Source: Bloomberg

Cobalt is finally getting its due. Driven by anticipated strong growth in electric vehicle sales, the LME price has increased 35% year to date with the cobalt chemicals pricing showing similar strength.

Just as with lithium, the demand story around cobalt is real and this is what has supply chain participants worried. It’s well known that 65% of mined cobalt originates in the Democratic Republic of the Congo (DRC) - a fact that has kept many investors away. Many of the cobalt “pure plays” are years away from meaningful cash flow generation so any value creation will be based more on discoveries of economically mineable deposits rather than sales into a market voraciously hungry for material.

As junior miners have begun to position themselves with opportunities mainly in Canada and Australia, Glencore (GLEN:LON) has moved to consolidate its holdings in the DRC by purchasing 31% of Mutanda for $922M and an additional 10.25% of Katanga for $38M. So the company effectively owns 100% and 86% of two of the best copper/cobalt assets in the world.

GLEN dominated the cobalt mining market last year, producing 28k t in 2016. With China Molybdenum (3993: HKG) and BHR Partners assuming majority control of the Tenke copper/cobalt mine in the DRC, it would appear that both GLEN and the Chinese have a stranglehold on the upstream portion of the cobalt supply chain. With the China Molybdenum acquisition of the Kokkola cobalt refinery, this also puts a majority of the downstream cobalt supply chain in China’s hands – furthering my thesis of the country playing the “long game” to dominate next generation supply chains.

Source: Glencore Press Release

While consolidation is one theme to be mindful of, another concerns the overall supply demand balance. When I wrote last on cobalt in the fall of 2016, I forecast an average price of $18/lb by 2018. This was based on the aggressive plans of OEMs to electrify some or all of their fleets in the coming years.

My forecast was also hilariously wrong as cobalt sits closer to $20 per pound today.

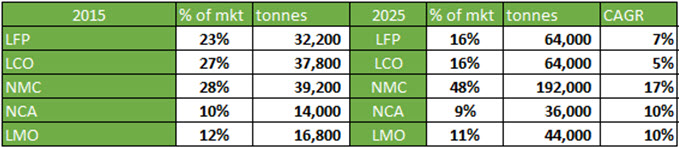

With roughly two thirds of the battery cathode demand out to 2025 centered on nickel and cobalt-heavy chemistries (NCA and NMC), the main demand driver for cobalt is in plain view. Almost 50% of cobalt chemical demand goes into the rechargeable battery business today and this is forecast to increase. Given the apparent shortage in available cobalt, it appears that a new long-term average price for the material will settle in the $20/lb range.

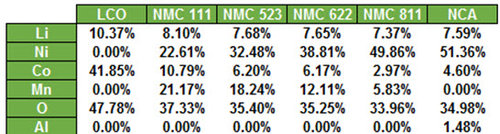

Cathode components by weight:

Source: Interviews with Industry Experts

To be clear, you could easily see cobalt prices accelerate well above this level (and likely will), but $20/lb could be a new long-term floor, just as many predict that $10,000/t is the floor for LCE based on lithium mining economics.

At current demand growth rates, my modeling shows a 10,000 t deficit of cobalt chemicals in 2020 as a distinct possibility. For this to be rectified, several things must happen:

· New cobalt supply from the likes of GLEN, ENRC, Katanga (KAT:TSE), or Zhejiang Huayou Cobalt (603799:SHA) must materialize. That most of the near-term supply is in the DRC is a key risk.

· Recycling must become more pronounced. Battery recyclers have indicated that a $20/lb cobalt salts price make the economics appealing. Umicore recycled 7,000 t of lithium batteries last year - the equivalent of 35,000 EVs.

· Copper and nickel prices must remain firm. Both metals have recovered from their post-supercycle lows but a major pullback in the price of either metal could also constrict cobalt supply as roughly two thirds of global cobalt supply comes from copper with the other third coming from nickel mining.

