Full size / Rockland‘s Lithium Butte Property in Utah hosts high lithium grades in claystone.

Disseminated on behalf of Rockland Resources Ltd. and Zimtu Capital Corp.

Ridiculed in the past decade, sedimentary lithium (“clay“) projects are up and coming in this decade. Due to the gigantic dimensions, these “soft-rock“ lithium deposits are considered to be the only viable option for the United States to supply enough feedstock for a domestic lithium-ion battery industry. The federal and state governments have recognized that the Western United States is home to an exceptional high number of large, high-grade and near-surface lithium “clay“ deposits not seen elsewhere in the world. And now they have started to bring this lithium deposit-type into meaningful production – for the first time in the Western World – in a joint effort involving government and end-users, such as car manufacturers, funding mine development projects which showcased compelling economics and simple flowsheets for conventional processing at competitive costs with minimal environmental impact. Lithium-clays to the rescue!

A lot has happened in the sedimentary lithium (“clay“) market since last October, when Rockstone published its first report on Rockland Resources Ltd., which also provided an overview of the major players with projects located in the United States. The latest developments around sedimentary lithium projects in the United States are positive for the entire exploration and mining industry, in particular for junior exploration companies such as Rockland focusing on US-based lithium projects within established mining districts. Rockland‘s shareholders are eagerly awaiting the start of this year‘s exploration season, including drilling. According to Bloomberg last Friday, Tesla Inc. is weighing a takeover of Sigma Lithium Corp. (market capitalization $4 billion), however Sigma is said “to not be the only firm that Tesla is considering acquiring“.

Since Rockstone‘s initiating coverage (PDF) on Rockland Resources Ltd. last October, the “soft-rock“ lithium-“clay“ space has received a lot of positive attention from media and investors alike.

