Unloading nickel matte in port of Nikkelverk (Norway) from Sudbury, Canada (Source)

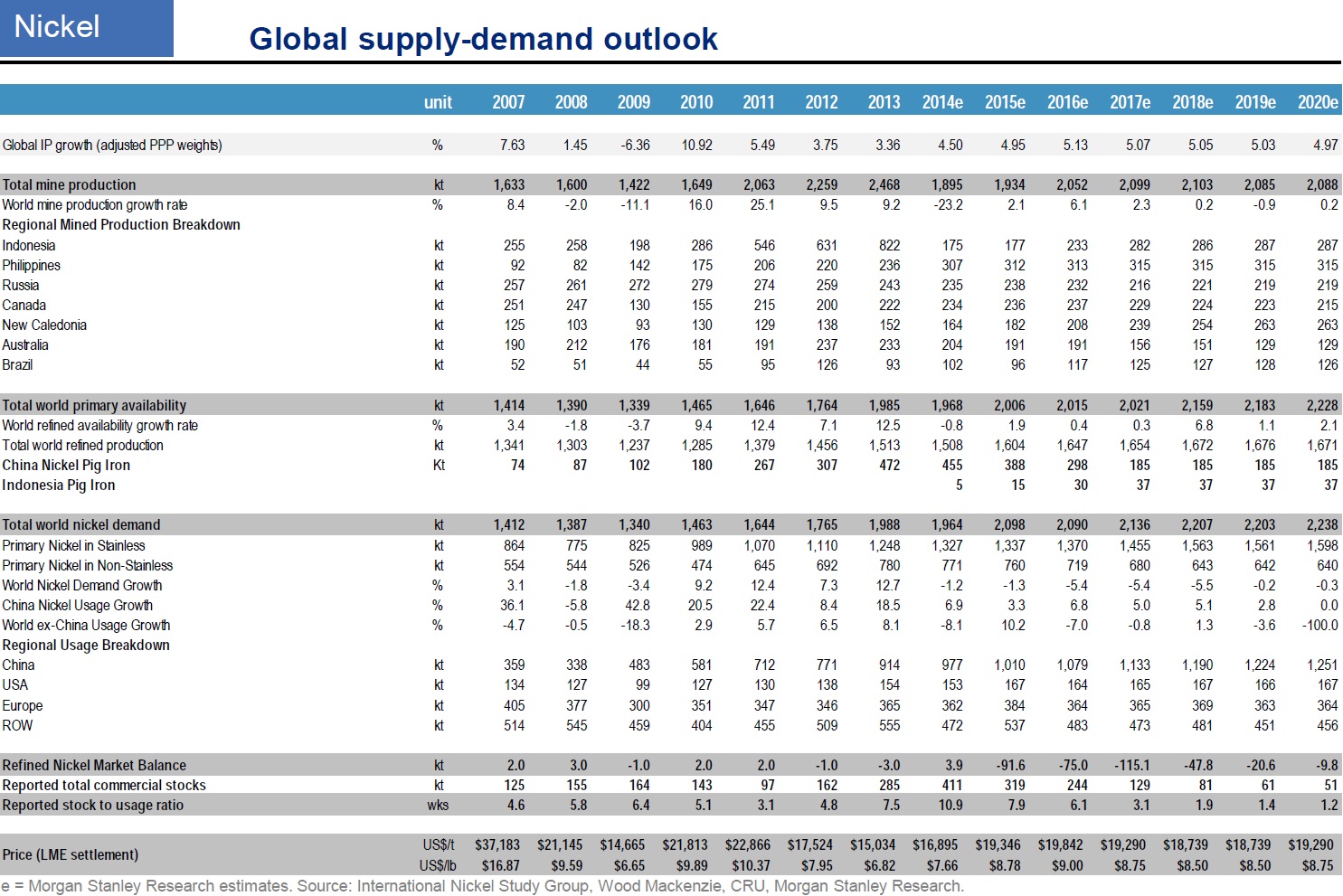

Nickel was the best performing metal in 2014 finishing off the year with a +20% gain, whereas its price rose strongly (+50%) within the first 5 months. Nickel is Morgan StanleyÂ’s top commodity pick for 2015; with a price target of 19,842 USD/lb in 2015 (+58 from its current price of 12,590 USD/lb):

“Persistent price support/driver is Indonesia’s laterite export ban; price tension to return during stainless steel-led seasonal uptick in trade flows in 1Q15.”