As I’ve stated in the past with lithium, placing a probability on these events can help paint a clearer picture of the supply and demand dynamics of the cobalt market.

The threats to overall cobalt demand growth remain primarily with lithium ion battery technology. I have written a great deal in the past on this subject as technological advances have an uncanny way of solving problems around raw material availability and concurrent high prices. One company I continue to watch closely in this regard is Nano One Materials Corp (NNO:TSX).

As cobalt prices continue their ascent, you can expect to see more attention paid to the likes of NNO to transform lithium ion battery economics.

The takeaway here is that cobalt is intent on following lithium into mainstream popularity. This is a unique opportunity but is dependent on continued pricing strength. I see three ways to express a view here: early stage exploration, buying physical cobalt and stockpiling it, and disruptive battery technologies which could serve to moderate cobalt demand.

The window is open.

Chris Berry

President of House Mountain Partners LLC and Co-Editor of Disruptive Discoveries Journal

Chris Berry (@cberry1) is a well-known writer, speaker, and analyst. He focuses much of his time on Energy Metals – those metals or minerals used in the generation or storage of energy. He is a student of the theory of Convergence emanating from the Emerging World and believes it will have profound effects across the globe in the coming years. Active on the speaking circuit throughout the world and frequently quoted in the press, Chris spent 15 years working across various roles in sales and brokerage on Wall Street before shifting focus and taking control of his financial destiny.He is also a Senior Editor at Investor Intel. He holds an MBA in Finance with an international focus from Fordham University, and a BA in International Studies from The Virginia Military Institute. Please visit www.discoveryinvesting.com and www.house-mountain.com for more information and registration for free newsletter as well as his disclaimer.

Our Thinking and What We Do

We are believers in the theory of Convergence. As the quality of life between East and West slowly merges due to advances in technology, continued urbanization, and changing demographics, opportunities across numerous industries will arise which we can take advantage of. We aim to point out the strategic opportunities in the commodity space which arise from these themes.

Throughout history, no society has sustained a higher quality of life without access to cheap commodities or materials. As global population increases, putting stresses on resource availability, efficiency and technology must come to the fore to continue to provide for a higher quality of life. The looming convergence of lifestyles between the emerging world and the developed world is a fact we must all understand and accept in order to chart a sustainable path forward for humanity.

The material herein is for informational purposes only and is not intended to and does not constitute the rendering of investment advice or the solicitation of an offer to buy securities. The foregoing discussion contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (The Act). In particular when used in the preceding discussion the words “plan,” confident that, believe, scheduled, expect, or intend to, and similar conditional expressions are intended to identify forward-looking statements subject to the safe harbor created by the ACT. Such statements are subject to certain risks and uncertainties and actual results could differ materially from those expressed in any of the forward looking statements. Such risks and uncertainties include, but are not limited to future events and financial performance of the company which are inherently uncertain and actual events and / or results may differ materially. In addition we may review investments that are not registered in the U.S. We cannot attest to nor certify the correctness of any information in this note. Please consult your financial advisor and perform your own due diligence before considering any companies mentioned in this informational bulletin.

The information in this note is provided solely for users’ general knowledge and is provided “as is”. We at the Disruptive Discoveries Journal make no warranties, expressed or implied, and disclaim and negate all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose or non-infringement of intellectual property or other violation of rights. Further, we do not warrant or make any representations concerning the use, validity, accuracy, completeness, likely results or reliability of any claims, statements or information in this note or otherwise relating to such materials or on any websites linked to this note. I own no shares in any companies mentioned in this note and have no relationships with any other companies mentioned.

The content in this note is not intended to be a comprehensive review of all matters and developments, and we assume no responsibility as to its completeness or accuracy. Furthermore, the information in no way should be construed or interpreted as – or as part of – an offering or solicitation of securities. No securities commission or other regulatory authority has in any way passed upon this information and no representation or warranty is made by us to that effect.