As contrarian opportunities go, nickel offers an interesting case study. Throughout much of 2014, nickel market participants were almost universally bullish based on the Indonesian government’s plan to ban exports of nickel-bearing laterite ore. Nickel ore exports from Indonesia account for approximately 15% of global supply, so any curtailment in exports would have a material effect on pricing. It was also believed that other metals including tin would follow suit.

As China, the main destination for global nickel supply, had no real options to satisfy its insatiable demand (the Philippines is an exporter but on a smaller scale), the belief was that upward price pressure on nickel would ensue. While there was a rally after the ban went into effect, it was not sustained.

Source: Bloomberg

As the data above shows, this bullishness was premature. A closer examination of Chinese port data has revealed ample nickel metal stocks. Exacerbated by China’s economic slowdown, excess supply exists in the nickel market today and has driven the 3 month nickel price to a $10,480 per tonne on the LME ($4.76 per pound), a decrease of 30.83% YTD as of October 14, 2015. The chart below shows nickel’s performance relative to other base and precious metals in 2015.

Source: Bloomberg

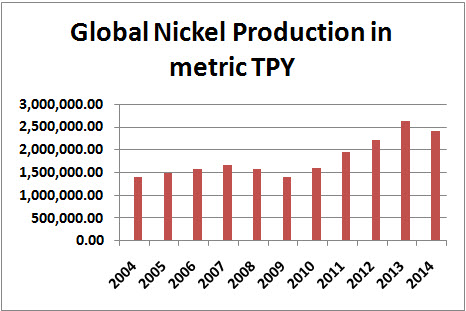

With current production of approximately 2M t per year as per the metals consultancy CRU, the nickel market is roughly $34 billion in size owing primarily to nickel’s use in stainless steel. Nickel is certainly one of the most ubiquitous metals, but a buildup of capacity must be worked off before higher nickel prices can return and along with it the incentive to explore for future supplies.

Source: USGS

Nickel production has remained steady as per the USGS:

Source: USGS

The increase in production since 2009 is likely due to a number of factors, including additional production capacity built up in the earlier part of the decade.

What Changed the Bullish Thesis?

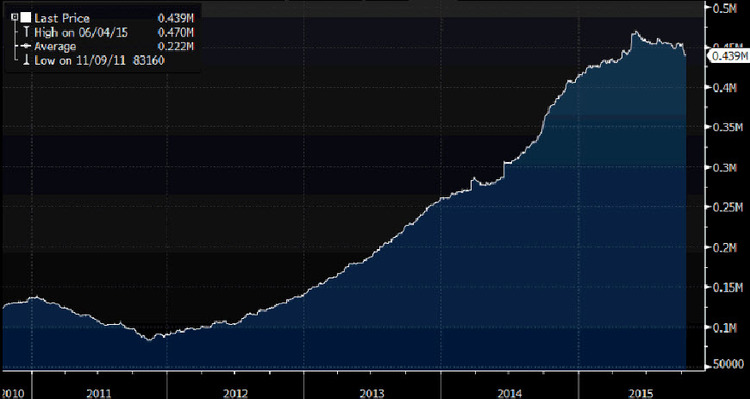

There are several answers to the above question. Perhaps the most surprising was the inability of nickel to sustainably rally after the Indonesian laterite export ban went into effect. The increase in nickel stocks on the LME shown below has acted as a “cap” on the price and has delayed a price recovery.

Source: Bloomberg

Nickel stocks at the LME are just off their all-time high of 470,376 tonnes set this past summer. While the trend has peaked, we await an identifiable turn.

Other factors affecting nickel prices (as well as other commodities) include the strong US Dollar. The USD has appreciated by 4% in 2015 and is up by roughly 10% on a year-on-year basis. With the Federal Reserve recently declining to raise short term interest rates, the USD rally has slowed and experts are divided on the future path for the currency.

Source: Bloomberg

With nickel effectively a “dollar denominated” commodity, the USD strength has made it relatively more expensive on world markets. However, the overwhelming amount of nickel produced in non-USD as well as a lower oil price means nickel has been relatively cheaper to produce, adding to existing supply.

Slack demand for nickel pig iron, a cheaper alternative to pure nickel used in stainless steel production is also widely believed to be responsible for the downward pricing pressure.