(Morgan Stanley; Global Metals Playbook 2015)

Glencore in its Investor Day presentation (12/2014):

“Nickel Market Transitioning to Deficit; Balanced 2015 and Deficits Thereafter:

• Nickel demand growth conservatively projected at c.4.5% p.a.

• Substantial deficits forecast over the outlook period

• LME nickel price rallied to $21,200/t in May, up 52% from the start of the year. Prices subsequently settled in an $18,000-$20,000/t range, then declined rapidly from Sep, along with commodities in general. Market recently recovered most Sep/Oct losses.

• The increase in price was primarily driven by the Indonesian ban on nickel ore exports and the anticipation of reduced nickel output.

• Yet, continuous increases in LME inventory, Chinese metal exports, higher Philippine ore exports, macro-economic downgrades and liquidity issues in China have all impacted sentiment and nickel prices.

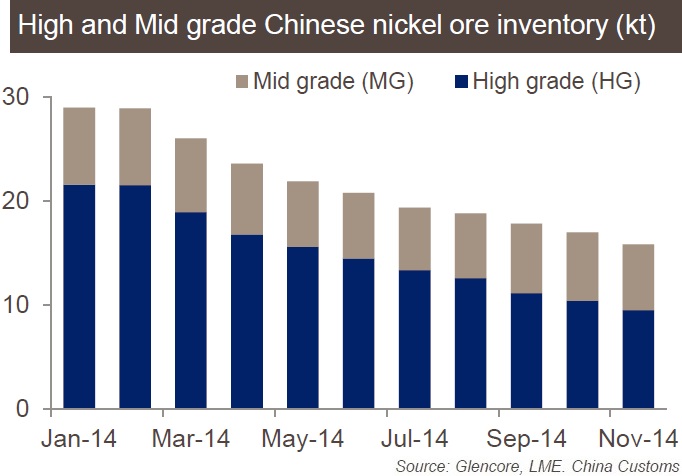

NPI Output Supported by High Grade Ore Stocks:

• Significant stockpiles of Indonesian high grade ore (>1.8% Ni) were built in China prior to the export ban (27Mt HG/MG ore).

• These stockpiles, blended with Philippine ore, have supported continued high levels of Chinese nickel pig iron (NPI) production in 2014 (c.480Kt Ni) albeit with production decreasing Q on Q.

• Estimated at over 20Mt at the start of the year, stockpiles of high grade ore in China are currently below 10Mt and trending towards critical levels.

• Philippine shipments will decrease in the coming months due to the monsoon season. Shipments will not pick back up materially until April when Surigao area exports resume.

• HG stocks will be at critical levels by April 2015 and seasonality will become a major factor going forward.

Philippine Ore Supplies Determine Chinese NPI Outlook:

With the Indonesian ban on ore exports sustained (also confirmed by recent Constitutional Court ruling), Chinese inventory of Indonesian high grade ore will ultimately deplete and NPI production will depend on ore exports from the Philippines.

•2014 Philippine exports to China are forecast at c.52Mt wet ore and constitute LG >50%, MG >30% with the balance HG. Lower average grade ores increase NPI production costs, all things being equal.

•No game changers elsewhere: New Caledonia may supply 1-2Mtpa additional ore to market while Guatemala may supply up to 30kt Ni contained in higher grade ore to European FeNi plants.

•Based on our projection of volume and composition of Philippine ore supply, China’s NPI production is forecast to fall from 480kt Ni in 2014 to 400kt Ni in 20151 and 350-400kt Ni over the outlook period.

Supply Outlook – Limited Growth Amid Ore Ban:

• Global nickel supply in 2014 is forecast to be relatively unchanged on 2013 as decreased output from existing producers and Chinese NPI is offset by increased production from new projects.

• Longer term, Chinese NPI production is forecast at 350-400kt vs. 510kt in 2013. However, increased supply from new projects (all going well) should offset projected losses and overall supply growth is forecast at c.1% p.a. to 2019.

• China’s NPI dependence on lower grade ore from the Philippines will increase production costs.

• Ramp up performances highlight the need for a cautious outlook, with the majority of new projects delayed due to technical, environmental, permitting and social challenges.

• We assume limited growth in actual Indonesian NPI output. While capacity will be built in a higher price environment, the extent and pace of commissioning is likely to be challenged for a variety of reasons.

• We forecast less than 100kt Ni in Indonesian NPI by 2019.

