Disseminated on behalf of NevGold Corp. and Zimtu Capital Corp.

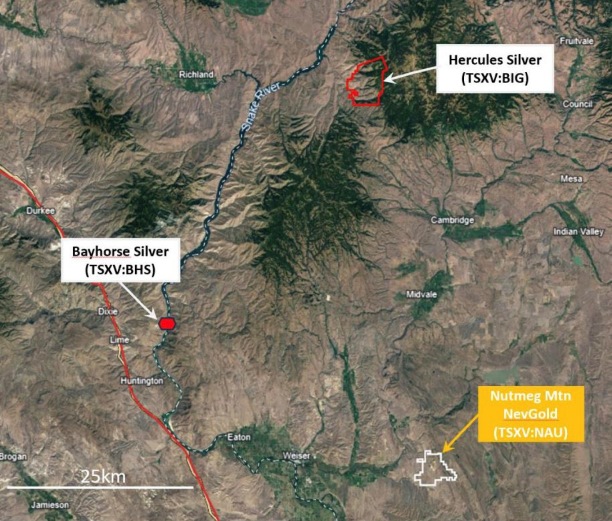

Last October, Hercules Silver Corp. (TSX.V: BIG) was trading at 20 cents and announced assays of the first deep hole drilled at its Hercules Project in Idaho, confirming a major porphyry discovery by intersecting 185 m @ 0.84% copper at 246 m depth. Its share price then soared to $1 by the end of the month and in early November, Barrick Gold Corp. (the world‘s second largest gold miner) invested $23 million in a private placement at $1.10 per unit. Hercules‘ share price then rose to as high as $1.62 and the company currently enjoys a market capitalization of more than $200 million. Despite different deposit types, the similarities between Hercules Silver Corp. and its neighbor NevGold Corp. are striking.

In 2022, NevGold Corp. announced an option agreement for the Nutmeg Mountain Gold Project from GoldMining Inc. (TSX: GOLD, current market capitalization: $219 million). In January, NevGold executed the 100% acquisition, with GoldMining becoming its largest shareholder owning about 30% of the outstanding shares.

GoldMining also invested into NevGold in a private placement as the formed partnership aims to share potential benefits as NevGold conducts the “work to grow and develop the Nutmeg Mountain Project“, whereas GoldMining also stated to be “encouraged by the continued exploration success at Limousine Butte in Nevada, and the upside potential of the other assets within the NevGold portfolio“.

Similar to Hercules, NevGold not only plans continued drilling of its near-surface deposits to expand resources but also to make discoveries at depth. In contrast to the lower grade porphyry mineralization seen at the Hercules Project, NevGold targets high-grade feeder systems typically seen in low-sulphidation epithermal gold deposits.

With gold prices having marked new all-time highs recently, gold exploration and mining stocks may soon enter a strong bull market, in particular those few companies operating in favorable jurisdictions and holding resources in excess of 1 million ounces with substantial growth upside, lead by highly experienced management teams with serious “skin in the game“ and backed by prominent strategic partners and long-term shareholders.

Full size / Source / “Gold has definitively broken out of the range it‘s been stuck in since the start of this decade, reaching a record $2,195 per troy ounce this month. While a surge of buying from China is likely behind the recent rally, some of the more conventional factors that typically propel the yellow metal are starting to fall into line. Fresh records beckon.“ (Source: “Gold’s Record-Setting Pace Is Exuberantly Rational: The economic backdrop is increasingly favorable for the yellow metal to achieve fresh highs“, Bloomberg on March 14, 2024)

While gold continues to trade at record highs, gold exploration and mining stocks have finally started to appreciate as well, albeit somewhat slower than many have expected. However, the underperformance of gold stocks relative to a rising gold price is a phenomenon which is not uncommon, in particular in the beginning (and also in the final phases) of a bull market.

“For those fretting about the underperformance of gold stocks vs gold since the start of the year – take a look at what happened in 2016. The GDX massively underperformed gold during the first weeks of the year before going up 150% in the next 6 months.“ (Source)

“Simply put, there is no historical analog for today’s gold, and gold mining sector market environment. Bob believes that sentiment on gold miners is at historical lows, meaning that the sector could see a ferocious rally... But the fact that everybody hates gold stocks means that there are going to be a lot of stocks up 500% and a fair number of stocks up 1000%.“ (Source: “Bob Moriarty: There Is No Historical Precedent For Today’s Gold Market, Miners Could Rally 500%“, March 11, 2024)

“Owning stock in the right mining companies is essential for any well-rounded gold investor. The right picks can yield higher returns than physical gold, given certain conditions.“ (Peter Schiff in February 2024)

Idaho: An attractive jurisdiction for exploration and mining

• Idaho has one of the world‘s most favorable regulatory environment for the exploration and mining industry with a pro-mining congressional delegation, governor and state legislature and local political and community support for exploration and mining projects. The state government has established clear permitting processes and regulations for exploration and mining projects, which can streamline the development process for companies.

• Idaho is known for its stable political environment and generally supportive attitude towards the mining industry. The state government recognizes the economic importance of mining and often works collaboratively with companies to encourage responsible development while balancing environmental concerns.

• Idaho benefits from well-developed infrastructure, including roads, railways, and access to power and water resources. This infrastructure facilitates transportation of equipment and supplies to mining sites, reducing operational costs and logistical challenges.

• Idaho is rich in mineral resources, including gold, silver, copper, lead, zinc, molybdenum, and other precious and base metals. The state has a long history of mining dating back to the 1860s gold rush, and it continues to be a significant producer of precious metals.

• Idaho‘s diverse geological landscape offers a variety of mineralization opportunities. The state features various geological formations, including sedimentary basins, volcanic rocks, and metamorphic terrains, which host a wide range of mineral deposits.

Similarities between Hercules and Nutmeg

The recent porphyry copper discovery made by Hercules Silver Corp. (TSX.V: BIG; current market cap.: $217 million) is ~35 km to the northwest of NevGold‘s Nutmeg Mountain Project within Washington County, Idaho. Hercules Silver‘s discovery was followed by a strategic investment of ~$23 million into Hercules by Barrick Gold Corp. (TSX: ABX; current market cap.: $38 billion). Subsequently, activity in Washington County has increased substantially. NevGold has a strong position in this emerging precious and base metals district with its 100% owned Nutmeg Mountain Project and will continue to advance strategic opportunities to leverage its technical and operating expertise in the area. Nevgold has been actively looking at opportunities to add to its control of the district looking at how to leverage its operational presence in Washington County, Idaho.

In 2021, Hercules Silver Corp. acquired the Hercules Project, a silver asset last mined in the 1920s and subsequently defined by extensive historical drilling in the 1960-1980s (>28,000 m in >300 holes). In 2023, the deeper copper porphyry feeder system to the disseminated silver-lead-zinc mineralization near surface was discovered in the first deep hole drilled at Hercules: 185 m @ 0.84% copper, 111 ppm molybdenum, 2.6 g/t silver (from 246 m depth). The discovery hole was drilled into a blind chargeability anomaly below historical drilling. The near-surface silver represents a potential bulk-tonnage target above the porphyry (now understood to be a halo around a larger copper porphyry system at depth). The shallow mineralization (across 3.5 km of strike) is still open in all directions, with the best surface targets still to be tested.

In 2022, NevGold Corp. acquired the Nutmeg Mountain Project from GoldMining Inc. (TSX: GOLD; current market cap.: $219 million). The low-sulphidation epithermal gold deposit was initially identified as a mercury deposit in 1936 and was exploited for this commodity between 1939 and 1972. Mercury, a litophile element often associated with hydrothermal fluids that precipitate gold, is an important pathfinder element for gold deposits. Starting in 1980, the Nutmeg Mountain Property was explored for its gold potential including several metallurgical bulk samples and 934 historical drill holes with an aggregate length of ~70,000 m. Historical drilling at Nutmeg focused on defining the disseminated gold mineralization which starts at surface. This drilling was nearly all vertical and averaged less than 75 m depth. At Hercules, average depth of historical drilling was less than 90 m as previous operators focused on developing a shallow high-grade open-pit resource with short vertical drill holes, preventing a full understanding of structural controls. At Nutmeg, the potential for high-grade feeder systems at depth remains virtually untested and NevGold plans to target deeper structures in future drilling (high-grade feeder systems are typically seen in low-sulphidation epithermal deposits) as well as expanding the resource laterally.

Below table includes significant gold exploration and development projects in Idaho (NevGold‘s Nutmeg Mountain Project averages 0.61 g/t gold in 2023-Indicated Resources):

DeLamar Project: 0.45 g/t gold

Operator: Integra Resources Corp. (TSX: ITR; current market cap.: $90 million)

Black Pine Project: 0.51 g/t gold

Operator: Liberty Gold Corp. (TSX: LGD; current market cap.: $90 million)

Beartrack-Arnett Project: 1.03 g/t gold

Operator: Revival Gold Inc. (TSX.V: RVG; current market cap.: $32 million)

NevGold‘s CEO, Brandon Bonifacio, commented in June 2022, when the option to acquire Nutmeg was executed: “NevGold is extremely pleased to enter the option agreement to acquire Nutmeg Mountain. The asset has attractive scale with a historical resource completed in 2020 of 910,000 Indicated ounces of gold, and 160,000 Inferred ounces of gold starting at surface, and significant exploration upside, while also being located in a premier jurisdiction with excellent infrastructure near site. We see many opportunities to extract value at Nutmeg Mountain like we have at Limousine Butte over the past 12 months, and we see the value extraction roadmap as being very similar. This transaction also adds the benefits of a new strategic partner and investor, especially with a long-term growth focused, well-established team like GoldMining. We look forward to the next chapter of NevGold as we continue to build one of the marquee gold resource and exploration platforms in the Western USA.”