This has all led to an environment of slight excess nickel supply globally. This is likely to reverse once the Indonesian export ban is felt.

Nothing Cures Low Prices Like Low Prices

According to Norilsk Nickel CEO Vladimir Potanin roughly 60% of the nickel industry is operating at a cash loss as of the end of August 2015. For the sake of reference, about 50% of global nickel supply is not profitable at $5.23 per pound as per Wood Mackenzie in Q1 2015.

This situation is unsustainable and we would expect to see expansions halted or reviewed and high cost nickel supply erased from the market. Any new nickel project development will only move forward in an environment of a substantially higher nickel price. This allows for a higher project IRR. The paradox is that the current nickel price, while harming balance sheets and discouraging growth, is sowing the seeds for higher nickel prices in the coming years and along with it, additional exploration and development.

Regarding the China demand story, we found the following chart of Chinese refined nickel imports surprising:

Source: Bloomberg

We view the above chart as constructive in that it may go some way to explaining the current state of the nickel market. Given the low nickel price, once must assume that China is taking advantage of this by stockpiling metal. Additionally, a nickel contract is now traded on the Shanghai Futures Exchange and the imports represented above could be used for physical delivery of the Shanghai nickel futures contracts where appropriate. It has been confirmed that these imports are coming mainly from Russia as the Indonesian ban remains in effect and ore from the Philippines is limited.

In order for a new equilibrium to return to the nickel market, we see a key question that needs to be answered:

How soon will the downstream processing capacity in Indonesia be built out?

Mining officials in Indonesia announced that $2.4 billion had been committed towards the building of eleven nickel smelters in the country since the ban went into effect. These smelters need a nickel price of $15,000 per tonne to break even, but as this comes on stream in phases, you would expect the supply overhang to diminish as demand remains steady. PT Sulawesi Mining Investment, a joint venture between Star Group Eight and Tsingshan Holding Group (China’s second largest stainless steel company), will reportedly invest $1.04 billion for the second of a three phase project to grow nickel pig iron (NPI) capacity in Indonesia. The planned capacity is 600,000 tons per year. This is on top of a first phase of the project for 300,000 tpy at a cost of $635.56 million. We view these sums as significant and another forward-looking positive sign.

The oversupply in the nickel market is likely to continue until the smelting capacity is in production, though Norilsk sees a deficit to the tune of 60,000 tonnes returning to the market as soon as 2016. This is primarily dependent on the drawdown of nickel stocks at the LME and a resurgence of demand for NPI in China.

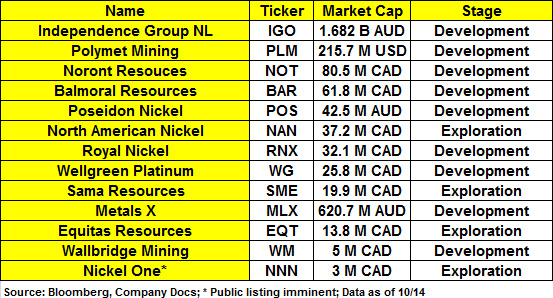

The Market Participants

Given the size of the nickel market and its uses in the global economy, there is no shortage of current and aspiring production stories in the nickel space. From a producer perspective, the current landscape is quite similar to other metals: a halt to exploration and a rather severe cutback to production or planned expansion until some stability returns to the market. Norilsk Nickel, the largest nickel miner in the world is deep in the throes of a “capital discipline” program, but has still found the time (and capital) to implement a share buyback program worth over $150 million USD since June. This is in addition to a dividend program worth over $2.1 billion USD in 2014. If the largest nickel miner in the world sees the best way to reward shareholders being share buybacks and dividends versus organic growth, we think these actions are more telling than any spin in a press release.

The nickel “majors” are all well known and include Norilsk Nickel, Glencore, BHP Billiton, Sherrit, Lundin Mining, First Quantum, and Talvivaara. However, there likely rests a longer-term opportunity in those companies that could be ready to either actively contribute to nickel supply once the market definitively turns or companies which have made legitimate discoveries and have the potential to contribute to growing demand for nickel in the future. Some of these companies include:

Ultimately, we think it is the behavior of the producers that will sow the seeds for the resurgence in nickel as available and future supply may not be able to keep up with steady demand. Market participants we have spoken with believe the market could tip into deficit as early as 2016. The forecast deficits range from 35,000 to 70,000 tonnes.

