With few exceptions, deflationary forces are likely to challenge growth in much of the world in 2015. With the global economy more tightly integrated than ever before, the risk of much of the world catching a “disinflationary” or deflationary cold is pronounced. Most commodities are trading at or near five year lows, real interest rates negative in various countries, and Central Banks are having difficulty hitting their (admittedly low) inflation targets of 2%. It’s obvious to even the most casual observer that the inflation genie is not even close to being let out of the bottle.

Given that the global economy is generally struggling to generate “escape velocity” growth, the main question is how deflation might spread? I see three transmission mechanisms:

globalization, high debt to GDP ratios, and innovation in technology spurred by R&D.

This note discusses the first two mechanisms with a focus on China’s efforts to halt the “export” of deflation.

Globalization as the Great Equalizer

Globalization is a profoundly deflationary force. It is paradoxical that increased trade among nations would lead to lower prices, but this is exactly what comparative advantage and competition are designed to do. Capital travels in search of the highest returns which are often accompanied by the lowest costs of production. In recent decades, much of this has occurred in Asia (specifically China). While it has brought untold millions out of abject poverty and up into the global middle class, those countries with historically higher living standards have seen their quality of life generally stagnate through flat real wage growth. With wage growth in China growing at double digit rates in recent years, and the cost of energy in the US plummeting, at least some of that capital has found its way back to the United States. This is a real challenge for the Chinese economy which has grown in recent decades based on manufacturing job growth.

Whither China? If there is one country which has potential to give the global economy the deflationary “cold” I spoke of above, China certainly qualifies. With President Xi determined to reorient the country around a new growth model and also glide the country to a lower and more sustainable growth rate, all eyes will focus on the Middle Kingdom in 2015. President Xi’s ability to walk the tightrope between sustainable growth and an economic tailspin must be on the mind of anyone with social, political, or economic interests in the country.

With respect to deflation in China, the situation is notable. Producer prices (as measured by the PPI) have been falling for 33 months.

The crash in iron ore prices (the worst performing commodity in 2014 as I write) is another sign of softening demand for this commodity critical for the unparalleled infrastructure build out in China in recent decades. Excess capacity in many commodities is one of the main reasons mining has been such a challenging sector to invest in over the past three years. Between 2002 and 2011, billions of dollars were spent on acquisitions and building additional productive capacity for a host of commodities as many believed that commodity prices were set to maintain their linear path upwards. This was underpinned by ChinaÂ’s seemingly insatiable appetite for metals. Though demand for some metals (zinc or aluminum, for example) is healthy both in and outside of China, overall excess capacity and supply must be brought back into balance before a new commodity cycle can begin. This seems increasingly unlikely in the face of massive deleveraging that is still required globally. The excess capacity I speak of will provide deflationary bent in the markets overall (in particular in China).

Debt as Future Consumption Denied

Another deflationary force concerns the debt load in China.

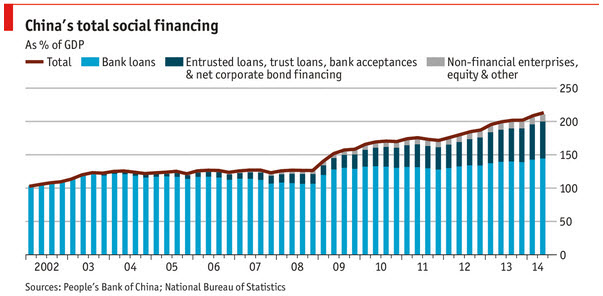

I could likely write an entire note about the nuances here and will be doing so in the future. The above chart from The Economist demonstrates how China has been able to sustain its growth rate and pull the global economy from the brink of a major depression in 2008 – through a massive debt binge. If you believe that issued debt is future consumption denied, then this certainly makes the case for deflation in China that much stronger. With producer prices falling, debt servicing could become an issue as revenue growth may not be adequate to cover the interest and principal payments on the debt. I realize there are a host of other issues I am skirting over here (the role of SOEs, the relative size of the financial markets in China, the possibility of write offs or debt restructurings) however the flow of revenues servicing interest payments rather than growing the capital stock is one which can’t be dismissed – even in a tightly controlled economy like China’s. How much of this debt issued in China since 2008 is actually productive?

To be fair, the debt to GDP ratio in other countries such as Greece is much higher than those in China, but this doesnÂ’t mean that a lower ratio cannot harm growth prospects in China. HereÂ’s hoping that ChinaÂ’s FX reserves can help alleviate any pain.

There are a number of obvious and painful ways to work through each of these challenges and a likely one should sluggish growth continue is perhaps the easiest way out: currency manipulation.

Chinese officials have attempted several “mini” stimulus measures of late including waving the requirement for lenders to set aside reserves for some deposits. This may not be enough to maintain the growth rate in the country and therefore weakening the Chinese Renminbi (RMB) is an “easy out” for an economy which has become dependent on exports for growth.

The recent strength in the USD has affected sectors of the global economy differently and has been one of the main economic forces moving markets during the second half of 2014. While economic growth in the US appears to be moving in a positive direction, I think the USD strength is more a result of weakness in the Euro Zone and in Japan. A stronger USD would ostensibly take some of the pressure off of exporters in China, but this will not solve the challenges I listed above. The PeopleÂ’s Bank of China (PBOC) manipulating the RMB value against the USD through setting the trading band at different parameters is certainly an option. ChinaÂ’s slowdown has affected the currencies of commodity producer countries including Canada and Australia as well.

Deflation: The Chicken or The Egg?

Ultimately, the core issue is to stimulate global aggregate demand rather than deflation and China, as the primary producer and consumer of a host of commodities, is a very big part of this equation. Japan is in its fourth recession since 2008, the Euro Zone is struggling to keep its head above water, Russia and Brazil are in trouble, and the Chinese economy is choking on overcapacity as the growth rates moderate. Can the US (and perhaps the UK) economies help blunt the forces of deflation? Not without adept monetary maneuvering from China. Can they pull this off? We shall see in 2015.

Chris Berry

President of House Mountain Partners LLC and Co-Editor of Disruptive Discoveries Journal

Chris Berry is a well-known writer, speaker, and analyst. He focuses much of his time on Energy Metals – those metals or minerals used in the generation or storage of energy. He is a student of the theory of Convergence emanating from the Emerging World and believes it will have profound effects across the globe in the coming years. Active on the speaking circuit throughout the world and frequently quoted in the press, Chris spent 15 years working across various roles in sales and brokerage on Wall Street before shifting focus and taking control of his financial destiny.He is also a Senior Editor at Investor Intel. He holds an MBA in Finance with an international focus from Fordham University, and a BA in International Studies from The Virginia Military Institute. Please visit www.discoveryinvesting.com and www.house-mountain.com for more information and registration for free newsletter as well as his disclaimer.