Disseminated on behalf of Zinc8 Energy Solutions Inc. / MGX Renewables Inc. and Zimtu Capital Corp.

With stock markets crashing like there was no tomorrow, the fear of a global recession is becoming a reality. During such times, smart institutional and private investors don‘t watch from the sidelines but are deploying their capital into recession-proof sectors that provide “essential services“. With all kinds of stocks getting liquidated at the moment, investors and portfolio managers alike are basically just re-allocating funds to re-balance their portfolios in order to adapt to the new realities. At best, recession-proof stocks are added to investment portfolios to safeguard them against times of uncertainty and economic decline – while at the same time, betting on the next big industry evolving as a clean winner out of this dirty mess.

Renowned John Persinos describes in his article “The Recession-Resistant Power of Utilities” why this specific breed of service providers is known to be immune to recessions:

“The growing need for utilities will never wane... Whether we’re in an expansion or contraction, in a bull or bear market, people will always need certain necessities... Utilities confer growth, safety and income, in good times or bad. In these fraught market conditions, when the daily news sometimes seems like a nightmare, utilities are a sleep-well-at-night sector...”

With Zinc8 Energy Solutions Inc. targeting utilities, they have focused on some of the most stable partners and customers in the market place. Unlike many other companies, business at public power utilities typically does not slow down during a recession but decision makers, following state government regulations, tend to even increase capital investments, ramping up (e.g. efficiency projects) in order to make services more affordable for their customers.

As Zinc8’s patented long-duration energy storage system targets creating a more efficient next-generation smart grid, the company is providing a much-needed solution to utilities, irrespective of economic up or downturns. The aforementioned article advised that “you should focus on long-term investment trends that are unstoppable.” Zinc8 is a unique bet on just that.

Last week, Forbes contributor David Vetter published the article “How Coronavirus Makes The Case For Renewable Energy“, commencing as follows: “Reliance on fossil fuels has left countries more exposed to the economic shock of global crises like coronavirus, and governments should look to renewable energy to help reduce such risks, a leading financial economist has said...”

“The one-two punch of coronavirus and an oil price war devastated markets this week, underscoring the weaknesses of a global economy that is tied closely to the volatile behaviour of fossil fuel markets.” (Source: “How Coronavirus Makes The Case For Renewable Energy“, Forbes, March 13, 2020)

The Forbes article continues as follows:

Dr Charles Donovan, Executive Director of the Centre for Climate Finance and Investment at London’s Imperial College Business School, made the comments to Forbes.com at the end of a week that saw the confirmation of the COVID-19 coronavirus as a pandemic, along with an announcement by Saudi Arabia that it would increase oil supply at a time of declining demand. The one-two punch of events sent the Dow Jones Industrial Average tumbling by as much as 10%—the largest drop since 1987, causing central banks to issue further dire predictions of recession.

“I think we’re entering a whole new phase of volatility,” Donovan said. “These are the unfortunate repercussions of a global market that’s exposed to the volatility of the oil markets, and suffers when unforeseeable events like coronavirus arise at the worst time.”

Donovan suggested that such volatility was built into the global economy owing to over-reliance on fossil fuels.

We are now seeing the downsides of the choices we’ve made about the kind of energy economy that we have,” he said.

Guarding against the risks of further crises, from climate change to pandemics, would require not just short-term cash injections, but “joined-up thinking” by decision makers who should prioritize developing economies that are not coupled to oil and gas.

While campaigners and climate scientists promote renewable energy on environmental grounds, Donovan stressed that sustainable energy sources such as wind, solar and tidal power ought to be more attractive to investors and policymakers than fossil fuels on a purely economic basis.

“There has to be recognition that the increased volatility in the oil markets will stand in stark contrast to what may become the great virtue of renewable energy, which has nothing to do with its greenness, but more about the stability of cash flows from underlying assets,” Donovan said. “The relative stability of renewable energy that’s fully contracted, that already has power purchase agreements ... should make it immune from deterioration.”

This analysis rests in part on inherent characteristics of renewable energy: fuelled by wind, water or sunlight and captured by sustainable infrastructure, renewables are viewed as being more resistant to monopolization by cartels and outright manipulation...

