PDF version includes few more pictures than below web version

Disseminated on behalf of Emerita Resources Corp. and Zimtu Capital Corp.

In late November, about 30 people from Canada, the United States and Europe came to Andalusia´s capital Seville (Spain´s 4th largest metropolitan area with a population of 1.5 million) to visit the Iberian Pyrite Belt properties from Emerita Resources Corp. (TSX.V: EMO). We saw and experienced much more than that.

For 3 days we were on the road in Andalusia, which gave everybody the chance to meet the company as closely as one gets. By no means at all did Emerita give the impression of a foreign-based company running exploration projects from abroad. Quite the contrary, Emerita is a well-respected local company with an impressive number of Spanish employees running the day-to-day business in a highly professional manner. We met Emerita´s in-house staff; geologists, geophysicist, managers, attorneys, corporate development and public relations officers along with a diligent workforce in the field and at the core shack. All these people were locals with only CEO David Gower and Director Larry Guy flying in from Canada. President Joaquin Merino-Marquez is spearheading the Andalusian organization for the clearly visible success of Emerita in Spain. Within Seville, the company recently relocated to 21 Avenida de la Constituciòn into a large and prestigious office in the heart of the city centre. All told, Emerita is an authentically thriving Sevillian company with deep local roots expanding at an accelerating pace.

The Latin name "Emerita" means "the worthy" / "the deserving", or "man of merit". One of the local staff mentioned that the corporate name was chosen in reference to Mérida, a town 190 km north of Seville that was founded 25 BC by the first Roman emperor Caesar Augustus as a Roman Colonia under the name Emerita Augusta (meaning the veterans – discharged soldiers – of Augustus´ army resettled here in classiness; the name "Mérida" is an evolution of this). Back then, Emerita Augusta was the capital of the Roman province of Lusitania, and was one of the largest cities in Hispania, because it was situated at the junction of several important routes and mining camps within the heart of the Iberian Pyrite Belt.

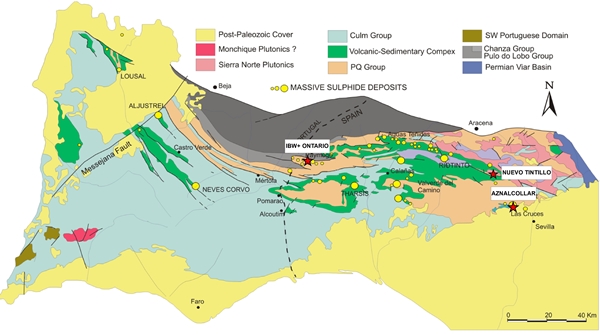

Mining has been active in the Iberian Pyrite Belt since the Copper Age, also known as Chalcolithic Age (from Greek "khalkós" meaning "copper") or Aeneolithic Age (from Latin "aeneus" meaning "of copper"), when copper predominated in metalworking technology (hence it was the period before it was discovered that by adding tin to copper one could create bronze, a metal alloy harder and stronger than either component). The result: "today almost all the outcropping and near-surface deposits are exhausted and mineral prospecting must now orientate itself towards finding deeper orebodies... It was the 1977 discovery of Neves-Corvo with its Cu and Sn-rich orebodies that led to renewed exploration interest in the area. This deposit was a major discovery, not only because Neves-Corvo is a deep blind deposit, but because the richness of the deposit showed that the Iberian Pyrite Belt still contains major economic metal potential; subsequent renewed exploration has already resulted in further orebodies being discovered. The other interesting aspect of the mining revival is that the Iberian Pyrite Belt has also become a major field area for worldwide scientific research, research that has harvested a wealth of new data, that has given rise to new metallogenic concepts, and that has led to revised geological interpretations not only of this province, but of the entire Western Hercynides."

Recently in October, 29 geology students from Barcelona visited Emerita´s core shack, with their professor Joaquín A. Proenza explaining to the press: "The Iberian Belt West Project is special, among other reasons, because the mineralized horizon is one of the richest in zinc documented in the Iberian Pyrite Belt, with grades that exceed 30%."

Not only major shareholders of Emerita toured Andalusia in late November but also several institutional analysts from Canada with research updates on the site-visit recently distributed among its clients. Also, officials from the Ministry of Mines, the Mayor of Paymogo and other policymaker joined parts of the site-visit, which was "a strong signal of support for the project" according to Varun Arora of Clarus Securities Inc. As the weeks have passed since the site-visit and media production professional Andy Schmidt has yet to get started cutting the vast amount of footage into presentable videos, consider below layman-produced videos as a sneak preview of what is coming shortly.

Site-visit recap plus update and 2022-preview by Emerita´s CEO David Gower

Click above player or here to listen to David Gower (published by The Investors Coliseum on December 13, 2021).

Interview with President Joaquin Merino-Marquez during the site-visit by Doc Jones

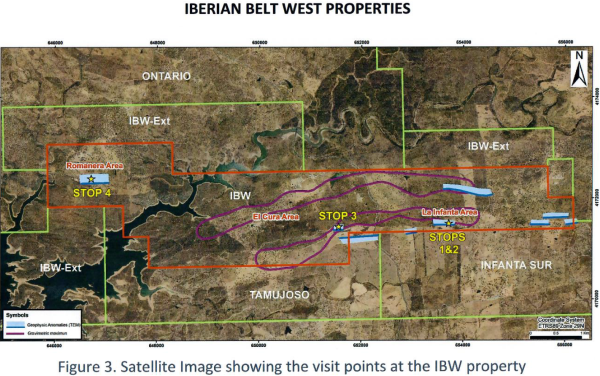

In a research update entitled "Site Visit Reveals a Giant in the Making", Varun Arora (analyst at Clarus Securities Inc.) recently noted: " We return highly encouraged from our site visit to Emerita’s assets in the Iberian Pyrite Belt (IPB) of Spain that demonstrated excellent infrastructure, a skilled team at the helms to unlock value and a stupendous amount of resource growth potential that could be many multiples of what we are currently modelling in our valuation for the Company. Overall, the site visit has not only strengthened our view that Emerita’s assets will become mines within the current commodity bull cycle but also demonstrated that the next year’s drill program could prove our ‘Base Case’ modelling assumptions on the resource front to be very conservative... IN THE MIDDLE OF MINES & GREAT INFRASTRUCTURE: The entire IPB is dotted with past & currently producing mines with power lines straddling throughout the area. There is excellent access to all the three properties (IBW, Nuevo Tintillo and Aznalcollar) through highways, paved roads and all-season gravel roads on the projects. Located within just a couple hours from the major city of Seville by road. Topography at the projects is extremely favourable with great access and easy to explore with several outcrops and gossans, and with the ability to drill all-year-round... Overall, we expect a drill program of ~50,000 – 60,000 m next year with continued fleet expansion to 8 rigs drilling at La Infanta, Romanera, El Cura and potentially regional targets. With a cash balance of ~C$25 MM & warrants being exercised, EMO is well-funded for the 2022 drill program."

