-- After a tumultuous few years unleashed by geopolitical rivalries in Asia, the rare earth sector has mean reverted with rare earth element (REE) prices having fallen by as much as 90% from their peak in 2011.

-- It is interesting to note that the core issue which drove exponential gains in rare earth prices – supply chain dependence on China – is still a reality.

-- In the wake of Molycorp’s (MCPIQ:OTCBB) spectacular implosion and bankruptcy and the financial struggles of Lynas (LYC:ASX), many are questioning whether or not a REE supply chain outside of China is even feasible.

-- While the collapse in REE prices has rendered most non-Chinese deposits uneconomic, a weaker local currency coupled with government support may be enough to begin to establish a reliable source of saleable REE products outside of an increasingly unstable China.

-- Additionally, reports have emerged that many REE producers inside China are operating at a loss.

-- Thanks to these market inefficiencies, this industry is set to consolidate. Expect to see M&A and co-opetition as the industry adjusts to a new normal of lower prices despite healthy demand.

-- This white paper looks at the current state of the REE sector and aims to present a vision of what a REE supply chain might look like in this new macroeconomic environment.

Introduction

Few metals have captivated investors in recent years in the same way that REEs have. Nobody except the most seasoned REE analyst would have thought that a chance encounter in the South China Sea between a Japanese military patrol boat and a Chinese fishing vessel would have led to a freezing of REE exports from China to Japan and disruption of global supply chains.

This event served as a stark wake-up call to non-Chinese electronics manufacturers and military procurement officials regarding absolute dependence on China for critical materials. Unsurprisingly, everyone from politicians to materials scientists to procurement managers “woke up” and began to think hard about where the next kilogram of material would come from. This also gave rise to thinking about either engineering REEs “out” of products like motors or developing a non-Chinese REE supply chain from mining to final manufacturing.

This concern was not lost on the Chinese REE industry that took several decades to build their supply chain dominance and would not let it slip from their grasp easily. Quotas, taxes, differing prices inside and outside of China, jawboning the market through talk of market consolidation, and creating a REE “exchange” were but a few of the tactics employed by the Chinese to maintain their dominance. The export quotas have now been rescinded due to a WTO ruling effectively normalizing prices, but excess supply still remains in place largely due to illegal mining.

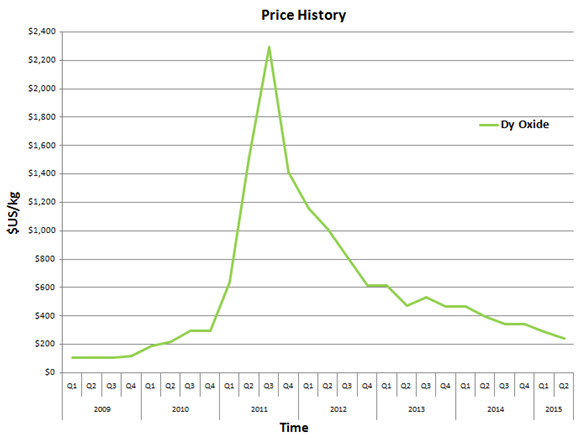

As of early 2016, REE prices have mean reverted and though many questions surround the sustainability of China’s economic growth model, the supply chain is only slightly less dominant than it was a few years ago. As an example, the sole source of dysprosium ore is effectively the South China Clays with no other significant source globally. The price of dysprosium oxide has fallen by over 90% from peak to trough though still remains above its pre-crisis low.

This raises several questions. First, how have recent events altered rare earth supply chains? Second, in this low price environment, is there a need for a non-Chinese focused supply chain? Third, if so, what might it look like?

This paper aims to answer these questions through examining the current supply chain situation and projecting what a non-Chinese supply chain might look like.