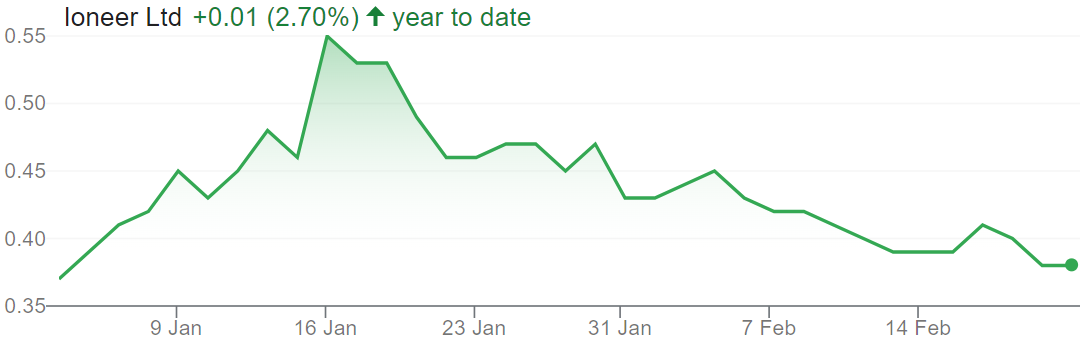

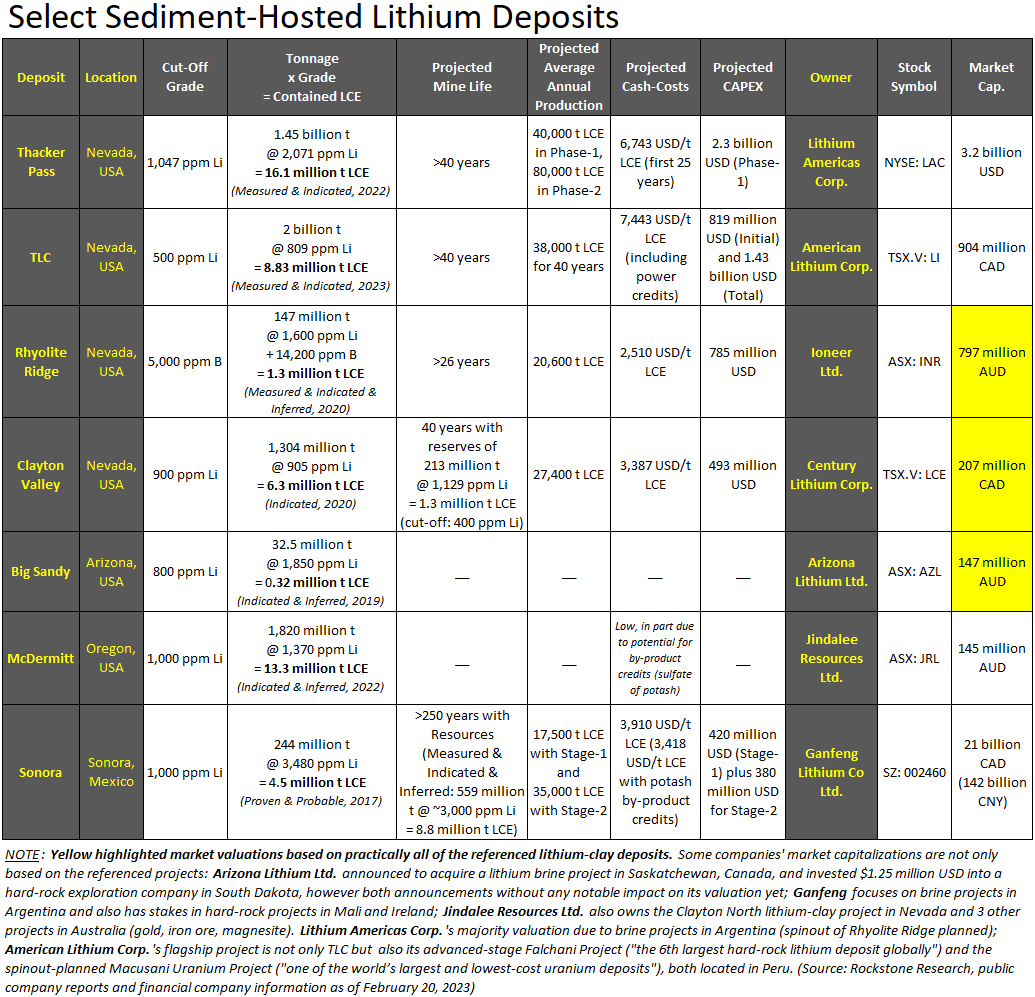

The share prices of public companies with sedimentary lithium (“clay“) projects in the United States have been surging since early January, such as TSX-listed Century Lithium Corp. (+57%; formerly Cypress Development Corp.) and American Lithium Corp. (+51%), NYSE-listed Lithium Americas Corp. (+32%), and ASX-listed Jindalee Resources Ltd. (+35%), Arizona Lithium Ltd. (+5%) and Ioneer Ltd. (+3%).

With Rockland having a closed an oversubscribed private placement financing for gross proceeds of $900,300 in December, investors are eagerly awaiting the start of exploration activities by Utah‘s leading lithium-clay exploration company with its district-scale property adjacent to the Be Mine (the world‘s largest bertrandite ore reserve) from Materion Corp. (market capitalization: $2.3 billion USD) located at Spor Mountain. Back in October, Rockland announced to begin the drill permitting process on initial high-priority lithium targets at its 100% owned Lithium Butte Project. Newsflow is expected to pick up over the next weeks and months as Rockland starts its 2023 exploration season at its large-scale land package (16,219 hectares) prospective for lithium clay and brine deposits.