GoldMining‘s CEO, Alastair Still, added: “We are excited to have formed a partnership with NevGold to share in the potential benefits as they conduct work to grow and develop the Nutmeg Mountain Project. GoldMining is also encouraged by the continued exploration success at Limousine Butte in Nevada, and the upside potential of the other assets within the NevGold portfolio.”

Full size / The Carlin Trend in Nevada has been a prolific producer of gold since its discovery. It has yielded millions of ounces of gold over the decades, making it one of the most important gold mining districts in the world. Major mining companies, including Newmont, Barrick, and others, have active operations within the Carlin Trensd, contributing to Nevada‘s status as a top gold-producing jurisdiction. The Carlin Trend is characterized by its unique geological setting, which differs from traditional gold mining districts. Gold mineralization in the Carlin Trend occurs primarily within sedimentary rocks, rather than in traditional vein-type deposits associated with igneous or metamorphic rocks. The gold is often disseminated at microscopic levels within carbonate rocks, making it challenging to detect visually.

Nevada: A leading gold-producing jurisdiction

NevGold is not only actively advancing its Nutmeg Mountain Project in Idaho, but also the advanced-stage Limousine Butte Gold Project located in the world-renowned Carlin Trend of northeastern Nevada, and the early-stage Cedar Wash Gold Project in southeastern Nevada.

• The Carlin Trend is one of the most significant gold mining districts in the world. Discovered in the 1960s by Newmont‘s geologist John Livermore and his team, the Carlin Trend revolutionized gold exploration in Nevada, leading to the discovery of multiple large gold deposits. The Carlin Trend is known for its unique geological characteristics, including invisible (micron-sized) gold mineralization disseminated within sedimentary rocks, which has contributed significantly to Nevada‘s gold production.

• Nevada‘s gold mining industry has benefited from continuous technological innovation and advancements in exploration, extraction, and processing techniques. Companies operating in the state have adopted state-of-the-art technologies such as heap leaching, autoclave processing, and advanced geological modeling to improve efficiency and recoveries, allowing for the economical extraction of gold from low-grade deposits.

• Nevada has a favorable regulatory environment for mining activities, with well-established permitting processes and supportive government policies. The state government recognizes the importance of the mining industry to Nevada‘s economy and has implemented measures to facilitate responsible mineral exploration and development while maintaining environmental standards.

• Nevada benefits from excellent infrastructure, including a network of roads, railways, and access to power and water resources. This infrastructure facilitates efficient transportation of equipment, supplies, and personnel to exploration and mining sites, reducing operational costs and logistical challenges.

• Nevada has a long history of gold mining dating back to the mid-19th century gold rush. Over the years, the state has developed a skilled workforce and a strong mining culture, attracting investment and expertise from around the world.

• Nevada possesses a highly favorable geological setting for gold mineralization. The state‘s geology is characterized by a complex history of tectonic activity, volcanic processes, and sedimentary deposition, which has led to the formation of numerous gold deposits. These deposits range from large, low-grade disseminated ore bodies to high-grade vein systems, making Nevada one of the most prolific gold-producing regions globally.

• Carlin-type deposits are typically large in scale and have low to moderate gold grades but are economically viable due to their bulk tonnage and favorable metallurgy, in particular heap-leachable gold oxide mineralization.

Full size / 1) Nutmeg Mountain’s Mineral Resource Estimate (“MRE”) information is extracted from a report titled ”NI 43-101 Technical Report – Nutmeg Mountain Gold Property, Washington County, Idaho” completed by NevGold with an effective date of June 22, 2023. 2) Historical Mineral Resource Estimate – Limousine Butte: Limousine Butte’s Historical Mineral Resource Estimate information is extracted from a report titled “NI 43-101 Technical Reportfor the Limousine Butte Project, White Pine County, Nevada“ with an effective date of July 1, 2009. NevGold considers the 2009 NI 43-101 mineral resource estimate as an Historical MRE that is both relevant and reliable in the context of the data and analysis tools available at that time. A NevGold Qualified Person has not done sufficient work to classify the Historical MRE as a Current MRE for purposes of NevGold disclosure, and NevGold is not treating the Historical MRE as current mineral resources. Further drilling and geological work will be required before the Historical MRE can be classified as a Current MRE for NevGold disclosure.

Full size / Updated market capitalizations as per March 15, 2024: NevGold: $29M, West Vault Mining: $54M; Revival Gold: $32M; Augusta Gold: $77M; Integra: $90M; Nevada King Gold: $134M; Liberty Gold: $90M

Nutmeg Mountain

Deposit: Low-sulphidation epithermal gold deposit (formerly known as Almaden Property) with geology similar to several other epithermal deposits in Western USA.

Location & Access: Washington County, Idaho; 20 km east of Weiser (county seat) and 120 km northwest of Boise (state capital) on paved state highway. The property is well-located relative to road, power and water infrastructure. The property is located in an historic mining area and encompasses a near-surface, low-sulphidation epithermal gold deposit.

Full size / Mining operations are common in this part of the US, and it is reasonable to assume that appropriate mining personnel could be recruited from within Idaho or adjacent states. Boise, ~120 km southeast of the Property, has a population of >200,000, and is a regional transportation and commercial hub. Weiser, where the field office for the Property is located, has a population of ~5,400 and basic services and supplies can be obtained here.

Infrastructure: The closest high-voltage power transmission lines are 230-kilovolt lines which pass within 10 km of the property and may be a possible source of electrical power for a future mining operation. The property has sufficient area to accommodate potential mining operations and infrastructure, including processing plant sites, as well as potential storage of tailings and disposal of waste, and heap leach pads.

Full size / The past-producing Bayhorse underground mine (2018-Inferred: 6.3 million ounces of silver @ 742 g/t) is ~30 km northeast from the Nutmeg Mountain Property. In February 2024, Bayhorse Silver Inc. (TSX.V: BHS; current market cap.: $21 million) increased its property to 10 km2 on the basis of preliminary results from a geophysics study “to determine whether a long-postulated feeder anomaly is present at the Bayhorse Mine that could indicate the presence of either more high-grade silver mineralization or a porphyry copper deposit.“

Ownership: 100%; acquired from GoldMining Inc. (TSX: GOLD; current market cap.: $219million) in June 2022 with the following royalties (NSR): 5% on patented claims (large portion of resource) and 3% on untatented federal claims. As announced in January 2024, GoldMining holds, and has control and direction over, 26,670,250 shares and 1,488,100 warrants, representing ~29.4% of NevGold‘s outstanding shares on an undiluted basis and ~30.5% on a partially-diluted basis assuming the exercise of the warrants held by GoldMining.

NevGold‘s CEO, Brandon Bonifacio, commented in the news-release on January 19, 2024: “Completing the acquisition of 100% of Nutmeg Mountain from GoldMining is a monumental milestone for the Company. We have diligently advanced our efforts since closing the transaction on Nutmeg Mountain in August-2022. After less than 12 months of working on the project we released our initial Mineral Resource Estimate in August-2023, where we delivered an open-pit, oxide, heap-leachable gold Indicated Mineral Resource of 1.01Mozs and Inferred Mineral Resource of 275kozs. We will continue to focus our future efforts on drilling the many high priority drill targets both on the private ground and fully permitted Bureau of Land Management (BLM) unpatented claims to unlock further value at the Project. We are fortunate to now own 100% of one of the very few open-pit, oxide, heap-leach gold projects of scale and grade with mineralization starting at surface in the Western USA. Nutmeg Mountain’s location in Western Idaho (Washington County) also offers many benefits as it is a premier mining jurisdiction with excellent infrastructure in place, which will allow for rapid project advancement.”

Recent Exploration: In January 2023, NevGold started a drill program (5 holes over 1,371 m), with the first round of heap-leachable (oxide) gold assays announced in April: Hole NMD0003: 79.3 m @ 0.72 g/t gold (from 10 m depth), including 13.4 m @ 2.32 g/t gold (from 26 m depth); and Hole NMD0001: 23.9 @ 0.56 g/t gold (from 24.1 m depth) with 4.33 g/t gold intercepted near the bottom of the hole (hole lost in mineralization). Further assays were announced in June: Hole NMD0004: 51.5 m @ 0.8 g/t gold (from surface) including 11.3 m @ 1.4 g/t gold (from 9.8 m depth), whereas intercepted mineralization in this hole was extended to 66.8 m @ 0.74 g/t gold as announced in November (samples from this hole sent for metallurgical testwork). These initial drill results highlight the potential grade upside and growth potential for the resource which begins at surface and requires minimal stripping. NevGold issued a NI 43-101 Technical Report on July 17, 2023.