The rest of the Forbes article also impressively demonstrates that Zinc8 Energy Solutions is strategically positioned with its long-duration zinc-air energy storage battery, entering the most ambitious ramp-up of a carbon-free energy infrastructure in the United States. Once again the center stage for pioneers of a new era: New York, the Empire State.

“On this day [March 15] in 1956, NYPA trustees approve the design for a Power Authority seal, developed by sculptor Paul Manship. Other notable works by Manship include the Prometheus Fountain in Rockefeller Center and the Paul J. Rainey Memorial Gateway at the Bronx Zoo.” (Source: Twitter @NYPAenergy)

Last Friday (March 13, 2020), New York State Governor Andrew Cuomo unveiled “details of the awards for 21 large-scale solar, wind, and energy storage projects across upstate New York, totaling 1,278 megawatts of new renewable capacity“:

These projects, which New York Energy Research and Development Authority and other State and local agencies will ensure are sited and developed responsibly, will spur over $2.5 billion in direct, private investments toward their development, construction and operation and create over 2,000 short-term and long-term jobs. The awards accelerate New York‘s progress towards Governor Cuomo‘s Green New Deal goal to obtain 70 percent of the state‘s electricity from renewable sources by 2030, as codified by the Climate Leadership and Community Protection Act, and supports the State mandate for a 100 percent carbon-free electricity sector by 2040.

“New York continues to be a leader in developing large-scale renewable energy projects in a way that brings significant economic benefits and jobs to the state,“ Governor Cuomo said. “With these projects we will build on our aggressive strategy to combat climate change and lay a foundation for a more sustainable future for all New Yorkers.“

This milestone demonstrates New York‘s real-time commitment to implementing the most ambitious clean energy agenda in the United States. Expected to generate over 2.5 million megawatt-hours of renewable energy annually - the projects will provide enough to power over 350,000 homes and reduce carbon emissions by more than 1.3 million metric tons annually, equivalent to taking nearly 300,000 cars off the road every year. The awards, totaling $1 billion in State investment, include projects that offered bids 23 percent lower than the bids received three years ago, representing considerable value for New Yorkers and highlighting the continuing significant cost declines of renewable energy.

The awards announced today are the third in a series of annual NYSERDA land-based renewable procurements that are expected to result in the development of dozens of large-scale renewable energy projects over the coming decade. For three consecutive years, NYSERDA has demonstrated the State‘s firm commitment to advancing renewable energy, awarding over 67 projects since 2018 – the most significant State commitment to renewables in the nation. These three rounds of land-based renewable awards, combined with New York‘s record-breaking commitment to offshore wind announced earlier this year, will be capable of generating over 12 percent of the state‘s expected electricity demand in 2030.

Alicia Barton, President and CEO, NYSERDA, said, “Under Governor Cuomo‘s leadership and as emphasized in his 2020 State of the State address, New York‘s steady advancement of large-scale renewable energy projects is helping create a clean energy future faster and more affordable than ever anticipated. Building on our success over the past three years, these projects, once completed, will deliver a significant amount of clean, renewable energy to all New Yorkers while helping to grow the state‘s green economy. With the impacts of climate change being felt in New York and around the world, moving rapidly to renewable forms of energy is imperative...“

ZAIR – Zinc8‘s New Trading Symbol

Yesterday after market close, Zinc8 Energy Solutions Inc. announced that its corporate name change will become effective at opening of the market on Friday, March 20, 2020 under the new symbol ZAIR. The new CUSIP number is 98959U108.

Ron MacDonald, President and CEO of Zinc8, commented: “This announcement is the latest step we have taken at Zinc8 Energy Solutions to bring clarity to the global market about who we are and the business we are in, long duration Zinc-Air energy storage. This official name change follows two recent Zinc8 announcements; our contract award and project collaboration with the New York Power Authority (NYPA) and our private sector deployment agreement with Digital Energy supported by Nyserda.“

Bottom Line

The recent COVID-19 outbreak has brought lots of uncertainty and has virtually caused an economic recession, with the energy sector being no exemption of this economic downturn. “However, economic crises also provide an opportunity for companies, industries and entire nations to restructure productive facilities and to explore new opportunities”, a research paper on “The Impact of the Economic Crisis on Innovation“ found out.