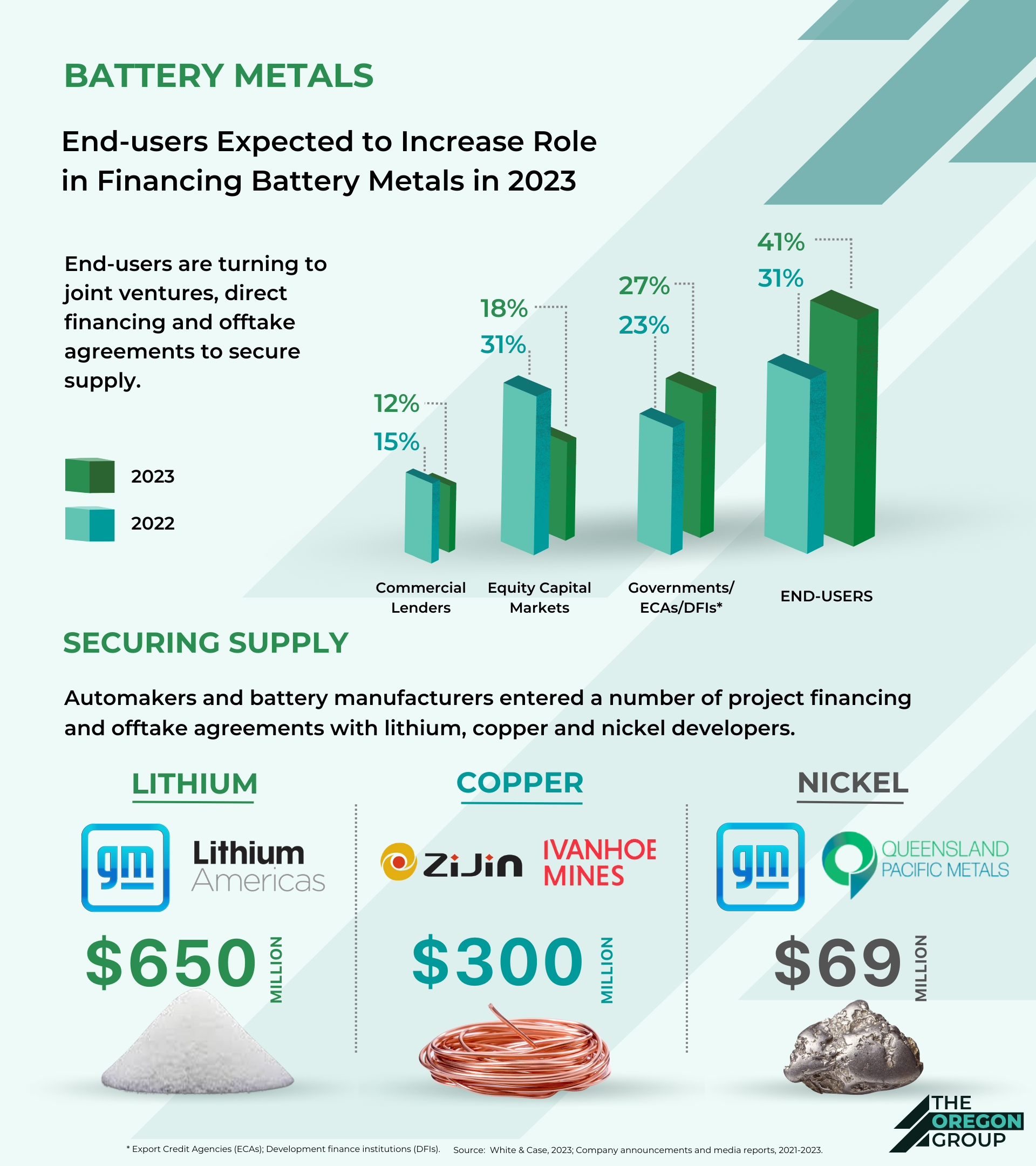

Lithium-Clay Credibility-Boost

Most recently on January 31, “mining investors [...] might have received the news required to pump some life into the sector“, according to an article by The Deep Dive. “General Motors (NYSE: GM) and Lithium Americas (TSX: LAC) [market cap: $3.2 billion USD] have jointly announced that they will work together to develop the Thacker Pass mine in Nevada, which is currently viewed as the third largest lithium deposit globally. The deal will see General Motors invest a whopping $650 million in Lithium Americas, which amounts to the largest investment by an auto manufacturer into raw materials for batteries... In exchange for the investment, GM will obtain exclusive access to lithium carbonate produced under phase one production at the mine, and will have the right of first offer on phase two production.“

Last November, Lithium Americas Corp. filed a Feasibility Study on its 100% owned Thacker Pass Project, concluding that when the project is fully operational, it could generate average EBITDA of more than $1 billion USD annually for 40 years “based on conservative commodity prices“ (Proven & Probable: 217 million t @ 3,158 ppm Li containing 3.65 million t LCE; Measured & Indicated: 1.45 billion t @ 2,071 ppm Li containing 16.1 million t LCE), Inferred: 297 million t @ 1,867 ppm Li containing 2.95 million t LCE).

According to the Deep Dive article “Thacker Pass Gets A Credibility Boost With GM Investment“: “[The] GM transaction hinges on a positive decision from the U.S. District Court of the District of Nevada (and on constructive potential further court rulings if complainants were to appeal that decision). Chief Judge Miranda Du is expected to rule within the next few months on the merits of various environmental groups’ contentions that the U.S. Bureau of Land Management erred when it approved Thacker Pass construction in January 2021.“

On February 6, shares of Lithium Americas jumped 10.3% in New York after a US court decision gave permission to begin construction, whereas there is still a chance of appeal (however unlikely to yield a different ruling).

According to “Lithium Americas Soars After GM Invests $650 Million. The EV War Is Escalating“ (Barron‘s, January 31, 2023): “The Thacker Pass investment should amount to all the lithium GM needs to meet its goal of selling 1 million electric vehicles in North America by mid-decade... Now auto makers are going further up the supply chain to ensure those battery plants have all the materials they need at prices they can afford.“

