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the Prospera‘s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through its documents filed on SEDAR at www.sedarplus.ca. All statements in this report, other than statements of historical fact should be considered forward-looking statements. Much of this report is comprised of statements of projection. Statements in this report that are forward looking include that Prospera, or any other company or market, will perform as expected; that Prospera is proving to be a rising star in the oil and gas industry; that Prospera is focusing on optimizing production and expanding its portfolio which positions the company as a promising player in the Canadian oil and gas market; that Peospera is well-positioned for future growth; that as management continues to expand operations, optimize production, and diversify the company‘s portfolio, Prospera is expected to soon become a recognized force in the Canadian oil and gas sector; that Prospera holds an estimated 400 million barrels of untapped oil with roughly 9% recovered; that Prospera emerges as a promising investment opportunity in the oil and gas sector, combining strategic planning, technological innovation, and a commitment to growth; that Prospera is strategically positioned to capitalize on the increasing global demand for energy; that Prospera has a commitment to driving shareholder value with excellence; that this achievement marks just the initial step, with the subsequent phases of the growth plan poised to propel Prospera even further, solidifying its position as an industry innovator and setting the stage for continued success; that having successfully completed the first phase, Prospera is poised for a pivotal moment, ready to advance into the next phases with a well-funded growth plan and a commitment to significantly increase production; that Prospera aims to maintain its momentum in a positive oil price environment by converting vertical wells to horizontal infill wells; that in 2024,Prospera plans to further increase production through a summer drilling program of >30 locations and the continuation of the development in medium-light oil; that Prospera aims to exit 2024 with its organic development program at 3,500 boepd, and that additionally, with strategic acquisitions at play, the company is looking at a 2024 exit rate of 5,000 boepd; that the ongoing development program aims to achieve a substantial increase in production; that Prospera’s low-cost operations, coupled with a competitive royalty regime, position it favorably in the current market; that looking ahead, Prospera plans to implement comprehensive reservoir management to optimize production and reduce decline rates; that the long-term goal is to diversify its product portfolio, targeting 50% light oil, 40% heavy oil and 10% gas; that Prospera is and will be unlocking potential with advanced technologies; that Prospera holds significant pools with high Original-Oil-In-Place (OOIP) and low recovery factors, presenting an opportunity for enhanced oil recovery and an overall production increase; that Prospera‘s focus on reservoirs with excellent porosity and permeability enhances predictability and lowers risks compared to unconventional shale wells; that the use of proven technologies and strategic deployment of capital positions Prospera as a cost-effective player in the Canadian oil and gas sector; that Prospera strategically reinvests revenue generated from oil sales into further development to boost production; that by leveraging cutting-edge innovations and seizing enhanced oil recovery opportunities, the company not only amplifies its growth trajectory but also augments its barrel output with remarkable capital efficiency; that this approach unlocks previously untapped reserves, contributing to the company‘s Net Asset Value (NAV); that Prospera has and will continue to have a large drilling inventory of >150 horizontal drilling locations; that horizontal wells allow the abandonment of >200 vertical wells on Prospera‘s properties; that having abandoned >60 vertical wells to date as part of the 3-year LMR plan allows Prospera to reclaim surface land and reduce environmental footprint; that currently, the total production capability of Prospera is 2,200 boepd that will be optimized in the next few weeks barring any extreme winter weather conditions; that Prospera’s future development plans are substantiated and encouraged by the 2023 development drilling and production results; that in 2024, Prospera is proposing robust development and acquisition plans to attain year end production rates of 5,000 boepd; that Prospera plans to pilot and implement Enhanced Oil Recovery (EOR) methods and add to existing production levels; that the strategic acquisitions are to expand the core reserve base and to diversify the product mix; that funding for Prospera’s 2024 development program will be facilitated from cash flow generated from existing operations, debt, and equity financing through private placement; that this production increase will translate to sustainable revenue for operations, development and remains steadfast in its commitment to eliminating