In a research update entitled "Site Visit Provides Comfort to Move Infanta to DCF", Adam Schatzker (analyst at Research Capital Corp.) recently noted: "The visit gave us the opportunity to review the core from the drilling at Infanta as well as visit Infanta, Romanera and El Cura. We were very impressed with the geological upside of the IBW project and the potential for EMO to make discoveries along the 10km trend from Infanta to Romanera... The most relevant take-away that affects our valuation of EMO is the comfort we gained regarding the potential of Infanta... The site visit provided us with a very good overview of the IBW project and its potential. The company plans to increase the number of drill rigs and we expect there will be substantial new flow going forward. Looking to the long-term, we see Emerita as a potential takeover target regardless of whether it wins the Aznalcóllar tender (winning the tender would only make a takeover even more likely). We think the IBW property has excellent potential to host multiple economic deposits located in close proximity allowing for significant synergies and cost savings. For now, we are not valuing the company as a takeover target as we believe it premature to do so (the company has yet to publish a 43-101 resource and has only announced 27 drill holes at Infanta and none at Romanera or El Cura). However, it is hard to ignore the potential that the company has in its portfolio."

3 drill rigs in action at Infanta (IBW Property)

Click above player or here to watch.

• The video shows excellent property access to the Infanta area (east) of the IBW (Iberian Belt West) Property.

• Red flags: Projection of VMS lens at surface (see below map) / Yellow flags: Projection of a parallel trending VMS lens

• During the site-visit, we saw 3 drill rigs: One at hole IN030 (which was just starting to drill a ~325 m step-out to the west), another one at IN029 testing for down-dip extension at the North Block (see video with fresh core here) and a third rig drilling hole IN031. These 3 drill rigs can be seen in the above video starting at 0:33 with rig at IN030, then flying over IN029 and IN031, and finally across the VMS outcrop with historic mine workings.

• Hole IN030 (assays pending) aims to confirm a surface strike length of ~1,000 m. Prior to assays from IN030, results from 7 holes (in blue: IN019, 20, 22-25) are expected to be released, with IN025 being the eastern-most hole (a ~200 m step-out to the east) close to the historic mine workings at the outcropping VMS lens (towards the end of above video).

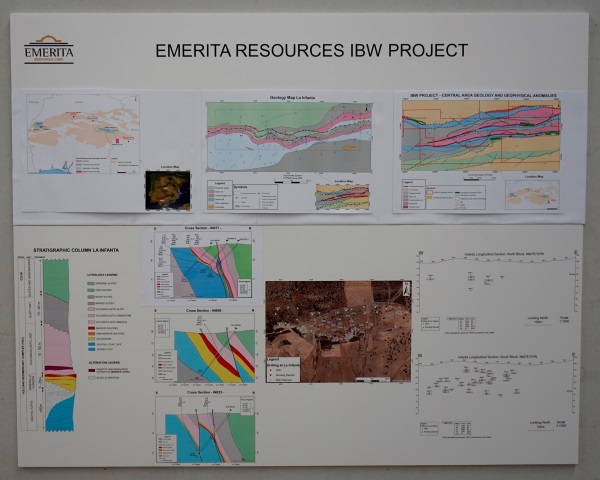

Full size / Map from site-visit booklet "Emerita Resources Site Visit to its Iberian Pyrite Belt Properties" (with green annotations by Rockstone).

According to Varun Arora in his latest research update for Clarus Securities Inc.: "There are 3 rigs currently turning at La Infanta, testing a +300 m step-out to the west and a ~200 m step-out to the east (assays pending). If successful, this will expand the strike length to +1 km (vs 600 m modelled & historic). Recent TEM surveys indicated depth potential to at least 400 m (vs ~250 m modelled and ~120 m tested historically)... Geophysics highlights expansion potential: The TEM survey at La Infanta indicates that one of the strongest conductors extend at least 300 m west of the historic resource and positive results from the above-mentioned step-out holes will be a strong validation of management’s exploration/drill targeting strategy, as well as the team’s understanding of the geological model, in our opinion. Mineralization also continues 400 m east where a small historical mining excavation is located and we expect holes #25 and #31 to confirm the strike extension potential to the east."

According to Adam Schatzker in his latest research update for Research Capital Corp.: "INFANTA – BETTER THAN WE EXPECTED: The Infanta deposit is a volcanogenic massive sulphide (VMS) deposit that is exhibits high grade zinc-lead-copper mineralization with associated silver and gold. The deposit currently has a strike length defined by drilling of approximately 650m and drilling to date has been fairly shallow. We expect that the depth potential of the deposit is significant as observed in many other VMS targets, globally... Emerita has identified a number of geophysical anomalies (gravity and TEM) that indicate there is significant potential to expand the deposit. One of the most interesting of the Infanta targets is a large TEM anomaly that lies to the north of the currently defined mineralization and runs in a sub-parallel direction. We expect EMO will test this target in early 2022."

According to the site-visit booklet provided by Emerita, the outcropping VMS lens and its historic mine workings (east; at the end of video) is a "Contact between volcanoclastic sequence and dacitic tuff unit hosting the massive sulphide mineralization at La Infanta... Waste dumps have massive sulphide blocks and characteristic sulphide smell comes out from the old shaft. Drilling and mapping indicates that the massive sulphide trend is continuous at least up to the western shaft (Stop 2). Detailed geological mapping performed up to El Cura shows the contact hosting the massive sulphide trending continuously up to El Cura. The continuity of the contact westwards to El Cura is still open since detailed geological mapping westwards to El Cura is being performed in the next weeks." (In other words, Emerita is testing the potential for a strike length of >3000 m.)

