| US Debt Ceiling Visualized in $100 Bills |

| United States owes a lot of money. As of 2012, US debt is larger than the size of the economy. The debt ceiling is currently set at $16.394 Trillion and approaching rapidly. To see current debt live visit US Debt Clock. |

| One Hundred Dollars |

| $100 - Most counterfeited money denomination in the world. Keeps the world moving. |

| Ten Thousand Dollars |

| $10,000 - Enough for a great vacation or to buy a used car. Approximately one year of work for the average human on earth. |

| One Million Dollars |

| $1,000,000 - Not as big of a pile as you thought, huh? Still, this is 92 years of work for the average human on earth. |

| One Hundred Million Dollars |

| $100,000,000 - Plenty to go around for everyone. Fits nicely on an ISO / Military standard sized pallet. The couch is made from $46.7 million of crispy $100 bills. |

| $100 Million Dollars = 1 year of work for 3500 average Americans |

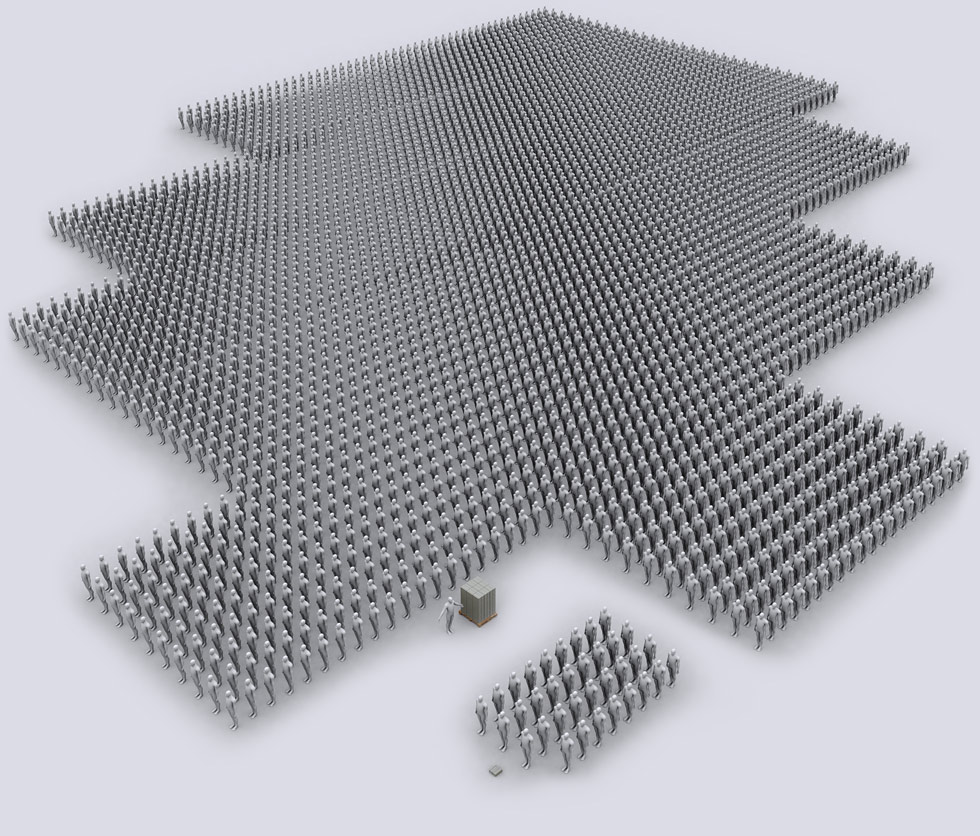

| Here are 2000 people standing shoulder to shoulder, looking for a job. The Federal Reserve´s mandate is to maintain price stability and low unemployment. The Federal Reserve prints money based on the assumption that increasing money supply will boost jobs. |

| One Billion Dollars |

| $1,000,000,000 - You will need some help when robbing the bank. Interesting fact: $1 million dollars weighs 10kg exactly. You are looking at 10 tons of money on those pallets. |