the legacy arrears to landowners, regulators, and the local community anticipated by the year end 2024; that the Trans Mountain pipeline will, after its expansion, be able to carry 590,000 bpd more in crude oil than it did before the expansion, which will raise the total capacity of the pipeline to 890,000 bpd; that Alberta oil majors are already planning further production expansion in anticipation of the Trans Mountain project’s completion; that Canadian Natural Resources said it eyed an output expansion of some 40,000 barrels of oil equivalent daily this year, and that Cenovus is also investing in production growth; that the energy ministers of Alberta, Saskatchewan and Newfoundland & Labrador were unified in promoting an objective that their oil and gas sectors should grow; that what the world needs right now is… more clean Canadian oil and gas; that that the objective was the phasing out of emissions, not oil and gas; that Prospera anticipates that John McMahon’s leadership will contribute to innovation and efficiency for Prospera to become a low-cost producer; that Prospera’s Phase Two development strategy is in progress to increase production by additional 1,000 boepd and cature significant remaining recovery; that Prospera’s Phase Two development strategy includes 10 heavy oil horizontal wells and 8 medium light oil directional wells, along with strategic acquisitions and expansion in core area, and light oil acquisition, and educing environmental footprint; that Phase 3 will add production and recovery, lower decline and optimize recovery by 10+%, reducing environmental footprint, and acquisition to diversify product mix, and to eliminate carbon emissions; that Prospera anticipates summer drilling of 100+ locations and 10 additional wells producing during Phase Two; that with staregic acquisitions Prospera targets year-end 2024 at 5,000 boepd and an organic development target of 3,500 boepd. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in these forward-looking statements. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Risks and uncertainties include: The receipt of all necessary approvals and permits for exploration, development and production; the ability to find sufficient oil and gas for profitable production; uncertainty of future production, uncertain capital expenditures and other costs; financing and additional capital requirements for exploration, development and production may not be available at reasonable cost or at all; quantities and quality of oil and gas on the properties may not be as high as expected; past production may not be indicative of any further potential on the properties; that oil and gas encountered with drilling will be uneconomic; that the targeted prospects can not be reached; the receipt in a timely fashion of further permitting; legislative, political, social or economic developments in the jurisdictions in which Prospera carries on business may hinder progress; there may be no agreement with neighbors, partners or government on developing the respective projects or infrastructure; operating or technical difficulties or cost increases in connection with exploration, development and production activities; the ability to keep key employees and operations financed; what appear at first to be similarities with other projects may not be substantially similar; share prices and market valuations of Prospera and other companies may fall as a result of many factors, including those listed here and others listed in the companies’ and other oil and gas companies’ disclosure; and the oil and gas prices available when production is ongoing may not be sufficient to produce economically. Like every company navigating the unpredictable oil and gas sector, Prospera faces a significant risk associated with commodity pricing. Decreases in prices can lead to diminished cash flows, consequently exerting a substantial influence on the company’s share price. This vulnerability is particularly pronounced for Prospera, given its dependence on cash flow to finance its growth-oriented business plan. Accordingly, readers should not place undue reliance on forward-looking information. Rockstone and the author of this report do not undertake any obligation to update any statements made in this report except as required by law. As per Prospera’s interim financial statements for the 9 months ended September 30, 2023, filed on SEDAR: “The Corporation’s activities expose it to a variety of financial risks arising from its financial assets and liabilities. The Corporation manages its exposure to financial risks by operating in a manner that minimizes its exposure to the extent practical. The main financial risks affecting the Corporation are: Credit Risk: The Corporation is exposed to credit risk in relation to its cash and trade and other receivables. Cash is held with highly rated Canadian banks. Therefore, the Corporation does not believe these financial instruments are subject to material credit risk. The Corporation’s trade and other receivables include amounts due from the sale of petroleum and natural gas. The Corporation’s production is sold to a variety of purchasers under normal industry