This interview was conducted on February 19, 2011, by Stephan Bogner with David C. Mathewson, VP Exploration of Gold Standard Ventures Corp.

Stephan Bogner:

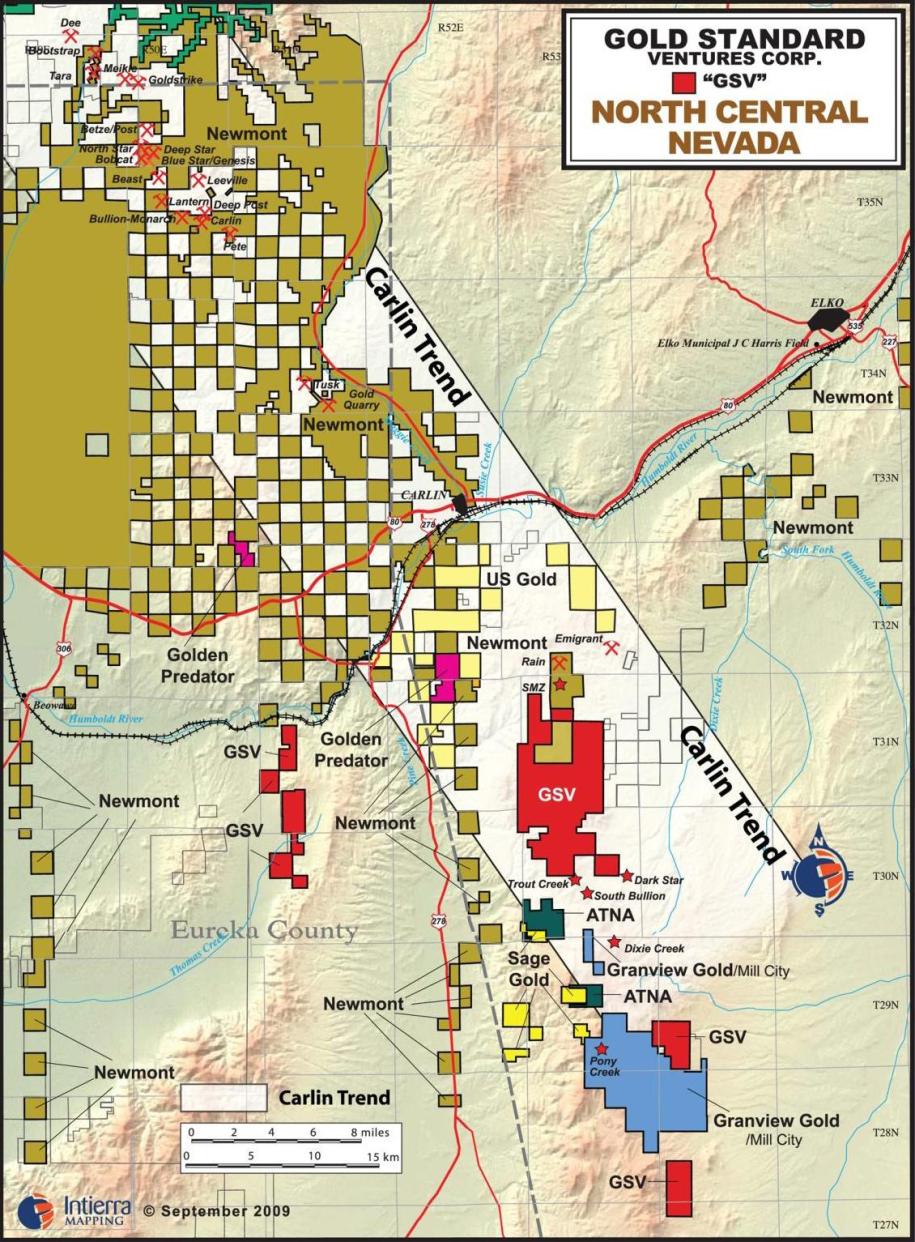

Nevada is one of the largest sources for precious metals in the world. Since the 19th century, some 5,000 tons of gold alone were recovered in this U.S. state alone – at today’s prices worth more than $200 billion. Newmont Mining and Barrick Gold benefitted from the emerging gold business in Nevada and are now the biggest and most profitable gold miners in the world.

