Disseminated on behalf of Eagle Bay Resources Corp. and Zimtu Capital Corp.

The technical team responsible for one of Canada‘s greatest mineral discoveries is now behind Eagle Bay Resources Corp., a company that is coming to trade today on the CSE under the symbol EBR. For more than a year, Eagle Bay has privately, and as such virtually unnoticed, consolidated an impressive land-package adjacent to Defense Metals Corp. and its Wicheeda Rare Earth Elements Project near Prince George in British Columbia, Canada.

Eagle Bay currently has 52,854,526 common Shares issued and outstanding. Of the 29,550,000 Common Shares owned by management, directors, and Zimtu Capital Corp., 2,955,000 (10%) will be released from escrow in connection with the commencement of trading, while 26,595,000 will remain in escrow, with batches of 4,432,500 released every 6 months over a period of 3 years.

David Hodge, President and CEO of Eagle Bay, commented in yesterday‘s news-release: “We are thrilled to commence our public listing with such a high-quality portfolio of rare earth and niobium exploration properties, now at a time when the North America is seeing increased exploration and development activities by majors and juniors alike. This is clearly an emerging rare earth minerals district with significant discovery having been advanced by Defence Metals Corp, with which we share a contiguous border, moving towards realising its full potential and we intend to be part of this.“

Michael Schuss, Director, added: “We are very grateful for the ongoing support of all our shareholders and the efforts of our team. Creating long-term value for our shareholders was very important to us and we are very eager to see what the future holds for the Company.“

Full size / Eagle Bay´s CAP Property includes several properties and claims consolidated over the last +12 months, including the Carbo claims adjacent to Defense Metals.

In September 2017, a small company by the name of 92 Resources Corp., trading below 10 cents, announced the acquisition the Corvette Property in Quebec following a site-visit by Dahrouge Geological Consulting Ltd., whose technical team discovered and sampled “a significant spodumene bearing pegmatite [...] at Corvette, with spodumene crystals up to ~1 metre in length, within an outcrop measuring approximately 150 metres by 30 metres.“

The rest is history!

Rockstone was the first one reporting on this emerging lithium discovery in 2018 (see here or here). Back then, market sentiment for lithium plays was poor and it was not until 2021, when this small company, trading at 20 cents or so, changed its name to Patriot Battery Metals Inc. and started one of the greatest share price appreciations in the history of Canadian stock markets. Last month, the share price of Patriot Battery Metals reached a new all-time high at $17.69, enjoying a current market capitalization of $1.1 billion.

The technical team behind Patriot Battery Metals‘ lithium discovery at Corvette is led by the company‘s Vice President of Exploration, Darren Smith, who has been working for Dahrouge as a Project Manager / Senior Geologist since 2006.

For Dahrouge, Darren Smith also led the team that discovered the Ashram Rare Earth and Fluorspar Deposit in Quebec in 2009 for Commerce Resources Corp., where he serves as Ashram‘s Project Manager along with Jody Dahrouge as the company’s Vice President of Exploration. Both geologists have unmatched expertise on the development of rare earths and niobium deposits in Canada.

What sets apart Dahrouge from many others in the industry is that they recognize opportunity when others sleep or are awake frustratedly. In the years 2017-2020, when virtually nobody was interested in lithium discovery stories, Dahrouge recognized the future value of lithium pegmatites and patiently staked, acquired and consolidated large land-packages prospective for lithium in the James Bay Lithium District, the NWT and elsewhere, and transacted these with 92 Resources. Then in 2021, lithium carbonate prices exploded from less than $10,000 USD/t to more than $70,000 USD/t a year later, bringing back investors‘ interest for this sector.

Both top-notch geologists, Darren Smith and Jody Dahrouge, now serve as Directors of Eagle Bay Resources Corp. For more than a year, Dahrouge and the team behind Eagle Bay, spearheaded by Director Mike Schuss, have staked, acquired and consolidated an extensive land-package adjacent to Defense Metals Corp.‘s Wicheeda Deposit near Prince George, British Columbia. The original claims were staked by Dahrouge in 2006, when they recognized its potential to host both REEs and niobium, and explored intermitently since.

