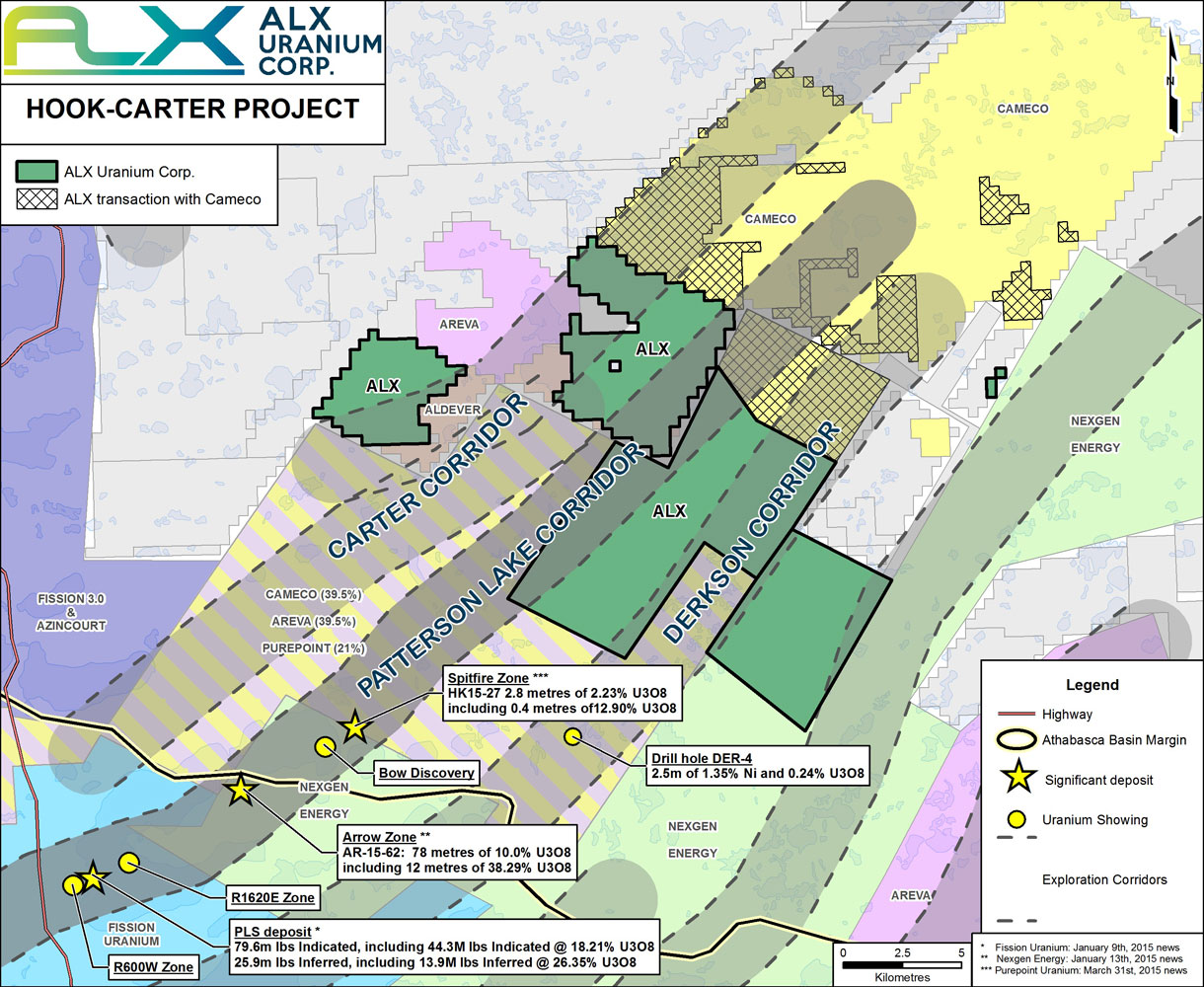

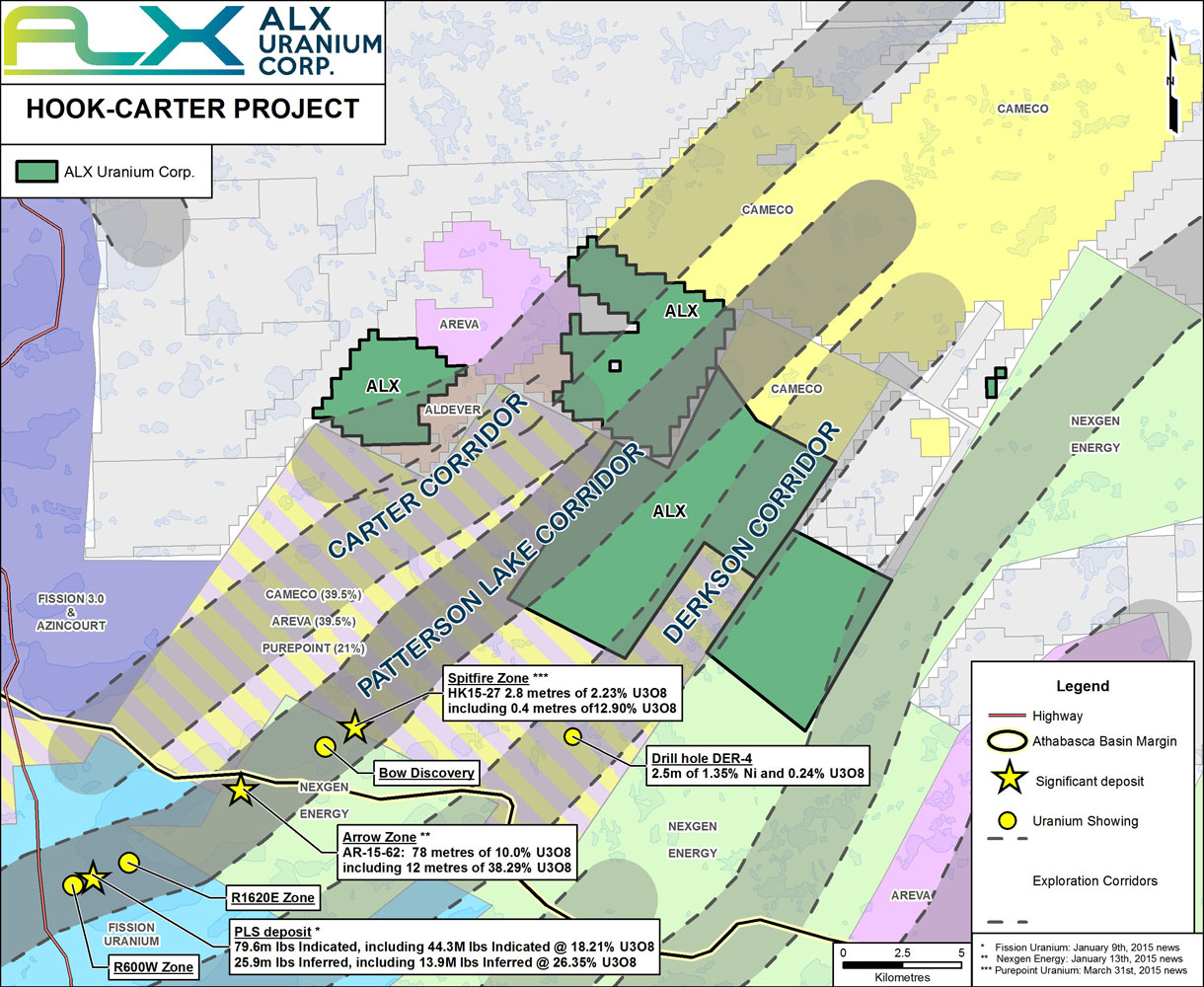

Renewed interest in the southwestern Athabasca Basin area’s Patterson Lake South camp comes from Cameco Corp TSX:CCO, as the giant signs a purchase agreement with ALX Uranium TSXV:AL. The merchandise consists of 27 claims totalling 7,064 hectares peripheral to ALX’s Hook-Carter property. That leaves ALX with a more closely consolidated PLS camp position of 16,461 hectares.

Most of the vended claims are isolated from Hook-Carter’s main contiguous block, states ALX’s February 25 announcement. They also “include a small, northeastern portion of the main block, covering ground with depths to the unconformity much deeper than the main parts of the property where ALX intends to focus its exploration.”

The development might portray Cameco in an acquisitive mood, following the previous day’s news that the company had optioned 60% of CanAlaska Uranium’s (TSXV:CVV) West McArthur project in the eastern Basin.