What a Long, Strange Trip it’s Been

Despite its small size relative to other base or precious metals (~150,000 tpy), REE production has suffered much the same fate as excess capacity has pushed prices relentlessly down. With China producing roughly 90% of global supply and consuming roughly 70% of demand, the need to adjust world supplies and add price transparency is obvious and though efforts have been undertaken by Chinese officials that have included the scrapping of quotas, creation of a rare earth “exchange” (which has since collapsed under ponzi-like circumstances)[1], and stamping out illegal mining, these actions have yet to produce their intended effects.

The graphic below of dysprosium oxide shows what happens when bubbles are formed and then pop:

Source: Asian Metal

While the core challenge of resource dependence remains, the market does not believe this to be so and the result is mean reversion in pricing.

Many of the rare earth exploration and development companies have managed to sustain themselves, but this tide may soon be turning as a combination of a lack of adequate funding and unworkable economics rear their ugly head. Though painful, we believe this to be a positive force as the best projects will ultimately survive as Darwinian influences take hold and mothball underwhelming opportunities.

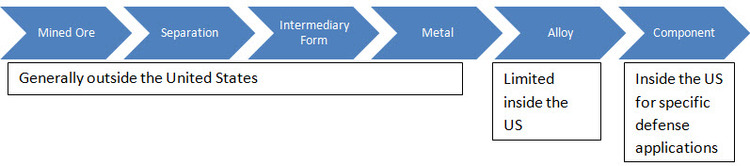

As such, China still controls much of the global supply chain. A typical mine to market supply chain would resemble the following:

Source: US GAO; Industry Interviews

The main bottlenecks for non-Chinese companies are domestically-mined ore and the separation capability. These tend to be the most cost prohibitive part of the REE supply chain which explains why most of this happens inside China, where producers have been able to leverage low cost labor, lax environmental standards, and technical expertise. Additionally, Chinese REE mining companies have tended to only focus on the deposit types that they “know” meaning that the Chinese likely have not and would not attempt to mine deposits where the metallurgy and mineralogy is not well understood and commercially viable.

Despite the unease of electronics manufacturers and the defense industry, little has been accomplished to alleviate concerns over Chinese-dominant supply chains. Creditors are still slugging it out over the wreckage of the MCPIQ implosion/bankruptcy and LYC has just barely become cash flow positive. Chinese overproduction of REEs continues with approximately 40% of production in the country illegal in nature according to IMCOA. This has kept a lid on prices but is also a clear signal of worsening sector economics in China[1]. Much of this concerns a lack of willingness on the part of the Chinese to cede market share.

However, the original crisis did have one lasting effect and it was to force manufacturers reliant on foreign REE supplies to find workable substitutes or to engineer REEs out of end products. While this has been met with mixed results, it still doesn’t negate the need for a reliable source of supply outside of China as typically engineering a material “out” means engineering “in” another material. Multiple industry sources have indicated that minimizing dysprosium in magnet feed, for example, means increasing the percentage of neodymium or praseodymium.

So what to do? As China contends with internal struggles including fighting corruption, slower growth, and pollution, and becomes more assertive outside her borders (in the South China Sea, for example), the opportunity for another supply shock and disruption to REE supply chains remains a possibility. The threat of pollution is particularly stark and as Chinese industry works towards a “cleaner” source of growth - vehicle electrification, as a single example - would imply increased REE demand inside China. The results from the recent Paris Climate Summit will also be worth watching as they indicate increased deployment of renewable energy technologies which are dependent on REEs to varying degrees.

While much of the investor populace has left the REE space for “greener pastures” (if they exist in the commodity sector today), it is notable that the pieces necessary to construct a supply chain outside of China are already in existence.

The question is: at what cost could a non-Chinese REE supply chain be constructed? We think the absolute cost of a supply chain blurs the real issue. Rather than focusing on the financial requirements, a better question to ask is: what is the cost of NOT having a non-Chinese REE supply chain in place?

Puzzle Pieces

From our perch, four main pieces of this supply chain puzzle exist. These are: the mined ore, the processing, separation and refining, and end use.