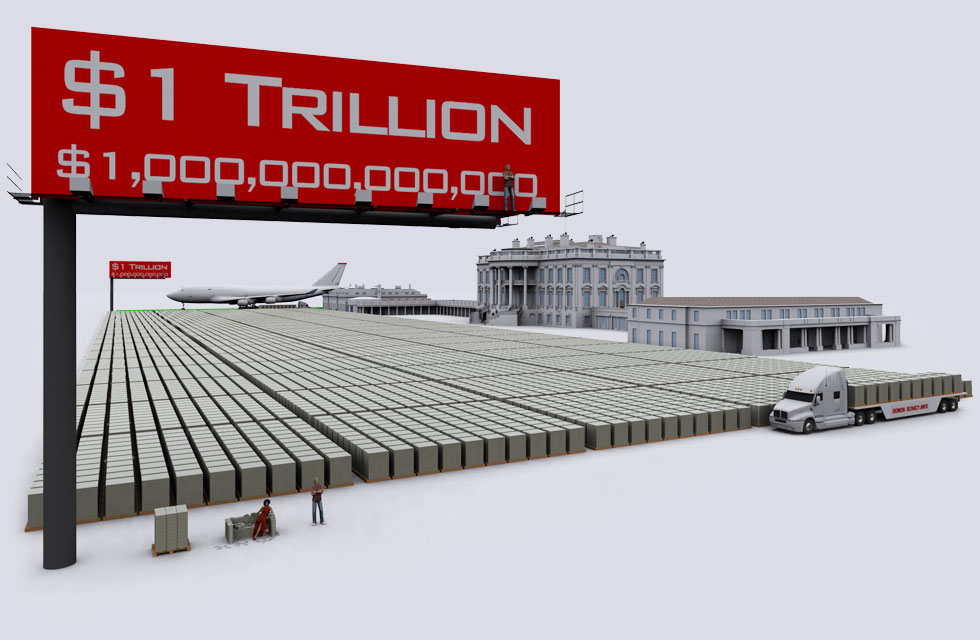

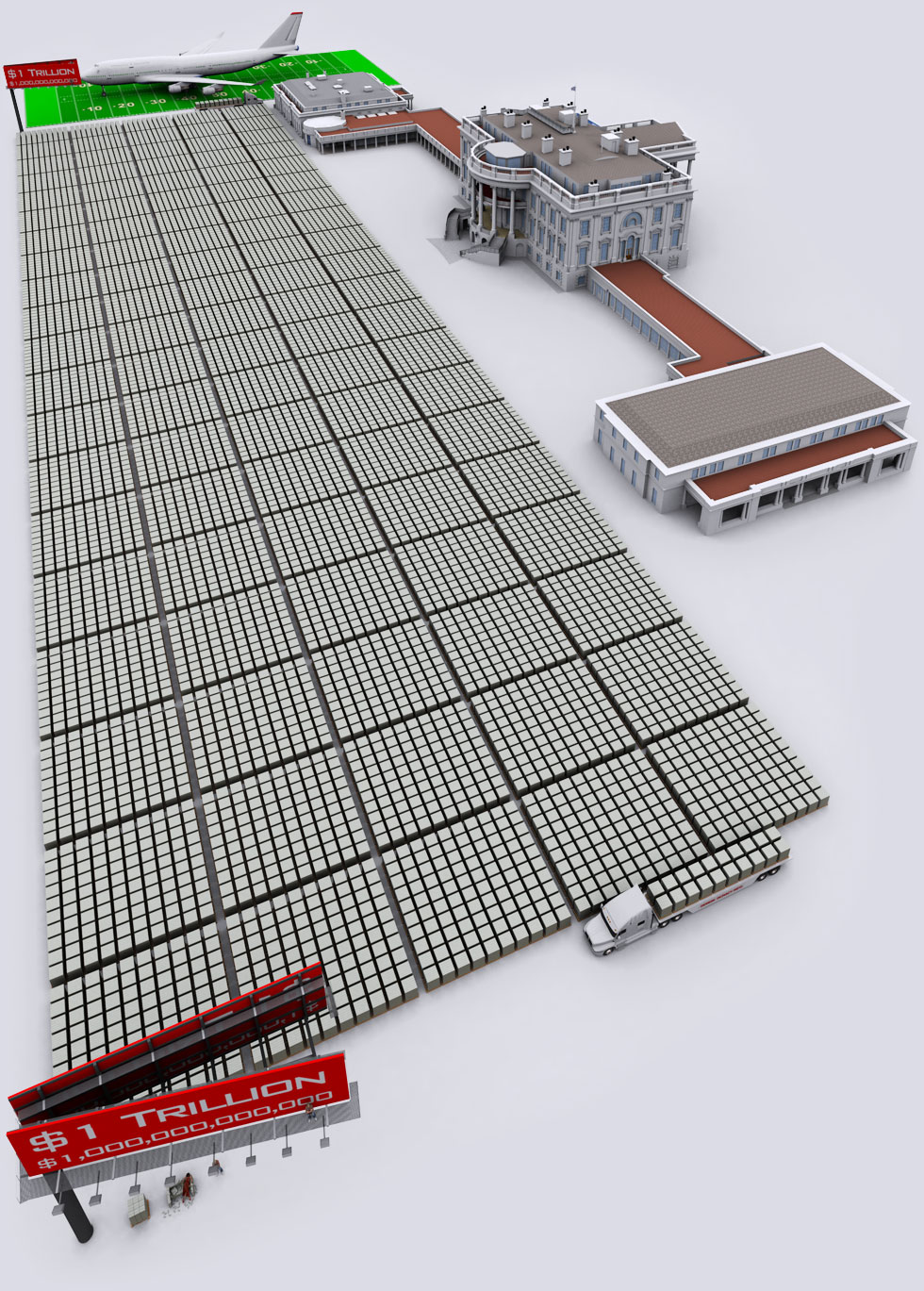

| One Trillion Dollars |

|

$1,000,000,000,000 |

| One Trillion Dollars |

|

Comparison of $1,000,000,000,000 dollars to a standard sized American Football field. You can see the White House with both wings to the right. "My reading of history convinces me that most bad government results from too much government." - Thomas Jefferson |

