Disseminated on behalf of Apex Critical Metals Corp. and Zimtu Capital Corp.

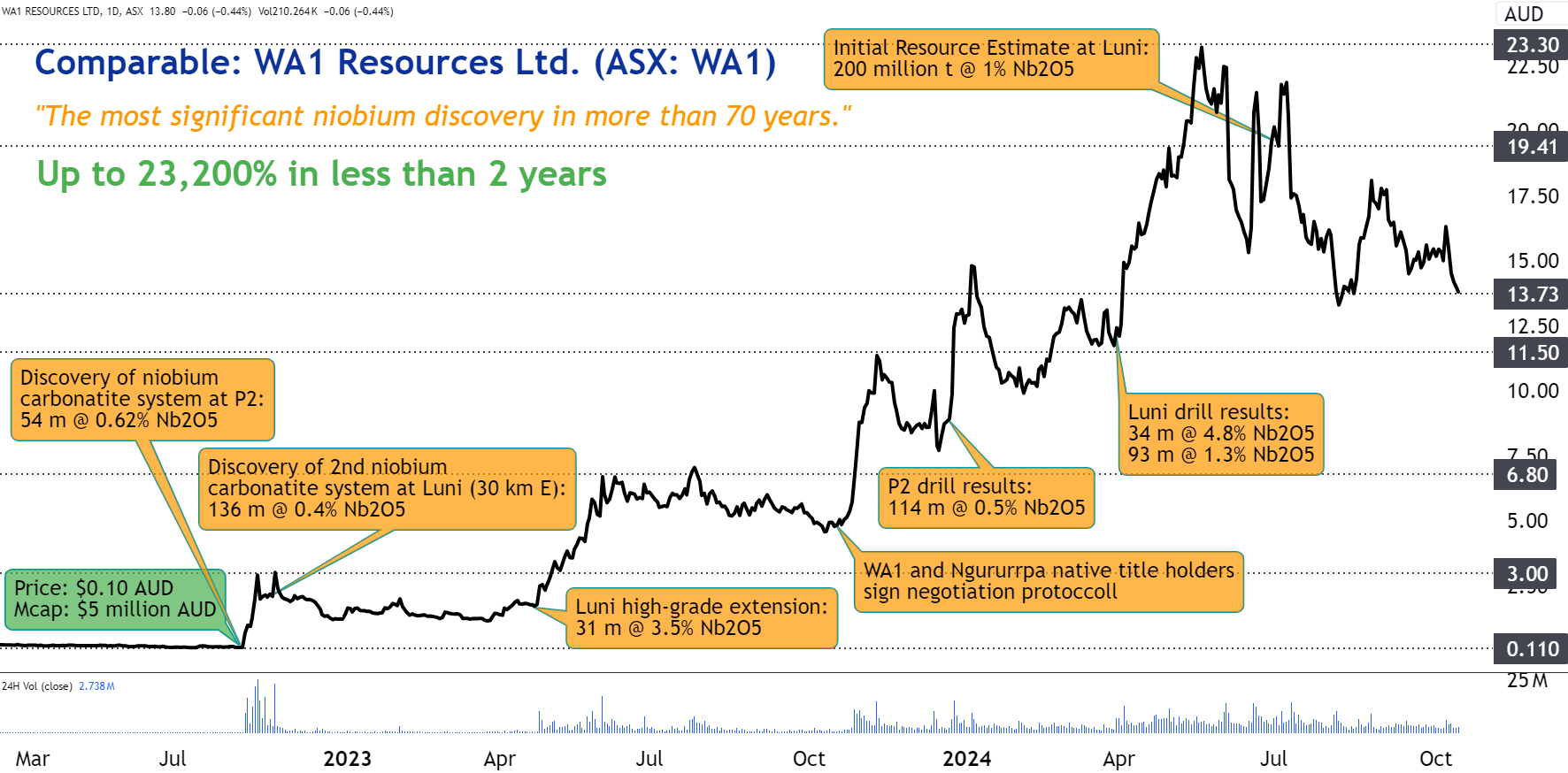

Niobium is back in the spotlight of investors following the remarkable discovery by WA1 Resources Ltd. in Western Australia. This former $5 million market cap company hit niobium paydirt in late 2022, when the stock was hovering around 10 cents. In July, WA1 Resources unveiled its maiden resource estimate of 200 million tonnes averaging 1% Nb2O5. With the company‘s valuation soaring to $1 billion and shares trading as high as $23 AUD, early investors have enjoyed a staggering 230-fold return in less than 2 years. This prime example underscores the crucial importance of early identification of the right company and project for investors.

Full size / Source / On July 1, 2024, WA1 Resources Ltd. announced its maiden resource estimate for the Luni Niobium Deposit in Western Australia containing “world-class grade and scale“ (Inferred: 200 million t averaging 1% Nb2O5 at a 0.25% Nb2O5 cut-off, spanning 3.6 x 1.4 km, with mineralized units ranging between 10-70 m in thickness with an average of 30 m): “This Mineral Resource estimate confirms Luni as the most significant niobium discovery globally in over 70 years... The shallow, high-grade nature of the deposit, coupled with the recently announced initial metallurgy results, indicates the deposit may be amenable to conventional processing techniques and reinforces Luni as a highly strategic critical mineral asset.“

The management team at Apex Critical Metals Corp. boasts an unparalleled track record in identifying early-stage projects with the potential to evolve into world-class ventures. Apex directors Jody Dahrouge and Darren Smith, both accomplished geologists, spearheaded the acquisition and discovery of the Corvette Lithium Deposit for Patriot Battery Metals Corp. This achievement catapulted the company to a valuation in excess of $1 billion last year, making it the steward of North America‘s largest lithium hard-rock deposit. Apex CEO Sean Charland brings extensive M&A and financing expertise to the table, having most recently served as a director during the sale of Alpha Lithium Corp. for an impressive sum exceeding $300 million.

Could history be repeating itself for this exceptional team, just as the surging interest in the critical metal niobium has ignited a new wave of investor excitement? Following a transformative restructuring, Apex is now poised to become yet another groundbreaking success story. With a compelling critical metals project portfolio focussed on niobium, rare earths and lithium, Apex has positioned its shareholders with exposure to some of the most lucrative and high-demand sectors in the resource industry. The Apex management team is committed to achieving another major discovery, striving to deliver exceptional value and returns for its shareholders. The moment has arrived for Apex Critical Metals to soar to unprecedented heights of excellence.