Full size / Cross-section looking north through the MRE (“Mineral Resource Estimate“) block model with all blocks above a 0.10 g/t gold cut-off. Mineralization starts at surface, with a high-grade, heap-leach core outcropping. As shown, there is further mineralization beneath the $1750 USD/ounce pit-shell used in the MRE (high-grade feeder vein targets at depth). Gold-dashed lines represent areas with additional mineralization potential.

Full size / Cross-section looking north through the MRE block model with 0.6 g/t gold cut-off.

Development Plans: NevGold has comprehensive plans for advancing the project, including:

• Continued drilling of new targets with the objective of expanding the resource laterally and at depth;

• Targeting the high-grade feeder system typically seen in low-sulphidation epithermal deposits (the high-grade feeder system has not been tested by prior operators with average historical drill hole depth to approximately 75 m, and is a highly promising exploration target);

• Detailed metallurgical program to characterize variances in the deposit‘s metallurgy and determine optimal recovery process for the future Preliminary Economic Assessment (PEA);

• Gather other information in preparation for commencing a PEA;

• Permitting to allow for baseline environmental surveys to commence.

Full size / MRE block model with deposit zones and classification. 74% of the pit-constrained tonnage is in the Indicated category (tight drill spacing over large portions of the 2023 MRE), with 26% in the Inferred category (minimal infill drilling required for resource conversion). Focus of further drilling is to expand resource laterally and at depth.

Full size / Plan view claim boundary. Mineralization contained within the 2023-MRE ($1750 USD/ounce) pit shell is outlined in red. Orange line outlines property boundary, with orange-shading defining unpatented BLM claims (permitted through Exploration Notice). The remaining unshaded areas are patented claims and private leases which can be drilled under different guidelines. Gold-dashed lines represent areas with additional mineralization potential.

Historical Exploration: Historical drilling at Nutmeg focused on defining the disseminated gold mineralization which starts at surface. This drilling was nearly all vertical and averaged less than 75 m depth. The potential for high-grade feeder systems at depth remains virtually untested. Until Nevgold’s 2023-drill program, the last drilling at the project had occurred in 2012. The property has been explored for gold starting in 1980 with geological mapping, geochemical and geophysical surveying, several metallurgical bulk samples, and 934 historical drill holes with an aggregate length of ~70,000 m (estimated at >$35 million USD to replicate historical work on exploration and drilling today).

Full size / Nutmeg faults and grade-thickness gold accumulations (2012). The figure shows the major structures in the Main and North Zone areas as well as the concentration of gold mineralization, expressed as contours of gold grade-thickness, adjacent to faults and at fault intersections.

Geology: The property contains sandstones of the Payette Formation which host the majority of the mineralization defined by the 2023-resource estimate. Additionally, the region was host to long-lived volcanism and hosts basalts of the Columbia River and Weiser basalt groups as well as volcanic tuffs and rhyolites of presumed Miocene age. Silicious sinter deposits cap the mineralized zone. Faulting in the area consists of large-scale normal faults that strike northwest and create multiple horsts blocks that are then cross-cut and offset by smaller scale east-northeast normal faults. The principal structures within the Property are faults that trend northwest and north-northeast, with both trends appearing to have been active both before and during the introduction of gold mineralization. Main Zone mineralization occurs within a graben bounded by syn-mineralization northwest-trending faults, the Main Fault on the east and the B-Fault on the west. Although no drill holes have penetrated deep enough to determine the behaviour of these 2 faults at depth, it is reasonable to assume that they converge, with the Main Fault being the controlling structure. The North Zone is bounded by northwest and north-trending structures. Smaller northeast-trending structures also localize mineralization in the North Zone. Hot-spring alteration and gold mineralization are strongest at structural intersections. The Stinking Water Zone is located just off the map to the northwest.

Full size / Nutmeg schematic cross-section (2012).

The Main Fault separates relatively strong alteration and mineralization within the graben from weaker alteration and mineralization to the east and is interpreted to have exerted fundamental controls on the distribution of mineralizing fluids, alteration and deposition of gold. The topographic and stratigraphic changes across the fault are consistent with steep, west-side-down movement along the fault and variations in thickness of Payette sandstone across the fault indicate that the fault was active during deposition. The B-Fault forms the western boundary of the graben and movement along the B-fault is indicated by offset across the fault of the contact between the arkosic sandstone and underlying claystone units of the Payette Formation. As well, the opalized sandstone thins to the west of the B-Fault, suggesting movement on the fault during the opalizing event.

Full size / Core photo of hole NMD0003 from 31.7-34.4 m, part of the zone which assayed 13.4 m @ 2.32 g/t gold.

Full size / Core photo of hole NMD0004 from 57.3-60 m, part of the zone which assayed 66.8 m @ 0.74 g/t gold from surface.

Limousine (limo) Butte

Deposit: Carlin-type gold deposits; sediment-hosted with disseminated (commonly micron-sized) gold mineralization.

Location: White Pine County, Nevada; 105 km from Ely and 125 km from Elko. The property is located within the prolific Carlin Trend of sediment-hosted gold deposits.

Access & Infrastructure: Via paved state highway (85 km from Ely) and county-maintained gravel road (19 km). There is a power line in Butte Valley and a water well, ~5 km southwest of the Property, that supplied the historical Golden Butte mining operation. It may be possible to rehabilitate this well to supply future mining development on the property.

Size: 67 km2 / 6,650 hectares (821 unpatented mining claims on BLM ground)

Ownership: 100%; acquired from McEwen Mining Inc. (TSX: MUX; current market cap.: $578 million) in June 2021, with the following royalties (NSR): 0.5% McEwen Mining, 2.5% Franco-Nevada; royalties on a select group of 4 claims include 1% to Amselco and 2.5% to Teck Resources, whereas the Teck royalty is unrecorded and the enforceability of the royalty is in question as it went through a previous bankruptcy via Alta Gold Corp.).

Historical Production: After 4,680 m of drilling, an open-pit produced ~91,000 ounces of near-surface oxide gold at the Golden Butte Mine from 1989-1990. Gold was discovered in Egan Canyon on the eastern flank of the Cherry Creek Range in 1861. The district became known as Gold Canyon and produced a small amount of gold and later silver. In 1872, silver, and in 1918 tungsten, deposits were discovered a few km north in Cherry Creek Canyon. Mining activity continued there through 1958. In total, ~1.5 million ounces of silver and 32,000 ounces of gold were produced from the district over that period. Exploration resumed in the area in the early 1960s and led to the discovery and mining of the Golden Butte Deposit (situated within NevGold‘s property).

