• Aside from perhaps gold, no other hard asset maintains such a high emotional appeal as diamonds.

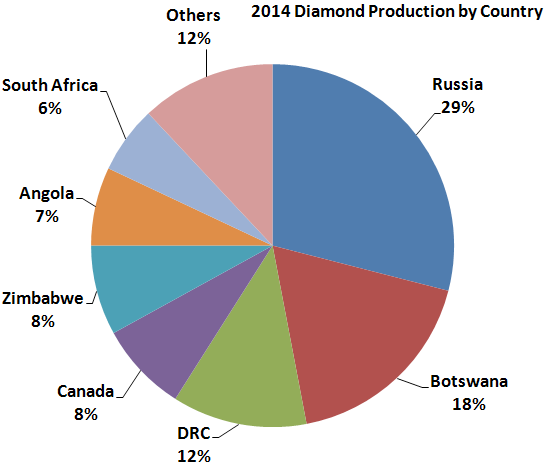

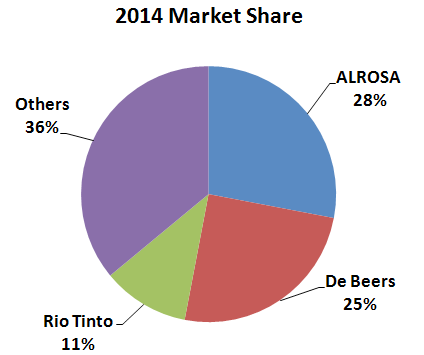

• The diamond market is akin to an oligopoly with De Beers, ALROSA, and Rio Tinto combining for 66% of global production in 2014. Additionally, three countries were responsible for 59% of production in 2014.

• 125 million carats worth $14.5 billion USD were produced in 2014. ALROSA forecasts a supply CAGR of 1% between 2015 and 2024 and a demand CAGR of 5% to 2024 driven by emerging markets such as China and India and supportive demand from the United States.

• Aside from a global economic slowdown, the production of synthetic diamonds is arguably the biggest long term threat to the natural diamond business. Approximately 3.5 million carats of synthetic diamonds were produced last year.

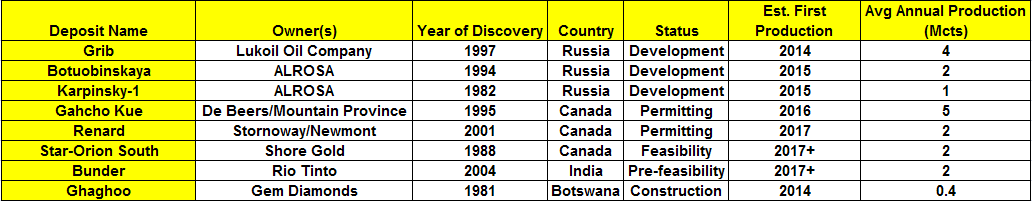

• With no major diamond discoveries since 2004 (Rio Tinto’s Bunder in India), having “the goods”, a high quality and long lived deposit, ought to place any incumbent favorably amongst the major diamond producers.

INTRODUCTION

PERHAPS NO OTHER COMMODITY BESIDES GOLD HAS SUCH A STRONG EMOTIONAL APPEAL AS DIAMONDS. ADDITIONALLY, PERHAPS NO OTHER COMMODITY IS AS SHROUDED IN MYSTERY AS ARE DIAMONDS, THOUGH THIS HAS CHANGED IN RECENT YEARS OWING TO A HOST OF FACTORS. DESPITE THE PERPETUAL APPEAL OF THESE “TEARS OF THE GODS”, THE INDUSTRY IS STILL SUBJECT TO LAWS OF SUPPLY AND DEMAND UNDERPINNED BY CONSUMER TASTES AND PREFERENCES.

Though there is some vertical integration in the diamond business, it generally remains dispersed amongst explorers, producers, polishers, and retail outlets who generally, but not always, focus on their specific niche. While the mining segment of this industry produced approximately 125 million carats of rough diamonds in 2014 worth USD $14.5 billion, the entire industry is estimated to be USD $80 billion per year in size. For the sake of perspective, the all time high in production was 176 million carats in 2005 leading some to believe we’ve hit “peak” diamonds.