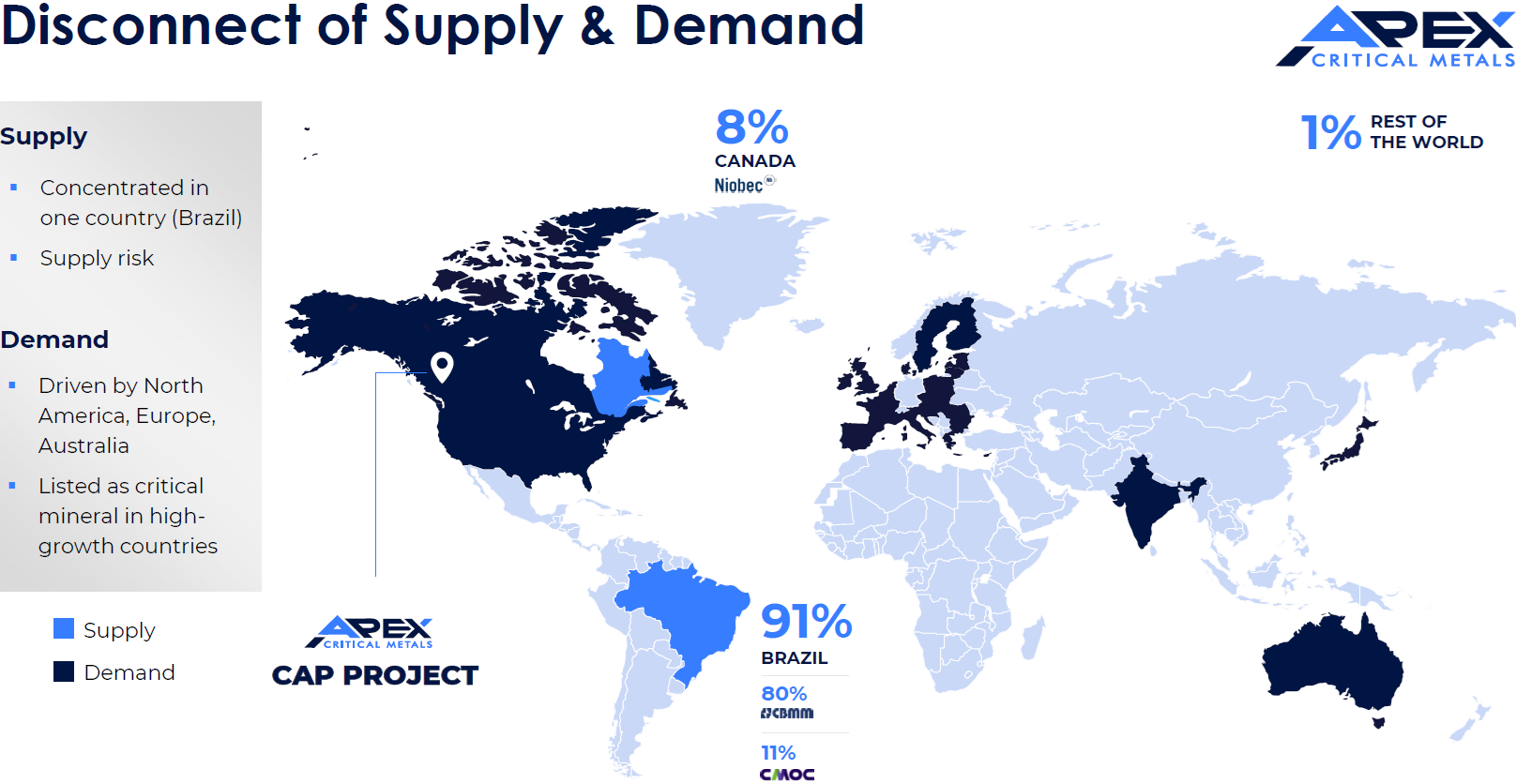

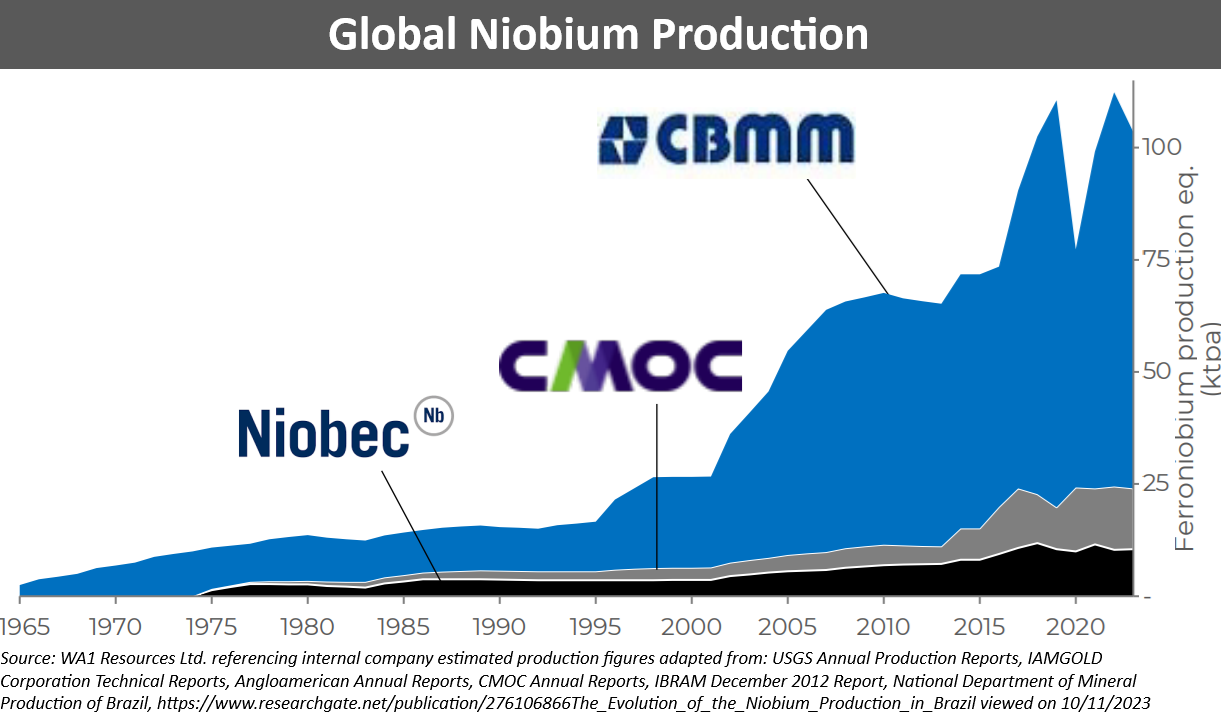

Discovering a significant niobium deposit is very special – and as such typically results in strong company valuations as recently evidenced by WA1 Resources – largely because only 3 primary niobium producers have been responsible for global supply over the last decades.