While an economic crisis has an adverse impact on most of the economic agents, in the long run it will not only generate losers. “Big companies will abandon speculative or underperforming business units”, a CNBC article forecasted last year. “On the plus side, this will leave new room for start-ups to find disruptive business models that the giants are suddenly too scared to touch.”

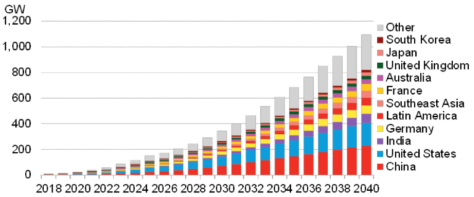

BloombergNEF expects the energy storage industry to grow 122-fold by 2040. There’s currently a race of contenders to position themselves on top of the leaderboard to get the largest size of the pie, with some companies being at a favorable stage to overcome the current economic shock and harness the positive outcomes that come thereafter. Zinc8 Energy Solutions, a Vancouver-based zinc-air battery manufacturer, is one of these companies poised to turn a global economic downturn to its own advantage.

According to the article “BNEF: Energy to storage increase 122X by 2040“: “Two big changes this year are that we have raised our estimate of the investment that will go into energy storage by 2040 by more than $40 billion, and that we now think the majority of new capacity will be utility-scale... Demand for storage will increase to balance the higher proportion of variable, renewable generation in the electricity system. Batteries will increasingly be chosen to manage this dynamic supply and demand mix. The report finds that energy storage will become a practical alternative to new-build electricity generation or network reinforcement. Behind-the-meter storage will also increasingly be used to provide system services on top of customer applications. The total demand for batteries from the stationary storage and electric transport sectors is forecast to be 4,584GWh by 2040, providing a major opportunity for battery makers...”

Zinc8 has some hard-to-stop momentum. The company has achieved breakthrough milestones in the past 4 months: a recent management reorganization, a private placement closing of an important amount, and two deployment agreements in different market sectors, including a 100kW/1.5 MW system in collaboration with the largest public power utility in the United States.

“Recessions test the mettle of investors and separate the strong companies from the weak”, the CNCB article noted. As a matter of fact, a recession might put Zinc8 in an advantageous position: companies that make it through to the other side of a recession will “face less competition, paving the way for massive upside during the next boom”.

Zinc8’s customers are recession-proof entities. Recession-proof refers to assets, companies, industries or other entities that do not decline in value during a recession, such as electric utilities. In a recession or stock market crash, utilities still earn significant amount of cashflow because they provide what’s called essential services: people will always find a way to pay the electricity bill, even in a recession.

There’s another reason why electric utilities are recession-proof: they typically operate under federal and state government regulations. And while this can limit the freedom of management’s decision-making, this sets a massive barrier of entry in the market, empowering them as a dominant economic force in an entire community. In fact, most electric utilities operate as legal monopolies. As regulated entities, utilities are kept from being exposed to potentially wild fluctuations in wholesale pricing, which avoids any impact on their balance sheet and expenditure plans.

Government expenditure supports Zinc8 Energy Solutions. During an economic recession, governments typically accelerate capital expenditure to try to reactivate the economy and avoid further downturn domestically, and investments in innovation for new energy storage technologies is high on the federal political agenda. Through internal technology, manufacturing, and supply chain development, the Department of Energy pursues to positioning the U.S. for global leadership in energy storage.

Proof of this is the announcement early this year of the Energy Storage Grand Challenge, which not only builds on the $158 million Advanced Energy Storage Initiative announced in President Trump’s Fiscal Year 2020 budget request, but also paves the development of a roadmap to 2030 for energy storage technologies. One of the main goals of the Energy Storage Grand Challenge is to reduce dependence on foreign sources of critical materials, which puts Zinc8 in an advantageous position against other storage technologies that rely on highly questionable components, such as cobalt and vanadium.