Mr. Mathewson, you are one of the most renowned and most respected geologists when it comes to Nevada – not only because you were the Head of Exploration for Newmont Mining in Nevada and now already having an experience of some 35 years focusing on Nevada. Numerous discoveries in the productive Rain District on the Carlin Trend are credited directly to your hands-on work and knowledge – and not only because you developed the famous and commonly-used “Rain Model” about this district. With such a background and with such a knowledge about the geology of this prolific mining district, what on/in earth made you become part of such a small and unknown junior exploration company like Gold Standard Ventures? What is so special about their 100% owned “Railroad Gold”-Project some 30 miles west of Elko?

Dave C. Mathewson:

Successful exploration is all about applying effective and often new ideas, basically geological concepts, in entrepreneurial ways to the rocks for the sole purpose of making discoveries. Private and public junior exploration companies provide the best vehicles to do exactly what needs to be done to be successful. Junior exploration companies work particularly well because there are no managerial or bureaucratic or philosophical encumbrances such as those that exist all too commonly within large mining companies. Gold Standard Ventures provides its exploration team an excellent vehicle by which to conduct exploration.

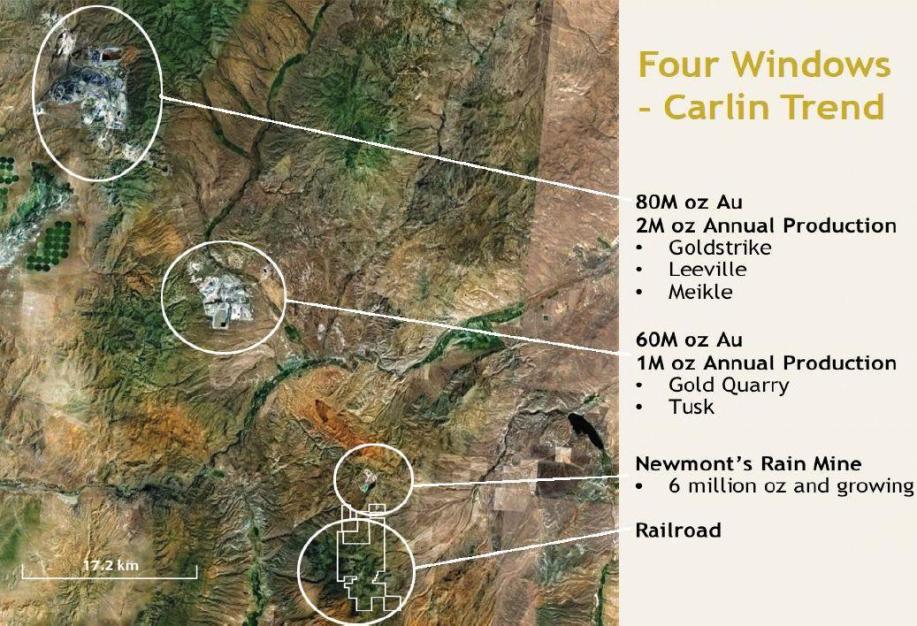

I helped found and committed to become part of Gold Standard Ventures when it was evident that we were going to be able to acquire the Railroad district property. The Railroad district is located immediately south and adjacent to the Rain district on the Carlin Trend. I have many times referred to them both as “sister” districts because of their proximity to each other and their almost identical geological characteristics. In the past, Railroad has been very underexplored with none of the tools or ideas that worked so exceptionally well in the Rain District ever having been applied to Railroad. From 1992 through 1994, I worked the Rain district for Newmont and was responsible for discovering several new gold deposits, comprising 4 to 5 million ounces. During this time and later while with Newmont, I tried several times to acquire Railroad on behalf of Newmont for the purpose of exploring what I recognized many years ago as a very high potential district. At that time, the economic encumbrances of excessive gross royalties, in places exceeding 10%, could not be overcome. Gold Standard Ventures acquired the property in 2009 with very reasonable underlying royalties.