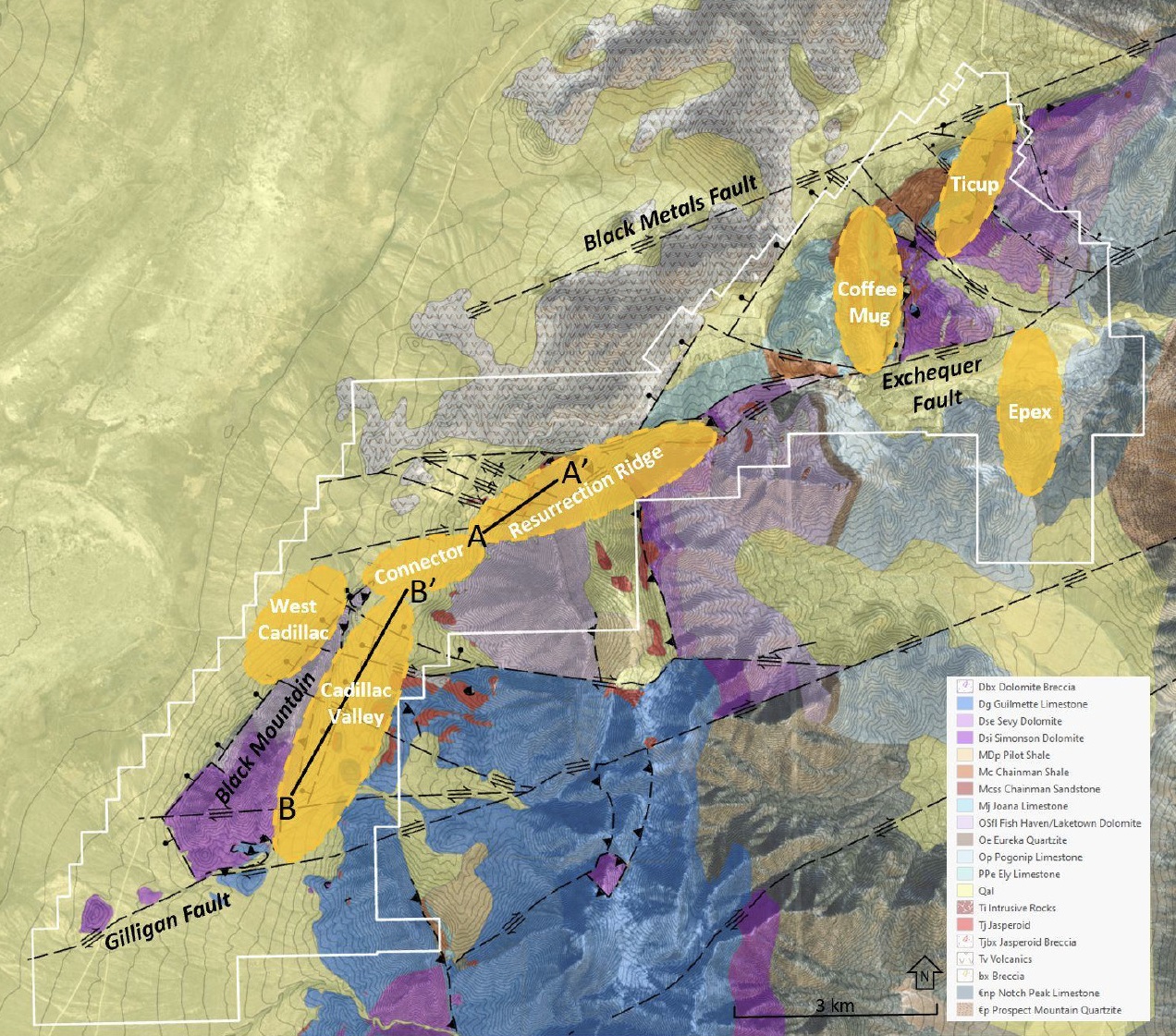

Historical Exploration: Significant exploration work completed on the property to date, including historic drilling of 887 holes over ~120,000 m (estimated at ~$50 million USD to replicate historical work on exploration and drilling today). Most of the historic drilling was focused on Golden Butte/Resurrection Ridge (370 holes) and Cadillac Valley (74 holes). The remaining holes tested other exploration targets including Coffee Mug, Epex, Crashed Airplane, and Ticup. As a result, historical exploration has defined multiple exploration targets of which Resurrection Ridge and Cadillac Valley are considered the most important.

NevGold‘s reinterpretation of the geology in the 2 km gap (Connector Zone) between the Resurrection Ridge and Cadillac Valley zones indicates the Exchequer Fault has created significant right-lateral fault offset between the 2 target areas. The minimal historical drilling in this area did not take the fault offset into account. Additional drilling to test both sides of the Exchequer Fault, where it is expected to cross-cut favorable host rocks, is needed to test for new gold zones between Resurrection Ridge and Cadillac Valley.

Full size / Plan view map of the Limo Butte Property with identified drill targets in orange and mineralized areas in red. The distance of >2 km between Resurrection Ridge and Cadillac Valley has not been tested to date.

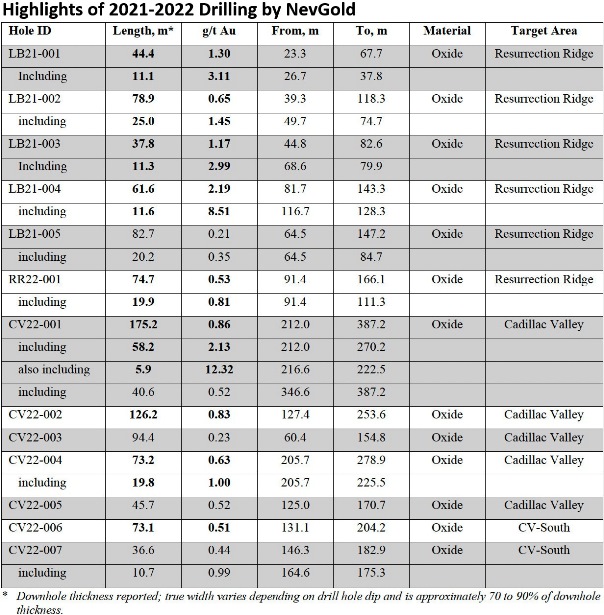

Recent Exploration: In 2021 and 2022, NevGold drilled 28 holes over 8,757 m: 12 at Resurrection Ridge (3,231 m), 11 at Cadillac Valley (3,682 m), 4 at West Cadillac (1,570 m) and 1 at Coffee Mug (274 m). The drilling confirmed the presence of gold intersected by historical holes and provided insights into the controls on mineralization. Key high-grade gold oxide drill intercepts include:

Resurrection Ridge:

• 61.6 m @ 2.19 g/t gold oxide, including 11.6 m @ 8.51 g/t gold oxide

Cadillac Valley:

• 175.2 m @ 0.86 g/t gold oxide, including 58.2 m @ 2.13 g/t gold oxide, including 5.9 m @ 12.32 g/t gold oxide

• 126.2 m @ 0.83 g/t gold oxide (CV22-002)

• CV22-006 (73.1m @ 0.51 g/t gold oxide) discovered new zone “Cadillac Valley South” with >650 m step-out from CV22-002.

• Open mineralization with >3 km of prospective targets to test. Geological model shows key units trending “up-dip” further south and east at Cadillac Valley.

Full size / Significant drill results from NevGold‘s 2021-2022 drilling program at Limo Butte. The table reports downhole thickness. The true width varies depending on drill hole dip and is approximately 70-90% of downhole thickness.

After the 2021/2022-drilling program, NevGold issued a NI 43-101 Technical Report on July 6, 2023, which recommends a 2-phased, $5.5 million USD exploration program of data compilation, geological mapping, geophysics, and drilling (13,000 m of RC holes and 8,000 m of core holes) to better define known targets, to identify additional mineralization, and to advance the most promising of those targets (budget includes calculation of a mineral resource estimate and completion of a Preliminary Economic Assessment including metallurgy).

Full size / Cross-section looking north through the Resurrection Ridge area. Red-dashed lines represent gold zones of 0.1 g/t defined from current and historical drilling. Orange-dashed lines represent areas with the potential for discovery of additional mineralization.

Full size / Long-section looking northwest through Resurrection Ridge. Red outlines represent gold zones of greater than 0.1 g/t defined from drilling. Orange-dashed line represents area with additional mineralization potential, where older barren dolomites have been faulted over the favorable Pilot Shale host rock.

Full size / Long-section looking northwest through the Cadillac Valley area. Red-dashed lines represent gold zones of 0.1 g/t defined from historical drilling. Orange-dashed lines represent areas with the potential for discovery of additional mineralization.

Also in July 2023, NevGold announced a new geological model identifying high-priority drill targets:

Resurrection Ridge:

The updated geological model indicates additional potential for the key host rock (Pilot Shale), particularly to the north and east of the currently defined mineralized footprint at Resurrection Ridge. Updated geologic mapping along with 3-D modeling of the 2022 drill results determined that the Exchequer Fault, one of the main hosts of mineralization at the adjacent Cherry Creek Project, has significant right-lateral strike-slip offset along the Cherry Creek Range. The right lateral strike-slip offset is specifically seen immediately south of the historical Golden Butte Mine where there is limited gold mineralization. This development in the structural model has identified highly prospective areas southwest of Resurrection Ridge in a new area named the “Connector Zone”, and northeast of Resurrection Ridge in the area leading to the gold mineralization at Coffee Mug. Another key development at Resurrection Ridge is the identification of dolomite units having been thrust faulted over the more prospective Pilot Shale unit on the northeastern portion of the target. This explains why historical drilling east of the previously mined Golden Butte pit had gold mineralization situated beneath the older dolomite unit. The historical drilling was not followed up on previously because of different interpretations of the faulting in the area. There are other prospective areas, where this may have occurred on the property, and this remains a new target concept to drill test in the future.

Cadillac Valley:

The 2022-drilling at Cadillac Valley South indicates the mineralization remains open, specifically to the south and east. Cadillac Valley was a key focus of drilling in 2022 and the results uncovered significant mineralization of thick, oxide gold intercepts over a large footprint spanning over 1.6 km northeast to southwest, and over 450 m laterally. After interpretation and 3-D modeling of the 2022 results, NevGold has identified opportunities to discover new mineralization to the south and east, and within the large, mineralized footprint that has been defined to date.

Additional Targets Identified:

West Cadillac and Coffee Mug (Northeast Exploration area) have been identified as areas with strong potential for the key Pilot Shale host rock. NevGold plans to drill both target areas in future drill programs. At West Cadillac, preliminary drilling in 2022 identified Pilot Shale host rock with anomalous gold values at the north end of Black Mountain Range under barren dolomites. Geologic mapping and modeling of this area indicates the Exchequer Fault intersects northwest striking antithetic faults, which may be prospective for gold mineralization. The Coffee Mug, Ticup, and Epex targets have been re-interpreted due to the new understanding of the orientation of the Exchequer and Black Metals faults and their important role in the formation of the Carlin-type gold deposits on the property. Both faults are major hosts and fluid conduits for the mineralization historically mined at the adjacent Cherry Creek Project. The recent work by NevGold indicates the right-lateral movement along the Exchequer Fault north of Resurrection Ridge offsets the mineralization east into the Coffee Mug zone and appears to have been the major fault related to the gold mineralization at Epex. Similarly, mineralization at Ticup is formed where the Black Metals Fault cross-cuts and offsets the Pilot Shale.