The most difficult to replicate would be the mining of ore. The reasons for this include difficult metallurgy, high capital expenditures, and lack of available financing despite the healthy growth rates in REE demand.

The key would be to focus on picking a project that struck a balance between these issues and offered a suitable rate of return; as an example, a deposit that produced a mixed rather than separated REE concentrate and passed this on to the next piece of the supply chain. To be sure, margin would be forfeited as separated oxides command a premium, but the stark economic realities of the REE mining space dictate that a new business model be created. With REE prices where they are, aspiring miners will be forced to compete on cost. We have discussed this theme frequently in recent years and expect to see hybrid business models emerge as a focus solely on price is both misguided and misplaced.

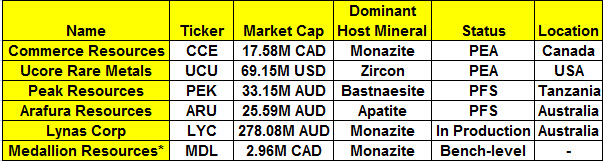

While market participants all have their “favorites”, some of the possible contenders for this portion of the value chain include:

Source: Bloomberg; Company Documents

With respect to the process of REE separation, an entity such as Innovation Metals (privately held) or Solvay (SOLB:EBR) would serve this purpose. In the case of SOLB, according to a Council on Foreign Relations piece authored by Dr. Eugene Gholz, at SOLB’s REE separation plant in France (formerly run by Rhodia) “from 2000 to 2011, only four out of eighteen separation units were in use” [1] so presumably some of the excess separation capacity still exists and a tolling agreement could be put together.

Real visibility would come from understanding the economics of the separation process. Innovation Metals (mentioned above) aims to provide low cost and scalable processing and separation workflow.

The company notes that there is little separation capacity for the heavy rare earths outside of China utilizing solvent extraction (SX) technology and intends to bridge this gap by serving as a centralized processing and separation facility. Recently, the company announced a potential leap in separation technology with its announcement of a “rapid” SX process which utilizes fewer resins, lowering operating expenses and processing time. This alters the original business model slightly, but provides both the company and its potential customers flexibility in the ever-changing REE business.

The process has been validated on a bench scale with multiple REEs separated from various concentrates and purities in excess of 99% demonstrated. The company’s current goal is to demonstrate the process at scale and has recently completed a pilot-scale facility which will commence operations shortly. The process is patent pending and we look forward to learning more.

Post-separation the number of end users varies far and wide depending upon the application. Though the REE market is roughly $3 billion in size, the size of the market for downstream finished products is thought to be several orders of magnitude larger. Large end users such as Shin-Etsu Chemical Co (4063: TYO), the largest magnet manufacturer in Japan, come to mind, however there are numerous other potential end users looking for a reliable source of feedstock.

One example of a company which leverages demand for advanced materials with low cost production technologies is Infinium Metals. Privately held, the company is pioneering methods to produce and recycle crucial elements for energy efficiency and technology. A recent grant of $2.85 million from the US Department of Energy’s ARPA-E program would seem to validate the potential for the company’s business model. This is on top of the $5 million previously granted from ARPA-E and $12 million from the EERE Office (Energy Efficiency and Renewable Energy) of the Department of Energy. The current focus is on magnesium and neodymium (though others can be produced) – metals whose demand remains healthy despite the current macroeconomic backdrop. The focus on just two metals – neodymium and magnesium – highlights a theme we’ve been seeing more of. Namely, end users don’t want all 17 REEs, instead just opting for specific ones. We believe this theme of efficiency and flexibility in supply chains is set to become more prevalent.

The Infinium model and focus on energy efficiency and associated technologies makes intuitive sense in light of the fact that China has for years successfully been moving up the value chain and producing these types of advanced materials both for export and a vibrant domestic market.

