- We first wrote about tin in September 2013. Since then the price of tin has strengthened markedly

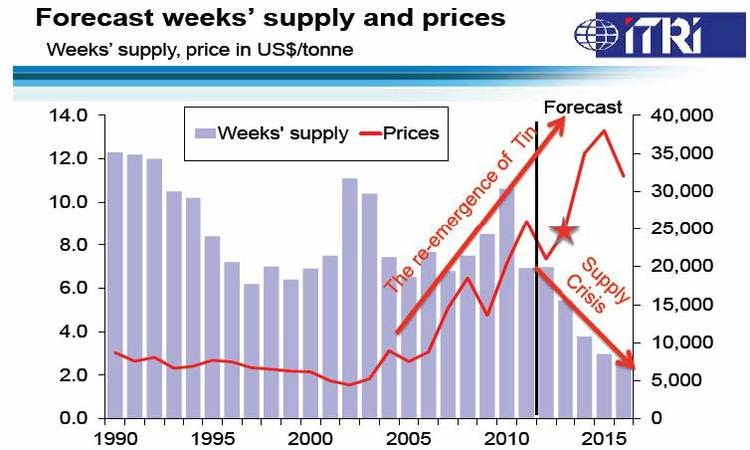

- Tin remains in backwardation in the futures markets implying a need for more supply – now

- Factors such as falling grades in existing mines, increasing use of tin in technological applications, and increasing cost inflation are all coalescing to paint this rosy picture

- However, the main culprit for the supply squeeze and subsequent price spike is the Indonesian Government

- A looming supply crisis for tin is still very much a possibility out to 2015-2016

So Far, So Good

Source: LME.com

Late last year, I presented the investment case for tin as a metal to watch in 2014. Thus far, this has proven to be a prescient move and there appears to be little reason to shift focus. With the growth slowdown in Emerging Markets and renewed economic uncertainty in the developed world, one would think industrial metals such as tin would be trending solidly downwards. As the chart below from the LME shows, this has not been the case, with tin up over 3% year-to-date.

Other factors pushing tin higher include: a lack of willingness to fund exploration and development, rampant cost inflation in mining, and increased tin use as a solder in electronics. These, however, are all longer-term structural issues that the tin sector must address going forward. The real culprit for higher tin prices is none other than resource nationalism – an increasingly familiar foe of the mining industry.

The Culprit

The culprit for a high and rising tin price rests in Indonesia, a country which is one of the largest producers and exporters of various forms of many metals including tin. As a brief refresher, last year the government of Indonesia mandated that raw tin ore exports would be banned in favor of promoting domestic processing and exporting higher value products. The initial intention was set to cover numerous metals including copper, zinc, lead, silver, iron ore, gold, nickel, bauxite, and tin but Indonesian President Susilo Bambang Yudhoyono altered the law slightly at the eleventh hour to allow exports of copper, zinc, lead, and iron ore concentrates until 2017.

As Freeport McMoRan Copper and Gold (FCX:NYSE) and Newmont Mining Corp (NEM:NYSE) produce 97% of IndonesiaÂ’s copper, this no doubt weighed on President YudhoyonoÂ’s decision.

The other metals mentioned above, however, are still subject to the new law and this is the reason for the recent strength in prices.

If the futures markets are the best forward looking indicator of pricing, recent data from the LME would certainly confirm that a tin squeeze is on as stocks are low and backwardation reigns.

Source: LME.com

While I donÂ’t begrudge the Indonesian government its attempts to build domestic industry and lessen reliance on the LME, instituting sweeping changes such as we have seen recently can cause market dislocations and send foreign direct investment to other shores.

As I understand the law, tin ingots can be sold and exported once they have been traded through the Indonesia Commodity and Derivatives Exchange (ICDX). Other tin products are exempt until January 1, 2015. Not surprisingly, tin solder exports have increased dramatically in place of tin ingot exports and this has caught the eye of the Indonesian Deputy Trade Minister Bayu Krisnamurthi. Increased solder exports have been viewed as “not normal” prompting the minister to possibly reassess the law and say,

“We´re evaluating it, whether to accelerate it or through other intervention," Krisnamurthi told Bloomberg, referring to the solder trade exemption deadline. "If something less than perfect, it will be perfected", he said. [Ed. Note: Bold is ours]

As risk of fear mongering (something I STRONLGY try to avoid in writing) these types of statements should send shivers up the spine of tin producers in Indonesia and have prospective tin investors licking their chops. “Perfected”? What exactly does that mean? Perfected by whom? These unanswered questions give companies pause before committing to capital expansion plans but give investors opportunities to take advantage of market anomalies.

The upheaval in this space doesnÂ’t seem to be subsiding anytime soon and so then this begs the question of how to take advantage of the recent events.

The Tin Universe

One of the real challenges involved in tin investing is that there don’t appear to be many (any?) pure plays. In short, when investing in a tin producer, developer, or explorer, you’re buying more than one metal. While this exposure can be unwarranted, in the case of the developers and explorers, this provides “optionality” and can provide the basis for above average returns when coupled with the tailwind of firm metals prices. I have written about this theme before and continue to believe in its validity despite the challenging macro environment for metals and mining plays.