According to Varun Arora of Clarus Securities Inc.: "On our way to the property, we drove past the wind and solar power farms and a substation that was within a few kilometers from the project that will allow a low capex connection to grid power. Water for drilling is available for purchase from the surrounding landowners."

Full size / Map from the site-visit booklet "Emerita Resources Site Visit to its Iberian Pyrite Belt Properties".

The ongoing drilling program at Infanta and the soon-to-start (Q1/2022) concurrent drilling program at Romanera aim to confirm and expand the historical resource estimates for the IBW Property (see below), and to file NI43-101-compliant resource estimates in due course:

According to Varun Arora of Clarus Securities Inc.: "Very high grade potential: The historic exploration program at La Infanta included ~5,000m of diamond drilling in 49 holes (1970s & 80s, incl. Phelps Dodge), resulting in a historic resource of 0.8 Mt at 26.5% ZnEq (with 1.77% Cu and 148 g/t Ag). While the mineralization at La Infanta is narrower (avg. 3 – 6m) as compared to Romanera, we believe the significant high grade nature makes this deposit equally compelling... Accelerating drill program: At the current rate, we expect management to achieve 2,500 – 3,000 m per month from the three rigs. We expect two more rigs to arrive: the fourth rig around Christmas and the fifth at the beginning of 2022, driving the total rig count to 5. This should increase the drilling rate to 4,000 – 5,000 m per month. Initially, all five rigs will be turning at La Infanta and once the remaining IBW land package is drill permitted, two rigs are planned to be moved to Romanera (mid-January). Management plans to add three more rigs in short order post commencement of drilling at Romanera, driving the total rig count to 8 rigs at IBW that will allow simultaneous drilling of the multiple targets/deposits on the property, including La Infanta, Romanera, El Cura and regional targets such as the northern coincident gravity & TEM anomaly."

Mine workings from Roman Era at Romanera (IBW Property)

Click above player or here to watch.

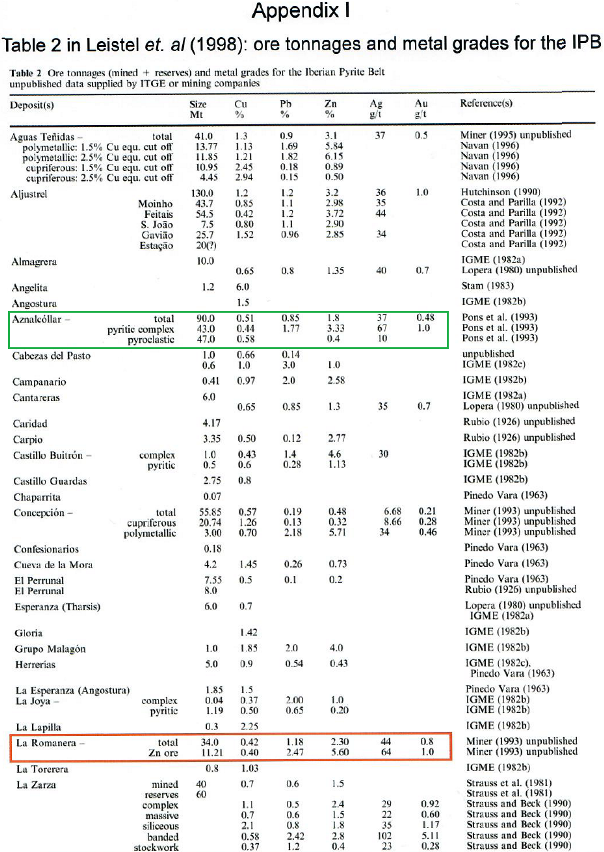

According to the site-visit booklet provided by Emerita: "Located 4 km to the west northwest of El Cura. Old workings, some dating to Roman times, follow a west-northwest trend, with distinctive gossan developed along a contact between foliated sediments and a rhyolitic unit to the south... Waste dumps occur at least 350 metres strike length, and a strong EM anomaly has been identified by Emerita´s geophysical survey. A historical, non-compliant, estimate (Leistel et al, 1998) suggests a resource of 34 Mt with 0.42% Cu, 1.18% Pb, 2.30% Zn, 44 g/t Ag and 0.8 g/t Au."

Core shack (5 km from IBW Property)

Click above player or here to watch.

According to Varun Arora of Clarus Securities Inc.: "We visited the core shack facility that was large and very well organized. In addition, there was another empty and equally large facility that could support a significant expansion of the drill program as Romanera and El Cura drilling commences in the near-term... Drilling costs are averaging ~C$130 - $150/m (on average, incl. rushed assays) which we believe are very reasonable as compared to several other major copper districts globally with costs typically averaging >C$200/m. We further note that the current turnaround on rushed assays is 7 – 10 days and ~4 weeks for normal (non-rushed) assays, significantly better than the typical >5 – 10 weeks in much of the rest of the major mining jurisdictions. The assays are sent to ALS Laboratory in Seville for sample preparation and moved to other locations (Ireland) within Europe for assaying."

Full size / Core displaying stratigraphic units at Infanta (IBW) with semi-massive sulphide mineralization in dark-grey and massive sulphides in black.

View above core samples from Infanta´s rock classes in combination with below (bottom left) stratigraphic column:

Full size / Geologic maps presenting Infanta within IBW Property at Emerita´s core shack. See close-up of stratigraphic column here

Infanta´s mineralized horizon ranges between 3-25 m and characteristically shows dark-grey to blackish VMS mineralization (semi-massive to massive sulphides):

Full size / Semi-massive sulphides in drill core (left) and massive sulphides (center and right) at Infanta.

Massive sulphide mineralization:

• Primary rock texture not visible.

• Fine-grained, dark-grey matrix occasionally with chalcopyrite and galena veins.

• Main sulphide minerals: sphalerite > galena > chalcopyrite > pyrite (individual sulphide species difficult to distinguish)

Full size / Close-up of semi-massive sulphides in drill core at Infanta.

Semi-massive sulphide mineralization:

• Primary rock texture clearly visible with intense veining.