Full size / Source / Global niobium supply is largely controlled by Asian companies: CBMM sold a 30% stake to Chinese, Japanese and South Korean consortiums in 2011; Niobec investors include CEF Holdings Ltd. (a Hong Kong based investment company owned 50% by the Chinese conglomerate CK Hutchison Holdings Ltd. from Hong Kong) and Temasek Holdings Ltd. (an investment company owned by the Government of Singapore).

Given that the private Brazilian company CBMM produces about 80% of the world‘s niobium supply, North America‘s only primary niobium producer, the Niobec Mine in Canada, was sold for $530 million USD in 2015 to a group of Asian companies led by Magris Resources Inc. (a private company). A year later (2016), Anglo American sold the Catalao Niobium Mine in Brazil for an impressive $1.5 billion USD to CMOC (previously known as China Molybdenum Co. Ltd.). This substantial increase in valuation, despite both mines supplying roughly the same amount of niobium, underscores the growing strategic importance and market demand for niobium resources, a trend first and foremost recognized by Asian companies.

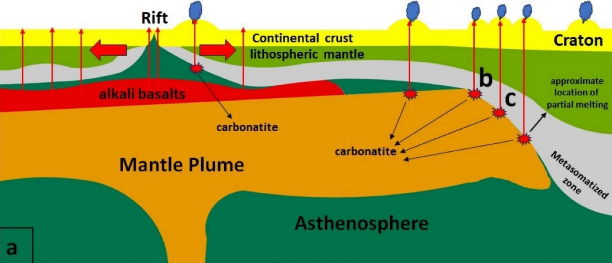

All 3 primary niobium mines, along with WA1 Resources‘ Luni Deposit, share a critical success factor: The niobium is hosted in carbonatite systems, a geologically ultra-rare type of mantle-derived magmatic intrusion.

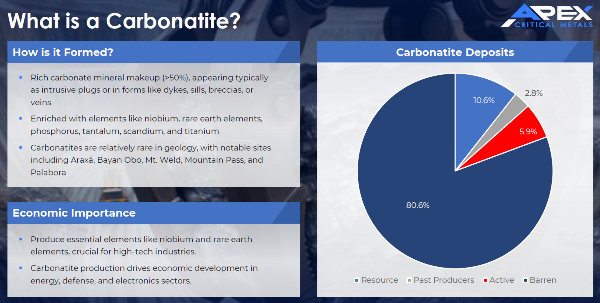

An estimated 600 carbonatites have been discovered globally, however most of them (80%) are barren. The remaining 20% of all carbonatites are mineralized with niobium, tantalum, REEs, fluorspar, scandium and/or titanium among other elements. “These [carbonatite] complexes are a subject of significant interest as they host large, sometimes unique in size, deposits of Nb, Ta, the cerium group of REE [...] and some other mineral commodities. In the 1970s, carbonatite-related deposits of Nb and Ce group of REE became the most important sources of these commodities...“ (Source)

Carbonatites are known to host some of the world‘s largest deposits, such as CBMM‘s Araxa (#1 in niobium, plus phosphate and REEs), Bayan Obo in China (#1 in REEs and fluorspar, plus iron and niobium), MP Materials‘ Mountain Pass in USA (REEs), Lynas‘ Mount Weld in Australia (REEs, plus niobium and tantalum), Commerce Resources‘ Ashram in Canada (REEs, fluorspar, niobium, tantalum, phosphate), and Palabora in South Africa (the world‘s only carbonatite-hosted copper mine, lacking significant concentrations of either niobium or REEs).

“Some 60% of the world‘s REE resources and the majority of world‘s global Nb production are associated with carbonatites... Some of the world‘s renowned carbonatite-associated REE deposits include the Bayan Obo deposit in Inner Mongolia, China, the Mountain Pass deposit in California, USA, and the Mount Weld deposit in Australia. Also, carbonatite-associated complexes in Brazil produce a majority of world‘s Nb. There are examples of Canadian REE +/− Nb occurrences associated with carbonatites; Saint-Honoré), Oka, and Ashram are hosted within the Canadian Shield, encompassing the Grenville, Superior, and Churchill geological provinces, whereas Wicheeda and associated occurrences within the Blue River complex are hosted within the Canadian Cordillera.“ (Mordor Intelligence, 2024)

Full size / Schematic representation of a scenario for the genesis of carbonatites (after Yaxley et al., 2021), including (a) direct partial melting of carbonated lithosphere near rift zones or along cratonic margins. (Source: “Predictive Modeling of Canadian Carbonatite-Hosted REE +/− Nb Deposits“, 2024)

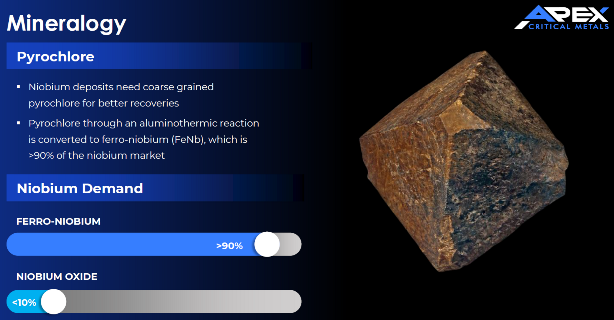

Full size / Source / “Pyrochlore is the most important group of the pyrochlore-supergroup minerals and constitutes the main Nb ore in the carbonatite deposits of the Late Cretaceous Alto Paranaíba Igneous Province (APIP), central Brazil... The APIP alkaline-carbonatite complexes, including the Araxá carbonatite complex (CBMM Nb mine: 896 Mt @ 1.49% Nb2O5) and the Catalão II carbonatite complex (Boa Vista Nb mine: 26 Mt @ 0.95% Nb2O5), account for ~92 % of the global Nb production over the last 50 years... In addition, the Niobec mine at Saint Honoré, Canada (2.6 Mt @ 0.42% Nb2O5) contributes approximately 7% of the global Nb production, while other minor deposits such as Lovozero, Russia and Pitinga, Brazil represent ~1%.“ (Source: “Origin of carbonatite-related niobium deposits: Insights from pyrochlore geochemistry“, 2023)

“The wide-ranging industrial applications of REEs and Nb coupled with the ever-increasing demand for these commodities render carbonatites highly appealing exploration targets...Decreasing discovery rates, a continually diminishing supply of current mineral resources, and a growing demand for various metals, all have the potential to disrupt the supply chains for many commodities. This is in particular pertinent to the so-called suite of “critical” minerals – metals, elements, or minerals that play a pivotal role in modern technologies and might face potential supply chain disruptions. Although different countries maintain their own lists of critical minerals, Canada‘s list (NRCan – RNCan, 2022) include niobium (Nb) and rare earth elements (REEs).“ (Source: “Predictive Modeling of Canadian Carbonatite-Hosted REE +/− Nb Deposits“, June 2024)