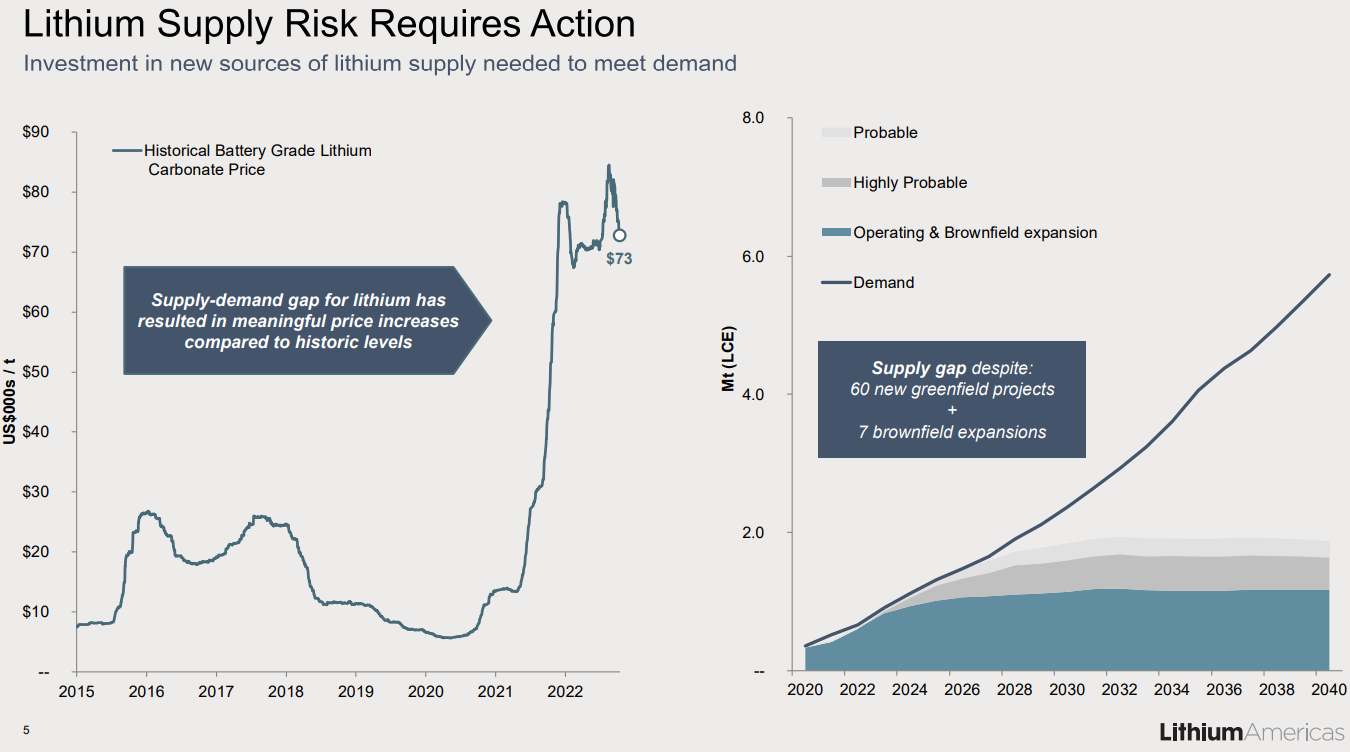

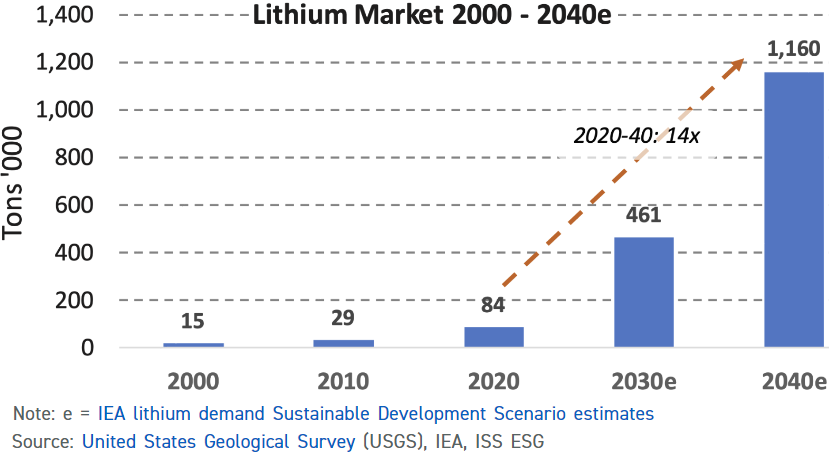

According to “Making the Entire U.S. Car Fleet Electric Could Cause Lithium Shortages“ (Scientific American, January 25, 2023): “The transition to electric vehicles could lead to lithium shortages... Simply converting the existing U.S. car fleet to battery-powered electric vehicles, for example, would require three times more lithium by 2050 than the world currently produces, according to new research from the University of California, Davis, and the Climate and Community Project... The world currently produces a little more than 100,000 tons of lithium a year. Under the base case scenario the researchers established, the United States alone would require 306,000 tons a year by 2050... In the worst-case scenario – in which the system remains unchanged and battery sizes grow significantly – the United States could consume 483,000 tons of lithium a year by 2050... Globally, demand for lithium is expected to skyrocket by as much as six times the current level, requiring 50 new mines, the International Energy Agency concluded in a report last year. The Biden administration has made moves recently to shore up the nation’s access to minerals such as lithium, both at home and abroad.“

On January 13, the U.S. Department of Energy’s Loan Programs Office (LPO) has offered a conditional commitment to lend up to $700 million USD to Ioneer Ltd. to develop a domestic lithium supply from the Rhyolite Ridge Project in Esmeralda County, Nevada. Rhyolite Ridge is a deposit formed by diagenesis of volcanic sediments deposited in an alkaline lake, characterized by very fine boron-rich searlesite crystals (up to 30,000 ppm boron) and lithium in illite-smectite layers (about 1,500-2,500 ppm lithium). It hosts 60 million t @ 1,800 ppm Li containing 0.58 million t LCE (Proved & Probable Stage 1 + 2 Quarry, 2020) with a current mine life of 26 years to produce 20,600 t LCE annually, making it the most-advanced lithium project in the US (CAPEX: $785 million USD) and expected to be one of the lowest-cost lithium producers in the world (only $2,510 USD/t LCE) in part due to boron as a by-product (revenue generated from boron production is estimated to cover all operating costs for lithium production). Rhyolite Ridge is “anticipated to come onstream in 2025“, according to the company. A completed Feasibility Study (2020) makes it “the most advanced lithium project in the US and expected to be the lowest cost lithium producer, in part due to the valuable boron co-product.“ Ioneer is up 3% YTD and has a current market capitalization of $797 million AUD.

According to the U.S. Department of Energy’s Loan Programs Office: “This year alone, the Biden-Harris Administration awarded $2.8 billion in funding to supercharge battery-related mining, processing, and manufacturing in the United States, and an additional $74 million in funding to advance domestic battery reuse and recycling. The urgency to secure critical materials for batteries is expected to rapidly increase in the coming years as demand for lithium is projected to exceed current global production by 2030. This is subsequently causing U.S. auto manufacturers to seek a robust domestic supply of critical materials to keep pace with the increased demand. The Rhyolite Ridge project has executed offtake agreements with Ford, Prime Planet Energy & Solutions (a joint venture battery company between Toyota Motor Corporation and Panasonic Corporation), and EcoPro Innovation (the world‘s second largest lithium nickel-cobalt-aluminum oxide cathode materials manufacturer and a major cathode supplier for global battery manufacturers)...“