Demand Outlook – Solid Growth in Key Markets:

• “While the days of double-digit growth in China are over, the greater size of the economy means lower growth still translates into strong absolute demand… It’s slower not lower.” (Julian Kettle, Wood Mackenzie)

• Primary nickel demand in stainless steel is projected to increase c.5% in 2014, reflecting growth in China, North America, Japan and India. Longer term, we forecast global nickel demand in stainless to increase at a rate >4.5% p.a., predominantly driven by China (Global CAGR 2008-2013: 9.6% p.a.).

• Activity in non-stainless applications is also robust with nickel usage projected to increase >8% in 2014. Going forward, non-stainless demand growth is forecast >4% p.a., with strong contributions from China, US and India

• Overall, we project solid nickel demand growth of c.4.5% p.a. between 2014 and 2019 (CAGR 2008-2013: 7.1% p.a.).

• Put simply, we conservatively expect demand will increase by 75-100Kt Ni per year.

Expanding Deficits to Emerge:

• Assuming the Indonesian ban on ore exports is sustained, market deficits will emerge.

• Increased supply from new projects (all going well) supports global production growth of c.1% p.a. to 2019.

• With nickel demand growth projected at a conservative c.4.5% p.a., the market is expected to transition to deficit, with substantial deficits forecast from 2018.

• Long run nickel pricing will largely be determined by the cost of bringing on marginal (low grade) limonite ore processing capacity.

• We do not see any new low cost technologies that will alter the outlook.“

TD Securities expects the start of a nickel supply deficit in 2015 with 12,000 tonnes. In 2016, the deficit is anticipated to increase 9-fold to 104,000 tonnes nickel. TD Securities as per their latest research report “2015/2016 Metals & Minerals Outlook“ (01/2015):

“Nickel — Supply Deficit Expected — Global Nickel Market Deficits Emerge in H2/15:

As NPI [Nickel Pig Iron] production starts to contract in China during 2015, the nickel market is expected to move into deficit during the second half of the year. Deficits are expected to increase into 2016. Global nickel demand is forecast to expand year-over-year by ~3% in each of 2015 and 2016, while refined production should contract ~1% in each year. Growing deficits should lead to a reversal of the rapid expansion of visible nickel inventories that put downward pressure on the nickel price in 2014.

We maintain our long-term price of US$10.00/lb (starting in 2017): We expect that under-investment in new global nickel production capacity (outside of NPI production) that has been the result of a protracted period of low prices will result in much tighter nickel markets over the medium to longer term.“

Morgan Stanley, in its Global Metals Playbook 2015, comments as follows on the positive outlook for the nickel price:

"IndonesiaÂ’s trade shock has yet to play out:

• Frustrating year revisited: We were all nickel bulls, early 2014: its price was to jump on Indonesia’s ban of Ni-bearing laterite exports, as China had no other ore options (the Philippines too small; other sources already engaged). Soon though, it became clear that there was adequate ore in the supply chain (pre-emptive stocking by China, as with bauxite); the mid-year Qingdao port probe prompted a release of previously unknown metal (i.e. record-high LME inventories); China’s industrial activity weakened anyway. Nickel’s price retreated on these drivers to below MCP; recovering a little by year’s end on speculation around monsoonal supply risk in the Philippines.

• Shortfall’s real: We still believe that Indonesia’s trade ban is a price driver for the metal: it just needs more time to play out. China’s laterite inventories are being run down, and the development of Indonesia’s downstream processing capacity is proving far slower than the general market probably expects.

• 1Q15 seasonal kick: In addition to a troubled supply growth story, we also expect a seasonal lift in 1Q15’s trade to support the metal’s price in 2015, making nickel one of our top picks. Stainless steel output expands with the rest of the industry in this quarter, typically led by China, but with US support this year.

• Indonesia shortfall quantified: When Indonesia announced its plan to push for the development of domestic downstream ore processing capacity in 2009, nickel-in-laterite exports (and some metal) represented 15% of global supply (200-300ktpa). During 2009-14, China boosted imports ahead of the trade ban, distorting China’s apparent consumption data. With the ban in place, what’s actually been done downstream? China’s stainless steel giant, Tsingshan (via JV Sulawesi Mining Investment) has developed capacity for up to 300ktpa NPI, ramping from 2015; Cahaya Modern Metal Industry began late 2013; Indoferro’s 8ktpa from 2012 – all delivering 15-40ktpa in 2015-18. Significant, but still not sufficient to replace Indonesia’s pre-ban and 300ktpa rate.

• First-use update: Global stainless steel dominates nickel demand (70% of primary metal demand), itself dominated by China (50% global demand; 50% of global melt capacity too). We expect melt production to rise 5% YoY in 2015 (China’s up 12% YoY).“