Could history be repeating itself for this team, just as interest in these critical metals increases?

The rationale has been the same as for Patriot Battery Metals: Securing a large land-package prospective for commodities with a bright future. This time, the feat of amassing such a large property was performed quitely on the back of a private company, Eagle Bay Resources Corp.

Jody Dahrouge commented in Eagle Bay‘s news-release yesterday: “In the mid 2000‘s we recognized the potential for both REE‘s and niobium mineralization within carbonatites proximal to the Wicheeda REE showings. We acquired a number of claims over the years south-easterly from Wicheeda to the Cap Property, which covered a large circular magnetic anomaly. We have discovered several unique carbonatites since then and are extremely encouraged by the large number of mineral showings. Our confidence grows daily that continued exploration at the Cap Property will produce a new series of rare metal showings!“

Eagle Bay has become the key player right next to one of the largest, most advanced and highest grade rare earths deposits in Canada: The Wicheeda REE Carbonatite Complex. Defense Metals’ recent drill successes at Wicheeda include 251 m @ 3.09% TREO, 221m @ 2.14% TREO, and 150 m @ 3.79% TREO including 60 m @ 4.77% TREO. None of the many drill results reported over the last +12 months are included in the current resource estimate dated November 2021 (Indicated: 5 million t @ 2.95% TREO and 0.3% niobium; Inferred: 29.5 million t @ 1.83% TREO and 0.21% niobium), when Defense Metals completed a PEA (Preliminary Economic Assessment). The company is now advancing to PFS (Prefeasibility Study) with a pilot plant expected to be completed in Q2 of 2023. With a current market capitalization of $58 million, Defense Metals is targeting ~10% of current global REE production with an initial CAPEX of $217 million USD and $422 million USD for off-site infrastructure and a hydrometallurgy plant.

Full size / Core picture showing carbonatite matrix with red-brown REE mineralization. This core is part of drill hole CA-10-006, , which assayed 37.3 m @ 1.43% TREO, from the 2010 drill program at the Carbo claims.

Full size / Assays from the 2010 drill program at the Carbo claims. Intervals may not be true thickness. TREO is defined as the sum of lanthanum through lutetium ply yttrium, expressed as oxides. (Source: Technical Report on the CAP Property, December 2022)

The Economic Importance of Carbonatite Deposits

The Foreland Belt contains part of a large alkaline igneous province which stretches from the Canadian Cordillera to the southwestern United States. It hosts several carbonatite and alkaline complexes, such as Aley (niobium), Rock Canyon (REE), and Wicheeda (REE). The Wicheeda carbonatite is inferred to be a deformed plug or sill exposed over an area approximately 250 m in diameter.

More than 80% of current global rare earths production is dominated by the rock type carbonatite. While >150 rare earth minerals exist, only 4 have been commercialized: Monazite, bastnaesite, xenotime and loparite, of which the first 3 account for more than 80% of global REO production (current and historic), with the remainder being dominated by ion-absorption type clay deposits in China. Being commercialized is the key point here, in that only those minerals out of >150 have been processed at a profit. Further, only monazite, bastnaesite and xenotime mineralogies are amenable to producing high-grade mineral concentrates of >40% REO.