• Sulphides occur as patches and millimetre-scale veinlets of galena and chalcopyrite (in places sufficiently close together to resemble the massive sulphide phase).

Full size / Stockwork mineralization at Infanta.

Infanta´s mineralized horizon also includes stockwork mineralization ("bands and veins"), typically much thicker (though lower grade) than semi- to massive sulphide zones. Stockwork mineralization provides potential for enlarged tonnage to be mined underground:

Full size / Stockwork mineralization at Infanta. See close-up here

Stockwork mineralization:

• This style of mineralization shows veins and bands up to several centimetres thick.

• Mineralogy: sphalerite > galena > pyrite > chalcopyrite

• Locally, some of the stockworks at Infanta can be pyrite-dominated.

Full size / Core displaying the volcanoclastic breccia unit at Infanta. This breccia is the rock type most commonly found immediately above the mineralized horizon.

Above core displays hydrothermal/volcanoclastic breccia strongly silicified with intense purple colour and hematite and manganese alteration, serving as marker level/horizon (guide level) indicating near-by VMS mineralization.

Below picture shows massive sulphides in core from hole IN008 with peak grades of 1.9 g/t gold, 387 g/t silver, 4.33% copper, 31.2% zinc and 18.85% lead (from 64.50 m to 75.60 m core length):

Full size / Massive sulphide mineralization in core with assays from hole IN008: See Emerita´s news-release announcing 11.1 m @ 0.8 g/t gold, 319.3 g/t silver, 3.6% copper, 27.8% zinc and 15.1% lead (September 8, 2021).

Ful size / Stockwork mineralization with intense quartz veining in core from Infanta.

Santa Flora underground mine (historic) at Nuevo Tintillo with Riotinto Mine in the background

Click above player or here to watch.

At Santa Flora both the historic mine workings (on top and at the side of the hill) followed high-grade copper and silver-lead-zinc bodies, with some of the workings crosscutting to intercept the mineralization. The purple marker horizon seen at Infanta is also visible here.

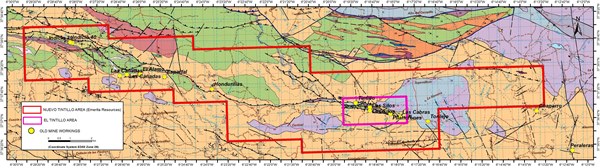

During the site-visit, we went to Nuevo Tintollo´s western-most property section where below map references Santa Flora as "Indicio 39/Indicio 40":

According to Varun Arora of Clarus Securities Inc.: "SIGNIFICANT OPTIONALITY FROM NUEVO TINTILLO: Nuevo Tintillo is located within ~10 km from the giant producing Riotinto mine (Atalaya Mining; 258 Mt at 0.4% Cu in M&I) and a few kilometers north of Aznalcollar. Regional mapping indicates that the same thrust fault controlling the mineralization at Riotinto outcrops at Nuevo Tintillo that controls ~25 km of this structure, highlighting the significant prospectivity of the property. The property is dotted with historic small-scale mines and we visited the Santa Flora mine in the west where we saw a number of mineralized sample rocks on surface. The property is fully permitted with no environmental concerns (same as La Infanta) and management expects to drill here sometime in the first half of 2022."

Going underground at Santa Flora (Nuevo Tintillo) with Doc Jones

Click above player or here to watch video going underground at Santa Flora (Nuevo Tintillo) with last shown videos from resource investor Doc Jones.

Full size / Mineralization of copper oxides, carbonates and silicates in the underground workings of the Santa Flora Mine: The copper oxide minerals malachite (green) and azurite (blue) occur together with chrysocolla (hydrated copper phyllosilicate mineral) and grainy masses of cuprite (a copper oxide mineral) associated with iron oxides. The last documented work in the area dates back to 1954-1959. (Source)

Specimen from the Santa Flora Mine are treasured by collectors (see here, here, here, here, here, here, and here):

Full size / From the Santa Flora Mine: Botryoidal aggregates of goethite (iron oxide mineral with iridescence of metallic tones) next to groups of lenticular crystals of azurite and acicular malachite. (Source)

Rock samples found near Santa Flora Mine (Nuevo Tintillo)

Click above player or here to watch.

Above video shows some rock samples found near the Santa Flora Mine during the site-visit:

• The first sample shows copper oxide mineralization with malachite (green) and azurite (blue) surrounded by jarosite (orange; a sulfate mineral; generally formed in ore deposits by the oxidation of iron sulphides) in a hematite-manganese-altered quartz-carbonate matrix. The sample indicates the oxidation of sulphide minerals.

• The second specimen shows very fine-grained massive sulphide mineralization in an altered carbonate matrix, where it‘s difficult to identify the minerals separately; however the lustre of sphalerite (a copper sulphide mineral) can be seen in a greyish mass usually made up of sphalerite and galena (a lead sulphide mineral). Within this greyish mass, it‘s possible to distinguish the iridescent lustre of bornite (a copper sulphide mineral; generally with brown to copper-red colour on fresh surfaces that tarnishes to various iridescent shades of blue to purple in places; its striking iridescence gives it the nickname “peacock ore“). In association to the bornite zones, minor chalcocite (a copper sulphide mineral) can also be recognized in the sample. Bornite is oftentimes replaced by chalcocite in the supergene enrichment zone of copper deposits.

• The last shown sample also hosts massive sulphide mineralization, however in an intermediate state of oxidation between the first and second samples. A higher level of chalcocite can be seen, whereas the sulphides are not yet completely oxidized (jarosite). Within a crystalline quartz matrix, the oxidation corresponds to a mass of hematite and goethite (both iron oxide minerals) with less manganese.

Riotinto Mine (Atalaya) on trend with Nuevo Tintillo (Emerita)

Click above player or here to watch a video of the Cerro Colorado open-pit with comments from Emerita´s President Joaquin Merino-Marquez (middle) and CEO David Gower (right) – video at the end from resource investor Doc Jones.