The lynchpin of this supply chain idea is access to adequate capital to tie the various pieces together. Given the challenges in the mining sector, each project likely should be viewed on a one off basis where IRR and NPV, flawed but widely accepted project metrics, are the benchmarks. While an off take agreement is preferable, a deal structured in the way that the LYC, Sojitz Corp and the Japan Oil, Gas and Metals National Corporation (JOGMEC) deal could serve as a viable template for other deals going forward. It’s true that the deal has had to be restructured owing to the challenges in the commodity sector since 2011, but the general model for the deal remains a viable one going forward as off take, marketing, and project financing are all factored into the deal.

As is the case with emerging technologies or supply chains, the role of government is a necessity as many of today’s technologies we take for granted were once funded by government grants. The U.S. Department of Defense has been known to sponsor emerging technologies (case in point is Innovation Metals’ rapid solvent extraction technology). On a provincial level in Canada and state level in the US, the Quebec government or the Alaska Import and Development Export Agency (AIDEA) respectively are examples of government offering support through various means.

SWOT – Why this Will (or Won’t) Work

In previous research reports we have presented the case both for and against various commodities in the form of a SWOT analysis. This has become challenging in that a strength could be viewed as a weakness depending upon one’s perspective. Also, given that this research piece is more of a case study than one designed to extol the virtues of a specific commodity, we believe that a list of some of the tailwinds and headwinds from a more macro perspective is more beneficial.

In regards to constructing a non-Chinese REE supply chain, we see the current collapse in the price of oil and current low interest rate environment as positives in that they hold out the possibility of lower operational expenses (in the case of oil) and more favorable debt financing terms (in the case of capital expenditures). We would agree with those forecasts for the price of oil and interest rates to stay “lower for longer” offering some relative certainty to changing project economics.

Until recently, the US Dollar strength has continued unabated and this could also serve as a tailwind for those projects non-USD based. While this issue isn’t black and white (many projects have costs in multiple currencies), the recent 20% depreciation in the CAD and AUD against the USD should improve project economics to varying degrees.

Thinking about the challenges to building a non-Chinese supply chain would likely require a report of its own. That said the main challenge here rests with China itself and the relative economic health of the country’s economy (and by extension) its internal REE supply chain. While we do not expect to see a “collapse” of the Chinese economy, it is clear that a slower growth trajectory is a certainty as the country struggles with the imperative of deleveraging. On a more granular level, the constant threat of illegal mining of REEs in China mentioned earlier is an issue that must be addressed by Chinese authorities with more than lip service. We say this with the knowledge that this may be easier said than done.

Very little is known about the current state of Chinese REE mines but anecdotal evidence reveals a general lack of environmental stewardship and questions around the long term sustainability of this piece of the supply chain in China. This uncertainty, despite excess supply, ought to only serve to emphasize the potential for a supply disruption.

Another challenge concerns politics and the willingness of the political class in the West to devote attention to the issue of resource dependence. Given that 2016 is an election year in the United States, any sweeping legislation on this issue will most certainly be postponed. A recent report published by the General Accounting Office[2] discusses in detail the necessity for the US Department of Defense to develop a comprehensive approach to determining national security risks in the supply chain. Encouragingly, the DoD acknowledged the report and plans on releasing more details on this issue later in 2016. This is a good sign, however we await this information before further comment.

A final area to monitor closely is the research and development of REE downstream products. The need for supply security has forced companies such as Hitachi Metals to find ways to either engineer out REEs from their end products or recycle existing supply [3]. This push has been met with mixed results. In some cases, REEs are “unsubstitutable” and in others while the use of dysprosium in magnets can be minimized, you end up using more of another material, basically trading dependence on one material for dependence on another while compromising efficiency in many cases. Additionally, your overall production costs may not fall despite minimizing use of expensive materials.

Despite this, REE usage continues to grow at a pace well above global GDP growth with demand CAGRs growing anywhere from 4% to 8% with permanent magnet demand forecast to lead this charge to 2020. These healthy demand forecasts offer the most salient rationale for continued interest in the REE sector going forward.