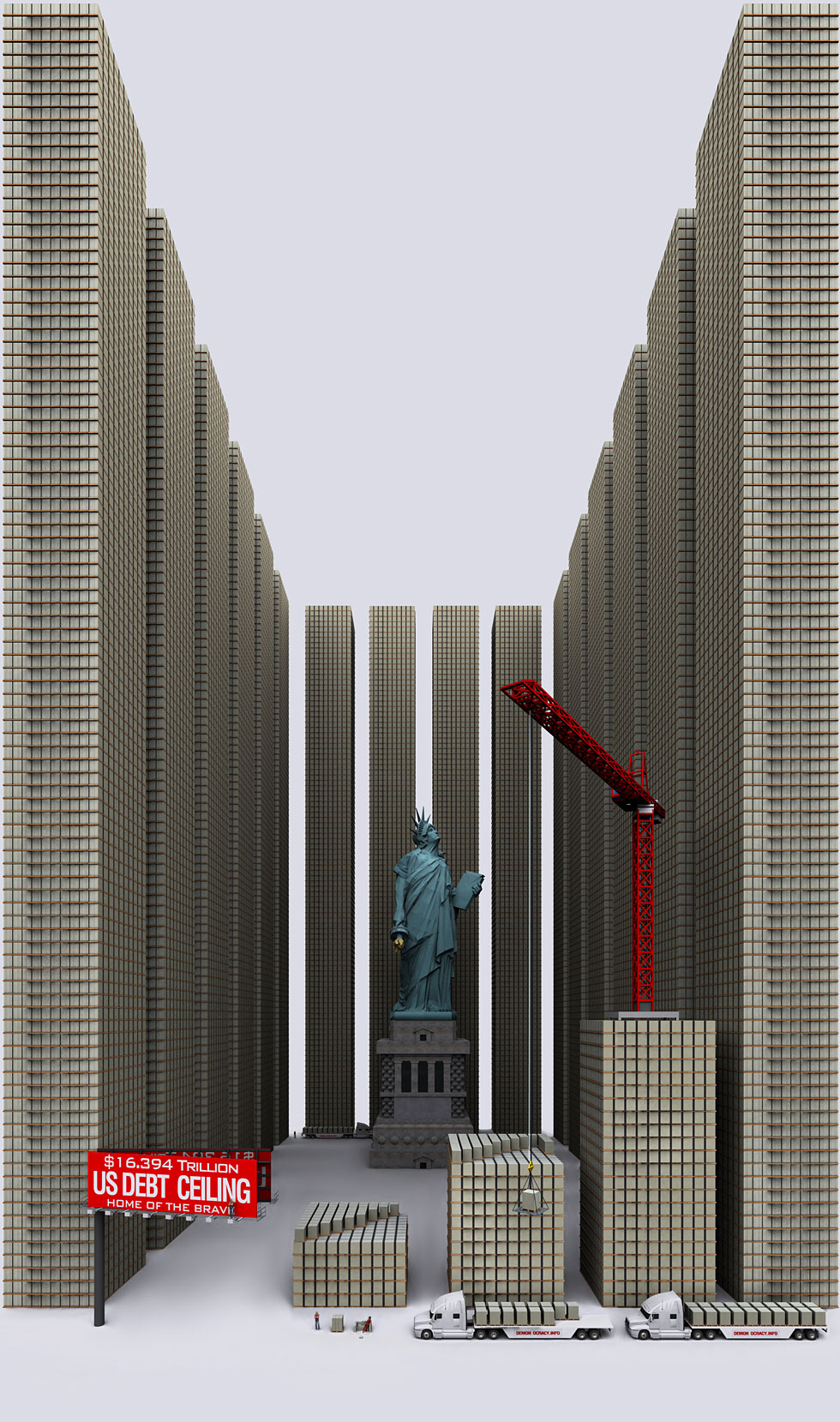

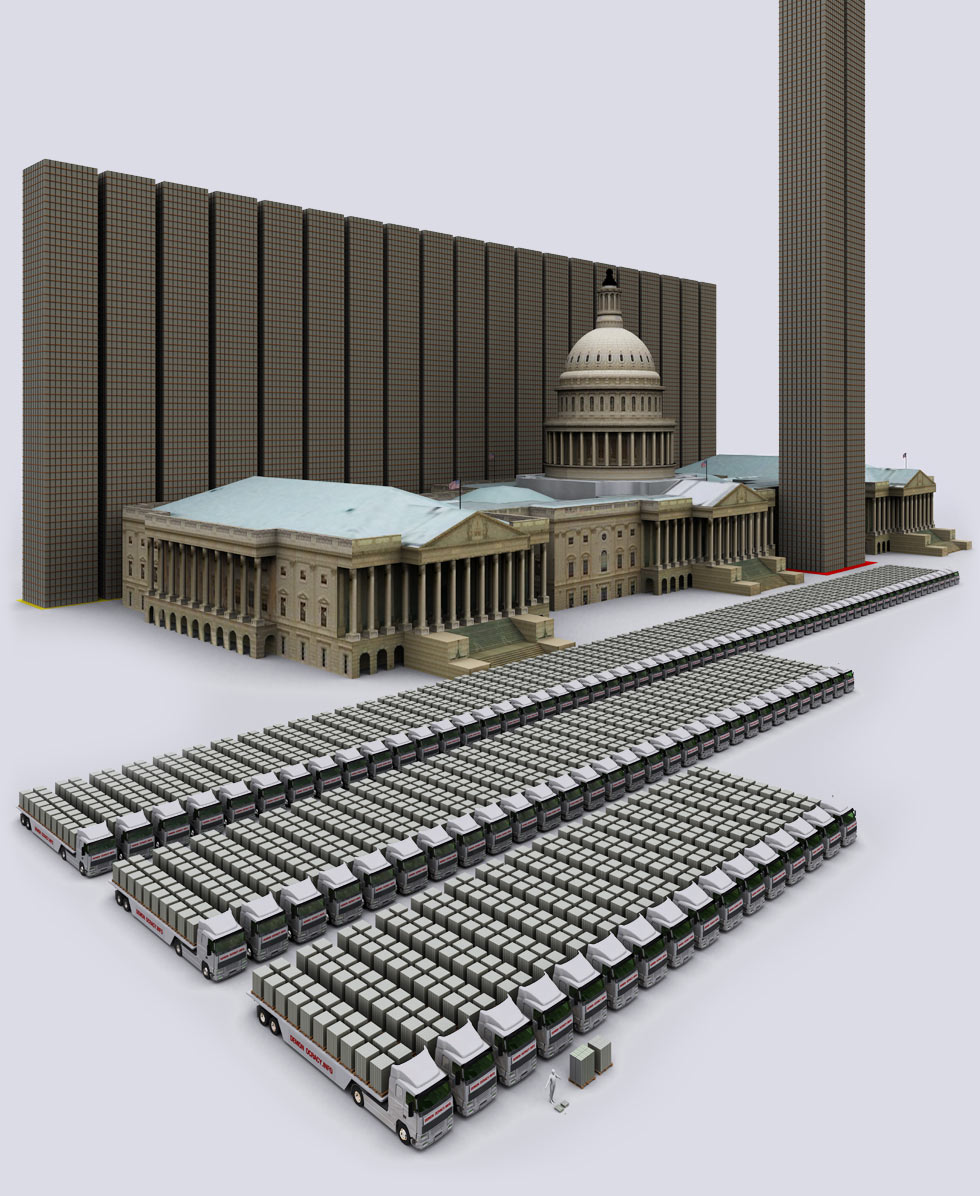

| US Debt Ceiling - $16.394 Trillion in 2013 |

|

The US debt ceiling limit D-Day is estimated for September 14, 2012. US Debt has now surpassed the size of US economy in 2011-- rated @ $15,064 Trillion. “I predict future happiness for Americans if they can prevent the government from wasting the labors of the people under the pretense of taking care of them.” - Thomas Jefferson |

| 122.1 Trillion Dollars | |

|

$122,100,000,000,000. - US unfunded liabilities by Dec 31, 2012. "This is when you need to remember that when a nation´s economy collapses, the wealth of the nation doesn´t disappear, it only changes hands."

|

| Canada |

| Canada has a $1577 billion USD economy, while carrying a relatively insignificant trade deficit of 9 billion dollars. In 2012 Canada must re-pay and/or re-finance a significant portion of its debt. It must refinance 42% of its debt, but since the country carries as AAA credit rating as of Jan, 2012 it faces little challenge to re-finance its debt. |

| 2012 Interest |

2012 Repayment |

Standing Debt |

Total Debt |

|

| $14B | $221B | $298.1B | $535.3B |

| China |

| The debt pile seems rather scary for China but the size of its economy and population is not to be underestimated. The debt only accounts for ~17.5% of the economy. China has the world´s second largest economy, it is still experiencing economic growth and has the biggest foreign exchange reserves in the world @ 3200 billion USD . The bigger the foreign exchange reserves, the more power the country has to influence the value of its own currency. "The greater a country´s foreign reserves, the better position it is in to defend itself from speculative attacks on the domestic currency". Read more on Foreign Exchange Reserves @ Wiki |