In late January, Cypress Development Corp. changed its name to Century Lithium Corp. Also in January, the company provided a progress update on its ongoing Feasibility Study on its Clayton Valley Project, immediately east of Albemarle Corp.’s Silver Peak Mine, North America’s only lithium brine operation (in continuous operation since 1966). At Century Lithium‘s Clayton Valley Deposit, lithium occurs within montmorillonite clays, which can be cheaper to process than refractory clay minerals (e.g. hectorite) requiring roasting and/or higher acid consumption to liberate the lithium. The Feasibility Study is anticipated to be completed in the second quarter 2023. The company is assessing future project financing opportunities and structures, which may include government grants and loans. A Prefeasibility Study (2020) shows Indicated Resources of 1.3 billion t @ 905 ppm Li containing 6.3 million t LCE. CAPEX was estimated at $493 million USD with production cash-costs of 3,387 USD/t LCE. In early January, Century Lithium‘s share price stood at $0.90 and reached $1.50 in early February, enjoying a current market cap of $207 million.

In early January, American Lithium Corp. received approval to list on NASDAQ. In mid-January, the Vancouver-based company announced an updated resource estimate on its TLC Project located in the Esmerelda Lithium District northwest of Tonopah, Nevada. In early February, the results of a maiden Preliminary Economic Assessment (PEA) were announced. The TLC lithium claystone deposit (with potential to produce magnesium sulfates as by-products now hosts Measured & Indicated Resources of 2 billion t @ 809 ppm Li containing 8.83 million t LCE (Inferred: 489 million t @ 713 ppm Li containing 1.89 million t LCE), making it the third largest sedimentary lithium resource in the United States (after Lithium America‘s Thacker Pass and Jindalee‘s McDermitt). American Lithium‘s share price increased by 51% YTD, currently with a market value of $904 million.

In December, Jindalee Resources Ltd. announced final assays from its 2022 drilling program at its McDermitt Project in southeast Oregon, including multiple wide lithium intercepts, such as 47.4 m @ 1,449 ppm Li (from 26.8 m) including 10.2 m @ 2,631 ppm Li (from 55.5 m). An updated resource estimate is “expected to be announced early 2023“. The 2022-drilling was designed to infill and extend the 2022-resource-estimate of 1.82 billion t @ 1,370 ppm Li containing 13.3 million t LCE, making it the second largest sedimentary lithium resource in the United States. Jindalee‘s share price appreciated by 35% YTD (market cap: $145 million AUD).

In early December, Arizona Lithium Ltd. announced a strategic alliance with Navajo Transitional Energy Company LLC (NTEC), wholly owned by the Navajo Nation. NTEC will take over the operational development of the Big Sandy Project and will manage all aspects from the permitting requirements for additional exploratory drilling process through to mine design, environmental assessments, construction, and contract mining operations for the project. NTEC owns the Navajo Mine, currently holds a 7% interest in the Four Corners Power Plant, and also owns and operates mines in Montana and Wyoming. NTEC will be designated as Big Sandy‘s mine operator and will manage and execute all programs and spending. NTEC would be entitled to the issue of up to 192 million shares of Arizona Lithium (currently issued & outstanding: 2.48 billion shares). 2019-drilling at Big Sandy resulted in Indicated & Inferred Resources of 32.5 million t @ 1,850 ppm Li containing 0.32 million t LCE, which represents 4% of the Big Sandy Project area that contains an estimated exploration target of between 271-483 million t @ 1,000-2,000 ppm Li, according to the company. In late November, Arizona Lithium announced the start of a Feasibility Study at Big Sandy, projected to be completed at the end of 2023. In early November, Arizona Lithium announced a strategic investment of $1.25 million USD in Midwest Lithium AG, which company holds a land position in the Black Hills of South Dakota, one of North America’s hard-rock (spodumene) lithium producing districts including numerous historical mines. In late December, Arizona Lithium announced an agreement to acquire 100% of the private company Prairie Lithium Corp., one of Canada’s most advanced lithium brine companies and one of the most advanced Direct Lithium Extraction (DLE) projects globally, according to the company (Inferred Resource: 111 mg/L Li containing 4.1 million t LCE; located in Saskatchewan). Shares of Arizona Lithium are up 5% YTD, with a current market cap of $147 million AUD.

Rockland: Utah‘s Leading Lithium Explorer

Source: https://youtu.be/_HcRxWnen8I

Full size / “Our early work at Lithium Butte is demonstrating that the Property hosts a volcanic formation that has a unique endowment in light metals including lithium and beryllium. This formation exhibits strong similarities with the Miocene Spor Mountain Formation that hosts currently mined Be deposits. Our initial results at Lithium Butte suggests that the Spor Mountain Formation may be more widespread than previously thought and has encouraged Rockland to significantly extend its property position in this region.“ (Dr. Richard Sutcliffe, Rockland‘s President, on August 4, 2022)

• The geologic setting and history of volcanism and mineralization at Utah‘s Spor Mountain is highly prospective for lithium-enriched claystone units: “Feldspathic and montmorillonitic (smectite) clay alteration zones, including lithium-bearing trioctahedral smectite, closely follow and enclose beryllium ore...“ (Source)

• Spor Mountain has similar geology to Nevada’s hotbed of activity in the Clayton Valley, where Albemarle Corp. produces lithium from brine and started looking at its clay deposits in 2021.