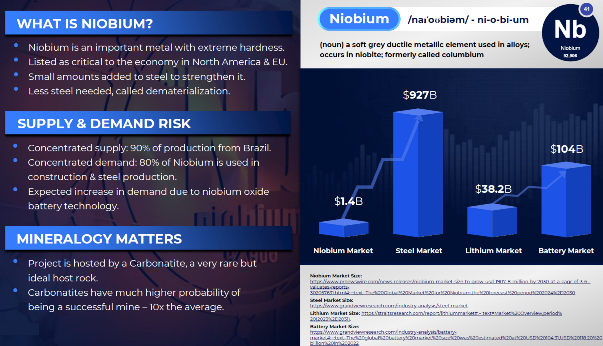

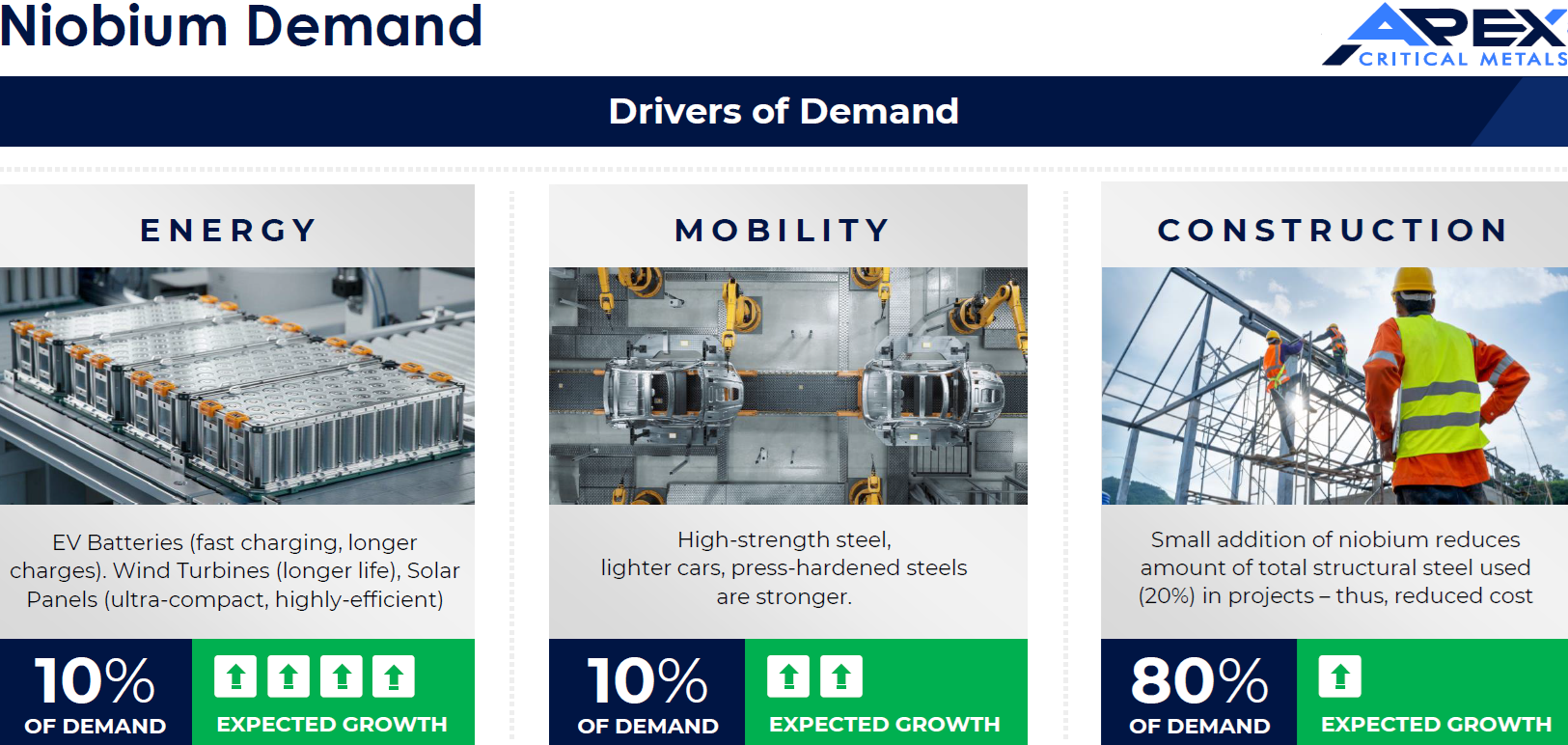

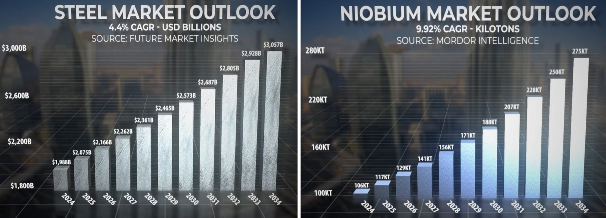

Full size / Source

“Over the medium term, accelerating usage of structural steel and increasing demand for lighter-weight and more fuel-efficient vehicles are some of the factors driving the growth of the [niobium] market... On the flip side, limited supply sources [...] is expected to hinder the growth of the market. However, the expected usage of niobium in next-generation lithium-ion batteries and innovative techniques [...] are anticipated to provide numerous opportunities over the forecast period. Asia-Pacific dominated the market with the largest consumption from countries, such as China and Japan... The construction industry is the largest consumer of niobium across the world... The building and construction industry is currently driving the demand for High Strength Low Alloys (HSLA) steel, which provides cost savings through weight reduction in buildings and prevents infrastructure failures... The construction sector has witnessed major investments in recent years. According to Oxford Economics, the global construction industry is expected to grow by USD 4.5 trillion, or 42%, between 2020 and 2030 to reach USD 15.2 trillion... Therefore, such robust growth in construction across the world is likely to boost the demand for the consumption of niobium during the forecast period.“ (Source: Mordor Intelligence, 2024)

