With an increasing amount of attention focused on metals used in technology, several issues have become clear. First, some are more important than others. Second, the amount of a metal used in an application isnÂ’t as important as is the cost to procure it. Third, a general lack of transparency in pricing clouds the overall potential opportunities.

Given these challenges, itÂ’s a wonder anyone would care at all about the Energy Metals, but it has become increasingly clear that the demand is there. One metal in particular which offers interesting answers to the above issues and deserves more careful study is cobalt.

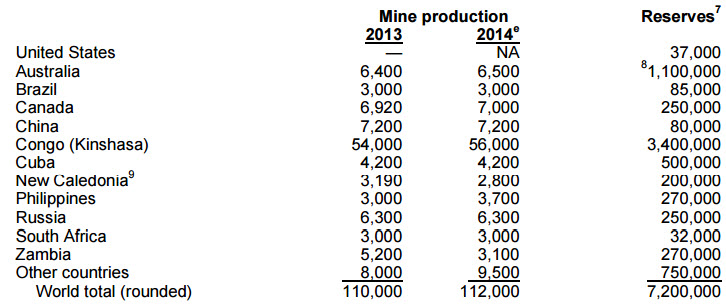

As shown above, the USGS puts the total mined production for cobalt at 112,000 tonnes (though refined cobalt production is lower). However, there are numerous downstream cobalt compounds including chlorides, carbonates, and powders used in various applications. This diversity of demand is very important as the metals markets struggle with oversupply. With the overall market demand for cobalt growing at an estimated 6 to 7% per annum, driven primarily by the battery business which uses cobalt chemicals and the aerospace business which uses high purity alloys, the demand story is sound.

Sources: CDI, Roskill, MMTA, Industry Sources

The supply side is more of an open question, but industry sources have indicated that the oversupply that is plaguing many of the metals also exists in cobalt. The key question here then is when will the balance tip and a new equilibrium emerge?

Source: LME.com

The cobalt price (above from the LME) would seem to reinforce the oversupply thesis and my own estimates indicate that prices will remain range bound in the intermediate future. That said, one of the real keys to analyzing the cobalt market involves not looking at the metal itself, but other external factors which can influence price and therefore usage.

ItÂ’s no secret that cobalt is, by and large, a byproduct. Approximately two thirds of cobalt production is directly related to copper production, slightly less than one third is related to nickel production, and the remainder (less than 5%) is the result of primary cobalt operations. Given that reality, it seems that both positive and negative catalysts for the copper and nickel markets should be more scrutinized than those only in the cobalt space. As an example, forecasts of slight oversupply in copper heading in to the second half of this year will weigh on cobalt pricing.

Additionally, with the battery business such a large and growing source of demand for cobalt chemicals, particular attention should be paid to Asia-based battery manufacturers such as LG Chem (051910:KRX), Sony (SNE:NYSE, 6758:TYO), Panasonic (PCRFY:OTCBB, 6752:TYO), and GS Yuasa (6674:TYO) to name a few. These are among the companies who collectively promise to determine the future trajectory of metals demand, in particular for cobalt. In short, Tesla isnÂ’t the only game in town.

Much of cobalt’s appeal concerns the perceived need for a reliable source and supply chain as roughly 50% of global mined production comes from the DRC and the lion’s share of refined cobalt comes from China. The real opportunity in cobalt lies in the lack of a longer-term pipeline of projects that can fill any supply gap in several years time. With the most well known crop of juniors likely unable to add to global supply before 2018, a focus on the “majors” is warranted. These would include Freeport McMoRan (FCX:NYSE) (one of the largest cobalt refiners in the world ex-China), Glencore (GLEN:LON), Vale (VALE:NYSE), and Sherrit (S:TSE, SHERF:OTCBB).

There are threats to this growth thesis including cost, technology, and recycling. I mentioned in the introduction that the cost of a material matters more than the aggregate amount used – specifically in batteries. For all of the talk about ten times as much graphite needed for a battery versus lithium, this really misses the point. What is the cost of that graphite? It’s for this reason that cobalt is such a sensitive issue in battery supply chains – it is currently one of the most expensive raw materials in lithium ion batteries. For example, if a tonne of battery grade lithium carbonate costs US $6,500, a tonne of high grade cobalt on the LME currently runs US $28,600 – over four times as much. These prices aren’t meant to be exact, but industry sources tell me they currently aren’t far off the mark.

Given this high relative cost, attempts to minimize cobalt use in various applications is on the rise, though it doesnÂ’t appear likely that cobalt will be replaced or outmoded anytime soon. That said, both nanotechnology and recycling are two areas I have begun focusing more intently on.

So with the pros and cons laid out, perhaps a prediction is in order. The looming need for additional secure supply is likely the worst kept secret in the battery business. Investors of all stripes are looking for the most likely current and future suppliers. With the crop of juniors unlikely to contribute before 2018 at the earliest, this means the existing producer/refiner group will be the only game in town. This means sourcing from countries like the DRC or refined product from China is highly likely. While high profile customers may demand volume discounts, given rising costs and flat prices, I think itÂ’s unlikely this will come to fruition, meaning battery producer margins will get squeezed. Keep your eye on the cobalt supply chain as weÂ’ll know whether or not this prediction is accurate in 6 to 12 months.

Chris Berry

President of House Mountain Partners LLC and Co-Editor of Disruptive Discoveries Journal

Chris Berry is a well-known writer, speaker, and analyst. He focuses much of his time on Energy Metals – those metals or minerals used in the generation or storage of energy. He is a student of the theory of Convergence emanating from the Emerging World and believes it will have profound effects across the globe in the coming years. Active on the speaking circuit throughout the world and frequently quoted in the press, Chris spent 15 years working across various roles in sales and brokerage on Wall Street before shifting focus and taking control of his financial destiny.He is also a Senior Editor at Investor Intel. He holds an MBA in Finance with an international focus from Fordham University, and a BA in International Studies from The Virginia Military Institute. Please visit www.discoveryinvesting.com and www.house-mountain.com for more information and registration for free newsletter as well as his disclaimer.