NevGold‘s CEO, Brandon Bonifacio, commented in a news-release on February 14, 2023: “The 2022 drilling discovered mineralization in many untested project areas and we have identified an abundance of new, high-priority targets to test in follow-up drilling. The EPO submission is another key milestone for the company as the goal of further drilling will be to expand and infill the mineralized footprints and advance to a resource estimate. With the application of a refreshed geological model of the district, we have materially increased the mineralization after only 12 months of being on the project, and it is great to see an increased level of activity with Freeport-McMoran (NYSE:FCX) drilling adjacent to our southwest, and Centerra Gold (TSX:CG, NYSE:CGAU) drilling adjacent to our northeast.“

Limo Butte is at the epicenter of this emerging Nevada district and controls over 20 km of the total ~30 km of strike length that has numerous styles of mineralization and metal types with gold, copper, silver, lead, and zinc.

Full size / Geologic map highlighting the major right-lateral (eastward movement) faults that offset the entire mountain range including mineralization. Key targets, where right-lateral faults intersect favorable host rocks, are highlighted in orange.

Full size / Gradient Survey: 6 spontaneous potential (SP) arrays were conducted in areas of alluvial gravel, looking for SP lows that might indicate an oxidized sulfide zone beneath the alluvial gravel.

Full size / Gravity Survey: To estimate the depth to bedrock in the alluvial gravel and volcanic rock covered areas and apparently successful in estimating depth to bedrock within about 20%.

Full size / NevGold‘s Limo Butte Property is adjacent to other exploration projects from Freeport-McMoran Inc. (NYSE: FCX; current market capitalization: $64 billion USD), Centerra Gold Inc. (TSX: CG; current market capitalization: $1.7 billion) and Ridgeline Minerals Corp. (TSX.V: RDG; current market capitalization: $10 million). Note that mineralization and other information on adjacent properties is not necessarily indicative of mineralization on NevGold’s properties, and therefore there is no guarantee NevGold will obtain similar results for its properties.

Adjacent Properties: 3 active exploration properties are located along the northern and southern extensions of the mineralized trend found at Limo Butte:

Butte Valley Project:

Adjacent to Limo Butte to the southwest, consisting of the Butte Valley Copper-Gold Porphyry Deposit first drilled in the 1960s with a historic resource of 50 million t @ 0.6% copper (~470 m below surface). In 2022, Freeport-McMoran Inc. (NYSE: FCX) executed a 2-stage, $33-million-USD earn-in deal on the Butte Valley Project for up to 80% interest from Falcon Butte Minerals Corp. (private): Currently drilling for “a big, partially-explored porphyry and skarn copper system“ at depth, with Falcon Butte noting: “We have a great belief in the potential of Butte Valley as one of the great deep copper prospects in North America and are excited that Freeport shares in this same vision [...] not just in its pre-eminent experience in deep copper deposits such as the Grasberg mine in Indonesia.“

Selena Project:

Adjacent to Limo Butte to the south and southwest, targeting a CRD deposit and distal Carlin-style mineralization (disseminated silver and gold). In December 2023, Ridgeline Minerals Corp. (TSX.V: RDG) announced drilling results, including 24.4 m @ 134.1 g/t silver, 2.5% lead, 2.4% zinc and 0.1 g/t gold. 2022 drilling included 32.5 m @ 153.42 g/t silver, 2.51% lead, 1.6% zinc and 0.09 g/t gold (starting at 235 m true vertical depth) and 44.2 m @ 123.2 g/t silver, 1.5% lead, 0.6% zinc and 0.1 g/t gold (starting at 232 m true vertical depth). Ridgeline interprets the near-by Butte Valley Porphyry as the primary source to mineralizing CRD fluids across the Selena Property.

Cherry Creek Project:

Adjacent to Limo Butte to the northeast. The 320 claims (27 km2) contain more than 20 past-producing silver, gold, and tungsten mines, including Blue Bird, Chance, Filmore, Last Chance, Exchequer / New Century, Ticup, and Motherlode. Ticup, New Century / Exchequer and Star are the 3 most important past producing mines. These, and the numerous smaller mines (mostly veins), can indicate a possible hidden large mineral system related to a buried acid intrusive pluton. In 2021, Centerra Gold Inc. (TSX: CG) executed a 4-year, $8-million earn-in deal on the Cherry Creek Project for up to 70% interest from Viscount Mining Corp. (TSX.V: VML): “Cherry Creek is one of the few remaining underexplored mining districts with geological attributes to the formation of both those in production at nearby Kinross’s Bald Mountain mine, and Newmont’s Long Canyon mine.“ In early 2023, phase-1 drilling returned 1.5 m @ 1,456 g/t silver and 5 m @ 297 g/t silver: “The geological setting at Cherry Creek has many similarities to the “Upper and Lower Hilltop Zones“ at the Ruby Hill gold mine recently reported on by i80 Gold Corp. [...] located approximately 50 miles west of the Cherry Creek project. There are many other examples of CRD deposits in the region, including those associated with the Bingham Canyon mining complex in Utah. CRD deposits are an important source of silver and base metals in many jurisdictions.“

Full size / The past producing Exchequer Mine on the Cherry Creek Property from Viscount Mining / Centerra Gold. (Source) “Cherry Creek has been one of White Pine County‘s best-producing districts for well over 100 years... In 1880 Cherry Creek revived and began its biggest boom. Rich new finds were made in the Exchequer and Tea Cup mines. Soon after, additional veins were discovered in the Star Mine...“ (Source)

Geology: The deposits of the Limo Butte Project are Carlin-type deposits, sediment-hosted, with disseminated gold. Gold is commonly micron-sized, and is associated with hydrothermal alteration of carbonate host rocks. Alteration commonly consists of removal of carbonate and addition of silica. Trace elements associated with Carlin deposits include arsenic (As), antimony (Sb), mercury (Hg), thallium (Tl) and barium (Ba).

The Limo Butte Project is located within the Basin and Range physiographic province of east-central Nevada. Paleozoic rocks deposited as sediments on the continental shelf, on what was then the western edge of North America and was later covered, and intruded, by Tertiary volcanic rocks.Compressional faulting of the region during the Cretaceous and early Tertiary Sevier and Larminde orogenies resulted in the formation of generally north-south trending folds and thrust faults. The Great Basin topography of the region is a result of crustal extension during the middle Tertiary forming the current north-south trending mountain ranges separated by alluvium-filled valleys. The mountain ranges consisting of Precambrian to Mississippian-age sedimentary rocks are folded and titled that have been uplifted on steeply dipping normal faults. This Tertiary extension also caused localized volcanism resulting in mafic to felsic flows capping some of the earlier sedimentary rocks.

The Southern Cherry Creek Mountains dominate the project area landscape. The Cherry Creek Mountain Range is underlain by of a package of sedimentary rocks that strikes along the north-south-trending range, and dips to the west at 25-30 degrees. Rocks range in age from the Ordovician Pogonip limestone to the Pennsylvanian Ely Formation. Tertiary jasperoids, volcanic and intrusive rocks also occur, and Tertiary and Quaternary alluvium fills the valleys and low areas. The sedimentary sequence is overlain by Tertiary rhyodacite tuff and intruded by rhyodacite sills and dikes. These dikes are probably related to the Cherry Creek Stock (32.8-36.1 Ma). A number of small andesite-lamprophyric dikes have been noted in the Limo Butte area.

Full size / Geology of Limo Butte Property.

The geological setting of the Limo Butte Property has been described as being similar to that of the Alligator Ridge deposit to the west (see also “Alligator ridge district, East-Central Nevada: Carlin-type gold mineralization at shallow depths“). The geology of the Limo Butte Property area and the distribution of mineralization are structurally controlled. Within the property, 2 major faults with apparent right-lateral strike-slip movement, the Black Metals and Exchequer, trend north 15-30 degrees east. The faults can be traced for over 16 km, from the Cherry Creek district to Resurrection Ridge, and there has been significant lateral displacement, on the order of 8 km, along this fault zone. Mineralization is found along these northeast-trending high-angle fault zones, especially where they are intersected by northwest-trending faults, and where these faults intersect favourable host rocks such as the Pilot shale and karst horizons within the dolomites and limestones.

Mineralization: Mineralization at Resurrection Ridge and Cadillac Valley is elevated in antimony (Sb), mercury (Hg) and arsenic (As), and is largely contained within silicified host rocks. Mississippian and Devonian calcareous shales have been hydrothermally altered; carbonate has been removed, followed by several stages of silica deposition. Gold was deposited during the latter stages of jasperoid development. Most sulfides have been converted to limonite. However, drill samples and select rock chip samples have contained pyrite, arsenopyrite, cinnabar and stibnite.

Mineralization is localized where northwest-trending structures intersect previously fractured rock along the northeast-trending Black Metals and Exchequer faults. It is believed that the gold-bearing hydrothermal fluids travelled along the northwest-trending structures. Where the fluids encountered permeable rocks, such as fractured jasperoid, the gold was deposited along fractures. Gold mineralization was preceded by a minimum of two episodes of brecciation and silicification. The mineralized breccia is composed of silicified fragments in a matrix of massive silica. Pyrite is locally present in the matrix with minor stibnite, stibiconite and barite.Early Jasperoids occurring along the NE zones are offset by NW trending faults creating channel ways for mineralization within in the heavily fractured siliceous rocks. The distribution of the jasperoids can be seen to lie at the intersections the NE-trending Exchequer and NW-trending faults. At the intersection of the two fault trends, alteration and mineralization is strongest. Brittle jasperoid within the faults is strongly fractured, rendering it highly permeable to mineralizing fluids. Ductile rocks (shale) between the two faults are locally argillically altered and intensely deformed. Some of the ductile rocks contain abundant carbonaceous material. A northwest- trending fault forms the southwest boundary of the Golden Butte deposit.