According to the site-visit booklet provided by Emerita: "Atalaya Mining started commercial production in February 2016 with an initial processing rate of 5Mtpa. Since then, the commercial production rate has increased to 15Mtpa. A recently updated Statement estimates Proven and Probable Ore Reserves totalling 197 Mt at 0.42% Cu (0.82 Mt of contained Cu). Measured and Indicated Resources total 258 Mt at 0.40% Cu. The Rio Tinto [also known as Riotinto] Deposit is thought to contain up to 500 Mt of Massive Sulphides and 100 kt of gossan. The gossan, mined since Roman times, grades 2 ppm Au and 60 ppm Ag, a much higher grade than found in the Massive Sulphides. A major part of the Cu Reserves is located in the stockwork below the Massive Sulphides. The deposit has two open pits: Atalaya and Cerro Colorado. This latter is the active one. The underlying stockworks crop out in the Cerro Colorado area."

Full size / Nuevo Tintillo map shown during site-visit (with green-yellow annotations by Rockstone).

According to the site-visit booklet provided by Emerita: "The Nuevo Tintillo Property is located between the Cobre Las Cruces and Rio Tinto deposits. A thrust belt running roughly along the centre of the Property is the main structural corridor along which mineralized occurrences and former mines are found. Regional mapping indicates that the same thrust fault controlling the mineralization at Rio Tinto outcrops here too. Waste dumps from Atalaya´s Rio Tinto mines are visible from Santa Flora in the distance."

On May 28, 2021, Emerita announced to have won a public tender process for the Nuevo Tintillo Property: “Emerita has increased its land position in the Iberia Belt and has acquired the highly prospective Nuevo Tintillo Property through a public tender, which is located approximately 10 km from the Aznalcollar property in Sevilla Province... Emerita’s work on the Property is in the early stages and a more detailed summary of the potential will be presented once compilation of historical data is completed. The Company has a 100% interest in the Nuevo Tintillo project which has numerous base metal occurrences [see figure ...] including several small historical open pits, some of which reportedly host high Cu grades (Pinedo Vara et al.). The project has not been subject to modern mineral exploration techniques. The project extends approximately 23 kilometers in an east-west direction along a well defined mineralized horizon and extends up to 5 kilometers in the north-south direction. It totals 8,960 hectares in 289 claims. There are at least 8 known mineralized zones within the project based on historical mining and prospecting.“

Aznalcollar and Los Frailes open-pits

Click above player or here to watch. To watch the same video with normal speed click here.

Above video shows both open-pits known as Corta Los Frailes and Corta Aznalcollar.

• Corta Aznalcóllar: “This pit was mined from October 1975 to June 1996... After mineral extraction was completed, it was used as a dump for the neighbouring Los Frailes pit. It then became a deposit for the sludge collected during the cleaning of the Guadiamar river after the dam was broken up in 1998, and has subsequently received materials from the cleaning of some low-grade stocks and has also been used as part of the water purification circuit prior to discharge into the river. It is currently partially filled with contact water, tailings and low-grade materials from Los Frailes and sludge from the cleaning of the tailings dam break.“ (Source)

• Corta Los Frailes: “After the end of ore mining at the Aznalcóllar mine, the Los Frailes mine was opened in September 1995 and remained in operation until 2001, when mining activity ceased definitively due to the fall in the price of metals. The cessation of operations at the Los Frailes pit occurred without completing the extraction of ore from the deposit, which is currently flooded with runoff and rainwater. Precisely because it was operated earlier, some of the necessary infrastructure and facilities are already in place, which means that less time is needed for the start of operations.“ (Source)

The video shows the tremendous size of the waste rock dumps and tailings ponds for the Aznalcóllar-Los-Frailes open-pit mining and processing operations. Such gigantic throughput can be reduced significantly with underground mining, minimizing the risk of future dam failures. Boliden’s mine plan for Los Frailes included a low-grade but large open-pit with a historical resource estimate* of 71 Mt @ 3.86% Zn, 2.18% Pb, 0.34% Cu + 60 g/t Ag. Emerita‘s review of the historical drilling data indicates the potential existence of a higher grade portion of the resource that is estimated* to contain 20 Mt @ 6.65% Zn, 3.87% Pb, 0.29% Cu + 84 g/t Ag (“remains open for expansion“). In its documentation filed for the public tender process, Emerita proposed to first mine the higher grade portion of the deposit with underground methods. Benefits: No huge waste rock piles and tailings ponds, with tailings going back underground as paste fill, lower capital expenditures, smaller mill, more environentally friendly.

Los Frailes pit walls with massive sulphides (VMS) in dark

Click above player or here to watch.

At Aznalcollar and Los Frailes, the outcropping and near-surface VMS lenses were mined towards the centre of the pits, hence mostly barren to low-grade rocks visible in the pit walls, however locally with offshoots, dikes and plate-like bodies of semi-massive to massive sulphide mineralization.

Full size / *A qualified person as defined in NI 43-101 has not done sufficient work on behalf of EMO to classify the historical estimate as a current mineral resource and EMO is not treating the historical estimate as current mineral resource or mineralreserve. The resource estimate is a historical estimate and should not be relied upon. Significant additional drilling and related work would be required to make the estimate a current mineral resource under NI 43-101. A summary of thehistorical resource estimate is available on the Government of Andalucia’s website in a report prepared by the prior operator of the Aznalcóllar Project entitled “Proyecto de Explotacion Yacimiento Los Frailes, Memoria Andaluza de Piritas, Boliden-Apirsa, Octubre 1994” (Los Frailes Development project Report, Boliden-Apirsa, October 1994) along with subsequent resource estimate updates, the latest being from 2000. (Source)

The 20 Mt high-grade portion of the historical resource* is entirely within the Los Frailes Deposit (center), the past producing Aznalcóllar Deposit (right) and a third deposit also “remain open and provide upside“. Deposit outcrops in the open-pit and remains open at shallow depths. The deposit thickness ranges between 30 and 90 m. The thickest section of the ore body lies below 150 m depth from surface. The Los Frailes and the previously mined Aznalcóllar deposits are both open for further expansion by drilling at depth, as historical drilling was primarily constrained to depths accessible by open pit mining. (Source)

Above cross-section of the Los Frailes Deposit shows Boliden‘s plans (1997) to mine the VMS lens with an “initial pit“ to be expanded later with 3 “pushbacks“, ultimately reaching depths of 300 m below surface with a high stripping ratio (i.e. a lot of waste material). To mitigate the environmental risks of large tailings ponds associated with open-pit mining, Emerita proposed in its tender documentation to extract the VMS body with underground mining methods, thus avoiding large waste rock piles and built-up of large tailings ponds at surface (waste and tailings to go back underground as paste fill) with the result of minimized environmental risks along with lower CAPEX requirements, including smaller mill.