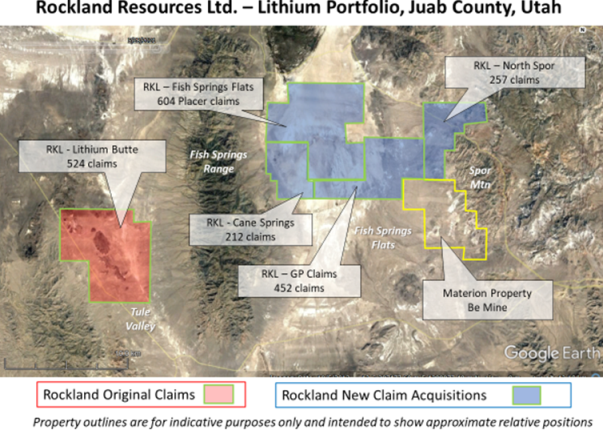

• In September 2022, Rockland announced a major expansion of its property holdings to 16,219 hectares, a district-scale land package prospective for lithium clay and brine deposits. The newly acquired claims contain beryllium (Be) mineralization with grades up to 4,810 ppm Be and are contiguous with Materion Corp.‘s producing Be Mine.

• Rockland‘s newly acquired Fish Springs Flat claims “cover an area interpreted to be prospective for lithium brine mineralization.“ (Utah Geological Survey, 2020).

• Rockland‘s original claims, the Lithium Butte Property (4,460 hectares; ~10 km east of newly acquired claims), host highly elevated lithium grades in the primary Spor Mountain Formation (Volcanic Beryllium-Tuff Formation).

• Alteration of Lithium Butte‘s claystone has further enriched lithium concentrations. Rockland‘s sampling in May 2022 and a historic (2010) database indicate widespread lithium mineralization hosted in clay or claystone volcanic tuff units. Initial grab samples at Lithium Butte showed lithium grades of up to 4,080 ppm in June 2022. In August, Rockland reported additional grab sample assays, showing significant beryllium grades between 1,790 and 4,810 ppm Be. These samples also contain anomalous lithium with grades between 380 and 440 ppm Li. The Be-mineralized samples were collected from an outcrop of bedded tuff-breccia approximately 340 m east-southeast of the claystone tuff-breccia samples that contained previously reported high lithium values ranging from 1,200 to 4,080 ppm Li. Channel sampling in July revealed 25.2 m @ 1,388 ppm Li including 8 m @ 2,155 ppm Li and 0.7 m @ 3,540 ppm. The sampled section represents the upper part of the prospective unit and the mineralization is open at depth.

“Our early work at Lithium Butte is demonstrating that the Property hosts a volcanic formation that has a unique endowment in light metals including lithium and beryllium. This formation exhibits strong similarities with the Miocene Spor Mountain Formation that hosts currently mined Be deposits. Our initial results at Lithium Butte suggests that the Spor Mountain Formation may be more widespread than previously thought and has encouraged Rockland to significantly extend its property position in this region.“ (Dr. Richard Sutcliffe, Rockland‘s President, on August 4, 2022)

Rockland‘s large property package (16,219 hectares) is highly prospective for both lithium claystone and brine deposits:

Full size / The picture shows the Volcanic Beryllium-Tuff Formation with widespread lithium mineralization hosted in clay or claystone and initial grab samples indicate high lithium grades of up to 4,080 ppm.

Full size / The picture shows Rockland‘s newly acquired Fish Springs Flat claims which cover an area interpreted to be prospective for lithium brine mineralization, according to the Utah Geological Survey (2020).

Excellent outcrop exposure allows for rapid characterization of lithium mineralization at Rockland‘s Lithium Butte Property.

• Outcropping exposure of clay altered tuff-breccia with a stratigraphic thickness estimated to be greater than 20 m.

• Outcrop contains at least 2 intervals of claystone mineralization, each of which is several meters in thickness

Mineralized grab samples from rhyolite tuff-breccia of Tertiary age is known to contain elevated Lithium contents:

• Mineralized tuff-breccia is overlain by rhyolite cap-rock and underlain by trachyte flows.

• Significant lithium contents are associated with well-developed clay alteration of tuff-breccia.

• Well-defined stratigraphic model enables Rockland to selectively target additional areas of lithium mineralization.

Full size / The area surrounding Rockland‘s eastern land package is the site of significant historical mining activity and contains the most productive beryllium mines on earth.

“The long term path for lithium is set, yet the supply chain scaling challenge has just begun,” Simon Moores, chief executive of Benchmark, explained. “What this data shows is that we are at just the beginning of a generational challenge, not one that’s going to be solved in the 2020s.” Benchmark is aware of 40 lithium mines that have been in operation – producing lithium – in 2022. By 2050, the company sees a need for 234 more lithium mines if there’s no battery recycling underway (which, of course, is completely unrealistic but is a place to start from for such an analysis)... “It’s crucial that legacy OEMs, EV producers, and battery cell makers make the big and at times uncomfortable decisions in investing in long term generational critical minerals supply, especially for lithium,” Moores said. “If not, Automakers won’t hit their EVs, governments won’t achieve Net Zero by 2050, and market volatility will be here to stay for much longer.” (Source: CleanTechnica, October 2022)

