Question: What is China’s #1 export?

Answer: Deflation

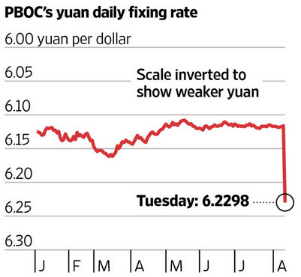

The correct answer to the question is electronic equipment ($571 billion USD worth according to the CIA Factbook), however the PBOC yesterday made a compelling case for replacing electronic equipment with deflation as banking officials in the country devalued the Chinese Renminbi (RMB) by almost 2%.

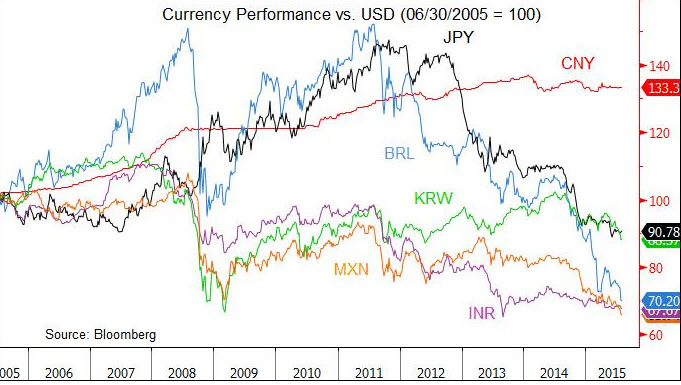

It is obvious to even the most casual China-watcher that the country has been losing export competitiveness as the RMB trading band has strengthened the RMB due to its peg to the US Dollar. The USD continues to strengthen relative to almost all other currencies and shows no real signs of plateauing as the Federal Reserve appears determined to raise the Fed Funds rate later this year. We are left to wonder why the PBOC did this with $4 trillion in foreign exchange reserves. A stronger RMB is in China’s longer-term interest as the economy rebalances.

Source: Wall Street Journal

Under the current mechanism, the RMB is allowed to fluctuate within a tightly controlled band. Each morning, the PBOC sets a midpoint for the currency and market participants are allowed to trade the currency within a 2% band up or down. The PBOC has kept the trading band in place, but by devaluing the RMB by 1.9%, has given Chinese exporters a (brief?) respite. According to Bloomberg, this is the most significant downward revision in the RMB since 1994.

Source: Bloomberg

We think that the slowdown in the Chinese economy is the reason for this currency intervention. The “last straw” may have been the July Chinese export numbers which declined more than 8% from a year earlier. Market expectations were for a 1.5% decline - a BIG miss. Though there are indications of the Chinese growth model shifting away from exports, this fall was clearly too much and so the powers that be in Chinese central banking had to intervene. In addition to this, China’s producer price index (PPI) continues to be in free fall, declining 5.4% on a year-over-year basis.

Of significance here is that this index has been declining for 41 consecutive months. If there ever was evidence of China exporting deflation, this is it and it’s about to become more pronounced.

This move to devalue the RMB, coupled with the effective “lockdown” Chinese authorities have on their domestic equity markets, has many wondering how China expects to have the RMB included in the IMF’s Special Drawing Rights (SDRs), a widely viewed basket of reserve currencies. Acceptance into this “club” is one of the country’s main goals and is no secret. The IMF has written a lengthy, but very informative piece on SDR valuation you can see here.

The PBOC has called this devaluation a “one time” move and is really more about market reform than propping up a collapsing export sector. In addition to the devaluation, the PBOC is pledging to let market forces play a more significant role in setting the RMB level by ensuring market makers take into account the previous session’s USD/RMB closing level as well as overnight developments in the financial markets. There does seem to be some validity here, but it is likely just as much posturing towards the IMF.

Commodities and the bond and currency markets have not reacted well to this news. The US 10 Year government bond dropped to yield 2.12%. Asian currencies including those in New Zealand, Taiwan, South Korea, and Australia all fell by 1% or so as of this writing. The inference here is that as the RMB weakens, Chinese exports will become “cheaper” relative to those of other countries and so those countries must also push down the value of their currencies to compete. This is a classic “race to the bottom” and beggar-thy-neighbor scenario and it seems clear that China is about to hammer its emerging market cousins in a bid to restore growth.