ALX president/CEO Jon Armes says the Hook-Carter transaction benefits both parties. ALX gets $170,000 and, on some claims, a 1% net refining returns royalty that can be reduced to 0.25% by paying ALX $750,000. Other claims have a 2% NRR reducible to 1% for $500,000. Cameco, he says, gets to “tidy up its land position” in the PLS area, making concerted exploration more viable.

“A lot of that ground is 600-plus metres to the unconformity,” Armes points out. “When you start drilling 1,000-metre holes at $400 a metre, that’s quite a costly endeavour for a junior. When you’ve got little bits and pieces, you’re not typically going to drill a 16-hectare piece when you’re surrounded by Cameco.”

The sale “provides ALX with some significant hard dollars, certainly more than we paid in our staking and other costs, and we maintain a small underlying royalty,” he adds. “The chance of Cameco making a discovery northeast of us would only benefit us.”

Before-and-after maps show geographical advantages to both Cameco and ALX Uranium.

ALX retains land covering the Patterson corridor hosting three attention-grabbing discoveries, as well as the parallel Carter and Derkson corridors. Winter plans currently under evaluation include ground electromagnetics to define deep conductors and possibly drilling, Armes says.

Encouraging news continues from the camp’s standouts, Fission Uranium’s (TSX:FCU)Patterson Lake South,NexGen Energy’s (TSXV:NXE) Arrow zone and Bow discovery, and theCameco/AREVA Resources Canada/Purepoint Uranium TSXV:PTU Spitfire zone.

Fission’s $7.9-million, 39-hole, 13,000-metre winter program aims to expand the Triple R deposit and do some exploration too. On the latter front, one hole recently added 135 metres to the project’s potential strike, now consisting of five zones along a 2.47-kilometre trend. Three of the zones lie outside Triple R’s January 2015 resource. That estimate, showing 79.61 million pounds indicated and another 25.88 million pounds inferred at shallow depths, formed the basis of a September preliminary economic assessment envisioning PLS as potentially one of the world’s lowest-cost uranium mines.

In January Fission closed an $82.2-million strategic investment, giving a Chinese uranium trader nearly 20% of the company.

Next-door neighbour NexGen has six rigs drilling a 30,000-metre winter program on the Rook 1 project’s Arrow zone. Last month the company announced its best assay so far, 10% U3O8 over 78 metres, including 38.29% over 12 metres. The project’s previous record-holder was 9.72% over 35.5 metres.

Earlier this month came more superlatives—Arrow’s “most significant accumulations of massive pitchblende” and scintillometer results showing the project’s “most intense mineralization to date.”

More recently NexGen added 25 metres to Arrow’s strike, now 670 metres with a lateral width of up to 235 metres and mineralization ranging from depths of 100 metres to 920 metres. The zone remains open in all directions and at depth. NexGen plans Arrow’s maiden resource for H1 release.

The company closed a $21-million bought deal in December, following last May’s $23.74-million private placement.

At Spitfire, project operator Purepoint announced an expansion to the mineralized area early this month with a 130-metre stepout that returned 0.67% eU3O8 over 10.1 metres, including 9.2% over 0.6 metres. Results came from a downhole probe that measures uranium oxide-equivalent. The winter agenda calls for at least 14 holes and 6,000 metres. Purepoint holds a 21% stake in the joint venture, with big guys Cameco and AREVA sharing the rest. Purepoint ended last year by closing a $204,000 private placement.

Looking at the Basin’s opposite side, ALX also announced assay results from last fall’s seven-hole, 1,005-metre campaign at Gibbon’s Creek. Although significant radioactivity failed to materialize, anomalous uranium (up to 297 ppm), nickel, copper and boron came from the basement near a previous hole that showed strongly anomalous geochemical pathfinders. ALX will evaluate further exploration after integrating drill results with regional and property-scale data.

With Hook-Carter now under consideration for ground EM and a possible drill program, the company last month announced exploration plans for four other projects. On the agenda are ground gravity for Gorilla Lake and Perch, a radon-in-lake survey for Lazy Edward Bay and ground EM for Newnham Lake. ALX holds one of the Basin’s largest uranium portfolios.

Late last month the company closed tranche two of a private placement totalling $358,500.

Read more at the original soruce: http://resourceclips.com/2016/02/25/the-high-grade-camp/