Stephan Bogner:

Although Nevada has produced a lot of gold and other metals over the last 150 years, or so, what has become known to be as the Carlin type gold deposits have had a relatively recent history of discovery, because of the “no see-um” (micron-scale) nature of the gold and the rather complex setting of geological structures and formations combined with the various ways of obscuring the expressions of the gold-bearing mineral systems. The Railroad-Project is located within the Great Basin – a relatively underexplored area as a result of and because most geologists did not fully understand the structural geology, the stratigraphy of the ore-hosting sediments, the complex nature of the ore deposits, and how to effectively apply various effective means to make the discoveries. Please inform us briefly about the regional geology and especially about the local geology of the 14,000 acres “Railroad Gold” property and why you believe that productive quantities of gold are present within the sedimentary host rocks of this property.

Dave C. Mathewson:

Railroad is a district-scale exploration opportunity with all the ingredients of system, host, structure, and discovery opportunity for both open pit and underground gold deposits. The district is a very close analog to NewmontÂ’s adjacent Rain district where approximately 6 million ounces of gold have been discovered and many more millions of ounces probably remain undiscovered. A very large volume of rock in the Railroad district has been affected by metal-bearing, including gold, hydrothermal activity. Dating of intrusive rocks indicate a Late Eocene mineral event age consistent with the time of emplacement of gold elsewhere on the Carlin Trend. Favorable host rock units with variable to strong gold system indications are exposed over a considerably larger area than that in the Rain district. Evaluation of the large geochemical database and the new, detailed gravity work and the drilling that Gold Standard Ventures conducted in 2010 provide good indications of the presence of potentially very significant gold deposits at Railroad.

Stephan Bogner:

In the end of July 2010, Gold Standard Ventures Corp.(TSXV-Symbol: GV) began an aggressive drill-program and announced the first assays in November 2010 at a share-price of approx. $0.55 – since then, the share-price has been increasing slowly but steadily to currently approx. $1.05 giving the immediate impression that the market likes and honors the results that are being increasingly announced lately. Looking closely at the drill-core and less at the share-price development over the last months, what are your interpretations of the intersected stratigraphy? Has the core met your expectations of what you thought to encounter? What do you think about the grades that were assayed until now?

Dave C. Mathewson:

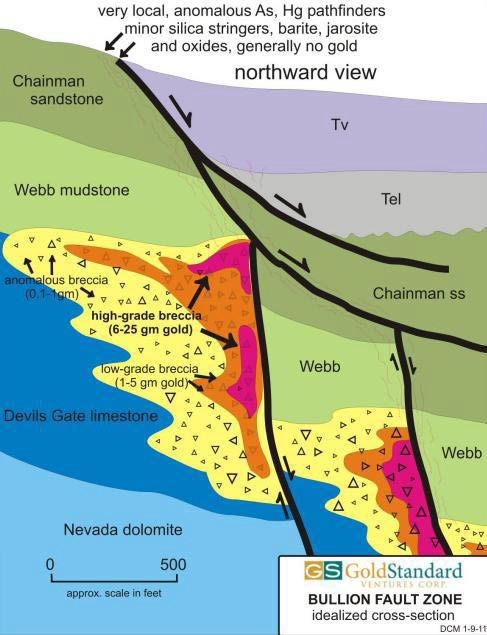

The drilling, especially core drilling that Gold Standard Ventures conducted in 2010 confirmed the presence of extensive bodies of altered and mineralized collapse breccias; the Rain model for gold deposits is very much in evidence. This particular model is also the model for about 80% of all the gold, especially the high grade gold mineralization on the Carlin Trend. A constant flow of visitors to the property and our Elko office seemed to like what they were seeing and what we were encountering in our drill holes. Well-conducted drill programs involve a very thorough evaluation process whereby it is necessary to implement iterative adjustments as to where best to drill. Towards the end of the season, in October and November, the drill results were improving as we gained more understanding of the targets and were better able to direct the drill. The last completed hole, RR10-8 drilled to 1559 feet, provided the best gold results with a continuous zone of 435 feet of gold mineralization including an interval of 105 feet of 1.4 g/t, and an interval of 140 feet of 1.2 g/t. We came a long way in the first year of drilling, but definitely have some way to go in order to achieve the results that we fully expect to achieve, specifically the kind of grades and volume of gold mineralization that exist commonly elsewhere on the Carlin Trend.

Stephan Bogner:

As per the rules of the “Rain Model”, if drilling encounters collapse breccias along with certain characteristic alterations, the probability of hitting a deposit-discovery hole are very high. As successfully having drilled these specifics already, you are definitely in the game of discovery and what typically follows is stepping out further in order to find the high-grade feeder zone at the right depth with gold grades in the area of 3 g/t. Is this the reason why the drill-program already steps out that big with intervals of 200-300 meters on the (few) 16 holes drilled in 2010? You must be quite certain of getting very close to the major structure of this deposit - typically such “final targets” are relatively small (thus difficult to find easily), maybe 300 x 800 feet, as being the case with for example Cortez Hills or at Barrick´s Goldstrike. The sensational discovery of the 450 x 30 feet “Sleeper Vein” in near-by Humboldt County in 1986 was not encountered until the 34th drill hole, so you may drill through such bonanza-style zones on the Railroad property sometime soon – especially when being the first explorer on this property of having the advantage of applying modern exploration techniques, such as gravity studies for example. Kindly elaborate as well on the gravities respectively densities that you measured at Railroad compared with Newmont´s Rain Deposit only 4 miles north, where 6 million gold ounces have been calculated so far (still growing) – but with the stunning difference of your gravity highs being around 3-times the size.

Dave C. Mathewson:

The early holes in a true exploration program are the search holes; I sometime refer to them as scout holes. These holes are directed to look for positive indicators of gold mineral systems within what one believes are the permissive package of rocks that may contain gold deposits. It is not so hit-and-miss as it might sound. The holes are very carefully sited and designed so as to maximize the chance of success. Once the drill is in progress, the material coming out of the hole is carefully examined and “milked” for every bit of information possible; this is where it is very important to have senior explorers involved; they can, and will see things, and perhaps imagine things that will subsequently lead to re-directing drilling to even more prospective places. The subtleties of information from drill holes can really matter.

Mother Nature did/does follow certain rulesÂ… we just have to be smart enough and work hard enough to figure out what she has done! The idea is to, as soon as possible, zero in on the high grade portions of the gold deposit. The high grade is what will determine the economics of the deposit and, of course, get the market excited about what we are doing.

In 1992 and 1993, while with Newmont and under my direction, detailed gravity surveys were conducted over the entire Rain mining district located immediately north of Railroad. The Rain gravity survey contributed very much to acquisition of prospective properties, identification of potential target zones, and siting of exploration holes. The success at Rain was reported by Joe Beetler, NewmontÂ’s geophysicist, and I, in a 1998 Geological Society of Nevada paper. It was very much a surprise to me that a similar survey had never been conducted at Railroad, but irrespective of that, immediately after Gold Standard acquired the Railroad properties, we commenced to do detailed gravity.

The 2009 gravity program very much helped guide our 2010 drilling program, and we completed doing gravity work over the entire property in late 2010. Gravity data/surveys provide two important sets of information: 1) relative depth from the surface to permissive, potentially gold- bearing rock formations, and 2) the approximate location of potential, major gold-feeder structures. The juxtaposition of these two sets of information comprise target locations. The gravity results at Railroad indicate a much larger prospective area than the Rain district, by at least three times the area, within which to encounter gold deposits at very reasonable and shallow depths, that is for both open pit and shallow underground mineable gold deposits.

Stephan Bogner:

What are the next exploration plans and steps?