Takeaways

In light of the value destruction in the mining sector, many would decry the attempt to become self-sufficient in critical metals as a fool’s errand. We think this misses the point. Though the idea of resource dependence has been overhyped by the media and stock promoters, the central issue of resource dependence remains and is likely to resurface in the future. The ramifications are manifold. The financial costs associated with this endeavor are well known and obscure the real issues. The central question concerns the costs of NOT constructing a supply chain. We would submit that these costs go well beyond just the capital and operational expenditure to build out a supply chain. The United States and her allies would like to make sure that the F-35 stays in the air when it’s really needed.

There are no easy answers to this predicament and higher REE prices are not a panacea. It took the Chinese decades to become essentially self-sufficient in the REE sector and one hopes it won’t take as long to wrest control back from China. Only time will tell, but the aura of near-term uncertainty surrounding China ought to stand out as an opportunity for both the public and private sectors to aggressively combine forces and begin this process.

Economics matter most at this point. Demand for REEs across the industrial and defense base is relatively inelastic, but the supply overhang and the resulting low REE price environment demand that stakeholders focus on costs rather than the hope of higher future prices. Low costs can be targeted in the extractive sector by finding those deposits with favorable metallurgy or the ability to use technology to minimize processing and separation costs. As we said above, the best opportunities are likely those that offer the optimal blend of metallurgy and cost. Further along the supply chain, companies that offer a value added service (separation, for example), would appear to be well positioned.

Many will decry faith in technology that has yet to scale as a stretch, but this offers the best opportunity, in our view, to begin to establish a non-Chinese REE supply chain. These markets are growing and expected to continue to do so into the future. With this in mind, non-Chinese stakeholders throughout the REE supply chain should embrace this opportunity to create value away from the Middle Kingdom.

[1] Eugene Gholz, “Rare Earth Elements and National Security” Council on Foreign Relations, October, 2014

[2] http://www.gao.gov/products/GAO-16-161

[3] http://www.hitachi.com/New/cnews/101206.html

[1] http://www.mining.com/most-chinese-rare-earth-miners-running-at-a-loss-report/

Chris Berry

President of House Mountain Partners LLC and Co-Editor of Disruptive Discoveries Journal

Chris Berry is a well-known writer, speaker, and analyst. He focuses much of his time on Energy Metals – those metals or minerals used in the generation or storage of energy. He is a student of the theory of Convergence emanating from the Emerging World and believes it will have profound effects across the globe in the coming years. Active on the speaking circuit throughout the world and frequently quoted in the press, Chris spent 15 years working across various roles in sales and brokerage on Wall Street before shifting focus and taking control of his financial destiny.He is also a Senior Editor at Investor Intel. He holds an MBA in Finance with an international focus from Fordham University, and a BA in International Studies from The Virginia Military Institute. Please visit www.discoveryinvesting.com and www.house-mountain.com for more information and registration for free newsletter as well as his disclaimer.

Our Thinking and What We Do

We are believers in the theory of Convergence. As the quality of life between East and West slowly merges due to advances in technology, continued urbanization, and changing demographics, opportunities across numerous industries will arise which we can take advantage of. We aim to point out the strategic opportunities in the commodity space which arise from these themes.

Throughout history, no society has sustained a higher quality of life without access to cheap commodities or materials. As global population increases, putting stresses on resource availability, efficiency and technology must come to the fore to continue to provide for a higher quality of life. The looming convergence of lifestyles between the emerging world and the developed world is a fact we must all understand and accept in order to chart a sustainable path forward for humanity.