| 2012 Interest |

2012 Repayment |

Standing Debt |

Total Debt |

|

| $41B | $121B | $907B | $1069B |

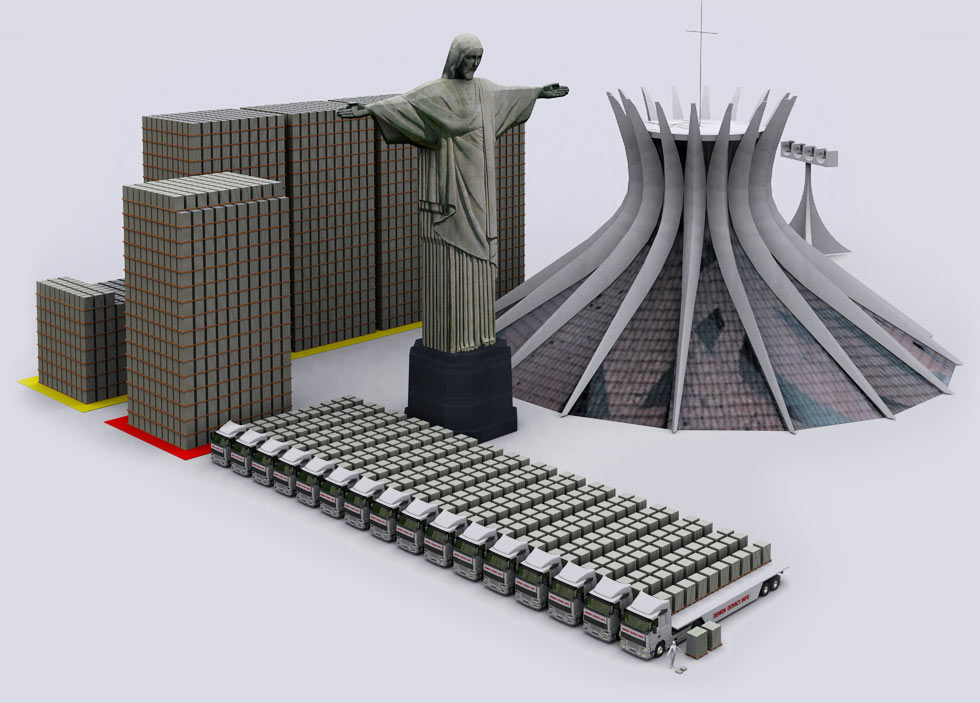

| Brazil |

| Brazil has in recent years become an Economic power-house and is now included in the G7 (Group of 7) nations meetings. The economy is rated @ 2517 Billion USD. With a 4.7% unemployment in 2011 and an export surplus it it is doing rather well. |

| 2012 Interest |

2012 Repayment |

Standing Debt |

Total Debt |

|

| $31B | $169B | $873B | $1073B |

| India |

| India is rather poor if you look at individual income but because of its large population it is a significant Economic power-house in the world. It has racked up a debt of 71% of economy in 2011, which is more than the 60% debt to economy ratio set by EU for economic stability standard. |

| 2012 Interest |

2012 Repayment |

Standing Debt |

Total Debt |

|

| $39B | $57B | $1115B | $1211B |

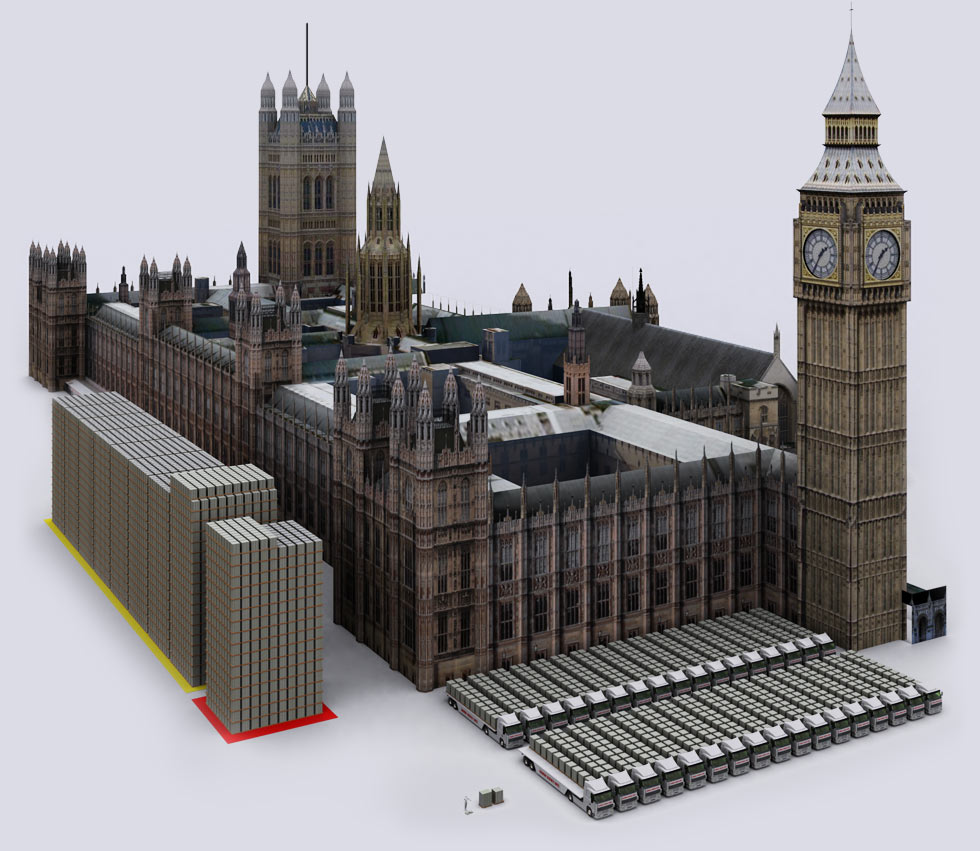

| United Kingdom |

| UK has a large economy of $2480 billion USD, but now holds debt in the size of 75% of economy, which is more than the 60% max debt to economy ratio set by EU for economic stability standard. As of Jan 2012, UK holds a AAA credit rating but has a staggering Gross External Debt of 8981 billion USD (not shown). The private sector of UK (people, business´, etc) are highly indebted, only surpassed by USA. High debt slows economic growth and it is reflected in the slow 0.9% growth of economy in 2011, which is much lower than the 4.2% inflation - meaning people of UK are becoming more poor as of 2011/2012. |