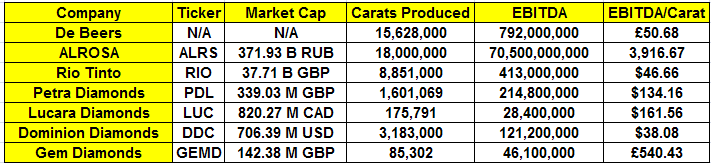

The diamond mining business can loosely be thought of as an oligopoly with De Beers, which AngloAmerican (AAL: LON) owns 85% of, AK ALROSA PAO (ALRS:MCX), and Rio Tinto (RIO:LON) as the “big three” with several Mid-tier producers including Petra Diamonds (PDL:LON), Lucara Diamonds (LUC:TSX), Dominion Diamond Corp (DDC:NYSE), and Gem Diamonds (GEMD:LON) contributing the remainder of supply alongside various privately held entities.

Source: Company Documents, Kimberley Process Statistics

Diamond production is also reasonably geographically concentrated with 59% of supply originating in three countries:

Source: Company Documents, Kimberly Process Statistics

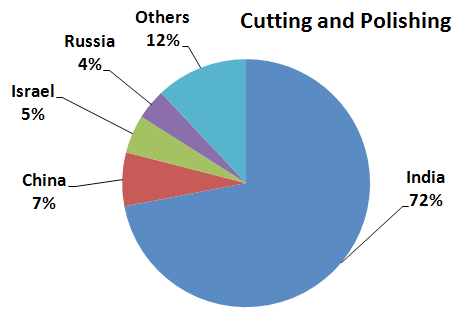

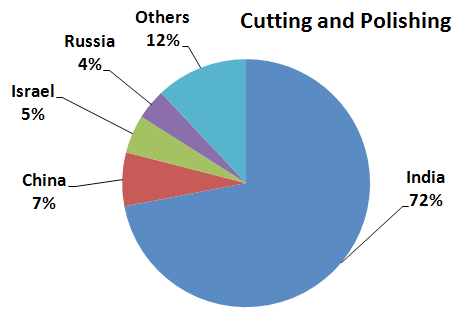

The cutting and polishing segment of the diamond value chain is concentrated in India but is extraordinarily diverse with thousands of companies and multiple business models catering to a diverse client base, according to De Beers.

Source: ALROSA

Given that mining costs are increasing owing to the fact that producers must “dig deeper” in existing mines, it is anticipated that the cost inflation here will filter throughout the value chain in the coming years. This will also pressure “middle market” margins and require this segment of the market to search for unique financing strategies to function properly.

Finally, despite the relatively small size of the global diamond market, the importance of diamond mining to the long term health of certain economies cannot be understated. As an example, Botswana, with a GDP of $14.78 billion counts diamond production by value as 26% of its GDP (2013).

No other commodity besides gold has such a strong emotional appeal as diamonds.

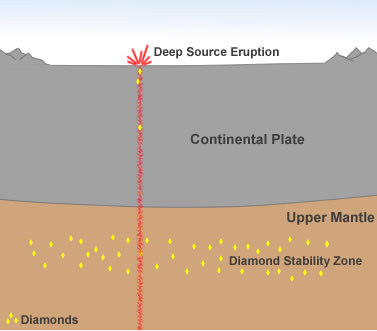

GEOLOGY

Diamonds are typically formed deep in the Earth’s crust (at approximately 250 km depth) under Archean cratons. The extreme pressure at this depth, coupled with temperatures in the range of 900 to 1,200 degrees centigrade, provides the ideal environment for diamond formation.

Source: gia.edu

Volcanic activity serves as the conduit by which diamonds emerge on or near the surface of the Earth. The entire process is believed to take from 1 billion to 3 billion years and as the magma which acts as the transport mechanism for the diamonds cools, it forms an igneous rock known as a kimberlite. Other types of magma which can host diamonds are lamproite and lamprophyre. More broadly, “kimberlite” refers to a kimberlite “pipe” or a vertical igneous structure which is known to host diamonds. Kimberlite became part of the popular lexicon during a diamond staking rush in South Africa in the 1860s.

Source: Geology.com

A schematic of the kimberlite diamond mines in existence today is shown below:

As you can see, the most prolific of the world’s diamond mines are located in Russia, Southern Africa, and Canada though exploration occurs in many other parts of the world.