Cedar Wash

Deposit: Nevgold’s Cedar Wash Project is a high-potential, advanced exploration prospect with 2 styles of gold mineralization found on the property: Disseminated Carlin-style gold (hosted by the Claron Formation) and gold-bearing quartz-calcite veins.

Location: Lincoln County, Nevada; 75 km southeast of Pioche, Nevada, on the southern flank of the Clover Mountains. The southeastern part of Nevada is underexplored compared to the other parts of the state.

Ownership: 100%; acquired from McEwen Mining Inc. (TSX: MUX; current market cap.: $578 million) in June 2021.

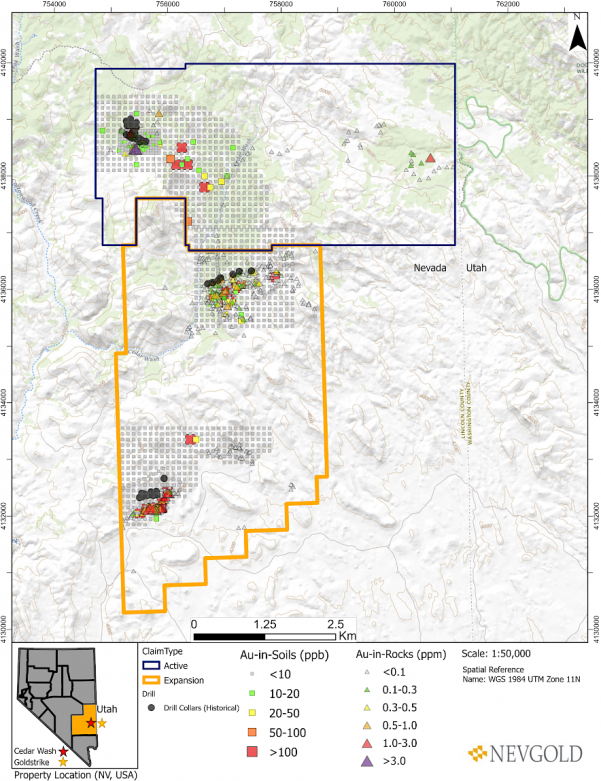

In September 2021, NevGold announced the expansion of its Cedar Wash Property by over 100% through low-cost, organic claim staking. The expanded land position incorporates all prospective gold-silver targets identified in the Cedar Wash district. As seen in below figure, the newly staked area to the south had historical surface mapping, soil and rock chip sampling, and shallow drilling completed. Historical results include surface sampling of up to 2.1 g/t gold in a number of areas. Previous shallow air-track and RC drilling, all historically completed by McEwen Mining Inc., encountered mineralization in multiple holes including 6.1 m @ 1.06 g/t gold within 17.1 m @ 0.62 g/t gold; and 7.6 m @ 0.9 g/t gold within 10.7 m @ 0.75 g/t gold. The mineralization was intersected at or near surface.

Summary: As one of Nevada’s newest gold discoveries, Cedar Wash is a project with truly “open in all directions” potential. The path to discovery began in 2015, when McEwen Mining began reconnaissance-stage exploration in the area. Drilling by McEwen in 2017 proved the presence of a strong gold mineralizing system (16 m @ 1.36 g/t gold and 10.7 m @ 2 g/t gold) which closely resembles the nearby (15 km to the east in Utah) past-producing Goldstrike Project from Liberty Gold Corp. (TSX: LGD; current market cap.: $90 million) with a 2018-resource of 925,000 ounces gold @ 0.5 g/t (Indicated) and 296,000 ounces gold @ 0.47 g/t (Inferred) at a 0.2 g/t cut-off. NevGold aims to build on the early work completed by McEwen to aggressively explore this exciting gold discovery.

History: In 2015, McEwen had embarked on a reconnaissance program aimed at generating new projects. Evidence of historical exploration in the Clover Mountain area is limited to a few prospect pits and a dimension-stone quarry. An old iron and manganese prospect pit, hosted by Cambrian Bonanza King Dolomite, is located in the southern portion of the Cedar Wash area. A sample from this pit contains 31% Fe, 4.6% Mn and 200 ppm Ba, with no precious or base metal values, nor any Carlin-type pathfinder elements such as As, Sb, Hg or Ti. Prior to 2015, there was no evidence of claim staking or prospecting in the area of any of the mineralized outcrops in the project area. The concept of exploring for gold targets hosted in the Claron Formation came from a curious occurrence of an altered, calcareous, Tertiary-age tuffaceous sedimentary rock with strong arsenic west of the Bristol district in Lincoln County. The Claron was reported as the host rock for the Goldstrike Mne in Utah, located approximately 30 km ENE of Cedar Wash, where 200,000 ounces of gold were mined in the 1980s. A program of regional stream-sediment sampling analyzed by bulk leach extractable gold (“BLEG”) was designed to sample drainages that flowed from areas of mapped Claron Formation in eastern Nevada. Early BLEG sampling resulted in the project area a sample containing 0.003 ppm gold found draining a 3-km2 area. Follow-up BLEG sampling led to the discovery of outcropping gold-bearing jasperoid in a bed of Claron limestone. Additional BLEG sampling in the region led to additional prospect areas with surface gold mineralization in windows of Claron, one of which is called The Narrows. Subsequent drilling found gold mineralization in all targets but the host rocks dip under thickening volcanic rocks which are variably altered and only locally mineralized with gold- and silver-bearing quartz-calcite veins. Strongest gold mineralization in drill holes is found at The Narrows target, along a WNW-trending window of Claron for a length of 335 m, with an additional WNW-trending zone of gold- and silver-bearing veins and a corresponding gold-in-soil anomaly in overlying volcanic rocks extending for 2,000 m.

Recent Exploration: More recent exploration was done by McEwen between 2015 and 2017. This consisted of mapping, rock and soil geochem, and some limited RC drilling. This work has identified a number of gold target areas with drilling yielding gold mineralization of significance (16 m @ 1.36 g/t gold and 10.7m @ 2 g/t gold). Future work will focus on compilation of all McEwen data and targeting of additional exploration programs in high-potential areas where the Claron Formation is known to exist.

Geophysics: Regional gravity distinguishes between Tertiary volcanic rocks and the Paleozoic and Mesozoic older sedimentary rocks. The Claron Formation, forming the base of the Tertiary sequence, is located at the transition from higher-density Paleozoic and Mesozoic sedimentary rocks and lower density Tertiary volcanic rocks. The Caliente Caldron appears as a gravity low. Cedar Wash is located on a gradient between the volcanic center and the basement platform. The regional magnetic map shows magnetic highs associated with the volcanic rocks of the Caliente Caldron, contrasted with the lower magnetic sedimentary package. Cedar Wash lies at the southern edge of the volcanic field, along a regional NNW-trending feature in the magnetic data. The gold prospects at Cedar Wash are aligned with the magnetic feature, as are mineralized faults mapped in detail.

Geology: Cedar Wash lies 6-12 km southeast of the Caliente Caldron boundary. Gold mineralization at Cedar Wash is hosted by the Claron Formation. Alteration associated with gold includes stratiform silicification, argillization, iron oxides and, locally, gypsum, where mineralization follows bedding. High-angle faults, trending north-northwest, west-northwest and east-northeast, locally control the shape of mineralized zones, and may have served as conduits for mineralizing fluids. Iron oxides, argillization and quartz-calcite veins have extended into the overlying volcanic rocks. Gold- and silver-bearing veins occur in The Narrows prospect. Gold soil data correlate strongly-to-moderately with Ag-Zn-Te-Sb-Hg-Tl-Se-Mo-As. This is similar to the geochemical signature of the Goldstrike Mine with the notable addition of Se at Cedar Wash. No intrusive rocks have been identified at Cedar Wash or the surrounding area. In the Goldstrike mining district in Utah, a Miocene granite porphyry laccolith is found at Mineral Mountain, which may have been a source for hydrothermal solutions for the gold deposits there.

Cedar Wash is located along a regional contact between Paleozoic and Mesozoic rocks to the south, with overlying Tertiary volcanic rocks to the north. The oldest rocks in the area are Cambrian dolomites mapped as Bonanza King Formation. To the east, in the nearby Goldstrike District in Utah, it is reported that southeast-directed regional tectonism of the Sevier orogenic event (160M to 50 M years ago) that placed deformed older Paleozoic rocks over younger Mesozoic rocks. East of Cedar Wash, at Square Top Mountain and Jackson Peak, geologic mapping found Paleozoic strata thrust over folded Mesozoic rocks. Subsequent erosion of the Paleozoic and Mesozoic rocks produced low topographic relief prior to deposition of lacustrine and fluvial sedimentation in early Tertiary time. These sediments comprise the Claron Formation, which consists of variable thicknesses of sandstone, conglomerate, limestone and tuff. The Claron was deposited on the erosional surface of exposed Paleozoic and Mesozoic sedimentary rocks. Cedar Wash is located near the western limit of the Claron depositional basin and is significantly thinner there than in the central part of the basin in Utah. The Claron Formation at Cedar Wash is variable and ranges in thickness from 25 m to nearly 100 m at The Narrows. It thickens to the east and appears to pinch out just west of the project area.