Latest Media Coverage on Zinc8 Energy Solutions

Mining Journal: “Zinc8 says zinc-air battery‘s time has come“ (March 17, 2020). Excerpts: “Teck Cominco had previously held the technology in its portfolio but ultimately divested when it became clear the closed-loop chemical process would not be a significant consumer of the base metal. But MacDonald said if batteries increased their share of the energy storage market from 2% to 10%, and Zinc8 took 5% of that storage market segment, it could capture a lucrative slice of the total market over the next few decades. ‘This translates into an accumulated installed capacity of 0.67GW by 2050. The Zinc8 battery consumes about 10kg of zinc per installed kWh, meaning the total accumulated demand for zinc from zinc-air batteries would be 1.33Mt,‘ MacDonald said.“

BestMag: “Zinc-air firm Zinc8 takes three positive steps into securing its energy storage future“ (March 13, 2020)

NYPA: “Energy Tech Roundup“ (March 13, 2020)

Energy Storage News: “New York to host second 15-hour duration zinc battery energy storage system“ (March 13, 2020)

SmallCapNetwork: “Zinc8 Energy Solutions Update: First Private Sector Deployment“ (March 13, 2020)

TotallyEV: “A Manufacturer of Low-Cost Zinc-Air Batteries Gets a $600,000 Boost from NYSERDA“ (March 11, 2020)

North American Clean Energy: “NYSERDA Supports Zinc-Air Battery Energy Storage System in Brooklyn“ (March 11, 2020)

Bloomberg: “Meet Zinc, the Cheap Metal Gunning for Lithium’s Battery Crown“ (March 6, 2020)

Previous Rockstone Coverage

Report #5: “First Private Sector Energy Storage Deployment Contract for Zinc8 Energy Solutions: Second Commercial Agreement in New York City“

Report #4: “Visiting the Zinc8 Energy Storage Development and Production Facility: The Dawn of the Utility-Scale Battery Era“

Report #3: “The Largest State-Owned Power Utility in the USA Announces Collaboration with Zinc8 Energy Solutions“

Report #2: “Reborn as Zinc8 Energy Solutions“

Report #1: “Bridging the Renewable Energy Infrastructure Gap“

Company Details

Zinc8 Energy Solutions Inc. (dba) /

MGX Renewables Inc.

#1 – 8765 Ash Street

Vancouver, BC, Canada V6P 6T3

Phone: +1 604 558 1406

investors@zinc8energy.com (Patrick)

www.zinc8energy.com

ISIN: CA59325P1080 / CUSIP: 59325P108

Shares Issued & Outstanding: 75,711,374

Canada Symbol (CSE): MGXR

Current Price: $0.32 CAD (03/17/2020)

Market Capitalization: $24 Million CAD

Germany Symbol / WKN (Tradegate): 0E9 / A2PNN3

Current Price: €0.202 EUR (03/17/2020)

Market Capitalization: €15 Million EUR

Contact:

Rockstone Research

Stephan Bogner (Dipl. Kfm.)

8260 Stein am Rhein, Switzerland

Phone: +41-44-5862323

Email: info@rockstone-research.com

www.rockstone-research.com

Disclaimer: This report contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Zinc8 Energy Solutions Inc. / MGX Renewables Inc. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the iZnc8 Energy Solutions Inc. / MGX Renewables Inc.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through their profiles on SEDAR at www.sedar.com. Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist. Zinc8 Energy Solutions Inc. / MGX Renewables Inc. pays Zimtu Capital Corp. to provide this report and other investor awareness services.The author, Stephan Bogner, holds a long position in Zinc8 Energy Solutions Inc. / MGX Renewables Inc. and is being paid by Zimtu Capital Corp. for the preparation and distribution of this report, whereas Zimtu Capital Corp. also holds a long position in Zinc8 Energy Solutions Inc. / MGX Renewables Inc. The cover picture (page 1) has been obtained and licenced from luck luckyfarm and the picture of the earth covered by corona virus from Chameleon Pictures.