SUPPLY, DEMAND, AND PRICING

As demand for natural diamonds is based primarily on lifestyle choices (engagements, anniversaries), the demand trends ought to be reasonably predictable and track GDP and personal income growth. The main engine of demand will come from emerging markets in the coming years supported by steady demand from western economies. The International Monetary Fund forecasts GDP growth in advanced economies for 2015 and 2016 at 2% and 2.2%. Developing economies are forecast to grow at a rate of 4% and 4.5% in 2015 and 2016. Though this forecast is short term, it does validate the idea that despite the global slowdown, the developing world will lead global growth prospects and diamond demand along with it.

Source: DeBeers; Data as of May 2014

Source: DeBeers; Data as of May 2014

A current threat to diamond demand growth concerns China. As Chinese authorities have cracked down on corruption and ostentatious shows of wealth, diamond demand has moderated. Watching this dynamic closely will be key to accurate forecasting. The damage is already apparent in financial earnings reports released by publicly traded diamond producers. As an example, Dominion Diamond recently reported a 31% decrease in sales in volume terms and a 25% decrease in the average price per carat during the third quarter. The blame was placed on slower than anticipated Chinese demand. Other producers have voiced similar sentiments.

Nonetheless, ALROSA has offered a view of the diamond market to 2024, with supply forecast to increase by a CAGR of 1% between 2015 and 2024, with a 3% CAGR to 2019 due to increased production from mines in Russia, Australia, and Canada and a 2% decline in production from 2019 to 2024 due to mine depletions in Australia and Canada. This generally flat production profile is contrasted with a forecast 5% demand CAGR between 2015 and 2024.

One’s view of the diamond market should take into account current and looming supply on the market. With the market balanced currently, we find it interesting to note that diamond exploration spending today is approximately half of what it was in 2007, then approximately $1B. According to De Beers,

$7 billion has been spent on diamond exploration since 2000. Given the forecast decrease in production commencing around 2019, the dearth of exploration funding and long lead times necessary to build new mines dictate that higher diamond prices may loom in the future.

According to De Beers, here is the pipeline of diamond projects, forecast to add over 18 M carats of supply to the market in the coming years.

The twin headwinds of excess supply and muted demand show up in the diamond price in 2015, down approximately 19%.

As is the case with many other commodities, those diamond deposits with the lowest cost of production can survive and thrive in the current pricing environment. Gem quality diamonds command a premium price and so those deposits which can demonstrate superior economics based on a long mine life of gem quality stones hold out the potential for positive returns. Obviously, lower diamond prices will affect all parts of the supply chain and this must factor into your capital allocation decision.

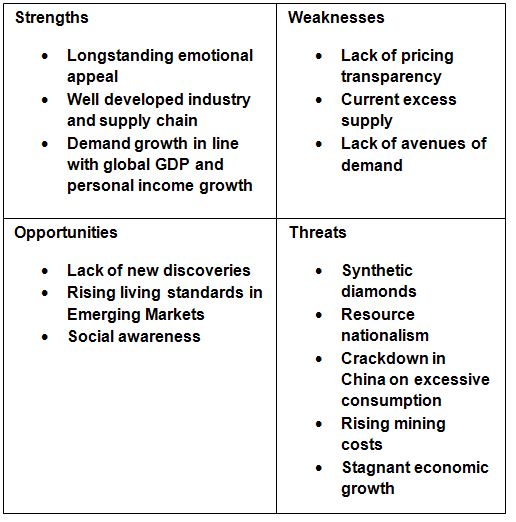

SWOT ANALYSIS

While SWOT analyses can be valuable, they can also be slightly dangerous as one individual may see a strength as a weakness and vice versa. Nonetheless, we include a brief analysis of the diamond industry:

Lower diamond prices will affect all parts of the supply chain and this must factor into your capital allocation decision.

INDUSTRY PARTICIPANTS

As is the case with any commodity, the diamond industry maintains its own value chain with diamond exploration/developers, diamond producers, wholesalers, polishers, and commercial outlets each playing their own role. A search we conducted on Bloomberg showed over 200 distinct deposits owned by numerous diamond mining and exploration plays around the world. This may seem like a lot, but given the slim margin for success in the diamond business, the steady demand, and the need for existing producers to “replace mined carats”, this seems about right.

While diamond prices have been under pressure recently, this obviously lays bare the need to consider multiple parts of the value chain when deploying capital as low prices will affect different parts of the value chain more than others. As is the case with any capital allocation decision, the balance between risk and return is crucial. Here is an abbreviated list of the diamond industry producers and developers.