Conclusion

Until the excess capacity in the nickel market is effectively soaked up, this will remain a market under pricing pressure. The keys going forward will be to watch Chinese import figures, watch for the drawdown of stocks on the LME, and watch for the pace of the processing build out in Indonesia. The relative success or delay of these three factors will chart the future direction of the price of nickel.

With so much of the current global nickel supply operating at below its respective cash costs, existing producers will continue to retrench and take supply off the global market. Norilsk and Glencore are only two examples of companies who are suddenly focused on “balance sheet optimization”.

One would think that those companies brave enough to be developing early stage nickel deposits at this point in the commodity cycle could fill the gap of lost production in coming years. This is of course all subject to a rebound in the nickel price. This rebound could commence as early as next year as the Indonesian laterite ore ban makes itself felt. Only time will tell.

While China’s economy is slowing, we argue that it is also maturing. This has implications for the metals and commodities which are better positioned given the country’s maturation. While “early cycle” commodities such as iron ore have been under pressure for a number of reasons, “mid” or “late” cycle metals should arguably perform better going forward. We would submit that nickel is one such late cycle commodity and is better positioned relative to other metals.

Select Sources

http://www.ssina.com/overview/how.html

http://www.insg.org/ - International Nickel Study Group

http://www.nickelinstitute.org

http://www.imf.org/external/np/res/commod/index.aspx - IMF Commodity Price Forecasts

http://databank.worldbank.org/data/reports.aspx?source=Global-Economic-Monitor-(GEM)-Commodities – World Bank Commodity Data Bank

Chris Berry

President of House Mountain Partners LLC and Co-Editor of Disruptive Discoveries Journal

Chris Berry is a well-known writer, speaker, and analyst. He focuses much of his time on Energy Metals – those metals or minerals used in the generation or storage of energy. He is a student of the theory of Convergence emanating from the Emerging World and believes it will have profound effects across the globe in the coming years. Active on the speaking circuit throughout the world and frequently quoted in the press, Chris spent 15 years working across various roles in sales and brokerage on Wall Street before shifting focus and taking control of his financial destiny.He is also a Senior Editor at Investor Intel. He holds an MBA in Finance with an international focus from Fordham University, and a BA in International Studies from The Virginia Military Institute. Please visit www.discoveryinvesting.com and www.house-mountain.com for more information and registration for free newsletter as well as his disclaimer.

Our Thinking and What We Do

We are believers in the theory of Convergence. As the quality of life between East and West slowly merges due to advances in technology, continued urbanization, and changing demographics, opportunities across numerous industries will arise which we can take advantage of. We aim to point out the strategic opportunities in the commodity space which arise from these themes.

Throughout history, no society has sustained a higher quality of life without access to cheap commodities or materials. As global population increases, putting stresses on resource availability, efficiency and technology must come to the fore to continue to provide for a higher quality of life. The looming convergence of lifestyles between the emerging world and the developed world is a fact we must all understand and accept in order to chart a sustainable path forward for humanity.

The Disruptive Discoveries Journal is a free weekly newsletter we write focused uncovering and interpreting both the opportunities and challenges in the natural resources, nanotech, and clean tech sectors resulting from the belief mentioned above.

The material herein is for informational purposes only and is not intended to and does not constitute the rendering of investment advice or the solicitation of an offer to buy securities. The foregoing discussion contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (The Act). In particular when used in the preceding discussion the words “plan,” confident that, believe, scheduled, expect, or intend to, and similar conditional expressions are intended to identify forward-looking statements subject to the safe harbor created by the ACT. Such statements are subject to certain risks and uncertainties and actual results could differ materially from those expressed in any of the forward looking statements. Such risks and uncertainties include, but are not limited to future events and financial performance of the company which are inherently uncertain and actual events and / or results may differ materially. In addition we may review investments that are not registered in the U.S. We cannot attest to nor certify the correctness of any information in this note. Please consult your financial advisor and perform your own due diligence before considering any companies mentioned in this informational bulletin.