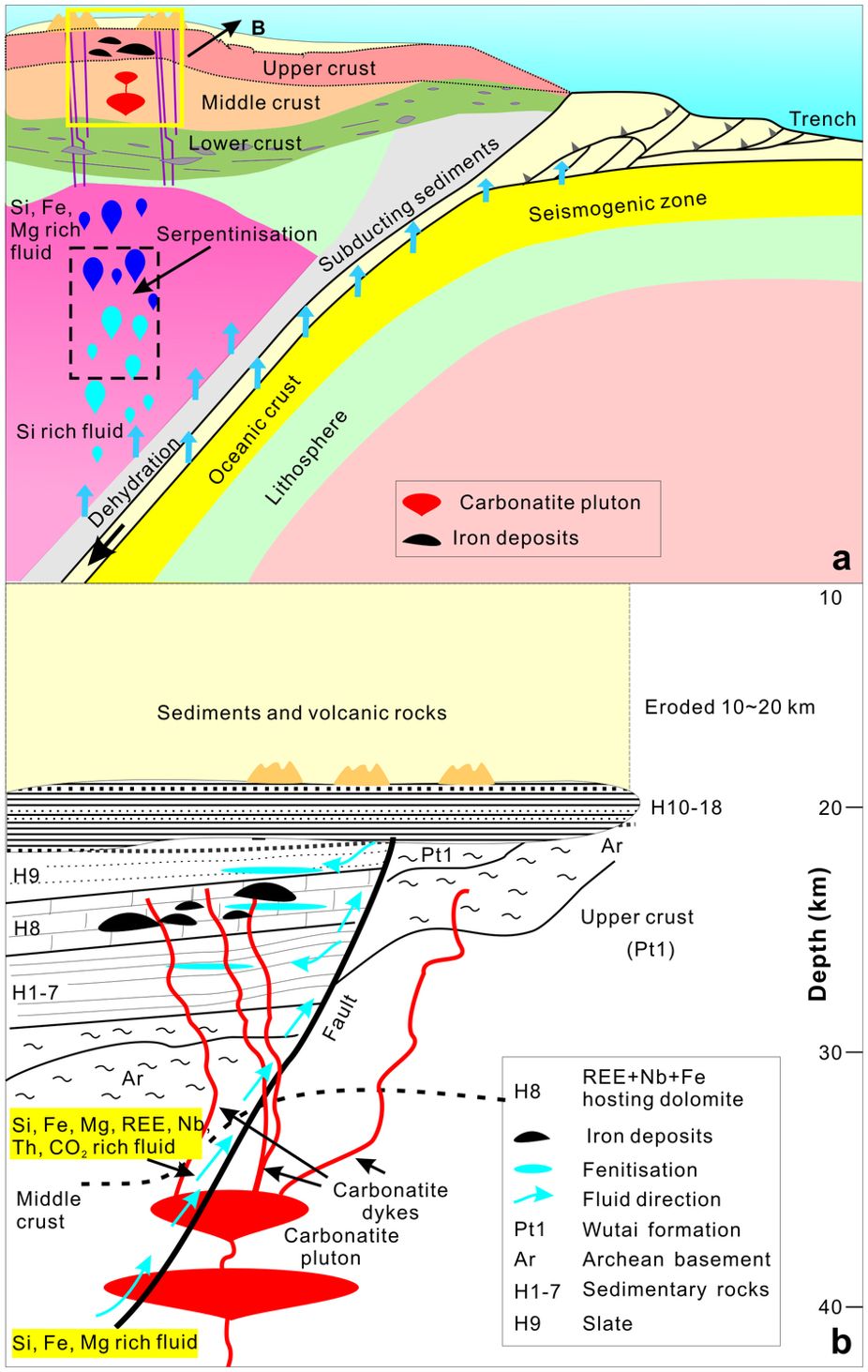

Full size / Schematic model for the formation of the subduction-related Bayan Obo Carbonatite in China, the world‘s largest rare earths deposit and mine.

Carbonatite is a type of intrusive or extrusive igneous rock defined by mineralogic composition consisting of greater than 50% carbonate minerals. Carbonatites are rare, peculiar igneous rocks formed by unusual processes and from unusual source rocks. Mineralized carbonatite systems have been mined for and/or are potential sources for commodities such as REEs, niobium, tantalum, copper, nickel, iron, titanium, zirconium, platinum group elements (PGEs), gold, fluorspar, lime, sodalite, and vermiculite. Strong demand growth, stemming in part from a number of green energy solutions, has placed upward price pressure on a number of those commodities associated with carbonatites. Some of the more notable active and past producing carbonatite deposits known worldwide include Palabora (Cu, Ni, Au, PGEs, other), South Africa; Bayon Obo (REEs, Fe, Nb, fluorspar), China; Araxa (Nb), Brazil; Cargill (Phosphate), Canada; Niobec (Nb), Canada; Mountain Pass (REEs), United States; and Mount Weld (REEs), Australia.