As De Beers is not a publicly traded entity, determining a valuation is a challenging exercise. Nonetheless, the recent struggles faced by Anglo American, who owns 85% of the company, have laid bare the possibility of monetizing its stake in De Beers through an IPO or other means. A recent article from Bloomberg quoted an HSBC analysis which calculates Anglo’s stake in De Beers at $10 billion meaning a full market value of De Beers would be just under $12 billion.

Select diamond producers with most recent six months results:

Data as of Dec 7, 2015; Source: Bloomberg, Company Documents

Select exploration and development companies:

Data as of Dec 7, 2015; Source: Bloomberg, Company Documents

There also exists an entire cutting and polishing industry mentioned earlier in this report. The breakdown globally:

Source: ALROSA

The final piece of the diamond value chain is the retail sector and includes dozens of names including Tiffany & Co (TIF:NYSE) however a more extensive list is out of the scope of this report as hundreds of retail outlets exist to satisfy varied customer tastes. Much of the $80 billion valuation of the diamond industry exists here.

CONCLUSION

Diamonds aren’t immune from the forces of supply and demand, but the asset class does stand out somewhat relative to other commodities with respect to its emotional appeal. While the major producers are under pricing pressure due to slack demand, this may not always be the case and therein exists an opportunity along the diamond supply chain. Additionally, mining costs are on the increase generally which means that new diamond mines may not come online as expected. As demand for gem quality diamonds remains steady over the next several years, a lack of funding for exploration to replace mined carats is supportive of higher prices.

In the current pricing environment for diamonds, prudence dictates that one should focus only on what they can control. For this reason, lowest production cost or finding costs arguably offer the best value in the diamond space until prices recover. Put another way, those explorers or producers with “the goods”, high quality long-lived deposits, will be well positioned to benefit from any future turnaround in the diamond market.

SELECT SOURCES

• http://www.diamonds.net/

• http://www.mineweb.com/news/diamonds-and-gems/why-de-beers-lab-near-london-makes-diamonds-it-will-never-sell/

• http://www.sdasurat.org/

• http://www.idexonline.com/diamond_prices_index

• https://www.petradiamonds.com/our-industry/

• http://www.diamonds.net/

• https://kimberleyprocessstatistics.org/

• http://www.gia.edu/

• http://geology.com/articles/diamonds-from-coal/

DISCLAIMER AND INFORMATION ON FORWARD LOOKING STATEMENTS

The material herein is for informational purposes only and is not intended to and does not constitute the rendering of investment advice or the solicitation of an offer to buy securities. The foregoing discussion contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (The Act). In particular when used in the preceding discussion the words “plan,” confident that, believe, scheduled, expect, or intend to, and similar conditional expressions are intended to identify forward-looking statements subject to the safe harbor created by the ACT. Such statements are subject to certain risks and uncertainties and actual results could differ materially from those expressed in any of the forward looking statements. Such risks and uncertainties include, but are not limited to future events and financial performance of the company which are inherently uncertain and actual events and / or results may differ materially. In addition we may review investments that are not registered in the U.S. We cannot attest to nor certify the correctness of any information in this note. Please consult your financial advisor and perform your own due diligence before considering any companies mentioned in this informational bulletin.

The information in this note is provided solely for users’ general knowledge and is provided “as is”. We make no warranties, expressed or implied, and disclaim and negate all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose or non-infringement of intellectual property or other violation of rights. Further, we do not warrant or make any representations concerning the use, validity, accuracy, completeness, likely results or reliability of any claims, statements or information in this note or otherwise relating to such materials or on any websites linked to this note. Chris Berry owns no shares in any companies mentioned in this note. He is a consultant to Zimtu Capital Corp. which owns a stake in Equitas Resources and Nickel One, and he is paid a monthly fee by Zimtu Capital.

The content in this note is not intended to be a comprehensive review of all matters and developments, and we assume no responsibility as to its completeness or accuracy. Furthermore, the information in no way should be construed or interpreted as – or as part of – an offering or solicitation of securities. No securities commission or other regulatory authority has in any way passed upon this information and no representation or warranty is made by us to that effect.