The information in this note is provided solely for users’ general knowledge and is provided “as is”. We at the Disruptive Discoveries Journal make no warranties, expressed or implied, and disclaim and negate all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose or non-infringement of intellectual property or other violation of rights. Further, we do not warrant or make any representations concerning the use, validity, accuracy, completeness, likely results or reliability of any claims, statements or information in this note or otherwise relating to such materials or on any websites linked to this note. I own no shares in any companies mentioned in this note. I am a consultant to Zimtu Capital which owns a stake in Equitas Resources and Nickel One and I am paid a monthly fee by Zimtu Capital.

The content in this note is not intended to be a comprehensive review of all matters and developments, and we assume no responsibility as to its completeness or accuracy. Furthermore, the information in no way should be construed or interpreted as – or as part of – an offering or solicitation of securities. No securities commission or other regulatory authority has in any way passed upon this information and no representation or warranty is made by us to that effect. For a more detailed disclaimer, please click here.

The content in this note is not intended to be a comprehensive review of all matters and developments, and we assume no responsibility as to its completeness or accuracy. Furthermore, the information in no way should be construed or interpreted as – or as part of – an offering or solicitation of securities. No securities commission or other regulatory authority has in any way passed upon this information and no representation or warranty is made by us to that effect. All statements in this Research Report, other than statements of historical fact should be considered forward-looking statements. Some of the statements contained herein, may be forward-looking information. Words such as “may”, “will”, “should”, “could”, “anticipate”, “believe”, “expect”, “intend”, “plan”, “potential”, “continue” and similar expressions have been used to identify the forward-looking information. These statements reflect our current beliefs and are based on information currently available. For example, forward looking statements in this report include, but are not limited to a buildup of capacity must be worked off before higher nickel prices can return; higher prices will bring incentive to explore for future supplies; the slight excess in nickel supply globally is likely to reverse once the Indonesian ban is felt; any new nickel development will only move forward in an environment of substantially higher nickel price; forecast deficits ranging from 35,000 to 70,000 tonnes as early as 2016 and that the rebound could commence as early as next year. Forward-looking information involves significant risks and uncertainties, certain of which are beyond our control. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking information including, but not limited to, changes in general economic and market conditions, industry conditions, volatility of commodity prices, risks associated with the uncertainty of exploration results and estimates, currency fluctuations, exclusivity and ownership rights of exploration permits, dependence on regulatory approvals, the uncertainty of obtaining additional financing, environmental risks and hazards, exploration, development and operating risks and other risk factors. Although the forward-looking information contained herein is based upon what we believe to be reasonable assumptions, we cannot assure that actual results will be consistent with this forward-looking information. Investors should not place undue reliance on forward-looking information. These forward-looking statements are made as of the date hereof and we assume no obligation to update or revise them to reflect new events or circumstances, except as required by securities laws. These statements relate to future events or future performance. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements.

ABOUT ZIMTU CAPITAL CORP. This Research is published by Zimtu Capital Corp. We are focused on researching and marketing public companies in the resource sector where we have a pre-existing relationship (almost always as shareholder and a provider of services). Nothing in this article should be construed as a solicitation to buy or sell any securities mentioned anywhere in this Research & Opinion. This article is intended for informational and entertainment purposes only. The author of this article and its publishers bear no liability for losses and/or damages arising from the use of this article. Be advised, Zimtu Capital Corp. and its employees are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor or a registered broker-dealer. Never make an investment based solely on what you read in a newsletter, including Zimtu’s Research, especially if the investment involves a small, thinly-traded company that isn’t well known. Most companies featured in Research Report, and on our website, are paying clients an in many cases Zimtu owns shares in the companies featured. As at October 15, 2015, Zimtu owns 3,719,834 shares of Equitas Resources Corp. as well as 5,174,000 share purchase warrants at an exercise prices ranging from $0.10 to $0.25 per share. Zimtu owns a small investment in Nickle One and has committed to increase its holdings as Zimtu continues to assist with the financing and corporate development strategy of Nickle One. For those reasons, please be aware that Zimtu is biased in regards to the companies featured in this Research Report and on our websites. Because our featured companies pay fees to us for our administration and public relations services and rent and we almost always own shares in the companies we feature, you must recognize the inherent conflict of interest involved that may influence our perspective on these companies. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before investing in any securities. When investing in speculative stocks of this nature, it is possible to lose your entire investment. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. Our views and opinions regarding the companies we feature on in our newsletter are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this newsletter will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.