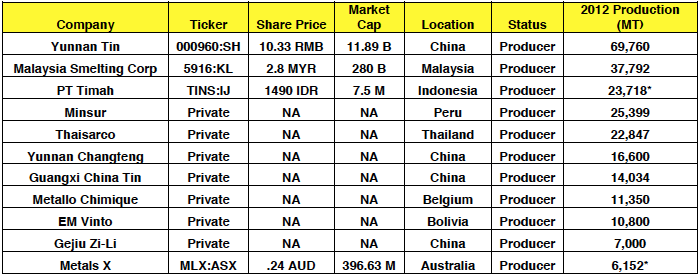

Here are the top ten producers of tin globally with their 2012 production totals included.

Source: ITRI, Bloomberg, Company Reports; All data as of Feb 18, 2014; Production totals for TINS and MLX are for 2013 (rolling 12 months for MLX); share prices and market caps are in local currency

As you can see, investing in the tin production “universe” is a tricky proposition mainly due to the fact that many of these companies are privately held and hold main listings on exchanges difficult for the typical North American investor to access. Another point to consider is the fact that the production totals listed above are for total production of refined tin. Several of the companies listed including Yunnan Tin, Malaysian Smelting Corp, PT Timah, Minsur, and Metals X, and EM Vinto include mine output in these totals while the other enterprises have no reported mine output per se.

A sampling of the tin junior exploration and development (E&D) space offers more opportunities, but at a substantially higher risk profile:

Source: ITRI, Bloomberg, Company Reports; All data as of Feb 18, 2014

I would argue that at this point in the cycle, the junior space offers a much higher degree of leverage to a higher tin price which is a positive. Given that most of these companies face the same challenges as juniors involved in other metals (financing risk, exploration risk, metallurgical risk, exchange rate risk), taking profits must be at the forefront of your mind. Any share price strength or “pop” should be sold into and profits reinvested elsewhere. Regardless of the commodity, cash flow and financial sustainability remain of paramount importance. As is the case with uranium, near-term or existing tin production stories would appear most attractive at this point in the cycle.

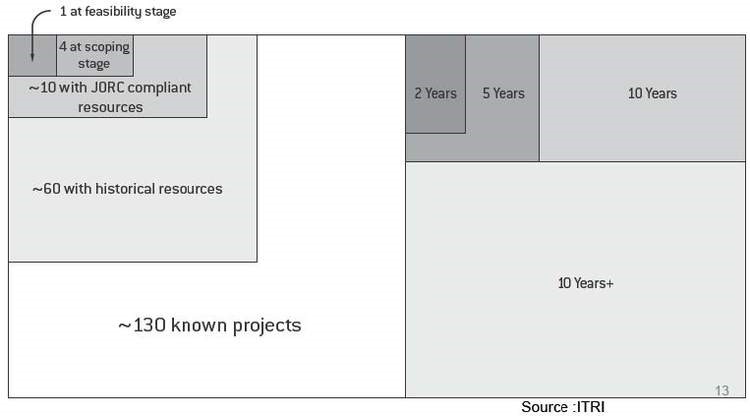

Looking out further, the tin sector production pipeline looks like this:

So, according to ITRI, additional supply is anywhere from 2 to 5 years out. This is forecast in the face of the recent actions of the Indonesian government which will presumably exacerbate the supply squeeze unless cooler heads prevail.

The Takeaway

It is less and less surprising to see a government insert itself into commodity markets with presumably good intentions and end up dislocating the entire market. This is just what officials in Indonesia have done with their attempt to set tin prices in Indonesia and wrest control of the market from the LME.

Demand for tin continues to grow regardless on the back of increased usage in personal electronics, packaging, and construction. Existing mines are faced with declining grades and increased costs. China continues to consolidate its tin industry to promote a more sustainable industry (and satisfy internal demand).

The move by Indonesian officials to establish a single trading venue (the ICDX) for tin products will presumably lower exports from the country and is, again, the main reason for the recent price strength and for anticipated strength going forward.

There are risks, of course, including the Indonesian government changing course and failing to enforce or delay the new rules and increased tin recycling. I will be watching for these events closely, but see no reason to anticipate any changes.

Tin remains one of my top metals to watch in 2014. As is the case with investing in any commodity, this can be a bumpy ride, but near-term producers or existing producers generating cash flow and by products stand to weather the storm and I believe offer the highest leverage to an increasing tin price.

Chris Berry

President of House Mountain Partners LLC and Co-Editor of Disruptive Discoveries Journal

Chris Berry is a well-known writer, speaker, and analyst. He focuses much of his time on Energy Metals – those metals or minerals used in the generation or storage of energy. He is a student of the theory of Convergence emanating from the Emerging World and believes it will have profound effects across the globe in the coming years. Active on the speaking circuit throughout the world and frequently quoted in the press, Chris spent 15 years working across various roles in sales and brokerage on Wall Street before shifting focus and taking control of his financial destiny.He is also a Senior Editor at Investor Intel. He holds an MBA in Finance with an international focus from Fordham University, and a BA in International Studies from The Virginia Military Institute. Please visit www.discoveryinvesting.com and www.house-mountain.com for more information and registration for free newsletter as well as his disclaimer.