The Cap Project

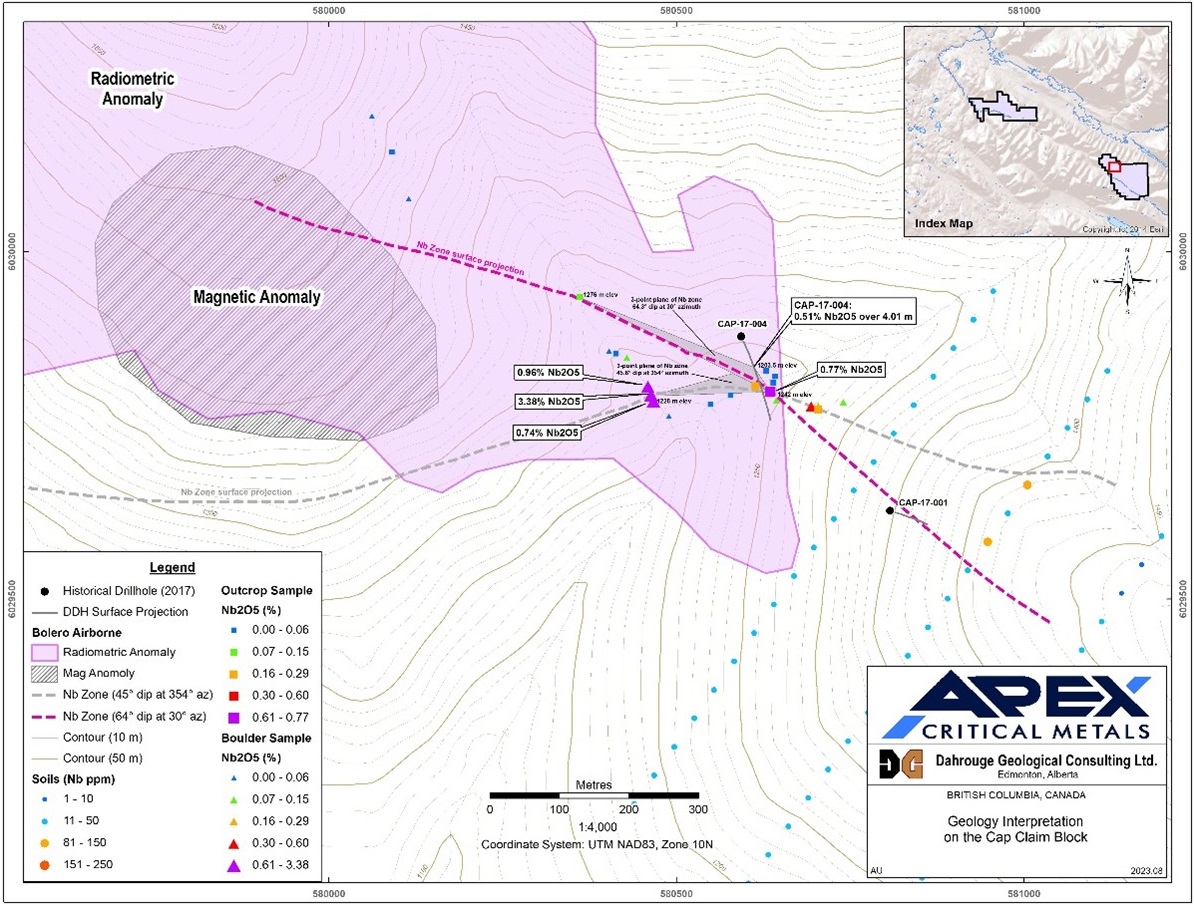

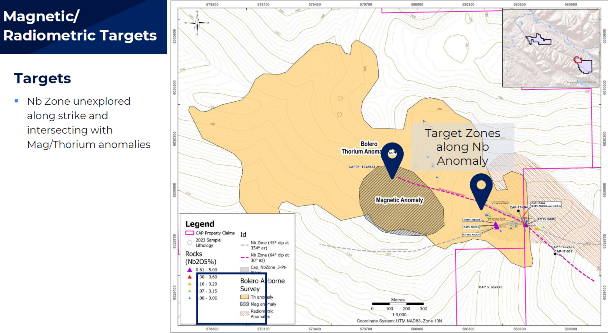

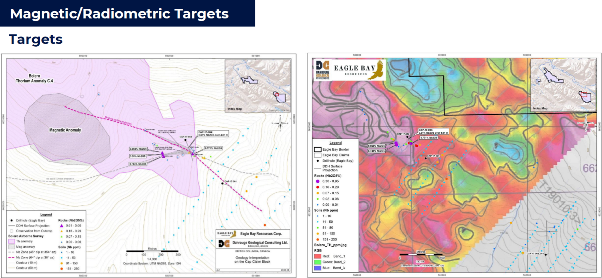

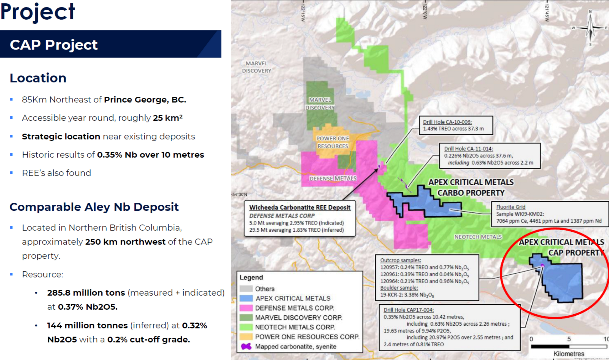

In July, Apex Critical Metals Corp. announced the start of a field exploration program at its Cap Project located in east-central British Columbia, near the community of Prince George. The Cap Project covers a large carbonatite complex which is considered highly prospective for both niobium and/or Rare Earth Element (REE) mineralization. The ongoing activities entail prospecting, geological mapping, rock and soil sampling to confirm previously identified niobium mineralization in both historical surface samples and drilling. The exploration work is expected to outline areas prospective for follow-up drill testing.

Full size / Source / Apex‘s Cap and Carbo Properties are located near Defense Metals Corp.‘s (TSX.V: DEFN; market cap.: $26 million) carbonatite-hosted Wicheeda REE Deposit (2023-Measured & Indicated: 34 million t @ 2.02% TREO; favourable conventional metallurgy; pre-feasibility study expected in 2025, targeting annual production of 25,000 t TREO, or ~10% of current global production).

The field exploration will be completed by Dahrouge Geological Consulting Ltd. of Edmonton, Alberta. Exploration activities are anticipated to last approximately three weeks and will expand upon a pre-existing soil grid that demonstrated niobium anomalies which correlated with the eastern margin of the known magnetic and radiometric anomaly. Field crews will continue to prospect near the previously identified carbonatite boulders and outcrops. Previously identified outcrop exposure was limited to drainage systems, with much of the project area covered by thick soil profiles and/or glacial till.

Historical results include:

• Large oval aeromagnetic anomaly, interpreted to correlated with a carbonatite igneous unit which may be associated with a larger alkalic complex.

• One outcrop sample and three boulder samples of carbonatite collected from within the aeromagnetic anomaly returned 0.77% Nb2O5, 3.38% Nb2O5, 0.96% Nb2O5, and 0.74% Nb2O5.

• A single drill hole along the southeast margins of the anomaly from 2017 returned 0.51% Nb2O5 over 4.01 m (Drill Hole CAP17-004).