DISCLAIMER AND INFORMATION ON FORWARD LOOKING STATEMENTS

The material herein is for informational purposes only and is not intended to, and does not constitute, the rendering of investment advice or the solicitation of an offer to buy securities. The foregoing discussion contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (The Act). In particular when used in the preceding discussion the words “plan,” confident that, believe, scheduled, expect, or intend to, and similar conditional expressions are intended to identify forward-looking statements subject to the safe harbor created by the ACT. Such statements are subject to certain risks and uncertainties and actual results could differ materially from those expressed in any of the forward looking statements. Such risks and uncertainties include, but are not limited to future events and financial performance of the company which are inherently uncertain and actual events and / or results may differ materially. In addition we may review investments that are not registered in the U.S. We cannot attest to nor certify the correctness of any information in this note. Please consult your financial advisor and perform your own due diligence before considering any companies mentioned in this informational bulletin. The information in this Research Report is provided solely for users’ general knowledge and is provided “as is”. We make no warranties, expressed or implied, and disclaim and negate all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose or non-infringement of intellectual property or other violation of rights. Further, we do not warrant or make any representations concerning the use, validity, accuracy, completeness, likely results or reliability of any claims, statements or information in this Research Report or otherwise relating to such materials or on any websites linked to this Research Report. The content in this Research Report is not intended to be a comprehensive review of all matters and developments, and we assume no responsibility as to its completeness or accuracy. Furthermore, the information in no way should be construed or interpreted as – or as part of – an offering or solicitation of securities. No securities commission or other regulatory authority has in any way passed upon this information and no representation or warranty is made by us to that effect. All statements in this Research Report, other than statements of historical fact should be considered forward-looking statements. Some of the statements contained herein, may be forward-looking information. Words such as “may”, “will”, “should”, “could”, “anticipate”, “believe”, “expect”, “intend”, “plan”, “potential”, “continue” and similar expressions have been used to identify the forward-looking information. These statements reflect our current beliefs and are based on information currently available. Forward-looking information involves significant risks and uncertainties, certain of which are beyond our control. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking information including, but not limited to, changes in general economic and market conditions, industry conditions, volatility of commodity prices, risks associated with the uncertainty of exploration results and estimates, currency fluctuations, exclusivity and ownership rights of exploration permits, dependence on regulatory approvals, the uncertainty of obtaining additional financing, environmental risks and hazards, exploration, development and operating risks and other risk factors. Although the forward-looking information contained herein is based upon what we believe to be reasonable assumptions, we cannot assure that actual results will be consistent with this forward-looking information. Investors should not place undue reliance on forward-looking information. These forward-looking statements are made as of the date hereof and we assume no obligation to update or revise them to reflect new events or circumstances, except as required by securities laws. These statements relate to future events or future performance. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Chris Berry owns no shares in any of the companies mentioned in this Research Report. He is a consultant to Zimtu Capital Corp. and is paid a monthly fee.

ABOUT ZIMTU CAPITAL CORP.

This Research Report is published by Zimtu Capital Corp. We are focused on researching and marketing public companies and commodities in the resource sector where we have a pre-existing relationship (almost always as shareholder and a provider of services). Nothing in this Research Report should be construed as a solicitation to buy or sell any securities mentioned anywhere. This Research Report is intended for informational and entertainment purposes only. The author of this article and its publishers bear no liability for losses and/or damages arising from the use of this Research Report. Be advised, Zimtu Capital Corp. and its employees are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor or a registered broker-dealer. Never make an investment based solely on what you read in a Research Report, including Zimtu’s Research & Opinion, especially if the investment involves small, thinly-traded companies that are not well known. Commerce Resources is a paying client in which Zimtu Capital Corp. owns 3,584,178 common shares and 1,051,900 share purchase warrants. For these reasons, please be aware that Zimtu Capital is biased in regards to the companies featured in this Research Report and on our websites. Because our featured companies pay fees to us for our administration and public relations services, and rent, and we often own shares in the companies we feature, you must recognize the inherent conflict of interest involved that may influence our perspective on these companies. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before investing in any securities. When investing in speculative stocks of this nature, it is possible to lose your entire investment.