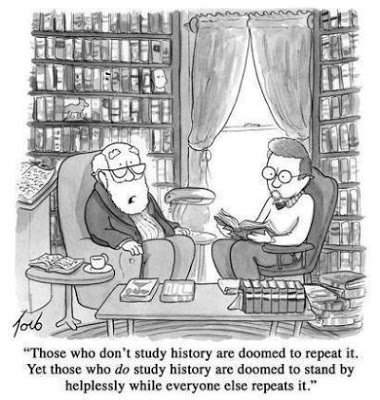

I know that I resemble the old guy in this cartoon, standing by helplessly as I watch central bankers experiment with the global economy. Bubbles are blown, again, in several asset classes. Negative interest rates have become an acceptable concept, as if they are just words and have no real economic meaning. Stock markets trade based on the next set of words from a central banker, regardless of how wrong these people have been, for almost a decade, on their ‘predictions’ and dot plots of the future. There is a Stephen King novel in the making here, something about the horrors of the people that created a gigantic problem also being the people in charge of fixing the problem they created, as if they aren’t at fault in the first place.

Speaking of horror, the latest ‘news’ from the FOMC and BOJ hit the street last week. The Fed, once again, did nothing but chose to sit on their hands while continuing to ‘talk’ up the economy and the need to raise rates. Isn’t there some old cliché about words versus actions?

This excellent Blomberg article, Central Bankers Throw in the Towel by Lisa Abramowicz, summed things up nicely:

We learned three things about central bankers today.

1) The Bank of Japan is almost out of ideas.

2) The Federal Reserve is unwilling to rattle markets.

3) Neither central bank beleives it can truly stimulate economic growth much more at this point and the onus is now on government officials and their policies.

So at last week’s FOMC we were told that the case for raising rates has increased, while at the same time the FOMC downgraded the US long-term growth prospects.

The European Central Bank’s balance sheet now equals 32% of the Eurozone GDP. This is higher than Fed´s total assets/GDP ratio, but way behind Bank of Japan (BOJ) who now leads the world in history-making monetary policy. Central bankers around the world are acting in the same ‘uncharted water’ way, but the BOJ has taken us to a whole new level of recklessness, as can be seen by this chart from Bloomberg showing the size of the Fed, ECB and BOJ’s balance sheet assets per GDP:

Globally central bank assets continue to rise:

I do find it amazing that these central bankers talk about creating more inflation, when they were originally chartered to prevent inflation. What they need to be focused on is growth, because as it is becoming plainly clear, the trillions of dollars of money printing and negative interest rate bonds has done nothing for the global economy:

In what appears to be the Fed’s first ‘floating’ of an idea, Janet Yellen said that the Fed would like to add the direct purchase of equities to their toolbox, something that is currently not allowed: “Federal Reserve Chairwoman Janet Yellen said Thursday there could be benefits to allowing the central bank to buy stocks as a way to boost the economy in a downturn.” Never mind that this has not helped the economies in Japan or Switzerland, printing money via a central bank requires that new money to buy something, and it is beginning to look like the Fed would like to be able to broaden their shopping list.

What I do find unexplainable is that billions of people seem to think these central bankers know what they are doing. Being an old guy, I remember Greenspan, having just been appointed head of the Fed in 1987, flooding the market with liquidity after the ’87 market crash. He did the same thing again in the late nineties, flooding the markets with liquidity because of the Y2K scare and blowing the tech bubble. Bernanke took over and in 2006 assured us that all was well and ‘contained’ as the housing market imploded and lead to the 2008 financial melt down (something Yellen admitted to never have seen coming as well). And now we have dot plots that are always revised lower and eight years of talk about raising interest rates and ‘normalization,’ yet no actions follow.

All of these crazy central bank policies are going to eventually hit the wall. Either they will create inflation, probably more than anyone will ever want to see, or they will kill the bond markets with all their purchases. The endgame nears, I fear, and it will probably be the bond markets declining, and rates rising, even while central banks demand the opposite. When these central bankers, like the great and mighty Oz, are seen as failing in this global monetary experiment, the wheels will come off the bus and we will all need to buckle up.

This information is for information purposes only and is not intended to be an offer or solicitation for the sale of any financial product or service or a recommendation or determination by Sprott Global Resource Investments Ltd. that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the objectives of the investor, financial situation, investment horizon, and their particular needs. This information is not intended to provide financial, tax, legal, accounting or other professional advice since such advice always requires consideration of individual circumstances. The products discussed herein are not insured by the FDIC or any other governmental agency, are subject to risks, including a possible loss of the principal amount invested. Generally, natural resources investments are more volatile on a daily basis and have higher headline risk than other sectors as they tend to be more sensitive to economic data, political and regulatory events as well as underlying commodity prices. Natural resource investments are influenced by the price of underlying commodities like oil, gas, metals, coal, etc.; several of which trade on various exchanges and have price fluctuations based on short-term dynamics partly driven by demand/supply and nowadays also by investment flows. Natural resource investments tend to react more sensitively to global events and economic data than other sectors, whether it is a natural disaster like an earthquake, political upheaval in the Middle East or release of employment data in the U.S. Low priced securities can be very risky and may result in the loss of part or all of your investment. Because of significant volatility, large dealer spreads and very limited market liquidity, typically you will not be able to sell a low priced security immediately back to the dealer at the same price it sold the stock to you. In some cases, the stock may fall quickly in value. Investing in foreign markets may entail greater risks than those normally associated with domestic markets, such as political, currency, economic and market risks. You should carefully consider whether trading in low priced and international securities is suitable for you in light of your circumstances and financial resources. Past performance is no guarantee of future returns. Sprott Global, entities that it controls, family, friends, employees, associates, and others may hold positions in the securities it recommends to clients, and may sell the same at any time.

Source: http://sprottglobal.com/thoughts/articles/as-central-bankers-spin/