All statements in this Research Report, other than statements of historical fact should be considered forward-looking statements. Some of the statements contained herein, may be forward-looking information. Words such as “may”, “will”, “should”, “could”, “anticipate”, “believe”, “expect”, “intend”, “plan”, “potential”, “continue” and similar expressions have been used to identify the forward-looking information. These statements reflect our current beliefs and are based on information currently available. For example, forward looking statements in this report include, but are not limited to a buildup of capacity must be worked off before higher nickel prices can return; higher prices will bring incentive to explore for future supplies; the slight excess in nickel supply globally is likely to reverse once the Indonesian ban is felt; any new nickel development will only move forward in an environment of substantially higher nickel price; forecast deficits ranging from 35,000 to 70,000 tonnes as early as 2016 and that the rebound could commence as early as next year. Forward-looking information involves significant risks and uncertainties, certain of which are beyond our control. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking information including, but not limited to, changes in general economic and market conditions, industry conditions, volatility of commodity prices, risks associated with the uncertainty of exploration results and estimates, currency fluctuations, exclusivity and ownership rights of exploration permits, dependence on regulatory approvals, the uncertainty of obtaining additional financing, environmental risks and hazards, exploration, development and operating risks and other risk factors. Although the forward-looking information contained herein is based upon what we believe to be reasonable assumptions, we cannot assure that actual results will be consistent with this forward-looking information. Investors should not place undue reliance on forward-looking information. These forward-looking statements are made as of the date hereof and we assume no obligation to update or revise them to reflect new events or circumstances, except as required by securities laws. These statements relate to future events or future performance. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements.

ABOUT ZIMTU CAPITAL CORP.

This Research is published by Zimtu Capital Corp. We are focused on researching and marketing public companies in the resource sector where we have a pre-existing relationship (almost always as shareholder and a provider of services). Nothing in this article should be construed as a solicitation to buy or sell any securities mentioned anywhere in this Research & Opinion. This article is intended for informational and entertainment purposes only. The author of this article and its publishers bear no liability for losses and/or damages arising from the use of this article.

Be advised, Zimtu Capital Corp. and its employees are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor or a registered broker-dealer. Never make an investment based solely on what you read in a newsletter, including Zimtu’s Research, especially if the investment involves a small, thinly-traded company that isn’t well known.

Most companies featured in Research Report, and on our website, are paying clients and in many cases Zimtu owns shares in the companies featured. As at October 15, 2015, Zimtu owns 3,719,834 shares of Equitas Resources Corp. as well as 5,174,000 share purchase warrants at an exercise prices ranging from $0.10 to $0.25 per share. Zimtu owns a small investment in Nickel One and has committed to increase its holdings as Zimtu continues to assist with the financing and corporate development strategy of Nickel One. For those reasons, please be aware that Zimtu is biased in regards to the companies featured in this Research Report and on our websites.

Because our featured companies pay fees to us for our administration and public relations services and rent and we almost always own shares in the companies we feature, you must recognize the inherent conflict of interest involved that may influence our perspective on these companies. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before investing in any securities. When investing in speculative stocks of this nature, it is possible to lose your entire investment.

Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. Our views and opinions regarding the companies we feature on in our newsletter are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this newsletter will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

Chris Berry

President of House Mountain Partners LLC and Co-Editor of Disruptive Discoveries Journal

Chris Berry is a well-known writer, speaker, and analyst. He focuses much of his time on Energy Metals – those metals or minerals used in the generation or storage of energy. He is a student of the theory of Convergence emanating from the Emerging World and believes it will have profound effects across the globe in the coming years. Active on the speaking circuit throughout the world and frequently quoted in the press, Chris spent 15 years working across various roles in sales and brokerage on Wall Street before shifting focus and taking control of his financial destiny.He is also a Senior Editor at Investor Intel. He holds an MBA in Finance with an international focus from Fordham University, and a BA in International Studies from The Virginia Military Institute. Please visit www.discoveryinvesting.com and www.house-mountain.com for more information and registration for free newsletter as well as his disclaimer.

Our Thinking and What We Do

We are believers in the theory of Convergence. As the quality of life between East and West slowly merges due to advances in technology, continued urbanization, and changing demographics, opportunities across numerous industries will arise which we can take advantage of. We aim to point out the strategic opportunities in the commodity space which arise from these themes.

Throughout history, no society has sustained a higher quality of life without access to cheap commodities or materials. As global population increases, putting stresses on resource availability, efficiency and technology must come to the fore to continue to provide for a higher quality of life. The looming convergence of lifestyles between the emerging world and the developed world is a fact we must all understand and accept in order to chart a sustainable path forward for humanity.

The Disruptive Discoveries Journal is a free weekly newsletter we write focused uncovering and interpreting both the opportunities and challenges in the natural resources, nanotech, and clean tech sectors resulting from the belief mentioned above.