Development Plans: According to NevGold‘s news-release in September 2021: “After completion of the data compilation, we identified a number of opportunities at Cedar Wash. Firstly, based on the historical work at the project we increased our land holdings to incorporate all of the prospective targets in the district... Secondly, through our data compilation and review, there are a number of key work streams that we have identified to systematically advance Cedar Wash. Our first objective is to build upon the existing rock chip sampling, soil sampling, and surface mapping to develop our understanding of the geology to better vector in on the key drill targets. An interesting take away from the data compilation is that there has been no project specific geophysics programs completed on the property to date, which represents an area of untested potential for target generation.“

Management & Directors

Brandon Bonifacio (President, CEO, Director)

Brandon is a mining executive with expertise in project development, mergers and acquisitions, and project evaluations with over 10 years of experience. He was the Finance Director of the Norte Abierto Joint Venture (Cerro Casale/Caspiche) in the Maricunga Region, Chile, and a member of the corporate development team at Goldcorp Inc. (now Newmont Corp.). Brandon holds a Master of Applied Science in Mining Engineering, an MBA from the University of Nevada, Reno, and a Bachelor of Commerce in Finance from the University of British Columbia. He is currently also a Director of Terra Balcanica Resources Corp., and a Director of Angold Resources Ltd.

Bob McKnight (Executive VP, CFO, Corporate Development)

Bob is a mining executive with over 40 years of relevant experience in the mining industry. He has been directly involved in over $1.5 billion in project debt, equity, stream, and M&A transactions. As Executive VP and CFO of Nevada Copper Corp., Bob has participated in the arrangement over $500 million in debt, equity, and metal stream financings for the Pumpkin Hollow Project. He holds a P.Eng., B.Sc., and MBA.

Derick Unger (VP Exploration)

Derick is a geologist with over a decade of experience leading exploration teams in the discovery of gold and silver deposits. His prior experience includes serving as Chief Geologist for NuLegacy Gold Corp., where he led the exploration team at NuLegacy’s Red Hill project in Nevada. Under his leadership, the NuLegacy team discovered the Serena zone, the highest-grade Carlin-type gold zone recognized at Red Hill and the Vio zone, a previously unidentified low-sulfidation epithermal gold-silver deposit. Prior to that, Derick held progressively senior roles with Nyrstar NV, Newmont Corp., and Victoria Gold Corp., and he played a key role in Newmont’s discovery of the East veins at the Midas Mine in Nevada and Victoria Gold’s discovery of the high-grade Helen zone at the Cove Project in Nevada. Derick most recently served as a Resource Geologist at Mine Development Associates Inc. in Reno, Nevada, where he gained valuable experience in completing resource estimations and authoring technical reports on projects in Nevada, Idaho, Nicaragua, and Mexico. Derick holds a Master degree in Geology from Auburn University and a Bachelor degree in Geology from Indiana State University.

Eugene Toffolo (Capital Markets)

Eugene has over 35 years of relevant experience in the investment sector with an in-depth understanding of public companies and raising capital in the resource industry. He acts as the key liason with investment advisors, institutional and retail investors. He was previously VP Investor Relations of Nevada Copper Corp.

Catherine Cox (Corporate Secretary)

Catherine has over 20 years of experience as Corporate Secretary to a variety of public and private companies in the resource sector. She was the former VP Corporate Secretary for Nevada Copper Corp. and has an extensive securities and corporate paralegal background working with both Canadian and US law firms.

Giulio T. Bonifacio (Non-Executive Chair)

Giulio has over 30 years of experience in senior executive roles in the mining industry in both the base and precious metals sector. He was the Founder, President, CEO, and Director of Nevada Copper Corp. from 2005 until his retirement in 2018. Giulio led and directed every stage of advancement of Nevada Copper‘s Pumpkin Hollow Copper Mine from exploration, development, permitting and construction. He is a Chartered Professional Accountant with considerable experience and knowledge of operations, capital markets and project finance while raising significant amounts of capital for projects of merit by way of project debt, offtake, and equity. During his 12 years at Nevada Copper, Giulio successfully permitted both the underground and open pit operations at Pumpkin Hollow, which is the only permitted copper project of scale in the United States in the past 25 years. He has held previous senior executive roles with Getty Resources Ltd., TOTAL Energold Corp. (an energy and gold producer), and Vengold Inc. (a gold producer prior to founding Nevada Copper in 2005). Giulio was formerly President, CEO and Non-Executive Chair of Faraday Copper Corp. from 2018 until 2022. Currently, he also serves as Executive Chair of Candente Copper Corp. and as Non-Executive Chair of Terra Balcanica Resources Corp.

Victor Bradley (Independent Director)

Educated in England, Victor is a Chartered Professional Accountant with more than 50 years experience in the mining industry, including more than 15 years with Cominco Ltd. and McIntyre Mines Ltd. in a wide variety of senior financial positions from Controller to CFO. Over the past 30 years, Victor has founded, financed and operated several mining and advanced-staged exploration and development companies, including Yamana Gold Inc., Aura Minerals Inc. and Nevoro Inc. (sold to Starfield Resources Inc.). He founded the original Yamana in early 1994 and served as President and CEO, and then served as Chairman of the Board and Lead Director until 2008. He also served as Chairman of Osisko Mining Corp. (from 2006 up to its sale for $4.1 billion to Agnico Eagle Mines Ltd. and Yamana in 2014), Director of Osisko Gold Royalties Ltd. (spun out of the Osisko Mining sale) from 2014 to 2018, and as Chairman of Nevada Copper Corp. from 2012 to 2017. He now serves as Chairman of Osisko Bermuda Ltd. (Osisko Gold Royalties‘ offshore subsidiary that controls all of its assets outside of North America).

Greg French (Independent Director)

Greg is a geologist with over 35 years of exploration experience in the western US and Canada. He has worked in various capacities for Homestake Mining Co., Atlas Precious Metals Inc., and Cornerstone Industrial Minerals Corp. as well as consulting for numerous junior mining companies. Greg has a Nevada gold discovery to his credit and extensive project development experience including two projects taken through feasibility and production.

Tim Dyhr (Independent Director)

Tim has 35 years of experience in mining. He has led multidisciplinary teams to successfully permit copper and gold mines in Nevada since 1983, and worked on projects in Arizona, California, Washington, Montana, Wyoming, Peru, Chile, Argentina, Australia, Africa, Turkey, China, and Papua New Guinea. His experience includes environmental, regulatory, land and legal affairs, as well as government, media, NGO, and public relations. He has worked as a mine site Environmental Manager, Environmental Consultant, Natural Resources Manager, and group Environmental Manager for BHP Group.

Morgan Hay (Independent Director)

Morgan is a partner with Maxis Law Corp., practicing securities, corporate, and commercial law for over 15 years. He assisted clients with a wide variety of transactions, including public and private equity offerings, debt financings, mergers and acquisitions, initial public offerings and stock exchange listings, capital pool company listings and qualifying transactions, reverse take-overs, spin-out transactions, and hostile take-over bids. He also provides legal advice on general corporate and securities matters, including continuous disclosure issues and mining technical disclosure. He regularly advises clients on corporate governance issues, including advising independent board committees with respect to transformative corporate transactions.