Rocks from the Los Frailes pit walls

Click above player or here to watch.

The Aznalcóllar area has a long history of mining, dating from 3,000 years BC. “The Aznalcóllar orebody was discovered in 1956 and brought into production in 1979 by Andaluza de Piritas, S.A. (Apirsa) owned by Banco Central S.A. (Eptisa, 1998). Boliden purchased Apirsa in 1987. A second orebody, named Los Frailes with more than 70 Mt of ore, was then discovered and was mined shortly after.“ (Source)

The Aznalcóllar Los Frailes Zinc-Lead-Copper-Silver Project includes 2 past producing open-pit mines: Aznalcóllar (“Corta Aznalcóllar“, 1975-1996) and Los Frailes (“Corta Los Frailes“; 1995-2001), the latter closed due to a combination of low zinc prices and a severe tailings damn failure (1997). The operator at that time, Swedish mining giant Boliden, and the government subsequently rehabilitated the site. Boliden ultimately left Spain, returning the project to the Spanish government. Due to demands of the local community for employment, the government initiated a public tender to re-develop the mine. The tender was unanimously supported by all political parties. Emerita participated in the tender and is hopeful to get awarded the project in the near future.

Los Frailes mine facilities with near-by solar parks

Click above player or here to watch.

Above video shows the re-industrialized area ("Minera Los Frailes") with run-off ponds, water treatment plants, restored tailings dam (now used for solar park) and finally the eastern waste rock dumps (solar park on top) near the Los Frailes pit.

Full size / See google maps here

According to Varun Arora of Clarus Securities Inc.: "We visited the Aznalcollar project and were impressed by the access (via highways and paved roads), infrastructure and the scale of the project (historic open pit mines). The property is located ~36 km from Seville and is just 10 km from First Quantum’s Las Cruces mine and also ~50 km from the Riotinto mine that was recently permitted for a sulphide expansion and underground mining (June 2021)... Update on Aznalcollar with Emerita’s Spanish counsel: Some important takeaway from our discussion with the counsel were:

• The validity of Emerita’s bid for the Aznalcollar public tender is not under adjudication in the current civil and criminal court case. This implies that, as per the Spanish law, if Minorbis-Grupo Mexico’s bid is disqualified then the tender will be granted to the next qualified bidder, which is Emerita in this case.

• The Company’s Spanish Counsel, Ramón Escudero, believes that the administrative court may announce its decision at any time within the next couple of months, and in advance of a verdict in the criminal case.

• In case the administrative court announces a resolution in favour of Emerita then the Regional government (Junta), which in the first place resolved in favor to Grupo México, can appeal that decision. The Appeals court will review only very specific points highlighted as grounds for appeal by the Junta, rather than reviewing the whole case again.

• The evidence discovered in the criminal investigation is also in front of the Administrative Court. Much of the evidence is related to administrative irregularities in the tender process that should allow the Administrative Court to base its decision on, ahead of the verdict from the criminal court case."

Full size / Corta Los Frailes in front of Corta Aznalcollar with town of Aznalcollar in the background.

The renowned Iberian Pyrite Belt is one of the most productive VMS terranes in the world. Infrastructure and access is exceptional.

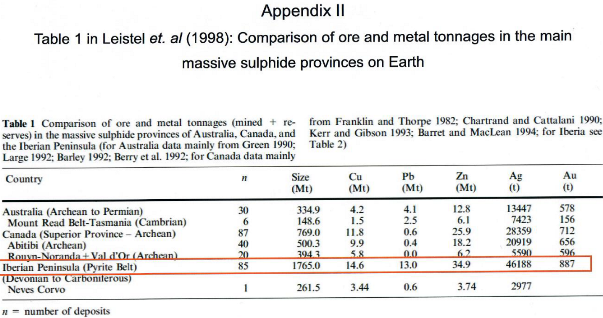

“The Iberian Pyrite Belt (IPB) has been one of the major mining districts in Europe since prehistoric times. It is an area of significant geological and metallogenic interest because it represents the largest concentration of metallic sulfide deposits on Earth. With more than 2000 Mt of massive sulfide ore, the IPB comprises an exceptional number of supergiant deposits, including the biggest in this class: Riotinto (>500 Mt) and Neves Corvo (≥300 Mt).“ (Source: “Massive Sulfide Ores in the Iberian Pyrite Belt“, 2019)