Dave C. Mathewson:

As early as possible in 2011, we will commence drilling on 3 major, currently defined targets, especially the Bullion Fault Zone where we discovered a new and potentially economic zone of gold mineralization late in 2010. The two other targets in this category are the alteration zone of the historic Bullion mining area, and the newly defined Railroad fault zone which appears to be an excellent analog of the productive Rain fault zone within the Rain district. We also have 3 other sizeable target areas that require additional ground-work leading to the design of targets for drilling. Any one of these 6 targets could lead to one or more, multimillion ounces of discovery. We have built an excellent exploration team; I believe we are up to the task of making the discoveries that can and should be made at Railroad.

Stephan Bogner:

In the 1980s, Barrick Gold acquired the Goldstrike deposit at a stage where it was only defined to a resource of around 1 million gold ounces, being the reason the majority thought it paid way too much for that. However, over the following years it turned out that this deposit was Barrick`s company-maker as increasing the mineable resource to some 100 million ounces. What is the exit-strategy of Gold Standard Ventures; at what stage would management consider a take-over by a senior? Can you confirm that Mr Carl Pescio, who is heard to be the largest individual shareholder of the $2.5 billion capitalized Allied Nevada Gold Corp, has recently become as well the largest individual investor of Gold Standard Ventures?

Dave C. Mathewson:

I would say that we are not very focused on our exit strategy at this time; we are fully focused on making the discoveries we believe can and will be made at Railroad. There seems little doubt, however, that if we are successful, we will become a take-over candidate, especially considering we are situated in the middle of billions of dollars of processing infrastructure that needs, or will need ore to feed. Carl Pescio, a longtime friend and business associate of mine, and a very capable geologist/explorer is a large shareholder of Gold Standard. I donÂ’t know, however, if he is the largest individual shareholder.

Stephan Bogner:

Kindly summarize the 5 major reasons from your point of view why investors should look at and follow closely the exploration and development of the “Railroad Gold”-Project.

Dave C. Mathewson:

1. Railroad is a district-scale exploration opportunity for multiple-millions of ounces of gold located on the productive Carlin Trend – the most prolific gold belt in the western hemisphere.

2. Gold Standard Ventures controls 100% of the project.

3. The checker-boarded land position comprised of half private surface and minerals and the other half public lands contributes significant facility to exploration and permitting and development of mines.

4. Nearby operational infrastructure with billions of dollars of existing processing facilities and the potential for fast-track gold delivery to these facilities provide immediate premium value to all new ounces discovered at Railroad.

5. The Gold Standard exploration team is comprised of an exceptional group of ore-finders that are applying the most effective means available in the industry to make discoveries at Railroad.”

Stephan Bogner:

Kindly mention the persons behind Gold Standard Ventures, especially your Nevada Exploration Team.

Dave C. Mathewson:

Corporate office:

Jonathan Awde, Director and President and CEO

Michael Waldkirch, CFO

Richard Silas, Director and Corporate Secretary

Others: Ewan Downie and Robert McCleod, Directors

Jonanthan Rubenstein and David Cole, Advisors

Nevada Exploration team:

Dave Mathewson: Director and Vice-President of Exploration, former Nevada exploration manager for Newmont, 1994-2001, responsible for the discovery of several millions of ounces of gold in several deposits on the Carlin Trend, and elsewhere in Nevada.

Warren Thompson: Chief Geologist, former Fronteer geologist, responsible for advancing the Long Canyon, Pequops project, and also several other major gold projects on the Rabbit Creek Gold Trend, Nevada.

James Wright: Wright Geophysics, Geophysical advisor, responsible for geophysical program implementation, management, and interpretation for Gold Standard Ventures.

Ernest (Buster) Hunsaker: Contract Exploration Geologist, long history of contributions with several successful companies in Nevada.

Joe Laravie: Exploration Geologist and Data-Technician, strong background and successful exploration career with Santa Fe Mining Company and Newmont, manages all of Gold Standard Ventures database.