| 2012 Interest |

2012 Repayment |

Standing Debt |

Total Debt |

|

| $67B | $165B | $1379B | $1611B |

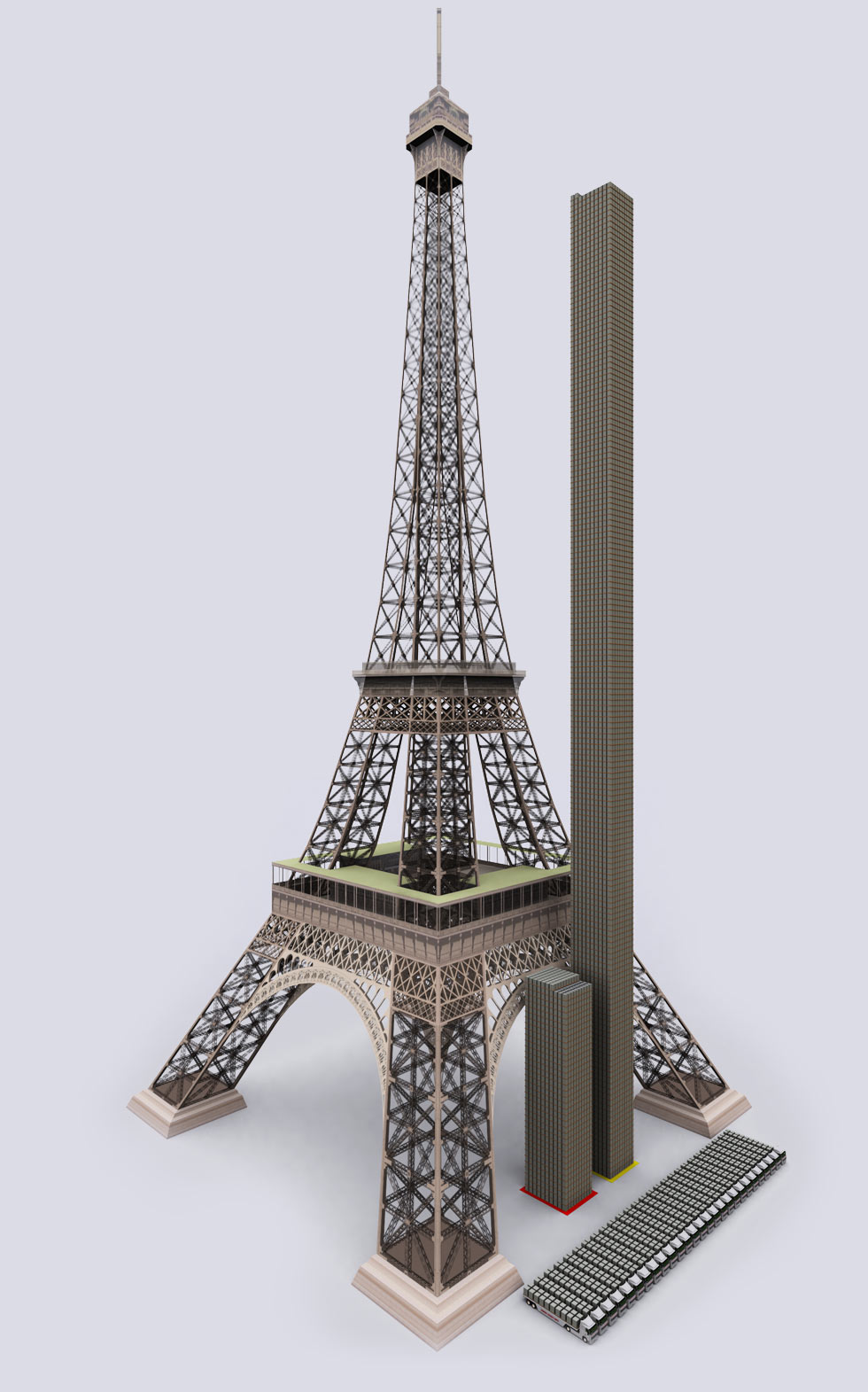

| France |

| Each story of the debt stack is $10 billion USD. The total debt of France is higher than the Eiffel Tower. The French are among the countries attacking Greece & PIIGS for their bad economic behavior, but are increasingly finding themselves in the same economic situation. Their credit rating was downgraded from AAA to AA+ recently and hold a 83.5% (2011) debt to economy ratio, above the 60% set by EU for economic stability standard. French banks are also among the financially weak banks that pose a danger to the French economy. |