Above picture shows Defense Metals‘ property bordering Eagle Bay‘s property to the right. Defense Metals has drilled within 440 m of Eagle Bay‘s property and about 550 m from Eagle Bay‘s drilling in 2010. Note the change in vegetation. The lighter small bushes are caused by the phosphate in the soils from the carbonatite. Cerium content can be over 1% in the soils which makes for a very fertile basic soil where grass can easily grow. The area near the black pine trees is a very acidic soil where virtually nothing grows.

Excerpts from the Technical Report on the CAP Property (December 2022):

Location & Size: The CAP Property is located approximately 85 km northeast of Prince George, British Columbia. The Property consists of 34 mainly contiguous mineral claims, totalling 11,825.83 ha.

Adjacent Properties: The only significant project to mention in the area of the CAP Property is the Wicheeda Project of Defense Metals Corp... The Wicheeda Project is 11 km northwest of the CAP Property and hosts a carbonatite-syenite intrusive complex with significant quantities of disseminated bastnaesite-parasite and monazite, REE-bearing minerals.

Full size / Source: Technical Report on the CAP Property, December 2022

Conclusions & Reccomendations: The CAP Property extends for about 50 km from southeast to northwest and surrounds the Wicheeda Lake Carbonatite Complex. The Property includes the Cap Carbonatite Complex and the Carbo Carbonatite Complex; both of which are known to contain interesting concentrations of REE and niobium. All three carbonatite intrusions occur within an apparent northwest to southeast structural corridor and are hosted by the Ordovician Skoki Formation or Cambrian- Ordovician Kechika Group. At the CAP Complex elevated concentrations of REEs and Nb have been identified both in outcrop and one drill hole. At the Carbo Complex, 18 of 20 holes drilled in 2010 and 2011 intersected carbonatite with REE concentrations... Based on the elevated Nb2O5 and REEs from both rock samples and drill hole CAP17-004, the CAP property has significant exploration potential for both Nb and/or REE mineralization... Further exploration work is required to evaluate the geometry (extent, width, and dip) of the carbonatite complex as well as evaluate the potential Nb and REE mineralization on the additional ground recently added to the Property... During the author’s 2019 site visit, sample 19-KCR-2 was collected from a pyrochlore-bearing, boulder of carbonatite that returned 3.38% Nb2O5. This sample was collected from the northeast flank of a small oval (< 1km diameter) magnetic anomaly coincident with the area identified as having a radiometric anomaly by Aeroquest (2011). This discovery confirms the exploration potential along the strike length of the CAP Carbonatite complex to the north-west.

Geology & Mineralization: Carbonatite and syenite have been observed in outcrop on the Property, and recent drilling has identified thick sequences of carbonatite, alkaline intrusive rocks and fenite. The carbonatite bodies are often brecciated and locally surrounded by fenitized (altered) wall rocks. Observed minerals include calcite, quartz, feldspar, biotite, fluorite, richterite, olivine (serpentinized), pyrrhotite, pyrite, galena, and fluorite. Pyrochlore is believed to be the primary mineral which contains the niobium present. The REE mineralogy is complex and consists of Ca-REE-fluorocarbonates, Ba-REE-fluorocarbonates, ancylite-(Ce), monazite-(Ce), euxenite- (Y), and allanite-(Ce) (Dalsin, 2013)... Carbonatite complexes generally consist of sub-circular to elliptical bodies with extensive surrounding metasomatic alteration, foliated and deformed sill-like bodies, or linear zones of small plugs, dikes, and sills, such as in the Wicheeda Lake Carbonatite Complex... The Property is located within the McGregor Plateau, which is defined by two dominant faults. The first is the McLeod Lake Fault, to the west and to the east is the northwest trending Rocky Mountain Trench (Armstrong et al., 1969). The latter likely follows the Parsnip River valley, dominates the structural and geographical setting of the region, and occurs to the west of the complex. A number of other major northwest-trending faults occur in the area.