The lithium market needs to scale up to 25 times or more of the 2021 level by 2050... Analysts from Benchmark Mineral Intelligence forecast 2.9 million tonnes of LCE (Lithium Carbonate Equivalent) a year by 2032. Consider that, in total, 2.7 million tonnes of LCE were produced from 2015 through 2022 so far. In 2040, one month’s lithium needs are expected to be equal to all of the battery-grade lithium produced in 2021. (Source: CleanTechnica, October 2022)

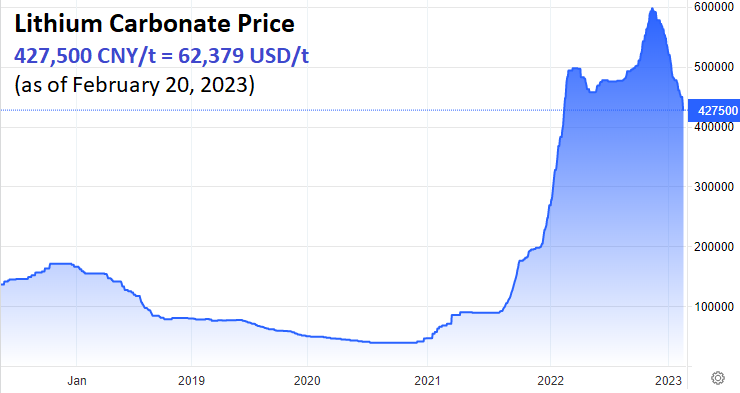

“In 2022, a total of ~$4.68 billion USD was raised through public markets for companies listed in Australia, Canada, the United Kingdom and the United States. This is a 146% increase over 2021 and represents the largest amount of money raised since 2016. In 2021, lithium markets hit new highs as demand for the battery metal skyrocketed with countries and companies committing to low-carbon technologies and policies while surging EV sales provided a tailwind to the price momentum. In 2022, this trend continued with prices reaching $80,800 per tonne in November, a 1,000% increase since 2021.“ (Source: Mining Intelligence, February 2023)

Disconnect between demand and capital invested: Wood Mackenzie Vice President of Metals and Mining Markets Nick Pickens said there was a significant disconnect between the material demand of the energy transition and the capital invested in mining projects. “There is an obvious shortage of mining projects and for many markets the pool of metal is not sufficient enough, he said. “Recycling is part of the solution but still needs investment in projects.“ BMO Capital Markets Managing Director of Commodities Research Colin Hamilton said the energy transition would cause markets for critical metals to become supply-constrained, with end-users forced to compromise by reducing the metal intensity within their products, such as the manufacture of smaller batteries. “The cost of risk must take into account risk of not taking risk when considering the development of new mining projects,“ he said. (Source: “Decarbonization can‘t happen without more investment in mining projects“, S&P Global Commodity Insights, February 8, 2023)

LG Chem Ltd. is prioritizing efforts to secure raw materials used in electric-vehicle batteries and establishing a self-sufficient global supply chain, including via potential partnerships and investments in mining companies. “We are preparing ourselves first of all to secure supply of raw material, which is more important than the price,” LG Chem Chief Executive Officer Shin Hak-cheol said in an interview with Bloomberg Television in Seoul. “Our first and foremost priority is to secure enough raw material for the future. LG Chem makes cathode-active materials, a key ingredient for EV batteries. It is the parent of LG Energy Solution, the world’s second-largest battery cell maker and supplier for automakers including Tesla Inc., General Motors Co., Ford Motor Co. and Stellantis NV. The South Korean company is doing “a lot of projects” to ensure it has a stable source of supply, according to Shin. “I don’t think we’ll ever be a mining company. However, if there’s a project that makes sense, maybe we can invest.” (Source: “Battery Giant LG Chem Prepares to Lock In Mineral Supplies“, Bloomberg, February 12, 2023)

Automakers are starting to realize that the only way to guarantee lithium supplies is to own or have a controlling stake in the source... General Motors’ announcement on Tuesday that it plans to invest $650 million into Lithium Americas to secure access to lithium is the first of what surely will be more to come, according to Simon Moores, the CEO of Benchmark Mineral Intelligence. “EV companies, especially the auto majors, have learnt the hard way over the last five years that scaling batteries – giga factories – is much easier and quicker than scaling mining,” Moores said... Going forward, automakers will need to make even larger investments in mining, according to Moores. “This $650 million is a significant investment,” but “what the industry really needs” is checks in the billions of dollars, Moores said, “otherwise these EV goals will not be met.” GM’s investment in Lithium America “is only literally one piece of an ever-growing puzzle,” he added... “The rush for lithium has just started. It is a land grab,” Moores told CNBC. “This land grab will last the next decade. I don’t think this is a two- or three-year thing. I think this is a decadelong process.” (Source: “The ‘land grab’ for lithium is just getting started with GM deal, says EV materials expert“, CNBC, January 31,2023)