WTI crude is down 4% to $43.16 per barrel and copper down 3% to $2.32 per pound. The gold price seems to have held its own, up .44% to $1,109 per ounce. With China as the largest producer (and consumer) of a host of metals, a cheaper RMB will only encourage domestic production, further depressing prices and adding to gluts in already oversupplied markets.

While the economic repercussions are clear and visible, the geopolitical repercussions are less certain but likely to be just a profound. As China has manipulated value of the RMB anew, politicians will have an absolute field day with this. In the United States, as we head into the real heart of a Presidential election cycle, we can’t wait to hear Donald Trump pontificate on this move.

On a more serious note, Chinese President Xi Jinping is preparing for a state visit to Washington later this year. One must assume that China’s intervention in global currency markets will be at the top of the list of items to discuss. One can only wonder if a few phone calls from the White House to the IMF haven’t been placed discussing “a review” of China’s hopes to be included in the SDRs.

What this unfortunately means is that we’ve just taken one step closer to a deflationary spiral. Sub-par global growth is a given. In the immediate-term, keeping a close eye on the RMB performance within the trading band is going to be important. Over the longer-term, performance of emerging market currencies and balance of payments data will give a clear signal of just how much deflation China is indeed exporting.

Chris Berry

President of House Mountain Partners LLC and Co-Editor of Disruptive Discoveries Journal

Chris Berry is a well-known writer, speaker, and analyst. He focuses much of his time on Energy Metals – those metals or minerals used in the generation or storage of energy. He is a student of the theory of Convergence emanating from the Emerging World and believes it will have profound effects across the globe in the coming years. Active on the speaking circuit throughout the world and frequently quoted in the press, Chris spent 15 years working across various roles in sales and brokerage on Wall Street before shifting focus and taking control of his financial destiny.He is also a Senior Editor at Investor Intel. He holds an MBA in Finance with an international focus from Fordham University, and a BA in International Studies from The Virginia Military Institute. Please visit www.discoveryinvesting.com and www.house-mountain.com for more information and registration for free newsletter as well as his disclaimer.

Our Thinking and What We Do

We are believers in the theory of Convergence. As the quality of life between East and West slowly merges due to advances in technology, continued urbanization, and changing demographics, opportunities across numerous industries will arise which we can take advantage of. We aim to point out the strategic opportunities in the commodity space which arise from these themes.

Throughout history, no society has sustained a higher quality of life without access to cheap commodities or materials. As global population increases, putting stresses on resource availability, efficiency and technology must come to the fore to continue to provide for a higher quality of life. The looming convergence of lifestyles between the emerging world and the developed world is a fact we must all understand and accept in order to chart a sustainable path forward for humanity.

The Disruptive Discoveries Journal is a free weekly newsletter we write focused uncovering and interpreting both the opportunities and challenges in the natural resources, nanotech, and clean tech sectors resulting from the belief mentioned above.

The material herein is for informational purposes only and is not intended to and does not constitute the rendering of investment advice or the solicitation of an offer to buy securities. The foregoing discussion contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (The Act). In particular when used in the preceding discussion the words “plan,” confident that, believe, scheduled, expect, or intend to, and similar conditional expressions are intended to identify forward-looking statements subject to the safe harbor created by the ACT. Such statements are subject to certain risks and uncertainties and actual results could differ materially from those expressed in any of the forward looking statements. Such risks and uncertainties include, but are not limited to future events and financial performance of the company which are inherently uncertain and actual events and / or results may differ materially. In addition we may review investments that are not registered in the U.S. We cannot attest to nor certify the correctness of any information in this note. Please consult your financial advisor and perform your own due diligence before considering any companies mentioned in this informational bulletin.

The information in this note is provided solely for users’ general knowledge and is provided “as is”. We at the Disruptive Discoveries Journal make no warranties, expressed or implied, and disclaim and negate all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose or non-infringement of intellectual property or other violation of rights. Further, we do not warrant or make any representations concerning the use, validity, accuracy, completeness, likely results or reliability of any claims, statements or information in this note or otherwise relating to such materials or on any websites linked to this note. We own no shares in any companies mentioned in this note and have no financial relationship with any company mentioned.

The content in this note is not intended to be a comprehensive review of all matters and developments, and we assume no responsibility as to its completeness or accuracy. Furthermore, the information in no way should be construed or interpreted as – or as part of – an offering or solicitation of securities. No securities commission or other regulatory authority has in any way passed upon this information and no representation or warranty is made by us to that effect. For a more detailed disclaimer, please click here.