Deposit Types: The target host rocks on the CAP Property are carbonatites and carbonatite-associated rock units, similar to those observed at the Wicheeda Lake Carbonatite Complex near Wicheeda Lake, British Columbia... Carbonatites can contain economic or anomalous concentrations of incompatible elements such as: rare earth elements (including yttrium), niobium-tantalum, zirconium- hafnium, iron-titanium-vanadium, uranium-thorium; and industrial minerals such as apatite, fluorite, vermiculite, and barite. Some deposits also contain economic concentrations of copper, gold, silver, and platinum-group elements... Carbonatites tend to occur in groups or provinces; over 527 examples are known (Woolley and Kjarsgaard, 2008). Additional examples of carbonatite-associated mineral deposits include: Cargill, Ontario (phosphate); Niobec and Oka, Quebec (niobium); Mountain Pass, California (rare earth elements, barium); Araxa and Catalao, Brazil (niobium, phosphate, rare earth element); and Palabora, South Africa (copper, phosphate, rare earth elements, gold, silver, platinum group elements). Along the Rocky Mountain Trench in British Columbia, known carbonatite systems include Mt Grace, Ice River, Blue River, Cap-Carbo, Wicheeda, Aley, Vergil, Lonnie and Kechika (Millonig et al, 2012).

Exploration: Historic exploration in the region east of Prince George began in the 1960s. Teck Corporation (Teck)conducted exploration in 1986 and 1987 which overlapped the northern area of the Property. Exploration on the Property started in earnest in 2006 on the Carbo claims. Field work included, prospecting, magnetometer surveys, rock, and soil grid sampling, airborne magnetometry and diamond drilling. Rare earth mineralization was encountered in carbonatite dykes... Drilling returned values ranging from 4.7% Total Rare Earth Oxide (TREO) over 0.9 m to 1.4% TREO over 37.3 m. Radiometric results identified 6 anomalous areas (Koffyberg and Gilmour, 2012), one of which occurs within the current CAP Property and is coincident with a magnetic high. The earliest documented exploration on the southern part of the Property began in 2009 with an airborne gravity and magnetic survey... In 2011, [...] a 310 line-kilometer, high-resolution magnetic and radiometric survey on claims CAP 1 to CAP 5 [was completed]. The magnetic data indicated a very strong anomaly in the centre of the property, as well as other magnetic features to the northwest of the central high.

Full size / Airborne magnetics over the Wicheeda Deposit and parts of Eagle Bay‘s property. (Source: CIM in August 2011; blue annotations by Rockstone)

“Contrary to the supply-shock between 2010-11, this time we rather expect a demand-shock. Our expectation is that many critical elements are about to enter a demand-shock episode: within the EV and wind turbine sectors mainly for magnet materials (Neodymium-Praseodymium, Dysprosium and Terbium). Whereas supply-shocks are generally short-to-medium term affairs, demand-shocks normally persist longer.” (Laurent Krull, The Rare Earth Elements Fund)

Company Details

Eagle Bay Resources Corp.

#1450 - 789 West Pender Street

Vancouver, BC, V6C 1H2 Canada

Phone: +1 604 910 2607

Email: info@eaglebayresources.com

www.eaglebayresources.com

Management & Board of Directors

Dave Hodge (CEO, President, Director)

Jody Bellefleur (CFO, Director)

Jody Dahrouge (Director)

Darren L. Smith (Director)

Michael Schuss (Director)

Jason Birmingham (Director)

Date of Listing: March 15, 2023

ISIN: CA2694211038 / CUSIP: 269421103

Shares Issued & Outstanding: 52,854,526

Canada Symbol (CSE): EBR

Current Price: -

Market Capitalization: -

German Symbol / WKN : Not listed

Contact:

www.rockstone-research.com

Disclaimer: This report contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Zimtu Capital Corp., and Eagle Bay Resources Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the Eagle Bay Resources Corp.’s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through Eagle Bay Resources Corp.´s profile on SEDAR at www.sedar.com. Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist. The author owns equity of Eagle Bay Resources Corp., and also holds a long position in Zimtu Capital Corp., and thus may also benefit from volume and price appreciation of those stocks. The author is being paid by Zimtu Capital Corp., which company holds an equity position in Eagle Bay Resources Corp., whereas the featured company Eagle Bay Resources Corp. pays Zimtu Capital Corp. for the preparation, publication and additional distribution of this report. The cover picture (amended) has been obtained and licenced from Juanjo Tugores.