sale and payment terms. Accounts receivables are from customers and joint operating partners in the Canadian petroleum and natural gas industry and are subject to normal industry specific credit risk. Liquidity Risk: The Corporation’s approach to managing liquidity risk is to ensure that it will have sufficient liquidity to meet its financial liabilities when they become due. Management mitigates liquidity risk by maintaining banking and other borrowing facilities, continuously monitoring forecast and actual cash flows, and actively seeking equity financing to assist with projected cash outflows. As at September 30, 2023, the Corporation has a working capital deficiency of $11,916,745 and an accumulated deficit of $32,631,063. The Corporation’s ability to continue as a going concern Note 2 is continuously dependent on achieving profitable operations and accessing additional financing. Market Risk: Interest rate risk: Interest rate risk is the risk that the fair value of future cash flows of a financial instrument will fluctuate with changes in market interest rates. The Corporation is not exposed to interest rate fluctuations at September 30, 2023 as there are no investments of excess cash in short-term money market investments and credit facilities are at fixed rates of interest. Foreign currency risk: Management believes the foreign currency risk arising from currency exchange rate fluctuations related to financial instruments held in foreign currencies is negligible as the Corporation held no foreign denominated financial instruments as at September 30, 2023. Commodity price risk: The nature of the Corporation’s operations results in exposure to commodity price fluctuations. The Corporation closely monitors commodity prices to determine the appropriate course of action to be taken. The Corporation does not hedge commodity price risk and has no physical forward price or financial derivatives sales contracts as at September 30, 2023. Capital Management: The Corporation’s policy is to maintain a strong capital base for the objectives of maintaining financial flexibility, to sustain the development of the Corporation’s current capital projects and for future development of the Corporation. The Corporation monitors its working capital and expected capital spending and raises additional equity by the issue of share capital to manage its development plans. The Corporation has no externally imposed capital requirements apart from the banking covenants on the Corporation’s credit facilities. The Corporation continues to assess additional petroleum and natural gas projects and plans to raise additional debt or equity amounts as needed to fund acquisitions and to maintain sufficient working capital to meet administrative expenditures.”

Disclosure of Interest and Advisory Cautions: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Rockstone, its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including Rockstone’s report, especially if the investment involves a small, thinly-traded company that isn’t well known. The author of this report, Stephan Bogner, is paid by Zimtu Capital, a TSX Venture Exchange listed investment company. Part of the author’s responsibilities at Zimtu Capital is to research and report on companies in which Zimtu Capital has an investment. So while the author of this report is not paid directly by Prospera Energy Inc. (“Prospera”), the author’s employer Zimtu Capital will benefit from appreciation of Prospera’s stock prices. The author currently does not own any equity of Prospera, but he holds an equity position in Zimtu Capital Corp., and thus will also benefit from volume and price appreciation of its stock. Prospera pays Zimtu to provide this report and other investor awareness services. Since October 2023, Prospera pays Zimtu $7,500 per month. Overall, multiple conflicts of interests exist. Therefore, the information provided in this report should not be construed as a financial analysis or recommendation but as an advertisement. Rockstone’s and the author’s views and opinions regarding the companies that are featured in the reports are the author‘s own views and are based on information that was received or found in the public domain, which is assumed to be reliable. Rockstone and the author have not undertaken independent due diligence of the information received or found in the public domain. Rockstone and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, Rockstone and the author do not guarantee that any of the companies mentioned in the report will perform as expected, and any comparisons that were made to other companies may not be valid or come into effect. Please read the entire Disclaimer carefully. If you do not agree to all of the Disclaimer, do not access this website or any of its pages including this report in form of a PDF. By using this website and/or report, and whether or not you actually read the Disclaimer, you are deemed to have accepted it. Information provided is educational and general in nature. Data, tables, figures and pictures, if not labeled or hyperlinked otherwise, have been obtained from Stockwatch, Tradingview, Prospera Energy Inc. and the public domain.