| 2012 Interest |

2012 Repayment |

Standing Debt |

Total Debt |

|

| $54B | $367B | $1772B | $2193B |

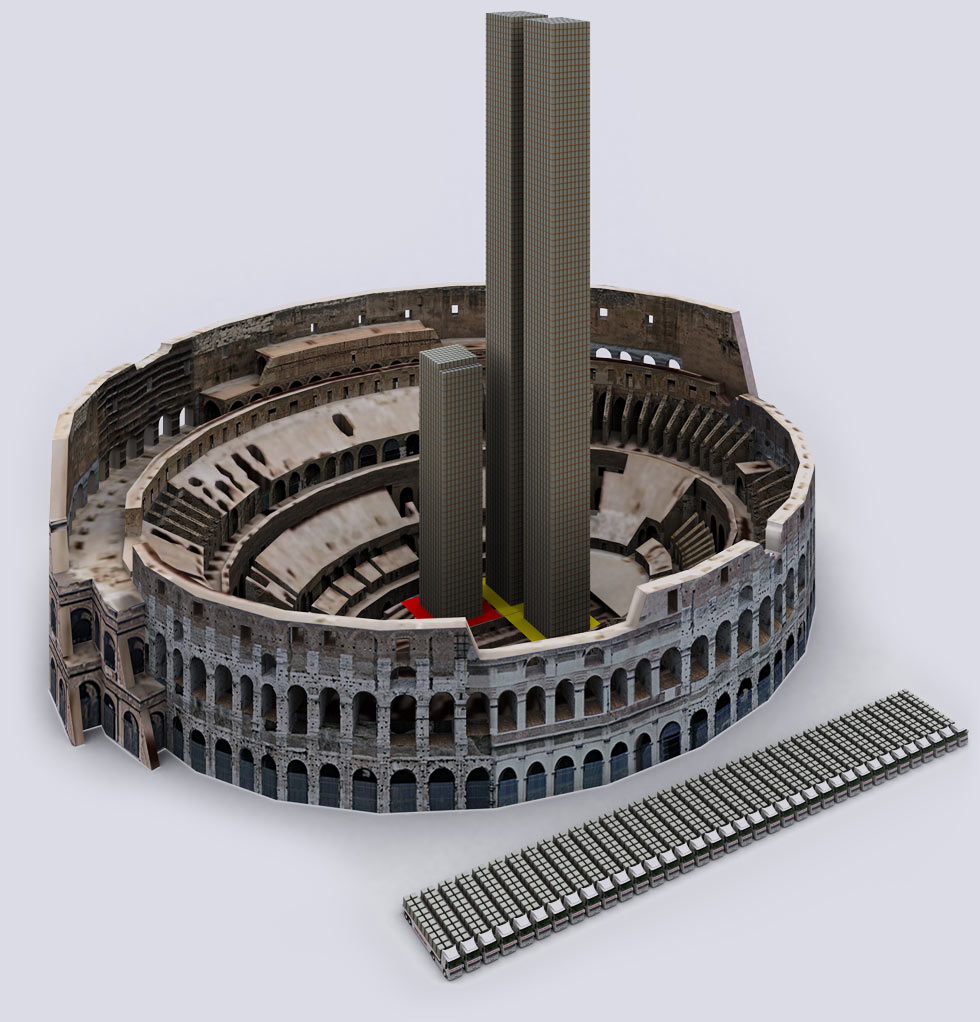

| Italy |

| Italy´s economy is considered weak and too indebted for safe financial operation. It has a debt ratio of 118.1% (2010) to economy, far above the 60% limit set by EU for stability. Italy faces a GIANT re-payment / re-finance of $428 billion USD of its debt in 2012, with strong fear that it will have problems finding lenders/investors that want to lend the weak country money. Credit rating agencies say the outlook for Italy is negative, which means their credit rating will be down-graded in the future, as the debt takes serious toll on the economy and try struggle to pay back their debt. This will further scare lenders / investors away and force the interest rates up - amount of trucks full of cash of tax-payer money sent to investors / banks / lenders. |

| 2012 Interest |

2012 Repayment |

Standing Debt |

Total Debt |

|

| $72B | $428B | $2000B | $2500B |

| Germany |

| Germany is considered the flag-ship of European economies. Germany holds a 78.8% debt ratio to economy, above the 60% limit standard set by EU for stability, while being mad at Greece and PIIGS for doing the same. Germany faces a $285 Billion USD repayment/refinance of debt in 2012 but sees no problem of finding lenders, since Germany´s economy looks great compared to the rest of the industrialized world. |