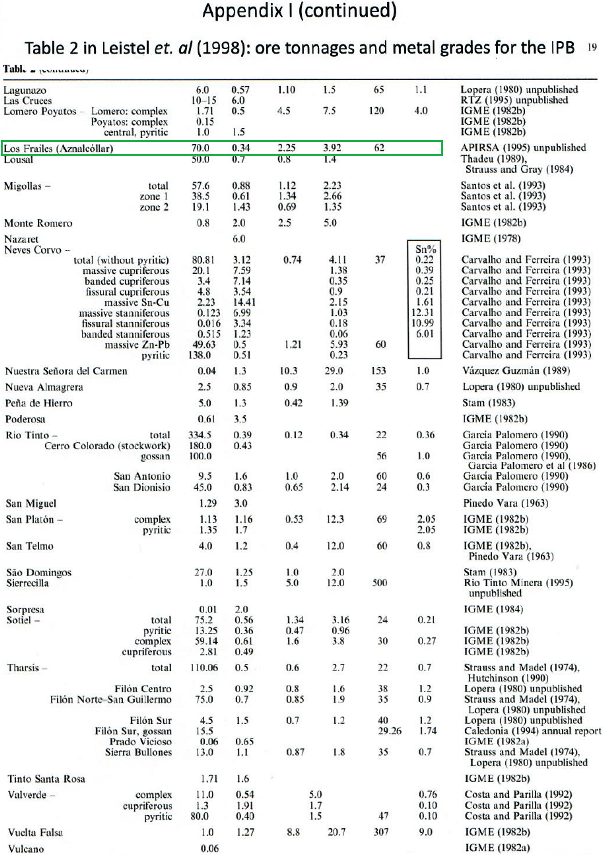

“The Iberian Pyrite Belt (IPB), with more than 80 known deposits containing >1700 Mt of sulphide ore (mined and reserves), is one of the largest (if not the largest) of the world‘s massive sulphide provinces... Compared with other world-class provinces, especially on an equal-area basis, the IPB stands out clearly as a “monster“ in terms of relative metal weight; its sulphide and metal tonnages are far greater, and the Neves-Corvo deposit alone is comparable to the whole of the Canadian and Australian provinces... With more than 80 known deposits, the IPB sulphide resources (ore mined + reserves) are in excess of 1700 Mt, totalling 14.6 Mt Cu [32 billion lbs], 13.0 Mt Pb, 34.9 Mt Zn, 46.1 Kt Ag [1.5 Boz] and 880 t Au [28 Moz]). Moreover, numerous deposits in the IPB were traditionally mined only for pyrite and their polymetallic potential was commonly not recognized; improved knowledge of these deposits will probably increase the known sulphide tonnage significantly and improve the metal potential of the belt, as has been indicated recently by the discovery or confirmation of extensions to the old mines of Aguas Tenidas, Concepcion, La Zarza and Tharsis. Furthermore, the potential of the IPB is still open for sophisticated exploration at depth, as is shown by the discovery of blind deposits such as Gaviao, Lagoa Salgada, Neves-Corvo, Cabezo Migollas, Los Frailes, Valverde and Las Cruces.“ (Source: “The volcanic-hosted massive sulphide deposits of the Iberian Pyrite Belt”, 1998)

Full size / Source: Site-visit booklet provided by Emerita in November 2021 (with green annotations by Rockstone). A Qualified Person, as defined in National Instrument 43-101, has not done sufficient work on behalf of Emerita to classify the historical estimates reported above as current mineral resources or mineral reserves and Emerita is not treating the historical estimate as current mineral resources or mineral reserves. The historical estimates should not be relied upon. Stated deposits are not necessarily indicative of the potential of Emerita and its properties and should not be understood or interpreted to mean that similar results will be obtained from EMO and its properties. Results of stated deposits, past producers, active mines, exploration and development projects in the region or globally are not necessarily indicative of the potential of Emerita´s properties and should not be understood or interpreted to mean that similar results will be obtained.

Full size / Source: Site-visit booklet provided by Emerita in November 2021 (with green annotations by Rockstone). A Qualified Person, as defined in National Instrument 43-101, has not done sufficient work on behalf of Emerita to classify the historical estimates reported above as current mineral resources or mineral reserves and Emerita is not treating the historical estimate as current mineral resources or mineral reserves. The historical estimates should not be relied upon. Stated deposits are not necessarily indicative of the potential of Emerita and its properties and should not be understood or interpreted to mean that similar results will be obtained from EMO and its properties. Results of stated deposits, past producers, active mines, exploration and development projects in the region or globally are not necessarily indicative of the potential of Emerita´s properties and should not be understood or interpreted to mean that similar results will be obtained.

“The Iberian Pyrite Belt (IPB) is one of the largest volcanic/sediment-hosted massive sulphide (VSHMS) provinces including more than 88 known deposits, representing the largest sulfur and iron crustal anomaly on Earth. Some of those deposits are considered giant in size, e.g., Neves-Corvo, Aljustrel, Lousal and São Domingos (in Portugal) and Rio Tinto, Tharsis, Sotiel and Aznalcóllar (in Spain), comprising ca. 2000 Mt of massive sulfides. Identical metallogenetic provinces, such as Val d´Or (Canada) and the Mount Read Belt (Tasmania), are also hosted in a Volcanic Sedimentary Complex (VSC) sequence as IPB polymetallic mineralizations. Due to its base metal occurrences, the IPB has been subject of numerous mineral exploration programs in the last decades, which have gathered a huge volume of geological, geochemical and geophysical data.“ (Source: “Geochemistry of Iberian Pyrite Belt“, 2020)

Full size / Source: Site-visit booklet provided by Emerita in November 2021.

Previous Rockstone Reports

August 18, 2021: "BACK TO WHERE IT ALL BEGAN: To Bring Back Metallic Mammoth Deposits With Modern Exploration And Environmentally Sound Mining" (PDF)

February 10, 2021: "Emerita trades heavy volumes amid Spanish media reporting important ruling in the case of the Aznalcollar public tender"

September 9, 2020: "From Zero to Hero: Emerita Resources wins Paymogo mining rights to now go full blast developing a best-in-class zinc project in Spain" (PDF)

October 28, 2016: "Emerita on the case to get awarded the Aznalcóllar Zinc-Lead-Silver Project in Spain"

Company Details

Emerita Resources Corp.

36 Lombard Street – Floor 4

Toronto, Ontario, Canada M5C 2X3

Phone: +1 416 566-8179

Email: info@emeritaresources.com

www.emeritaresources.com

ISIN: CA29102L4064

Shares Issued & Outstanding (Fully Diluted; as of August 4, 2021): ~232,460,841

Canadian Symbol (TSX.V): EMO

Current Price: $2.89 CAD (12/21/2021)

Market Capitalization: $672 Million CAD (Fully Diluted)

German Symbol / WKN (Frankfurt): LLJA / A2PKVQ

Current Price: €1.83 EUR (12/21/2021)

Market Capitalization: €425 Million EUR (Fully Diluted)

Contact:

Rockstone Research

Stephan Bogner (Dipl. Kfm.)