The technical content of this news release has been reviewed and approved by Nate Schmidt, P. Geo., who is an Qualified Person (QP) as defined in National Instrument 43-101, Standards of Disclosure for Mineral Projects. The QP and the Company has not completed sufficient work to verify the historical information on the CAP Property, particularly regarding historical exploration, neighbouring companies, and government geological work.

5-Million-Share Stake in Discovery Lithium Inc. (CSE: DCLI) Adds Lithium Exposure

In June, Apex Critical Metals Corp.announced to have entered into an Earn-In Option Agreement with Discovery Lithium Inc. and DG Resource Management Ltd. on the West James Bay property portfolio. The portfolio includes the Mantle, Cirrus East, Cirrus West, Neptune, Alto, Opus and Bruce Lake projects located within the James Bay Region.

Click here to watch a corporate video from Discovery Lithium Inc. highlighting the company‘s highly prospective lithium portfolio in Quebec backed by an expert team working alongside Shawn Ryan who earned his reputation as a successful, world-renowned prospector. Shawn now brings his expertise to focus on the flourishing lithium sector by leveraging his proven methods and persistent approach into making Quebec the next chapter in his growing story of success.

Key Terms of the Transaction

Upon and subject to the terms of this Agreement, Apex and DG Resource will grant Discovery Lithium the sole and exclusive right and option to acquire, as to 40% from DGRM and as to 40% from Apex, an undivided 80% Earned Interest in the Mantle, Cirrus East, Cirrus West, Neptune, Alto, Opus and Bruce Lake projects, free and clear of any Encumbrance, subject only to the Royalty. To maintain the Option in good standing, Discovery Lithium will make a share issuance within 5 days of signing the agreement of 5,000,000 shares, and a incur a minimum expenditure of $1,000,000 on or before the date that is six (6) months from the effective date.

Project Portfolio

Mantle and Bruce Lake Project(s): Situated within the Yasinski Lake Greenstone Belt, the Mantle Project aligns with several significant lithium discoveries. Spanning 5049 hectares (~12476 acres) across 89 claims in the James Bay area, Quebec, the project is adjacent to recent LCT Pegmatite discoveries of Q2 Metals Corp and Ophir Gold Corp. This under-explored region has seen a surge in LCT Pegmatite exploration, with several active exploration projects within the area. Bruce Lake, lies immediately north of Q2 Metals Corp. Mia Project, where recent drilling identified several spodumene bearing pegmatites.

Cirrus East Project: The Cirrus East Project, less than 3 km from newly discovered Spodumene-bearing pegmatites, comprises 44 claims across 2252 hectares (~5565 acres) within the James Bay area. The easternmost claims are in close proximity to the Cancet West lithium pegmatite discovery of Fin Resources Ltd. (ASX) and approximately 15 km from the Warhawk Pegmatite of James Bay Minerals (ASX).

Cirrus West Project: Comprising 333 claims across 16953 hectares (~41892 acres) within the James Bay area, the Cirrus West Project is proximal to several known lithium occurrences, including the Warhawk Pegmatite. The project is underlain by favourable host lithology, including metasediments and metavolcanics of the Lac Guyer greenstone belt.

Neptune Project: Known for its anomalous lithium in stream/sediment samples, the Neptune Project consists of 78 claims across 4009 hectares (~9906 acres) within the James Bay area. The region hosts several tourmaline-bearing pegmatites and is home to notable lithium explorers such as Azimut Exploration Inc. and Brunswick Exploration Inc.

Alto Project: Situated less than 10 km from recent pegmatite discoveries, the Alto Project comprises 79 claims across 4136 hectares (~10221 acres) within the James Bay area. The project is west of Ophir Gold Corps Pilipas Project and Quebec Precious Metals newly discovered Ninaaskumuwin spodumene pegmatite, which is described as a 175-meter long by 42-meter wide outcrop.

Opus Project: Located just north of Lebel-sur Quevillon village, the Opus Project consists of 61 claims across 3413 hectares (~8434 acres) within the James Bay area. The project is within a short distance of the 1055 road and is crossed by a forest path. Historical geochemical data show 18 lithium anomalies up to 963 ppm within and near the property.

The technical content of this news release has been reviewed and approved by Jody Dahrouge, P. Geo., who is an independent Qualified Person (QP) as defined in National Instrument 43-101, Standards of Disclosure for Mineral Projects. The QP and the Company has not completed sufficient work to verify the historic information on the properties comprising the Project Portfolio, particularly regarding historical exploration, neighbouring companies, and government geological work.

Management & Directors

SEAN CHARLAND

CEO, PRESIDENT, DIRECTOR

Mr. Charland has worked for over 15 years in capital markets and resource exploration. His experience is focused on raising capital, mergers & acquisitions, marketing public resources companies and managing diverse teams. Most recently he was a Director of Alpha Lithium, which was acquired for over $300 million. Mr. Charland leads as CEO for both Apex Critical Metals and Zimtu Capital, and serves as a director at Maple Gold Mines and Core Assets.

JODY DAHROUGE

P.GEO, DIRECTOR

Mr. Dahrouge is a Professional Geologist with over 25 years of experience in Canada and Internationally, and has a successful background in base metals, industrial minerals, rare earth metals and uranium exploration. Since 1998, Mr. Dahrouge has been the President of Dahrouge Geological Consulting Ltd., a geological services company that provides consulting services to a broad range of public and private exploration and mining companies. He is a Professional Geologist (Alberta) and holds Bachelor of Science degrees in geology and computing science, both from the University of Alberta. Mr. Dahrouge has been involved in all aspects of mineral exploration and development for a wide variety of commodities worldwide.

DARREN L. SMITH

M.SC., P.GEO, DIRECTOR

With more than 17 years experience in the industry, Mr. Smith specializes in high-level project management including program design and implementation, technical reporting, land management, community engagement, and technical disclosure. He has provided technical oversight for PEA, PFS, and FS level projects as well as complex metallurgical programs. Mr. Smith’s experience includes carbonatite complexes and associated metals (tantalum, niobium, scandium, REEs), lithium (brine, sediment, pegmatite), cobalt, uranium, phosphate, fluorspar, as well as base and precious metals. In 2009, Darren and his team discovered one of the world’s largest REE deposits (Ashram), and in 2017 discovered the Corvette Lithium Pegmatite District, where one of the largest lithium pegmatites in the world (CV5) has been defined through drilling.