| 2012 Interest |

2012 Repayment |

Standing Debt |

Total Debt |

|

| $45B | $285B | $2304B | $2634B |

| United States of America |

| USA is the nation with most debt by far in the history of human civilization. USA´s total debt, including personal debt, real estate (mortgage) debt, consumer debt, credit card debt and government debt totals a mega $47,992 Billion USD ($47.9 trillion), roughly 2400 trucks full of money. Source: US Debt Clock USA borrowed $1229 billion in 2011 - roughly 2.5x towers of cash in the background. USA runs a mega ~35% budget deficit, far above the 3% max limit set by EU for economic stability standard. With industrialized world economies in crisis, USA faces little problem to finance its budget deficit in 2012 since world´s money is currently flowing into USA in great numbers as investors try to find "safety" where to store their money, since Europe is not safe; neither are banks. As long as USA has access to cheap credit due to scared investors willing to hand over their money in name of "safety", USA´s interest payments will remain far below normal. As of Feb 2012, the debt numbers are following: |

| 2012 Interest |

2012 Repayment |

Standing Debt |

Total Debt |

|

| $212B | $2783B | $12532B | $15527 |

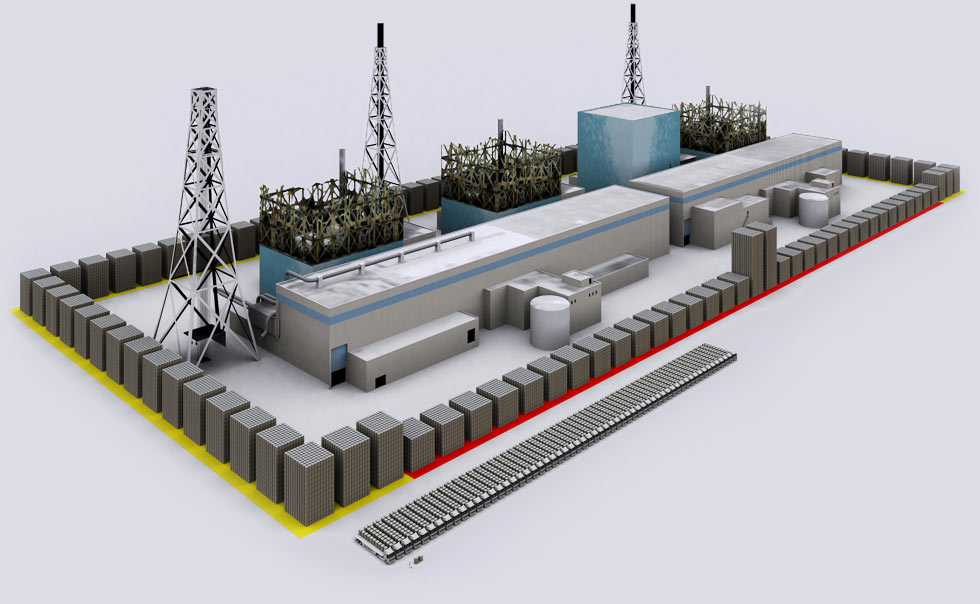

| Japan |

| Japanese debt stacked around the destroyed Fukushima Nuclear Power Plant. Japan could have built a wall of money to keep Fukushima safe from the Tsunami, with all the money they borrowed. Fukushima Power Plant compared to the trucks is GIANT. Japan is a unique example. It holds a MASSIVE 225% debt to economy ratio. This is only possible because of loyalty of Japanese people to the Japanese government. Japan´s people are the main buyers of Japanese government debt, and as long as they blindly buy the debt, and interest rates don´t go up, they can practically run up the debt indefinitely. The issues start when everyone starts wondering how they will get the money back. While historically having a good export surplus; Japan still has two "lost decades", where it has experienced no economic growth. This is mainly due to the large amounts of debt. |

| 2012 Interest |

2012 Repayment |

Standing Debt |

Total Debt |

|

| $117B | $3000B | $9324B | $12441B |

| RUSSIA |

| $1479B |

| $45B |

| $23B |

| $13B |

| $9B |

| CANADA |

| $1577B |

| $535B |

| $298B |

| $221B |

| $14B |

| CHINA |

| $5878B |

| $1069B |

| $907B |

| $121B |

| $41B |

| BRAZIL |

| $2090B |

| $1073B |

| $873B |

| $169B |

| $31B |

| INDIA |

| $1631B |

| $1211B |

| $1115B |

| $57B |

| $39B |

| UNITED KINGDOM |

| $2250B |

| $1611B |

| $1379B |

| $165B |

| $67B |

| FRANCE |

| $2562B |

| $2193B |

| $1772B |

| $367B |

| $54B |

| ITALY |

| $2055B |

| $2500B |

| $2000B |

| $428B |

| $72B |

| GERMANY |

| $3286B |

| $2634B |

| $2304B |

| $285B |

| $45B |

| JAPAN |

| $5458B |

| $12441B |

| $9324B |

| $3000B |

| $117B |

| USA |

| $14526B |

| $15527B |

| $12532B |

| $2783B |

| $212B |

| Total Debt: $40.83 Trillion |

| Economy (GDP) |

| Total Debt |

| Standing Debt |

| 2012 Repayment |

| 2012 Interest |

| A World in Debt |

|

The world is in debt - A whole city of sky-scrapers of cash. |

Read more at the original source:

http://demonocracy.info/infographics/usa/us_debt/us_debt.html