8260 Stein am Rhein, Switzerland

Phone: +41-44-5862323

Email: info@rockstone-research.com

www.rockstone-research.com

Clarus Securities Inc. Disclaimer: "The analyst has visited the Company’s operations in Spain in November 2021. Partial payment or reimbursement was received from the issuer for the associated travel costs. Within the last 24 months, Clarus Securities Inc. has managed or co-managed a public offering of securities of this company. Within the last 24 months, Clarus Securities Inc. has received compensation for investment banking services with respect to the securities of this company. The information and opinions in this report were prepared by Clarus Securities Inc. (“Clarus Securities”). Clarus Securities is a whollyowned subsidiary of Clarus Securities Holdings Ltd. and is an affiliate of such. The reader should assume that Clarus Securities or its affiliate may have a conflict of interest and should not rely solely on this report in evaluating whether or not to buy or sell securities of issuers discussed herein. The opinions, estimates and projections contained in this report are those of Clarus Securities as of the date of this report and are subject to change without notice. Clarus Securities endeavours to ensure that the contents have been compiled or derived from sources that we believe are reliable and contain information and opinions that are accurate and complete. However, Clarus Securities makes no representation or warranty, express or implied, in respect thereof, takes no responsibility for any errors and omissions contained herein and accepts no liability whatsoever for any loss arising from any use of, or reliance on, this report or its contents. Information may be available to Clarus Securities or its affiliate that is not reflected in this report. This report is not to be construed as an offer or solicitation to buy or sell any security. No part of this report may be reproduced or re-distributed without the written consent of Clarus Securities. The research analyst and/or associates who prepared this report are compensated based upon (among other factors) the overall profitability of Clarus Securities and its affiliate, which includes the overall profitability of investment banking and related services. In the normal course of its business, Clarus Securities or its affiliate may provide financial advisory and/or investment banking services for the issuers mentioned in this report in return for remuneration and might seek to become engaged for such services from any of such issuers in this report within the next three months. Clarus Securities or its affiliate may buy from or sell to customers the securities of issuers mentioned in this report on a principal basis. Clarus Securities, its affiliate, and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities discussed herein, or in related securities or in options, futures or other derivative instruments based thereon. Each Clarus Securities research analyst whose name appears on the front page of this research report hereby certifies that (i) the recommendations and opinions expressed in the research report accurately reflect the research analyst’s personal views about the Company and securities that are the subject of this report and all other companies and securities mentioned in this report that are covered by such research analyst and (ii) no part of the research analyst’s compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed by such research analyst in this report. Clarus Securities’ Equity Research is available via our website and is currently distributed in electronic form to our complete distribution list at the same time. Please contact your Clarus institutional sales or trading representative or investment advisor for more information. Institutional clients may also receive our research via THOMSON and REUTERS."

Research Capital Corp. Disclaimer: "RISKS: EMO is exposed to a variety of business risks including, but not limited to, unexpected development or operating issues, permitting factors, and commodity and currency fluctuations. External financing requirements are also key risks, owing to the Company’s lack of operating cash flow. EXPLORATION RISKS| Exploration comes with the risks inherent with exploration activities. Exploration can provide significant upside for investors, but it can also disappoint. TENDER PROCESS RISKS | EMO is awaiting the outcome of a tender process for the Aznalcóllar project. There is a risk that the company will not be successful. COMMODITY RISKS| Like all exploration companies, EMO is subject to fluctuations in commodity prices, specifically zinc (and other metals). If the price of these commodities drops materially, future equity raises may come with higher than anticipated dilution and the development of the project may become more challenging as financing would be more difficult to arrange. CURRENCY RISKS| EMO’s functional currency is the Canadian dollar, while metals are priced in US Dollars and its exploration occurs in Spain. Changes in the exchange rates between these currencies may have a positive or negative impact on EMO. FINANCIAL RISKS| We believe EMO is sufficiently financed to complete its 2021 exploration program with a cushion remaining at the end of the year. If the company is to maintain an aggressive exploration program and/or it wins the Aznalcóllar tender process, it will likely have to raise additional funds. POLITICAL, SOCIAL AND ENVIRONMENTAL RISKS| EMO operates in Spain, a country with a well-developed mining culture and legislation. However, environmental concerns are taken very seriously and EMO will have to work diligently to maintain itself as a good corporate citizen. The information contained in this report has been drawn from sources believed to be reliable but its accuracy or completeness is not guaranteed, nor in providing it does Research Capital Corporation assume any responsibility or liability. Research Capital Corporation, its directors, officers and other employees may, from time to time, have positions in the securities mentioned herein. Contents of this report cannot be reproduced in whole or in part without the express permission of Research Capital Corporation. US Institutional Clients – Research Capital USA Inc., a wholly owned subsidiary of Research Capital Corporation, accepts responsibility for the contents of this report subject to the terms and limitations set out above. US firms or institutions receiving this report should effect transactions in securities discussed in the report through Research Capital USA Inc., a Broker – Dealer registered with the Financial Industry Regulatory Authority (FINRA). RELEVANT DISCLOSURES APPLICABLE TO COMPANIES UNDER COVERAGE: 1. Relevant disclosures required under IIROC Rule 3400 applicable to companies under coverage discussed in this research report are available on our web site at www.researchcapital.ca 2. This Issuer has generated investment banking revenue for RCC. 3. The analyst conducted a site visit to view operations in November 2021. Accommodations, meals, and the COVID PCR test were paid by the issuer. 4. The analyst does not own shares of EMO. I, Adam Schatzker, certify the views expressed in this report were formed by my review of relevant company data and industry investigation, and accurately reflect my opinion about the investment merits of the securities mentioned in the report. I also certify that my compensation is not related to specific recommendations or views expressed in this report. Research Capital Corporation publishes research and investment recommendations for the use of its clients. Information regarding our categories of recommendations, quarterly summaries of the percentage of our recommendations which fall into each category and our policies regarding the release of our research reports is available at www.mackieresearch.com or may be requested by contacting the analyst. Each analyst of Research Capital Corporation whose name appears in this report hereby certifies that (i) the recommendations and opinions expressed in this research report accurately reflect the analyst’s personal views and (ii) no part of the research analyst’s compensation was or will be directly or indirectly related to the specific conclusions or recommendations expressed in this research report."

Rockstone Disclaimer: This Rockstone report contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Emerita Resources Corp. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to Emerita Resources Corp.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through its profile on SEDAR at www.sedar.com. Please read the full disclaimer within the full research reports as a PDF (here) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, holds an equity position in Emerita Resources Corp., as well as in Zimtu Capital Corp., and is being paid by Zimtu Capital Corp. for the preparation, publication and distribution of this report, whereas Zimtu Capital Corp. also holds a long position in Emerita Resources Corp. Note that Emerita Resources Corp. pays Zimtu Capital Corp. to provide this report and other investor awareness services. The author has received partial payment or reimbursement from Emerita Resources Corp. for the associated travel costs and has received accomodation and other hospitality organized and paid by Emerita.