Excerpts from “Nevada’s Carlin Trend“ (November 2020): “Events of the past few decades have rewritten the history of American gold mining. California billed as the “Golden State,” no longer leads all states in cumulative gold production. Taking its place is Nevada, which, ironically, is known as the “Silver State.” Since 1983, Nevada has hosted America’s greatest gold-mining boom ever. During those 35 years, the state has produced 200 million troy ounces (6,250 metric tons) of gold with a cumulative, year-mined value of roughly $140 billion. To put these figures into perspective, recall that in 1852, the California gold rush’s peak year, miners recovered 2.5 million troy ounces of gold. This year, Nevada will produce more than five million troy ounces – and has done so for the past 28 consecutive years. Nevada, which accounts for 80 percent of the United States’ current annual gold output, has produced nearly half of all the gold ever mined in the nation. If Nevada were a country, it would now rank fourth in annual world gold production. And most of Nevada’s gold has come – and is still coming – from a five-mile-wide, 40-mile-long strip of land called the Carlin Trend that is the world’s third-richest gold-mining district of all time. Nevada’s gold mining adventure began in 1849, with a series of minor placer strikes that went unnoticed in the shadow of the California gold rush. But in 1859, small-scale placer-gold mining led to the discovery of the Comstock Lode, when sluice boxes became clogged with heavy, black sands that were identified as oxidized silver minerals. As the nation’s first major source of silver, the Comstock Lode gave Nevada both statehood and its “Silver State” nickname. By the time the Comstock’s best ores were gone in 1875, it had yielded 20 million troy ounces of silver and 700,000 troy ounces of gold. At that point, Nevada’s mining industry fell flat until 1900, when rich gold strikes revived it at Goldfield and Tonopah. By 1980, Nevada had turned out 20 million troy ounces of gold – certainly respectable, but not much compared to California’s 110 million troy ounces. Nevada’s entry into the big leagues of gold mining began in spring 1961, near the little town of Carlin 23 miles west of Elko. For months, two geologists had left their motel at daybreak, heading out in their pickup into the sage-covered hills of the Tuscarora Mountains. Folks in Carlin all knew the geologists were searching for gold, and that made the old-timers smile because they had futilely searched those same hills for gold themselves. The geologists, John Livermore and J. Alan Coope were looking for a specific type of gold – invisible, micron-sized particles. Along with that goal, most importantly, an unproven theory that concentrations of microscopic gold could occur in sedimentary formations. Livermore and Coope studied rock formations and collected thousands of samples. But all the assays only reported grades far too low to be mined. In June, the old-timers in Carlin were surprised when the two geologists staked 17 claims for the Carlin Gold Mining Company, a “paper” corporation consisting only of the two geologists, their prospecting equipment, and a pickup truck. The geologists then bulldozed three trenches and collected more samples. Assay reports from the first two trenches were disappointing, but those from the third trench showed an encouraging 0.22 troy ounces of gold per ton. That was much higher than all previous samples, but still very low-grade when measured against traditional mining standards. In their next step, Livermore and Coope ordered in a three-month-long core-drilling program. By December, the cores had revealed exactly what they had found – a very low-grade, but massive, ore body. They estimated the size of the ore body at 11 million tonnes, and its average grade at nearly 0.3 troy ounces of gold per ton. The microscopic gold particles, which were included or dissolved in pyrite, were disseminated throughout a massive...“

Full size / “Considering the significant worldwide debt levels, it‘s logical to anticipate central banks prioritizing enhancing the caliber of their international reserves to stabilize monetary conditions. Furthermore, it‘s important to acknowledge that overall investors usually mimic the actions of these prominent institutions, and from my perspective, gold is yet to attract substantial flows from more general capital allocators.“ (Source)

According to “Rising Rates and Robust Gold Demand?“ (February 2, 2024): “Although real interest rates continue to inch higher, and Westerners continue to sell gold, all this selling is being met by Central Bank purchasing. Once Western investors stop selling gold and begin accumulating, their buying will quickly bump up against Central Bank demand. The next leg of the gold bull market is likely to begin at that moment. We are getting closer and closer, and we continue recommending investors maintain significant precious metals exposure. Physical gold has significantly outperformed precious metals equities, as Western investors have been selling both physical and equities. Gold stocks (as measured by the GDX ETF) are down almost 30% from the 2020 peaks. Silver stocks, as measured by the SIL ETF, have pulled back even more – they have now pulled back 40%, and both represent excellent value.“

Excerpts from “Gold demand to hit record with central bank buying, WGC says“ (January 31, 2024): “Total gold demand hit a record last year and is expected to expand again in 2024 as the US Federal Reserve moves toward cutting interest rates, potentially aiding prices, according to the World Gold Council. Overall consumption climbed by about 3% to 4,899 tons last year, supported by strong demand in the opaque over-the-counter market, as well as from sustained central-bank buying, according to the WGC’s full-year report. That’s the highest total figure in data going back to 2010. “The landscape is appropriate for emerging central banks to continue to be net buyers,” Joseph Cavatoni, chief market strategist at the WGC, said in an interview... The comprehensive demand figure includes bullion for investment, jewelry, coins, central-bank buying, exchange-traded funds and OTC activity. In that latter market, participants including sovereign funds, high net-worth individuals, and hedge funds invest in gold bars, Cavatoni said. The precious metal rallied 13% last year, touching a record in early December, on the back of economic and political uncertainty, geopolitical tensions, and expectations that the Fed is poised to start easing policy after an aggressive hiking campaign to tame inflation. Investors typically want to own gold in a rate-cutting cycle as it benefits from lower Treasury yields and a weaker dollar...“

“Annual demand growth in the OTC market hit 753% last year, the most since at least 2011, WGC data showed. Investors are expected to continue accumulating gold at an accelerated pace this year, largely driven by the Federal Reserve’s expected pivot toward easing, according to Cavatoni.“ (Source)

“Central-bank buying maintained a breakneck pace, with annual net purchases of 1,037 tons last year, just 45 tons shy of the record set in 2022, the WGC said in the report. It expects central-bank buying to top 500 tons this year. The expected OTC spree, as well as central-bank buying, will provide a key counterweight to softness elsewhere, especially exchange-traded funds. That provides strong upside for prices, with a case for $2,200 an ounce or more, according to Cavatoni.“ (Source)

“Western investors are behaving as they have in the past rising real rate cycles: they are selling gold. We track eighteen physical gold ETFs, and the relationship between real rates and gold accumulation is clear. The last time real interest rates rose was between 2012 and 2016, during which period Western investors liquidated over 1,000 tonnes from the physical ETFs, causing gold to fall 45%. Since the summer of 2020, real rates have again surged, and Western investors have predictably shed 760 tonnes of gold. Somehow, gold remains near its all-time high. The difference is central banks. Over the last several years, central banks have gone on a massive gold-buying spree. Last year, central banks accumulated 1,136 tonnes – a record as far back as our dataset goes. This year, they have continued to accumulate. For the first nine months of 2023, the World Gold Council (WGC) reports central banks purchased an additional 800 tonnes of gold, with 337 tonnes coming in the third quarter alone. Year-to-date, central bank gold purchases are up 14% compared to last year...We believe strong central bank buying will continue... The last three periods of radical commodity undervaluation (late 1920s, late 1960s, and late 1990s) saw a significant change in the global monetary regime... After decades of excessive monetary growth and globalization, trade imbalances now dwarf the size of the global gold market. If a new monetary system emerged in which gold was used to settle trade imbalances, central banks would have to continue accumulating gold, driving prices higher.“ (Source: “Rising Rates and Robust Gold Demand?“, February 2024)

“After an estimated 7.6% decline in 2022, gold production is expected to increase by 3.9% to 121.2moz in 2023. Russia, Ghana and the US will be the key contributors to the growth in global supply in 2023... Meanwhile, gold production growth in the US will be supported by increases in output from Newmont’s Cortez and Turquoise Ridge mines. In contrast, gold production in China, the world’s largest producer, is expected to decrease slightly by 1.1% in 2023, linked to declining ore grades. Newmont, Barrick Gold, Agnico-Eagle Mines, Jiangxi Copper, AngloGold Ashanti, Polyus, Gold Fields, Newcrest, Kinross and Zijin Mining Group are the world’s largest gold producers, accounting for 26% of global gold production in 2022. Looking ahead, global gold mine production is expected to remain flat during the forecast period (2024-2030), at a CAGR of 0.9%, primarily due to the depletion of its gold resources in China alongside scheduled closures of several mines in China and Ghana.“ (Source: Mining-Technology.com, November 2023)

“Canadian miner Barrick Gold Corp said on Tuesday its full-year preliminary production of gold fell from a year earlier, even as output rose sequentially in the fourth quarter. The world‘s second-largest gold miner said in November its 2023 gold production was forecast to be lower than expected due to equipment issues at its Dominican Republic mine and lower output at two sites in the Nevada Gold Fields project. Barrick reported a 2.17% fall in 2023 gold output at 4.05 million ounces from a year earlier, which came below its forecast, and analysts‘ average estimate of 4.16 million ounces, according to LSEG data. Copper production also fell 4.76% to 420 million pounds. Analysts had estimated 433 million pounds of output.“ (Source: Reuters, January 2024)

Company Details

![]()

NevGold Corp.

Suite 250 – 200 Burrard Street

Vancouver, BC, V6C 3L6 Canada

Phone: +1 604 337 5033

Email: info@nev-gold.com

www.nev-gold.com

CUSIP: 641536 / ISIN: CA6415361071

Shares Issued & Outstanding: 93,483,319

Canadian Symbol (TSX.V): NAU

Current Price: $0.31 CAD (03/15/2024)

Market Capitalization: $29 Million CAD

German Ticker / WKN: 5E50/ A3CTE1

Current Price: €0.202 EUR (03/15/2024)

Market Capitalization: €19 Million EUR

Contact:

www.rockstone-research.com

Disclaimer: This report and the referenced news-releases contain forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, NevGold Corp. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to NevGold Corp.s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through its profile on SEDAR at www.sedarplus.ca. Please read the full disclaimer within the full research report as a PDF (see here or below) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, currently does not own any equity of NevGold Corp., however he owns equity of Zimtu Capital Corp. and thus will profit from volume and price appreciation of this stock. The author is being paid by Zimtu Capital Corp. for the preparation, publication and distribution of this report, whereas Zimtu Capital Corp. holds an equity position of NevGold Corp. and thus will profit from volume and price appreciation. Note that NevGold Corp. pays Zimtu Capital Corp. to provide this report and other investor awareness services.