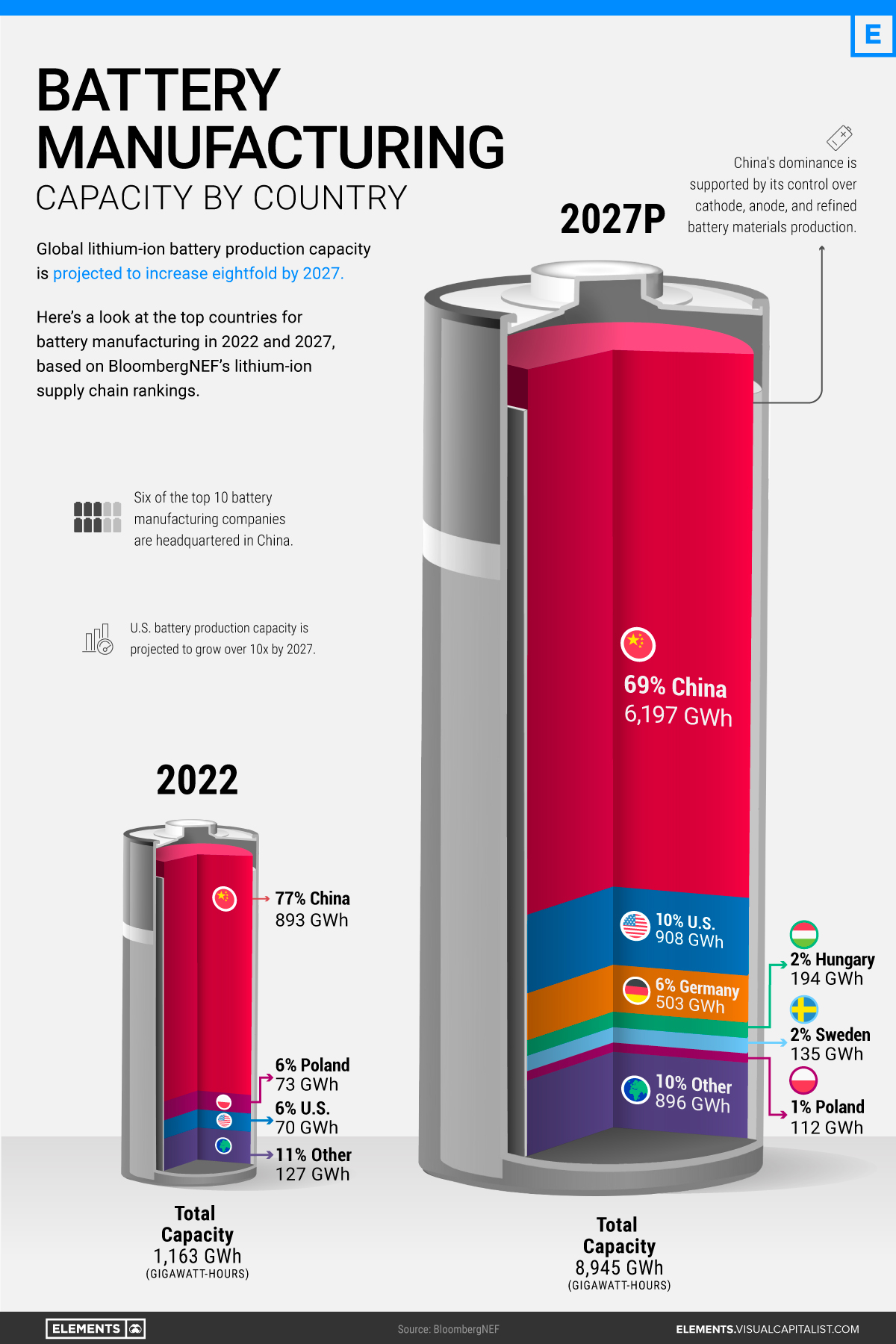

“With the world gearing up for the electric vehicle era, battery manufacturing has become a priority for many nations, including the United States. However, having entered the race for batteries early, China is far and away in the lead. Using the data and projections behind BloombergNEF’s lithium-ion supply chain rankings, this infographic visualizes battery manufacturing capacity by country in 2022 and 2027p, highlighting the extent of China’s battery dominance. With nearly 900 gigawatt-hours of manufacturing capacity or 77% of the global total, China is home to six of the world’s 10 biggest battery makers. Behind China’s battery dominance is its vertical integration across the rest of the EV supply chain, from mining the metals to producing the EVs. It’s also the largest EV market, accounting for 52% of global sales in 2021... Although it lives in China’s shadow when it comes to batteries, the U.S. is also among the world’s lithium-ion powerhouses. As of 2022, it had eight major operational battery factories, concentrated in the Midwest and the South.“ (Source)

Company Details

Rockland Resources Ltd.

#1240 – 789 W Pender Street

Vancouver, BC, V6C 1H2 Canada

Phone: +1 604 683 3995

Email: info@rocklandresources.com

www.rocklandresources.com

Date of Listing: February 22, 2021

ISIN: CA7736671008 / CUSIP: 773667100

Shares Issued & Outstanding: 54,017,787

Canada Symbol (CSE): RKL

Current Price: $0.065 CAD (02/17/2023)

Market Capitalization: $3.5 Million CAD

German Symbol / WKN : Not listed

Contact:

www.rockstone-research.com

Disclaimer: This report contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Zimtu Capital Corp., and Rockland Resources Ltd. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the Rockland Resources Ltd.’s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through Rockland Resources Ltd.´s profile on SEDAR at www.sedar.com. Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist. The author owns equity of Rockland Resources Ltd., and also holds a long position in Zimtu Capital Corp., and thus may also benefit from volume and price appreciation of those stocks. The author is being paid by Zimtu Capital Corp., which company holds an equity position in Rockland Resources Ltd., whereas the featured company Rockland Resources Ltd. pays Zimtu Capital Corp. for the preparation, publication and additional distribution of this report.