JONESS LANG

INDEPENDENT DIRECTOR

Mr. Lang is an experienced executive leader with 15 years of corporate growth strategy and capital markets experience within the natural resource sector. Mr. Lang is the CEO of Canter Resources, a critical metals exploration company focused on lithium and boron in the western USA. He has served as President for American Pacific Mining, and prior to that he served as the Executive Vice President of Maple Gold Mines. Mr. Lang brings significant transaction experience to the Apex board, with a track record of leading project acquisitions and securing major mining companies as strategic partners. His career began with corporate development work for a multi-commodity prospect generator where he was lead for numerous acquisitions and sourced significant funding for the company through joint-ventures, asset sales and strategic alliance partnerships. He played an important role in bringing Agnico Eagle in as a strategic partner, increasing institutional ownership and leading or co-leading property acquisitions and equity financing transactions while at Maple Gold Mines. While at American Pacific, the company was nominated for “Deal of the Year“ twice by S&P Global Platts. Mr. Lang received his Bachelor of Commerce degree from Royal Roads University, graduating with distinction. Mr. Lang also graduated with honours from the British Columbia Institute of Technology where he received his Marketing Management Entrepreneurship diploma.

JODY BELLEFLEUR

CFO, DIRECTOR

Ms. Bellefleur is a CPA with over 25 years of experience as a corporate accountant, focusing exclusively on public companies for the last 10 years. She obtained her B.Comm degree from the University of British Columbia in 1994.

Company Details

Apex Critical Metals Corp.

Suite 1450 – 789 West PenderStreet

Vancouver, BC, V6C1H2 Canada

Phone: +1 604 681 1568

Email: info@apexcriticalmetals.com

www.apexcriticalmetals.com

CUSIP: 03753D104 / ISIN: CA03753D1042

Shares Issued & Outstanding: 28,452,094

Canadian Symbol (CSE): APXC

Current Price: $0.51 CAD (10/11/2024)

Market Capitalization: $14 Million CAD

German Symbol / WKN: KL9 / A40CCQ

Current Price: €0.36 EUR (10/11/2024)

Market Capitalization: $10 Million CAD

Contact:

www.rockstone-research.com

Disclaimer: This report, the referenced news-releases and videos contain forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Apex Critical Metals Corp. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to Apex Critical Metals Corp.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through its profile on SEDAR at www.sedarplus.ca. Please read the full disclaimer within the full research report as a PDF (see here or below) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, currently does not hold an equity position in Apex Critical Metals Corp., however he owns equity of Zimtu Capital Corp. and thus will profit from volume and price appreciation of this stock (Capacitor Metals Corp. The author is being paid by Zimtu Capital Corp. for the preparation, publication and distribution of this report, whereas Zimtu Capital Corp. holds an equity position of Apex Critical Metals Corp. and thus will profit from volume and price appreciation of the stock. Note that Apex Critical Metals Corp. pays Zimtu Capital Corp. to provide this report and other investor awareness services.

Disclaimer and Information on Forward Looking Statements: Rockstone Research, Zimtu Capital Corp. (“Zimtu“) and Apex Critical Metals Corp. (“Apex“; “the Company“) caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the Apex‘s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through its documents filed on SEDAR at www.sedarplus.ca. All statements in this report, other than statements of historical fact should be considered forward-looking statements. Much of this report is comprised of statements of projection. Statements in this report that are forward looking include that the success story of WA1 Resources Ltd. is a prime example underscoring the crucial importance of early identification of the right company and project for investors; that the management team at Apex boasts an unparalleled track record in identifying early-stage projects with the potential to evolve into world-class ventures; that history could be repeating itself for this exceptional team, just as the surging interest in the critical metal niobium has ignited a new wave of investor excitement; that following a transformative restructuring, Apex is now poised to become yet another groundbreaking success story; that with a compelling critical metals project portfolio focussed on niobium, rare earths and lithium, Apex has positioned its shareholders with exposure to some of the most lucrative and high-demand sectors in the resource industry; that the Apex management team is committed to achieving another major discovery, striving to deliver exceptional value and returns for its shareholders; that the moment has arrived for Apex to soar to unprecedented heights of excellence; that discovering a significant niobium deposit is very special – and as such typically results in strong company valuations as recently evidenced by WA1 Resources – largely because only 3 primary niobium producers have been responsible for global supply over the last decades; that this substantial increase in valuation, despite both mines supplying roughly the same amount of niobium, underscores the growing strategic importance and market demand for niobium resources, a trend first and foremost recognized by Asian companies; that recently announced initial metallurgy results indicate the Luni Deposit may be amenable to conventional processing techniques and reinforces Luni as a highly strategic critical mineral asset; that decreasing discovery rates, a continually diminishing supply of current mineral resources, and a growing demand for various metals, all have the potential to disrupt the supply chains for many commodities; that this is in particular pertinent to the so-called suite of “critical” minerals – metals, elements, or minerals that play a pivotal role in modern technologies and might face potential supply chain disruptions; that over the medium term, accelerating usage of structural steel and increasing demand for lighter-weight and more fuel-efficient vehicles are some of the factors driving the growth of the [niobium] market; that on the flip side, limited supply sources [...] is expected to hinder the growth of the market; that the expected usage of niobium in next-generation lithium-ion batteries and innovative techniques [...] are anticipated to provide numerous opportunities over the forecast period; that the global construction industry is expected to grow by USD 4.5 trillion, or 42%, between 2020 and 2030 to reach USD 15.2 trillion; that such robust growth in construction across the world is likely to boost the demand for the consumption of niobium during the forecast period; that Apex’s Cap Project covers a large carbonatite complex which is considered highly prospective for both niobium and/or Rare Earth Element (REE) mineralization; that the ongoing activities entail prospecting, geological mapping, rock and soil sampling to confirm previously identified niobium mineralization in both historical surface samples and drilling; that the exploration work is expected to outline areas prospective for follow-up drill testing; that the field exploration will be completed by Dahrouge Geological Consulting Ltd.; that exploration activities are anticipated to last approximately three weeks and will expand upon a pre-existing soil grid that demonstrated niobium anomalies which correlated with the eastern margin of the known magnetic and radiometric anomaly; that field crews will continue to prospect near the previously identified carbonatite boulders and outcrops; that historical results include a large oval aeromagnetic anomaly, interpreted to correlated with a carbonatite igneous unit which may be associated with a larger alkalic complex; that Wicheeda REE Deposit’s pre-feasibility study is expected in 2025, targeting annual production of 25,000 t TREO; that upon and subject to the terms of this Agreement, Apex and DG Resource will grant Discovery Lithium the sole and exclusive right and option to acquire, as to 40% from DGRM and as to 40% from Apex, an undivided 80% Earned Interest in the Mantle, Cirrus East, Cirrus West, Neptune, Alto, Opus and Bruce Lake projects, free and clear of any Encumbrance, subject only to the Royalty; that to maintain the Option in good standing, Discovery Lithium will make a share issuance within 5 days of signing the agreement of 5,000,000 shares, and a incur a minimum expenditure of $1,000,000 on or before the date that is six (6) months from the effective date. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in these forward-looking statements. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Risks and uncertainties include: The receipt of all necessary approvals and permits for exploration and mining; the ability to find sufficient mineralization to mine; uncertainty of future production, uncertain capital expenditures and other costs; financing and additional capital requirements for exploration, development and construction of a mine may not be available at reasonable cost or at all; mineral grades and quantities on the projects may not be as high as expected; samples found to date and historical drilling may not be indicative of any further potential on the properties; that mineralization encountered with sampling and drilling will be uneconomic; that the targeted prospects can not be reached; the receipt in a timely fashion of further permitting; legislative, political, social or economic developments in the jurisdictions in which Apex carries on business may hinder progress; there may be no agreement with neighbors, partners or government on developing the respective projects or infrastructure; operating or technical difficulties or cost increases in connection with exploration and mining or development activities; the ability to keep key employees and operations financed; what appear at first to be similarities with operating mines and projects may not be substantially similar; share prices and market valuations of Apex and other companies may fall as a result of many factors, including those listed here and others listed in the companies’ disclosure; and the resource prices available when the resource is mined may not be sufficient to mine economically. Accordingly, readers should not place undue reliance on forward-looking information. Rockstone and the author of this report do not undertake any obligation to update any statements made in this report except as required by law. As per Apex’s Interim Financial Statements for the 9 months ended April 30, 2024, filed on SEDAR: “The Company has no source of operating cash flows, has not yet achieved profitable operations, has a working capital of $933,923 as at April 30, 2024 (July 31, 2023: $82,162 deficiency), has accumulated losses since its inception, expects to incur further losses in the development of its business, and has no assurance that sufficient funding will be available to conduct further exploration of its mineral properties. These material uncertainties cast significant doubt about the Company’s ability to continue as a going concern. In recognition of these circumstances, management is pursuing various financial alternatives to fund the Company’s exploration and development programs. There is no assurance that these initiatives will be successful. In the future, the Company may raise additional financing through the issuance of share capital or shareholder loans; however, there can be no assurance that it will be successful in its efforts to do so and that the terms will be favourable to the Company. These financial statements do not include any adjustments to the carrying values of assets and liabilities, the reported expenses and statement of financial position classifications that might be necessary should the Company be unable to realize its assets and settle its liabilities as a going concern in the normal course of operations. Management is actively seeking to raise the necessary capital to meet its funding requirements and has undertaken available cost-cutting measures. There can be no assurance that management’s plan will be successful. If the going concern assumption were not appropriate for these financial statements, then adjustments would be necessary in the carrying value of assets and liabilities, the reported expenses and the statement of financial position classifications used. Such adjustments could be material. The business of mining and exploration involves a high degree of risk and there can be no assurance that current exploration programs will result in profitable mining operations. The Company has no source of revenue, and has significant cash requirements to meet its administrative overhead and maintain its mineral interests... The Company’s risk management policies are established to identify and analyze the risks faced by the Company, to set appropriate risk limits and controls, and to monitor risks and adherence to market conditions and the Company’s activities. The Company has exposure to credit risk, liquidity risk and market risk as a result of its use of financial instruments. This note presents information about the Company’s exposure to each of the above risks and the Company’s objectives, policies and processes for measuring and managing these risks. Further quantitative disclosures are included throughout these financial statements.” Note that mineral grades and mineralization described in similar rocks and deposits on other properties are not representative of the mineralization on Apex’s properties, and historical work and activities on its properties have not been verified and should not be relied upon. Mineralization outside of Apex’s projects is no guarantee for mineralization on the properties from Apex, and all of Apex’s projects are exploration projects. Also note that surface sampling does not necessarily correlate to grades that might be found in drilling but solely shows the potential for minerals to be found at depth through drilling below the surface sampling anomalies.

Disclosure of Interest and Advisory Cautions: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Rockstone, its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including Rockstone’s report, especially if the investment involves a small, thinly-traded company that isn’t well known. The author of this report, Stephan Bogner, is paid by Zimtu Capital Corp. (“Zimtu”), a TSX Venture Exchange listed investment company. Part of the author’s responsibilities at Zimtu is to research and report on companies in which Zimtu has an investment. So while the author of this report is not paid directly by Apex Critical Metals Corp. (“Apex“), the author’s employer Zimtu Capital Corp. will benefit from volume and appreciation of Apex’s stock prices. The author currently does not own any equity of Apex Critical Metals Corp., but he holds an equity position in Zimtu Capital Corp. and thus will also benefit from volume and price appreciation of this stock. Apex Critical Metals Corp. pays Zimtu Capital Corp. to provide this report and other services. As per news-release on June 6, 2024: “Zimtu Capital Corp. (TSX.V: ZC; FSE: ZCT1) (the “Company” or “Zimtu”) announces it has signed an agreement with Apex Critical Metals (CSE: APXC) (OTCQB:APXCF) to provide its ZimtuADVANTAGE program (https://www.zimtu.com/zimtu-advantage/). Zimtu will receive $150,000 from the company for the duration of the one-year contract. ZimtuADVANTAGE is a comprehensive marketing initiative designed to assist companies in navigating capital markets through strategic marketing efforts. It includes services such as in-depth research reports, content creation, investor lead generation, targeted awareness advertising, video news releases, social media management & newsletters. This program aims to enhance a company’s visibility and engagement with high-value investors, leveraging various digital platforms and media outlets for effective dissemination of company updates and information... Zimtu Capital Corp. is a public investment issuer that aspires to achieve long-term capital appreciation for its shareholders. Zimtu Capital companies may operate in the fields of mineral exploration, mining, technology, life sciences or investment. The Company trades on the TSX Venture Exchange under the symbol “ZC” and Frankfurt under symbol “ZCT1”. For more information visit: www.zimtu.com.” Overall, multiple conflicts of interests exist. Therefore, the information provided in this report should not be construed as a financial analysis or recommendation but as an advertisement. Rockstone’s and the author’s views and opinions regarding the companies that are featured in the reports are the author‘s own views and are based on information that was received or found in the public domain, which is assumed to be reliable. Rockstone and the author have not undertaken independent due diligence of the information received or found in the public domain. Rockstone and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, Rockstone and the author do not guarantee that any of the companies mentioned in the report will perform as expected, and any comparisons that were made to other companies may not be valid or come into effect. Please read the entire Disclaimer carefully. If you do not agree to all of the Disclaimer, do not access this website or any of its pages including this report in form of a PDF. By using this website and/or report, and whether or not you actually read the Disclaimer, you are deemed to have accepted it. Information provided is educational and general in nature. Data, tables, figures and pictures, if not labeled or hyperlinked otherwise, have been obtained from Apex, Tradingview, Stockwatch, and the public domain.